0ab1c4a0dbd1d954f078ed272d980311.ppt

- Количество слайдов: 19

Bank market structure, competition, and SME financing relationships in European regions Mergers and Acquisitions of Financial Institutions FDIC, Arlington, VA. 30 th November – 01 st December 2007 Steve Mercieca University of Southampton Klaus Schaeck Cass Business School Simon Wolfe University of Southampton

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion What the paper does: a) We investigate the determinants of multiple bank relationships based on SME firm, bank market, and financial system architecture characteristics. b) How do changes in bank market structure and competition among banks affect the number of bank relationships that SMEs maintain? First paper – to the best of our knowledge – that a) investigates determinants of the number of bank relationships maintained by SMEs b) disentangles the effects of concentration and competition on bank relationships c) emphasizes regional perspective Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion What do we mean by bank financing relationship? Any kind of financing activity, e. g. firm start up, product development, business acquisition, management buy-in/buy-out, stock purchase, tax payments. Our definition excludes bank relationship based only on deposit accounts/cheque usage. Why are these issues important? a) In Europe, SMEs account for 99% of all companies, employ around 75 million people and generate one in every two new jobs (European Commission, 2004). b) Important benefits arise from interaction between borrowers and banks (e. g. Elyasiani and Goldberg, 2004) Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Why are these issues important? (cont’d) c) The link between structure and competitive conduct is not clear-cut. Many previous studies proxy competition by the degree of concentration, with the (implicit) assumption of an inverse relationship between the two! This however gives rise to several issues: (1) Definition of a market affects measurement of concentration (Shaffer, 2004). (2) Measures of market structure are not necessarily related to competition (Baumol et al. , 1982). (3) Empirical evidence that concentration and competition describe different characteristics of banking systems (Claessens and Laeven, 2004; Carbo et al. , 2006). Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion One bank relationship vs > 1 one bank relationship 1. 2. Superior information enables single bank to extract monopoly rents. Competition from additional informed bank eliminates ‘hold up’ costs (Sharpe, 1990; Rajan, 1992) Legal setting and institutional environment (La Porta et al. , 1997) 1. Easier access to credit (Petersen and Rajan, 1994) 2. Pre-existing relationship as source of financial services has effect on potential lender’s decision to extend credit (Cole, 1998) 3. Diversification (Detragiache et al. , 2000) Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Market structure vs. competitive conduct Wave of consolidation across European banking systems due to increasing number of M&As (Goddard et al. , 2007), de Guevara et al. (2005), and Amel et al. (2004). Increasing degrees of competition in European banking systems (Staikouras and Koutsomanoli-Filipaki (2006), and Cihak and a 2 nd author (2007) Fears that consolidation decreases the number of banks specializing in relationship banking (e. g. community banks) with possibly detrimental welfare effects for local firms, especially SMEs, these Firms’ access to credit, and ultimately, economic growth. Extensively studied for the US (e. g. Craig and Hardee, 2006; Berger and Udell, 2002; Cole et al. , 2004; Berger and Frame, 2005). Beneficial effects arising from increased competition in banking for the provision of banking services may be offset by greater concentration in banking. Market power hypothesis: competition enhances access to credit (e. g. Boot and Thakor, 2000) Information hypothesis: less competition improves credit availability (e. g. Petersen and Rajan, 1995) Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Overview on SMEs The EU defines SMEs as enterprises that employ fewer than 250 people, have an annual turnover not exceeding 50 million EUR, and/or annual balance sheet total not exceeding 43 million EUR. Our data Taken from the 2002 ESRC survey conducted by the Centre for Business Research of the University of Cambridge. Survey focuses on funding of SMEs in three different regions in Europe (South east of England, Bavaria in Germany, and Emilia-Romagna in Italy). Questionnaire contains 191 questions for Germany and the UK, and 188 for Italy. 247 responses for the UK, 161 for Italy, and 114 for Germany. Questions from the survey include but are not limited to: • • • the main markets served the type of finance used whether firms have used bank finance the role played by banks whether firms make use of providers of venture capital Steve Mercieca, Klaus Schaeck, and Simon Wolfe

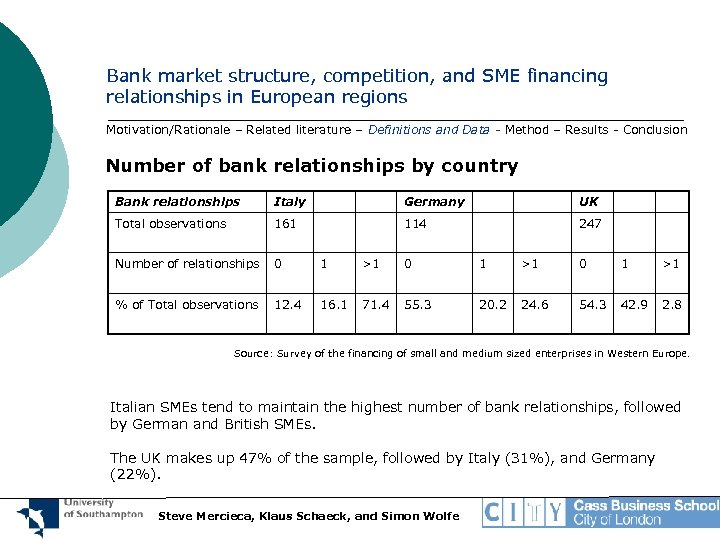

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Number of bank relationships by country Bank relationships Italy Germany UK Total observations 161 114 247 Number of relationships 0 1 >1 % of Total observations 12. 4 16. 1 71. 4 55. 3 20. 2 24. 6 54. 3 42. 9 2. 8 Source: Survey of the financing of small and medium sized enterprises in Western Europe. Italian SMEs tend to maintain the highest number of bank relationships, followed by German and British SMEs. The UK makes up 47% of the sample, followed by Italy (31%), and Germany (22%). Steve Mercieca, Klaus Schaeck, and Simon Wolfe

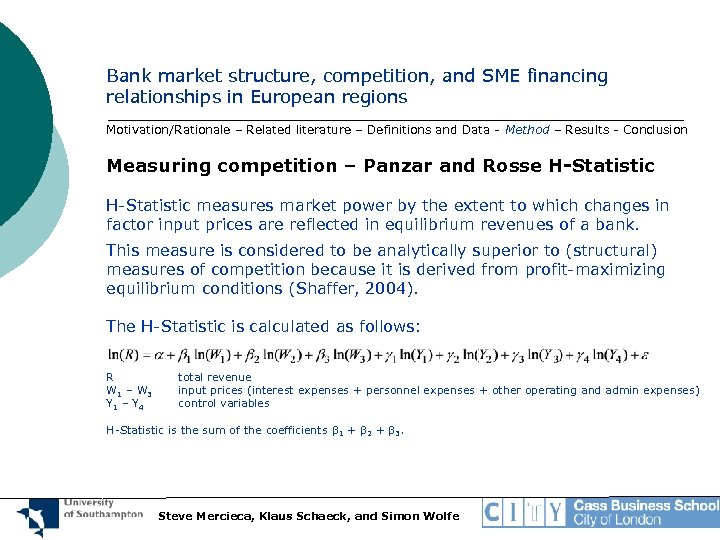

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Measuring competition – Panzar and Rosse H-Statistic measures market power by the extent to which changes in factor input prices are reflected in equilibrium revenues of a bank. This measure is considered to be analytically superior to (structural) measures of competition because it is derived from profit-maximizing equilibrium conditions (Shaffer, 2004). The H-Statistic is calculated as follows: R W 1 – W 3 Y 1 – Y 4 total revenue input prices (interest expenses + personnel expenses + other operating and admin expenses) control variables H-Statistic is the sum of the coefficients β 1 + β 2 + β 3. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Estimation strategy We regress the number of bank relationships on firm, market, and region-specific variables. The dependend variable is coded as 0 – no bank relationship 1 – one bank relationship 2 – more than one bank relationship Caveat: The survey does not provide details beyond more than one bank relationship. We use both tobit and logit models (for the decision to have more than just one bank relationship) for the empirical setup. All regressions control for SME characteristics, variables that describe SMEfirm relationship, and distance. We also include environmental variables such as regional GDP growth, regionally active population, and concentration in the banking system. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

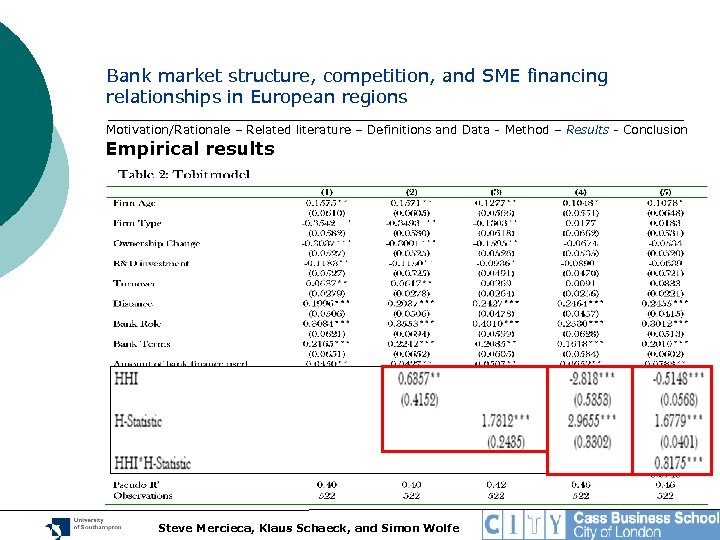

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Empirical results Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Empirical results (1) Competition and concentration both enter positively and signficiantly when included in separate regressions. (2) However, the sign of the coefficient for the HHI becomes negative when we account for the effect of competition as measured by the HStatistic. The negative effect of consolidation (or, better, concentrated markets) is aligned with the evidence in Craig and Hardee (2007). These results imply (1) Concentration and competition measure different characteristics of banking systems. (2) The degree of competition should not be proxied with concentration measures. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

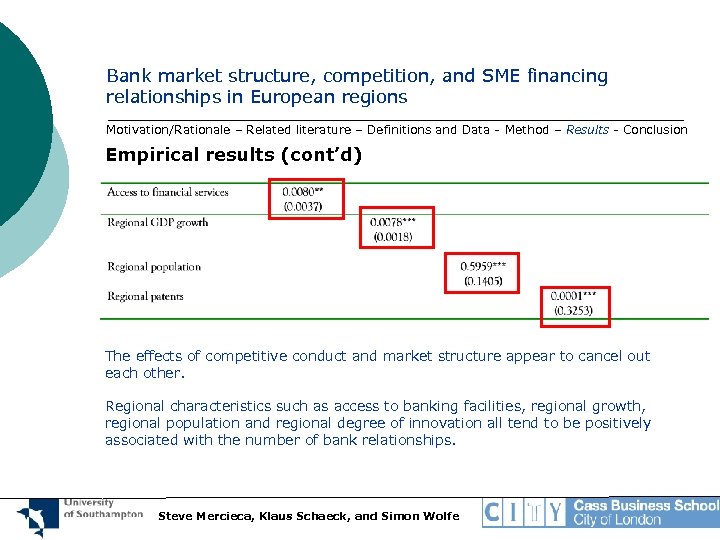

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Empirical results (cont’d) The effects of competitive conduct and market structure appear to cancel out each other. Regional characteristics such as access to banking facilities, regional growth, regional population and regional degree of innovation all tend to be positively associated with the number of bank relationships. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

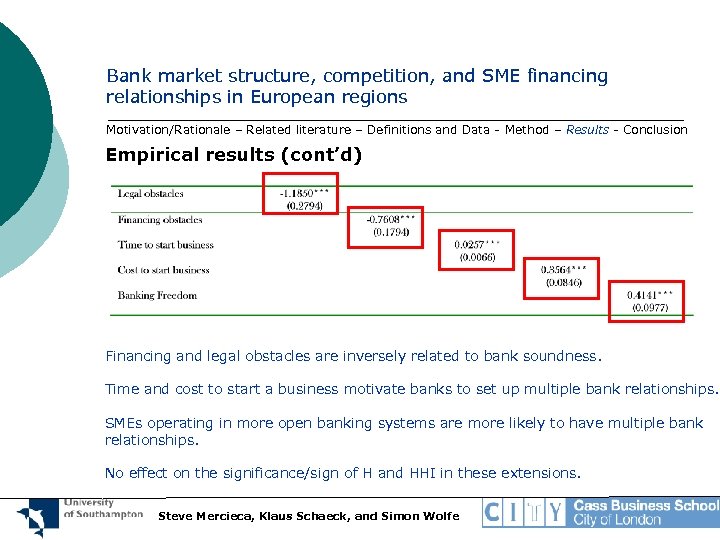

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Empirical results (cont’d) Financing and legal obstacles are inversely related to bank soundness. Time and cost to start a business motivate banks to set up multiple bank relationships. SMEs operating in more open banking systems are more likely to have multiple bank relationships. No effect on the significance/sign of H and HHI in these extensions. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Robustness checks Our inferences are insensitive to a) Alternatively computed H-Statistics (interest revenue as dependent variable) b) Alternative measures of market structure (3 bank concentration ratio instead of HHI) c) Using a logit model with marginal effects rather than a Tobit model Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Economic significance of the effects of HHI and H-Statistics We assess the affect of HHI and H-Statistics using marginal effects. Increasing the HHI by one percent decreases the probability of having an additional bank relationship by 0. 04 percent. However, increasing the H-Statistic by one percent increases the probability of having an additional bank relationship by 0. 05 percent. The negative effect of concentration is offset by increasing competition. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Summary (1) Competition and concentration appear to be different characteristics of banking systems. Our results support the “market power” hypothesis according to which firms maintain more bank relationships in more competitive banking systems. (2) We uncover contrasting independent effects arising from both concentration and competition. (3) Regional characteristics also impact on the number of bank relationships. (4) Firm size, bank role, and distance are also important determinants of the number of bank relationships. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Caveats/Qualifiers The comparatively small sample size recommends that we exert some caution when interpreting the results. However, our findings are aligned with a growing body of empirical work that disentangles the effects of concentration and competition. We refrain from interpreting the results in a causal sense. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

Bank market structure, competition, and SME financing relationships in European regions Motivation/Rationale – Related literature – Definitions and Data - Method – Results - Conclusion Concluding remarks (1) To the best of our knowledge, our study is the first one that investigates the determinants of SME-bank financing relationships in Europe. (2) We also focus on the effect of changes in bank market structure on on the number of bank relationships maintained by SMEs. (3) Our results suggest that policies that promote competition among banks may have potential to facilitate access to finance for SMEs. (4) Policymakers’ concerns about the adverse ramifications arising from consolidation in banking may be overstated. Steve Mercieca, Klaus Schaeck, and Simon Wolfe

0ab1c4a0dbd1d954f078ed272d980311.ppt