2c4c821caf23216a5e6023bf28cd49ca.ppt

- Количество слайдов: 15

Bank of Montreal CI C. A. P. I. T. A. L. Deposit Notes™ Enhanced Yield Class, Series 3 Selling Period: May 24 to July 15, 2005 -1 -

The information contained herein is not to be reproduced or distributed to the public or the press. The information contained herein is for information purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein and will be qualified in its entirety by reference to the Information Statement relating to the securities referred to herein. ®CI Funds and the CI Funds design are registered trademarks of CI Mutual Funds Inc. “BMO (M-Bar rounded symbol)” is a registered trademark of Bank of Montreal used under license. “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited used under license. -2 -

Challenging Investment Environment Market volatility: Attention focused on safety “I want to participate in the capital markets without risking my hard-earned money” Record-low interest rates: Need for stable, higher-yielding alternatives to GICs “current GIC rates may not cover inflation rates, let alone reaching my financial goals” -3 -

Why Protected Notes? They offer a response to the challenge – Financial goals can still be achieved – Your original investment is protected Most popular alternative to straight-up funds*: Sales have topped $7. 7 B in last two years * Annual Dollars & Sense Survey, 2004 -4 -

Choosing the Right Structure is Key Bank of Montreal CI C. A. P. I. T. A. L. Deposit Notes ily da * le rv ab Se em und de F Re gh ou thr • Enhanced Yield Class, Series 3 – Boosts income potential – Hedge against Min $2, 000 • Inflation / higher interest rates • Market volatility * In a secondary market provided by BMO Nesbitt Burns Inc. as outlined in the Information Statement -5 -

Enhanced Yield Class, Series 3 Selling period ends July 15, 2005 Give a Boost portfolio to your income Enhanced Income Potential with Capital Guarantee at Maturity -9 years- -6 -

Enhanced Yield Class, Series 3 at a Glance Up to 200% exposure to Signature High Income Fund and Signature Income & Growth Fund 75% of REALIZED Distributions (including additional participation) paid out monthly without affecting principal guarantee 25% of REALIZED Distributions (including additional participation) reinvested -7 -

Enhanced Yield Class, Series 3 Benefits of Dynamic Leveraging Policy Ø Formulaic: not subject to human emotions Ø Dynamic: leveraging / deleveraging regulates risks and costs Ø Hedge against Market conditions Ø Markets go up: Leveraging increases exposure to the Funds Ø Markets go down: Exposure decreased to minimize risk Ø Principal protection is not affected by distributions -8 -

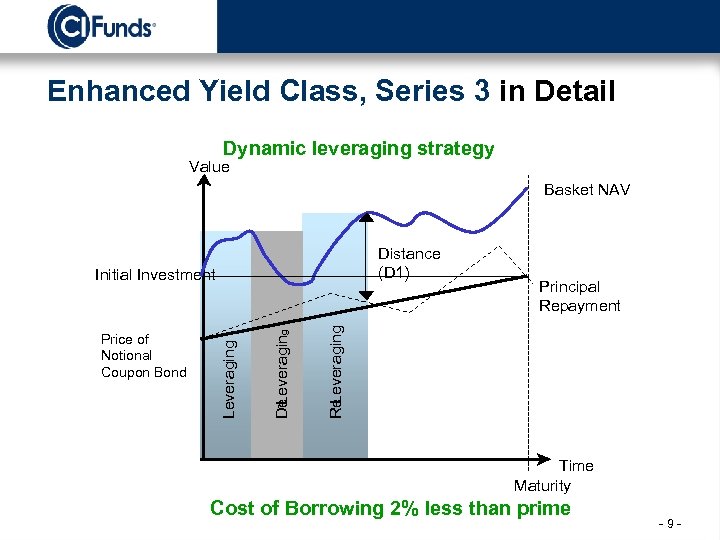

Enhanced Yield Class, Series 3 in Detail Dynamic leveraging strategy Value Basket NAV Distance (D 1) Principal Repayment Re Leveraging De Leveraging Price of Notional Coupon Bond Leveraging Initial Investment Time Maturity Cost of Borrowing 2% less than prime -9 -

Enhanced Yield Class, Series 3 in Detail Allocation Grid DT = % Difference between the Basket NAV and theoretical 9 -year, Coupon Bond Value This allocation to the Funds is determined at the end of every day as per a predefined and outlined formula. - 10 -

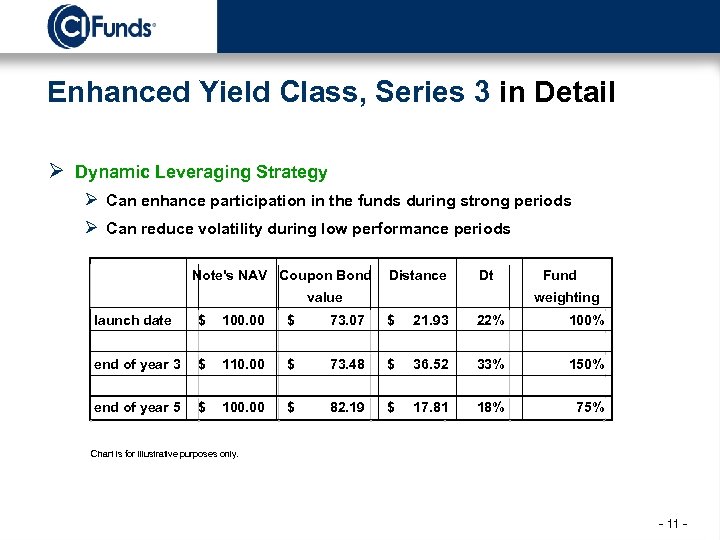

Enhanced Yield Class, Series 3 in Detail Ø Dynamic Leveraging Strategy Ø Can enhance participation in the funds during strong periods Ø Can reduce volatility during low performance periods Note's NAV Coupon Bond Distance Dt value Fund weighting launch date $ 100. 00 $ 73. 07 $ 21. 93 22% 100% end of year 3 $ 110. 00 $ 73. 48 $ 36. 52 33% 150% end of year 5 $ 100. 00 $ 82. 19 $ 17. 81 18% 75% Chart is for illustrative purposes only. - 11 -

Enhanced Yield Class, Series 3 Potential Investors Ø Conservative Investors Ø Retirement Accounts Ø Replacement for Fixed Income Holdings - 12 -

Thank you - 13 -

2c4c821caf23216a5e6023bf28cd49ca.ppt