Present. Fin. ent & org.pptx

- Количество слайдов: 28

BASIS OF FUNCTIONING OF FINANCE OF ENTERPRISES AND ORGANIZATIONS (FEO) Finance of enterprises and organizations includes finance of: enterprises, plants, firms, societies, concerns, associations; branch ministries and other economic bodies, intereconomic, interbranch, cooperative orga-nizations, establishments which carry out industrial, agricultural, construction, transport, supply-marketing, trade (intermediary), procuring, prospecting, design activity, household service of the population, commu-nication, housing municipal service, granting of various financial, credit, insurance, scientific, educational, medical, information, marketing and other services in diverse spheres of public-useful activity

Functions of FEO Finance of enterprises and organizations carries out reproductive function. Its content consists of maintenance of conformity between movement material and money resources during their circulation at simple and extended reproduction Сontrol function of finance plays the enterprises and organizations the important role in economy of the enterprise: it is impossible to manage without the account and control

Integrated groups of relations in sphere of FEO These relations arise between: the state and enterprises (organizations); by the enterprises (organizations) and of credit system; by the enterprises (organizations) and their parent orga-nizations; between different enterprises and organizations within each other in economic relations; the enterprises (organizations) and insurance agencies; by the enterprises and organizations at release of shares and other securities, at mutual crediting and individual share at creation of joint ventures; by the owners and hired workers (workers and employees); inside the enterprises and organizations in connection with formation and use of target funds inside facilities of purpose; the basic activity of enterprises and organizations and own capital construction

The basic features of FEO 1) many-sided of financial relations, variety of their forms and special-purpose designations; 2) obligatory presence of production assets (capital) and for the non-productive enterprises and organizations – non-productive funds (capital) and occurrence in this connection relations connected with their formation, constant updating, increase and redistribution; 3) high activity, opportunity of influence on all parties of economic activity of the enterprise; 4) they represent an initial basis of all financial system.

Definition of FEO Finance of enterprises and organizations represents economic relations connected with creation, distribution and use of financial resources by manufacture and realization of production, jobs and rendering of services

Classification of FEO 1. Character of organization of finance: – material (real sector) or non-material (service sphere) 2. The character of financial activity of the FEO: – commercial and noncommercial 3. Belonging to the certain form of property: – private (the private property acts as the property of the citizens and non state legal persons and their associations, also based on properties of public associations); – state (the republican and communal)

Organizational-legal forms of managing 1. State enterprises based on state ownerships including: • republican – for solving of nation-wide tasks of economic and social development of Kazakhstan; • the enterprises of the communal property – for solving tasks on satisfaction of social economic needs of population of the appropriate territory are in local submission; • Subjects of quasi state sector 2. Enterprises and organizations based on private property of the legal persons: economic companies of a different type, including joint-stock companies, cooperative enterprises and organizations. 3. Enterprises and organizations based on properties of public associations. 4. Joint venture on the basis of association of property of the founders, including foreign legal persons and citizens. 5. Private enterprises and organizations based on the properties of the citizens. 6. Mixed enterprises with participation of above mentioned patterns of ownership.

Features of formation of financial resources of FEO The financial resources of the industrial enterprises and organizations are formed at the expense of own sources (amortisation deductions, net profit; credits of banks; means from issue of securities; at the state enterprises these sources of means are supplemented in necessary cases by assignments from the budget and of off-budget funds; at cooperative societies off-budget means share of forming of cooperative members

Distribution of the financial results of economic activity According to formation initial financial resources of manufacture are distributed and the financial results of economic activity are used: the net profit; the percentage income; the dividends; the share incomes; the reimbursement of the budget (budget credits) and of offbudget funds

FINANCE OF COMMERCIAL ENTERPRISES AND ORGANIZATIONS The purpose of commercial activity is the reception of profit. The basic principles of organization of finance of this type of enterprises and organizations are: cost accounting, planned character, equality of all patterns of ownership, availability of financial reserves. Determining principles of cost accounting are selfrecoupment ( ability to pay on its own way) and self-financing, the financial independence , financial responsibility, financial interest

Financial resources of FEO Forms of financial resources: statutory capital (fund), reserve capital, resources for accumulation, consumption, wages, exchange, repair

Production assets of FEO Due to finance constant circuit of production assets (industrial capital) of the enterprises and organizations is carried out – basic and circulating. Еxpressed in value terms, they are fixed and current production assets.

Fixed assets are involved in the production process for a long time and pass its value to the product manufactured parts; the value of the portable part is determined based on the life of the subjects of work, to the extent of wear. Transfer process is called amortization, share-tolerated value - depreciation rate, and the monetary value of this share – depreciation.

• The circulating capitals include: circulating production assets (industrial stocks, uncompleted manufacture, charges of the future periods); funds of circulation. Funds of circulation (circulating assets) are connected with sphere of circulation to them concern: ready production in warehouses and shipped to the consumers, money resources in cash department and in bank accounts, means in accounts, accounts receivable.

Financing of production assets • The money resources, advanced in turnaround production assets and circulating assets act as circulating means of the enterprises • On the acting enterprises basic and the circulating capitals are formed after realization of production (services) and receipt of the income , of which in the form of amortization deductions are formed the means for compensation of a worn out fixed capital , and other part of income from realization of production is directed on purchase commodity-material of values which are included in structure of circulating capital.

At formation of the new enterprises or their expansion the significant part of means is formed at the expense of payments of the founders involved financial assets from sales of the shares; for state enterprises are means of the budget and state of off-budget funds. The part of means can be advancing at the expense of the centralized financial resources of a higher control link – corporation, association, ministry, department. Recently increasing distribution as a source of financing the means of the foreign investors act.

• On the acting enterprises and organizations the important source of financing of a gain of production assets is the net profit. • Sources of increase of production assets are: a reinvestment part of outside turnaround assets (fixed capital), immobilized part of turnaround assets, creditor debts, issue of debt securities (bonds), leasing. Thus source of financing of creation and gain of production assets is possible to group on the following: own, involved and borrowed.

Financial results of activity of enterprises • The character of use of production assets – from effective up to inefficient – is expressed by special parameters and testify productivity of financial management of enterprises and organizations. This productivity defines in sizes of the proceeds (income) from realization of production, works or services, costs of the enterprise, profit. • In Kazakhstan, in accordance with International Financial Reporting Standards in the index of "Proceeds" (formerly called the figure "income from sales of products and services") reflects income from business activities, net of VAT, excise and other taxes and obligations, the cost of returned goods and discounts on sales and prices.

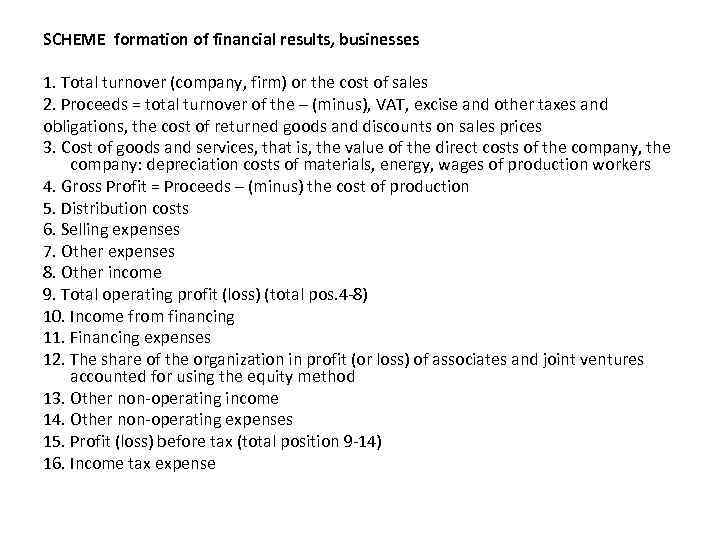

SCHEME formation of financial results, businesses 1. Total turnover (company, firm) or the cost of sales 2. Proceeds = total turnover of the – (minus), VAT, excise and other taxes and obligations, the cost of returned goods and discounts on sales prices 3. Cost of goods and services, that is, the value of the direct costs of the company, the company: depreciation costs of materials, energy, wages of production workers 4. Gross Profit = Proceeds – (minus) the cost of production 5. Distribution costs 6. Selling expenses 7. Other expenses 8. Other income 9. Total operating profit (loss) (total pos. 4 -8) 10. Income from financing 11. Financing expenses 12. The share of the organization in profit (or loss) of associates and joint ventures accounted for using the equity method 13. Other non-operating income 14. Other non-operating expenses 15. Profit (loss) before tax (total position 9 -14) 16. Income tax expense

17. Profit (loss) after tax from continuing activities 18. Profit (loss) after tax from discontinued operations, STI 19. Profit for the year (profit (loss) after tax from continuedment of profit (loss) after tax from discontinued operations) attributable to: owners of the parent share of non-controlling owners 20. Other comprehensive profit, total 21. Total comprehensive profit (profit for the year in other comprehensive-profit) 22. Total comprehensive profit attributable to: owners of the parent proportion of non-controlling owners 23. Earnings per share

Distribution of profit The distribution of profit is reduced to prime transfer of its part in the state budget or in state off-budgets funds in the legislatively established share according to the working taxes and other obligatory payments.

Report about profit (losses) The results of financial-economic activity of enterprises and organizations are reflected in the appropriate report – about profit (losses), – in a section of separate parameters. Besides the report on movement of money, in which this movement on three directions is shown: • from operational activity (describing basic activity of the managing subject); • from investment activity (causing changes in structure and size of long-term assets); • from financial activity (causing changes in structure both size of the own capital and extra means).

Finance of noncommercial organizations and establishments • Feature of non-profit organizations and establishments is that the primary motivation of their operation is not a profit or income from the results of such activities, and the satisfaction of social needs

Kinds of the noncommercial activity The noncommercial activity is submitted by various kinds, which can be united on the following directions: 1) state management and state services of general character; 2) defence; 3) protection of internal legal order and safety; 4) prevention and liquidation of consequences of extreme situations connected with adverse natural phenomena, accidents, failures and other disasters; 5) education; 6) public health services; 7) social protection of population; 8) fundamental science; 9) culture and art; 10) protection of an environment; 11) public-household accomplishment of cities and occupied items (illumina-tion, gardening, roads, bridges, sidewalks etc. ); 12) public associations and organizations; 13) charitable and humanitarian organizations and funds.

Methods of economic activity of NOE • Methods of conducting economic activity of noncommercial activity is budget financing – at gratuitous rendered services and boons, and at reimburstment – on the basis of cost accounting and self-recoupment ( ability to pay on its own way). In conditions of the market ever more than organizations pass by the beginning of commercial account – realize rendered services at the price of demand with formation of sufficient accumulation for self-development

Sources of financing of NOE • state budget • the own means received as the income from given services, carried out jobs, profit on production at the subordinated enterprises • the credits of banks • the member payments of their participants. • deductions on the charitable purposes • the grants • the incomes of ac-commodation of a part available by them resources on deposits

Charges of NOE • The charges of noncommercial organizations and establishments directed on maintenance of their functional activity stipulated by a rule, to the charter or other authorized document. Structure of the charges is defined by belonging of organization or participants of establishment to one of directions of activity and also used method of conducting this activity. • The organizations and establishments working on the basis of self-financing and self-recoupment expect and plan financial results of job and make out them in parameters of the usual financial plan or business plan. • Organizations and establishments consisting of budget financing, develop the individual plan of financing in which the characteristic parameters of activity of establishment and distribution of means under clauses are reflected.

Grouping costs of NOE According to economic classification in the individual plans of financing the charges are grouped on a category, class, subclass, specificity. The category "The Current charges", "The Capital charges", "Representation of credits, individual share", "Financing" includes classes, and classes – subclasses and further – specificity with detailed elaboration of charges. For separate directions and kinds of noncommercial activity the prevalence of the separate making charges is peculiar.

Present. Fin. ent & org.pptx