b16d85b4eabcaa7bab9d00ff17989c88.ppt

- Количество слайдов: 26

Bank’s Logo Check 21 and Image Exchange 11/19/03

Agenda Payments System n Check 21 n What the Check 21 Does Not Cover n Implementation of the Check 21 n 11/19/03 2

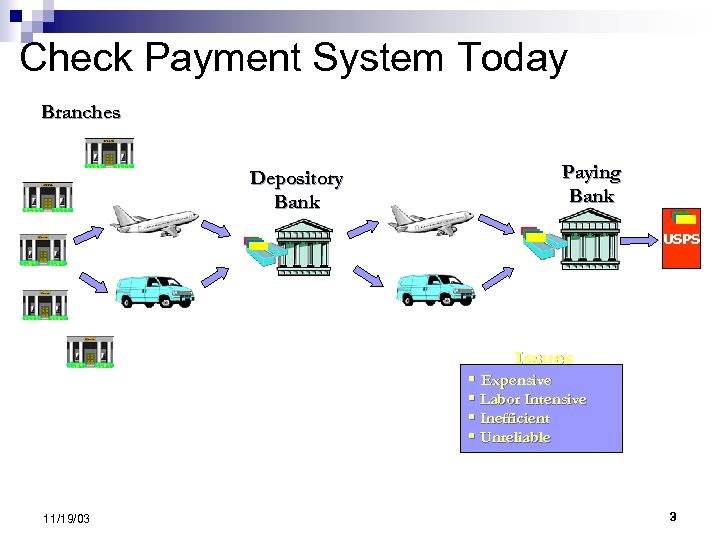

Check Payment System Today Branches Depository Bank Paying Bank USPS Issues § Expensive § Labor Intensive § Inefficient § Unreliable 11/19/03 3

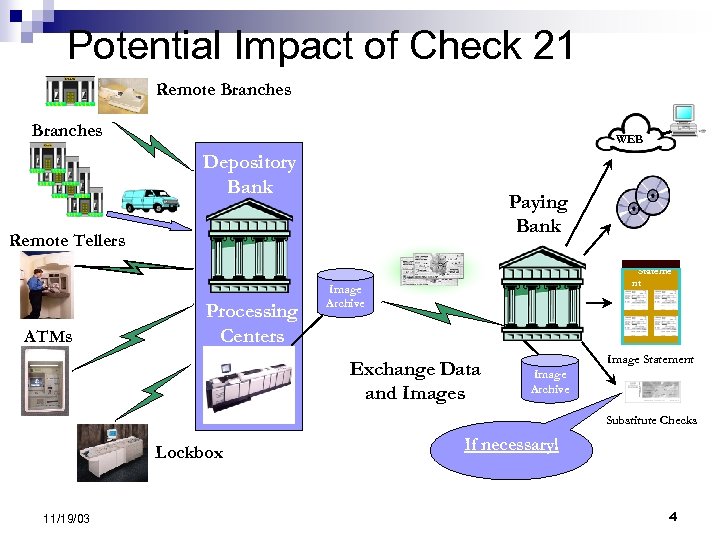

Potential Impact of Check 21 Remote Branches WEB Depository Bank Paying Bank Remote Tellers ATMs Processing Centers Stateme nt Image Archive Exchange Data and Images Image Statement Image Archive Substitute Checks Lockbox 11/19/03 If necessary! 4

Bank’s Logo Check 21/ Check Clearing for the st Century Act for the 21 Catalyst for Change 11/19/03

Federal Reserve’s Objectives To facilitate truncation n To foster innovation in check collection systems without mandating receipt of checks in electronic format n To improve the overall efficiency of the nation’s payments systems n 11/19/03 6

Legislation n Encourages check truncation by allowing unilateral decisions to truncate checks ¨ Unlike current environment with requirement to obtain agreements from all the parties Creates a new legal instrument - Substitute Check - that replaces the original paper check ¨ For those customers that have not agreed to check truncation ¨ For those banks that have not agreed to receive electronic files Use and Acceptance ¨ Use of substitute checks does not require an agreement between any of the parties ¨ The substitute check must be accepted by any party ¨ This includes forward collection and returns processes 11/19/03 7

Legislation n n Check 21 only applies to “Substitute Checks” ¨ Image reprints of original paper checks ¨ Use of substitute checks does not require agreement between the parties Excluded from the Check 21 are: ¨ Check safekeeping products ¨ Other check truncation or conversion products ¨ ECP & image exchanges Products and services under other agreements 11/19/03 8

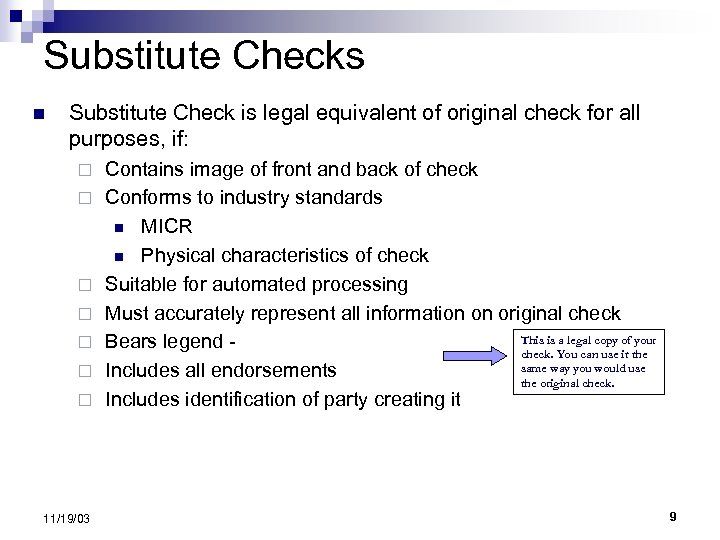

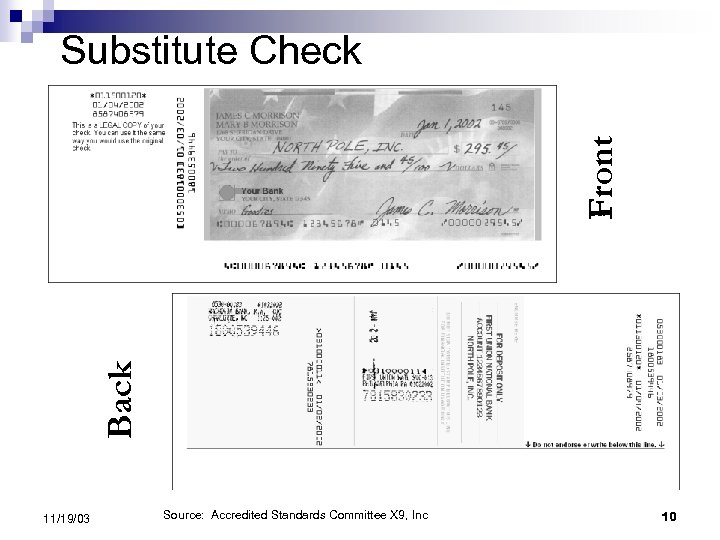

Substitute Checks n Substitute Check is legal equivalent of original check for all purposes, if: ¨ ¨ ¨ ¨ 11/19/03 Contains image of front and back of check Conforms to industry standards n MICR n Physical characteristics of check Suitable for automated processing Must accurately represent all information on original check This is a legal copy of your Bears legend - check. You can use it the same way you would use Includes all endorsements the original check. Includes identification of party creating it 9

Back Front Substitute Check 11/19/03 Source: Accredited Standards Committee X 9, Inc 10

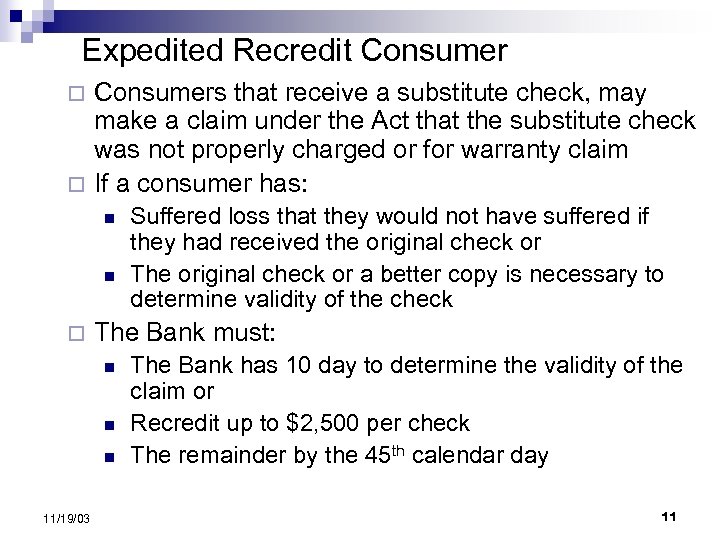

Expedited Recredit Consumers that receive a substitute check, may make a claim under the Act that the substitute check was not properly charged or for warranty claim ¨ If a consumer has: ¨ n n ¨ The Bank must: n n n 11/19/03 Suffered loss that they would not have suffered if they had received the original check or The original check or a better copy is necessary to determine validity of the check The Bank has 10 day to determine the validity of the claim or Recredit up to $2, 500 per check The remainder by the 45 th calendar day 11

Expedited Recredit Consumer n Bank may withhold availability for exception situations (similar to Reg. CC) New accounts ¨ Excessive ODs ¨ Cause to believe fraud ¨ Emergency conditions ¨ n n n Bank may withhold availability for 45 days Bank must notify consumer of delay in availability Bank can not charge overdraft fees for 5 days 11/19/03 12

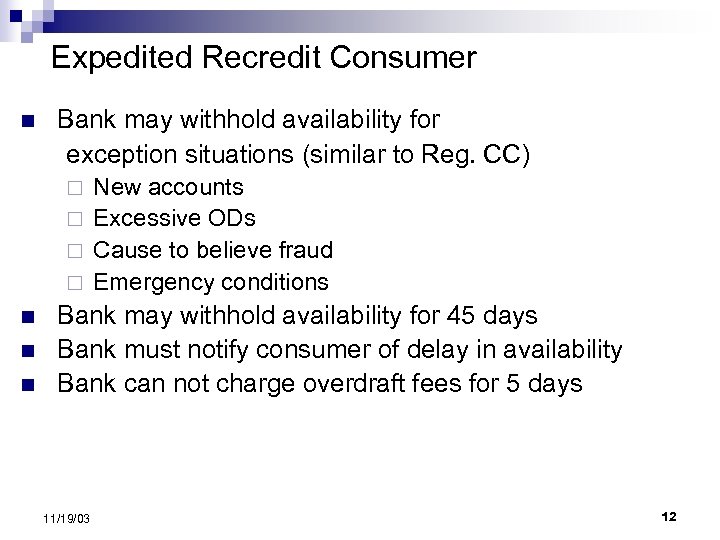

Check 21 Expedited Recredit - Banks n Banks may make claims ¨ When consumer makes claim or bank makes warranty claim ¨ Bank has suffered a loss ¨ Original check or substitute check necessary to determine validity of charge n A claim must be made within 120 days of transaction 11/19/03 13

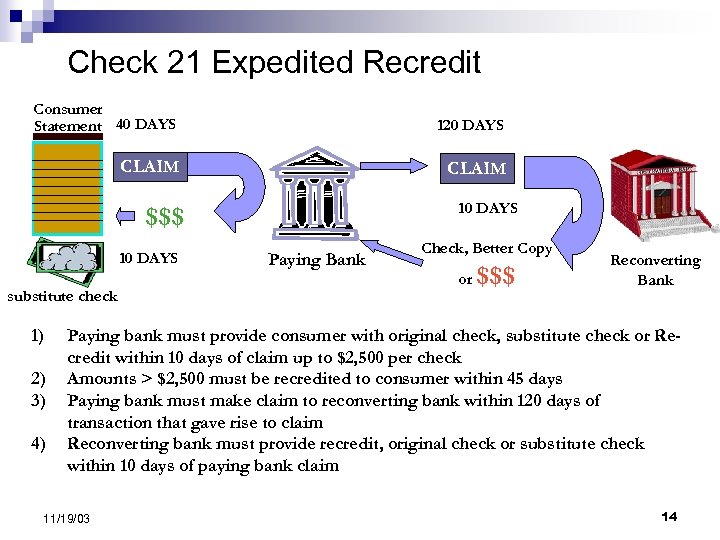

Check 21 Expedited Recredit Consumer Statement 40 DAYS 120 DAYS CLAIM 10 DAYS $$$ 10 DAYS substitute check 1) 2) 3) 4) Paying Bank Check, Better Copy or $$$ Reconverting Bank Paying bank must provide consumer with original check, substitute check or Recredit within 10 days of claim up to $2, 500 per check Amounts > $2, 500 must be recredited to consumer within 45 days Paying bank must make claim to reconverting bank within 120 days of transaction that gave rise to claim Reconverting bank must provide recredit, original check or substitute check within 10 days of paying bank claim 11/19/03 14

Notice to Consumers n n Banks must notify consumers of: ¨Check substitution process and how it differs from original check process ¨Expedited recredit rights Fed has provided “Substitute Check Policy Disclosure” 11/19/03 15

Bank’s Logo What the Check 21 Does Not Cover Image Exchange 11/19/03

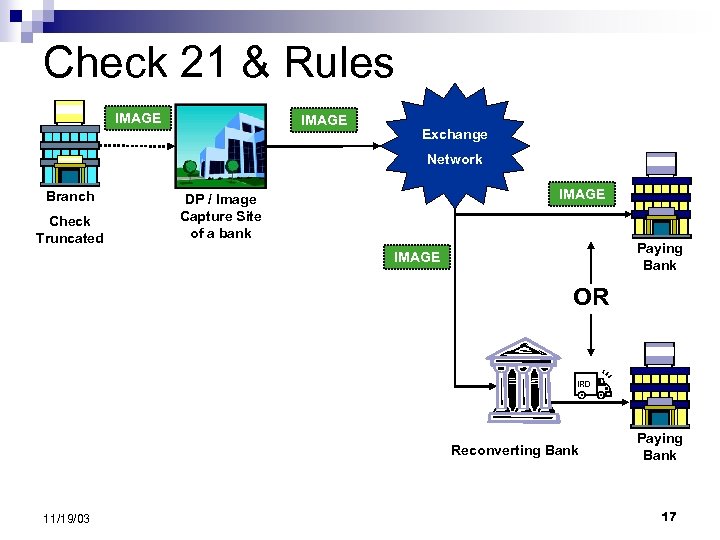

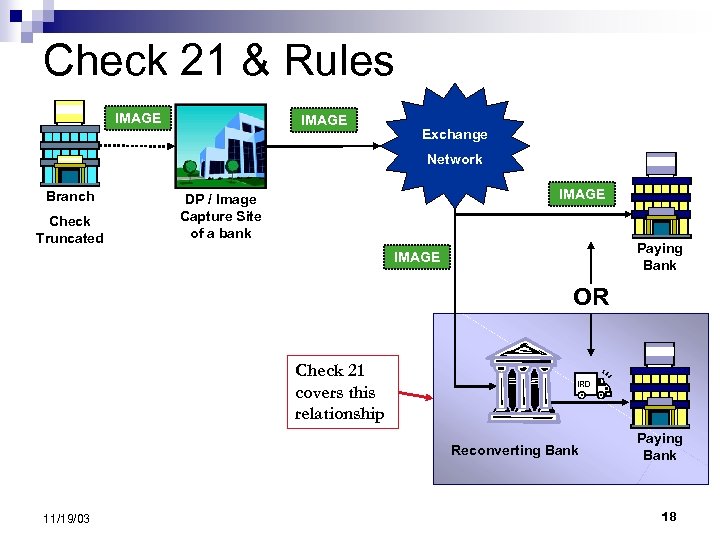

Check 21 & Rules IMAGE Exchange Network Branch Check Truncated IMAGE DP / Image Capture Site of a bank Paying Bank IMAGE OR IRD Reconverting Bank 11/19/03 Paying Bank 17

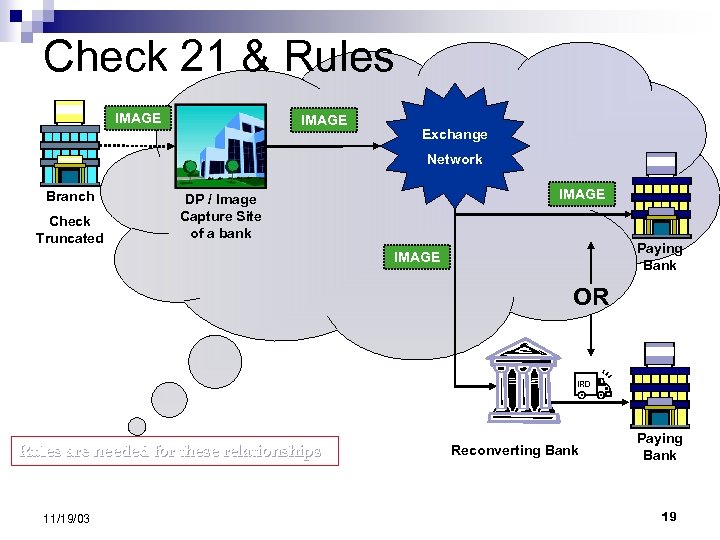

Check 21 & Rules IMAGE Exchange Network Branch Check Truncated IMAGE DP / Image Capture Site of a bank Paying Bank IMAGE OR Check 21 covers this relationship IRD Reconverting Bank 11/19/03 Paying Bank 18

Check 21 & Rules IMAGE Exchange Network Branch Check Truncated IMAGE DP / Image Capture Site of a bank Paying Bank IMAGE OR IRD Rules are needed for these relationships 11/19/03 Reconverting Bank Paying Bank 19

Check 21 & Rules n Image rules are needed to support the Check 21 because: ¨ Check 21 is image based ¨ Image exchanges are not covered by the Check 21 ¨ All depository financial institutions must have a common national set of image exchange rules for image exchange to work. 11/19/03 20

Bank’s Logo Implementation of the Check 21 What Banks Must Do! 11/19/03

Multiple Step Process n Prepare for Check 21 and the Substitute check ¨ Customers ¨ Contact Staff ¨ Operations n Develop strategic plan for image exchange 11/19/03 22

Bank’s Role with Consumers n Customer Awareness ¨ Advance notice to customer of substitute checks ¨ Check 21 notice to consumers beginning October 28, 2004 n Substitute Check Policy Disclosure from Fed rules ¨ Consumer education ¨ Education of business customers n Training ¨ All contact staff should be trained on substitute check and expedited recrediting Q & A for Staff n Expedited Refund procedures n 11/19/03 23

Check 21 Ops Minimum n n n Expedited recredit procedures Qualified returns of substitute check – change to MICR line Identifying duplicate checks Determine how substitute checks look on image statements Procedures to detect fraud with substitute checks Deposit Agreement change to move liability to a customer that deposits a substitute check. 11/19/03 24

Conclusion Consumers have rights under bill n Bill drafted to minimize potential fraud and consumer inconvenience n Prepare customers and public n Plan for the future of check processing n 11/19/03 25

Bank’s Logo ? ? ? 11/19/03 ? Questions? ?

b16d85b4eabcaa7bab9d00ff17989c88.ppt