9ecead8bd2d5d4db75938864b3a40ab1.ppt

- Количество слайдов: 29

Basics of Investing

Things To Do Before Investing n Pay off credit card debt! l No investment pays as much as credit card companies charge Build an emergency fund n Consider your goals n Timeline n l How soon will you need the $? 2

Consider your Goals Vehicle purchase/replacement n Down payment on a home n Child’s education n To build wealth n For retirement n What are your financial goals? n How much $ will you need? n 3

Determine your Risk Tolerance n How much risk can you stand? l If you have trouble sleeping at night because you are worried about your investments then pick a more conservative mix

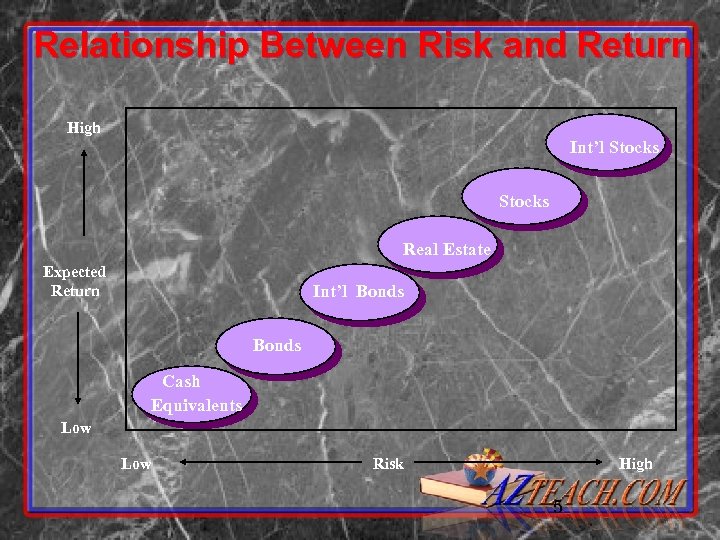

Relationship Between Risk and Return High Int’l Stocks Real Estate Expected Return Int’l Bonds Cash Equivalents Low Risk High 5

Before you Invest n n Is your budget balanced? Do you save every month? Do you pay credit cards in full every month? Do you carry adequate insurance to protect against major catastrophes? 6

Potential Risks n Being too conservative (Savings accounts, CDs, etc. ) l Keeps principal safe but… l Inflation reduces purchasing power n Inflation l Risk averages about 3. 1% not reaching your goal(s) 7

Risks n Being too aggressive (too much in stocks) Higher potential for growth but… l More market volatility l No guarantee or insurance l Potential to lose some or all of the principal l 8

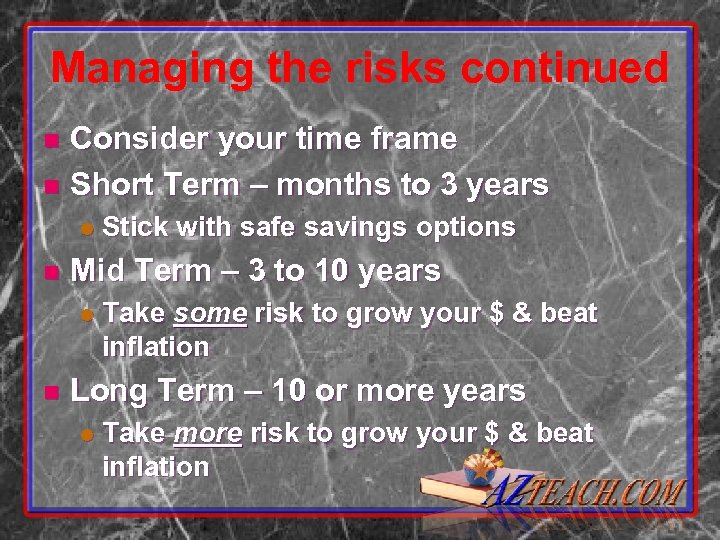

Managing Risks n Consider your goal Emergency fund- be conservative l Retirement- be more aggressive l n Match your goals with your risk tolerance l Can you handle the market volatility?

Managing the risks continued Consider your time frame n Short Term – months to 3 years n l n Mid Term – 3 to 10 years l n Stick with safe savings options Take some risk to grow your $ & beat inflation Long Term – 10 or more years l Take more risk to grow your $ & beat inflation

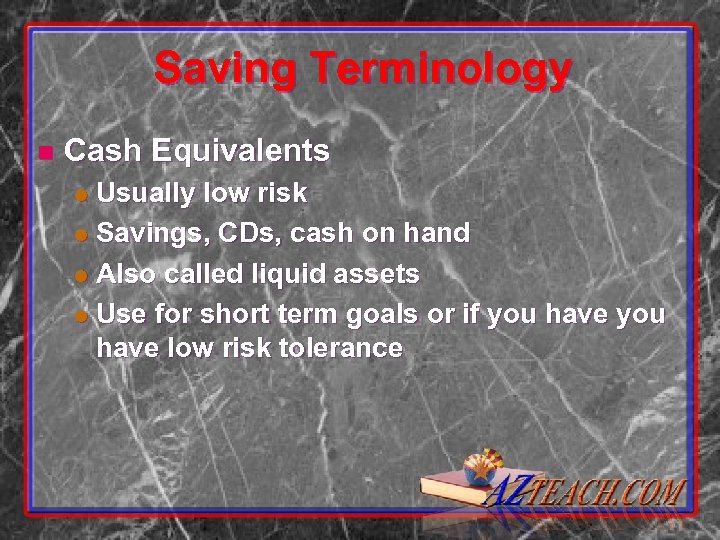

Saving Terminology n Cash Equivalents Usually low risk l Savings, CDs, cash on hand l Also called liquid assets l Use for short term goals or if you have low risk tolerance l

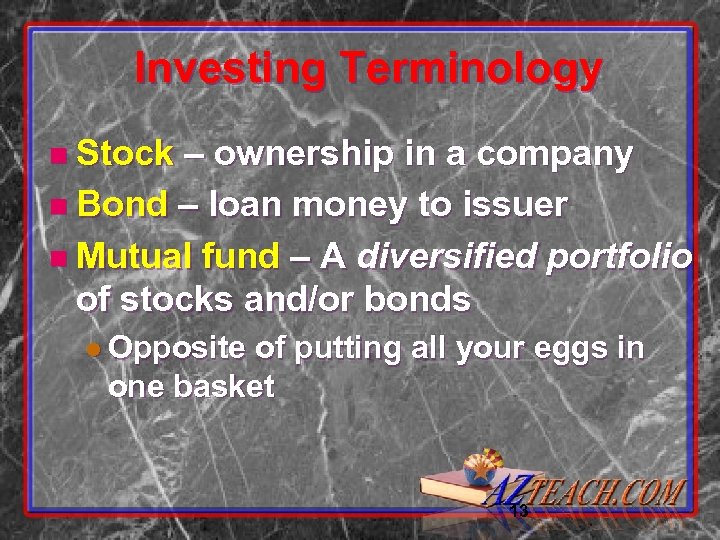

Investing Terminology n Stock – ownership in a company n Bond – loan money to issuer n Mutual fund – A diversified portfolio of stocks and/or bonds l Opposite of putting all your eggs in one basket 13

14

Retirement Funds n 401(k) retirement plan offered by employer l $ grows tax deferred l Some employers will match (~3%) n Need n to invest > just the match IRA: individual retirement account l Invest on your own l $ grows tax deferred

Retirement Funds n Roth IRA l Pay taxes now l No taxes when you withdraw = no taxes on the growth! n Traditional l Upfront IRA tax deduction l Pay taxes at withdrawal

Retirement Funds n Retirement accounts are NOT an investment l How the government treats that money for tax purposes l Where you put that money is up to you 17

IRA Criteria n Must have an earned income l If married, non-earning spouse can use a spousal IRA n $5, 500 l You annual limit can contribute less l Age 50+: $6, 500

401(k), Roth, or traditional IRA? n Invest in 401(k) up to full match l Instant 100% rate of return!! l Possible downsides n employer picks the funds n May charge heavy fees n If no employer match, consider an IRA

401(k), Roth, or traditional IRA? n Use a traditional IRA if l Your employer doesn’t match or you’ve already invested up to the match l You expect to be in a lower tax bracket at retirement n. Take the tax break now

401 k, Roth, or traditional IRA? n Use a Roth IRA if l You expect taxes to rise l You expect to be in a higher tax bracket at retirement l Offers tax diversification n If most of your retirement income will be taxable… invest in a Roth

Establish Your Long-Term Investment Strategy n Strategy 1: Buy and hold anticipates long-term economic growth. l Stock market has offered a positive return over every 15 year period n Past returns no guarantee, but long-term buying and holding is a great strategy

Long-Term Investment Strategy 2 • Dollar-cost averaging buys at “below-average” costs – Invest same amount every month – Avoid following the crowd – Jumping in when the market is high – Pulling out when it drops – Set up automatic deposit

Long-Term Investment Strategy 3 & 4 • Portfolio diversification reduces volatility • Money is like manure. Left in a pile, it stinks. If you spread it around, it'll grow some stuff. – Dave Ramsey • Asset allocation keeps you in the right investment categories at the right time

Investing Made Easy n Set up Automatic Investing l Payroll deduction or l Automatic transfer from checking to: n Individual Retirement Account n Mutual fund n Other investment

n Advantages Mutual Funds l Professional management l Reduce risk through diversification n l n Monitoring investments is easy Disadvantages l n Own small part of lots of different investments Funds charge fees Be aware l follow market performance (down & up) l No guaranteed rate of return

Successful Investing n n n Educate yourself Determine your risk tolerance Decide on asset allocation Stick to your plan Monitor investment performance If you need help, consult a professional advisor l n (N. B. most are salespeople) Avoid fraud!

Remember Never invest in something you don’t understand 28

QUESTIONS? 29

9ecead8bd2d5d4db75938864b3a40ab1.ppt