Basic Financial Reports of the Enterprise: types and

Basic Financial Reports of the Enterprise: types and explanations Made by Tropnikova Alexandra group 5524

Companies prepare interim financial statements and annual financial statements. 2000 X

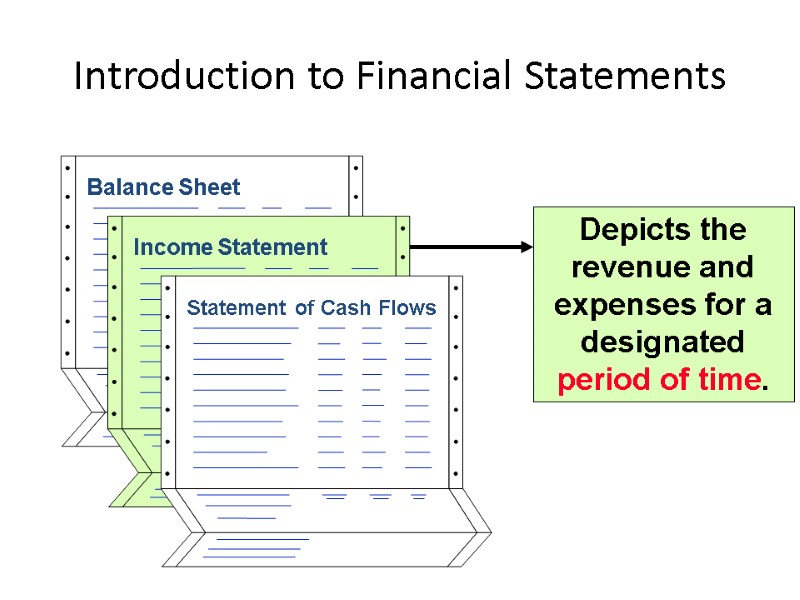

Introduction to Financial Statements Three primary financial statements.

Introduction to Financial Statements

Introduction to Financial Statements

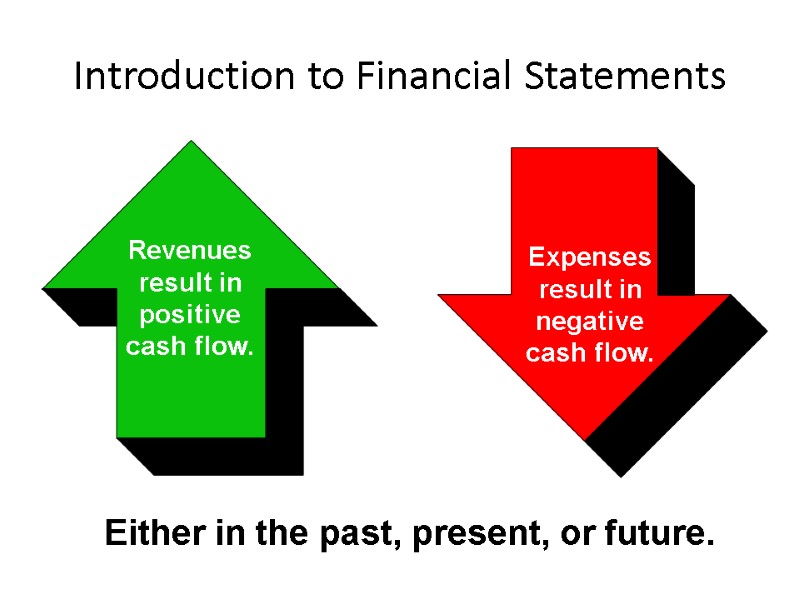

Introduction to Financial Statements Revenues result in positive cash flow. Expenses result in negative cash flow. Either in the past, present, or future.

Introduction to Financial Statements

Introduction to Financial Statements

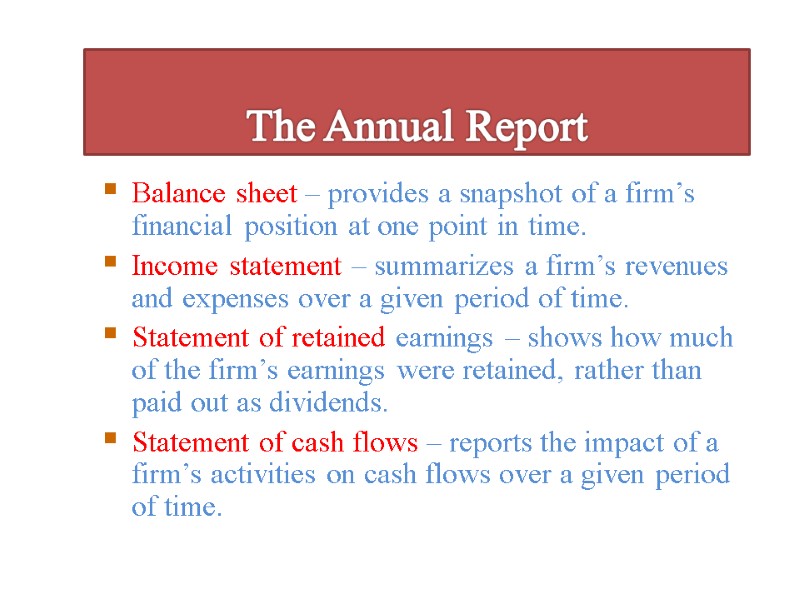

Balance sheet – provides a snapshot of a firm’s financial position at one point in time. Income statement – summarizes a firm’s revenues and expenses over a given period of time. Statement of retained earnings – shows how much of the firm’s earnings were retained, rather than paid out as dividends. Statement of cash flows – reports the impact of a firm’s activities on cash flows over a given period of time. The Annual Report

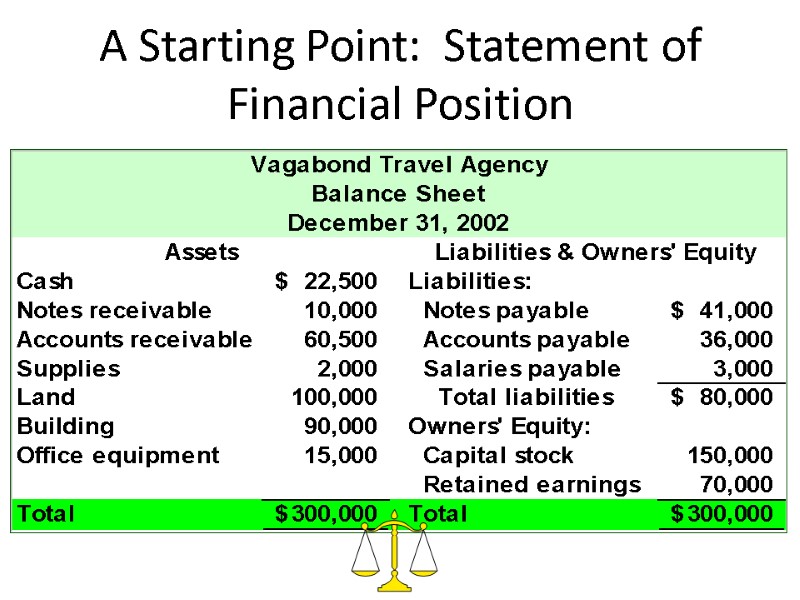

A Starting Point: Statement of Financial Position

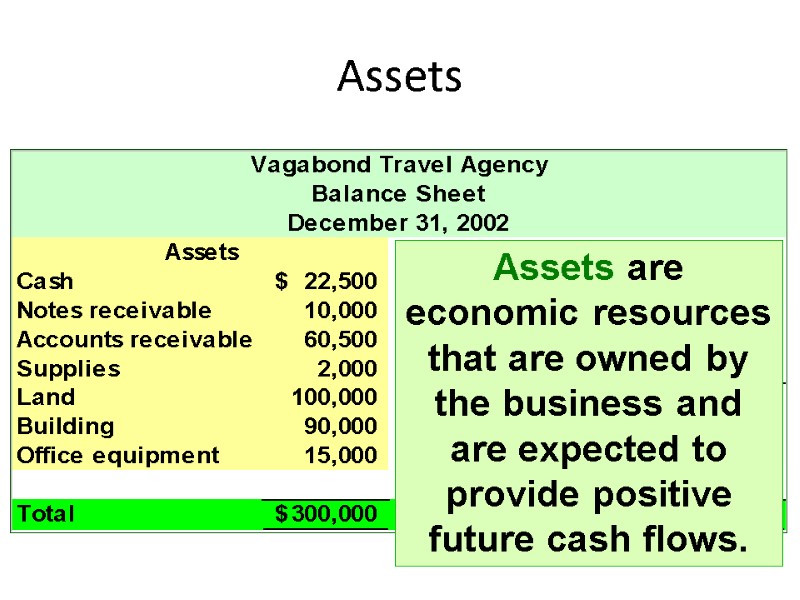

Assets Assets are economic resources that are owned by the business and are expected to provide positive future cash flows.

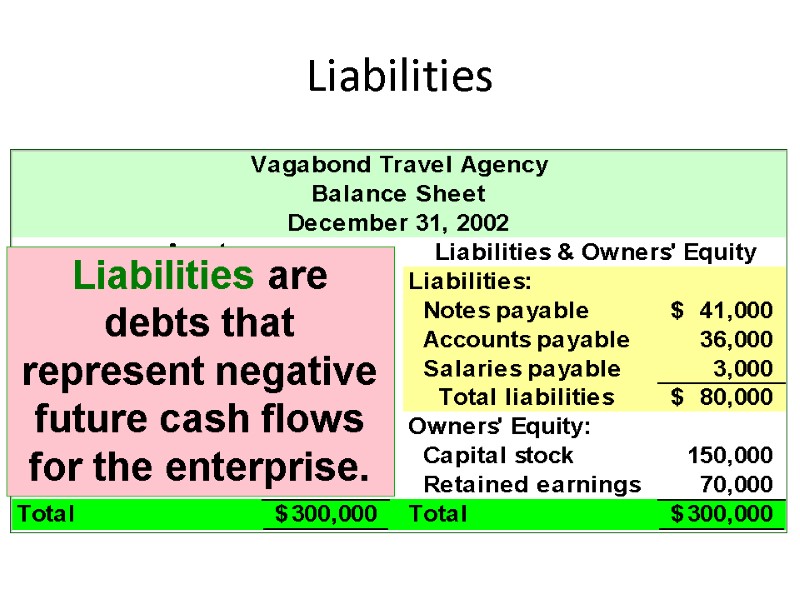

Liabilities Liabilities are debts that represent negative future cash flows for the enterprise.

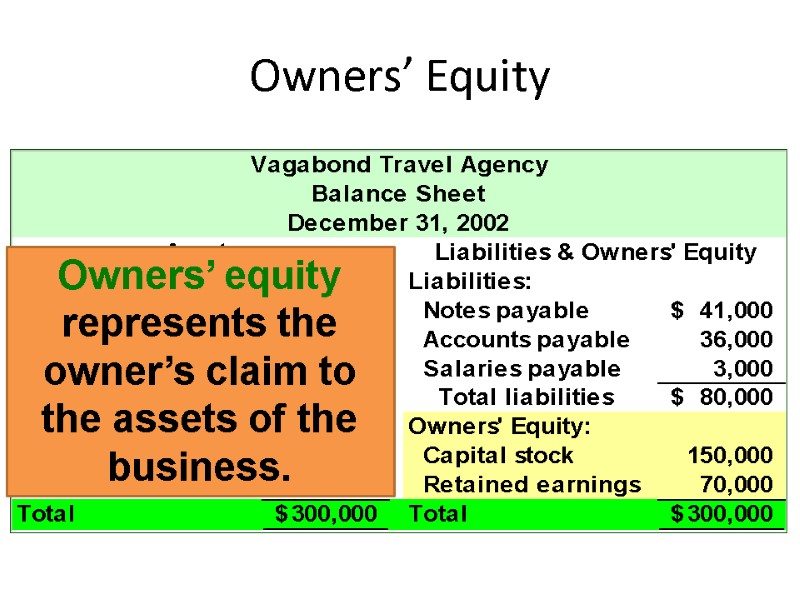

Owners’ Equity Owners’ equity represents the owner’s claim to the assets of the business.

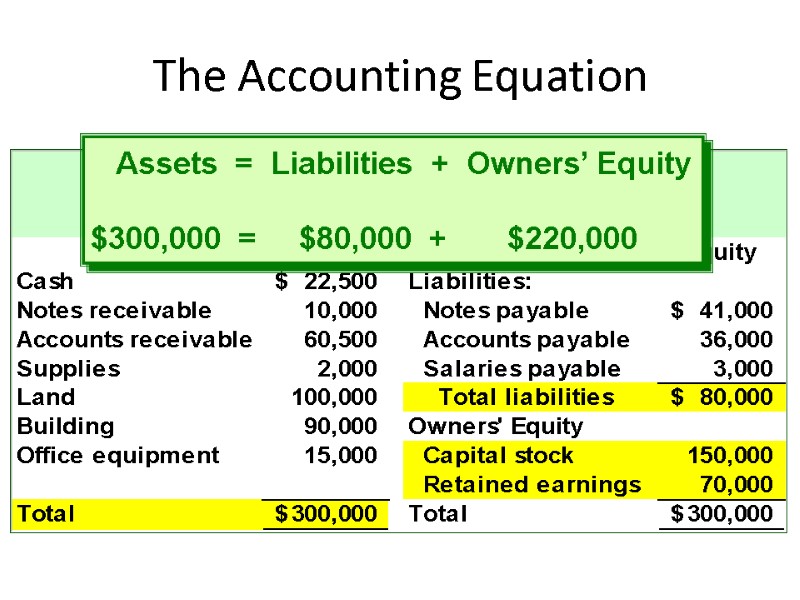

The Accounting Equation Assets = Liabilities + Owners’ Equity $300,000 = $80,000 + $220,000

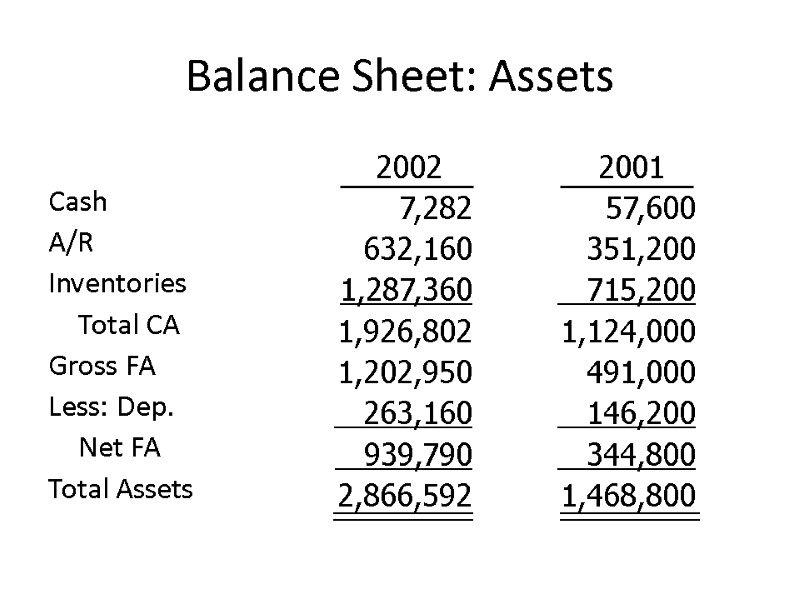

Balance Sheet: Assets Cash A/R Inventories Total CA Gross FA Less: Dep. Net FA Total Assets

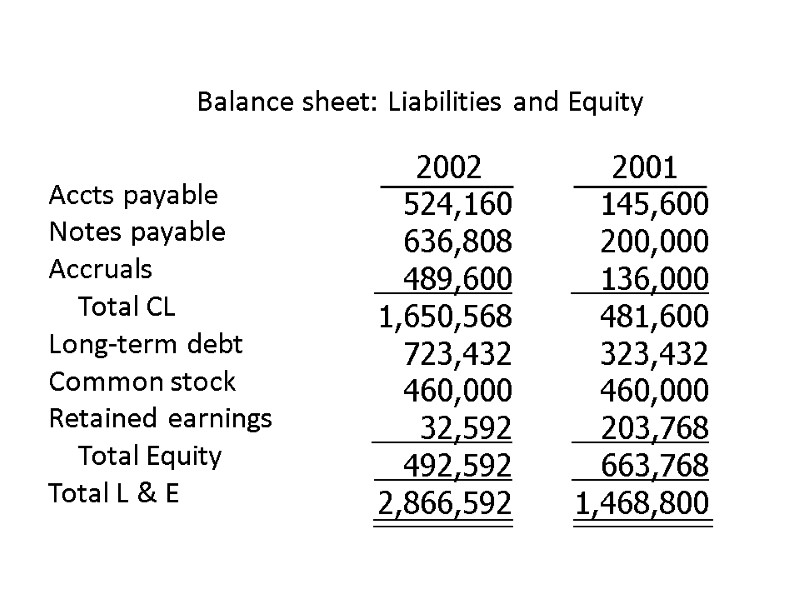

Balance sheet: Liabilities and Equity Accts payable Notes payable Accruals Total CL Long-term debt Common stock Retained earnings Total Equity Total L & E

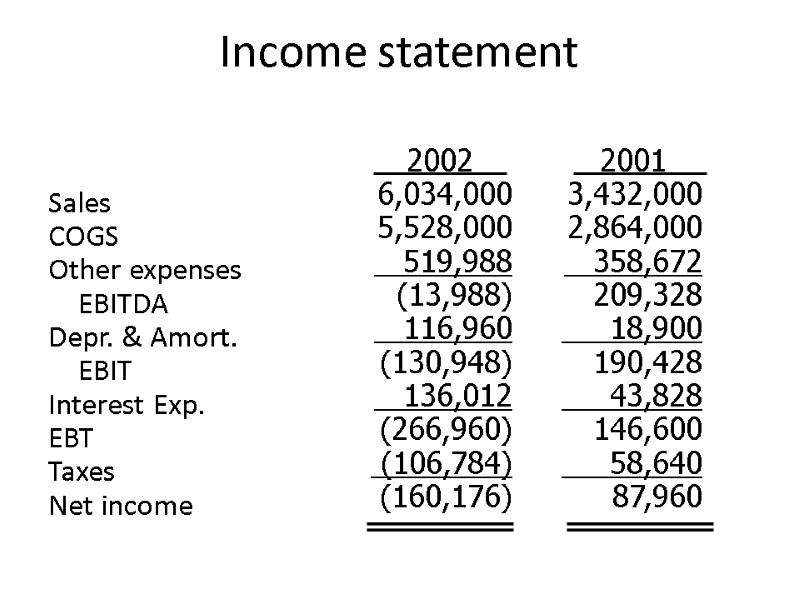

Income statement Sales COGS Other expenses EBITDA Depr. & Amort. EBIT Interest Exp. EBT Taxes Net income 2002 6,034,000 5,528,000 519,988 (13,988) 116,960 (130,948) 136,012 (266,960) (106,784) (160,176) 2001 3,432,000 2,864,000 358,672 209,328 18,900 190,428 43,828 146,600 58,640 87,960

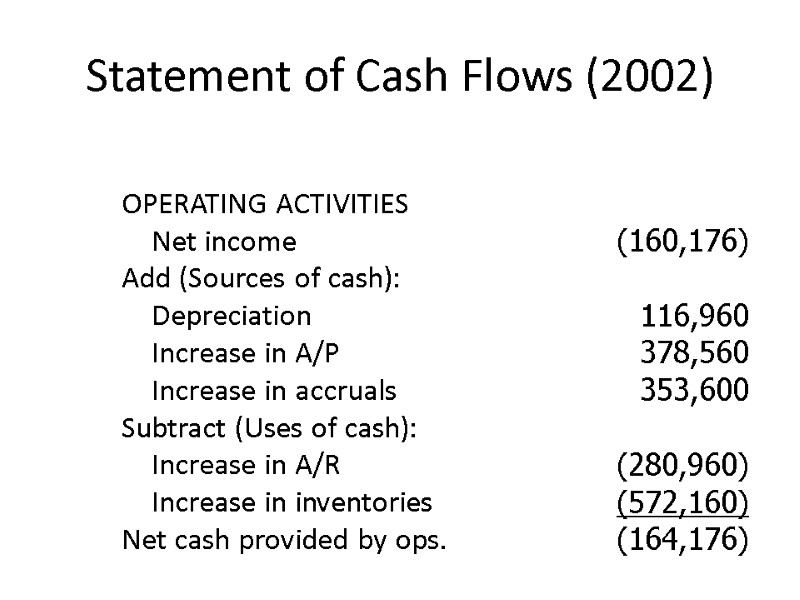

Statement of Cash Flows (2002) OPERATING ACTIVITIES Net income Add (Sources of cash): Depreciation Increase in A/P Increase in accruals Subtract (Uses of cash): Increase in A/R Increase in inventories Net cash provided by ops. (160,176) 116,960 378,560 353,600 (280,960) (572,160) (164,176)

7716-12basic-financial-statement-1231407912838821-1.ppt

- Количество слайдов: 18