48516ebd51b9bb4d62fb81b3748640a5.ppt

- Количество слайдов: 86

BEHIND A CUP OF COFFEE: HOW FAMOUS BRANDS COVER THEMESELVES Creti Carolina, Francesconi Elena, Martiriggiano Sara, Saccenti Elisa Risk Management & Derivatives, A. Y 2013 -2014 1

Table Of Content The coffee market Starbucks Dunkin’ Donuts Green Mountain Conclusion 2

THE COFFEE MARKET SOME NUMBERS The second most traded commodity after oil; Global production of US$ 15. 4 billion in 2009/10 4 billion cups consumed every day around the World (Americans 400 million cups); 3

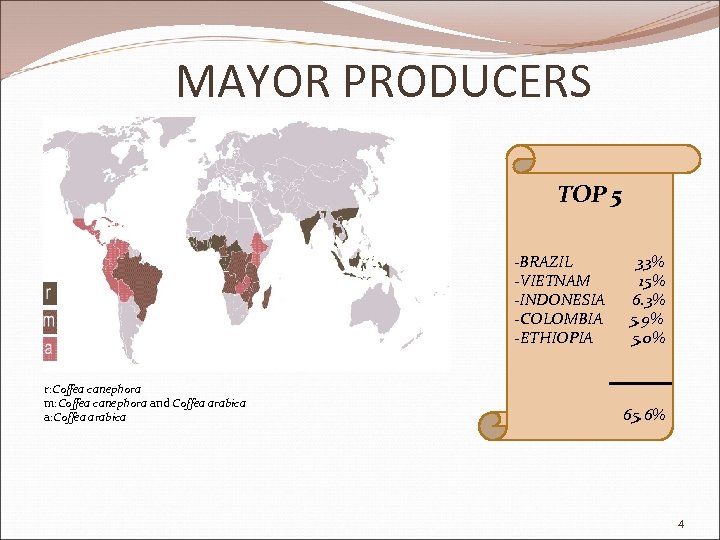

MAYOR PRODUCERS TOP 5 -BRAZIL -VIETNAM -INDONESIA -COLOMBIA -ETHIOPIA r: Coffea canephora m: Coffea canephora and Coffea arabica a: Coffea arabica 33% 15% 6. 3% 5. 9% 5. 0% 65. 6% 4

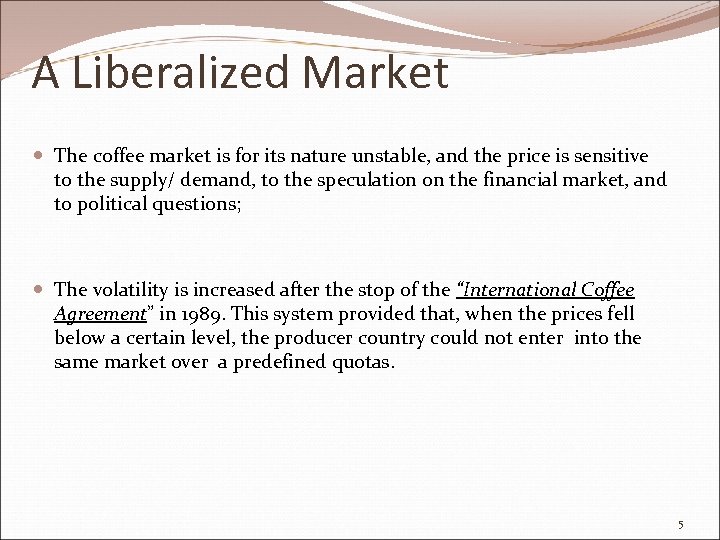

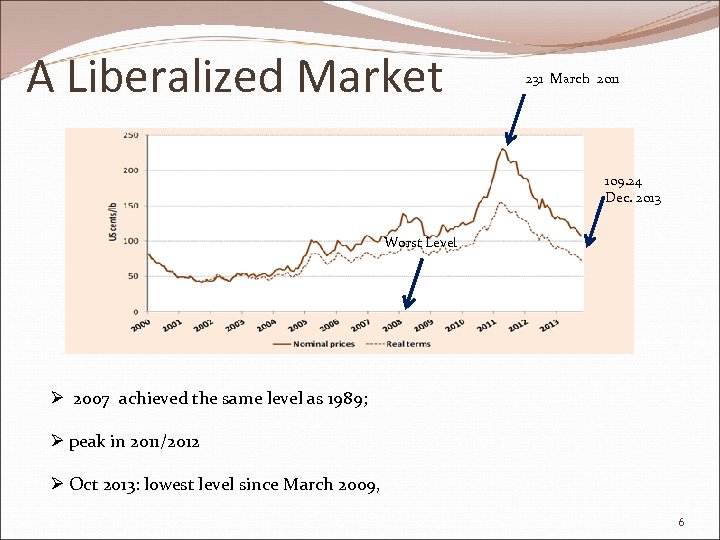

A Liberalized Market The coffee market is for its nature unstable, and the price is sensitive to the supply/ demand, to the speculation on the financial market, and to political questions; The volatility is increased after the stop of the “International Coffee Agreement” in 1989. This system provided that, when the prices fell below a certain level, the producer country could not enter into the same market over a predefined quotas. 5

A Liberalized Market 231 March 2011 109. 24 Dec. 2013 Worst Level Ø 2007 achieved the same level as 1989; Ø peak in 2011/2012 Ø Oct 2013: lowest level since March 2009, 6

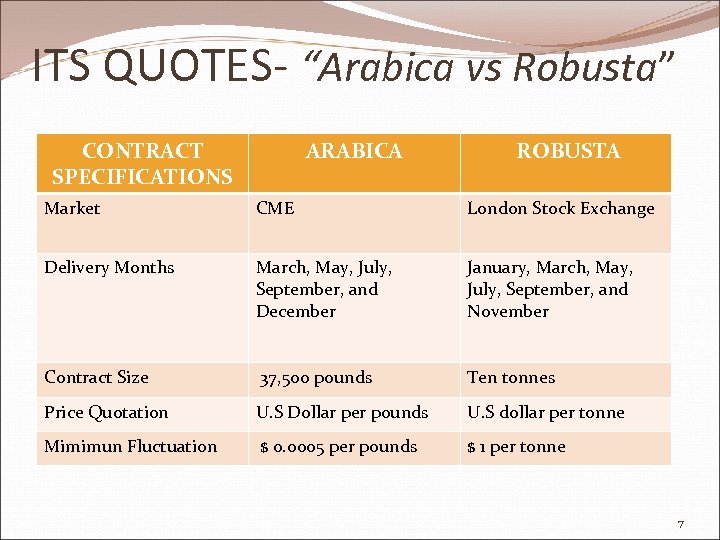

ITS QUOTES- “Arabica vs Robusta” CONTRACT SPECIFICATIONS ARABICA ROBUSTA Market CME London Stock Exchange Delivery Months March, May, July, September, and December January, March, May, July, September, and November Contract Size 37, 500 pounds Ten tonnes Price Quotation U. S Dollar per pounds U. S dollar per tonne Mimimun Fluctuation $ 0. 0005 per pounds $ 1 per tonne 7

A COMPETITIVE MARKET There are many realities widespread all over the World 8

OUR ANALYSIS 9

Company Overview 1 Starbucks Pw. C dicembre 2013 11

Core Business v purchase and roast high-quality whole bean coffees for sale v sell teas and other beverages, food items and beverage-related accessories and equipment, primarily through company operated retail stores + licensed retail stores v in addition to the flagship Starbucks brand the portfolio also includes goods and services offered under other brands: Teavana, Tazo, Seattle’s Best Coffee, Starbucks VIA, Starbucks Refreshers, Evolution Fresh, La Boulange and Verismo. Starbucks Pw. C dicembre 2013 12

The mission of the company “To inspire and nurture the human spirit – one person, one cup and one neighborhood at time”. The objective: “to maintain Starbucks standing as one of the most recognized and respected brands in the world” Starbucks Pw. C 13

The mission of the company Starbucks Global Responsibility they are keeping on their expansion of the stores on a global base Continue to offer consumers new coffee products in multiple forms, across new categories, and through diverse channels Pw. C 14

Global Expansion Today it is in 62 countries around the world and it has about 18000 stores world-wide. Starbucks Pw. C 15

Price Stock Starbucks Corporation’s common stock is listed on NASDAQ, under the trading symbol “SBUX”. The price of the stock is around 80 us$ Starbucks Pw. C 16

Financial Statement 2 Starbucks Pw. C dicembre 2013 17

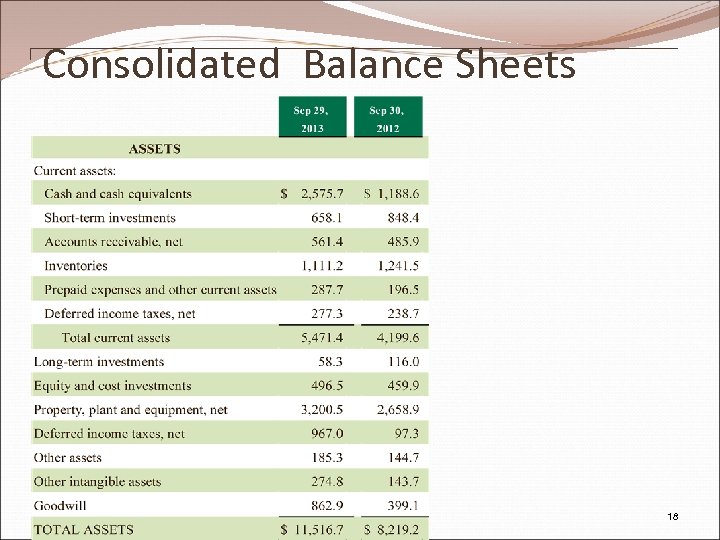

Consolidated Balance Sheets Pw. C 18

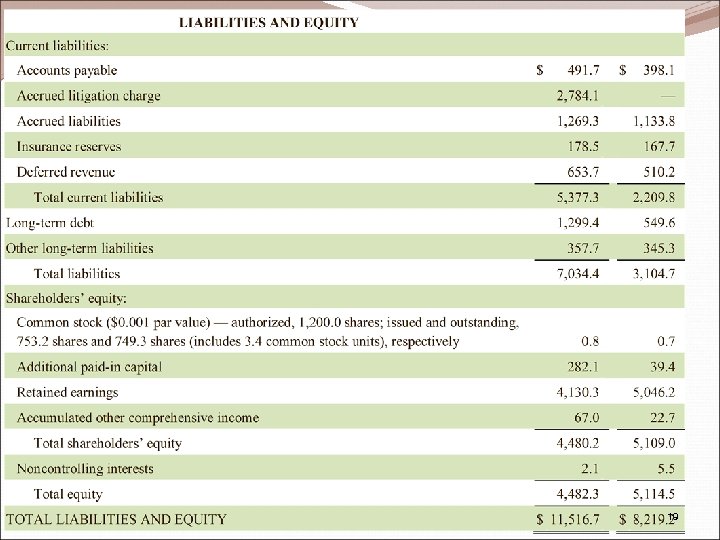

Pw. C 19

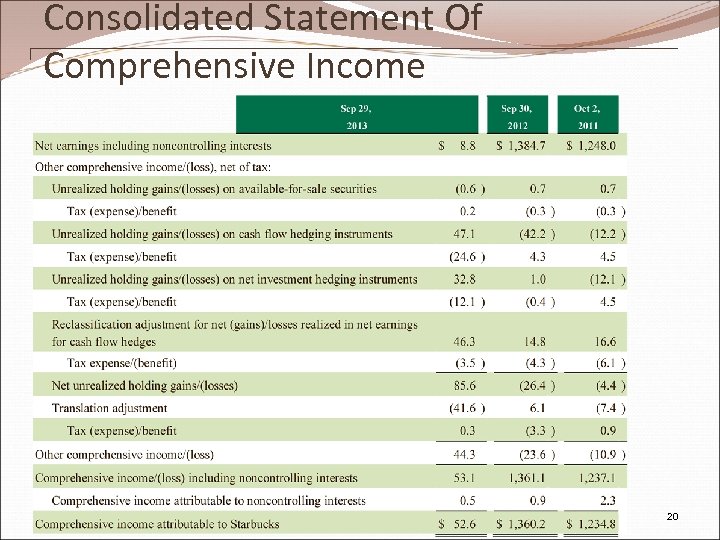

Consolidated Statement Of Comprehensive Income Pw. C 20

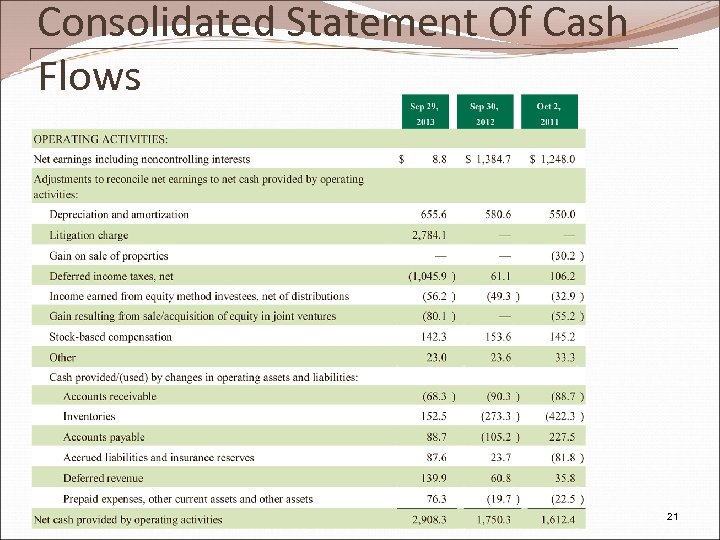

Consolidated Statement Of Cash Flows Pw. C 21

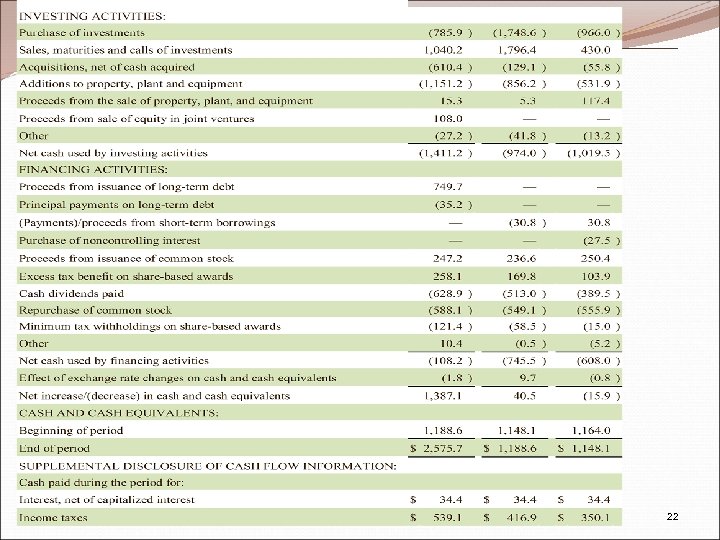

Pw. C 22

Risk Factors & Managements 3 Starbucks Pw. C 23

![General Risk Factors [1/3] Economic conditions in the US and international markets They may General Risk Factors [1/3] Economic conditions in the US and international markets They may](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-24.jpg)

General Risk Factors [1/3] Economic conditions in the US and international markets They may not be successful in implementing important strategic initiatives or effectively managing growth Construction cost increases associated with new store openings and remodeling of existing Delays in store openings for reasons beyond their control or a lack of desirable real estate locations available for lease at reasonable rates Lack of customer acceptance of new products due to price increases necessary to cover the costs of new products or higher input costs Starbucks Pw. C The degree to which they enter into, maintain, develop and are able to negotiate appropriate terms and conditions of, and enforce, commercial and other agreements dicembre 2013 24

deteriorat ion in their credit ratings, which could They face They are limit the intense highly availabilit competitio depende n in y of of each nt on additional their the financing channels financial They are and perform increasin increase markets, ance of gly the cost of which their depende obtaining could lead America nt on the financing General Risk Factors [2/3] Starbucks Pw. C tosuccess reduced s profitability operatin of their g EMEA segment and CAP (74% of operatin consolid g ated segment total net s in revenues order to dicembre 2013 25

Growth targets The performances of the international operations may be affected by: v foreign currency exchange rate fluctuations, or requirements to transact in specific currencies; v changes or uncertainties in economic, legal, regulatory, social and political conditions in their markets; v interpretation and application of laws and regulations; v restrictive actions of foreign or US governmental authorities affecting trade and foreign investment; v import or other business licensing requirements; v the enforceability of intellectual property and contract rights; v limitations on the repatriation of funds and foreign currency exchange restrictions due to current or new US and international regulations; v in developing economies, the growth rate in the portion of the population achieving targeted levels of disposable income may not be as fast as they forecast; v difficulty in staffing, developing and managing foreign operations and supply chain logistics, including ensuring the consistency of product quality and service, due to distance, language and cultural differences, as well as challenges in recruiting and retaining high quality employees in local markets; v local laws that make it more expensive and complex to negotiate with, retain or terminate employees; v delays in store openings for reasons beyond their control, competition with locally relevant competitors or a lack of desirable real estate locations available for lease at reasonable rates; v disruption Starbucks Pw. C in energy supplies affecting their markets. dicembre 2013 26

the cost of their high-quality brands and arabica failure to coffee beans preserve or other their commodities value, or decreases either in the through availability oftheir highactions or quality those of arabica their coffee beans business or other partners, commodities could have a negative Interruptionadverse The of rely an loss of They supply chain impact on key personnel impact on heavily on the or difficulties the business information financial recruiting and financial technology Adversetheir or andresults retaining results. The in public medical price of about opinions qualified operations, the health any personnel of coffee is and effects consumingto subject their material products significant failure, volatility inadequacy, interruption or security General Risk Factors [3/3] Starbucks Pw. C dicembre 2013 27

Financial Condition Financial condition and results of operations are sensitive to, and may be adversely affected by, a number of factors, many of which are largely outside their control: v declines in general consumer demand for specialty coffee products; v increases in labor costs such as increased health care costs, general market wage levels and workers' compensation insurance costs; v adverse outcomes of current or future litigation; v especially in larger or fast growing markets, labor discord, war, terrorism, political instability, boycotts, social unrest, and natural disasters, including health pandemics that lead to avoidance of public places or restrictions on public gatherings such as in their stores. Starbucks Pw. C dicembre 2013 28

Hedging Philosophy Market Risk • the risk of losses due to changes in commodity prices, foreign currency exchange rates, equity security prices, and interest rates Starbuck manages his exposure to various market-based risks according to a market price risk management policy. The market price risk management policy governs how hedging instruments may be used to mitigate risk Risk limits are set annually and prohibit speculative trading activity. Besides, Starbuck also monitors and limits the amount of associated counterparty credit risk. Starbucks Pw. C dicembre 2013 29

Commodity prices, availability and General Risk Conditions Commodity price risk represents Starbucks primary market risk, generated by the purchases of green coffee and dairy products, among other items. Risk arises from the price volatility of green coffee. Starbucks Pw. C dicembre 2013 30

![Financial Risk Management [1/2] Commodity Price Risk • They purchase commodity inputs, including coffee, Financial Risk Management [1/2] Commodity Price Risk • They purchase commodity inputs, including coffee,](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-31.jpg)

Financial Risk Management [1/2] Commodity Price Risk • They purchase commodity inputs, including coffee, dairy products and diesel that are used in the operations and are subject to price fluctuations that impact the financial results. In addition to fixed-price and price-to-be-fixed contracts for coffee purchases, they have entered into commodity hedges to manage commodity price risk using financial derivative instruments. Foreign Currency Exchange Risk • The majority of their revenue, expense and capital purchasing activities are transacted in US dollars. However, because a portion of their operations consists of activities outside of the US, they have transactions in other currencies, primarily the Canadian dollar, Japanese yen, Chinese renminbi, British pound, and euro. • As of September 29, 2013, they had forward foreign exchange contracts that hedge portions of anticipated international revenue streams and inventory purchases + forward foreign exchange contracts that qualify as accounting hedges of their net investment in Starbucks Japan to minimize foreign currency exposure. • Starbucks also had forward foreign exchange contracts that are not designated as hedging instruments for accounting purposes (free standing derivatives), but which largely offset the financial impact of translating certain foreign currency denominated payables and receivables. Equity Security Price Risk Pw. C • They have minimal exposure to price fluctuations on equity mutual funds and equity exchangetraded funds within their trading portfolio. dicembre 2013 31

![Financial Risk Management [2/2] Interest Rate Risk • They utilize short-term and long-term financing Financial Risk Management [2/2] Interest Rate Risk • They utilize short-term and long-term financing](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-32.jpg)

Financial Risk Management [2/2] Interest Rate Risk • They utilize short-term and long-term financing • They may use interest rate hedges to manage the effect of interest rate changes on their existing debt as well as the anticipated issuance of new debt. • As of September 29, 2013 and September 30, 2012, they did not have any interest rate hedge agreements outstanding. Available-for. Sale Securities • Their available-for-sale securities comprise a diversified portfolio consisting mainly of fixed income instruments. The primary objectives of these investments are to preserve capital and liquidity. • They do not hedge the interest rate exposure on our available-for-sale securities. • They performed a sensitivity analysis based on a 100 basis point change in the underlying interest rate of available-for-sale securities as of September 29, 2013, and determined that such a change would not have a significant impact on the fair value of these instruments Pw. C dicembre 2013 32

![Derivative Financial Instruments [1/4] Interest Rates Foreign Currency Starbucks Pw. C • During the Derivative Financial Instruments [1/4] Interest Rates Foreign Currency Starbucks Pw. C • During the](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-33.jpg)

Derivative Financial Instruments [1/4] Interest Rates Foreign Currency Starbucks Pw. C • During the third quarter of fiscal 2013, they entered into forwardstarting interest rate swap agreements with an aggregate notional amount of $750 million. These swaps hedged the variability in cash flows due to changes in the benchmark interest rate related to the $750 million of 10 -year 3. 85% Senior Notes due in October 2023 issued in the fourth quarter of 2013. • They enter into forward and swap contracts to hedge portions of cash flows of anticipated revenue streams and inventory purchases in currencies other than the entity's functional currency. • They also enter into net investment derivative instruments to hedge equity method investment in Starbucks Coffee Japan, Ltd. , to minimize foreign currency exposure. • In addition to the hedging instruments above, to mitigate the translation risk of certain balance sheet items, they enter into certain foreign currency swap contracts that are not designated as hedging instruments. dicembre 2013 33

![Derivative Financial Instruments [2/4] Coffee • Depending on market conditions, they enter into futures Derivative Financial Instruments [2/4] Coffee • Depending on market conditions, they enter into futures](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-34.jpg)

Derivative Financial Instruments [2/4] Coffee • Depending on market conditions, they enter into futures contracts to hedge a portion of anticipated cash flows under price -to-be-fixed green coffee contracts. Dairy • To mitigate the price uncertainty of a portion of future purchases of dairy products, they enter into futures contracts that are not designated as hedging instruments. Diesel Fuel Starbucks Pw. C • To mitigate the price uncertainty of a portion of our future purchases of diesel fuel, they enter into swap contracts that are not designated as hedging instruments. dicembre 2013 34

![Derivative Financial Instruments [3/4] The following table presents the pretax effect of derivative contracts Derivative Financial Instruments [3/4] The following table presents the pretax effect of derivative contracts](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-35.jpg)

Derivative Financial Instruments [3/4] The following table presents the pretax effect of derivative contracts designated as hedging instruments on earnings and other comprehensive income ("OCI") for fiscal years ending (in millions): Starbucks Pw. C dicembre 2013 35

![Derivative Financial Instruments [4/4] The following table presents the pretax effect of derivative contracts Derivative Financial Instruments [4/4] The following table presents the pretax effect of derivative contracts](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-36.jpg)

Derivative Financial Instruments [4/4] The following table presents the pretax effect of derivative contracts not designated as hedging instruments on earnings for fiscal years ending (in millions): Notional amounts of outstanding derivative contracts (in millions): Starbucks Pw. C dicembre 2013 36

Company Overview 1 Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 38

Core Business v One of the world's leading franchisors of quick service restaurants (“QSRs”) serving hot and cold coffee and baked goods, as well as hard serve ice cream v Operate business in four segments: Dunkin' Donuts U. S. , Dunkin' Donuts International, Baskin-Robbins International and Baskin-Robbins U. S. Starbucks Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 39

The mission of the company At Dunkin' Brands, community is the heart of our business. That's why we established The Dunkin' Donuts & Baskin-Robbins Community Foundation. Working in partnership with Dunkin' Donuts and Baskin-Robbins franchisees across the country, the Foundation serves the basic needs of our communities through food for the hungry, safety and children's health. It's what we do every day. Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 40

Global Expansion- Dunkin' Donuts 3, 100 stores in 30 countries outside of the U. S. - Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 41

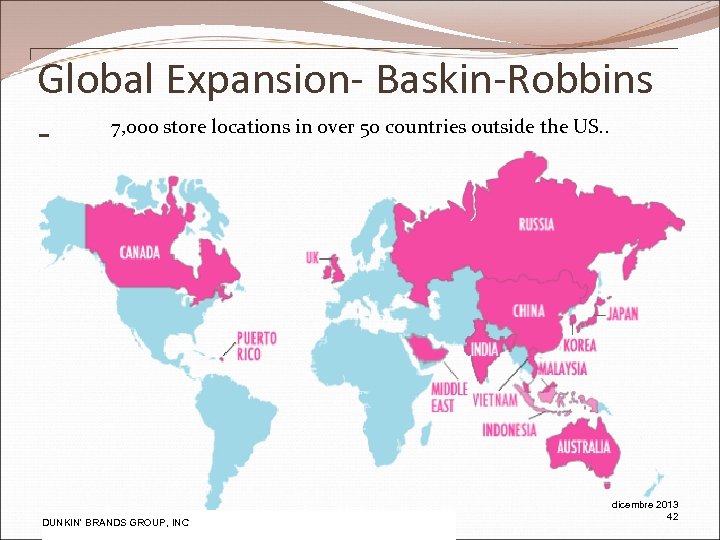

Global Expansion- Baskin-Robbins - 7, 000 store locations in over 50 countries outside the US. . Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 42

Price Stock Starbucks Corporation’s common stock is listed on NASDAQ, under the trading symbol “SBUX”. The price of the stock is around 80 us$ Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 43

Financial Statement 2 Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 44

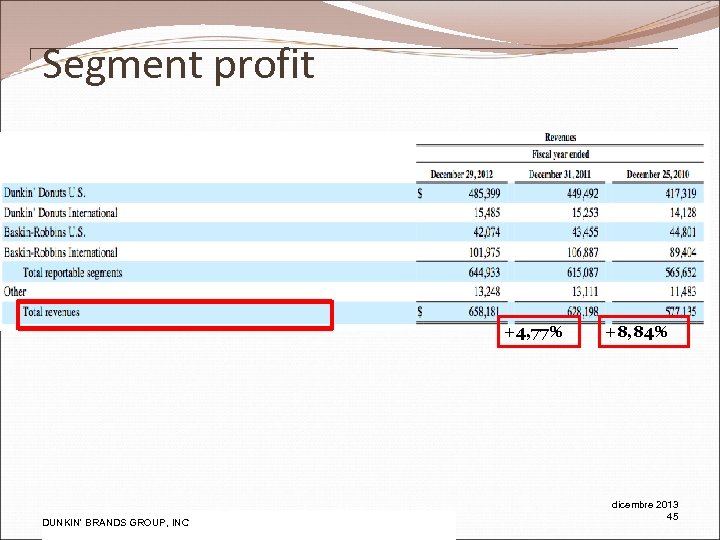

Segment profit +4, 77% Pw. C DUNKIN' BRANDS GROUP, INC +8, 84% dicembre 2013 45

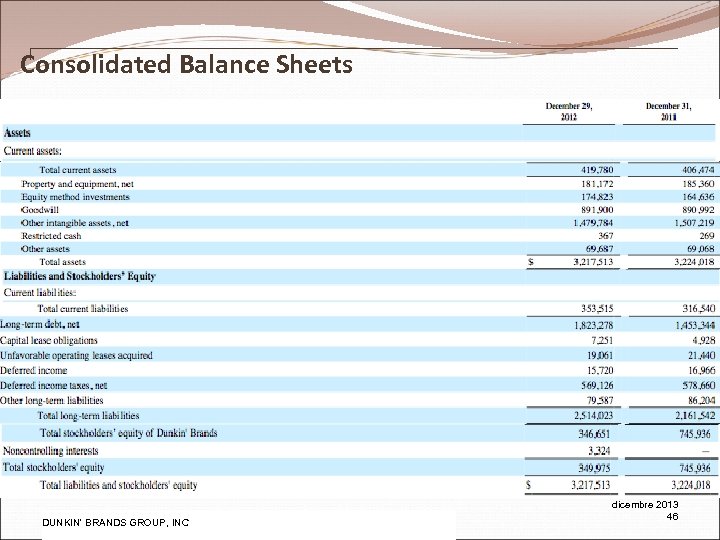

Consolidated Balance Sheets Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 46

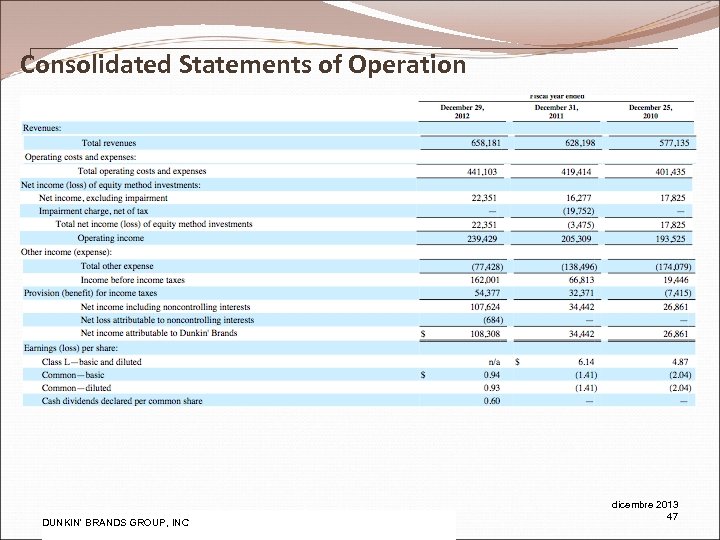

Consolidated Statements of Operation Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 47

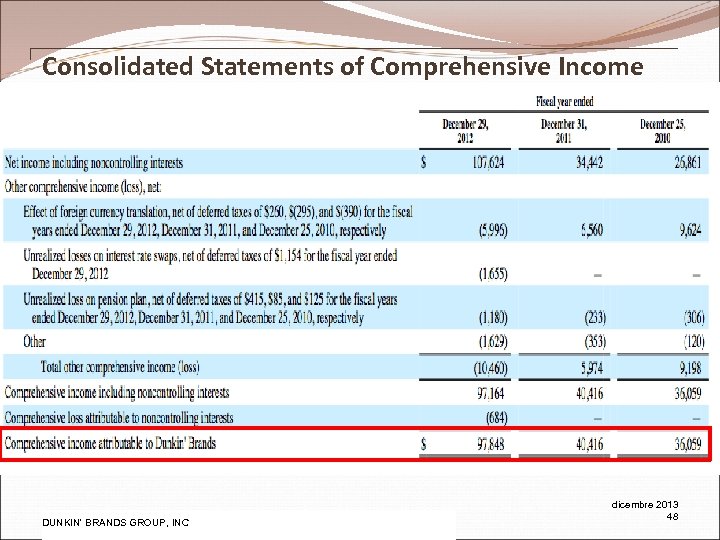

Consolidated Statements of Comprehensive Income Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 48

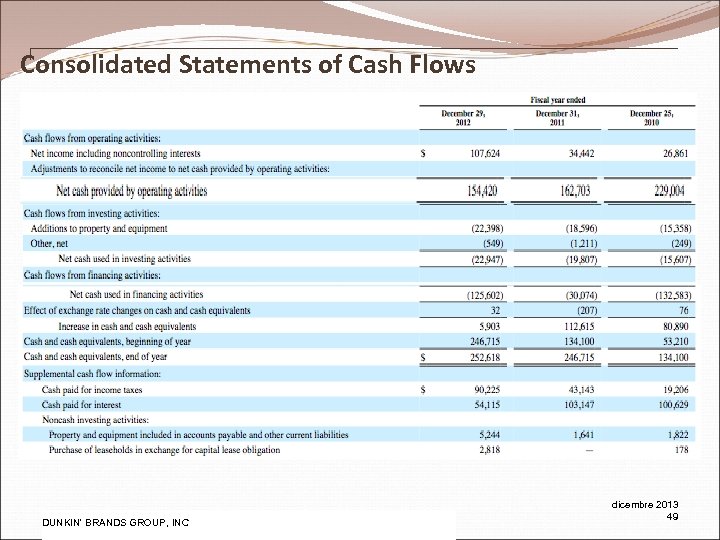

Consolidated Statements of Cash Flows Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 49

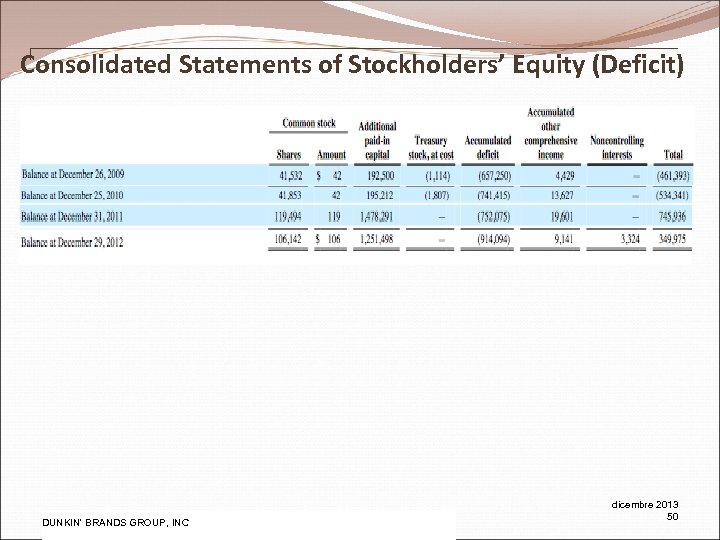

Consolidated Statements of Stockholders’ Equity (Deficit) Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 50

Risk Factors & Managements 3 Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 51

![General Risk Factors [1/2] Financial results are affected by THE OPERATING RESULTS OF FRANCHISEES General Risk Factors [1/2] Financial results are affected by THE OPERATING RESULTS OF FRANCHISEES](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-52.jpg)

General Risk Factors [1/2] Financial results are affected by THE OPERATING RESULTS OF FRANCHISEES The quick service restaurant segment is highly competitive, and COMPETITION could lower revenues. The restaurant industry is affected by consumer PREFERENCES AND PERCEPTIONS. Changes in these preferences and perceptions may lessen the demand for products, which could reduce sales by franchisees and reduce royalty revenues. The substantial INDEBTEDNESS could adversely affect the financial condition (As of December 29, 2012, the total indebtedness was approximately $1. 9 billion) Starbucks Pw. C ECONOMIC CONDITIONS ADVERSELY AFFECTING CONSUMER discretionary spending may negatively impact the business and operating results. It is not possible to predict THE IMPACT that the following may have on the business: (i) NEW OR IMPROVED TECHNOLOGIES, (ii) ALTERNATIVE METHODS OF DELIVERY OR (iii) changes in consumer behavior facilitated by these technologies and alternative methods dicembre 2013 52

![General Risk Factors [2/2] The business is subject to various LAWS AND REGULATIONS and General Risk Factors [2/2] The business is subject to various LAWS AND REGULATIONS and](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-53.jpg)

General Risk Factors [2/2] The business is subject to various LAWS AND REGULATIONS and changes in such laws and regulations could adversely affect it. Failure to retain the existing senior management team or the inability to attract and retain new QUALIFIED PERSONNEL could hurt the business and inhibit the ability to operate and grow successfully. LITIGATION RISK could affect it adversely by subjecting it to significant money damages and other remedies or by increasing our litigation expense. If the company FAIL TO SUCCESSFULLY IMPLEMENT THE GROWTH STRATEGY, which includes opening new domestic and international restaurants, the ability to increase revenues and operating profits could be adversely affected Starbucks Pw. C If the international markets in which the company compete are affected by CHANGES IN POLITICAL, SOCIAL, LEGAL, ECONOMIC OR OTHER FACTORS, the business and operating results may be materially and adversely ADVERSE PUBLIC affected. OR MEDICAL OPINIONS about the health effects of consuming the products of the company, as well as reports of incidents involving food-borne illnesses or food tampering, whether or not accurate, could harm the brands and the dicembre 2013 53

Risks related to the common stock The stock price could be extremely VOLATILE and, as a result, you may not be able to resell your shares at or above the price you paid for them. . The certificate of incorporation and bylaws and Delaware law contain provisions which could make it HARDER FOR A THIRD PARTY TO ACQUIRE THE COMPANY, even if doing so might be beneficial to the stockholders. Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 54

Market risks THE RISK OF LOSSES DUE TO CHANGES IN COMMODITY PRICES, FOREIGN CURRENCY EXCHANGE RATES, EQUITY SECURITY PRICES, AND INTEREST RATES Hedging Philosophy The Company uses derivative instruments to mitigate the impact of these changes. • The Company does not use derivatives with a level of complexity or with a risk higher than the exposures to be hedged and does not hold or issue derivatives for trading purposes. • The Company's risk management objective and strategy with respect to the interest rate swaps is to limit the Company's exposure to increased interest rates on its variable rate debt by reducing the potential variability in cash flow requirements relating to interest payments on a portion of its outstanding debt. • The Company documents its risk management objective and strategy for dicembre 2013 Pw. C undertaking hedging transactions, as well as all relationships between 55 hedging instruments and hedged items.

![Derivative instruments and hedging transactions[1/3] The table below summarizes the effects of derivative instruments Derivative instruments and hedging transactions[1/3] The table below summarizes the effects of derivative instruments](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-56.jpg)

Derivative instruments and hedging transactions[1/3] The table below summarizes the effects of derivative instruments on the consolidated statements of operations and comprehensive income for fiscal year 2012 : Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 56

![Derivative instruments and hedging transactions[2/3] Interest Rate Risk • variable-to-fixed interest rate swap agreements Derivative instruments and hedging transactions[2/3] Interest Rate Risk • variable-to-fixed interest rate swap agreements](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-57.jpg)

Derivative instruments and hedging transactions[2/3] Interest Rate Risk • variable-to-fixed interest rate swap agreements to hedge the floating interest rate • In the future, the company may enter into additional hedging instruments, involving the exchange of floating for fixed rate interest payments, to reduce interest rate volatility. Foreign Currency Exchange Risk • In the future, the company may consider the use of derivative financial instruments, such as forward contracts, to manage foreign currency exchange rate risks. Pw. C dicembre 2013 57

![Derivative instruments and hedging transactions[3/3] The Company is exposed to credit-related losses in the Derivative instruments and hedging transactions[3/3] The Company is exposed to credit-related losses in the](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-58.jpg)

Derivative instruments and hedging transactions[3/3] The Company is exposed to credit-related losses in the event of non-performance by the counterparties to its hedging instruments. The Company ONLY ENTERS INTO CONTRACTS WITH MAJOR FINANCIAL INSTITUTIONS based upon their credit ratings and other factors, and continually assesses the creditworthiness of its counterparties. The Company has agreements with each of its derivative counterparties that contain a provision whereby if the Company defaults on any of its indebtedness, then the Company could also be declared in DEFAULT ON ITS DERIVATIVE OBLIGATIONS Pw. C DUNKIN' BRANDS GROUP, INC dicembre 2013 58

Green Mountain Coffee

Company Overview 1 Green Mountain Coffee Pw. C dicembre 2013 60

![Business [1/3] ● Green Mountain Coffee Roasters, Inc. is the American leader in the Business [1/3] ● Green Mountain Coffee Roasters, Inc. is the American leader in the](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-61.jpg)

Business [1/3] ● Green Mountain Coffee Roasters, Inc. is the American leader in the coffee and coffeemaker businesses ● Keurig, a“single-cup brewing systems” producer acquired by GMCR, spread the use of K-Cups (plastic container with a coffee filter inside) ● It offers whole bean, ground coffee and beverages in packs (tea, cocoa, fruit)

![Business [2/3] ● 2012: top four best-selling coffeemakers for the volume in USA ● Business [2/3] ● 2012: top four best-selling coffeemakers for the volume in USA ●](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-62.jpg)

Business [2/3] ● 2012: top four best-selling coffeemakers for the volume in USA ● Production and distribution divisions: USA and Canada ● Main strategies: ● increasing and managing programs in order to spread Keurig “Single Cup Brewer” in North America ● to be the leader in coffee field offering a high-quality and an innovative “Single Cup Brewing” technology • Competitive advantage: quality, convenience, variety ‘‘We create the ultimate beverage experience in every life we touch from tree to cup—transforming the way the world understands business’’

![Business [3/3] ● Social responsability Local communities partnership (supply chain), protecting the environment, sustainable Business [3/3] ● Social responsability Local communities partnership (supply chain), protecting the environment, sustainable](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-63.jpg)

Business [3/3] ● Social responsability Local communities partnership (supply chain), protecting the environment, sustainable products, Fair Trade certified sources (Rain Forest Alliance Certified farms) ● Brewing A Better World Foundation supports charitable organizations (help to local communities ) ● Employees 5800 full-time, part-time and seasonale • Competitors: coffee segment producers and coffeemakers sellers Constant innovation and high quality brings to superior cup of coffee

Financial Statement 2 Green Mountain Coffee Pw. C dicembre 2013 64

![Analysis of financial condition [1/4] ● Partnership with famous brands: Starbucks, Lavazza, Millstone, Twining Analysis of financial condition [1/4] ● Partnership with famous brands: Starbucks, Lavazza, Millstone, Twining](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-65.jpg)

Analysis of financial condition [1/4] ● Partnership with famous brands: Starbucks, Lavazza, Millstone, Twining of London (these brands are used with permission from each owner who has the property) ● Last years huge demand of single cup specialty coffee ● Different locations: home, office, professional locations, restaurants, hospitality and specialty coffee shops ● Increase the business: expanding consumer awarness/choice and new regions ● New launches: Keurig Rivo Cappuccino and Latte System and Rivo pack espresso blend varieties in partnership with Lavazza. Wellness Brewed collection which includes coffees, teas and Vitamin Burst fruit brew beverages (antioxidant vitamins)

![Analysis of financial conditions [2/4] 2012 ● Net sales of $3, 859. 2 million Analysis of financial conditions [2/4] 2012 ● Net sales of $3, 859. 2 million](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-66.jpg)

Analysis of financial conditions [2/4] 2012 ● Net sales of $3, 859. 2 million ● Gross profit $1, 269. 4 million ● Growth of 36% over 2011 $477. 8 million in cash from operations Innovation brings a more complicated product its performance in sales returns rates to possibly fluctuate

![Analysis of financial conditions [3/4] ● Operating segments: ● Specialty Coffee unit (SCBU) ● Analysis of financial conditions [3/4] ● Operating segments: ● Specialty Coffee unit (SCBU) ●](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-67.jpg)

Analysis of financial conditions [3/4] ● Operating segments: ● Specialty Coffee unit (SCBU) ● Keurig business unit (KBU) ● Canadian business unit (CBU)

![Analysis of financial conditions [4/4] Non-GAAP method Exclude transaction cost related to GMCR acquisitions Analysis of financial conditions [4/4] Non-GAAP method Exclude transaction cost related to GMCR acquisitions](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-68.jpg)

Analysis of financial conditions [4/4] Non-GAAP method Exclude transaction cost related to GMCR acquisitions Greater transparency for investor Better evalutation and trends of financial and business

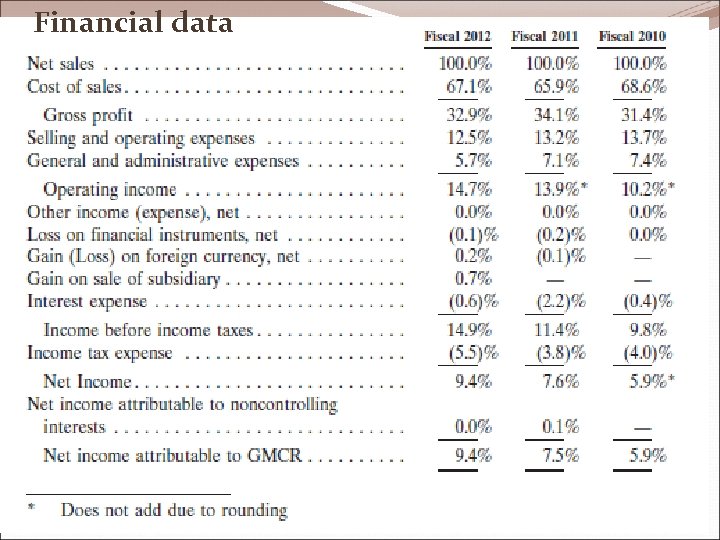

Financial data

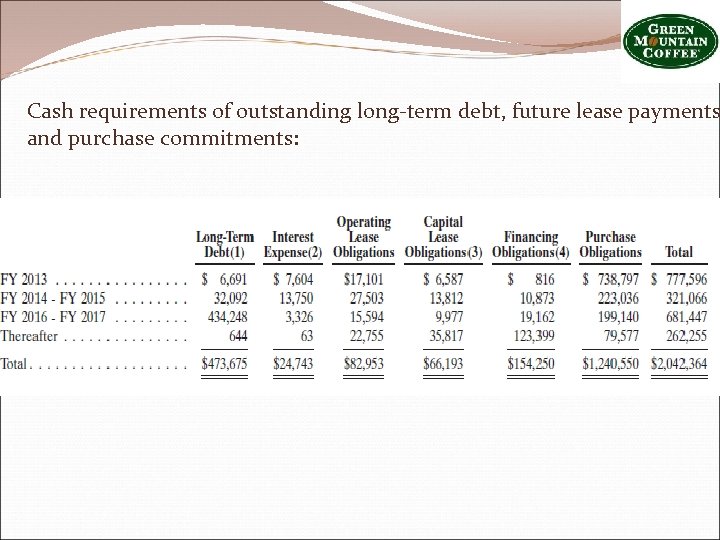

Cash requirements of outstanding long-term debt, future lease payments and purchase commitments:

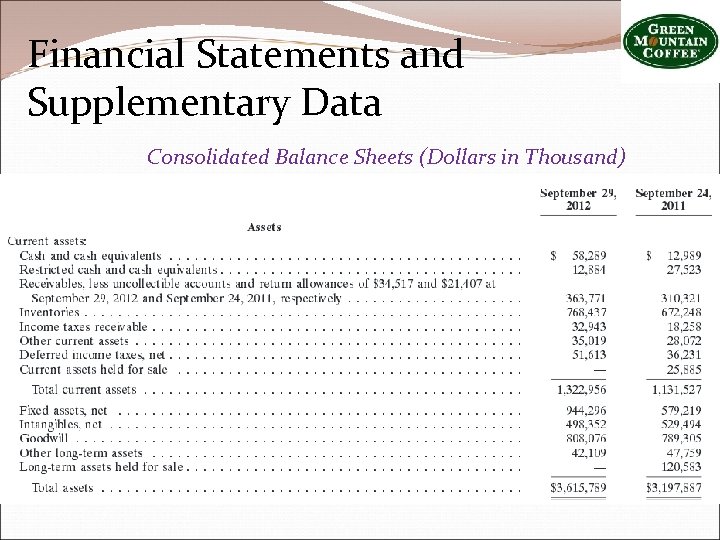

Financial Statements and Supplementary Data Consolidated Balance Sheets (Dollars in Thousand)

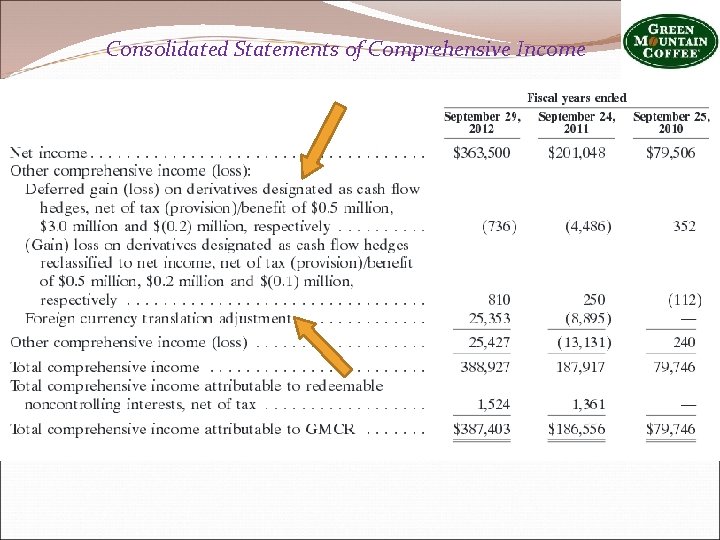

Consolidated Statements of Comprehensive Income

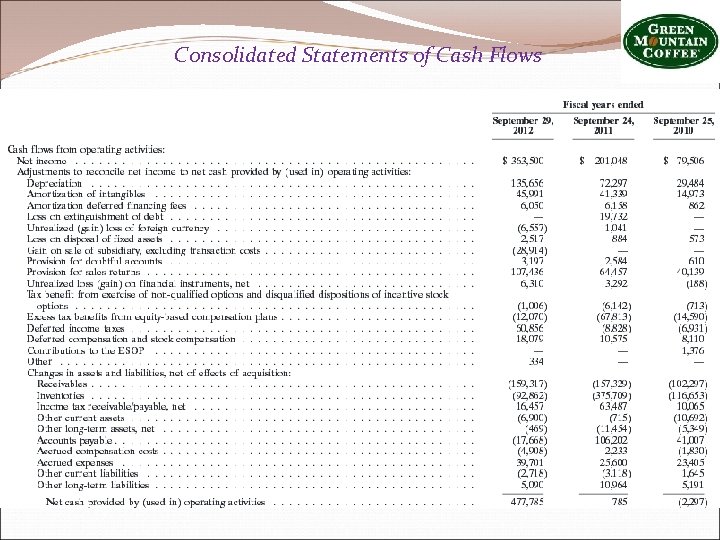

Consolidated Statements of Cash Flows

Risk Factors & Managements 3 Green Mountain Coffee Pw. C dicembre 2013 77

Risk factors Risks for any company: changes in industry and market conditions, political condition, competition and currency exchange rate Risk due to internal operation Risk due to the industry • Revenues depends on the Keurig's sales • Increase of coffee beans price • High competition can effect profitability • Changes in global economic • Negative impact on company's reputation conditions (or US economy) • Product recall/sales returns • • Failure in business relationships • Wrong forcast on demand • Law and regulation • Currency exchange risk • Seasonality of many products Investigations by Government

![Quantitative and Qualitative Disclosures about Market Risk [1/4] Interest rate risk (cash flows rated) Quantitative and Qualitative Disclosures about Market Risk [1/4] Interest rate risk (cash flows rated)](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-79.jpg)

Quantitative and Qualitative Disclosures about Market Risk [1/4] Interest rate risk (cash flows rated) 2012 $238 million of outstanding debt obligations subject to variable interest rates increase by 100 basis points Additional interest expense of $2. 4 million annually

![Quantitative and Qualitative Disclosures about Market Risk [2/4] Commodity price risk Fluctuations causes: Weather Quantitative and Qualitative Disclosures about Market Risk [2/4] Commodity price risk Fluctuations causes: Weather](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-80.jpg)

Quantitative and Qualitative Disclosures about Market Risk [2/4] Commodity price risk Fluctuations causes: Weather ● Political ● Economic conditions in coffee-producing countries ● Gross profit margins could be significantly impacted by changes in the commodity price of coffee. GMCR fixes coffee price contracts 3/9 months before the delivery in order to adjust its sales prices to the market place. September 2012 this company held outstanding futures contracts to cover 3. 2£ M of coffee

![Quantitative and Qualitative Disclosures about Market Risk [3/4] Foreign currency exchange rate risk ● Quantitative and Qualitative Disclosures about Market Risk [3/4] Foreign currency exchange rate risk ●](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-81.jpg)

Quantitative and Qualitative Disclosures about Market Risk [3/4] Foreign currency exchange rate risk ● Risk related especially with CBU ● Brewers from countries outside USA ● ● Majority of transactions are made in Canadian Dollar (positively affected when the United States dollar strengthens against the Canadian dollar) ITEM 8: GMCR hedges foreign currency exposure of a portion of our assets and liabilities denominated in Canadian dollars (at fair value)

![Quantitative and Qualitative Disclosures about Market Risk [4/4] Foreign currency exchange rate risk ● Quantitative and Qualitative Disclosures about Market Risk [4/4] Foreign currency exchange rate risk ●](https://present5.com/presentation/48516ebd51b9bb4d62fb81b3748640a5/image-82.jpg)

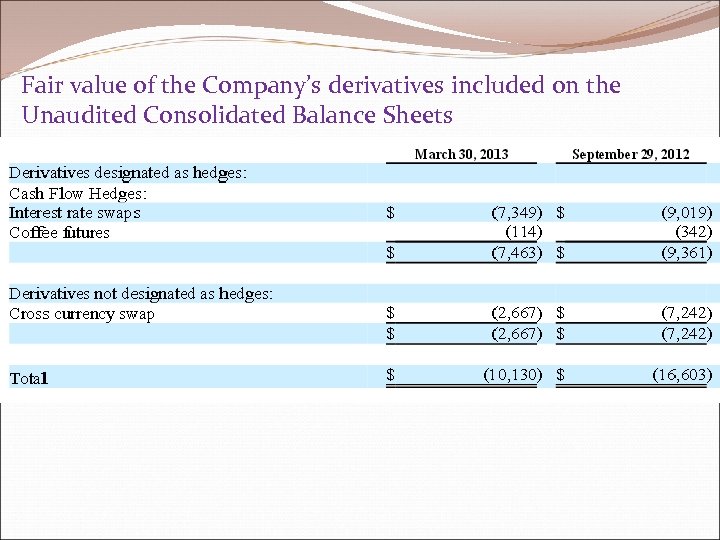

Quantitative and Qualitative Disclosures about Market Risk [4/4] Foreign currency exchange rate risk ● September 2012 GMCR held 4 -year cross-currency swap of Canadian Dollar $140 million that was not designated as a hedging instrument for accounting purposes: principal payments on the cross-currency swap are settled on an annual basis to match the repayments on the note receivable and the swap is adjusted to fair value each period ● GMCR uses foreign currency forward contracts to hedge certain capital purcha Liabilities for production (minimizing cost risk of market fluctuations). Any outstanding foreign currency forward contracts in September 2012

Fair value of the Company’s derivatives included on the Unaudited Consolidated Balance Sheets

CONCLUSION ØDerivative instruments are not common in this type of market; Ø Common risks among the 3 companies: -Interest Rate Risk; -Commodity Price Risk -Foreign Exchange Risk Ø Instrument used: Contract with the supplier; Interest Rate Swap; Foreign Currency Forward, Cross Currency Swap 84

Thanks fo r your atten tion!!! Any questions? ? 85

REFERENCES Annual report Starbucks, http: //www. starbucks. com/ Annual report Dunkin’ Donuts, http: //www. dunkindonuts. com/dunkindonuts/en. html https: //www. baskinrobbins. com/content/baskinrobbins/en. html Annual report Green Mountain, http: //www. greenmountaincoffee. com/ International Coffee Organization http: //www. ico. org/ http: //en. wikipedia. org/wiki/Economics_of_coffee http: //www. ibtimes. com/coffee-beans-market-watch-2014 -1436836 http: //blackgoldmovie. com/economics-of-coffee http: //www. coffeeresearch. org/marketintro. htm http: //www. iandmsmith. com/index. php? q=con, 29, %20 Coffee_Market_Report http: //www. cmegroup. com/trading/agricultural/softs/coffee. html https: //globalderivatives. nyx. com/products/commodities-futures/RC-DLON 86

48516ebd51b9bb4d62fb81b3748640a5.ppt