2ed3eb6cdcb9a3d7431556e78933652a.ppt

- Количество слайдов: 76

Barings Bank and Nick Leeson 3/16/2018 1

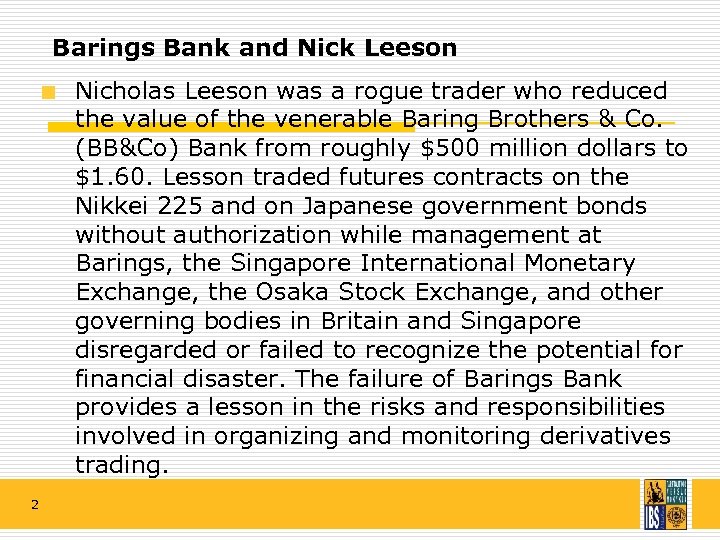

Barings Bank and Nick Leeson Nicholas Leeson was a rogue trader who reduced the value of the venerable Baring Brothers & Co. (BB&Co) Bank from roughly $500 million dollars to $1. 60. Lesson traded futures contracts on the Nikkei 225 and on Japanese government bonds without authorization while management at Barings, the Singapore International Monetary Exchange, the Osaka Stock Exchange, and other governing bodies in Britain and Singapore disregarded or failed to recognize the potential for financial disaster. The failure of Barings Bank provides a lesson in the risks and responsibilities involved in organizing and monitoring derivatives trading. 2

Barings Bank and Nick Leeson 3

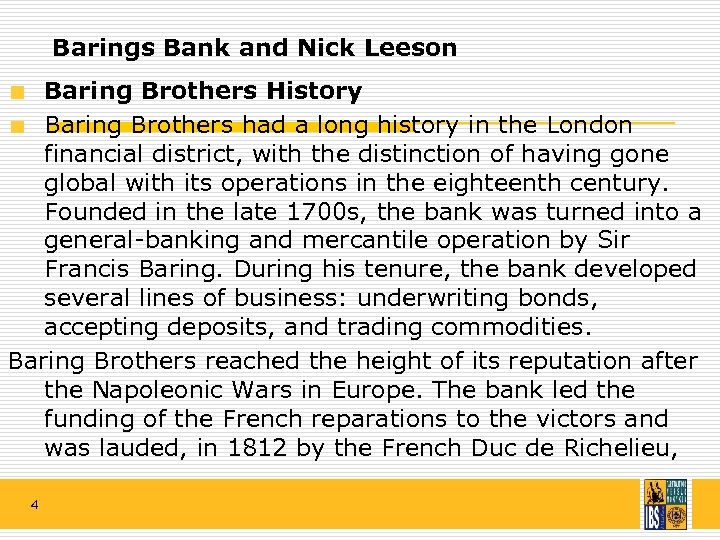

Barings Bank and Nick Leeson Baring Brothers History Baring Brothers had a long history in the London financial district, with the distinction of having gone global with its operations in the eighteenth century. Founded in the late 1700 s, the bank was turned into a general-banking and mercantile operation by Sir Francis Baring. During his tenure, the bank developed several lines of business: underwriting bonds, accepting deposits, and trading commodities. Baring Brothers reached the height of its reputation after the Napoleonic Wars in Europe. The bank led the funding of the French reparations to the victors and was lauded, in 1812 by the French Duc de Richelieu, 4

Barings Bank and Nick Leeson 5

Barings Bank and Nick Leeson as the "sixth power in Europe, " after Great Britain, France, Russia, Austria, and Prussia. Baring Brothers helped finance the Louisiana Purchase for the United States, underwrote railroad construction in Canada, and financed other projects throughout the Americas. One of those other projects was underwriting a 1, 2 million share issue for the Buenos Aires Water Supply and Drainage Co. in 1890. The issue did not sell, but Baring Brothers had already sent the money and was on the brink of failure when the Bank of England organized a consortium to bail it out. Thereafter, it was known as Baring Brothers & Co. 6

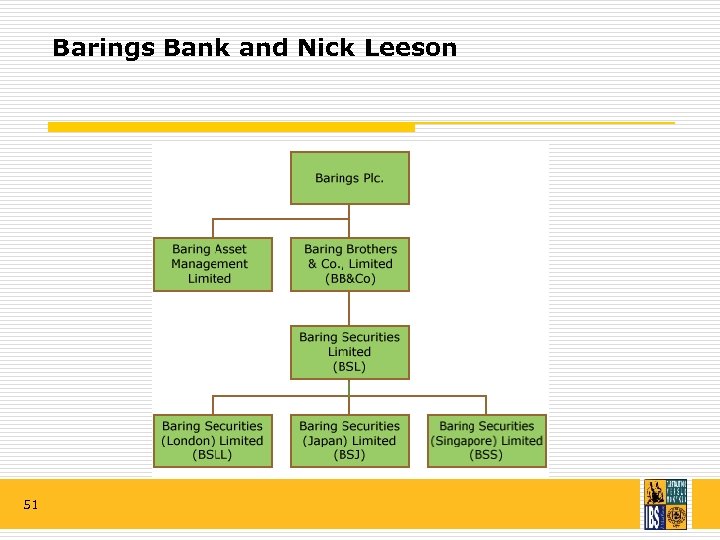

Barings Bank and Nick Leeson For all its long history in cross-border transactions, the bank never grew along with the size of the markets it served. In 1995, Baring Brothers & Co. remained a small, family controlled bank ranked 474 th in the world banking market. Barings entered the securities market in 1984 when it acquired the Far East department of Henderson Crothwaite (British stockbrokers). This new entity at Barings was called Baring Securities Ltd. (BSL). Christopher Heath, a specialist in Japanese instruments, managed to maintain independent control of Baring Securities until 1993. 7

Barings Bank and Nick Leeson During eight consecutive profitable years, everyone at Barings became accustomed to large bonuses, largely funded by profits in Baring Securities. In 1989, BSL provided £ 5 O million of £ 65 million total profit for Barings. Unfortunately, the losses incurred in 1992 led to Heath being asked to resign in March 1993. Nicholas Leeson was two days shy of his twentyeighth birthday when his trading activities forced Baring Brothers into bankruptcy. Leeson left a note on his desk saying "I'm 'sorry" and bolted to Kuala Lumpur with his wife following shortly thereafter. 8

Barings Bank and Nick Leeson 9

Barings Bank and Nick Leeson was born in Watford, England, just outside of London. His father was a plasterer and his mother was a nurse. He was the oldest of four children. Leeson did not attend university; instead, he went directly to work in London upon completion of high school. He worked with a British bank, Coutts & Co. , and then Morgan Stanley, before moving to Barings Securities London in 1989. 10

Barings Bank and Nick Leeson was twenty-two years old when he was hired for the position at Baring Securities London (BSLL). BSLL was looking to fill a position settling trades completed in Japan. Leeson, who had experience at Morgan Stanley settling futures and options in Japan, was a good replacement. He worked hard, kept to himself, and was known as someone anxious to learn and eager to please. He was subsequently selected as a member of a team of four people assigned to straighten out back office problems in Jakarta. 11

Barings Bank and Nick Leeson In 1992, he was selected to run the back office for the new Baring Futures Singapore (BFS), a subsidiary that would trade futures and options. His exact responsibilities were somewhat unclear, although they did include responsibility for both the back office accounting and control functions as well as for executing clients’ orders. This was when Leeson's unauthorized trading activities began. On his initiative, Leeson sat for and passed the futurestrading exam to become registered as an associated person with the Singapore International Monetary Exchange (SIMEX). 12

Barings Bank and Nick Leeson He did not need the license to fulfill his responsibilities, but he did need it to execute trades. To meet his Baring's responsibilities, he only needed to take orders from clients, and pass them to a trader for execution. In 1992, Leeson established the error account 88888 (eight is considered a lucky number by the Chinese), which, according to SIMEX investigators, he immediately began using to conceal unauthorized trading activities. While a legitimate error account, numbered 99002, was known to BSLL, the 88888 account did not show on files or statements transmitted from Singapore to London. 13

Barings Bank and Nick Leeson Account 88888 was known to SIMEX, but as a customer account, not as an error account. Leeson had to represent it differently to each group because he could not hide the existence of 88888 from SIMEX, and he could not explain its volume and balance to BSLL (but he could hide it from them). 14

Barings Bank and Nick Leeson Derivatives Since the early 1970 s, derivatives have increasingly been used by firms to manage their exposure to risks. When a derivative is purchased, only part of the value of the underlying asset is at risk, while the opportunity to benefit from favorable price fluctuations is retained. Derivatives can offer potentially enormous gains, which can lead to their use as speculative instruments. They also offer potentially debilitating losses, depending on the positions taken. 15

Barings Bank and Nick Leeson was trading futures and options on the Nikkei 225, an index of Japanese securities. Leeson was long Nikkei 225 futures, short Japanese government bond futures, and short both put and call options on the Nikkei index. He was betting that the Nikkei index would rise. He was wrong and ended up losing $1. 39 billion. For Leeson to suffer losses of this magnitude in futures positions during January and February of 1995, he had to have held approximately one quarter of the entire open interest on the Osaka and Singapore stock exchanges. Unfortunately, since management had given such free rein to Leeson by allowing him to control both front and back office operations, this level of investment went undetected by the firm. 16

Barings Bank and Nick Leeson offset any losses incurred on his long positions in Nikkei futures by writing Nikkei options. That is, when Leeson purchased futures contracts, he was required to pay cash, a margin of 15% of the contract's value to SIMEX, and when the losses on the contracts accumulated, additional margin was required because futures contracts are marked-to-market on a daily basis. However, when he wrote the options, he received cash, in the form of premiums. The premiums from the Nikkei options served two purposes: (1) they were used to hide losses created by the futures, which would otherwise have shown in BFS financial statements, 17

Barings Bank and Nick Leeson and (2) the premiums served to cover the margin calls on the futures. Leeson was able to do this due to the nature of the Japanese futures market at this time. In Japan, margin is posted on a net basis for all customers. Therefore, if many customers were short index futures, the firm can take long positions without having to post cash margin. In addition, daily settlement was one-sided. That is, losers must cover their losses daily, but winners were not permitted to withdraw gains. Therefore, it was possible to cover the firm's losses with customer gains. 18

Barings Bank and Nick Leeson Another aspect of the Japanese futures market, which enabled Leeson to do this, was that the exchange did not require a separation between customer and proprietary funds. Therefore, it was impossible to distinguish between the firm's and the customers' positions. The Nikkei 225 experienced an extended bull run throughout the late 1980 s, reaching a height of close to 40, 000 in 1989. By mid 1994, Leeson was convinced that since the Nikkei had fallen to half of its 1989 high, and interest rates were low, it would likely recover in the near future. 19

Barings Bank and Nick Leeson He was convinced it would not fall below 19, 000 and he was willing to put a lot of Barings’ money at risk based on that belief. However, a rise in interest rates would hurt him and, accordingly, be took short positions in Japanese government bonds futures contracts that would pay off if interest rates rose. Leeson's options positions were founded on his belief that volatility would be low. In fact, he had traded enough contracts by the time of the collapse that he was causing volatility to remain low. Increasingly, he had to write a larger volume of options in order to get the same amount of premiums. 20

Barings Bank and Nick Leeson When it became increasingly difficult for the options' premiums to cover the margin calls on the futures, Leeson requested money from London. By February 23, 1995, BSLL had sent approximately $600 million to BFS. BSLL funded his request with little information, and with the understanding that a portion of the money was "loans to clients, " as portrayed on the BFS balance sheet. 21

Barings Bank and Nick Leeson The Losses Leeson began trading futures in July 1992 and by the end of the month, he had bought and sold 2, 051 Nikkei futures, suffering a loss of approximately $64, 000 immediately. By the end of the year, his losses in account 88888 were more than $3. 2 million. The numbers turned somewhat in his favor by mid-1993 when the losses amounted to only $40, 000. Unfortunately, Leeson intended to keep trading until his numbers were positive. By the end of 1993, the losses were approximately $30 million. 22

Barings Bank and Nick Leeson At this point, Leeson wrote options for approximately $35 million to offset the futures losses and to avoid suspicion from London and the auditors. Throughout this time period, Leeson was reporting record profits, and was being heralded as a superstar. By the end of 1994, the Nikkei had fallen to just under 20, 000 and Leeson's losses approached $330 million. Meanwhile, Barings executives were expecting an estimated $20 million in profits from BFS for 1994. 23

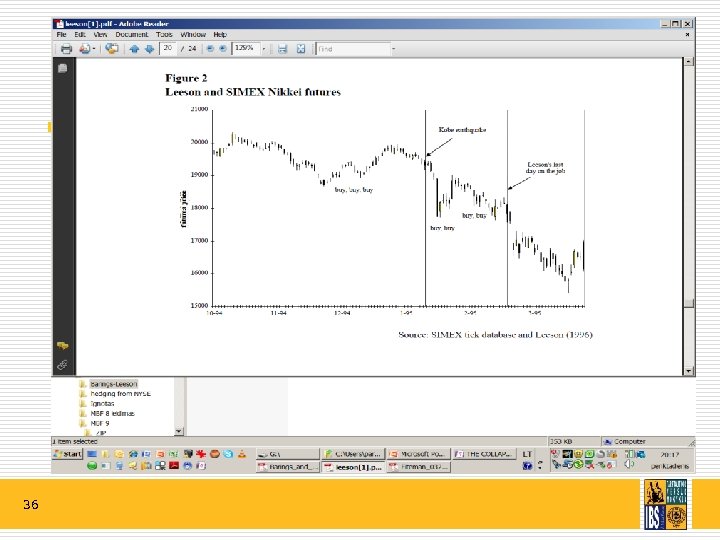

Barings Bank and Nick Leeson's activities in the first few months of 1995 were like those of any self-respecting speculator. On January 13, 1995, the Nikkei reached 19, 331 and Barings was long 3, 024 Nikkei futures contracts. But, on January 17, 1995, an earthquake measuring 7. 2 devastated the Japanese city of Kobe. The Nikkei plummeted below 18, 840 by January 20, at which point Leeson doubled his contracts to 7, 135. This process continued as the Nikkei fell to 18, 000 on February 23, 1995, and Leeson's exposure grew to more than 55, 399 unhedged Nikkei futures. 24

Barings Bank and Nick Leeson Compounding the problem, interest rates did not rise as Leeson had expected and he was losing on the Japanese government bond futures as well. By Friday, February 24, 1995, Barings and the world discovered that Leeson had incurred losses approaching $1. 1 billion, more than double the capitalization of the bank. The bank was headed toward bankruptcy. When the markets opened in Singapore and Osaka on Monday, the exchanges would declare Barings in default on its margins. 25

Barings Bank and Nick Leeson Throughout that weekend, the Bank of England hosted meetings in London to try to form a consortium to bail out Barings. Barclays Bank assumed the leadership role and was able to attain commitments for $900 million for three months. Unfortunately for Barings, no one would assume the contingent risk of additional, but as yet undiscovered losses, and the efforts failed. At the time, it was already known that on Monday, February 27, 1995, there would be an additional $370 million in losses from Barings positions, bringing the total loss to $1. 39 billion. Barings was bankrupt. 26

Barings Bank and Nick Leeson 1. What was Nick Leeson's strategy to earn trading profits on derivatives? 27

Barings Bank and Nick Leeson He dealt in 6 main financial futures and some options on them, as follows: 1. Nikkei 225 contract traded on SIMEX in Singapore; 2. Nikkei 225 contract traded on OSE (Osaka Stock Exchange) in Japan; 3. 10 -year JGB (Japanese government bonds) contract traded on SIMEX in Singapore; 4. 10 -year JGB contract traded on TSE (Tokyo Stock Exchange) in Japan; 5. 3 -month Euroyen contract traded on SIMEX in Singapore; 6. 3 -month Euroyen contract traded on TIFFE (Tokyo Financial Futures Exchange) in Japan. Around 1993 arbitrage business began to be an important part of Baring’s Far Eastern operations. 28

An arbitrage is a type of transaction or portfolio. Actually, the term is used in two different ways, so it refers to either of two very different types of transactions or portfolios. People also speak of arbitrage as an activity—the activity of seeking out and implementing either of the two types of arbitrage transactions or portfolios. An arbitrageur is an individual or institution who engages in such arbitrage. 29

An arbitrage In finance theory, an arbitrage is a "free lunch"—a transaction or portfolio that makes a profit without risk. Suppose a futures contract trades on two different exchanges. If, at one point in time, the contract is bid at USD 45. 02 on one exchange and offered at USD 45. 00 on the other, a trader could purchase the contract at one price and sell it at the other to make a risk-free profit of a USD 0. 02. 30

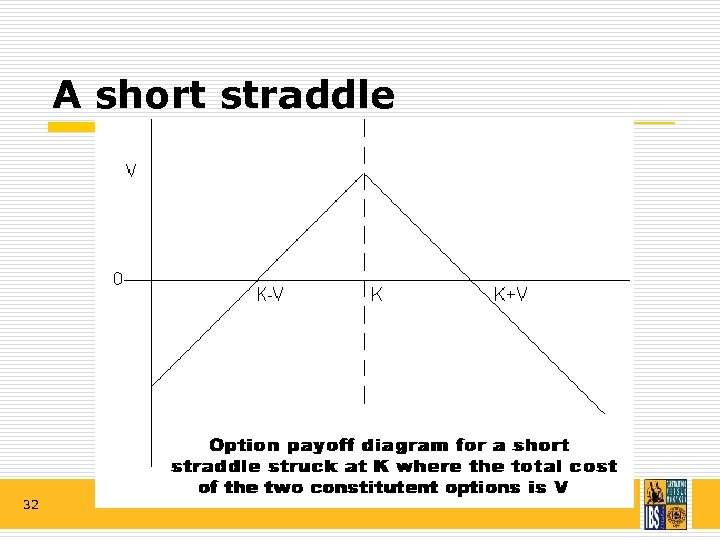

A short straddle Short straddle A short straddle is a non-directional options trading strategy that involves simultaneously selling a put and a call of the same underlying security, strike price and expiration date. 31

A short straddle 32

A short straddle The profit is limited to the premiums of the put and call, but it is risky if the underlying security's price goes up or down much. The deal breaks even if the intrinsic value of the put or the call equals the sum of the premiums of the put and call. 33

A short straddle position is highly risky, because the potential loss is unlimited, whereas profitability is limited to the premium gained by the initial sale of the options. The Collar is a more conservative "opposite" that limits gains and losses. 34

Barings Bank and Nick Leeson 1. What was Nick Leeson’s strategy to earn trading profits on derivatives? Answer: Nick Leeson was trading futures and options on the Nikkei 225, an index of Japanese securities. He was long Nikkei 225 futures, short Japanese government bond futures, and short both put and call options on the Nikkei Index. He was betting that the Nikkei index would rise, but instead, it fell, causing him to lose $1. 39 billion. 35

Barings Bank and Nick Leeson 36

Barings Bank and Nick Leeson 2. What went wrong that caused his strategy to fail? 37

Barings Bank and Nick Leeson + The beginning of the end occurred on January 16, 1995, when Leeson placed a short straddle in the Stock Exchange of Singapore and Tokyo stock exchanges, essentially betting that the Japanese stock market would not move significantly overnight. However, the Kobe earthquake hit early in the morning on January 17, sending Asian markets, and Leeson's investments, into a tailspin. Leeson attempted to recoup his losses by making a series of increasingly risky new investments, this time betting that the Nikkei Stock Average would make a rapid recovery. But the recovery failed to materialize, and he succeeded only in digging a deeper hole. 38

Barings Bank and Nick Leeson What went wrong that caused his strategy to fail? Answer: Nick Leeson’s strategy failed because the Nikkei 225 index kept falling while he continued to bet that it would rise. 39

Barings Bank and Nick Leeson 3. Why did Nick Leeson establish a bogus error account (88888) when a legitimate account (99002) already existed? 40

Barings Bank and Nick Leeson Why did Nick Leeson establish a bogus error account (88888) when a legitimate account (99002) already existed? Answer: Nick Leeson established a bogus error account (88888) when a legitimate account (99002) already existed in order to conceal his unauthorized trading activities. While the legitimate error account was known to Barings Securities in London, the bogus account was not. However, the bogus account was known to SIMEX as a customer account, not as an error account. In this way Leeson could hide his balances and losses from London—but not Singapore. One the other hand, SIMEX thought the bogus error account, 88888, was a legitimate customer account rather than a proprietary Barings account. 41

Barings Bank and Nick Leeson 4. Why did Barings and its auditors not discover that the error account was used by Leeson for unauthorized trading? 42

Barings Bank and Nick Leeson Why did Barings and its auditors not discover that the error account was used by Leeson for unauthorized trading? Answer: Internal Reasons. Leeson engaged in unauthorized trading, as well as fraud. However, it is clear that he was hidden in the organized chaos that characterized Barings. “There were no clearly laid down reporting lines with regard to Leeson, through the management chain to Ron Baker [Head of Financial Products Group for Barings]” (Bank of England, p. 235). In fact, it seems there were several people responsible for monitoring Leeson’s performance, each of whom assumed the other was watching more closely than he. 43

Barings Bank and Nick Leeson In August 1994, James Baker completed an internal audit of the Singapore office. He made several recommendations that should have alerted Barings executives to the potential for unauthorized trading: (a) segregation of front and back office activities—a fundamental principle in the industry, (b) a comprehensive review of Leeson’s funding requirements, and (c) position limits on Leeson’s activities. None of these had been acted upon by the time of the bank’s collapse. With regard to the first concern, Simon Jones, Director of BFS and Finance Director of BSS, in Singapore, offered assurances that he would address the segregation issue. 44

Barings Bank and Nick Leeson However, he never took action to segregate Leeson’s front and back office activities. Tony Hawes, Barings Treasurer in London agreed to complete a review of the funding requirements within the coming year. Ian Hopkins, Director and Head of Treasury and Risk in London, placed the issue of position limits on the risk committee’s agenda, but it had not been decided when the collapse occurred. 45

Barings Bank and Nick Leeson According to the Bank of England report, senior management in London considered Jones a poor communicator and were concerned that he was not as involved as he should have been in the affairs of BFS. In fact, Peter Norris, the chief executive officer for Baring Securities Limited wanted to replace Jones, however, was protected by James Bax, Managing Director of Baring Securities Singapore, who was well liked in London. The Bank of England also found fault with the process of funding Leeson’s activities from London. First, there was no clear understanding of whether the funds were needed for clients or for Baring’s own accounts, making reconciliation impossible. 46

Barings Bank and Nick Leeson Second, given the large amounts, credit checks should have been completed as well. The report places the responsibility for the lack of due diligence with Tony Hawes, Ian Hopkins, and the Chairman of the Barings Credit Committee. The issue of proper reconciliation arose as early as April 1992 when Gordon Bowser, the risk manager in London, recommended that a reconciliation process be developed. Unfortunately, Bowser left Simon Jones and Tony Dickel, who had sent Leeson to Singapore, to agree on a procedure. 47

Barings Bank and Nick Leeson With internal conflict over who was responsible for Leeson’s activities, no agreement was reached between those two, and Leeson was left to establish reconciliation procedures for himself. There are numerous similar examples of internal conflict benefitting Leeson’s covert trading throughout the three years. But one of the late failures occurred in January 1995 when SIMEX raised concern over Barings’ ability to meet its large margins. In a letter dated January 11, 1995, and addressed to Simon Jones, SIMEX officials noted that there should have been an additional $100 million in the margin account for 88888. 48

Barings Bank and Nick Leeson Jones passed the letter to Leeson to draft a esponse. External Reasons. In January 1995, SIMEX was getting close to Leeson’s activities, but had not yet managed to determine what was happening. In response to a second letter dated January 27, 1995 and sent to James Bax in Singapore, SIMEX expressed concerns regarding Barings’ ability to fund its margin calls. Bax referred the letter to London, and SIMEX received reassurance that opposite positions were held in Japan. Unfortunately, SIMEX officials did not follow up with the Osaka Stock Exchange to verify the existence of those positions. 49

Barings Bank and Nick Leeson 5. Why did none of the regulatory authorities in Singapore, Japan, and the United Kingdom discover the true use of the error account? 50

Barings Bank and Nick Leeson 51

Barings Bank and Nick Leeson Why did none of the regulatory authorities in Singapore, Japan, and the United Kingdom not discover the true use of the error account? Answer: SIMEX assumed that Barings was hedging and not speculating when it granted an exemption on the number of contracts that Barings could hold. Due to Barings’ reputation for being a conservative firm, the exchange and clearing houses were operating under a false sense of security. 52

Barings Bank and Nick Leeson In addition, the speculative position of Barings was hidden due to use of an omnibus account to clear trades. With an omnibus account, the identity of the broker’s customers is hidden from the exchange and the clearinghouse. Several incidents in London also made Leeson’s activities easier to manage and hide. The Bank of England had a Large Exposure rule where a bank could not lend more than 25% of its capital to any one entity. However, Barings had requested that an exception be made, arguing that an exchange should not be treated as one entity. 53

Barings Bank and Nick Leeson Christopher Thompson, the supervisor in charge of Barings activities, acknowledged receipt of the request and said he would review it. In the meantime, he offered an informal concession for Japan, which Barings took the liberty of also applying to Singapore and Hong Kong. Thompson did not respond for a year, and when he did on February 1, 1995, the answer was that an exception could not be made for exchanges and that the positions taken under the informal concession should be unwound. 54

Barings Bank and Nick Leeson The second incident was the solo-consolidation of Baring Securities Ltd and Baring Brothers & Co. This allowed them to be treated as one entity for capital adequacy and large exposure purposes. This meant Leeson had access to a larger amount of capital. The Bank of England found the process of solo-consolidation to have been too informal and the results to have facilitated Leeson’s fraudulent activities. 55

Barings Bank and Nick Leeson 6. Why was Barings Bank willing to transfer large cash sums to Barings Futures Singapore? 56

Barings Bank and Nick Leeson Why was Barings Bank willing to transfer large cash sums to Barings Futures Singapore? Answer: Barings Bank believed that the large cash sums transferred to Barings Futures Singapore was for loans to customers as portrayed on the Barings Futures Singapore balance sheet. 57

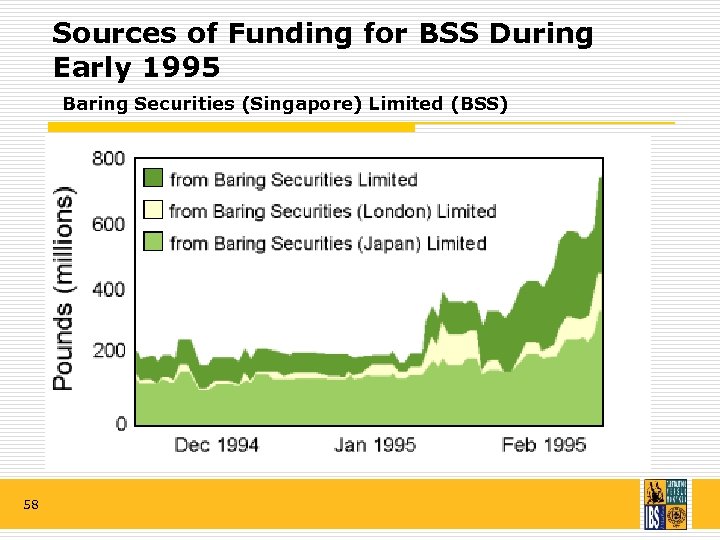

Sources of Funding for BSS During Early 1995 Baring Securities (Singapore) Limited (BSS) 58

Barings Bank and Nick Leeson 7. Why did the attempt by the Bank of England to organize a bailout for Barings fail? 59

Barings Bank and Nick Leeson Why did the attempt by the Bank of England to organize a bailout for Barings fail? Answer: The attempt by the Bank of England to organize a bailout for Barings failed because no one would assume the contingent risk of additional, but as yet undiscovered losses. 60

Barings Bank and Nick Leeson 8. Suggest regulatory and management reforms that might prevent a future debacle of the type that bankrupted Barings. 61

Barings Bank and Nick Leeson Suggest regulatory and management reforms that might prevent a future debacle of the type that bankrupted Barings. Answer: Due to incidents of staggering losses to corporate and banking entities as early as 1993, calls for financial reforms, particularly in relation to derivatives, had been ongoing for quite some time. However, it took the Baring Brothers bankruptcy to finally bring about action. The Bank of England, SIMEX and the Group of Thirty all created reports on how regulators, administrators, legislators, international firms and associations could address the issues of regulating financial activities. 62

Barings Bank and Nick Leeson The Bank of England wrote a report describing how the losses occurred, why they went unnoticed within and outside Barings, and lessons learned. How the losses occurred and why they went unnoticed has already been explained. The Bank produced five lessons from the bankruptcy. They are (Bank of England Report): (a) Management teams have a duty to understand fully the businesses they manage (b) Responsibility for each business activity has to be clearly established and communicated; (c) Clear segregation of duties is fundamental to any effective control system; 63

Barings Bank and Nick Leeson (d) Relevant internal controls, including independent risk management, have to be established for all business activities; (e) Top management and the Audit Committee have to ensure that significant weaknesses, identified to them by internal audit or otherwise, are resolved quickly. Despite these simplistic recommendations, at least one and usually several, of the points was the reason why firms lost large sums of money within the derivatives market. SIMEX, like the other exchanges in the world, implemented changes to decrease default and counterparty risk as well as systemic risks. 64

Barings Bank and Nick Leeson These changes were made as a direct result of the Barings collapse. SIMEX joined with other exchanges to share information about similar positions participants held on different exchanges. To reduce the risk of nonpayment of contracts, SIMEX and other exchanges placed the resources of their entire membership behind the settlements. The Group of Thirty based out of Washington, DC, has become particularly concerned with the risks derivatives pose. Since 1995, it has issued several publications to address these problems. 65

Barings Bank and Nick Leeson The first of these was published in August 1996, and is titled “International Insolvencies in the Financial Sector, Discussion Draft. ” This document advances fourteen ideas to reduce the risk in the financial sector particularly with regard to derivatives (see Exhibit 2 for the complete list). The second publication printed in April of 1997 is titled “International Insolvencies in the Financial Sector, Summary of Comments from Respondent Countries on Discussion Draft. ” This publication gives the responses and opinions of those member countries to the proposed reforms. 66

Barings Bank and Nick Leeson The support for these reforms was generally very strong among all the countries that responded. Germany and other countries did mention several drawbacks to some of the reforms, but they, too, were generally supportive. Ironically, Singapore expressed reservations or outright opposition to five of the reforms (#1, 2, 4, 6 and 9). 1 A third publication dealing with the aftermath of Barings, is titled “Global Institutions, National Supervision and Systemic Risk” (1997). This discusses reforms that have already been put in place. These reforms include “expanded use of netting and collateral; improvements in measuring risk; 67

Barings Bank and Nick Leeson greater disclosure of off-balance-sheet risk; substantial increases in equity capital of major financial institutions; financial sector consolidation; and the growth of securitization. ” 68

Barings Bank and Nick Leeson Postscript: ING, a Dutch insurance company, was looking to enter the banking business, especially in Asia. It paid one pound sterling for Baring Brothers and added an additional $1 billion to pay off the debts Baring Brothers had accumulated and restore the bank’s capital position. In addition, ING also had to pay $677 million to the holders of subordinated debt that was issued by Barings plc, the holding company, just before the bankruptcy. Legally, ING was not liable for the bonds, but since the bondholders were Barings best customers, ING had to make good on the notes in order to save the customer relationships. 69

Barings Bank and Nick Leeson On February 23, 1995, Nick Leeson fled in his Mercedes across the bridge from Singapore to Malaysia. He hid out in Thailand for the next week with his wife and was caught flying into Germany one week later. He was extradited back to Singapore, stood trial and was subsequently sentenced to 6. 5 years in a Singapore prison for fraud. In August 1998, Leeson underwent surgery for colon cancer and began receiving chemotherapy. Despite his condition, authorities in Singapore did not release Leeson until June 1999. 70

Barings Bank and Nick Leeson 71

Barings Bank and Nick Leeson 72

Nick Leeson 73

Barings Bank and Nick Leeson Christopher Thompson was the Bank of England supervisor in charge of Baring Brothers at the time of the bankruptcy. He was responsible for allowing Baring Brothers to invest over the legal limit of 25% of its capital in the SIMEX and OSE. The day before the Bank of England report was to be published about the Baring Brothers collapse, Thompson resigned. 74

Barings Bank and Nick Leeson 75

Barings Bank and Nick Leeson 76

2ed3eb6cdcb9a3d7431556e78933652a.ppt