a6e2a47734180bdfb3c96557f71ca4bf.ppt

- Количество слайдов: 27

Bank On It The Basics

Homework (Passport page 9)

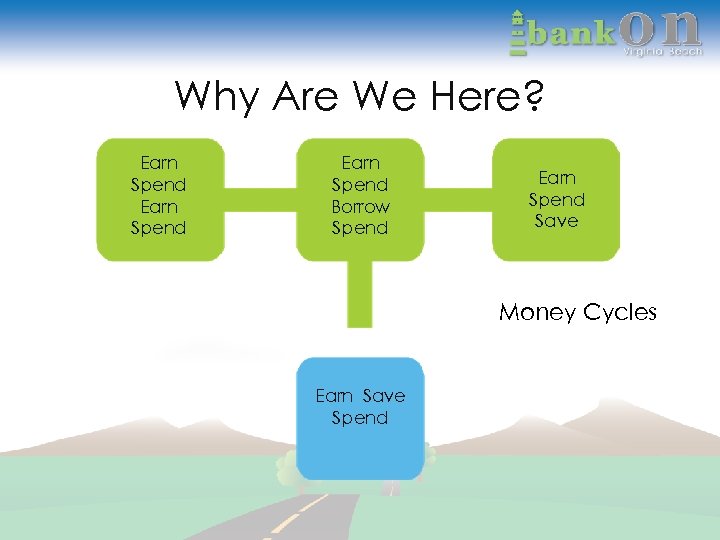

Why Are We Here? Earn Spend Borrow Spend Earn Spend Save Money Cycles Earn Save Spend

What Do You Know? (Pre-Test pages 5 -6)

Let’s Talk About You

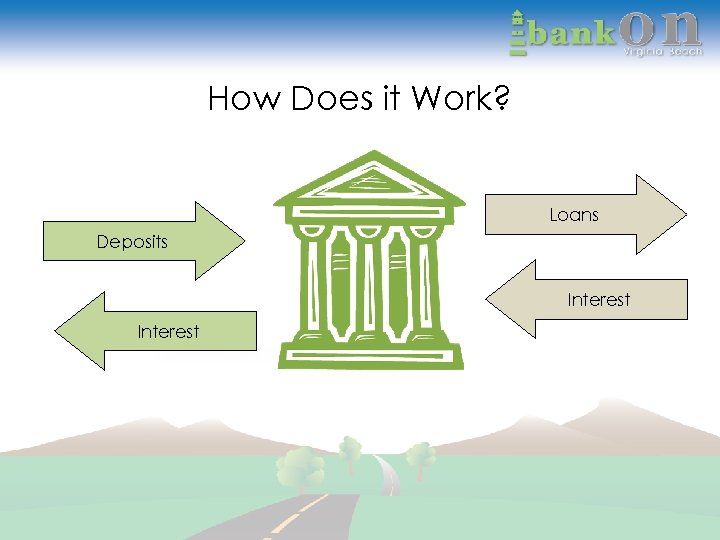

How Does it Work? Loans Deposits Interest

Why Keep Money in an Account? Safety Convenience Cost Security Financial future

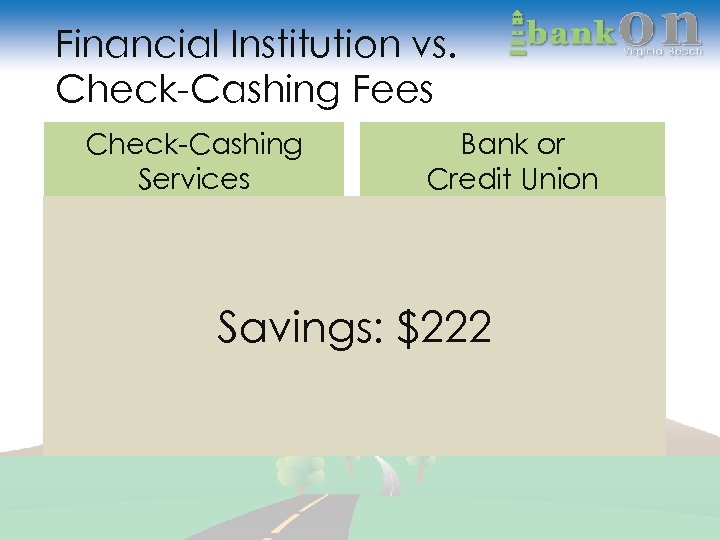

Financial Institution vs. Check-Cashing Fees Check-Cashing Services Bank or Credit Union Check-cashing fees: Money order fees: 4 x $5 = $20 a month 5 x $1 = $5 a month Box of checks: Monthly fee: $18 $5 Total: $60 $78 Savings: $222 a year Total: $300 $240 a year $60 a year

Financial Institutions Make loans Pay checks Accept deposits Other financial services Insured Open to anyone Ownership may be limited Not for profit Bank Credit Union

Types of Checking Accounts Free/low cost Electronic-only/ ATM Regular Interest-bearing

Common Services Direct Deposit Remittance Stored Value Card Loan ATM Debit Card Wire Transfer Money Order Phone/Online Banking

Deposits & Withdrawals Deposit –Direct deposit, cash, checks, ATMs –Check hold ~ you may not have immediate use of deposited funds Withdrawals –Debit card, ATM, write checks to “cash” –Fees

Fee Schedules Monthly Service Per-Check Printing ATM Use Overdraft Returned Deposit Stop Payment Phone Inquiry Teller

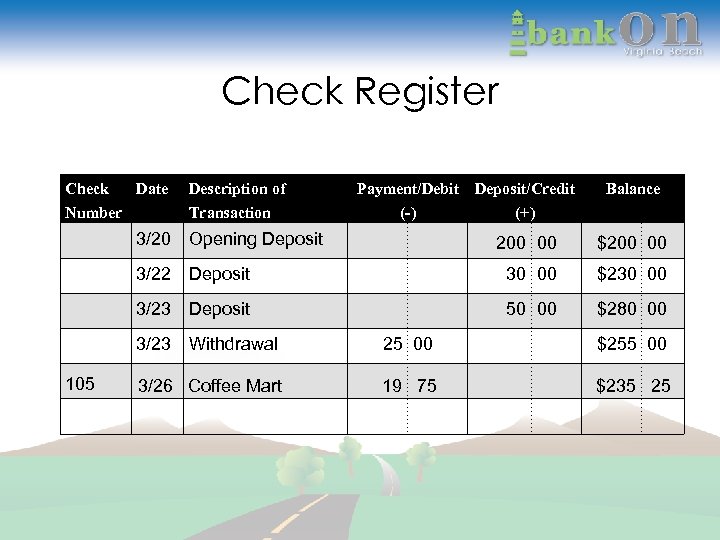

Check Register Check Date Number Description of Transaction Payment/Debit Deposit/Credit (-) (+) 3/20 Opening Deposit Balance 200 00 $200 00 3/22 Deposit 30 00 $230 00 3/23 Deposit 50 00 $280 00 3/23 Withdrawal 105 25 00 $255 00 3/26 Coffee Mart 19 75 $235 25

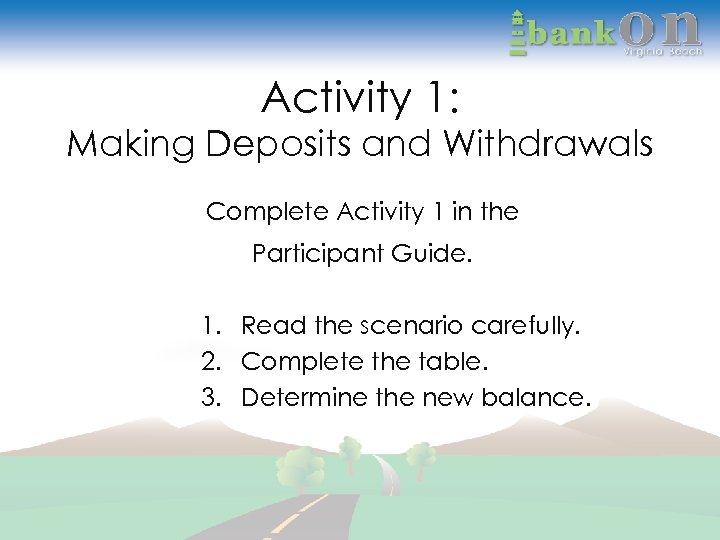

Activity 1: Making Deposits and Withdrawals Complete Activity 1 in the Participant Guide. 1. Read the scenario carefully. 2. Complete the table. 3. Determine the new balance.

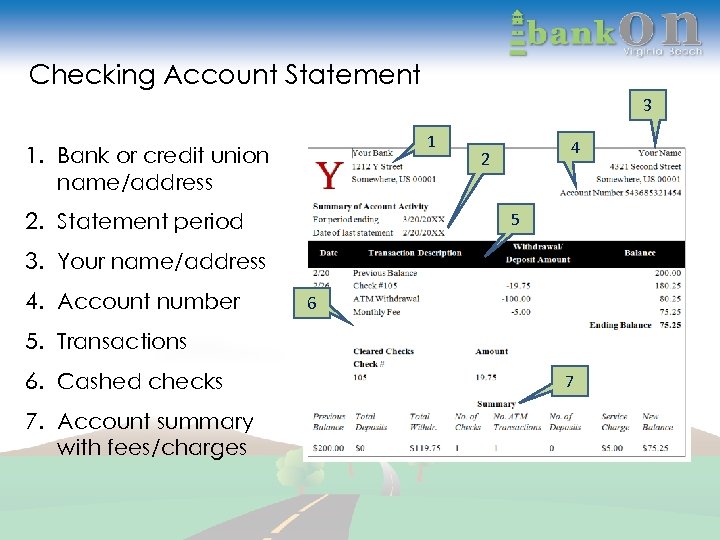

Checking Account Statement 3 1 1. Bank or credit union name/address 2. Statement period 4 2 5 3. Your name/address 4. Account number 6 5. Transactions 6. Cashed checks 7. Account summary with fees/charges 7

Reconciling Your Account Balancing: Keeping your checkbook register up-to-date and maintaining totals Reconciling: Finding and correcting any differences between the statement and your register

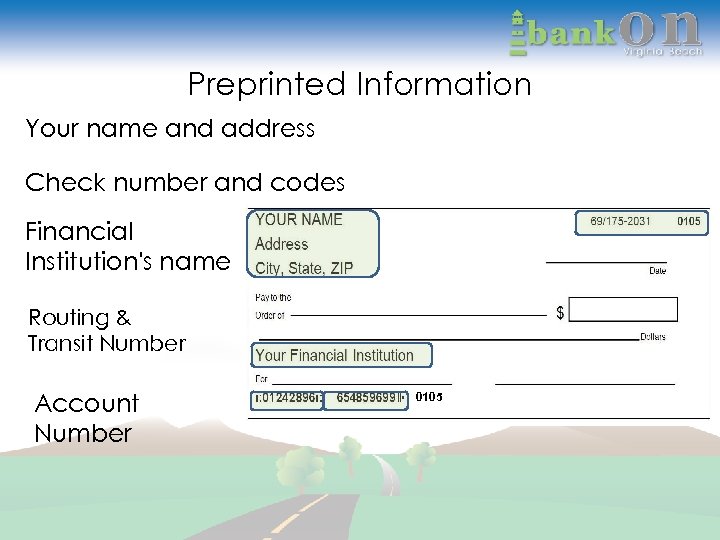

Preprinted Information Your name and address Check number and codes Financial Institution's name Routing & Transit Number Account Number 0105

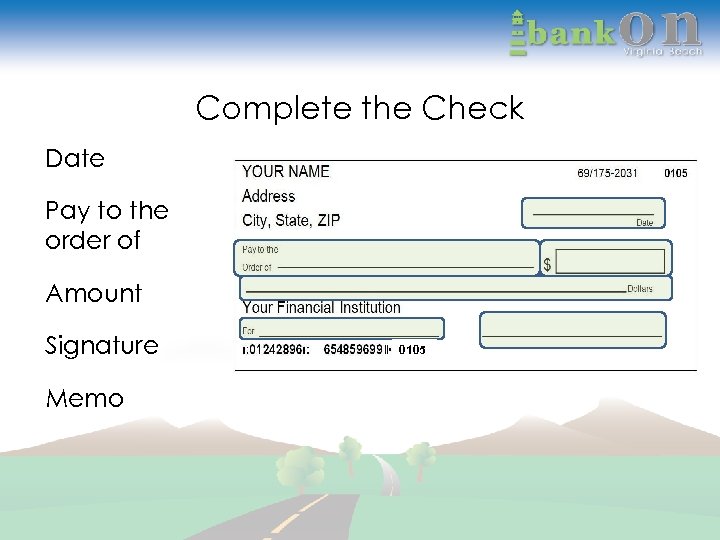

Complete the Check Date Pay to the order of Amount Signature Memo 0105

Barriers & Strategies 1. Keeping track of your money – 2. Your checking history – – 3. Bounced check fees Chex. Systems Second chance checking “I didn’t know!”

Temporary Holds Restaurants Gas Stations Hotels Phone/Online Purchases

Electronic Banking Automatic Bill Payment Online Bill Payment Mobile Banking

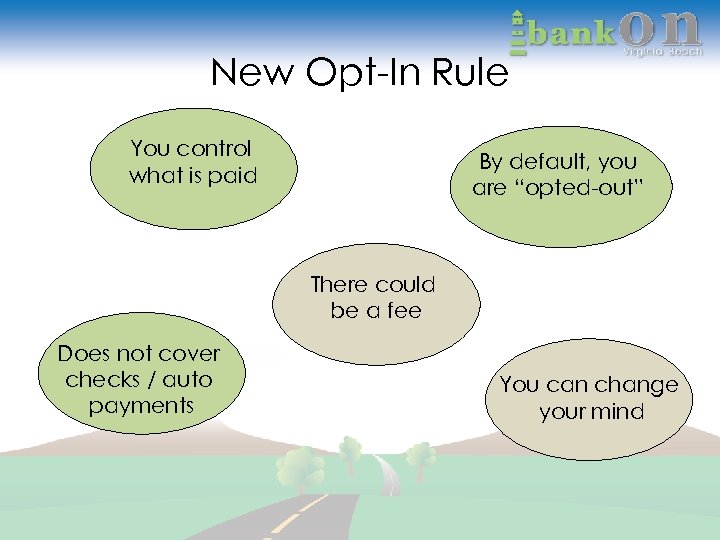

New Opt-In Rule You control what is paid By default, you are “opted-out” There could be a fee Does not cover checks / auto payments You can change your mind

Privacy Notices Explains how your personal financial information is shared and protected Under Federal law: • Personal financial information is private • You can stop or “opt out”

What Have You Learned? (Post-Test page 39)

Homework (Passport page 15)

Questions?

a6e2a47734180bdfb3c96557f71ca4bf.ppt