Project ALMOST DONE чтение.pptx

- Количество слайдов: 36

BASIC AND WORKING CAPITAL, ITS CIRCULATION, TURNOVER, DEPRECIATION By Almaz Suraganov 11 ‘A’

Content Types of capital • The various components of working 2 capital. 3 • What are the types of working capital? 4 To analyze the liquidity trend. To analyze the working capital trend. 5 References 1 6 7 Conclusion

Types of Capital: 1 • Two types of Capital are needed in the business enterprise— 2 • Fixed Capital (Basic) 3 • Working Capital

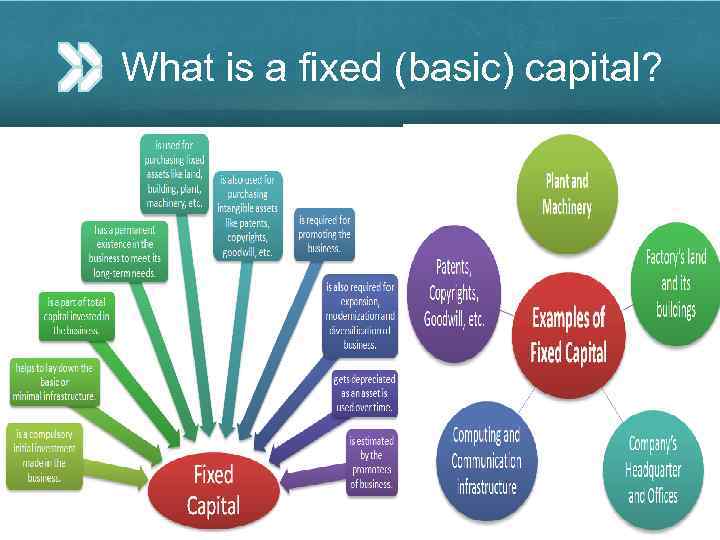

What is a fixed (basic) capital?

What is a working capital?

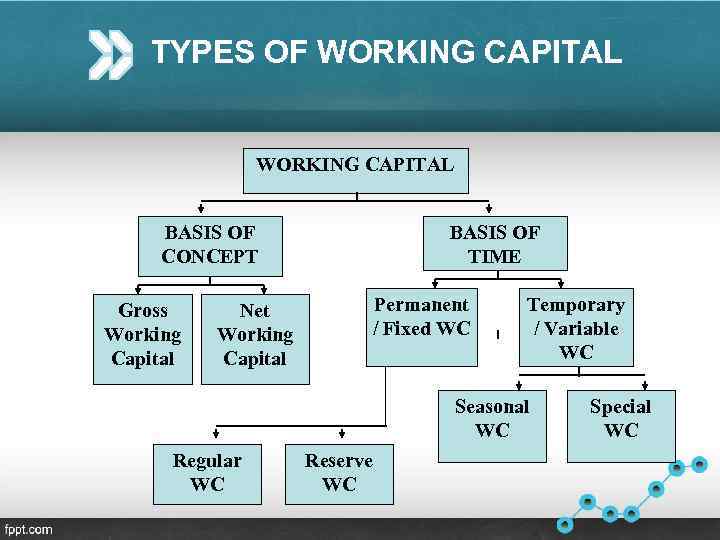

TYPES OF WORKING CAPITAL BASIS OF CONCEPT Gross Working Capital Net Working Capital BASIS OF TIME Permanent / Fixed WC Temporary / Variable WC Seasonal WC Regular WC Reserve WC Special WC

Circulating capital

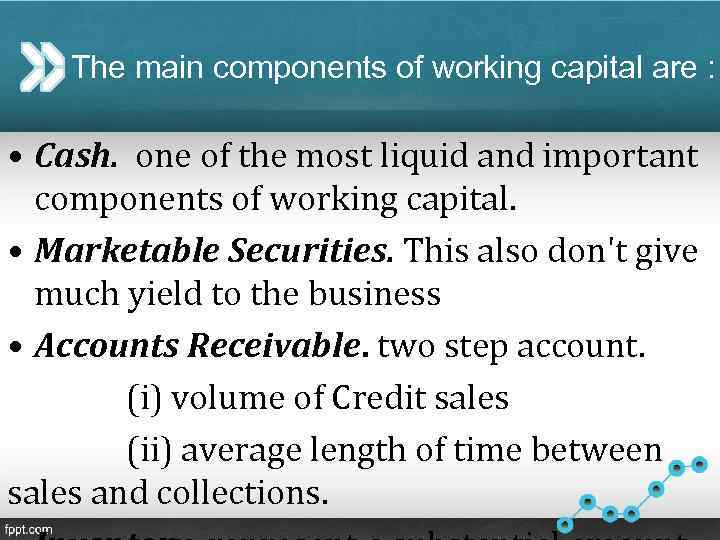

The main components of working capital are : • Cash. one of the most liquid and important components of working capital. • Marketable Securities. This also don't give much yield to the business • Accounts Receivable. two step account. (i) volume of Credit sales (ii) average length of time between sales and collections.

Why working capital? ? ? v. The firm has to maintain cash balance to pay the bills as they come due. v. In addition, the company must invest in inventories to fill customer orders promptly. v. And finally, the company invests in accounts receivable to extend credit to customers.

Working Capital Concepts Net Working Capital Current Assets - Current Liabilities. Gross Working Capital The firm’s investment in current assets. Working Capital Management The administration of the firm’s current assets and the financing needed to support current assets.

Gross Working Capital concept: ØThe gross working capital refers to investment in all the current assets taken together. ØGross Working Capital is also known as ‘ Circulating Capital’ or ‘Current Capital.

Valid reasons for Gross Working Capital: q. They should be considered as Working Capital. q. Total Current Assets represent the total funds available for operating purpose.

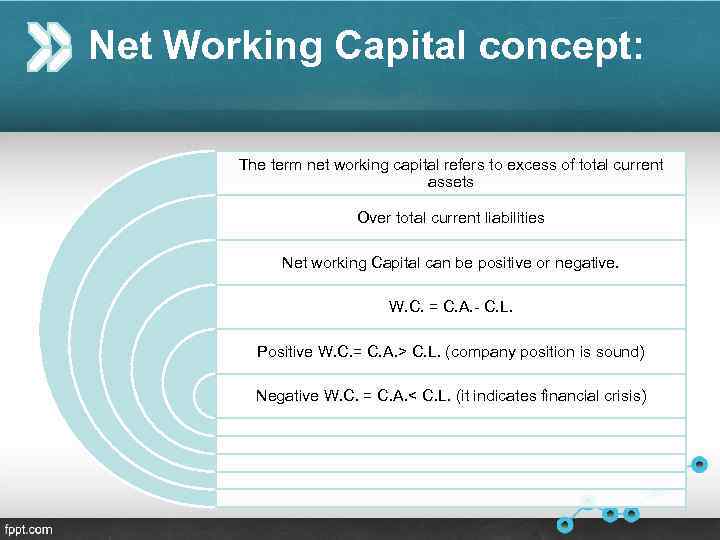

Net Working Capital concept: The term net working capital refers to excess of total current assets Over total current liabilities Net working Capital can be positive or negative. W. C. = C. A. - C. L. Positive W. C. = C. A. > C. L. (company position is sound) Negative W. C. = C. A. < C. L. (it indicates financial crisis)

Valid Reasons for net Working Capital: üSurplus of current assets over current liabilities. üFinancial health/soundness can easily be judged with this concept. üNot liable to be returned and which can be relied upon to meet any contingency.

What are the basic principles of working capital management? v. Principle of Risk Variation. v. Principle of Cost of Capital. v. Principle of Equity Position. v. Principle of Maturity of Payment.

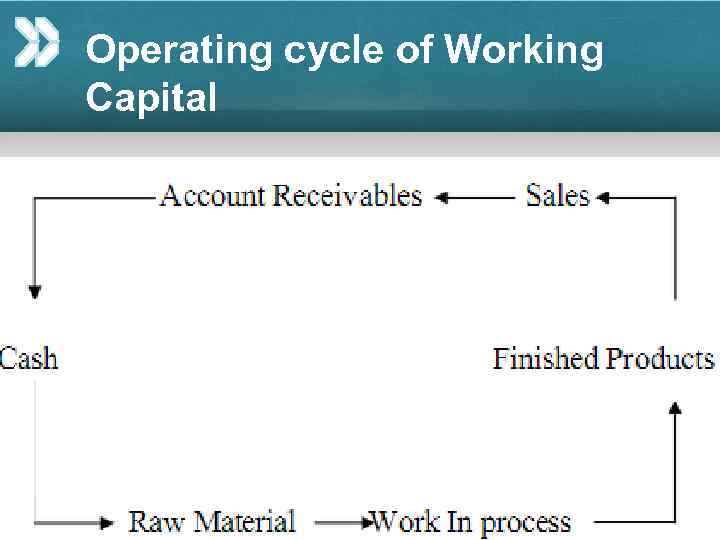

Operating cycle of Working Capital

Depreciation Policy v. Depreciation policy also exerts an influence on the quantum of working capital. Depreciation charges do not involve any cash outflows.

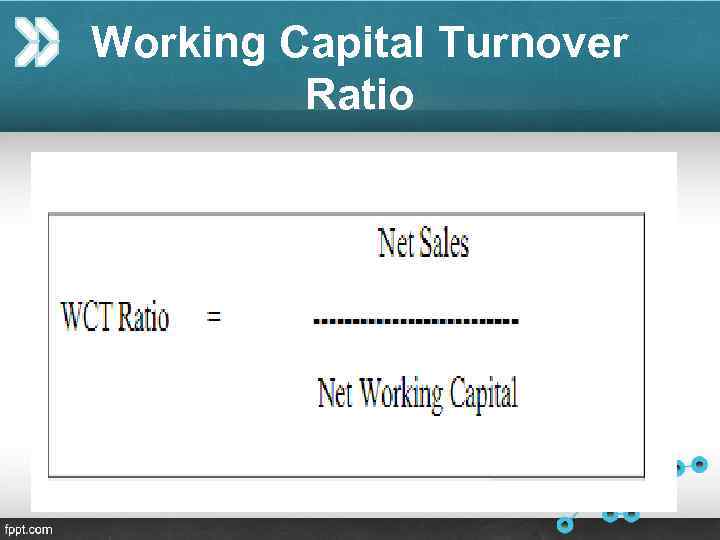

Working Capital Turnover Ratio

Problems of Excessive Working Capital üThe firm maintains a sound working capital position it should have adequate working capital to run its business operations üIt results in unnecessary accumulation of inventories. üIt is an indication of defective credit policy and slack collection period. üExcessive working capital makes

Equity turnover v. Capital turnover is used to calculate the rate of return on common equity, and is a measure of how well a company uses its stockholders' equity to generate revenue.

CORPORATE DEFINITION OF CASH MANAGEMENT v. The effective planning, monitoring and management of liquid / near liquid resources including: üDay-to-day cash control üMoney at the bank üReceipts üPayments üS-T investments and borrowings

BENEFITS OF GOOD CASH MANAGEMENT • Control of financial risk • Opportunity for profit • Strengthened balance sheet • Increased customer, supplier, and shareholder confidence 22

DEFINITION OF LIQUIDITY v The degree to which an asset or security can be bought or sold in the market without affecting the asset's price.

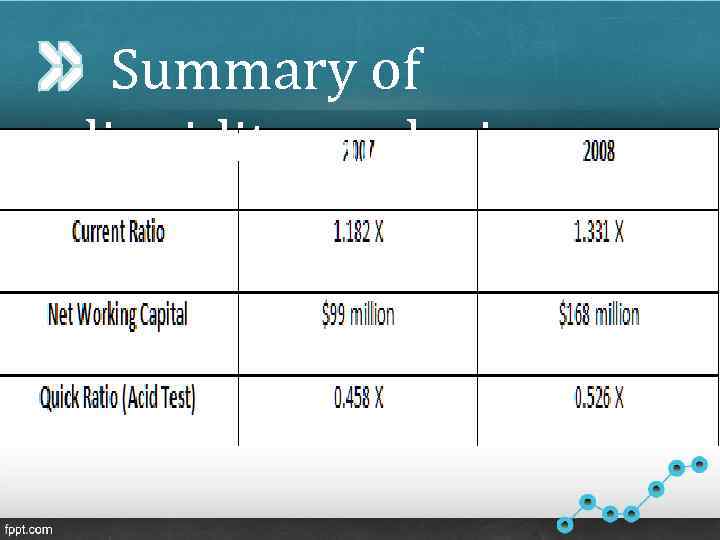

Summary of liquidity analysis

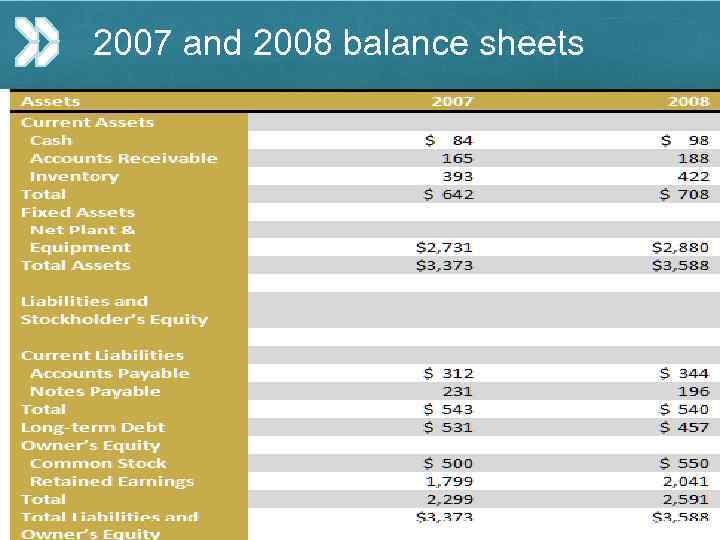

2007 and 2008 balance sheets

Disadvantages or Dangers of Inadequate or Short Working Capital õ Can’t pay off its short-term liabilities in time. õ Economies of scale are not possible. õ Difficult for the firm to exploit favorable market situations õ Day-to-day liquidity worsens

FORECASTING / ESTIMATION OF WORKING CAPITAL REQUIREMENTS Factors to be considered ü Total costs incurred on materials, wages and overheads ü The length of time for which raw materials remain in stores before they are issued to production. ü The length of the Sales Cycle during which FG are to be kept waiting for sales. ü The average period of credit allowed to customers. ü The amount of cash required to pay day-today expenses of the business. ü The amount of cash required for advance

Points to be remembered while estimating WC • (1) Profits should be ignored while calculating working capital requirements for the following reasons. • (a) Profits may or may not be used as working capital • (b) Even if it is used, it may be reduced by the amount of Income tax, Drawings, Dividend paid etc. • (2) Calculation of WIP depends on the degree of completion as regards to materials, labor and overheads.

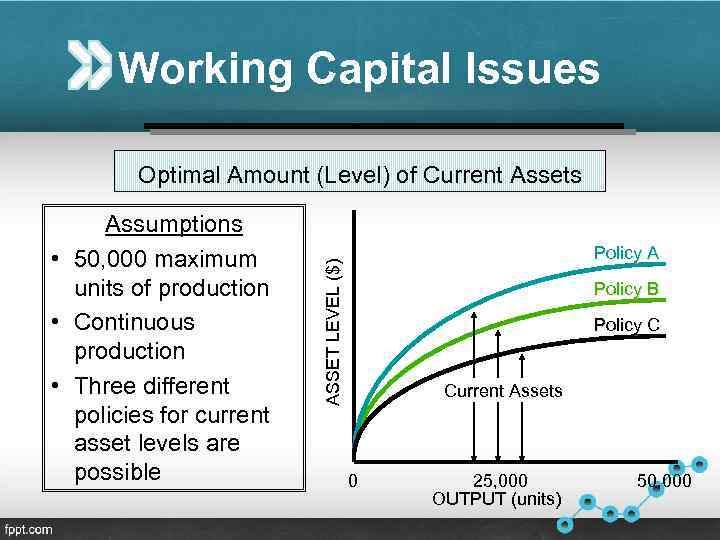

Working Capital Issues Optimal Amount (Level) of Current Assets Policy A ASSET LEVEL ($) Assumptions • 50, 000 maximum units of production • Continuous production • Three different policies for current asset levels are possible Policy B Policy C Current Assets 0 25, 000 OUTPUT (units) 50, 000

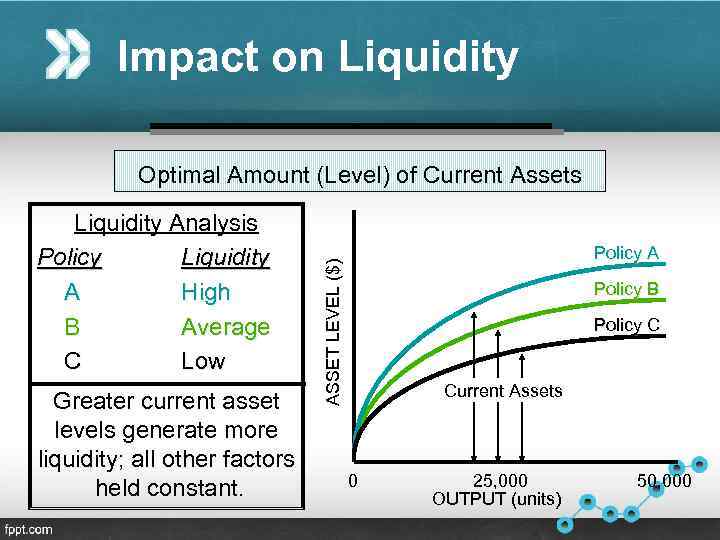

Impact on Liquidity Optimal Amount (Level) of Current Assets Greater current asset levels generate more liquidity; all other factors held constant. Policy A ASSET LEVEL ($) Liquidity Analysis Policy Liquidity A High B Average C Low Policy B Policy C Current Assets 0 25, 000 OUTPUT (units) 50, 000

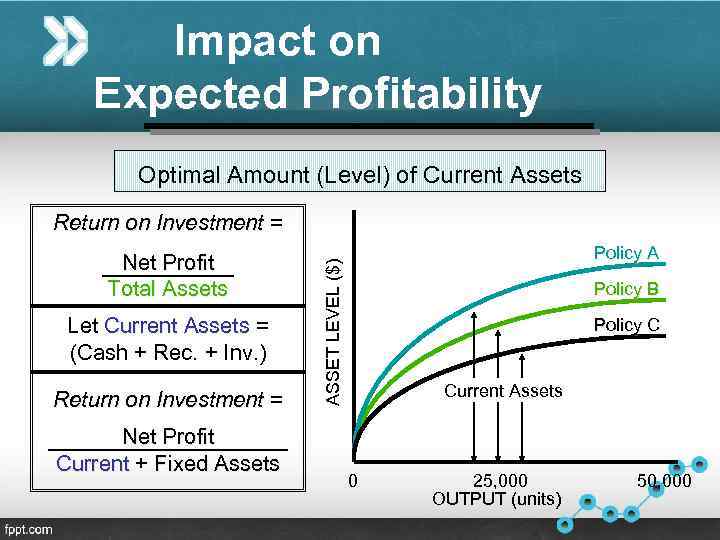

Impact on Expected Profitability Optimal Amount (Level) of Current Assets Return on Investment = Let Current Assets = (Cash + Rec. + Inv. ) Return on Investment = Net Profit Current + Fixed Assets Policy A ASSET LEVEL ($) Net Profit Total Assets Policy B Policy C Current Assets 0 25, 000 OUTPUT (units) 50, 000

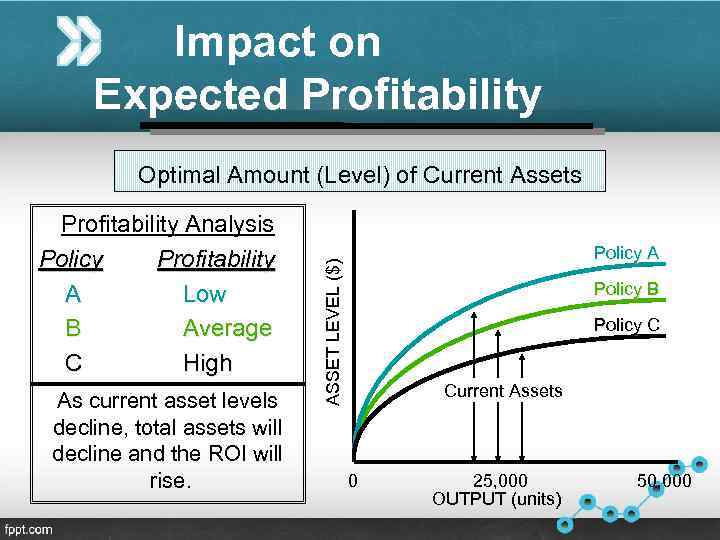

Impact on Expected Profitability Optimal Amount (Level) of Current Assets As current asset levels decline, total assets will decline and the ROI will rise. Policy A ASSET LEVEL ($) Profitability Analysis Policy Profitability A Low B Average C High Policy B Policy C Current Assets 0 25, 000 OUTPUT (units) 50, 000

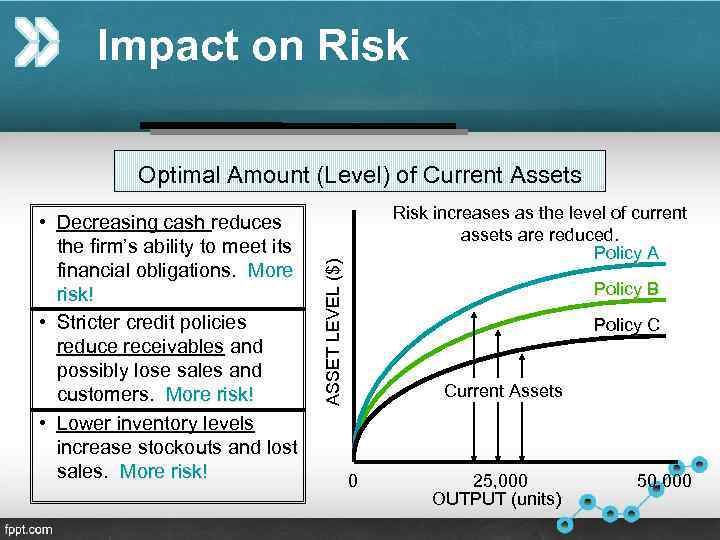

Impact on Risk Optimal Amount (Level) of Current Assets Risk increases as the level of current assets are reduced. Policy A ASSET LEVEL ($) • Decreasing cash reduces the firm’s ability to meet its financial obligations. More risk! • Stricter credit policies reduce receivables and possibly lose sales and customers. More risk! • Lower inventory levels increase stockouts and lost sales. More risk! Policy B Policy C Current Assets 0 25, 000 OUTPUT (units) 50, 000

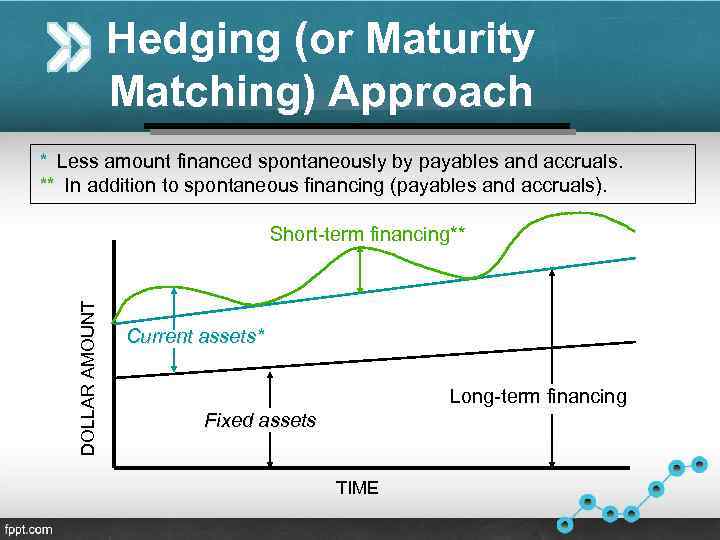

Hedging (or Maturity Matching) Approach * Less amount financed spontaneously by payables and accruals. ** In addition to spontaneous financing (payables and accruals). DOLLAR AMOUNT Short-term financing** Current assets* Long-term financing Fixed assets TIME

Conclusion üIt is easy to conclude that working capital is the lifeline of any organization. To stay healthy , to stay in business and to grow, it requires a strong working capital management plan. üCompany should give more attention on increasing its collection of revenue from wheeling of power. üWorking capital finance for a capital-intensive infrastructure is carried out by fund based and non-fund based sources.

References üwww. investopedia. com üReferences: - Pander, I. M. , Financial management, Visas publication, 2011. üBarratt, Michael, and Andy Mottershead. Business Studies. Pearson Education Limited, 2000. www. candcinfrastructure. com üwww. care. ac. in/candc üHoang, Paul. Business and Management. Victoria: IBID Press, 2007

Project ALMOST DONE чтение.pptx