281f7b0b7c8fbaca58a3d9d99e757dd7.ppt

- Количество слайдов: 8

BASEL II IMPLEMENTATION AND ITS IMPACT ON ISLAMIC FINANCIAL INSTITUTIONS St. Petersburg, Russia (June 2006) MALAYSIA DEPOSIT INSURANCE CORPORATION © Copyright 2006 All Rights Reserved

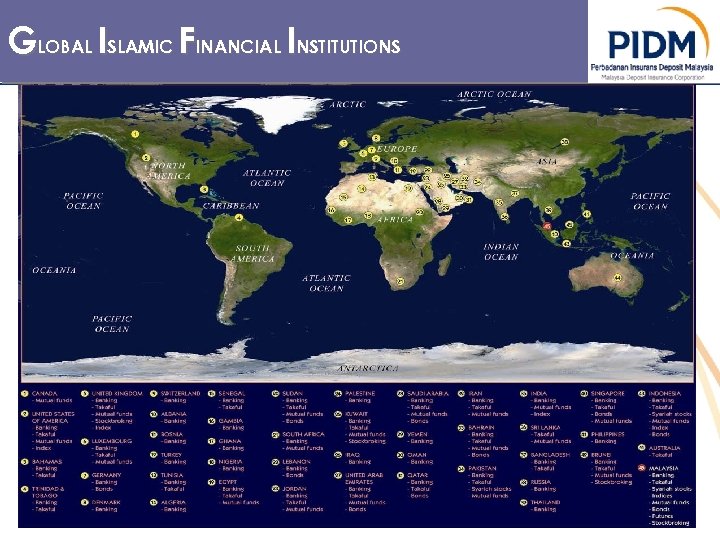

GLOBAL ISLAMIC FINANCIAL INSTITUTIONS

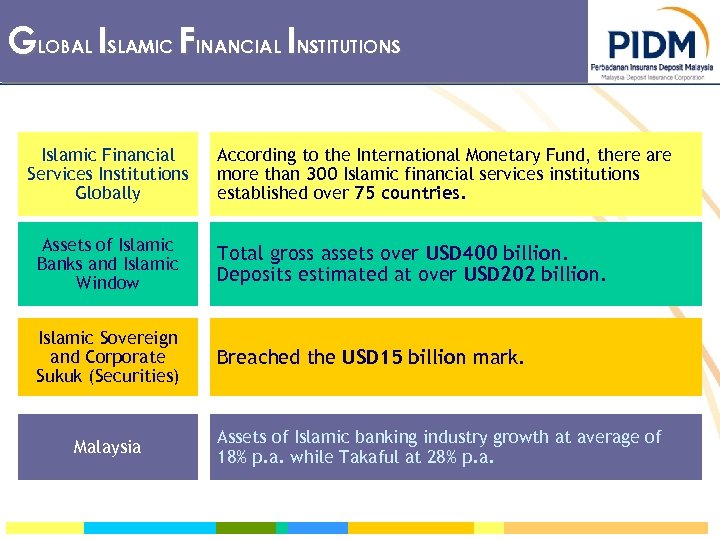

GLOBAL ISLAMIC FINANCIAL INSTITUTIONS Islamic Financial Services Institutions Globally According to the International Monetary Fund, there are more than 300 Islamic financial services institutions established over 75 countries. Assets of Islamic Banks and Islamic Window Total gross assets over USD 400 billion. Deposits estimated at over USD 202 billion. Islamic Sovereign and Corporate Sukuk (Securities) Breached the USD 15 billion mark. Malaysia Assets of Islamic banking industry growth at average of 18% p. a. while Takaful at 28% p. a.

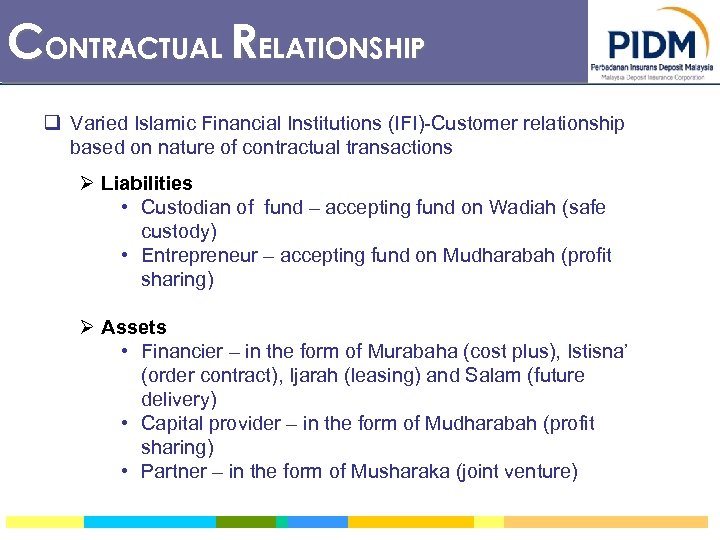

CONTRACTUAL RELATIONSHIP q Varied Islamic Financial Institutions (IFI)-Customer relationship based on nature of contractual transactions Ø Liabilities • Custodian of fund – accepting fund on Wadiah (safe custody) • Entrepreneur – accepting fund on Mudharabah (profit sharing) Ø Assets • Financier – in the form of Murabaha (cost plus), Istisna’ (order contract), Ijarah (leasing) and Salam (future delivery) • Capital provider – in the form of Mudharabah (profit sharing) • Partner – in the form of Musharaka (joint venture)

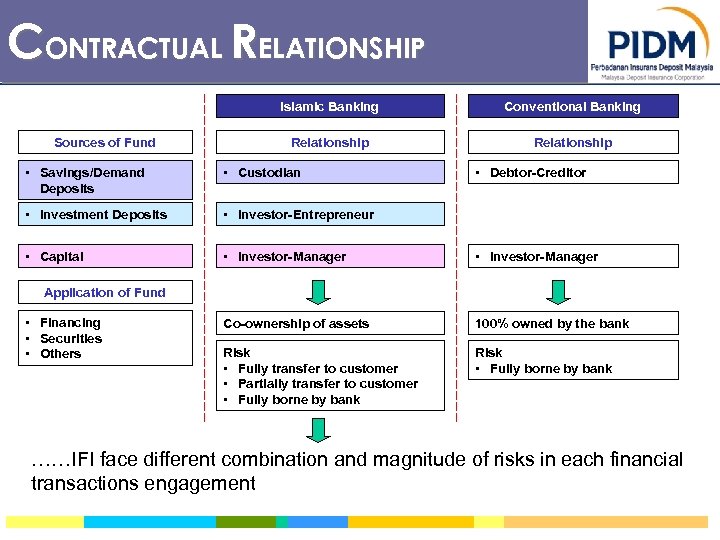

CONTRACTUAL RELATIONSHIP Islamic Banking Sources of Fund Conventional Banking Relationship • Savings/Demand Deposits • Custodian • Debtor-Creditor • Investment Deposits • Investor-Entrepreneur • Capital • Investor-Manager Co-ownership of assets 100% owned by the bank Risk • Fully transfer to customer • Partially transfer to customer • Fully borne by bank Risk • Fully borne by bank Application of Fund • Financing • Securities • Others ……IFI face different combination and magnitude of risks in each financial transactions engagement

OVERVIEW OF IFSB History The Islamic Financial Services Board (IFSB), which is based in Kuala Lumpur, was officially inaugurated on 3 rd November 2002 and started operations on March 2003. Vision & Mission IFSB promotes the development of a prudent and transparent Islamic financial services industry through introducing new, or adapting existing international standards consistent with Islamic Shari'ah principles. Members Issuance of Standards There are 89 members of the IFSB including 21 regulatory & supervisory authorities as well as the International Monetary Fund, the World Bank, BIS, the Islamic Development Bank, the Asian Development Bank, and 62 financial institutions from 16 countries. In December 2005, two standards were issued i. e. the Guiding Principles of Risk Management and Capital Adequacy Standard for Institutions (other than Insurance Institutions) offering only Islamic Financial Services.

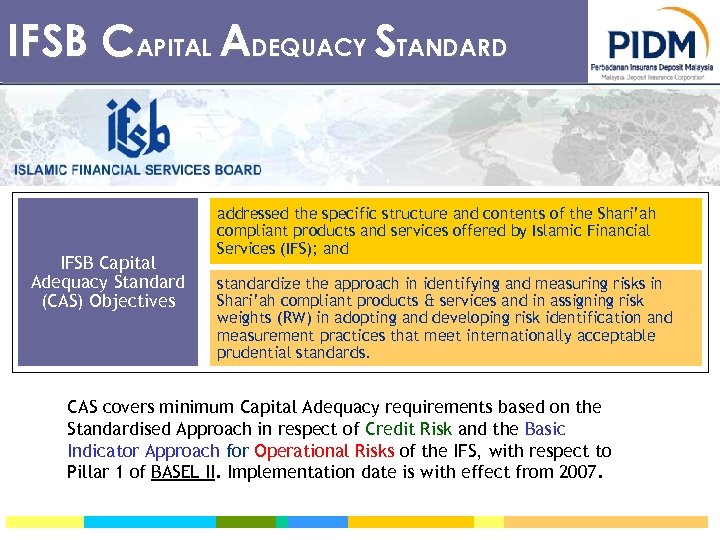

IFSB CAPITAL ADEQUACY STANDARD IFSB Capital Adequacy Standard (CAS) Objectives addressed the specific structure and contents of the Shari’ah compliant products and services offered by Islamic Financial Services (IFS); and standardize the approach in identifying and measuring risks in Shari’ah compliant products & services and in assigning risk weights (RW) in adopting and developing risk identification and measurement practices that meet internationally acceptable prudential standards. CAS covers minimum Capital Adequacy requirements based on the Standardised Approach in respect of Credit Risk and the Basic Indicator Approach for Operational Risks of the IFS, with respect to Pillar 1 of BASEL II. Implementation date is with effect from 2007.

Thank you …

281f7b0b7c8fbaca58a3d9d99e757dd7.ppt