896a9edb864107cc789dd346860aaf7b.ppt

- Количество слайдов: 13

Baring Asset Management Limited 155 Bishopsgate, London EC 2 M 3 XY Authorised and regulated by the Financial Services Authority Tel: +44 (0)20 -7628 6000 Fax: +44 (0)20 -7638 7928 www. barings. com INVESTMENT EXCELLENCE IN EUROPEAN EQUITIES James Buckley

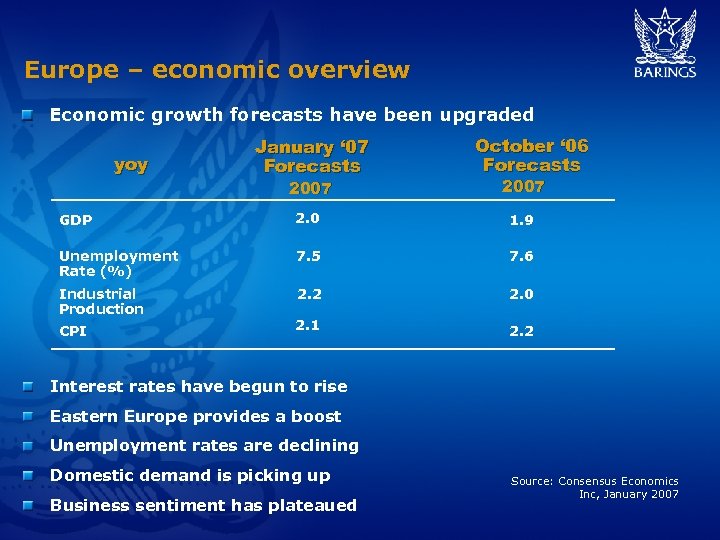

Europe – economic overview Economic growth forecasts have been upgraded yoy January ‘ 07 Forecasts 2007 October ‘ 06 Forecasts 2007 GDP 2. 0 1. 9 Unemployment Rate (%) 7. 5 7. 6 Industrial Production 2. 2 2. 0 2. 1 2. 2 CPI Interest rates have begun to rise Eastern Europe provides a boost Unemployment rates are declining Domestic demand is picking up Business sentiment has plateaued Source: Consensus Economics Inc, January 2007

Pan European M&A – Here to stay 600 €billion 500 400 Pending Shares Cash 300 200 100 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 M&A Activity has been a key theme in the last year Source: Citigroup Investment Research and Datastream, Jan 2007

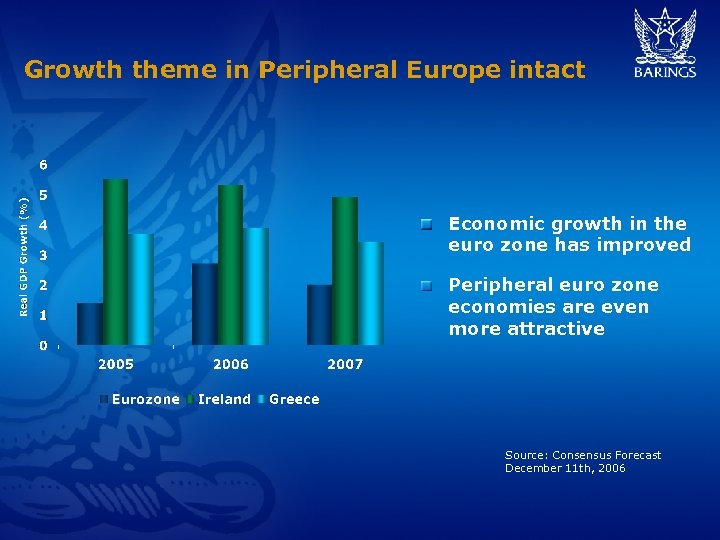

Growth theme in Peripheral Europe intact Economic growth in the euro zone has improved Peripheral euro zone economies are even more attractive Source: Consensus Forecast December 11 th, 2006

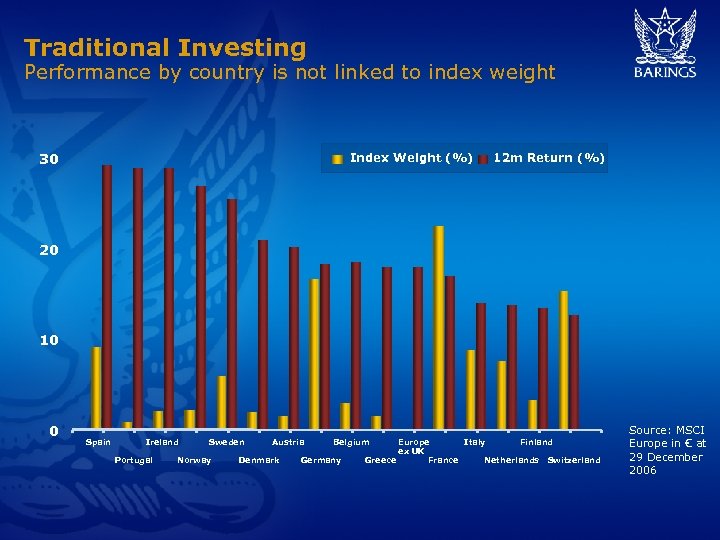

Traditional Investing Performance by country is not linked to index weight 30 Index Weight (%) 12 m Return (%) 20 10 0 Spain Ireland Portugal Sweden Norway Austria Denmark Belgium Germany Europe Italy Finland ex UK Greece France Netherlands Switzerland Source: MSCI Europe in € at 29 December 2006

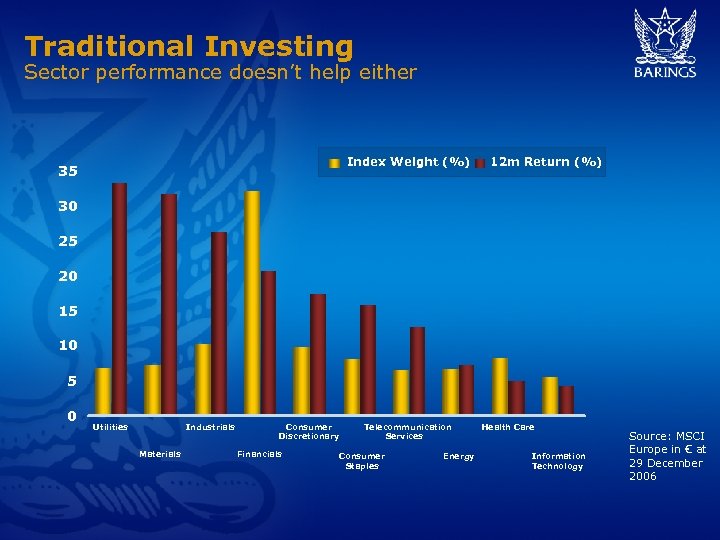

Traditional Investing Sector performance doesn’t help either Index Weight (%) 35 12 m Return (%) 30 25 20 15 10 5 0 Utilities Industrials Materials Consumer Discretionary Financials Telecommunication Services Consumer Staples Energy Health Care Information Technology Source: MSCI Europe in € at 29 December 2006

Stock picking is the only tool left Opportunity for active managers to benefit from market inefficiencies

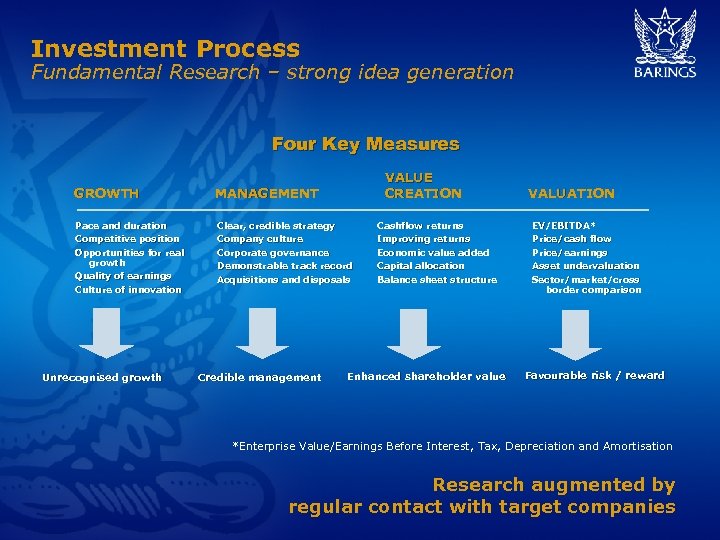

Investment Process Fundamental Research – strong idea generation Four Key Measures VALUE CREATION VALUATION GROWTH MANAGEMENT Pace and duration Competitive position Clear, credible strategy Company culture Cashflow returns Improving returns EV/EBITDA* Price/cash flow Opportunities for real growth Quality of earnings Culture of innovation Corporate governance Demonstrable track record Acquisitions and disposals Economic value added Capital allocation Balance sheet structure Price/earnings Asset undervaluation Sector/market/cross border comparison Unrecognised growth Credible management Enhanced shareholder value Favourable risk / reward *Enterprise Value/Earnings Before Interest, Tax, Depreciation and Amortisation Research augmented by regular contact with target companies

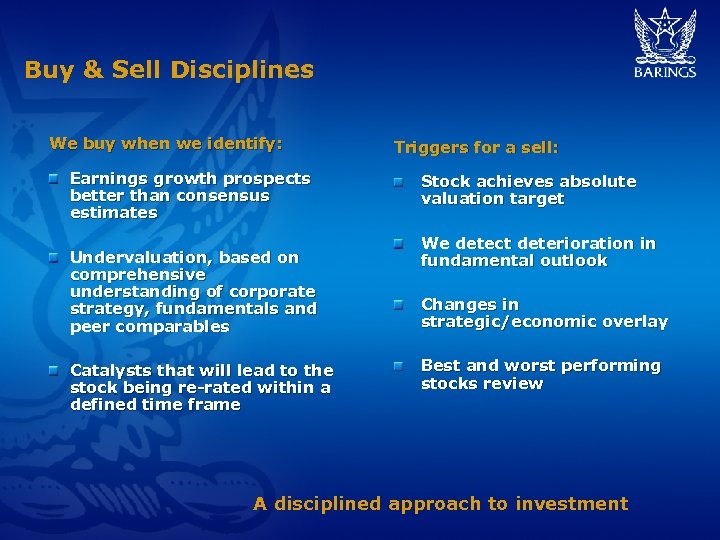

Buy & Sell Disciplines We buy when we identify: Earnings growth prospects better than consensus estimates Undervaluation, based on comprehensive understanding of corporate strategy, fundamentals and peer comparables Catalysts that will lead to the stock being re-rated within a defined time frame Triggers for a sell: Stock achieves absolute valuation target We detect deterioration in fundamental outlook Changes in strategic/economic overlay Best and worst performing stocks review A disciplined approach to investment

Baring Europa Fund Portfolio Characteristics as at 31 th January 2007 Fund Size (USD million) 382. 1 Number of holdings in portfolio 58 Large-cap eur>5 bn+ (%) 59. 72 Mid-cap eur 2 -5 bn (%) 13. 48 Small Cap eur<2 bn (%) 23. 27 Tracking Error 4. 05 Source: Baring Asset Management, data as 31/01/2007

Baring Europa Top 10 holdings Top 10 current overweight stocks* Top 10 current underweight stocks* % % Autonomy Corp. PLC 1. 80 HSBC Holdings PLC -2. 35 Standard Chartered PLC 1. 80 BP PLC -2. 33 CGG Veritas 1. 76 Glaxo. Smith. Kline -1. 74 Tullow Oil PLC 1. 76 Vodafone Group -1. 72 Ryanair Holdings PLC 1. 76 Total S. A. -1. 65 Puma AG 1. 75 Nestle S. A -1. 65 Shire PLC 1. 75 Novartis AG -1. 50 BK of Cyprus 1. 74 Royal Bank of Scotland -1. 43 D. Carnegie & Co. AB 1. 73 Royal Dutch Shell PLC -1. 42 Hexagon AB 1. 72 Banco Santander Central -1. 27 For Comparative Purposes Only Source: Baring Asset Management as at 31/01/07 * Relative to MSCI Europe index

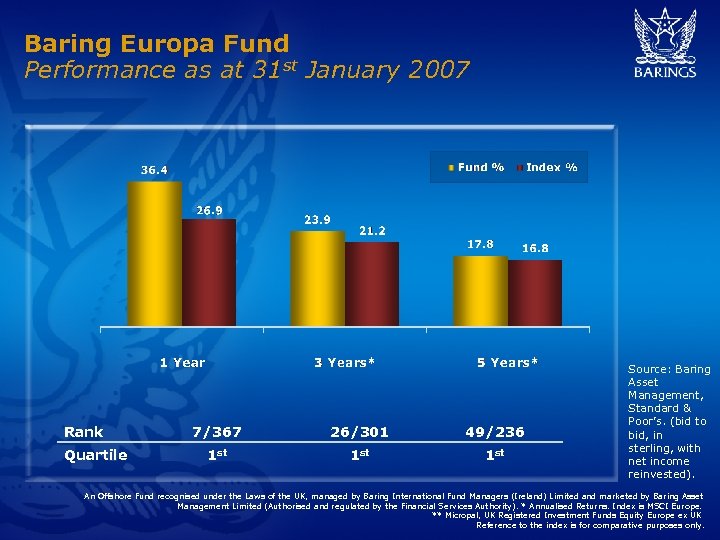

Baring Europa Fund Performance as at 31 st January 2007 Rank Quartile 7/367 26/301 49/236 1 st 1 st Source: Baring Asset Management, Standard & Poor’s. (bid to bid, in sterling, with net income reinvested). An Offshore Fund recognised under the Laws of the UK, managed by Baring International Fund Managers (Ireland) Limited and marketed by Baring Asset Management Limited (Authorised and regulated by the Financial Services Authority). * Annualised Returns. Index is MSCI Europe. ** Micropal, UK Registered Investment Funds Equity Europe ex UK Reference to the index is for comparative purposes only.

Important Information This document is issued by Baring Asset Management Limited and in jurisdictions other than the UK it is provided by its investment advisory affiliates. It has been produced for, and is intended for receipt by, professional investors/advisers and must not be relied on by any other category of recipient. The value of any investments and any income generated may go down as well as up and is not guaranteed. Past performance is not a guide to future performance. Quoted yields are not guaranteed. We reasonably believe that the information contained herein from 3 rd party sources, as quoted, is accurate as at the date of publication. This document must not be relied on for purposes of any investment decisions. This document may include forward-looking statements which are based on our current opinions, expectations and projections. We undertake no obligation to update or revise any forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements. The information in this document does not constitute investment, tax, legal or other advice or recommendation or, an offer to sell or an invitation to apply for any product or service of Baring Asset Management. Research Material Baring Asset Management only produces research for its own internal use. Where details of research are provided in this document it is provided as an example of research undertaken by Baring Asset Management and must not be used, or relied upon, for the purposes of any investment decisions. The information and opinions expressed herein may change at anytime. Complied (London): 14 th February 2007

896a9edb864107cc789dd346860aaf7b.ppt