51e1671835a5269d658d183632910e16.ppt

- Количество слайдов: 30

Basic Business Law (BPP 432/80) 2006 Fall Quarter Instructor: David Oliveiri Week 9: Facilitating Exchange Through Business Association; Unincorporated Associations – Partnerships and Hybrids

Agenda General Partnerships Hybrids: LLC’s, LP’s, LLP’s, …

Learning Objectives Understand Why People Associate as Partners Understand How People Associate as Partners, and Consequences Understand Some Basic Characteristics of General Partnerships – Form, Function, Finances Understand Pros and Cons of General Partnerships Understand the Nature, Costs, and Benefits of Popular Hybrid Forms of Business Association

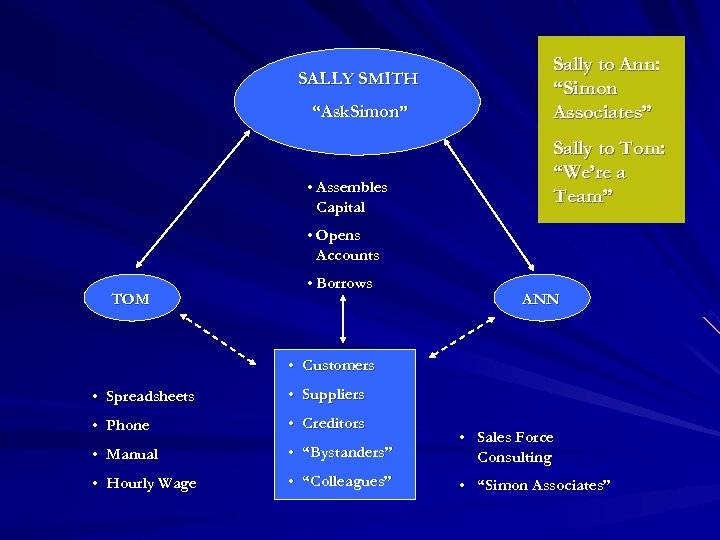

SALLY SMITH “Ask. Simon” • Assembles Capital Sally to Ann: “Simon Associates” Sally to Tom: “We’re a Team” • Opens Accounts TOM • Borrows ANN • Customers • Spreadsheets • Suppliers • Phone • Creditors • Manual • “Bystanders” • Sales Force Consulting • Hourly Wage • “Colleagues” • “Simon Associates”

Definition of Partnership “An association of two or more persons to carry on as co-owners a business for profit” Sharing Control and Return

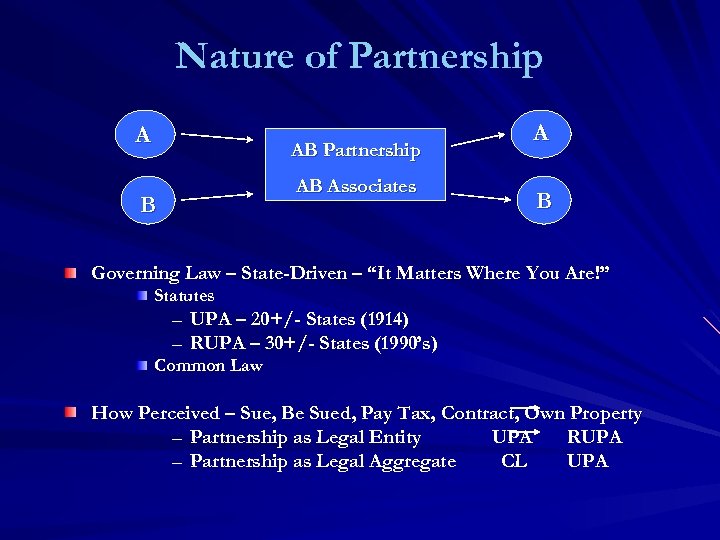

Nature of Partnership A AB Partnership AB Associates B A B Governing Law – State-Driven – “It Matters Where You Are!” Statutes – UPA – 20+/- States (1914) – RUPA – 30+/- States (1990’s) Common Law How Perceived – Sue, Be Sued, Pay Tax, Contract, Own Property – Partnership as Legal Entity UPA RUPA – Partnership as Legal Aggregate CL UPA

Formation of Partnership Why? ― Economic Rationale and Deal Points Joint Ownership vs. Purchased Inputs Need to Assemble At-Risk Capital/Services Control Follows Risk Combining Capital and Personal Services How? Formality – Not Necessary, But Recommended Statute of Frauds Firm Name

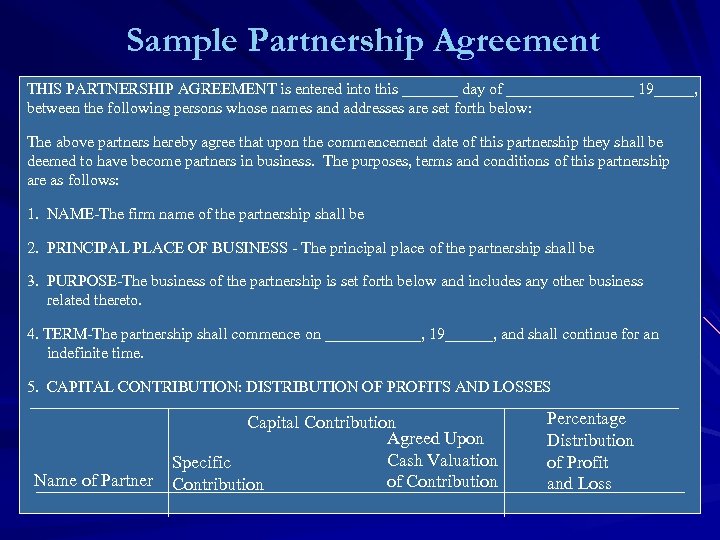

Sample Partnership Agreement THIS PARTNERSHIP AGREEMENT is entered into this _______ day of ________ 19_____, between the following persons whose names and addresses are set forth below: The above partners hereby agree that upon the commencement date of this partnership they shall be deemed to have become partners in business. The purposes, terms and conditions of this partnership are as follows: 1. NAME-The firm name of the partnership shall be 2. PRINCIPAL PLACE OF BUSINESS - The principal place of the partnership shall be 3. PURPOSE-The business of the partnership is set forth below and includes any other business related thereto. 4. TERM-The partnership shall commence on ______, 19______, and shall continue for an indefinite time. 5. CAPITAL CONTRIBUTION: DISTRIBUTION OF PROFITS AND LOSSES Name of Partner Capital Contribution Agreed Upon Cash Valuation Specific of Contribution Percentage Distribution of Profit and Loss

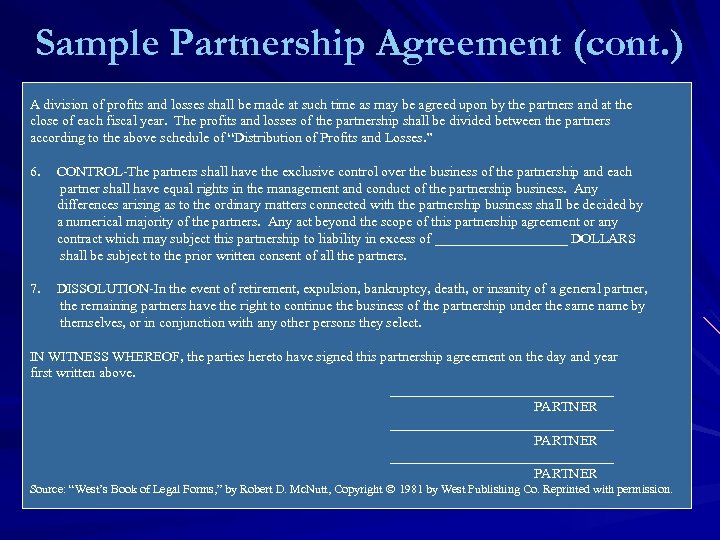

Sample Partnership Agreement (cont. ) A division of profits and losses shall be made at such time as may be agreed upon by the partners and at the close of each fiscal year. The profits and losses of the partnership shall be divided between the partners according to the above schedule of “Distribution of Profits and Losses. ” 6. CONTROL-The partners shall have the exclusive control over the business of the partnership and each partner shall have equal rights in the management and conduct of the partnership business. Any differences arising as to the ordinary matters connected with the partnership business shall be decided by a numerical majority of the partners. Any act beyond the scope of this partnership agreement or any contract which may subject this partnership to liability in excess of __________ DOLLARS shall be subject to the prior written consent of all the partners. 7. DISSOLUTION-In the event of retirement, expulsion, bankruptcy, death, or insanity of a general partner, the remaining partners have the right to continue the business of the partnership under the same name by themselves, or in conjunction with any other persons they select. IN WITNESS WHEREOF, the parties hereto have signed this partnership agreement on the day and year first written above. ________________________________ PARTNER Source: “West’s Book of Legal Forms, ” by Robert D. Mc. Nutt, Copyright 1981 by West Publishing Co. Reprinted with permission.

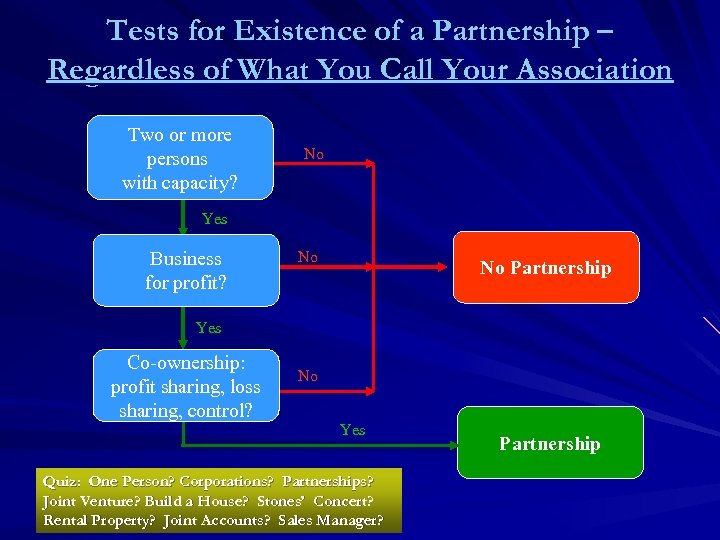

Tests for Existence of a Partnership – Regardless of What You Call Your Association Two or more persons with capacity? No Yes Business for profit? No No Partnership Yes Co-ownership: profit sharing, loss sharing, control? No Yes Quiz: One Person? Corporations? Partnerships? Joint Venture? Build a House? Stones’ Concert? Rental Property? Joint Accounts? Sales Manager? Partnership

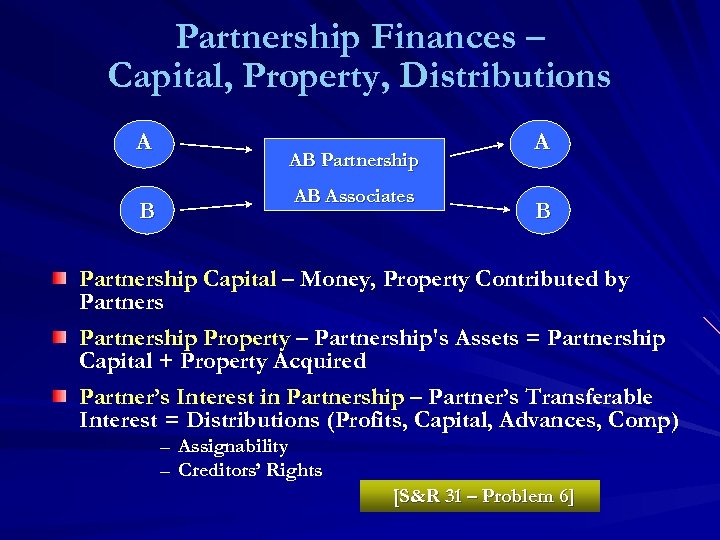

Partnership Finances – Capital, Property, Distributions A AB Partnership AB Associates B A B Partnership Capital – Money, Property Contributed by Partnership Property – Partnership's Assets = Partnership Capital + Property Acquired Partner’s Interest in Partnership – Partner’s Transferable Interest = Distributions (Profits, Capital, Advances, Comp) – – Assignability Creditors’ Rights [S&R 31 – Problem 6]

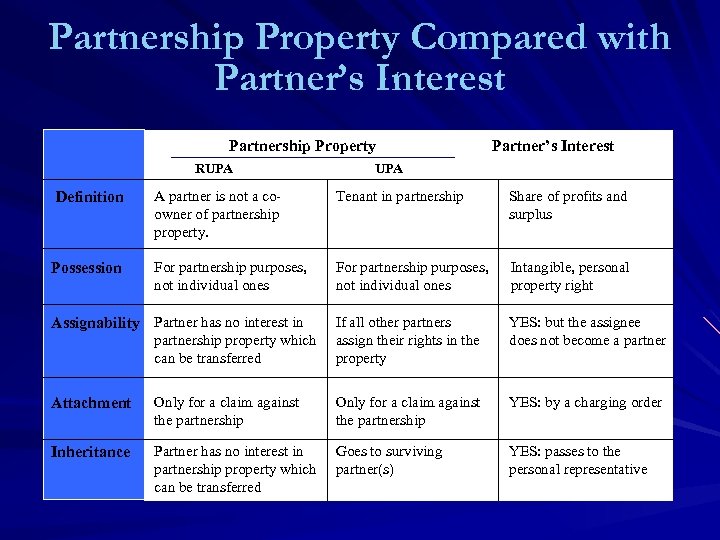

Partnership Property Compared with Partner’s Interest Partnership Property RUPA Partner’s Interest UPA A partner is not a coowner of partnership property. Tenant in partnership Share of profits and surplus For partnership purposes, not individual ones Intangible, personal property right partnership property which can be transferred If all other partners assign their rights in the property YES: but the assignee does not become a partner Attachment Only for a claim against the partnership YES: by a charging order Inheritance Partner has no interest in partnership property which can be transferred Goes to surviving partner(s) YES: passes to the personal representative Definition Possession Assignability Partner has no interest in

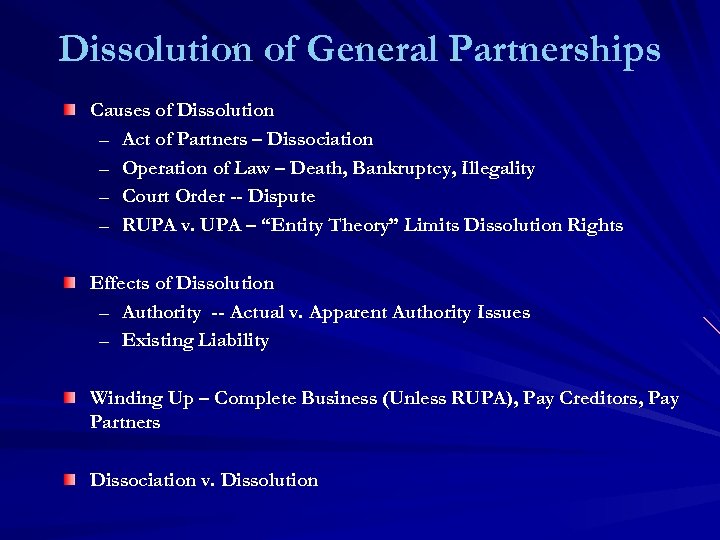

Dissolution of General Partnerships Causes of Dissolution – Act of Partners – Dissociation – Operation of Law – Death, Bankruptcy, Illegality – Court Order -- Dispute – RUPA v. UPA – “Entity Theory” Limits Dissolution Rights Effects of Dissolution – Authority -- Actual v. Apparent Authority Issues – Existing Liability Winding Up – Complete Business (Unless RUPA), Pay Creditors, Pay Partners Dissociation v. Dissolution

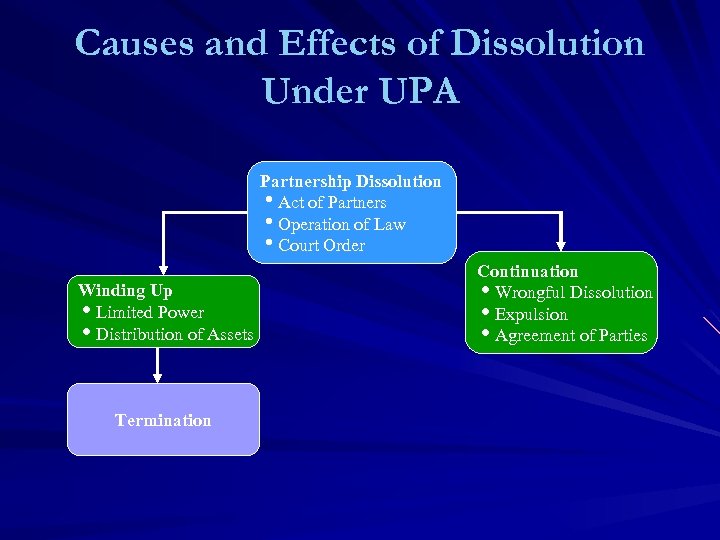

Causes and Effects of Dissolution Under UPA Partnership Dissolution Act of Partners Operation of Law Court Order Winding Up Limited Power Distribution of Assets Termination Continuation Wrongful Dissolution Expulsion Agreement of Parties

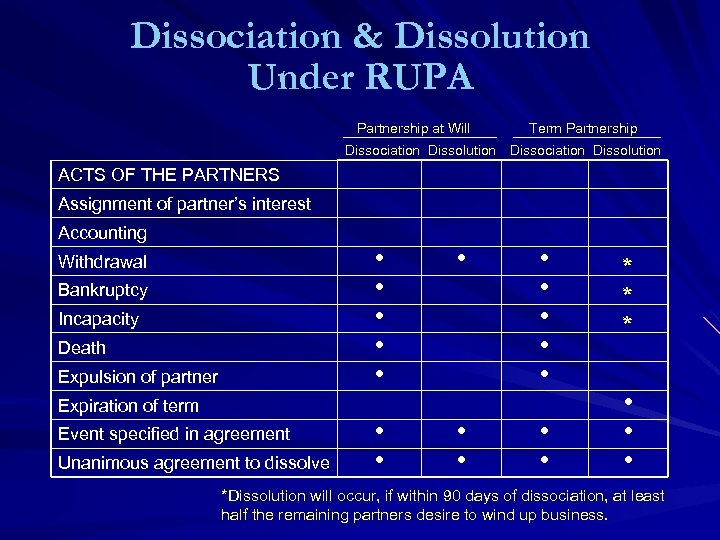

Dissociation & Dissolution Under RUPA Partnership at Will Term Partnership Dissociation Dissolution ACTS OF THE PARTNERS Assignment of partner’s interest Accounting • • • Withdrawal Bankruptcy Incapacity Death Expulsion of partner • • • Expiration of term Event specified in agreement Unanimous agreement to dissolve • • • * * * • • • *Dissolution will occur, if within 90 days of dissociation, at least half the remaining partners desire to wind up business.

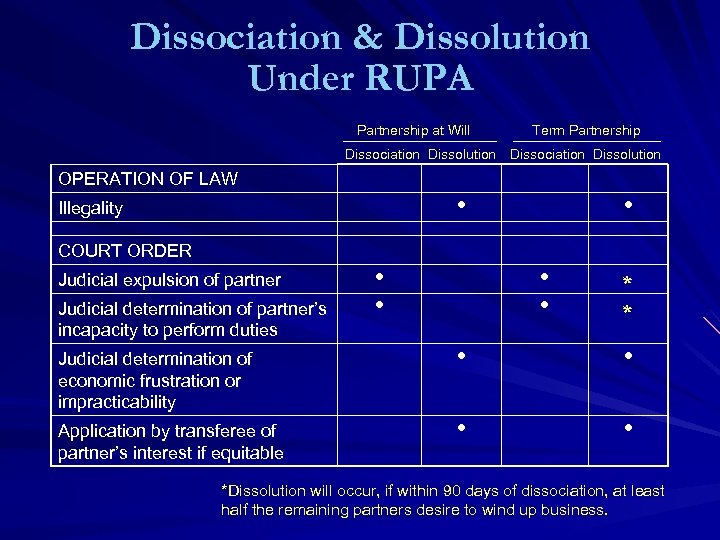

Dissociation & Dissolution Under RUPA Partnership at Will Term Partnership Dissociation Dissolution OPERATION OF LAW • Illegality • COURT ORDER Judicial expulsion of partner Judicial determination of partner’s incapacity to perform duties • • * * Judicial determination of economic frustration or impracticability • • Application by transferee of partner’s interest if equitable • • *Dissolution will occur, if within 90 days of dissociation, at least half the remaining partners desire to wind up business.

Relationships Among Partners – Duties Fiduciary Duty – Utmost (“Highest Punctilio”) Loyalty, Fairness, Good Faith Duty of Obedience – Abide by Partnership Agreement, Proper Partnership Business Decisions Duty of Care – Manage Partnership Affairs Without Gross Negligence, Reckless Conduct, Intentional Misconduct, Knowing Violation of Law

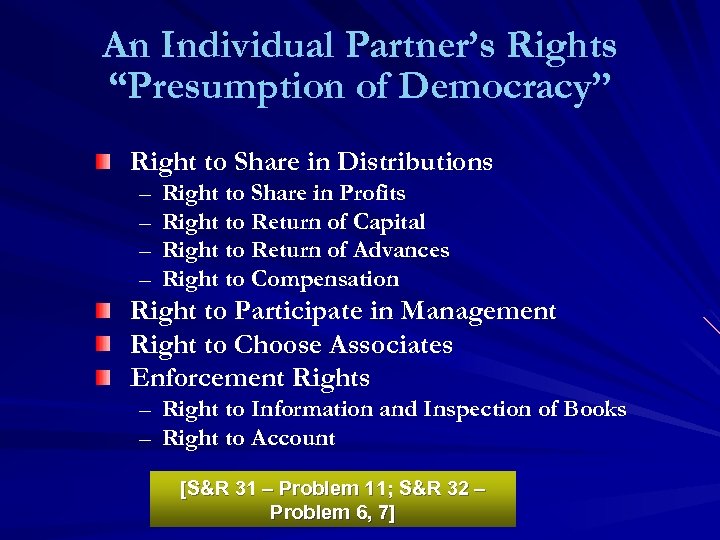

An Individual Partner’s Rights “Presumption of Democracy” Right to Share in Distributions – – Right to Share in Profits Right to Return of Capital Right to Return of Advances Right to Compensation Right to Participate in Management Right to Choose Associates Enforcement Rights – Right to Information and Inspection of Books – Right to Account [S&R 31 – Problem 11; S&R 32 – Problem 6, 7]

Relationship Between Partners and Third Parties Contracts of Partnership Torts and Crimes of Partnership Liability of Incoming Partner

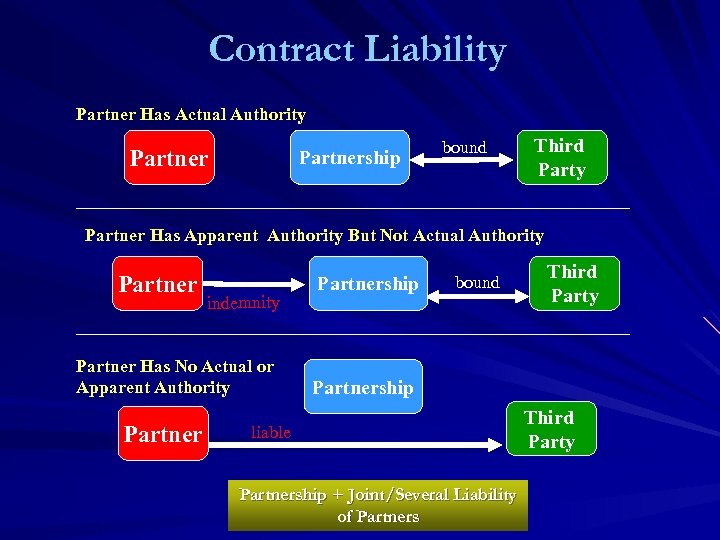

Contract Liability Partner Has Actual Authority Partnership bound Third Party Partner Has Apparent Authority But Not Actual Authority Partner indemnity Partner Has No Actual or Apparent Authority Partnership bound Third Party Partnership liable Partnership + Joint/Several Liability of Partners Third Party

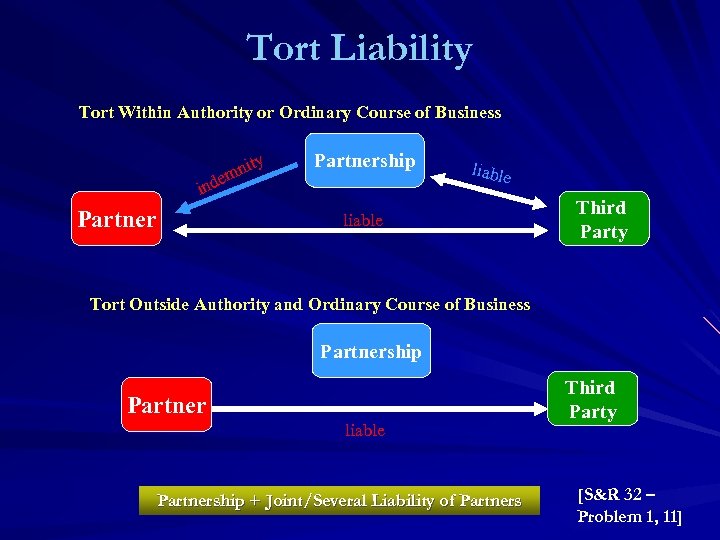

Tort Liability Tort Within Authority or Ordinary Course of Business nde nity m i Partnership liable Third Party Tort Outside Authority and Ordinary Course of Business Partnership Partner liable Partnership + Joint/Several Liability of Partners Third Party [S&R 32 – Problem 1, 11]

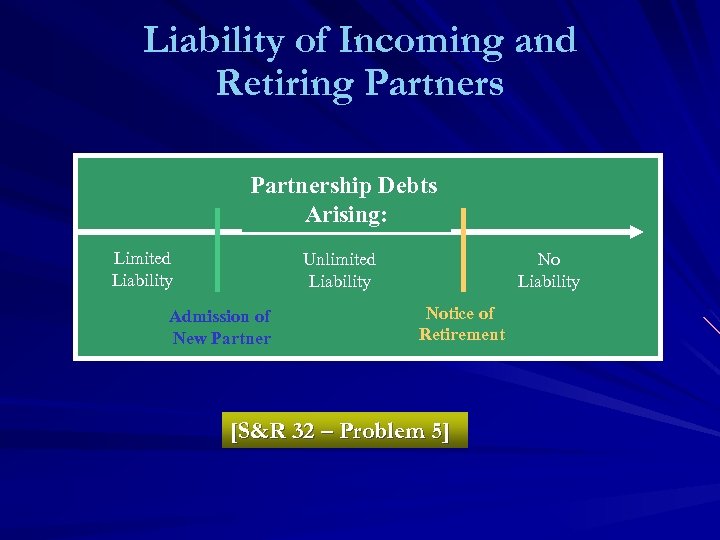

Liability of Incoming and Retiring Partnership Debts Arising: Limited Liability Unlimited Liability Admission of New Partner No Liability Notice of Retirement [S&R 32 – Problem 5]

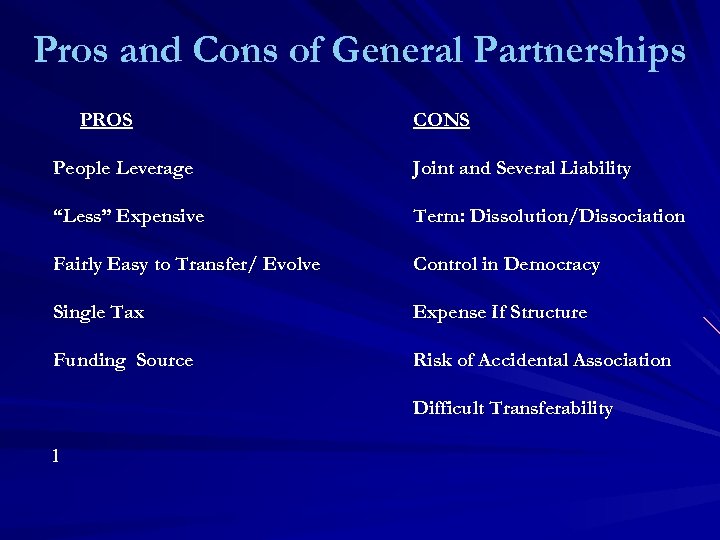

Pros and Cons of General Partnerships PROS CONS People Leverage Joint and Several Liability “Less” Expensive Term: Dissolution/Dissociation Fairly Easy to Transfer/ Evolve Control in Democracy Single Tax Expense If Structure Funding Source Risk of Accidental Association Difficult Transferability l

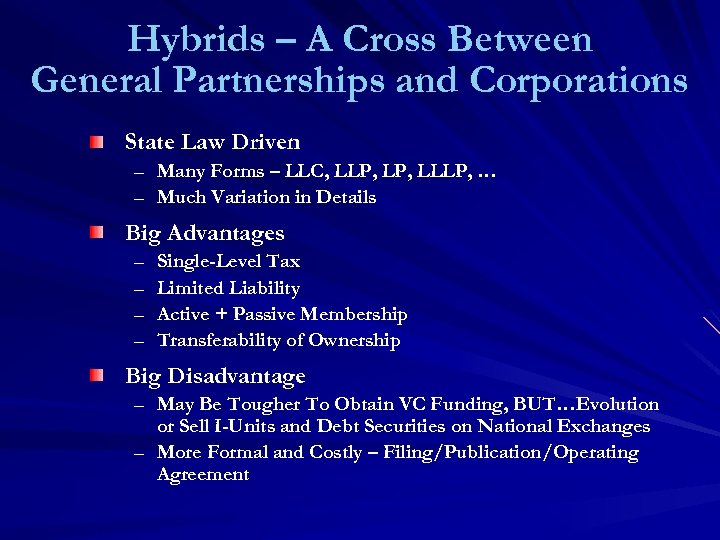

Hybrids – A Cross Between General Partnerships and Corporations State Law Driven – Many Forms – LLC, LLP, LLLP, … – Much Variation in Details Big Advantages – – Single-Level Tax Limited Liability Active + Passive Membership Transferability of Ownership Big Disadvantage – May Be Tougher To Obtain VC Funding, BUT…Evolution or Sell I-Units and Debt Securities on National Exchanges – More Formal and Costly – Filing/Publication/Operating Agreement

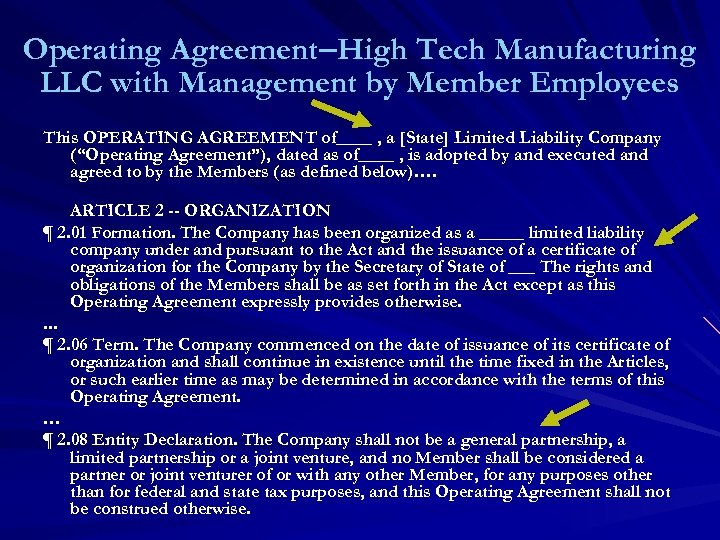

Operating Agreement–High Tech Manufacturing LLC with Management by Member Employees This OPERATING AGREEMENT of____ , a [State] Limited Liability Company (“Operating Agreement”), dated as of____ , is adopted by and executed and agreed to by the Members (as defined below)…. ARTICLE 2 -- ORGANIZATION ¶ 2. 01 Formation. The Company has been organized as a _____ limited liability company under and pursuant to the Act and the issuance of a certificate of organization for the Company by the Secretary of State of ___ The rights and obligations of the Members shall be as set forth in the Act except as this Operating Agreement expressly provides otherwise. . ¶ 2. 06 Term. The Company commenced on the date of issuance of its certificate of organization and shall continue in existence until the time fixed in the Articles, or such earlier time as may be determined in accordance with the terms of this Operating Agreement. … ¶ 2. 08 Entity Declaration. The Company shall not be a general partnership, a limited partnership or a joint venture, and no Member shall be considered a partner or joint venturer of or with any other Member, for any purposes other than for federal and state tax purposes, and this Operating Agreement shall not be construed otherwise.

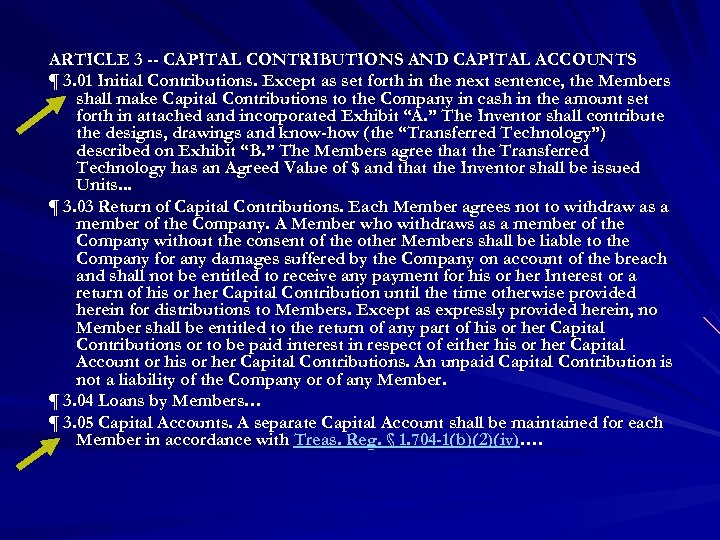

ARTICLE 3 -- CAPITAL CONTRIBUTIONS AND CAPITAL ACCOUNTS ¶ 3. 01 Initial Contributions. Except as set forth in the next sentence, the Members shall make Capital Contributions to the Company in cash in the amount set forth in attached and incorporated Exhibit “A. ” The Inventor shall contribute the designs, drawings and know-how (the “Transferred Technology”) described on Exhibit “B. ” The Members agree that the Transferred Technology has an Agreed Value of $ and that the Inventor shall be issued Units. . . ¶ 3. 03 Return of Capital Contributions. Each Member agrees not to withdraw as a member of the Company. A Member who withdraws as a member of the Company without the consent of the other Members shall be liable to the Company for any damages suffered by the Company on account of the breach and shall not be entitled to receive any payment for his or her Interest or a return of his or her Capital Contribution until the time otherwise provided herein for distributions to Members. Except as expressly provided herein, no Member shall be entitled to the return of any part of his or her Capital Contributions or to be paid interest in respect of either his or her Capital Account or his or her Capital Contributions. An unpaid Capital Contribution is not a liability of the Company or of any Member. ¶ 3. 04 Loans by Members… ¶ 3. 05 Capital Accounts. A separate Capital Account shall be maintained for each Member in accordance with Treas. Reg. § 1. 704 -1(b)(2)(iv)….

ARTICLE 4 -- ALLOCATIONS AND DISTRIBUTIONS ¶ 4. 01 Allocation of Profits and Losses. … Profits and Losses for each fiscal year shall be allocated among the Members in accordance with the Sharing Ratio. . ARTICLE 5 -- MEMBERSHIP; DISPOSITIONS OF INTERESTS ¶ 5. 01 Initial Members… ¶ 5. 03 Restrictions on Transfer of Interests… ¶ 5. 04 Purchase Price. The purchase price payable to a Withdrawing Member whose Membership Interests are being acquired pursuant to ¶ 5. 03 shall be determined as follows: … ¶ 5. 05 Additional Members. . . ¶ 5. 09 Information. . . ¶ 5. 10 Liability to Third Parties. No Member shall, by virtue of his or her status as a Member or his or her ownership of an Interest, be liable for the debts, obligations or liabilities of the Company. ¶ 5. 11 Lack of Authority. No Member has the authority or power to act for or on behalf of the Company, to do any act that would be binding on the Company, or to incur any expenditures on behalf of the Company, except to the extent that such act or expenditure has been approved by a Majority Interest or such greater interest required by this Operating Agreement, the Articles or applicable law.

ARTICLE 6 ― MANAGEMENT OF COMPANY AND MEETINGS OF MEMBERS ¶ 6. 01 Management of Company. The Members have the exclusive right to manage the Company's business. Accordingly, except as otherwise specifically limited in this Operating Agreement or under applicable law, the Members, at times acting through the officers of the Company, shall: (i) manage the affairs and business of the Company; (ii) exercise the authority and powers granted to the Company; and (iii) otherwise act in all other matters on behalf of the Company. No contract, obligation or liability of any kind or type can be entered into on behalf of the Company by any Member other than a Member or an officer of the Company acting with the consent of a Majority Interest (or a greater interest, if required by the terms of this Operating Agreement, the Articles or applicable law). The Members, at times acting through the Company's officers, shall take all actions which shall be necessary or appropriate to accomplish the Company's purposes in accordance with the terms of this Operating Agreement. ¶ 6. 02 Meetings. . . ¶ 6. 10 Officers. The officers of the Company shall consist of a President, a Treasurer and a Secretary. The officers shall exercise such powers and perform such duties as are prescribed by a Majority Interest. Any number of offices may be held by the same person, as a Majority Interest may determine, except that no person may simultaneously hold the offices of President and Secretary…

ARTICLE 9 ― RESTRICTIVE COVENANTS ¶ 9. 01 Noncompete Restriction… ¶ 9. 02 Nondisclosure. . . ¶ 9. 03 Return of Materials. . . ARTICLE 10 -- DISSOLUTION, LIQUIDATION AND TERMINATION ¶ 10. 01 Events of Dissolution… ¶ 10. 06 Inventor's Option To Purchase Property… IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first set forth above. EXHIBIT A -- [List of Members, their Capital Contributions, and their Units] EXHIBIT B -- [Description of Transferred Technology] © 2005 Thomson/West -- FLETCHER-FRM § 4295. 700

Bottom Lines; Q&A’s General Partnerships Leverage Contributions/Services Association in General Partnership – Deceptively Simple, or Intentionally Formal General Partners are Jointly/Severally Responsible for Partnership Acts Several Important Characteristics of General Partnerships – Form, Function, Finances – Depend on Location (UPA, RUPA) Significant Benefits of General Partnerships Include Leverage, Single Level Tax Hybrid Forms of Business Association Marry Some Benefits of General Partnerships with Benefits of Corporations

51e1671835a5269d658d183632910e16.ppt