34c4e7cc898348e18210d9f819ac5fcf.ppt

- Количество слайдов: 30

BEAR-ing the Markets “ How do I restore my clients confidence in a long-term investing approach? ” “ How do I build stronger consultative relationships without sacrificing the time I need to prospect and service higher net worth clients? ” IFS-A 074563 For Financial Professional Use Only

Remember the Basics. . . For Financial Professional Use Only

A Successful Managed Money Program includes: 1. Asset Allocation & Diversification 2. Professional Money Management 3. Rigorous, Ongoing Due Diligence • Research, Research! 4. Competitive Portfolios Can You Offer This To Your Client? For Financial Professional Use Only

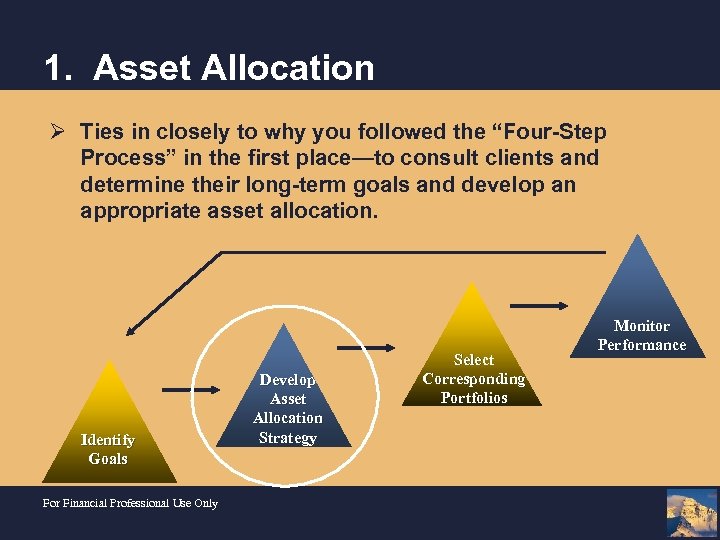

1. Asset Allocation Ø Ties in closely to why you followed the “Four-Step Process” in the first place—to consult clients and determine their long-term goals and develop an appropriate asset allocation. Identify Goals For Financial Professional Use Only Develop Asset Allocation Strategy Select Corresponding Portfolios Monitor Performance

1. Asset Allocation Ø Covers the range of asset classes, providing clients better diversification and returns despite short-term market fluctuations/trends. • • • Large-Cap Growth Large-Cap Value Small-Cap Growth Small-Cap Value International Equity For Financial Professional Use Only • • International Bond Total Return Bond Intermediate-Term Bond Mortgage-Backed Securities • U. S. Government Money Market

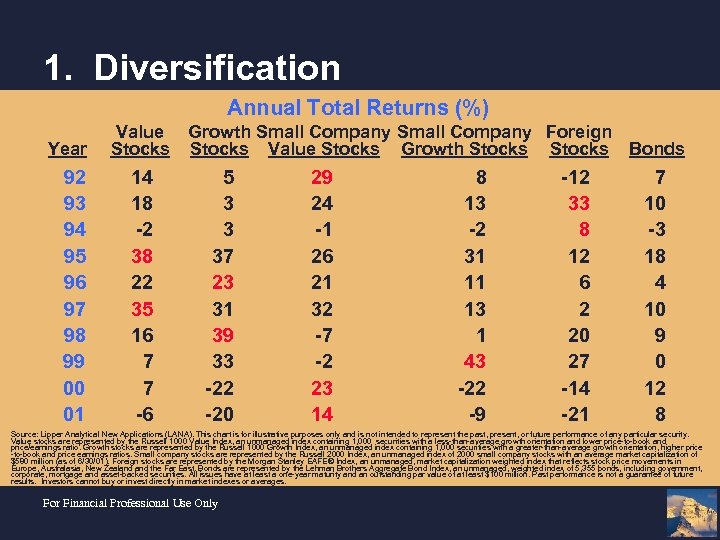

1. Diversification Annual Total Returns (%) Year 92 93 94 95 96 97 98 99 00 01 Value Stocks 14 18 -2 38 22 35 16 7 7 -6 Growth Small Company Foreign Stocks Value Stocks Growth Stocks Bonds 5 3 3 37 23 31 39 33 -22 -20 29 24 -1 26 21 32 -7 -2 23 14 8 13 -2 31 11 13 1 43 -22 -9 -12 33 8 12 6 2 20 27 -14 -21 7 10 -3 18 4 10 9 0 12 8 Source: Lipper Analytical New Applications (LANA). This chart is for illustrative purposes only and is not intended to represent the past, present, or future performance of any particular security. Value stocks are represented by the Russell 1000 Value Index, an unmanaged index containing 1, 000 securities with a less-than-average growth orientation and lower price-to-book and price/earnings ratio. Growth stocks are represented by the Russell 1000 Growth Index, an unmanaged index containing 1, 000 securities with a greater-than-average growth orientation, higher price -to-book and price earnings ratios. Small company stocks are represented by the Russell 2000 Index, an unmanaged index of 2000 small company stocks with an average market capitalization of $580 million (as of 6/30/01). Foreign stocks are represented by the Morgan Stanley EAFE® Index, an unmanaged, market capitalization weighted index that reflects stock price movements in Europe, Australasia, New Zealand the Far East. Bonds are represented by the Lehman Brothers Aggregate Bond Index, an unmanaged, weighted index of 5, 355 bonds, including government, corporate, mortgage and asset-backed securities. All issues have at least a one-year maturity and an outstanding par value of at least $100 million. Past performance is not a guarantee of future results. Investors cannot buy or invest directly in market indexes or averages. For Financial Professional Use Only

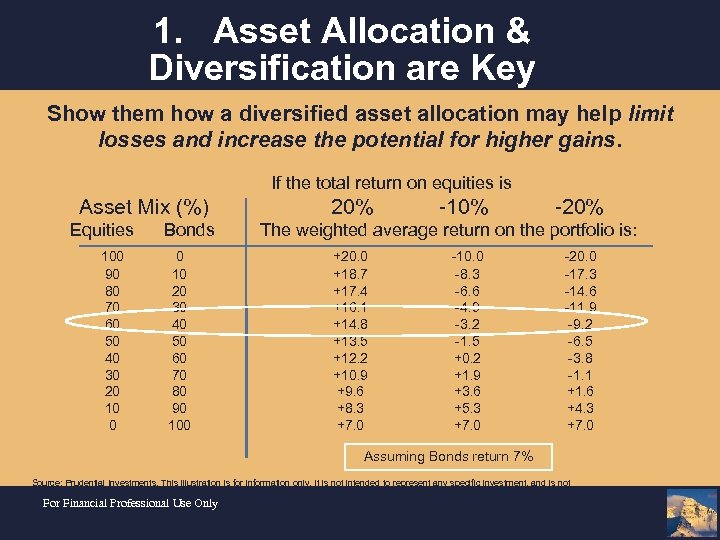

1. Asset Allocation & Diversification are Key Show them how a diversified asset allocation may help limit losses and increase the potential for higher gains. If the total return on equities is Asset Mix (%) Equities 100 90 80 70 60 50 40 30 20 10 0 Bonds 0 10 20 30 40 50 60 70 80 90 100 20% -10% -20% The weighted average return on the portfolio is: +20. 0 +18. 7 +17. 4 +16. 1 +14. 8 +13. 5 +12. 2 +10. 9 +9. 6 +8. 3 +7. 0 -10. 0 -8. 3 -6. 6 -4. 9 -3. 2 -1. 5 +0. 2 +1. 9 +3. 6 +5. 3 +7. 0 -20. 0 -17. 3 -14. 6 -11. 9 -9. 2 -6. 5 -3. 8 -1. 1 +1. 6 +4. 3 +7. 0 Assuming Bonds return 7% Source: Prudential Investments. This illustration is for information only. It is not intended to represent any specific investment, and is not indicative of past or future performance. For Financial Professional Use Only

2. Professional Money Managers • Experienced group of independent managers whose typical clients include Pension Funds and Fortune 500 companies. • Have a long-term discipline, style consistency and knowledge in retaining/growing your assets. For Financial Professional Use Only

3. Rigorous On-going Due Diligence Does the Program meet SIRG’s criteria/mandates? • Onsite Due Diligence Visits • Inhouse Due Diligence Visits • Manager Research Reports • Worth Knowings • Quarterly Commentaries / Attribution Analysis • 6 Metric Analysis For Financial Professional Use Only

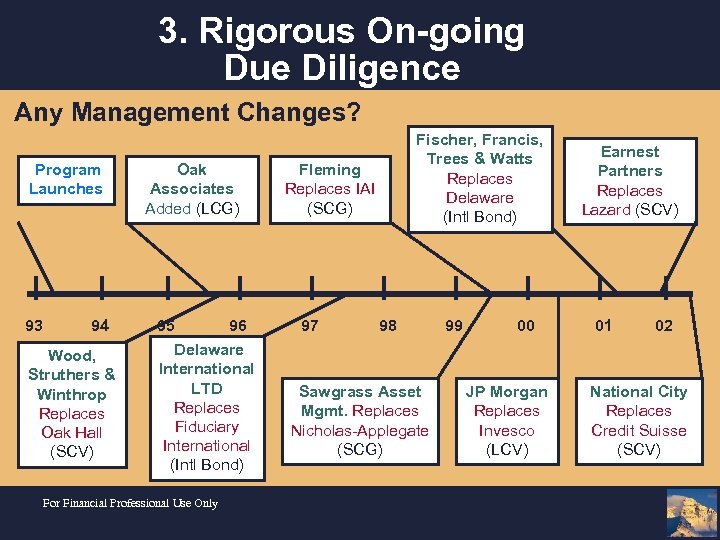

3. Rigorous On-going Due Diligence Any Management Changes? Program Launches 93 94 Wood, Struthers & Winthrop Replaces Oak Hall (SCV) Oak Associates Added (LCG) 95 96 Delaware International LTD Replaces Fiduciary International (Intl Bond) For Financial Professional Use Only Fischer, Francis, Trees & Watts Replaces Delaware (Intl Bond) Fleming Replaces IAI (SCG) 97 98 Sawgrass Asset Mgmt. Replaces Nicholas-Applegate (SCG) 99 00 JP Morgan Replaces Invesco (LCV) Earnest Partners Replaces Lazard (SCV) 01 02 National City Replaces Credit Suisse (SCV)

4. Competitive Strategies • A program that truly has “best in breed” strategies should seek to show over time that they have consistently performed in line or outperformed their respective benchmarks. • Managers in each domestic equity asset class should give clients style diversity while mitigating risk. • Strategies that are competitive with respect to their blended benchmark indexes over the long term. For Financial Professional Use Only

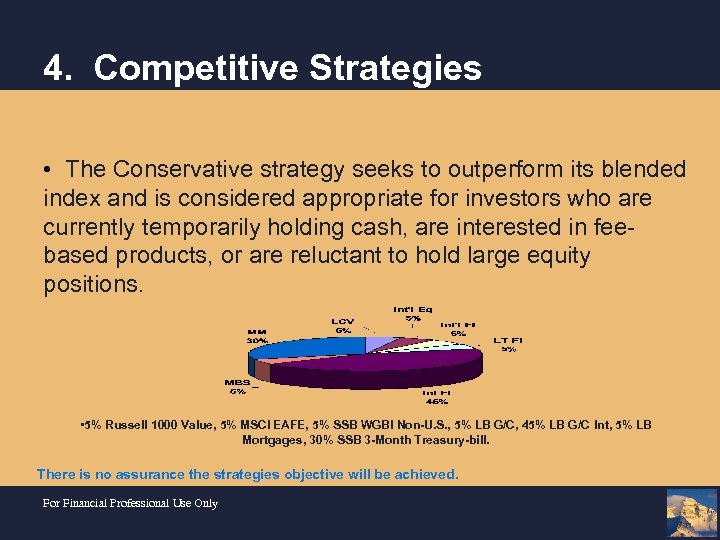

4. Competitive Strategies • The Conservative strategy seeks to outperform its blended index and is considered appropriate for investors who are currently temporarily holding cash, are interested in feebased products, or are reluctant to hold large equity positions. • 5% Russell 1000 Value, 5% MSCI EAFE, 5% SSB WGBI Non-U. S. , 5% LB G/C, 45% LB G/C Int, 5% LB Mortgages, 30% SSB 3 -Month Treasury-bill. There is no assurance the strategies objective will be achieved. For Financial Professional Use Only

4. Competitive Strategies • The Moderate strategy seeks to outperform its blended index over the long term and is suitable for investors who are willing to assume greater risk in return for potential long-term gains. • 15% Russell 1000 Growth, 20% Russell 1000 Value, 5% Russell 2000 Growth, 5% Russell 2000 Value, 15% MSCI EAFE, 25% LB G/C Int, 15% LB Mortgages. There is no assurance the strategies objective will be achieved. For Financial Professional Use Only

4. Competitive Strategies • The Aggressive strategy seeks to outperform its blended index over longer time periods, and outperform the S&P 500 Index. This strategy fits individuals looking for maximum long -term gains, but who are comfortable with short-term volatility. *25% Russell 1000 Growth, 25% Russell 1000 Value, 20% Russell 2000 Growth, 15% Russell 2000 Value, 15% MSCI EAFE. There is no assurance the strategies objective will be achieved. For Financial Professional Use Only

4. Competitive Strategies Rebalancing—an important tool In addition to other features, a program should offer automatic rebalancing option (quarterly or annually) that helps take the emotion out of investing, keeps clients on track to achieve their goals, and is critical to long-term success. Emotions usually drive investing behavior, and clients are sometimes reluctant to sell the winners in their portfolio and invest in sectors and securities that have recently underperformed. For Financial Professional Use Only

4. Competitive Strategies Automatic rebalancing also saves you from having to manually readjust your clients’ portfolios to account for market activity, thus freeing you up to devote more time to prospecting and servicing clients. For Financial Professional Use Only

? ? What program provides asset allocation & diversification, style consistency, due diligence, rebalancing, and competitive strategies? ? For Financial Professional Use Only ? ?

The TARGET Program For Financial Professional Use Only

Competitive Performance For more details on performance, refer to the TARGET Quarterly Performance Illustrations on the Managed Money website. For Financial Professional Use Only

Institutional Managers For Financial Professional Use Only

Institutional Managers Fund Manager Assets Under Management Large-Cap Growth Columbus Circle Investors Oak Associates, Ltd. $ Large-Cap Value JP Morgan Fleming Asset Mgt. Hotchkis & Wiley Capital Mgmt. $ 600 Billion 4. 9 Billion 1838 1980 $ 15 Million 10 Million Small-Cap Growth Sawgrass Asset Management JP Morgan Fleming Asset Mgt. $ 1. 6 Billion 600 Billion 1998 1838 $ 5 Million 15 Million Small-Cap Value National City Earnest Partners $ 28. 3 Billion 1845 2. 16 Billion 1989 $ 10 Million $ 65. 7 Billion 1848 $ 5 Million International Lazard Asset Management Equity For Financial Professional Use Only Since 3. 8 Billion 1975 14 Billion 1985 Sep. Acct Minimum $ 10 Million 3 Million

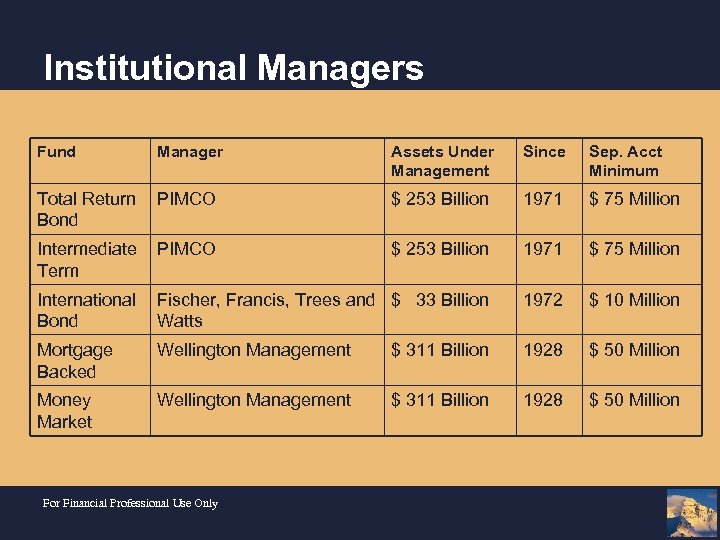

Institutional Managers Fund Manager Assets Under Management Since Sep. Acct Minimum Total Return Bond PIMCO $ 253 Billion 1971 $ 75 Million Intermediate Term PIMCO $ 253 Billion 1971 $ 75 Million International Bond Fischer, Francis, Trees and $ 33 Billion Watts 1972 $ 10 Million Mortgage Backed Wellington Management $ 311 Billion 1928 $ 50 Million Money Market Wellington Management $ 311 Billion 1928 $ 50 Million For Financial Professional Use Only

Domestic Equity / Stock classes are Co-managed Two leading money managers seek to smooth out fluctuations in investment returns without sacrificing the potential for higher returns in the TARGET Program. Large-Cap Growth – Oak Associates – Columbus Circle Large-Cap Value – Hotchkis & Wiley – JP Morgan Fleming For Financial Professional Use Only Small-Cap Growth – JP Morgan Fleming – Sawgrass Small-Cap Growth – National City – EARNEST Partners

Program Overview • Comprehensive Fee-Based Mutual Fund Program • 4 Step Investment Management Process 1. 2. 3. 4. Identify Goals Develop Asset Allocation Select Mutual Funds Monitor Performance • All inclusive, asset-based fee • $25, 000 minimum for retail accounts • $10, 000 minimum for retirement/custodial accts • Non-discretionary, all decisions are up to the client For Financial Professional Use Only

Fees § Retail Accounts 1. 50% Equity - 1. 40% FA Gross 1. 00% Fixed Income -. 90% FA Gross § Retirement Accounts 1. 25% Equity - 1. 20% FA Gross 1. 35% Fixed Income - 1. 30% FA Gross • Grid + 5 bp; 1 st year upfront payout option • Discounts depend on asset level, down to 25 bp For Financial Professional Use Only

Other Benefits: & Annual summaries Quarterly • Informs your clients about market developments • Measures your client’s progress towards their financial goals • Helps evaluate your client’s asset allocation strategy • Monitors performance of investments • Reviews activity in client’s account For Financial Professional Use Only

Your Business: Practice Management • Latest Program News or Fund News • Monthly Performance • Quarterly Performance Fact Sheets • Analyst Research Reports • Manager Commentaries • Marketing Materials • Worth Knowings For Financial Professional Use Only

Thank You For Financial Professional Use Only

For Additional Information Please contact your Sales Desk Associate or Tech Analyst, or visit our Managed Money website for additional info. For Financial Professional Use Only

Disclosures Target is a managed money program which may not be suitable for all investors. The Target Portfolio Trust is distributed by Prudential Investment Management Services, LLC (PIMS), Three Gateway Center, 14 th Floor, Newark, NJ 07102 -4077. The Target Program is offered by Prudential Securities Incorporated (member SIPC), 199 Water Street, New York, NY 10292, and Pruco Securities Corporation (member SIPC), 751 Broad Street, Newark, NJ 07102 -3777. All are Prudential Financial companies. Prudential Financial is a service mark of Prudential, Newark, NJ, and its affiliates. Neither Prudential nor its affiliates are legal or tax advisers. See the Target Portfolio Trust’s prospectus for more information on the funds available in the Target Program. For Financial Professional Use Only

34c4e7cc898348e18210d9f819ac5fcf.ppt