3c76ae76defcc47d7cc6b82ac852e411.ppt

- Количество слайдов: 16

BCG Matrix for ITC Ltd.

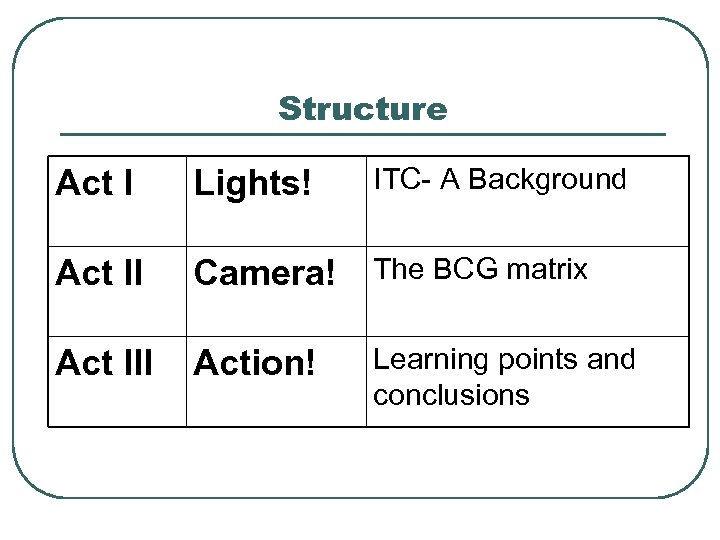

Structure ITC- A Background Act I Lights! Act II Camera! The BCG matrix Act III Action! Learning points and conclusions

![Act –I [Lights!] l l l Governance structure Strategic supervision Strategic management Executive management Act –I [Lights!] l l l Governance structure Strategic supervision Strategic management Executive management](https://present5.com/presentation/3c76ae76defcc47d7cc6b82ac852e411/image-3.jpg)

Act –I [Lights!] l l l Governance structure Strategic supervision Strategic management Executive management Core values Nation Orientation; Trusteeship; Excellence; Customer focus; respect for people; Innovation

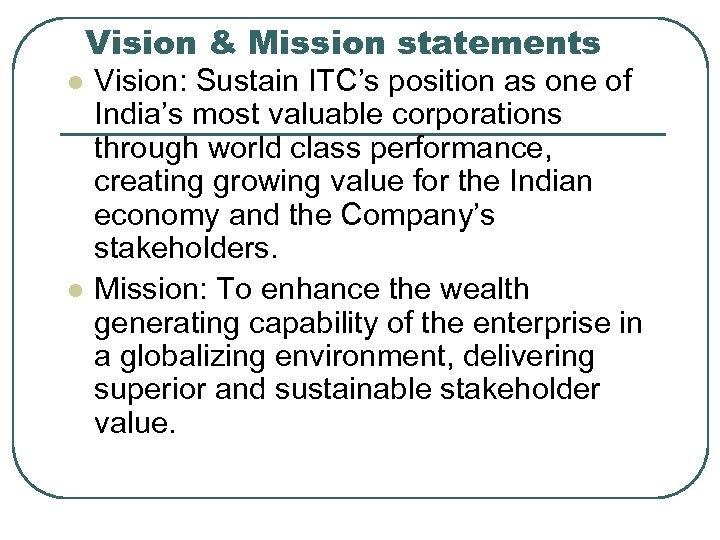

Vision & Mission statements l l Vision: Sustain ITC’s position as one of India’s most valuable corporations through world class performance, creating growing value for the Indian economy and the Company’s stakeholders. Mission: To enhance the wealth generating capability of the enterprise in a globalizing environment, delivering superior and sustainable stakeholder value.

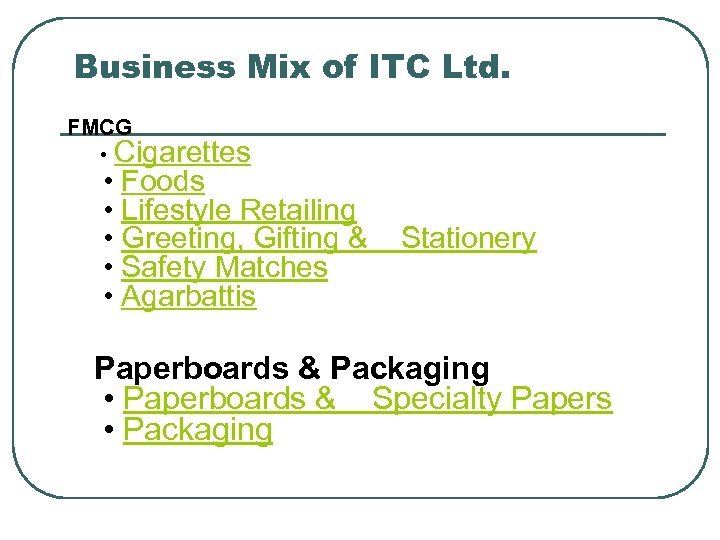

Business Mix of ITC Ltd. FMCG • Cigarettes • Foods • Lifestyle Retailing • Greeting, Gifting & • Safety Matches • Agarbattis Stationery Paperboards & Packaging • Paperboards & Specialty Papers • Packaging

Business Mix (Cont’d) Agri - Business • Agri-Exports • e-Choupal • Leaf Tobacco Hotels Group Companies • ITC Infotech; etc.

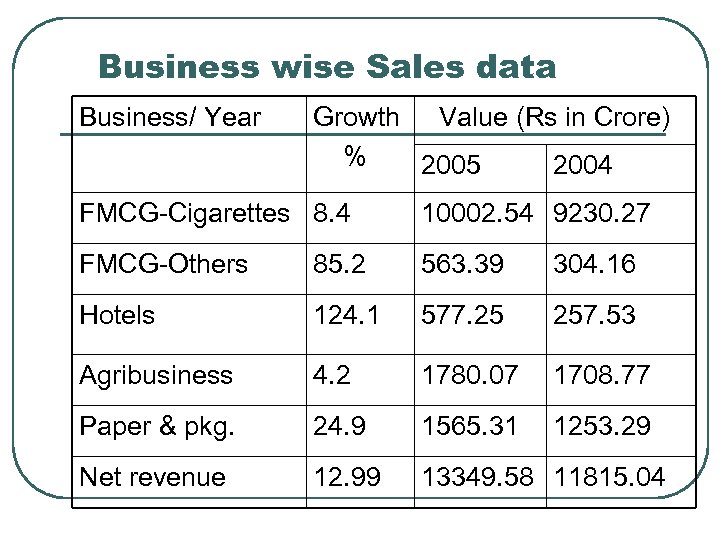

Business wise Sales data Business/ Year Growth Value (Rs in Crore) % 2005 2004 FMCG-Cigarettes 8. 4 10002. 54 9230. 27 FMCG-Others 85. 2 563. 39 304. 16 Hotels 124. 1 577. 25 257. 53 Agribusiness 4. 2 1780. 07 1708. 77 Paper & pkg. 24. 9 1565. 31 1253. 29 Net revenue 12. 99 13349. 58 11815. 04

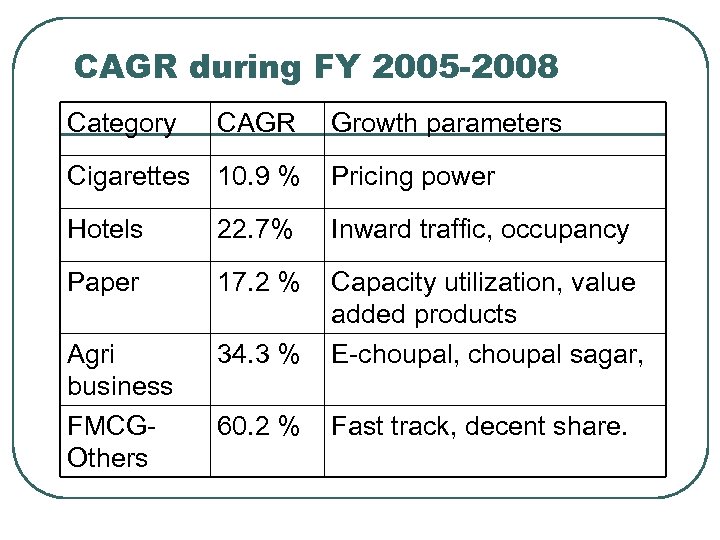

CAGR during FY 2005 -2008 Category CAGR Growth parameters Cigarettes 10. 9 % Pricing power Hotels 22. 7% Inward traffic, occupancy Paper 17. 2 % Agri business FMCGOthers 34. 3 % Capacity utilization, value added products E-choupal, choupal sagar, 60. 2 % Fast track, decent share.

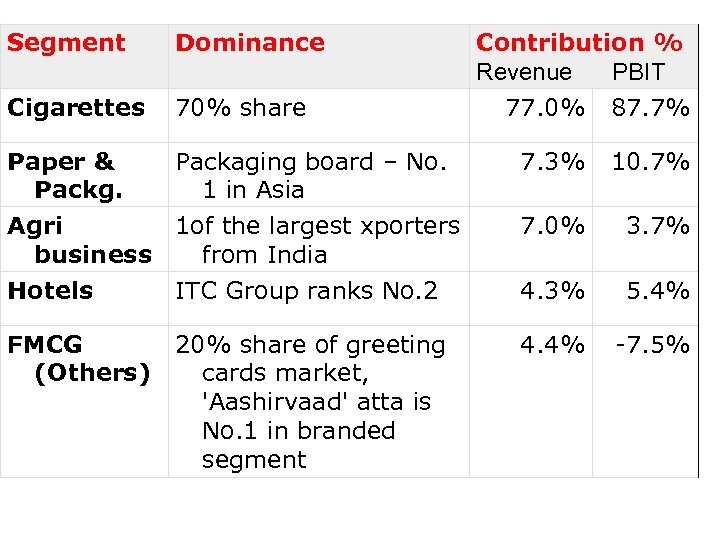

Market share of ITC Ltd. Outstanding market leader l Cigarettes, Hotels, Paperboards, Packaging and Agri-Exports. Gaining market share l Nascent businesses of Packaged Foods & Confectionery, Branded Apparel and Greeting Cards.

Segment Dominance Cigarettes 70% share Paper & Packg. Packaging board – No. 1 in Asia Contribution % Revenue PBIT 77. 0% 87. 7% 7. 3% 10. 7% Agri 1 of the largest xporters business from India Hotels ITC Group ranks No. 2 7. 0% 3. 7% 4. 3% 5. 4% FMCG (Others) 4. 4% -7. 5% 20% share of greeting cards market, 'Aashirvaad' atta is No. 1 in branded segment

A c t 2 Market attractiveness & Competitive strength is also important.

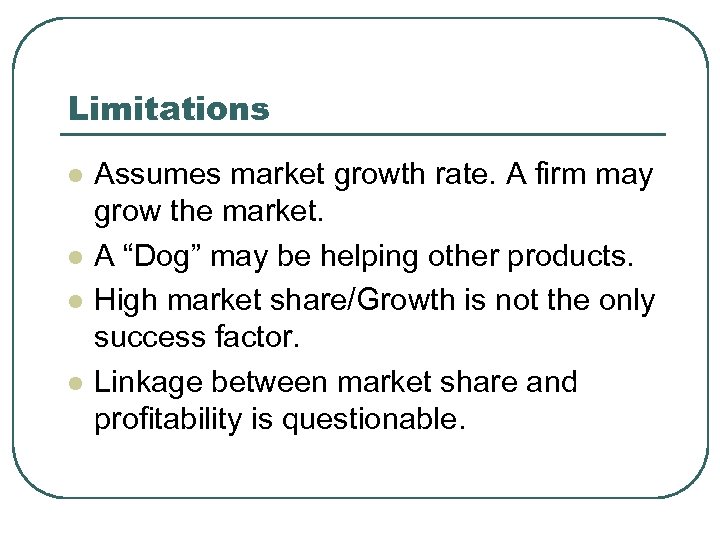

Limitations l l Assumes market growth rate. A firm may grow the market. A “Dog” may be helping other products. High market share/Growth is not the only success factor. Linkage between market share and profitability is questionable.

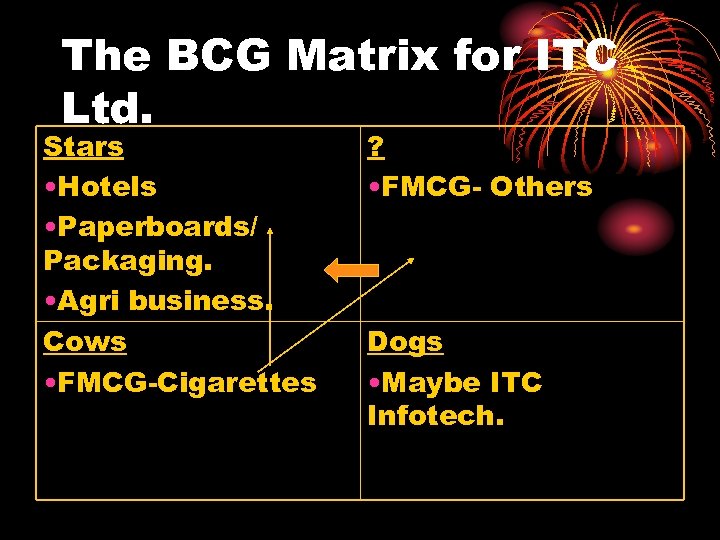

The BCG Matrix for ITC Ltd. Stars • Hotels • Paperboards/ Packaging. • Agri business. Cows • FMCG-Cigarettes ? • FMCG- Others Dogs • Maybe ITC Infotech.

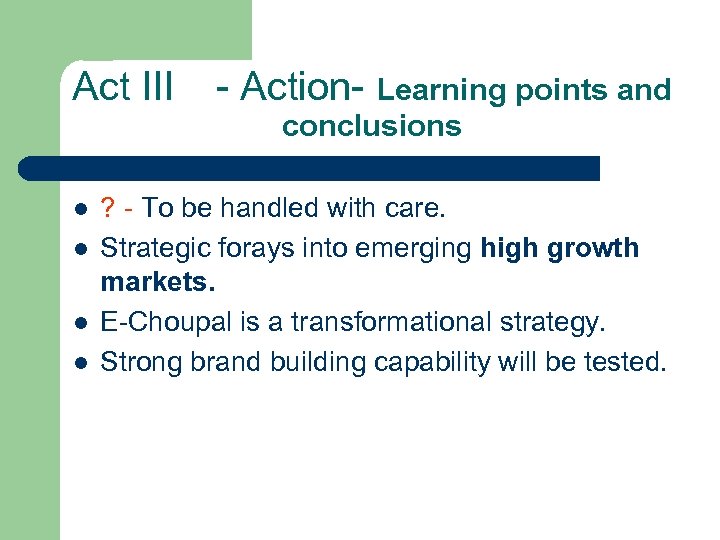

Act III l l - Action- Learning points and conclusions ? - To be handled with care. Strategic forays into emerging high growth markets. E-Choupal is a transformational strategy. Strong brand building capability will be tested.

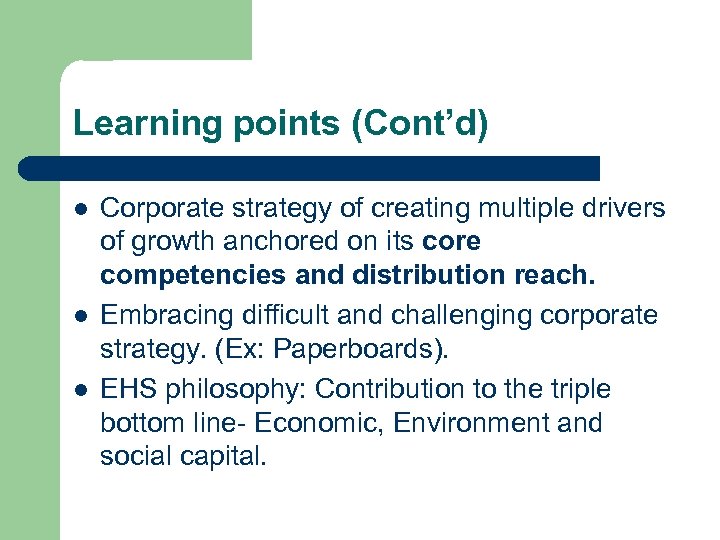

Learning points (Cont’d) l l l Corporate strategy of creating multiple drivers of growth anchored on its core competencies and distribution reach. Embracing difficult and challenging corporate strategy. (Ex: Paperboards). EHS philosophy: Contribution to the triple bottom line- Economic, Environment and social capital.

3c76ae76defcc47d7cc6b82ac852e411.ppt