13d588c3b810351af6fe8e5dfb96216e.ppt

- Количество слайдов: 12

Basic Building Blocks of SARS Domestic Resource Mobilisation Aidan Keanly South African Revenue Service

THE FIRST STEPS…… Remember…. . n Every country is very different n Understand YOUR particular environment n Customise by looking at three basic questions • • • 2 What’s NEW? What’s the TRUTH? What’s the RIGHT thing to do?

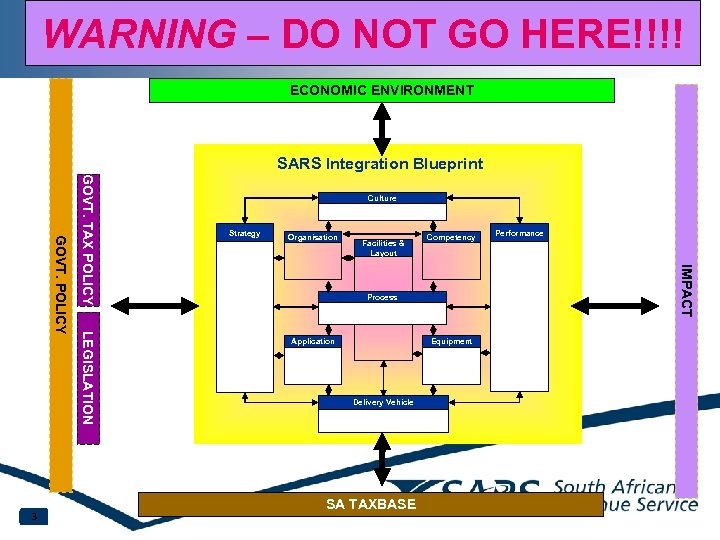

WARNING – DO NOT GO HERE!!!! ECONOMIC ENVIRONMENT SARS Integration Blueprint Strategy Organisation Facilities & Layout Competency Process LEGISLATION Application Equipment Delivery Vehicle SA TAXBASE Performance IMPACT GOVT. TAX POLICY GOVT. POLICY 3 Culture

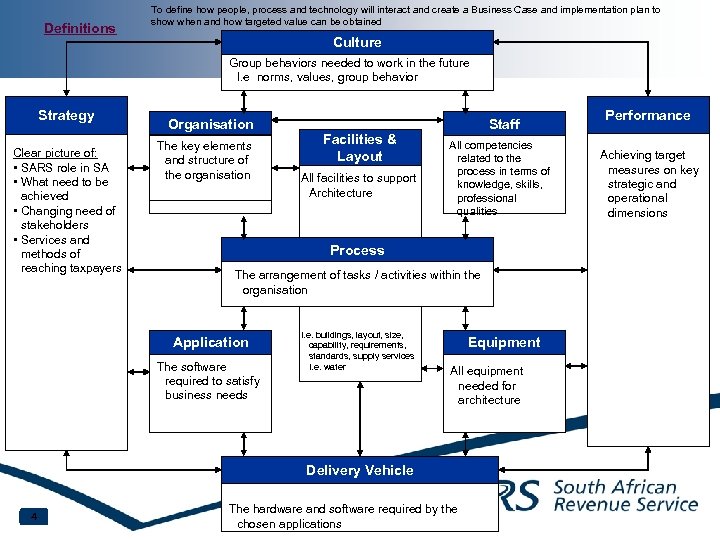

Definitions To define how people, process and technology will interact and create a Business Case and implementation plan to show when and how targeted value can be obtained Culture Group behaviors needed to work in the future I. e norms, values, group behavior Strategy Clear picture of: • SARS role in SA • What need to be achieved • Changing need of stakeholders • Services and methods of reaching taxpayers Organisation The key elements and structure of the organisation Facilities & Layout All facilities to support Architecture Staff All competencies related to the process in terms of knowledge, skills, professional qualities Process The arrangement of tasks / activities within the organisation Application The software required to satisfy business needs I. e. buildings, layout, size, capability, requirements, standards, supply services I. e. water Equipment All equipment needed for architecture Delivery Vehicle 4 The hardware and software required by the chosen applications Performance Achieving target measures on key strategic and operational dimensions

BUILDING BLOCKS OF SARS DMR n n n n 5 Political will, support and air-cover Required legal framework Functioning institution (process not products) Know your market and segment Involve all stakeholders Change management Manage donor support and advice Measurement of success

TAX GAP IN SOUTH AFRICA § Tax Gap in South Africa between 15% and 30% § Capital flight (unrecorded and untaxed illicit leakage of capital and resources) estimated at 6. 6% of GDP § Approach by SARS to address leakages; • Policy reform and International collaboration • Enhancement of administrative efficiencies to optimize compliance of formal economy taxpayers • Education and outreach to informal economy • Risk Management 6

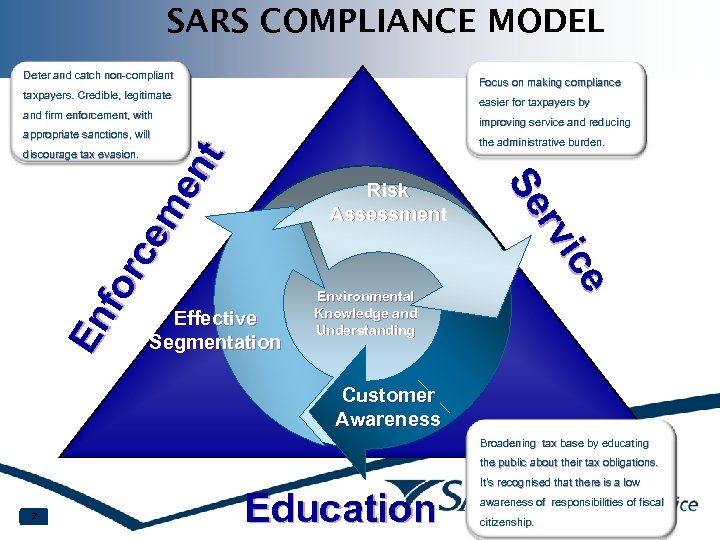

SARS COMPLIANCE MODEL Deter and catch non-compliant Focus on making compliance taxpayers. Credible, legitimate easier for taxpayers by and firm enforcement, with improving service and reducing appropriate sanctions, will the administrative burden. Risk Assessment Effective Segmentation Environmental Knowledge and Understanding ce iice rv rv Se Se En fo rc em en t discourage tax evasion. Customer Awareness Broadening tax base by educating the public about their tax obligations. 7 Education It’s recognised that there is a low awareness of responsibilities of fiscal citizenship.

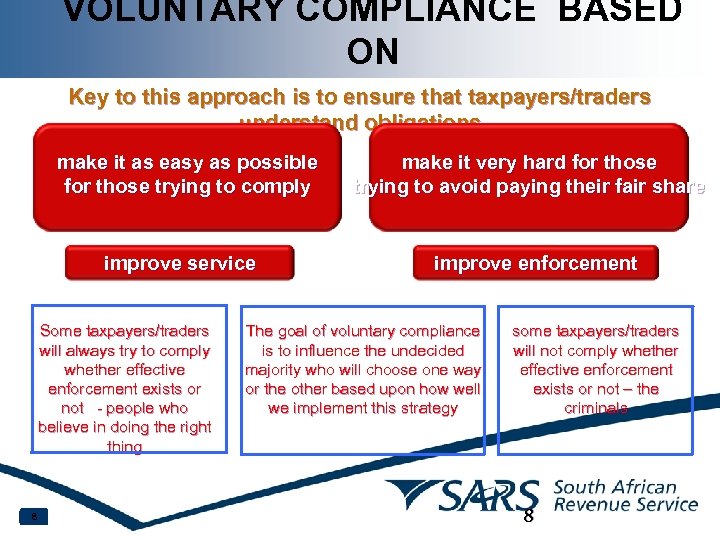

VOLUNTARY COMPLIANCE BASED ON Key to this approach is to ensure that taxpayers/traders understand obligations make it as easy as possible for those trying to comply improve service Some taxpayers/traders will always try to comply whether effective enforcement exists or not - people who believe in doing the right thing 8 make it very hard for those trying to avoid paying their fair share improve enforcement The goal of voluntary compliance is to influence the undecided majority who will choose one way or the other based upon how well we implement this strategy some taxpayers/traders will not comply whether effective enforcement exists or not – the criminals 8

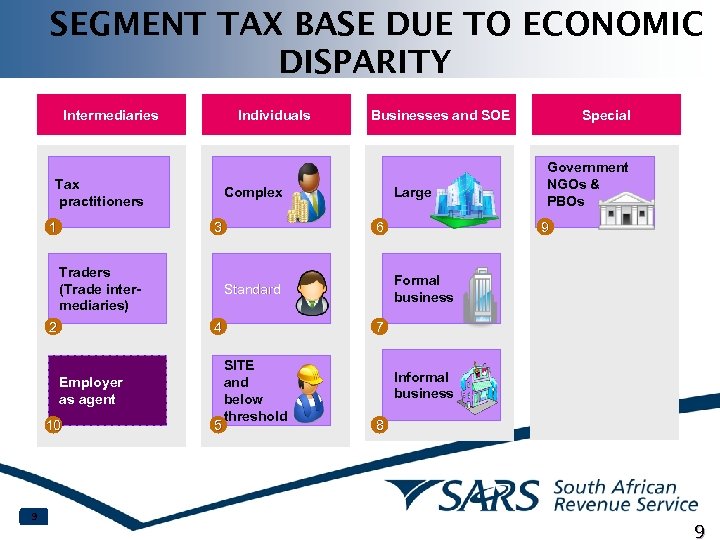

SEGMENT TAX BASE DUE TO ECONOMIC DISPARITY Intermediaries Individuals Tax practitioners 1 Complex 3 Traders (Trade intermediaries) 2 5 Special Government NGOs & PBOs 9 Formal business Standard Employer as agent 9 Large 6 4 10 Businesses and SOE 7 SITE and below threshold Informal business 8 9

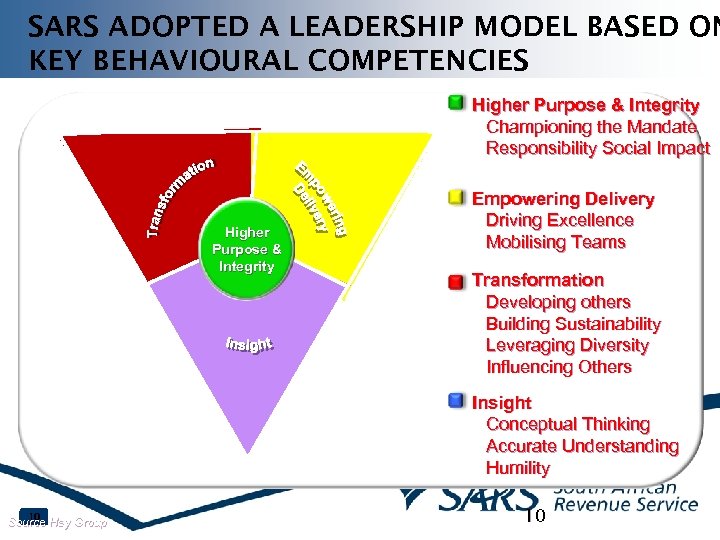

SARS ADOPTED A LEADERSHIP MODEL BASED ON KEY BEHAVIOURAL COMPETENCIES Higher Purpose & Integrity Championing the Mandate Responsibility Social Impact Higher Purpose & Integrity Empowering Delivery Driving Excellence Mobilising Teams Transformation Developing others Building Sustainability Leveraging Diversity Influencing Others Insight Conceptual Thinking Accurate Understanding Humility 10 Source Hay Group 10

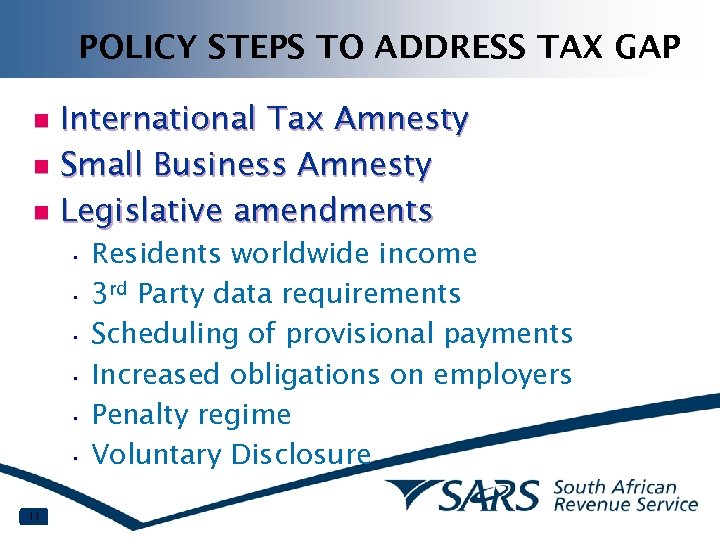

POLICY STEPS TO ADDRESS TAX GAP International Tax Amnesty n Small Business Amnesty n Legislative amendments n • • • 11 Residents worldwide income 3 rd Party data requirements Scheduling of provisional payments Increased obligations on employers Penalty regime Voluntary Disclosure

SUMMARY AND CONCLUSION n n n n 12 Compliance drives sustained SARS when GFC kicked in Exponential increase in e-channels Improved refund methodology and turnaround times Systematised deferment & agreements to assist taxpayers Widening of tax net through Risk Management via 3 rd party validations Better collections from Medium and Small companies Containment of suspicious VAT refunds & prosecution Significant improvement in provisional payments of individuals

13d588c3b810351af6fe8e5dfb96216e.ppt