a2141096c8b196912607ef54ff15628b.ppt

- Количество слайдов: 48

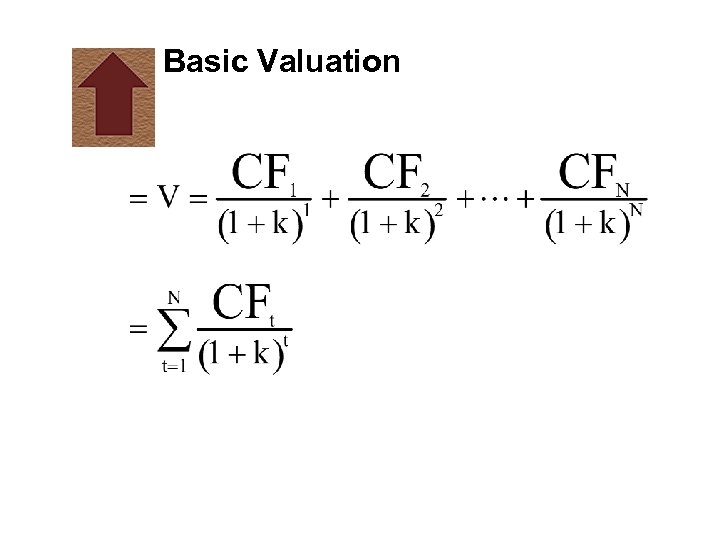

Basic Valuation

Basic Valuation

Key Terms

Key Terms

The Basic Bond Valuation Model

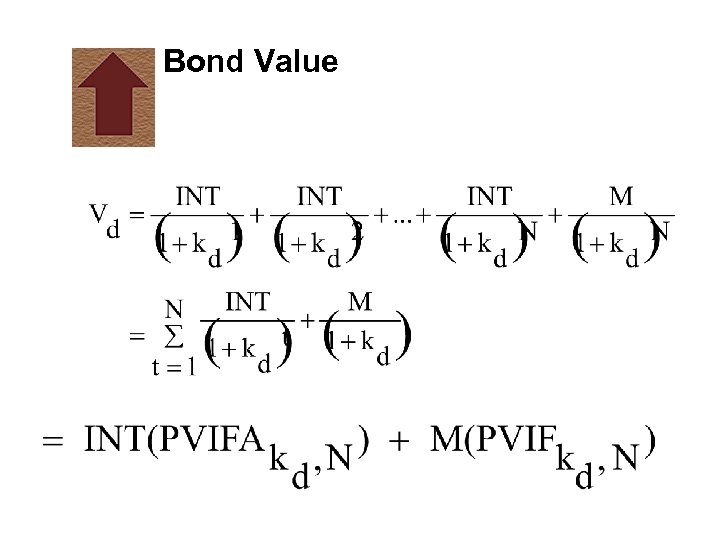

Bond Value

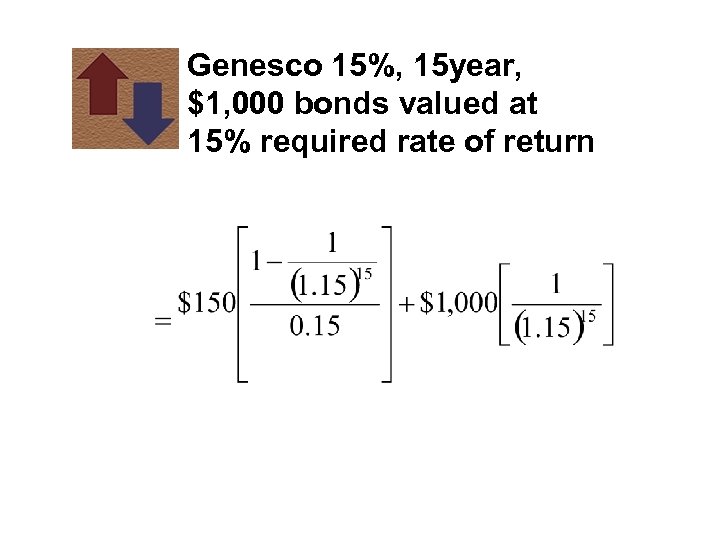

Genesco 15%, 15 year, $1, 000 bonds valued at 15% required rate of return

Genesco 15%, 15 year, $1, 000 bonds valued at 15% required rate of return

Genesco 15%, 15 year, $1, 000 bonds valued at 15% required rate of return

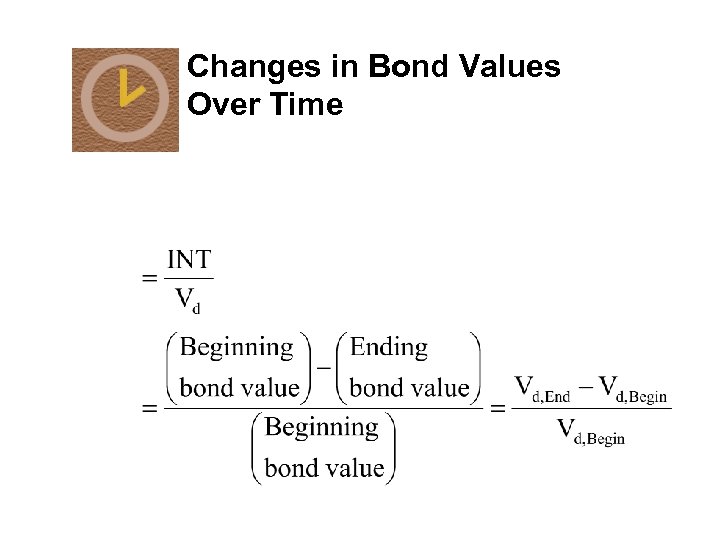

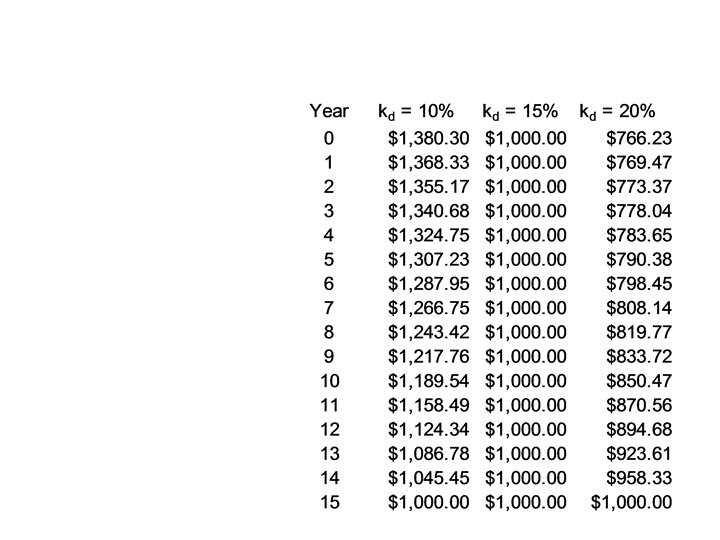

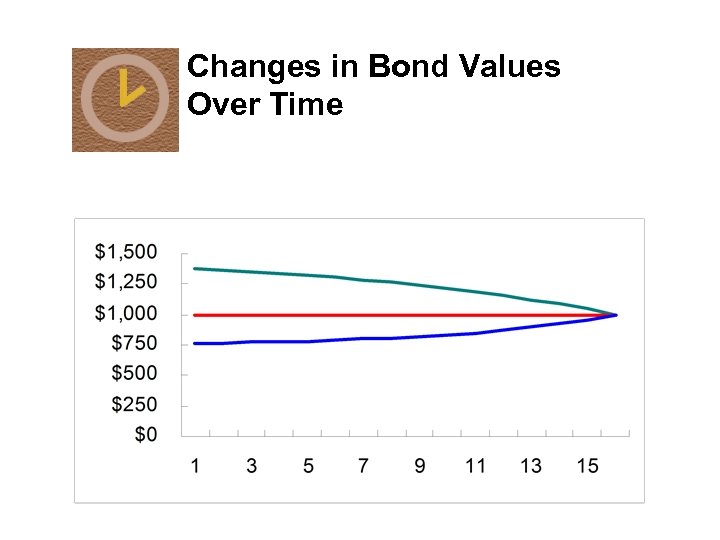

Changes in Bond Values Over Time

Changes in Bond Values Over Time

Changes in Bond Values Over Time

Changes in Bond Values Over Time

Changes in Bond Values Over Time

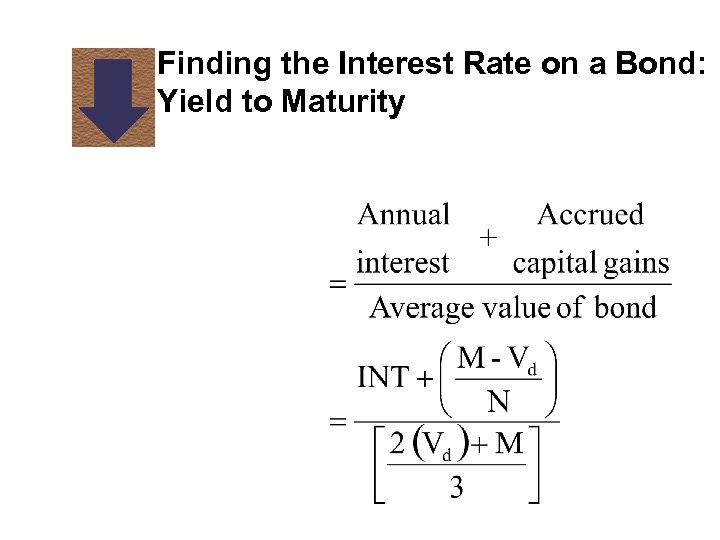

Finding the Interest Rate on a Bond: Yield to Maturity

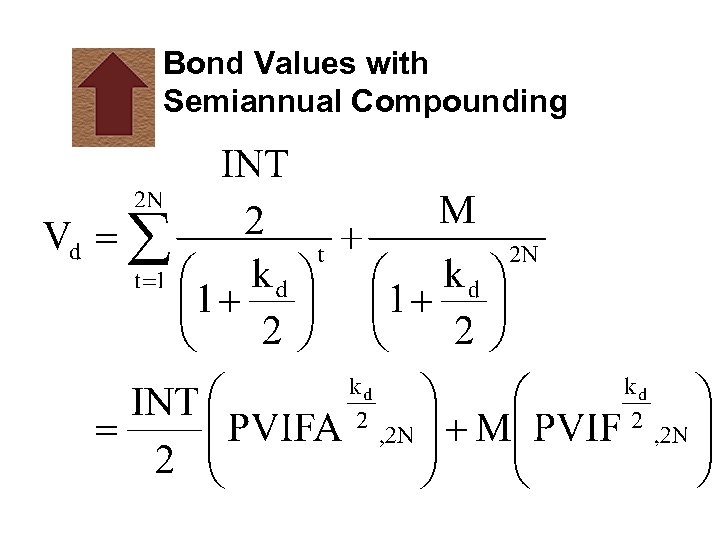

Bond Values with Semiannual Compounding

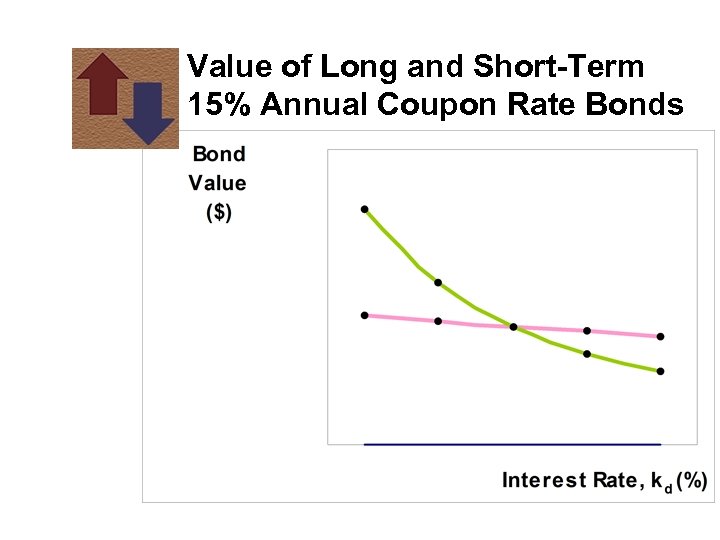

Interest Rate Risk on a Bond

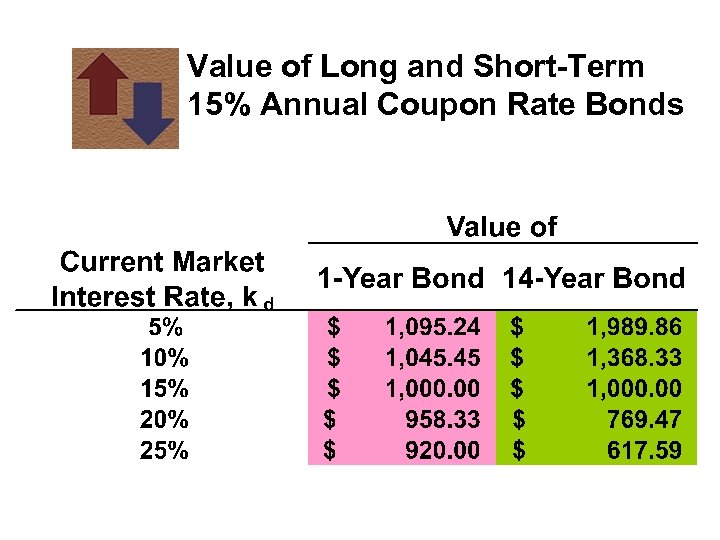

Value of Long and Short-Term 15% Annual Coupon Rate Bonds

Value of Long and Short-Term 15% Annual Coupon Rate Bonds

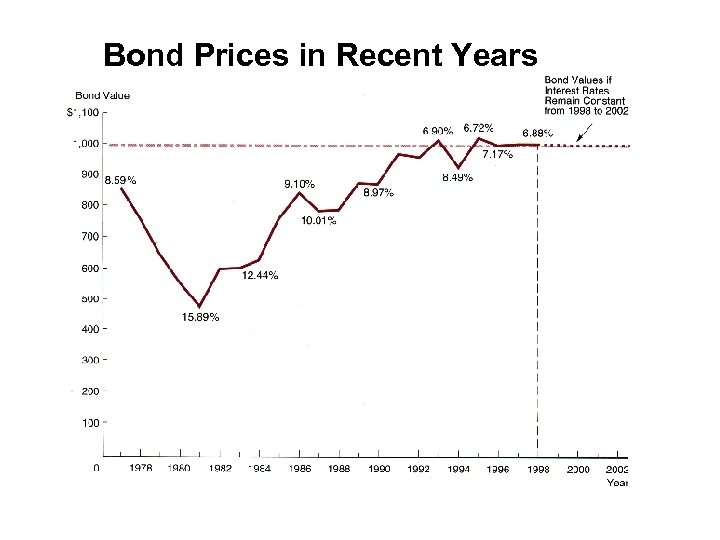

Bond Prices in Recent Years

Valuation of Financial Assets Equity (Stock)

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

Stock Valuation Models

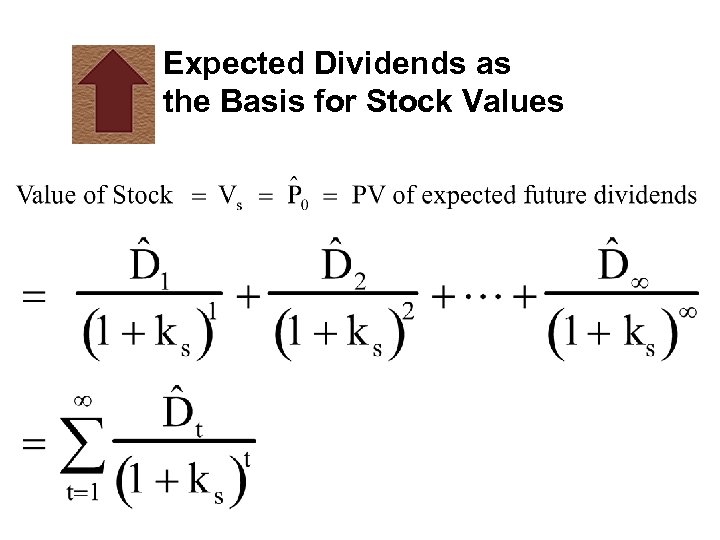

Expected Dividends as the Basis for Stock Values

Expected Dividends as the Basis for Stock Values

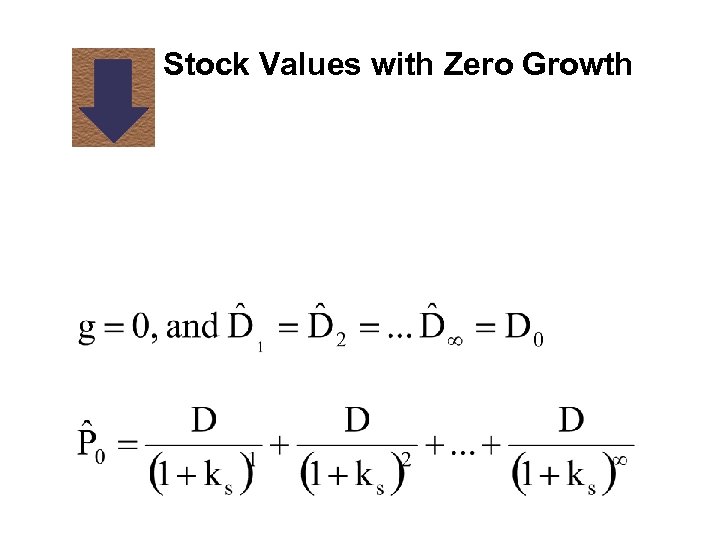

Stock Values with Zero Growth

Normal, or Constant, Growth

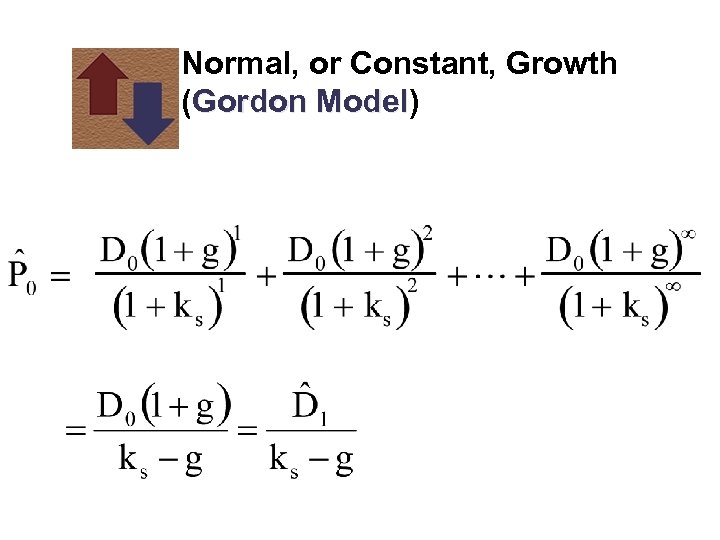

Normal, or Constant, Growth (Gordon Model) Model

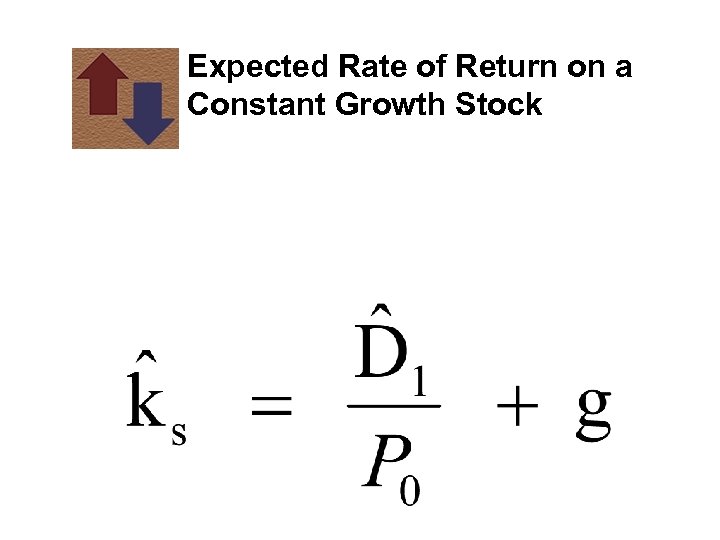

Expected Rate of Return on a Constant Growth Stock

Valuing Stocks with Nonconstant Growth

Valuing Stocks with Nonconstant Growth

Stock Market Equilibrium

Changes in Stock Prices

The Efficient Markets Hypothesis

Valuation of Real (Tangible) Assets

Valuation of Real (Tangible) Assets

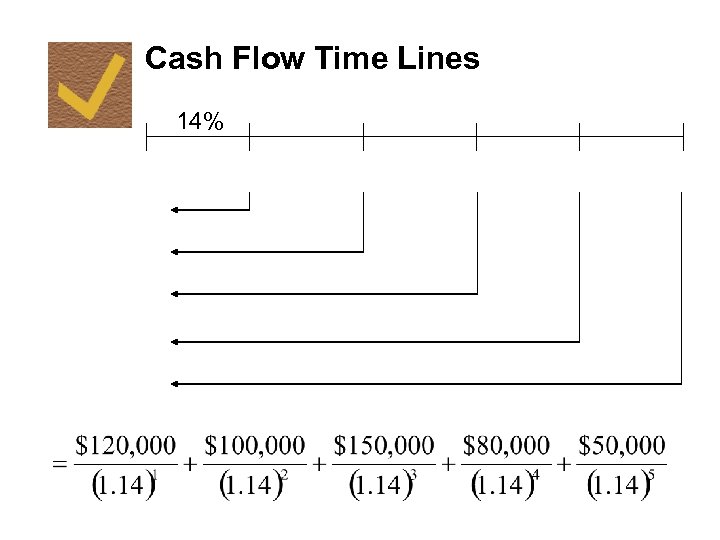

Cash Flow Time Lines 14%

a2141096c8b196912607ef54ff15628b.ppt