410f705f44ea2b6aff70b8349c9847b5.ppt

- Количество слайдов: 26

Bank of Greece – University of Oxford (SEESOX) Conference Challenges and Prospects of South East European Economies in the wake of the financial crisis Bank of Greece Friday, 16 October 2009 Resilience of SEEs to the crisis Paul Mylonas Chief Economist, Chief of Strategy, National Bank of Greece Group – Strategy & Economic Research

What people saw and what they expected What happened and current prospects Why a better-than-expected outcome NBG - Strategy & Economic Research Resilience of SEEs to the crisis 1

What people saw and what they expected NBG - Strategy & Economic Research Resilience of SEEs to the crisis 2

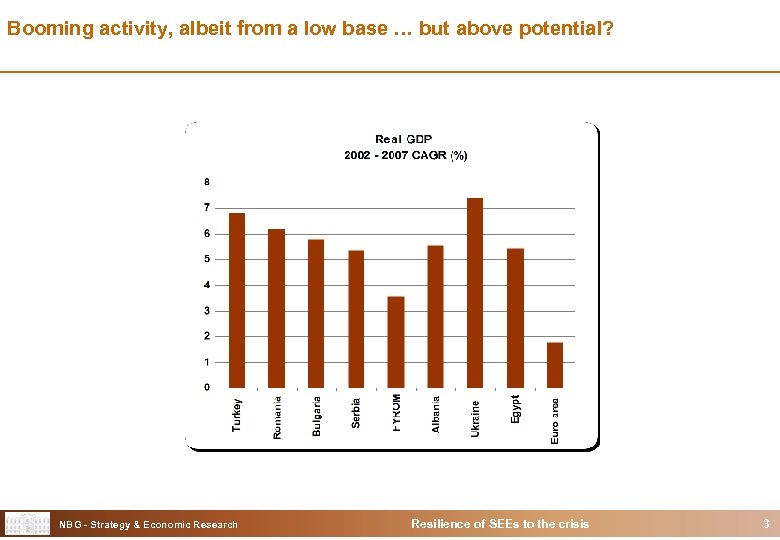

Booming activity, albeit from a low base … but above potential? NBG - Strategy & Economic Research Resilience of SEEs to the crisis 3

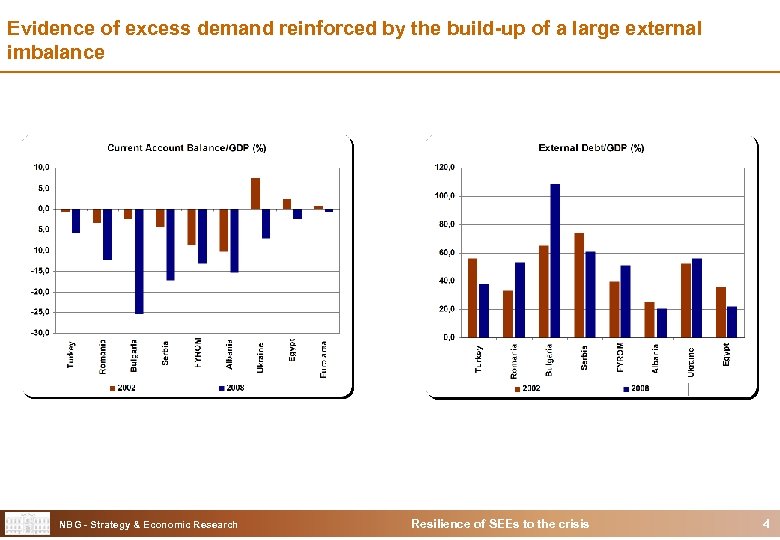

Evidence of excess demand reinforced by the build-up of a large external imbalance NBG - Strategy & Economic Research Resilience of SEEs to the crisis 4

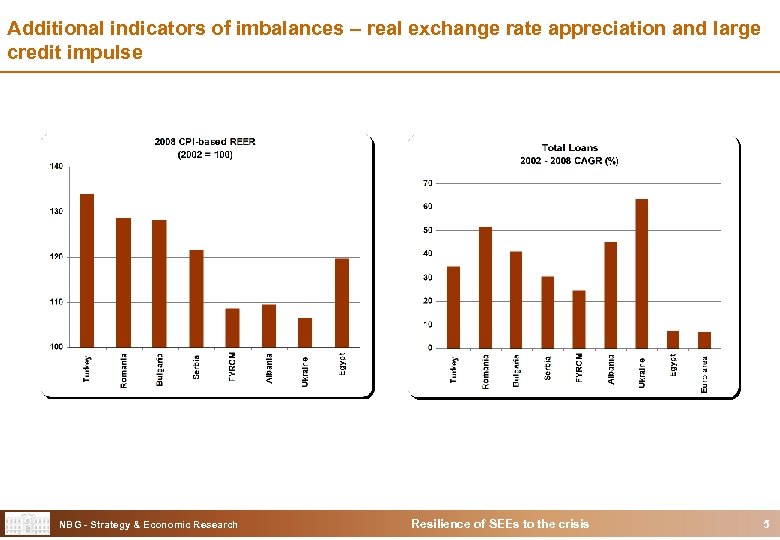

Additional indicators of imbalances – real exchange rate appreciation and large credit impulse NBG - Strategy & Economic Research Resilience of SEEs to the crisis 5

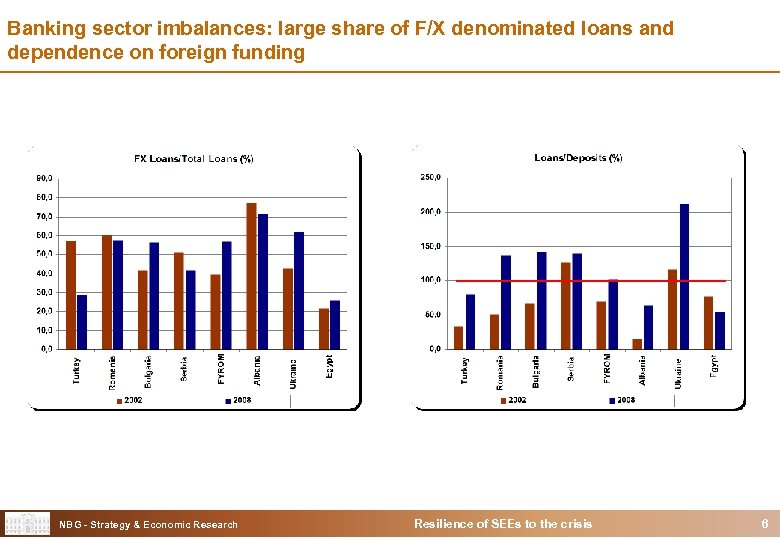

Banking sector imbalances: large share of F/X denominated loans and dependence on foreign funding NBG - Strategy & Economic Research Resilience of SEEs to the crisis 6

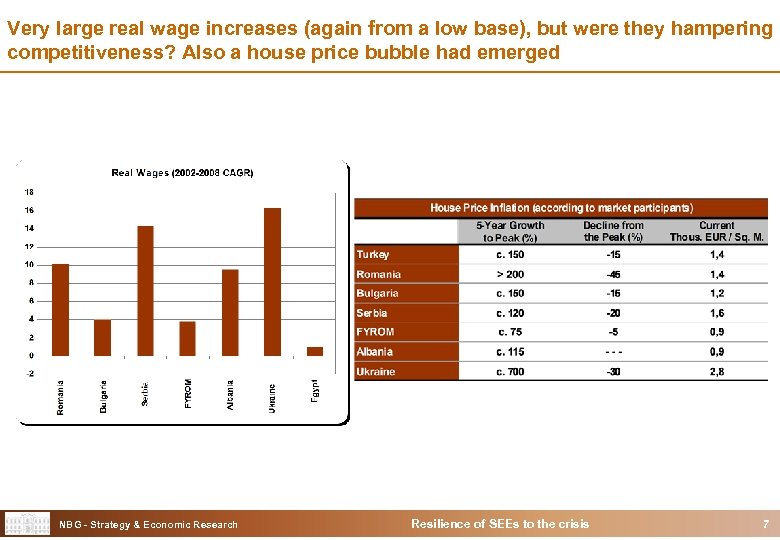

Very large real wage increases (again from a low base), but were they hampering competitiveness? Also a house price bubble had emerged NBG - Strategy & Economic Research Resilience of SEEs to the crisis 7

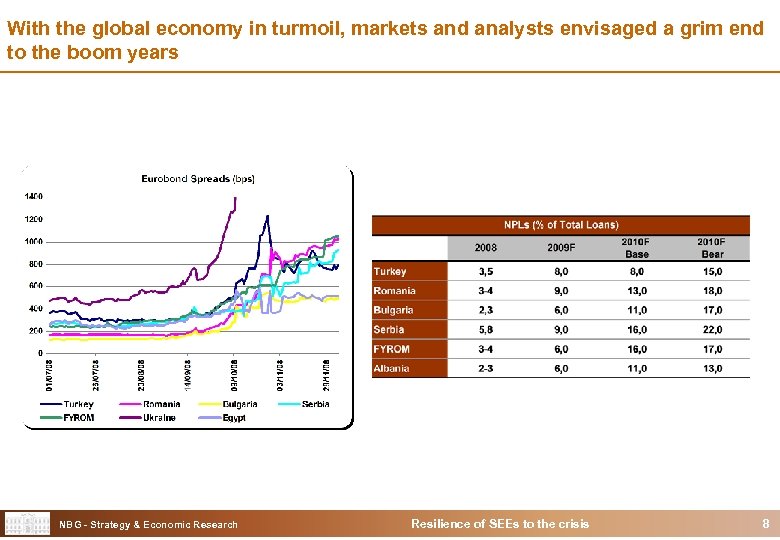

With the global economy in turmoil, markets and analysts envisaged a grim end to the boom years NBG - Strategy & Economic Research Resilience of SEEs to the crisis 8

What happened and current prospects NBG - Strategy & Economic Research Resilience of SEEs to the crisis 9

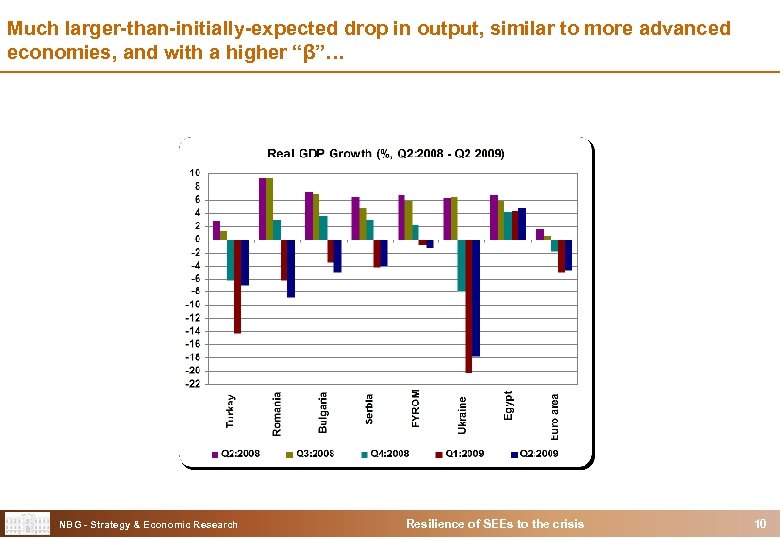

Much larger-than-initially-expected drop in output, similar to more advanced economies, and with a higher “β”… NBG - Strategy & Economic Research Resilience of SEEs to the crisis 10

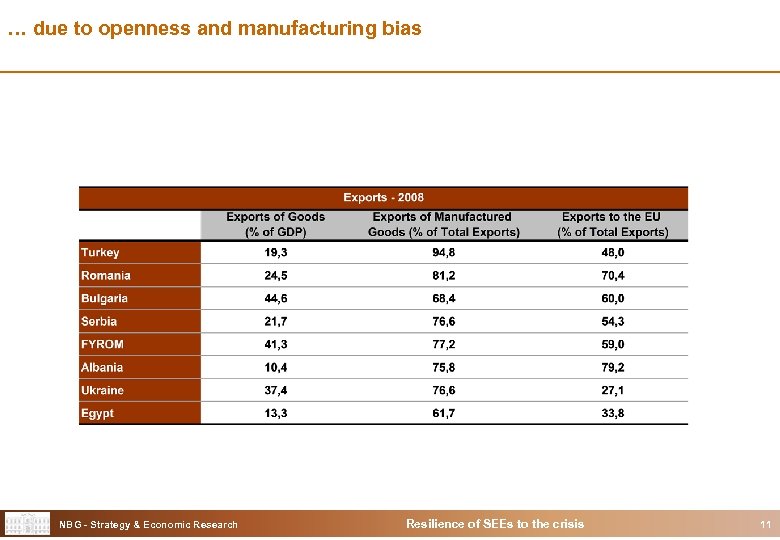

… due to openness and manufacturing bias NBG - Strategy & Economic Research Resilience of SEEs to the crisis 11

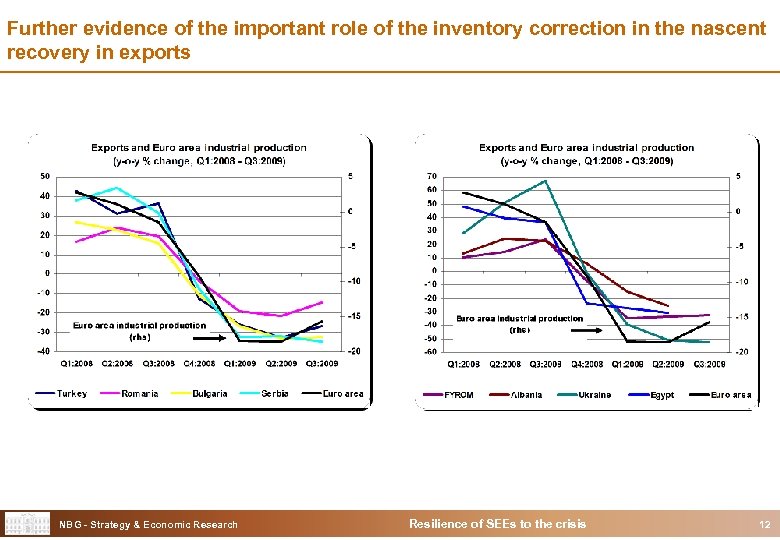

Further evidence of the important role of the inventory correction in the nascent recovery in exports NBG - Strategy & Economic Research Resilience of SEEs to the crisis 12

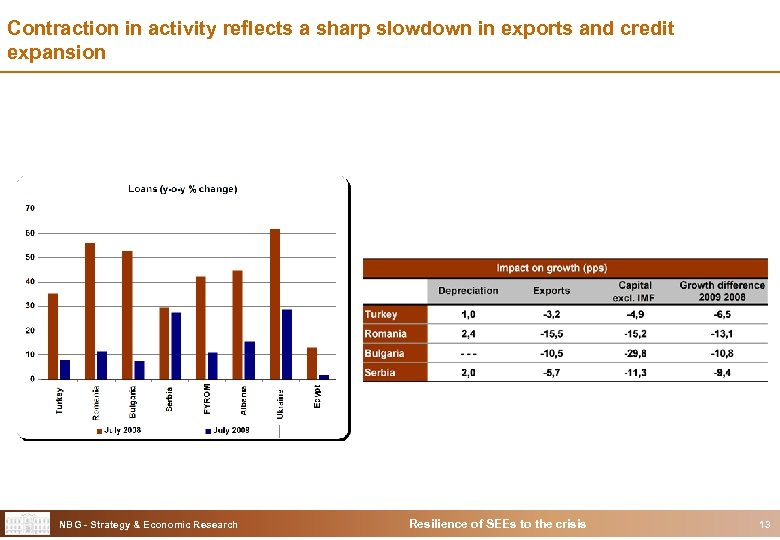

Contraction in activity reflects a sharp slowdown in exports and credit expansion NBG - Strategy & Economic Research Resilience of SEEs to the crisis 13

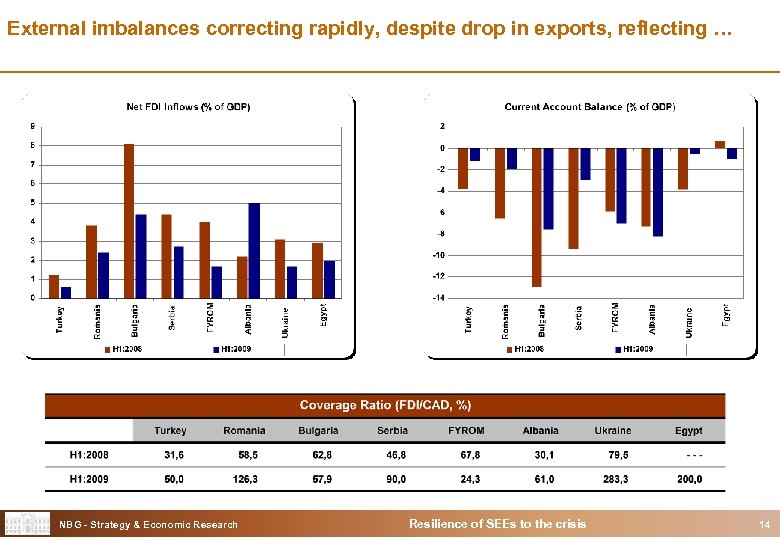

External imbalances correcting rapidly, despite drop in exports, reflecting … NBG - Strategy & Economic Research Resilience of SEEs to the crisis 14

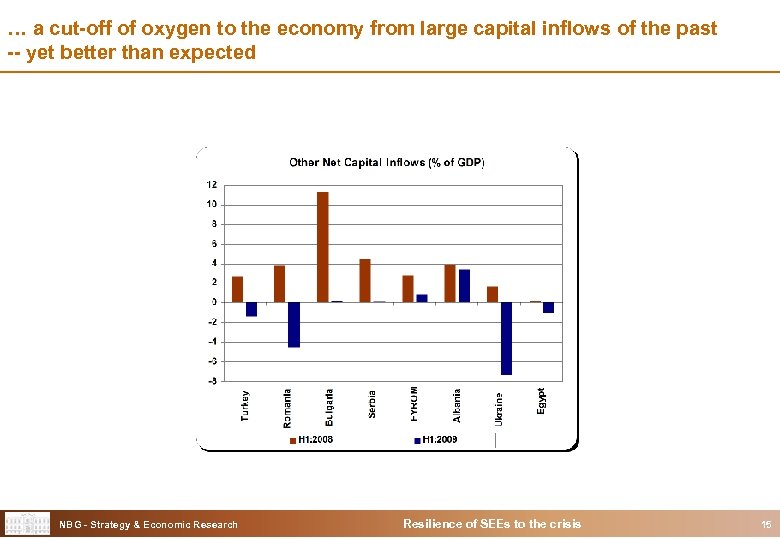

… a cut-off of oxygen to the economy from large capital inflows of the past -- yet better than expected NBG - Strategy & Economic Research Resilience of SEEs to the crisis 15

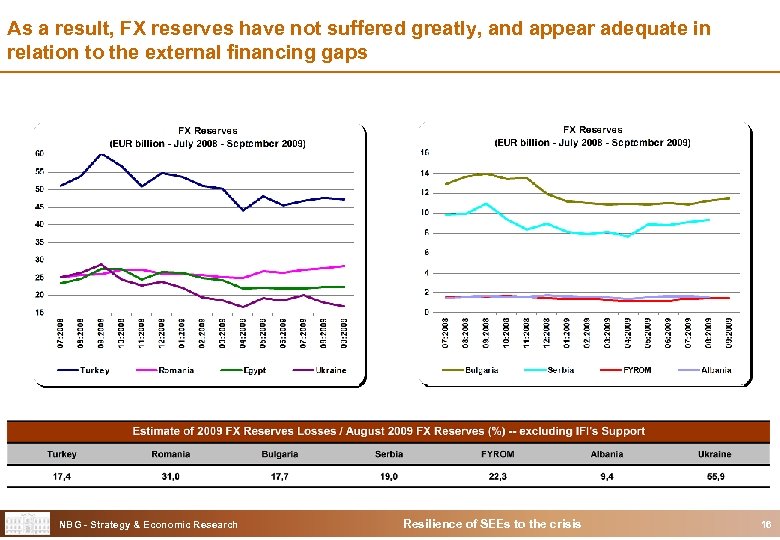

As a result, FX reserves have not suffered greatly, and appear adequate in relation to the external financing gaps NBG - Strategy & Economic Research Resilience of SEEs to the crisis 16

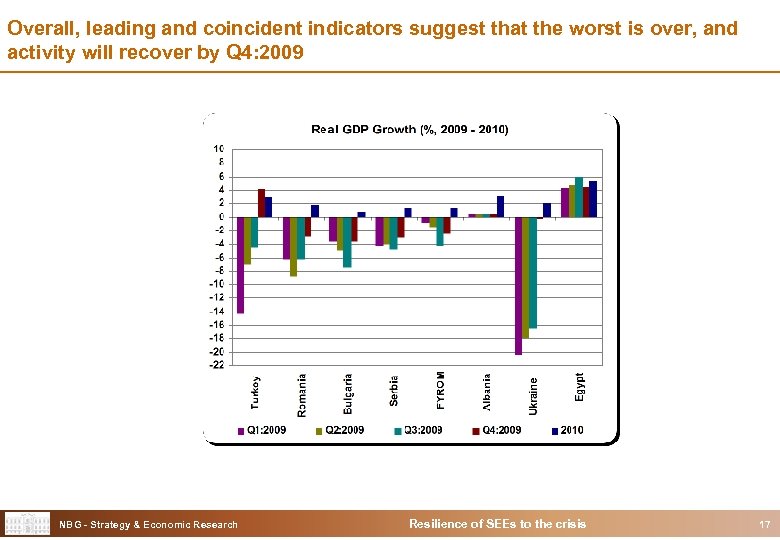

Overall, leading and coincident indicators suggest that the worst is over, and activity will recover by Q 4: 2009 NBG - Strategy & Economic Research Resilience of SEEs to the crisis 17

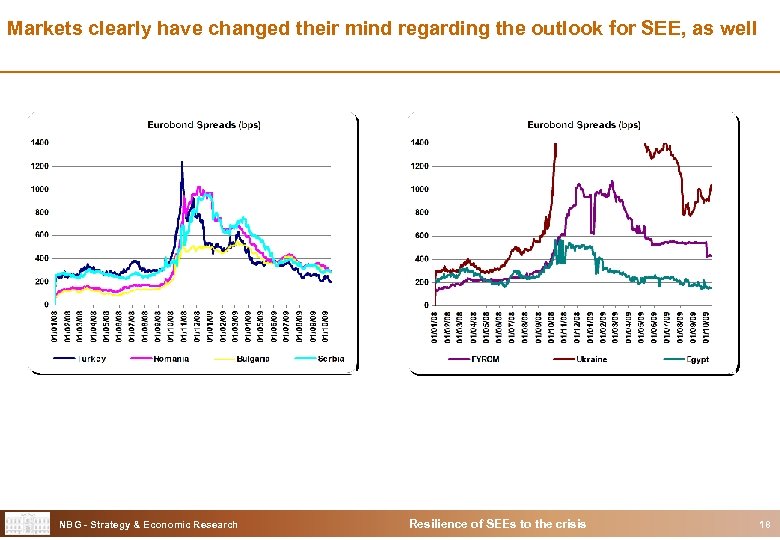

Markets clearly have changed their mind regarding the outlook for SEE, as well NBG - Strategy & Economic Research Resilience of SEEs to the crisis 18

Why a better-than-expected outcome NBG - Strategy & Economic Research Resilience of SEEs to the crisis 19

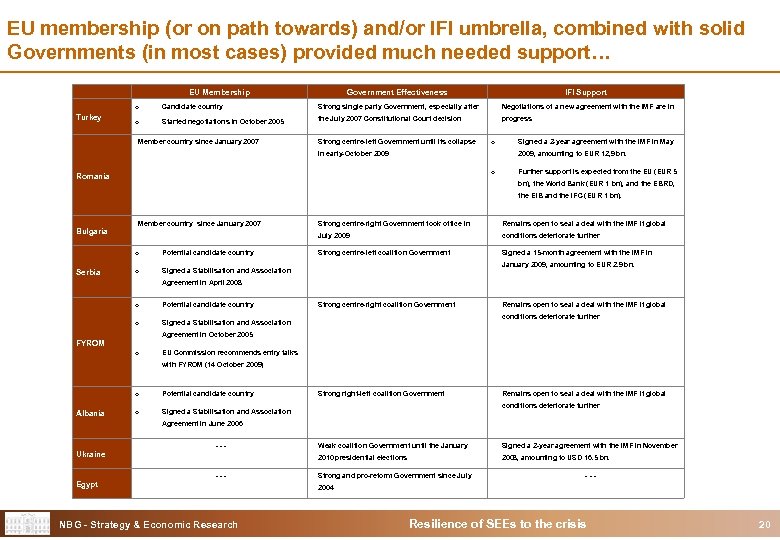

EU membership (or on path towards) and/or IFI umbrella, combined with solid Governments (in most cases) provided much needed support… EU Membership Government Effectiveness IFI Support o Turkey Candidate country Strong single party Government, especially after Negotiations of a new agreement with the IMF are in o Started negotiations in October 2005 the July 2007 Constitutional Court decision progress Member country since January 2007 Strong centre-left Government until its collapse o in early-October 2009 Signed a 2 -year agreement with the IMF in May 2009, amounting to EUR 12, 9 bn. o Romania Further support is expected from the EU (EUR 5 bn), the World Bank (EUR 1 bn), and the EBRD, the EIB and the IFC (EUR 1 bn). Member country since January 2007 o Serbia Potential candidate country o Strong centre-right Government took office in Remains open to seal a deal with the IMF if global July 2009 Bulgaria conditions deteriorate further Strong centre-left coalition Government Signed a 15 -month agreement with the IMF in Signed a Stabilisation and Association January 2009, amounting to EUR 2. 9 bn. Agreement in April 2008 o Potential candidate country o Strong centre-right coalition Government Signed a Stabilisation and Association Remains open to seal a deal with the IMF if global conditions deteriorate further Agreement in October 2005 FYROM o EU Commission recommends entry talks with FYROM (14 October 2009) o Albania Potential candidate country o Strong right-left coalition Government Signed a Stabilisation and Association Remains open to seal a deal with the IMF if global conditions deteriorate further Agreement in June 2006 --- Egypt NBG - Strategy & Economic Research Weak coalition Government until the January Signed a 2 -year agreement with the IMF in November 2010 presidential elections Ukraine 2008, amounting to USD 16. 5 bn. Strong and pro-reform Government since July --- 2004 Resilience of SEEs to the crisis 20

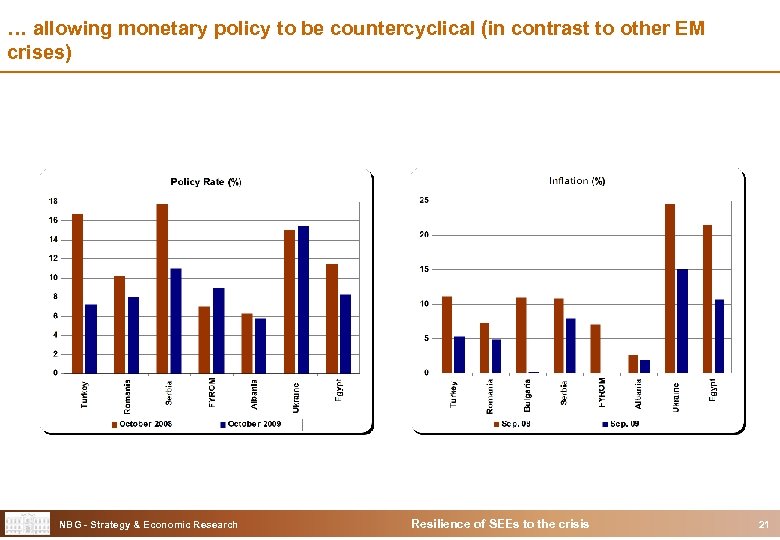

… allowing monetary policy to be countercyclical (in contrast to other EM crises) NBG - Strategy & Economic Research Resilience of SEEs to the crisis 21

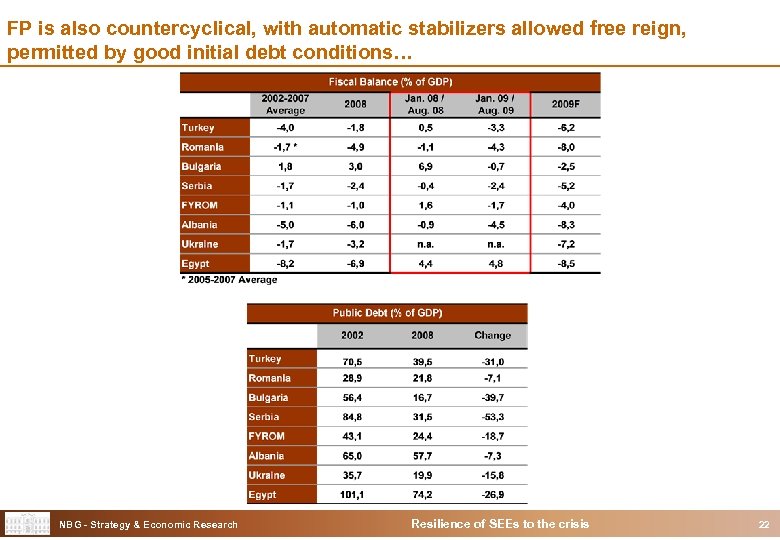

FP is also countercyclical, with automatic stabilizers allowed free reign, permitted by good initial debt conditions… NBG - Strategy & Economic Research Resilience of SEEs to the crisis 22

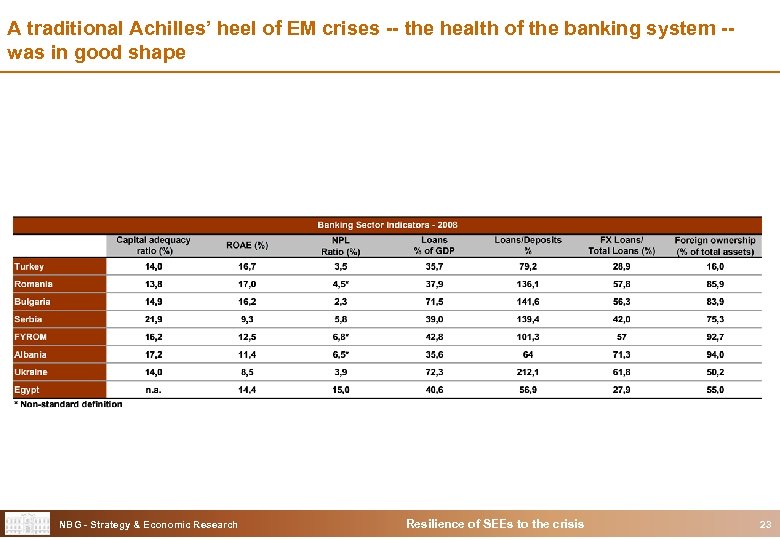

A traditional Achilles’ heel of EM crises -- the health of the banking system -was in good shape NBG - Strategy & Economic Research Resilience of SEEs to the crisis 23

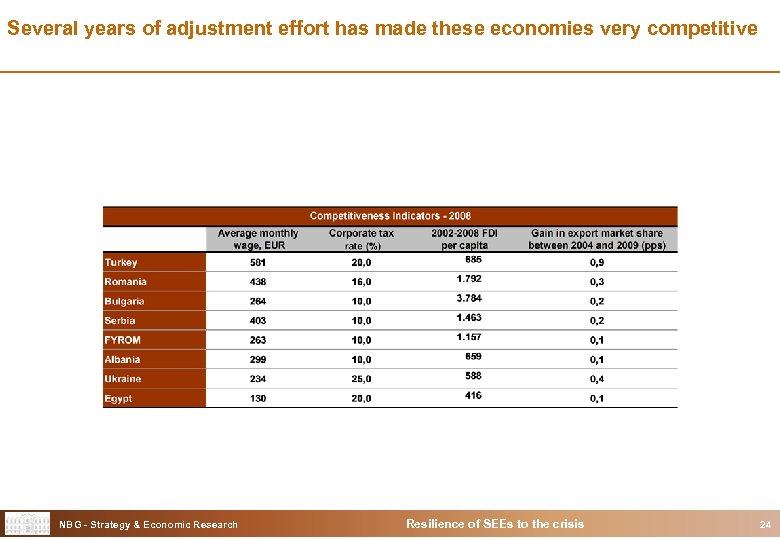

Several years of adjustment effort has made these economies very competitive NBG - Strategy & Economic Research Resilience of SEEs to the crisis 24

Thank you NBG - Strategy & Economic Research Resilience of SEEs to the crisis 25

410f705f44ea2b6aff70b8349c9847b5.ppt