bfe161a29bc3be39859959819b334074.ppt

- Количество слайдов: 81

Bank Management, 5 th edition. Management Timothy W. Koch and S. Scott Mac. Donald Copyright © 2003 by South-Western, a division of Thomson Learning BANK MERGERS AND ACQUISITIONS Chapter 22

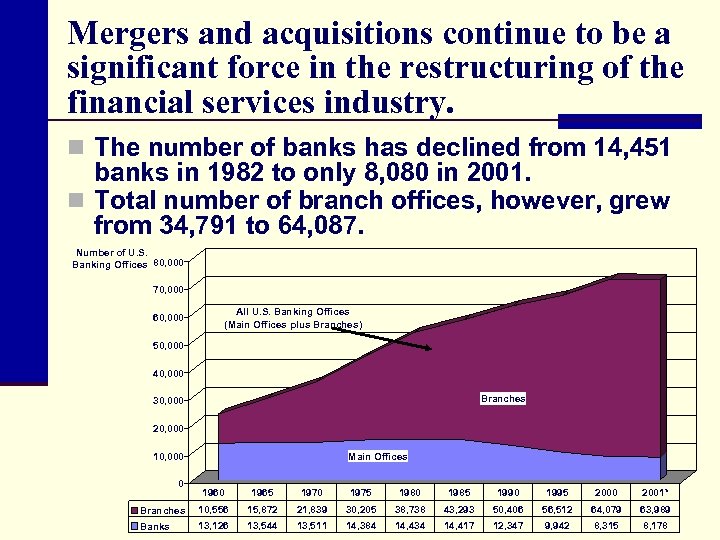

Mergers and acquisitions continue to be a significant force in the restructuring of the financial services industry. n The number of banks has declined from 14, 451 banks in 1982 to only 8, 080 in 2001. n Total number of branch offices, however, grew from 34, 791 to 64, 087. Number of U. S. Banking Offices 80, 000 70, 000 60, 000 All U. S. Banking Offices (Main Offices plus Branches) 50, 000 40, 000 Branches 30, 000 20, 000 10, 000 0 Main Offices 1960 1965 1970 1975 1980 1985 1990 1995 2000 2001* Branches 10, 556 15, 872 21, 839 30, 205 38, 738 43, 293 50, 406 56, 512 64, 079 63, 989 Banks 13, 126 13, 544 13, 511 14, 384 14, 434 14, 417 12, 347 9, 942 8, 315 8, 178

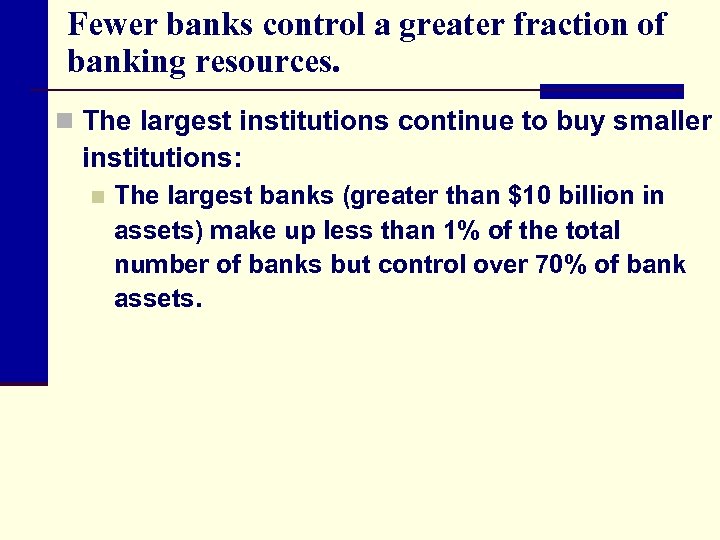

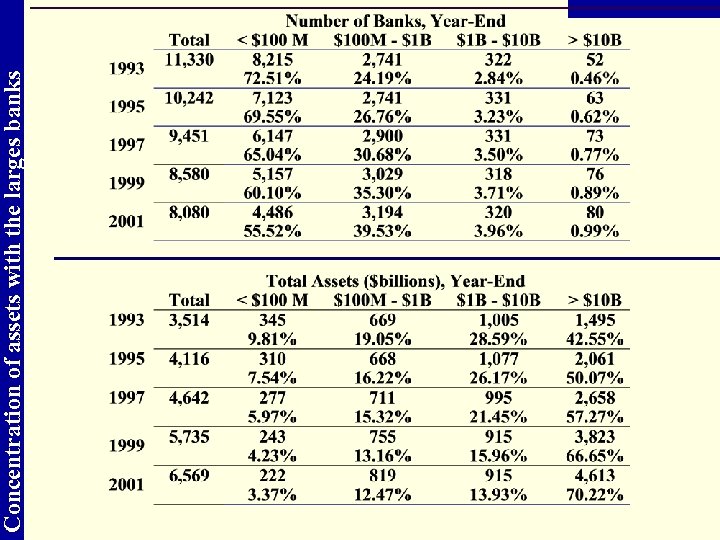

Fewer banks control a greater fraction of banking resources. n The largest institutions continue to buy smaller institutions: n The largest banks (greater than $10 billion in assets) make up less than 1% of the total number of banks but control over 70% of bank assets.

Concentration of assets with the larges banks

Many factors have lead to the merger mania of the 1990’s in banking. n The 1990’s was one of unprecedented growth in the economy. n Bank’s experienced record profits from 1990 through 2001. n Bank stocks values soared and this provided valuable currency for banks in acquiring other banks. n The elimination of interstate branching restrictions in the mid 1990’s n Repeal of Glass-Steagall in the late 1990’s and the resulting expansion outside traditional product lines and across international borders

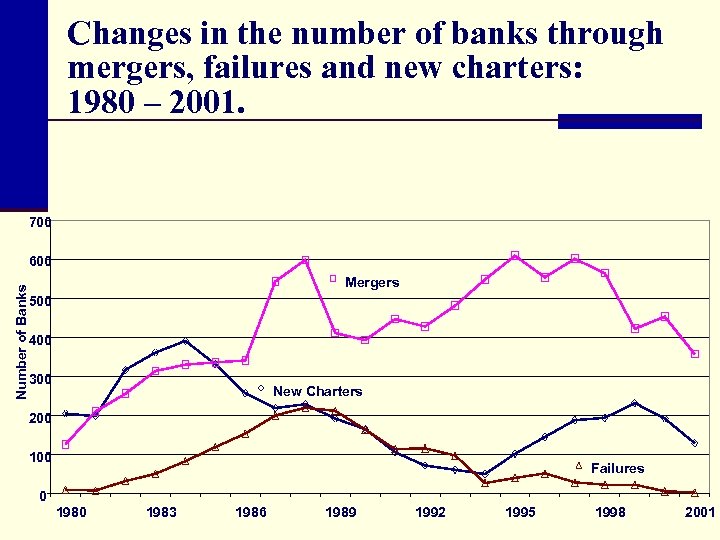

Changes in the number of banks through mergers, failures and new charters: 1980 – 2001. 700 Number of Banks 600 Mergers 500 400 300 New Charters 200 100 Failures 0 1983 1986 1989 1992 1995 1998 2001

The impact of the Riegle-Neal Interstate Branching and Efficiency Act n Interstate branching restrictions were removed in n n the mid 1990’s and the Riegle-Neal Interstate Branching and Efficiency Act became fully effective by June 1997. Prior the Riegle-Neal Act, each state determined the degree to which banks could branch across state lines. Many states did not allow interstate branching. Riegle-Neal allowed for nation-wide interstate branching. Savings institutions, on the other hand, have historically been allowed to branch across state lines.

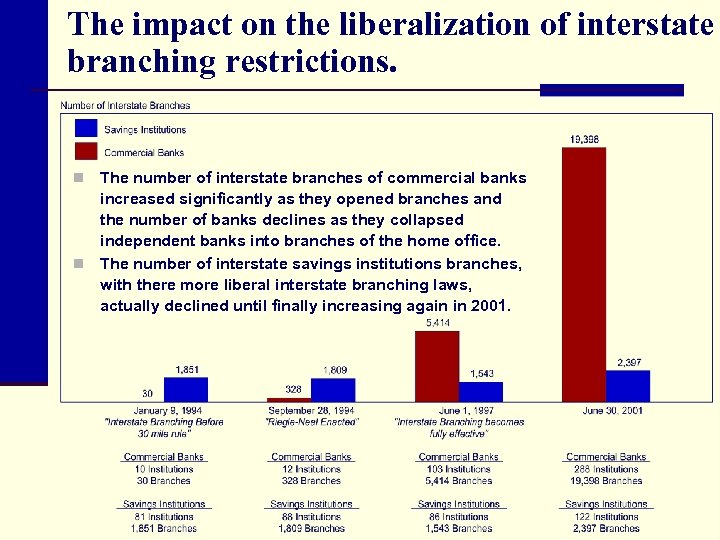

The impact on the liberalization of interstate branching restrictions. The number of interstate branches of commercial banks increased significantly as they opened branches and the number of banks declines as they collapsed independent banks into branches of the home office. n The number of interstate savings institutions branches, with there more liberal interstate branching laws, actually declined until finally increasing again in 2001. n

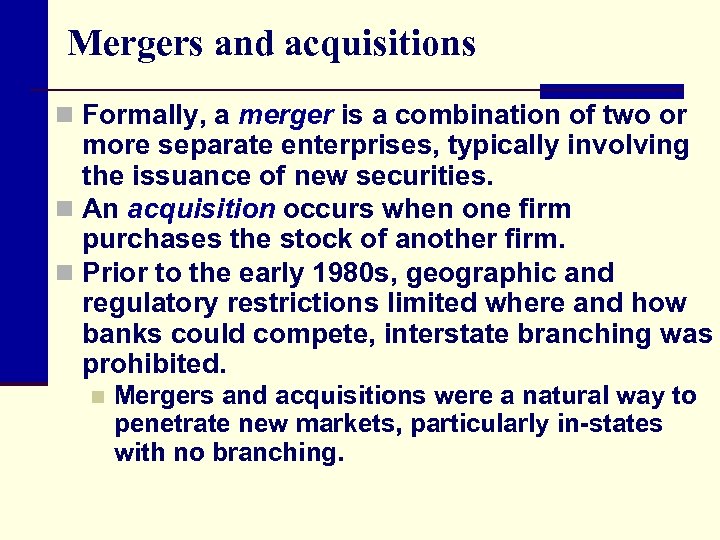

Mergers and acquisitions n Formally, a merger is a combination of two or more separate enterprises, typically involving the issuance of new securities. n An acquisition occurs when one firm purchases the stock of another firm. n Prior to the early 1980 s, geographic and regulatory restrictions limited where and how banks could compete, interstate branching was prohibited. n Mergers and acquisitions were a natural way to penetrate new markets, particularly in-states with no branching.

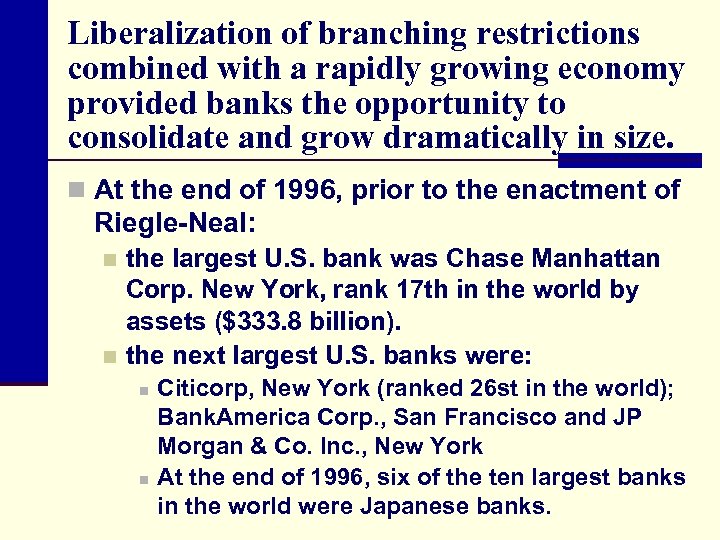

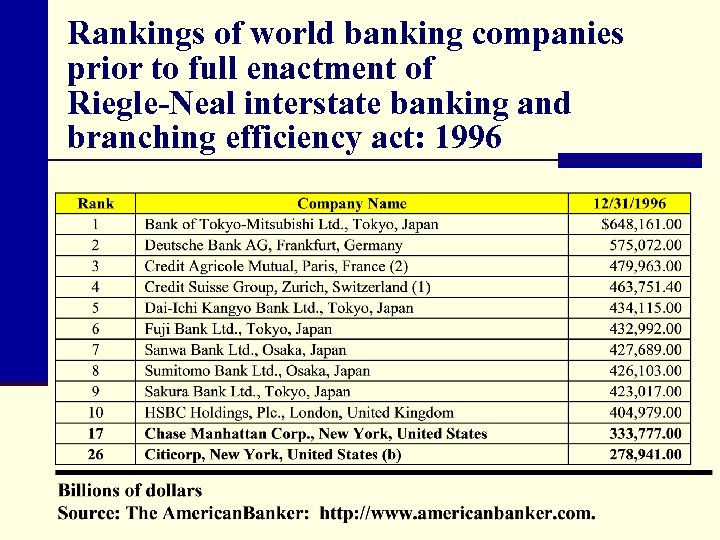

Liberalization of branching restrictions combined with a rapidly growing economy provided banks the opportunity to consolidate and grow dramatically in size. n At the end of 1996, prior to the enactment of Riegle-Neal: the largest U. S. bank was Chase Manhattan Corp. New York, rank 17 th in the world by assets ($333. 8 billion). n the next largest U. S. banks were: n n n Citicorp, New York (ranked 26 st in the world); Bank. America Corp. , San Francisco and JP Morgan & Co. Inc. , New York At the end of 1996, six of the ten largest banks in the world were Japanese banks.

Rankings of world banking companies prior to full enactment of Riegle-Neal interstate banking and branching efficiency act: 1996

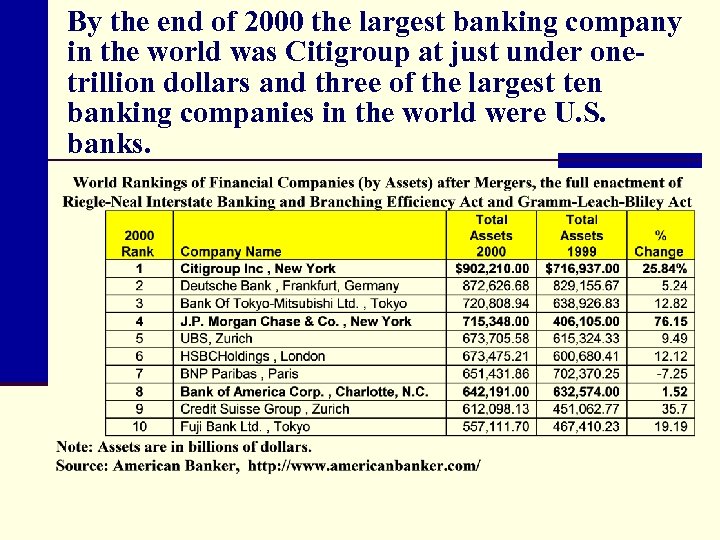

By the end of 2000 the largest banking company in the world was Citigroup at just under onetrillion dollars and three of the largest ten banking companies in the world were U. S. banks.

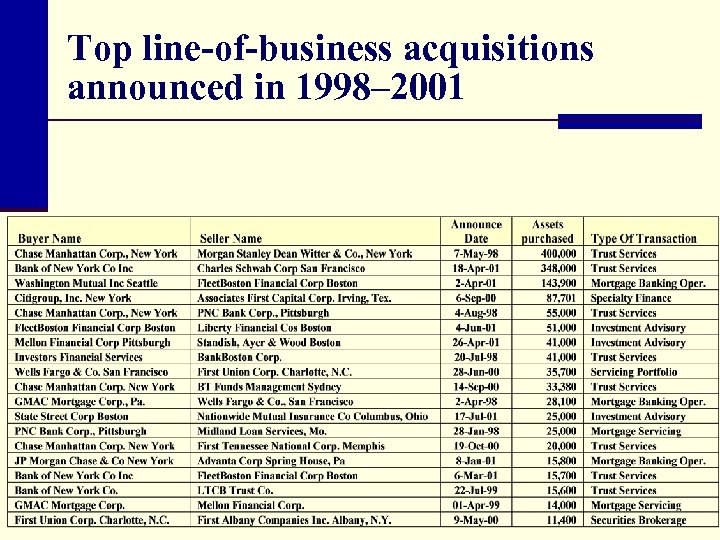

Acquisitions have also moved outside traditional product lines and across international borders. n Some of the largest lines of business acquisition from 1998 to 2001: n Chase Manhattan Corp. , New York acquired Morgan Stanley Dean Witter & Co. , New York in 1998, n Bank of New York Co Inc acquired Charles Schwab Corp, San Francisco in 2001, n Washington Mutual Inc Seattle acquired Fleet. Boston Financial Corp. ’s mortgage banking operation in 2001, n Citigroup, Inc. New York acquired Associates First Capital Corp. Irving, Texas in 2000, and n Chase Manhattan Corp. , New York acquired PNC Bank Corp’s trust services in late 1998.

Top line-of-business acquisitions announced in 1998– 2001

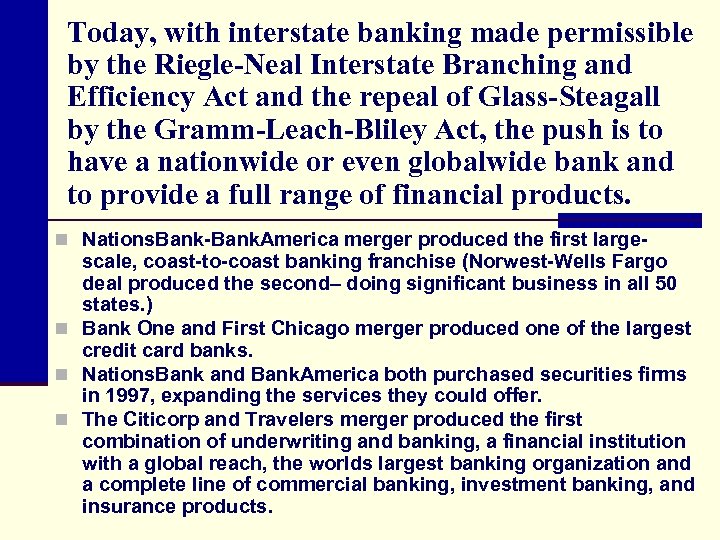

Today, with interstate banking made permissible by the Riegle-Neal Interstate Branching and Efficiency Act and the repeal of Glass-Steagall by the Gramm-Leach-Bliley Act, the push is to have a nationwide or even globalwide bank and to provide a full range of financial products. n Nations. Bank-Bank. America merger produced the first large- scale, coast-to-coast banking franchise (Norwest-Wells Fargo deal produced the second– doing significant business in all 50 states. ) n Bank One and First Chicago merger produced one of the largest credit card banks. n Nations. Bank and Bank. America both purchased securities firms in 1997, expanding the services they could offer. n The Citicorp and Travelers merger produced the first combination of underwriting and banking, a financial institution with a global reach, the worlds largest banking organization and a complete line of commercial banking, investment banking, and insurance products.

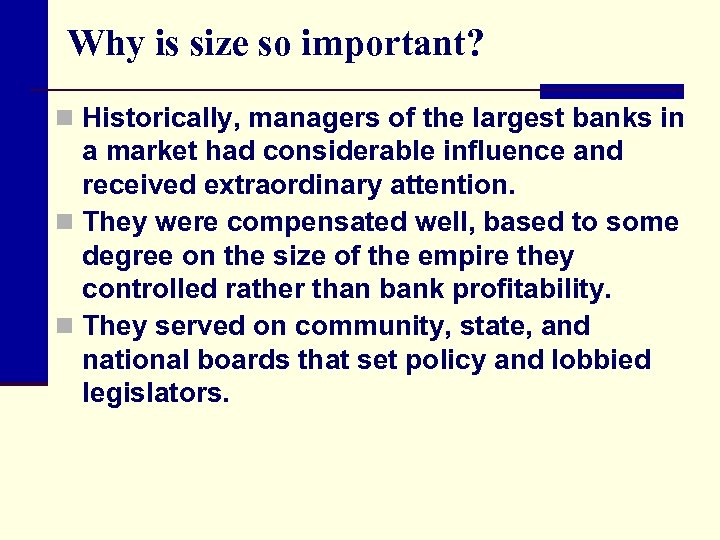

Why is size so important? n Historically, managers of the largest banks in a market had considerable influence and received extraordinary attention. n They were compensated well, based to some degree on the size of the empire they controlled rather than bank profitability. n They served on community, state, and national boards that set policy and lobbied legislators.

The traditional benefits of economies of scale and scope in business n Size, product diversity, and brand identification, which generate benefits from cross-selling more products to more customers. n Size can reduce the large fixed costs required for brand identification, distribution of a large variety of products and services, and the massive technology expenditure requirement. n Enhanced operating leverage n results from spreading fixed overhead cost across a larger operating and revenue base. n Reduction in a company's earnings risk n enhances the value of a franchise by creating a more diversified product and earnings base.

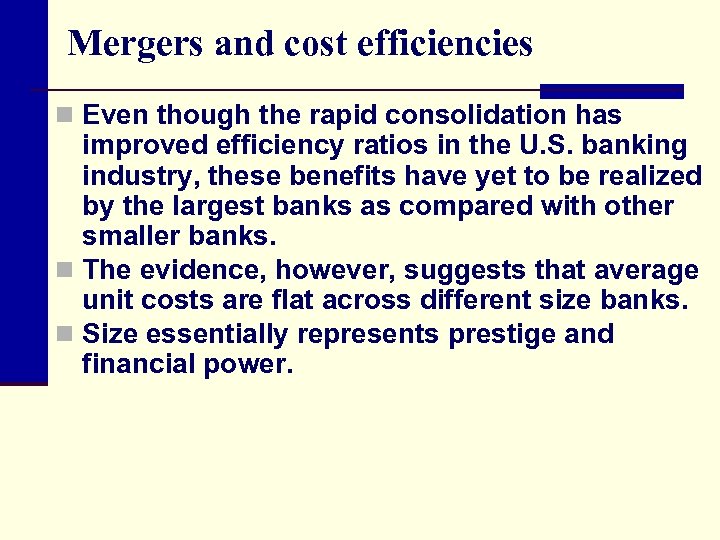

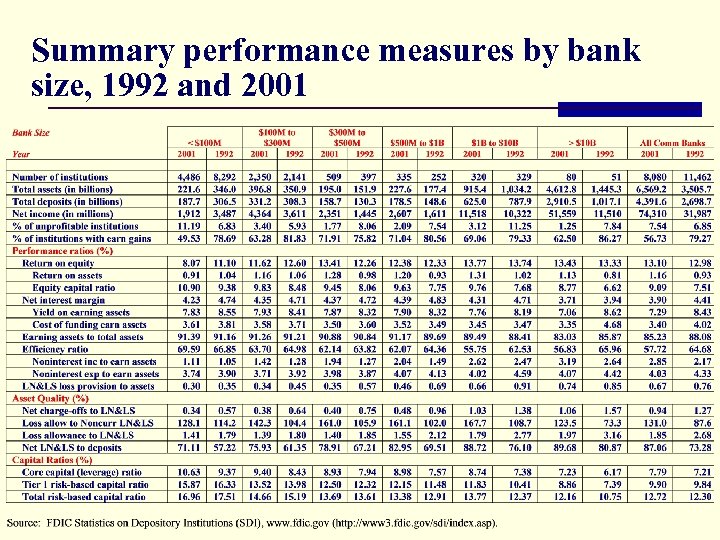

Mergers and cost efficiencies n Even though the rapid consolidation has improved efficiency ratios in the U. S. banking industry, these benefits have yet to be realized by the largest banks as compared with other smaller banks. n The evidence, however, suggests that average unit costs are flat across different size banks. n Size essentially represents prestige and financial power.

Summary performance measures by bank size, 1992 and 2001

Merger value is created in two ways: n The combined bank might be able to generate increased earnings (or cash flow) compared to historical norms. n Increasing market share. n Even if earnings rates remain unchanged after a merger, a bank can position itself as a future acquisition target by capturing a greater share of its deposit market.

Source of potential gains Economies of Scale, Cost Cutting Increase Market Share Enhanced Product lines Entry into Attractive New Markets Improved Managerial Capabilities, and Increased Financial Leverage 6. Financial and Operating Leverage 1. 2. 3. 4. 5.

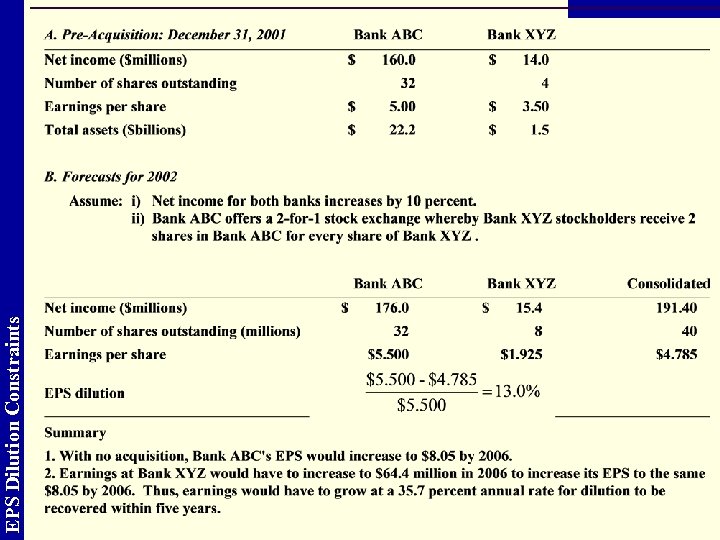

What makes a merger unattractive? n In financial terms, mergers are problematic when the buyer does not earn the expected return on investment in a reasonable period of time. n One broad standard of performance is that a merger should not produce any dilution in earnings per share (EPS) for the acquiring bank greater than 5 percent. n EPS dilution is measured as: Where; pro forma consolidated EPS is a forecast value for the upcoming period.

EPS dilution constraints n The 5% standard suggests that some dilution is acceptable because: n n most transactions are financed by an exchange of stock EPS for both the target and acquirer are not the same initially. n Most bank acquisitions do have a negative short-term effect on earnings, dilute the acquirer’s EPS, largely because the acquiring bank pays a premium for the target. n To be a successful merger, however, this decline in EPS should be of negligible size and short-lived for a merger to be attractive to the purchaser.

A second hurdle is whether the acquisition, when treated as an investment, earns the expected rate of return over time. n EPS dilution analysis focuses on short-run performance. n Many firms perform a workout time analysis that focuses on long-run results. n The analysis essentially computes the time necessary for the acquirer to earn enough to pay for the initial investment and meet the cumulative target return objective. n Obviously, the less that the acquirer pays and the greater the earnings growth, the shorter the time required to generate the target return.

Valuations procedures n Any merger or acquisition should be treated as an investment and evaluated accordingly n Thus, theoretically correct procedure for determining value is to discount expected cash flows from the new entity at the appropriate discount rate. n Because this approach involves estimating many key components of the present value model, market participants typically use a variety of less rigorous techniques to obtain a range of fair price estimates.

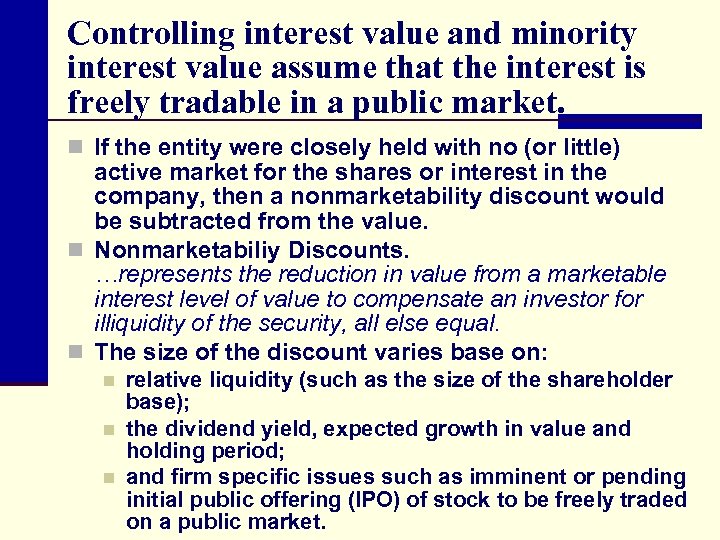

Levels or types of value …there actually several types or levels of value. n Controlling interest value …the value of the enterprise as a whole assuming that the stock is freely traded in a public market and includes a control premium. Control premium …reflects the risks and rewards of a majority or controlling interest. n A controlling interest is assumed to have control power over the minority interests. n n Minority interest value …represents the value of a minority interest “as if freely tradable” in a public market. n Minority interest discount …represents the reduction in value from an absence of control of the enterprise.

Controlling interest value and minority interest value assume that the interest is freely tradable in a public market. n If the entity were closely held with no (or little) active market for the shares or interest in the company, then a nonmarketability discount would be subtracted from the value. n Nonmarketabiliy Discounts. …represents the reduction in value from a marketable interest level of value to compensate an investor for illiquidity of the security, all else equal. n The size of the discount varies base on: n n n relative liquidity (such as the size of the shareholder base); the dividend yield, expected growth in value and holding period; and firm specific issues such as imminent or pending initial public offering (IPO) of stock to be freely traded on a public market.

Valuation methods …several methods of valuation exist but generally fall into two broad categories n Comparable analysis …often referred to as “comps” uses a direct comparison of the target bank with similar banks engaged in the same or similar lines of business. n Discounted cash flow analysis …often referred to as DCF, estimates value by summing the present value of all future economic benefits (cash earnings) that will come to the investors in the future.

Comparable analysis uses several value metrics n Price to Book Value n many bankers and market analysts discuss merger prices in terms of book values. n Price to Earnings per Share (EPS) n many analysts prefer to focus on earnings rather than balance sheet values when estimating a market price to pay n Price to Total Assets n a bank uses stockholders and depositors funds to invest in the assets of the bank, theoretically, therefore, the assets of the bank create value. n Price to Total Deposits n inexpensive core deposits are often seen as a bank’s greatest asset.

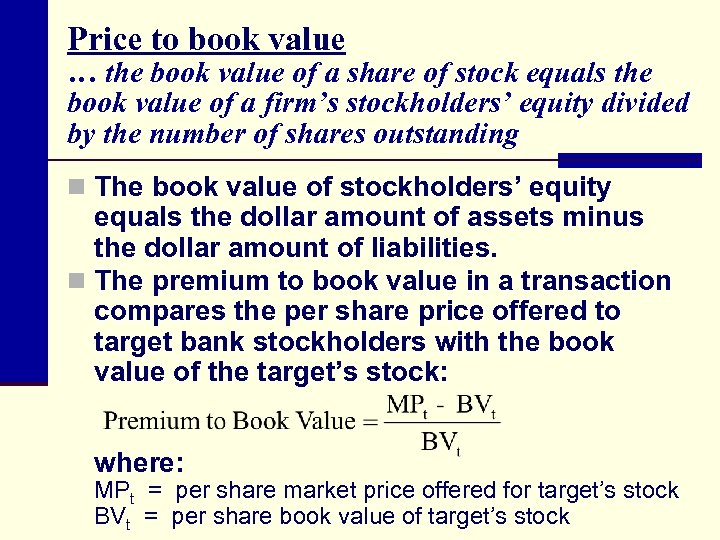

Price to book value … the book value of a share of stock equals the book value of a firm’s stockholders’ equity divided by the number of shares outstanding n The book value of stockholders’ equity equals the dollar amount of assets minus the dollar amount of liabilities. n The premium to book value in a transaction compares the per share price offered to target bank stockholders with the book value of the target’s stock: where: MPt = per share market price offered for target’s stock BVt = per share book value of target’s stock

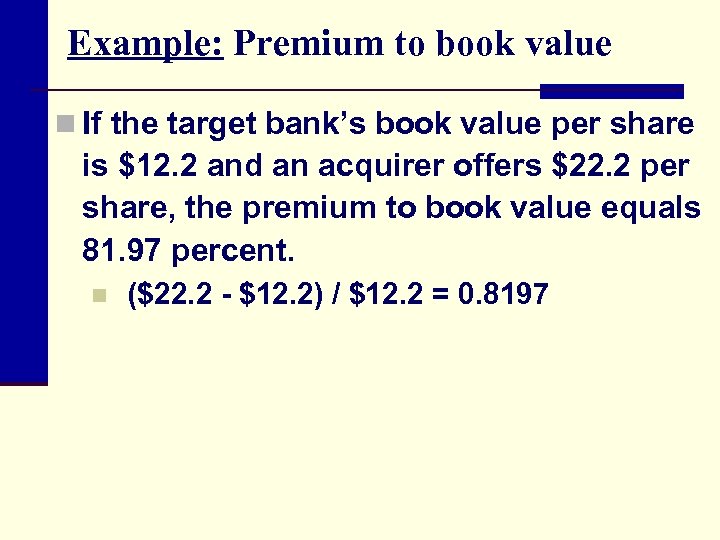

Example: Premium to book value n If the target bank’s book value per share is $12. 2 and an acquirer offers $22. 2 per share, the premium to book value equals 81. 97 percent. n ($22. 2 - $12. 2) / $12. 2 = 0. 8197

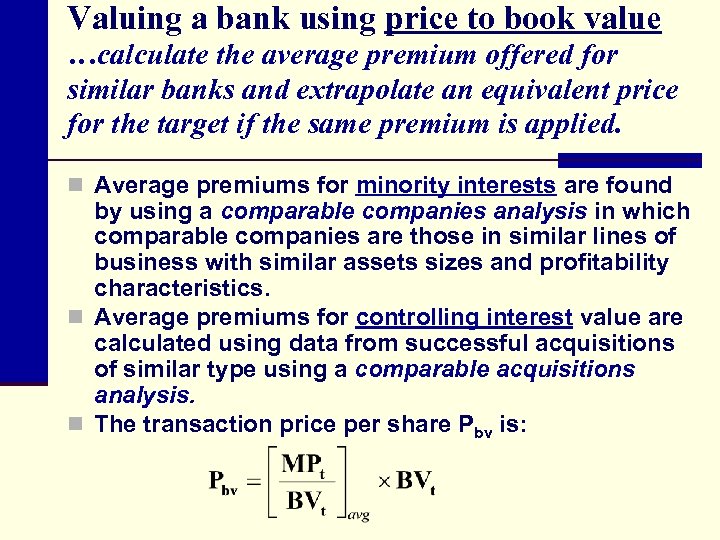

Valuing a bank using price to book value …calculate the average premium offered for similar banks and extrapolate an equivalent price for the target if the same premium is applied. n Average premiums for minority interests are found by using a comparable companies analysis in which comparable companies are those in similar lines of business with similar assets sizes and profitability characteristics. n Average premiums for controlling interest value are calculated using data from successful acquisitions of similar type using a comparable acquisitions analysis. n The transaction price per share Pbv is:

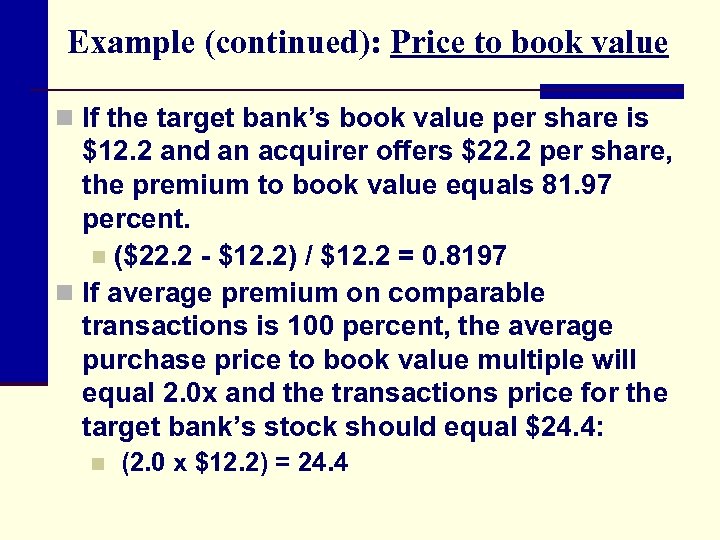

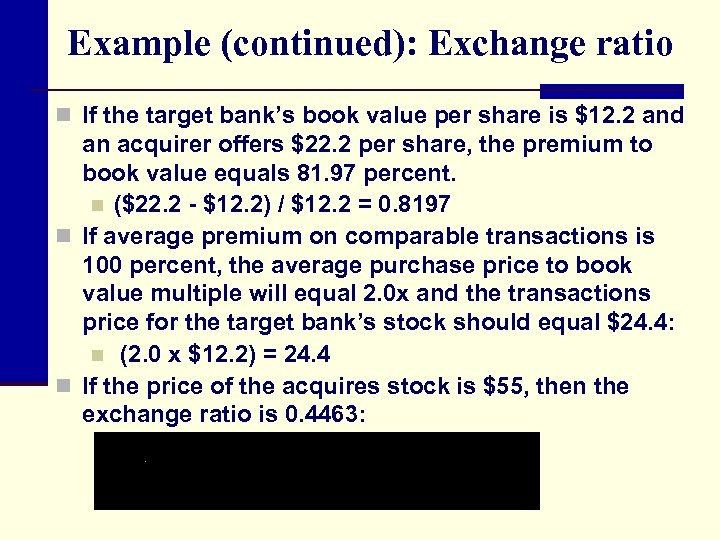

Example (continued): Price to book value n If the target bank’s book value per share is $12. 2 and an acquirer offers $22. 2 per share, the premium to book value equals 81. 97 percent. n ($22. 2 - $12. 2) / $12. 2 = 0. 8197 n If average premium on comparable transactions is 100 percent, the average purchase price to book value multiple will equal 2. 0 x and the transactions price for the target bank’s stock should equal $24. 4: n (2. 0 x $12. 2) = 24. 4

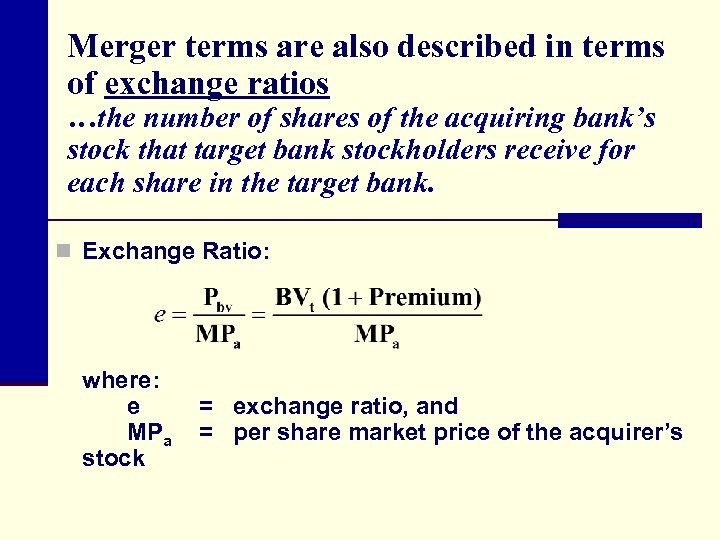

Merger terms are also described in terms of exchange ratios …the number of shares of the acquiring bank’s stock that target bank stockholders receive for each share in the target bank. n Exchange Ratio: where: e MPa stock = exchange ratio, and = per share market price of the acquirer’s

Example (continued): Exchange ratio n If the target bank’s book value per share is $12. 2 and an acquirer offers $22. 2 per share, the premium to book value equals 81. 97 percent. n ($22. 2 - $12. 2) / $12. 2 = 0. 8197 n If average premium on comparable transactions is 100 percent, the average purchase price to book value multiple will equal 2. 0 x and the transactions price for the target bank’s stock should equal $24. 4: n (2. 0 x $12. 2) = 24. 4 n If the price of the acquires stock is $55, then the exchange ratio is 0. 4463:

Normalized equity capital …capital levels at the target bank are “normalized” to a minimum level of capital and then excess capital is purchased dollar for dollar n One surprise to potential sellers of banks is the impact of “excess” capital. n The 1990’s produced record profits and many banks found their capital to asset levels at well over 10 percent. n Since capital, in excess of what is “required” to satisfy regulatory requirements and insure success of the bank, can be acquired by simply issuing stock or injecting this capital into the bank, potential acquirers will not pay more that dollar for “excess” capital.

Although what is considered normal capital varies, 8% is often considered a general guideline. n Multiplying the average price to book premium by the “normalized” equity for the target bank and then adding back “excess” capital, determines value. n The normalized book value of equity (BVnorm) and excess equity is found by: Normalized book value of equity (BVnorm) = total assets of target bank x normal equity n Excess equity = total equity – normalized equity n

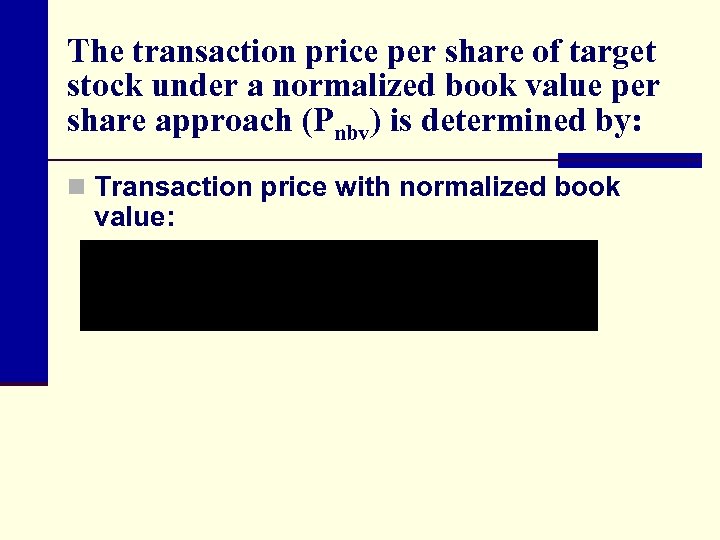

The transaction price per share of target stock under a normalized book value per share approach (Pnbv) is determined by: n Transaction price with normalized book value:

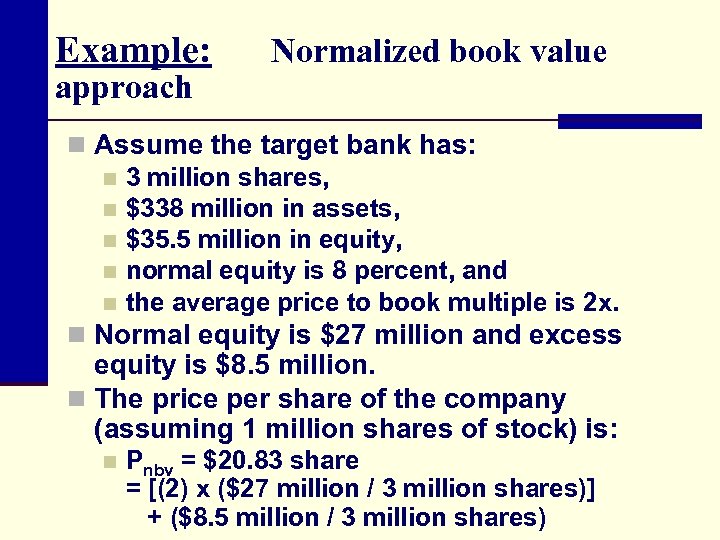

Example: approach Normalized book value n Assume the target bank has: n 3 million shares, n $338 million in assets, n $35. 5 million in equity, n normal equity is 8 percent, and n the average price to book multiple is 2 x. n Normal equity is $27 million and excess equity is $8. 5 million. n The price per share of the company (assuming 1 million shares of stock) is: n Pnbv = $20. 83 share = [(2) x ($27 million / 3 million shares)] + ($8. 5 million / 3 million shares)

Premium to book value procedure has many weakness: n The most obvious weakness is that book value may not even closely resemble a bank’s true economic value. n Premiums paid on other bank acquisitions have no relation to the rate of return that an acquirer can potentially earn on the investment, and completely ignore risk.

Premium to Adjusted Book Value n Because reported book value may differ substantially from true economic value, it is appropriate to compute an adjusted book value of equity for the target bank that recognizes the measurement error. n Adjusted book value can be obtained by adding or subtracting from the stated book value the following items: Change in loan loss reserve, n Change in market value of investments, n Change in other asset appraisals, n Value of off-balance sheet activities, n Value of core deposits. n

Price to earnings per share …many analysts prefer to focus on earnings rather than balance sheet values when estimating a market price to pay for a target bank. n Valuation involves computing the average purchase price to EPS ratio for similar banks and then multiplying this mean ratio by the target bank’s earnings per share (EPSt). Average price to EPS ratios for minority interests are found by using a comparable companies analysis. n Value for controlling interest is calculated using data from successful acquisitions of similar type using a comparable acquisitions analysis. n

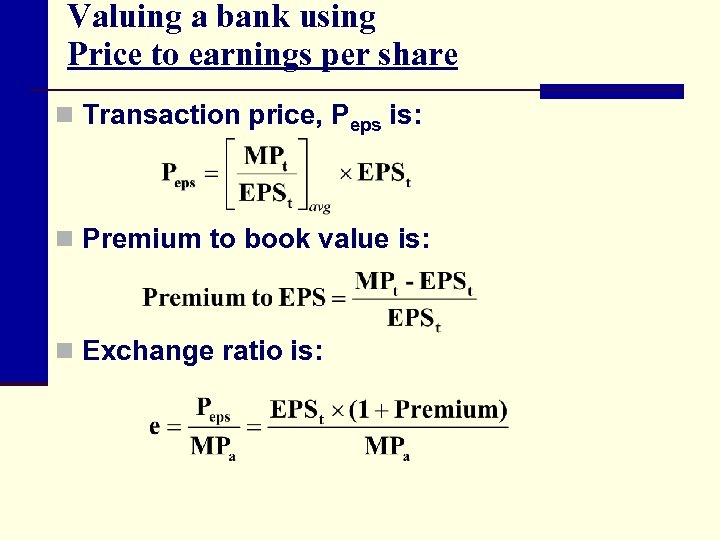

Valuing a bank using Price to earnings per share n Transaction price, Peps is: n Premium to book value is: n Exchange ratio is:

EPS Dilution Constraints

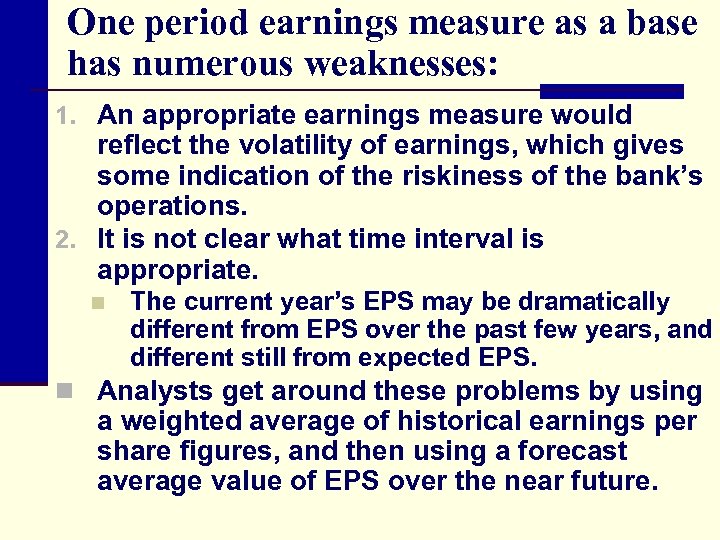

One period earnings measure as a base has numerous weaknesses: 1. An appropriate earnings measure would reflect the volatility of earnings, which gives some indication of the riskiness of the bank’s operations. 2. It is not clear what time interval is appropriate. n The current year’s EPS may be dramatically different from EPS over the past few years, and different still from expected EPS. n Analysts get around these problems by using a weighted average of historical earnings per share figures, and then using a forecast average value of EPS over the near future.

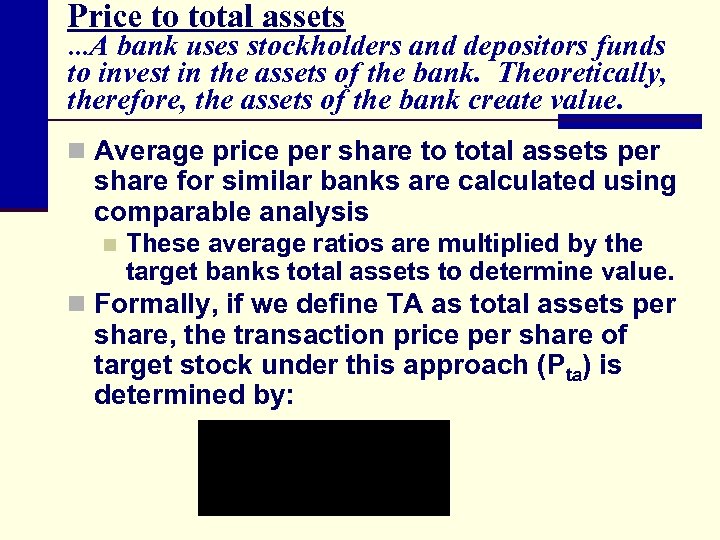

Price to total assets …A bank uses stockholders and depositors funds to invest in the assets of the bank. Theoretically, therefore, the assets of the bank create value. n Average price per share to total assets per share for similar banks are calculated using comparable analysis n These average ratios are multiplied by the target banks total assets to determine value. n Formally, if we define TA as total assets per share, the transaction price per share of target stock under this approach (Pta) is determined by:

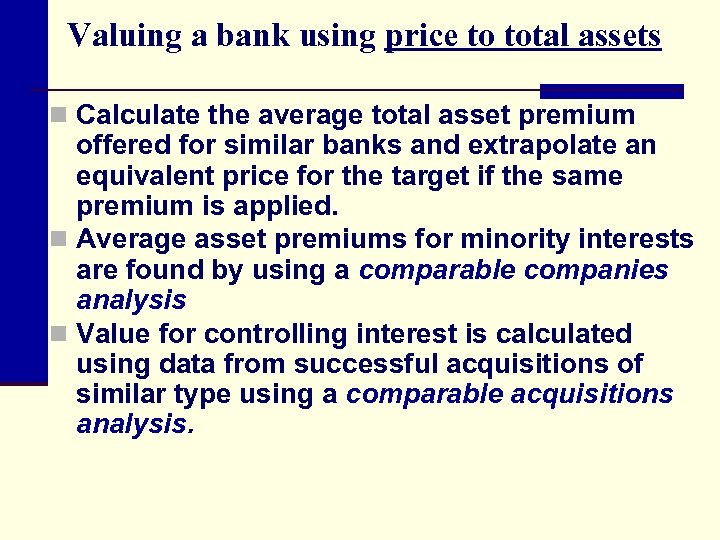

Valuing a bank using price to total assets n Calculate the average total asset premium offered for similar banks and extrapolate an equivalent price for the target if the same premium is applied. n Average asset premiums for minority interests are found by using a comparable companies analysis n Value for controlling interest is calculated using data from successful acquisitions of similar type using a comparable acquisitions analysis.

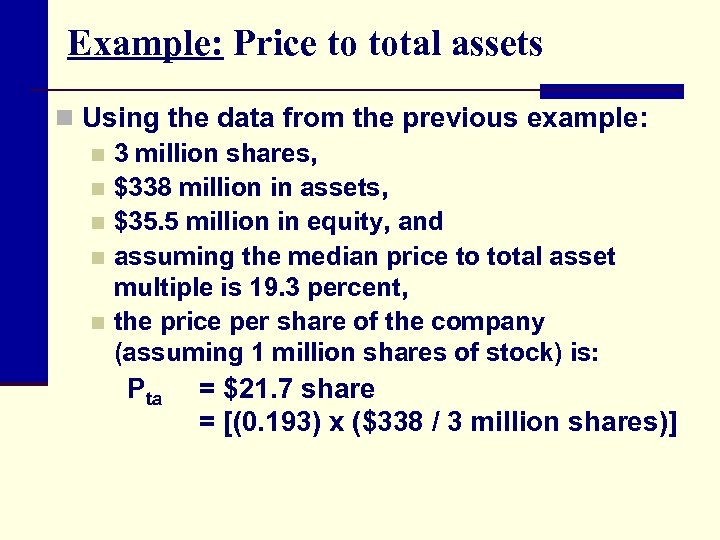

Example: Price to total assets n Using the data from the previous example: n 3 million shares, n $338 million in assets, n $35. 5 million in equity, and n assuming the median price to total asset multiple is 19. 3 percent, n the price per share of the company (assuming 1 million shares of stock) is: Pta = $21. 7 share = [(0. 193) x ($338 / 3 million shares)]

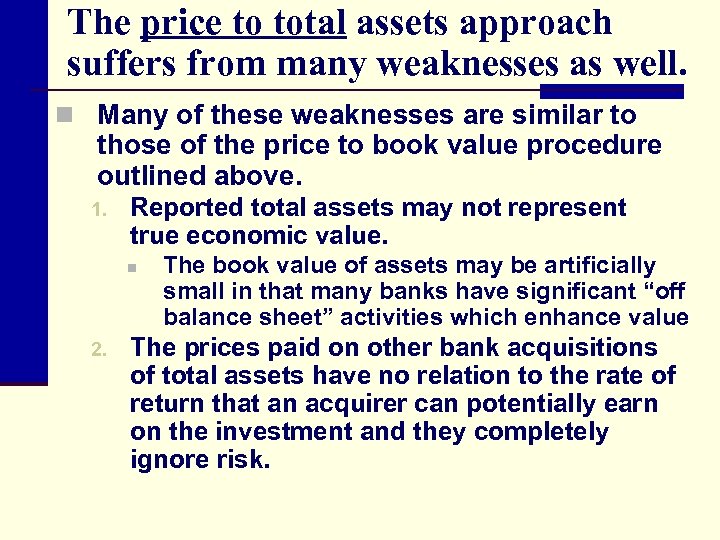

The price to total assets approach suffers from many weaknesses as well. n Many of these weaknesses are similar to those of the price to book value procedure outlined above. 1. Reported total assets may not represent true economic value. n 2. The book value of assets may be artificially small in that many banks have significant “off balance sheet” activities which enhance value The prices paid on other bank acquisitions of total assets have no relation to the rate of return that an acquirer can potentially earn on the investment and they completely ignore risk.

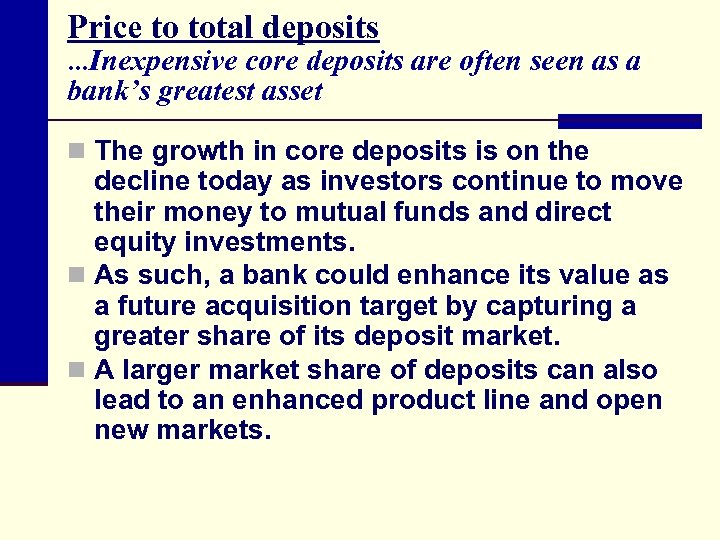

Price to total deposits …Inexpensive core deposits are often seen as a bank’s greatest asset n The growth in core deposits is on the decline today as investors continue to move their money to mutual funds and direct equity investments. n As such, a bank could enhance its value as a future acquisition target by capturing a greater share of its deposit market. n A larger market share of deposits can also lead to an enhanced product line and open new markets.

Valuing a bank using Price to total deposits n Average price per share to total deposits per share for similar banks is calculated using comparable analysis and these average ratios are multiplied by the target banks total deposits to determine value. n Formally, if we define TD as total deposits per share, the transaction price per share of target stock under this approach (Ptd) is determined by:

Example: Price to total deposits n Using the data from the previous example: n 3 million shares, n $338 million in assets, n $35. 5 million in equity, and n assuming the median price to total deposits ratio of 24. 6 percent, the price per share of the company (assuming 1 million shares of stock) is: Ptd = $22. 9 share = [(0. 246) x ($279 / 3 million shares)]

The price to total deposits approach suffers from many weaknesses as well. n Many of these weaknesses are similar to those of the price to book value procedure outlined above. 1. Reported total deposits may not represent true core deposits. n 2. The bank may have obtained their deposits as brokered deposits or by offering a premium rate over the Internet. Just because a bank acquires core deposits, these deposits will only enhance the acquiring banks profitability if they are successful in reinvesting these funds at a profitable spread and these deposits remain with the bank.

Discounted cash flow (DCF) n This approach views the purchase of a bank’s stock as an investment and compares the present value of expected cash flows discounted at some target rate of return with the current equity value. n If the discounted value exceeds the current equity value, the net present value of the stock purchase is positive and the investment meets the minimum required return. n The real value of this procedure is that it provides an estimate of economic value. n n The estimated value or premium to be paid for the target bank’s stock is often lower as compared to other approaches because only realized cash flows are incorporated in the analysis. Thus, sellers often ignore this analysis when they have any market power.

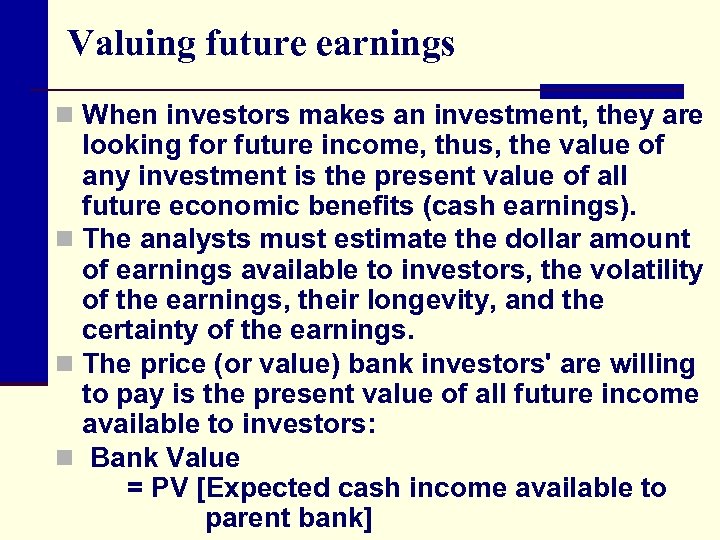

Valuing future earnings n When investors makes an investment, they are looking for future income, thus, the value of any investment is the present value of all future economic benefits (cash earnings). n The analysts must estimate the dollar amount of earnings available to investors, the volatility of the earnings, their longevity, and the certainty of the earnings. n The price (or value) bank investors' are willing to pay is the present value of all future income available to investors: n Bank Value = PV [Expected cash income available to parent bank]

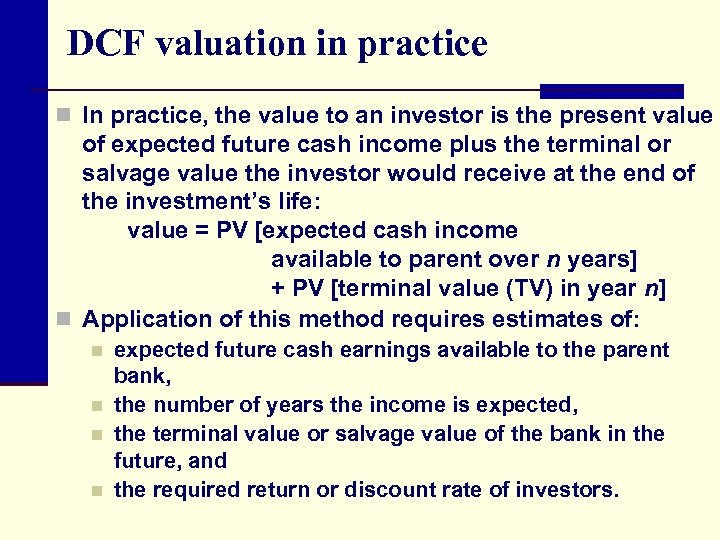

DCF valuation in practice n In practice, the value to an investor is the present value of expected future cash income plus the terminal or salvage value the investor would receive at the end of the investment’s life: value = PV [expected cash income available to parent over n years] + PV [terminal value (TV) in year n] n Application of this method requires estimates of: n n expected future cash earnings available to the parent bank, the number of years the income is expected, the terminal value or salvage value of the bank in the future, and the required return or discount rate of investors.

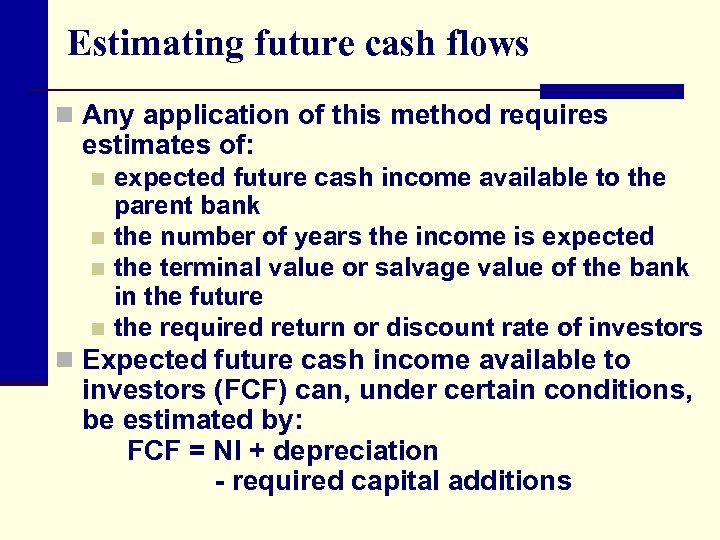

Estimating future cash flows n Any application of this method requires estimates of: expected future cash income available to the parent bank n the number of years the income is expected n the terminal value or salvage value of the bank in the future n the required return or discount rate of investors n n Expected future cash income available to investors (FCF) can, under certain conditions, be estimated by: FCF = NI + depreciation - required capital additions

Required capital additions n Once a bank is purchased, the parent will presumably try to minimize capital at the subsidiary bank such that the parent can maximize their return on investment (equity). n Hence, required capital additions are a function of existing equity (TEt-1), earnings (NI), total asset (TA) growth, and the required capital to asset ratio: n Ignoring depreciation and new equity issues, future cash income available to investors (FCF) can be approximated by:

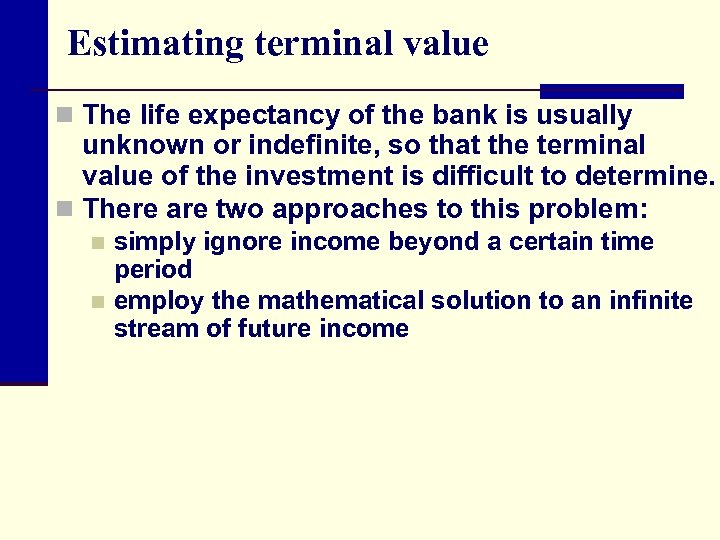

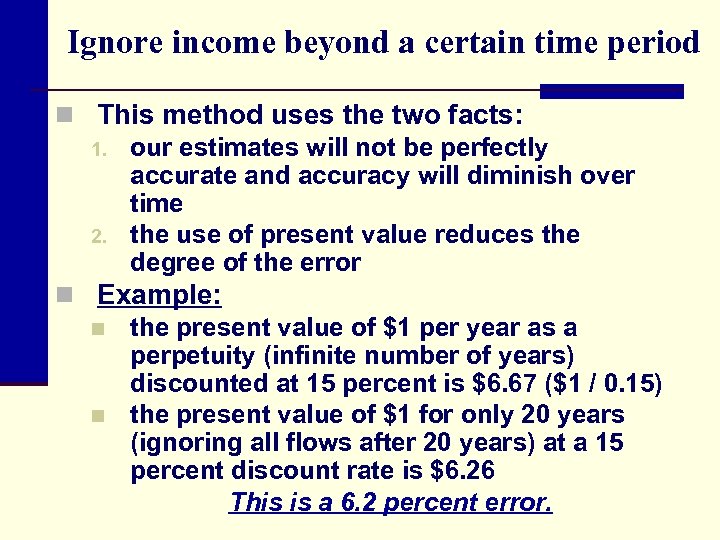

Estimating terminal value n The life expectancy of the bank is usually unknown or indefinite, so that the terminal value of the investment is difficult to determine. n There are two approaches to this problem: simply ignore income beyond a certain time period n employ the mathematical solution to an infinite stream of future income n

Ignore income beyond a certain time period n This method uses the two facts: 1. our estimates will not be perfectly accurate and accuracy will diminish over time 2. the use of present value reduces the degree of the error n Example: n the present value of $1 per year as a perpetuity (infinite number of years) discounted at 15 percent is $6. 67 ($1 / 0. 15) n the present value of $1 for only 20 years (ignoring all flows after 20 years) at a 15 percent discount rate is $6. 26 This is a 6. 2 percent error.

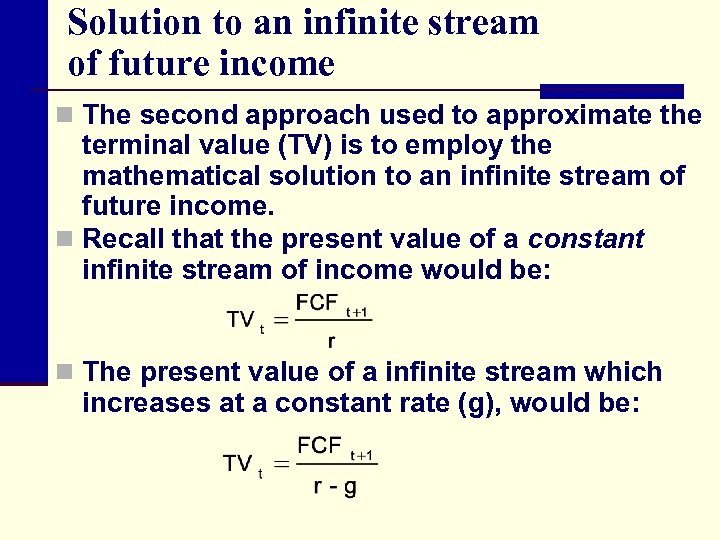

Solution to an infinite stream of future income n The second approach used to approximate the terminal value (TV) is to employ the mathematical solution to an infinite stream of future income. n Recall that the present value of a constant infinite stream of income would be: n The present value of a infinite stream which increases at a constant rate (g), would be:

Break the problem into two parts: 1. The first in which explicit FCF estimates are made, 2. The second in which a stabilized income is projected to grow at a constant rate into the indefinite future: n If we assume the target bank’s stabilized income will grow at a constant rate, g, then :

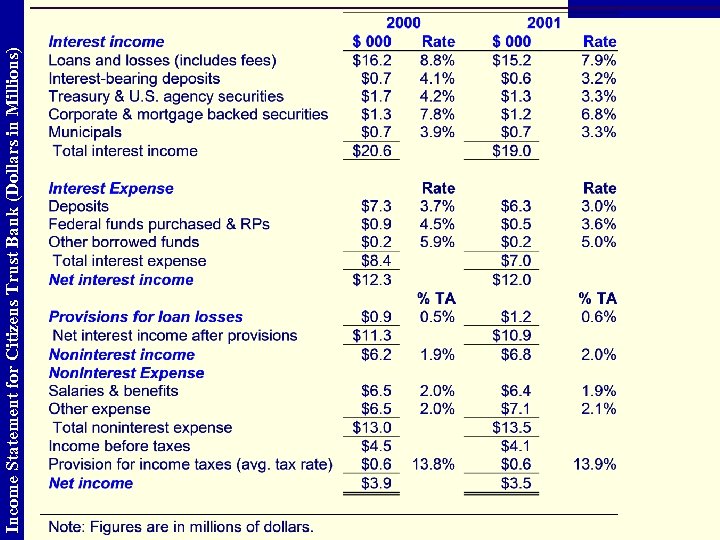

Bank valuation: an application n Western Plains National Bank (WPNB) is considering buying 100 percent of Citizens Trust Bank's stock. n WPNB's stock price is currently $60 and Citizens Trust Bank's stock price is $15. n WPNB’s management is also unwilling to accept EPS dilution beyond 5 percent. n Net income for WPNB is forecast to be $22. 6 million in 2002, while net income for CTB is forecast at $5. 2 million.

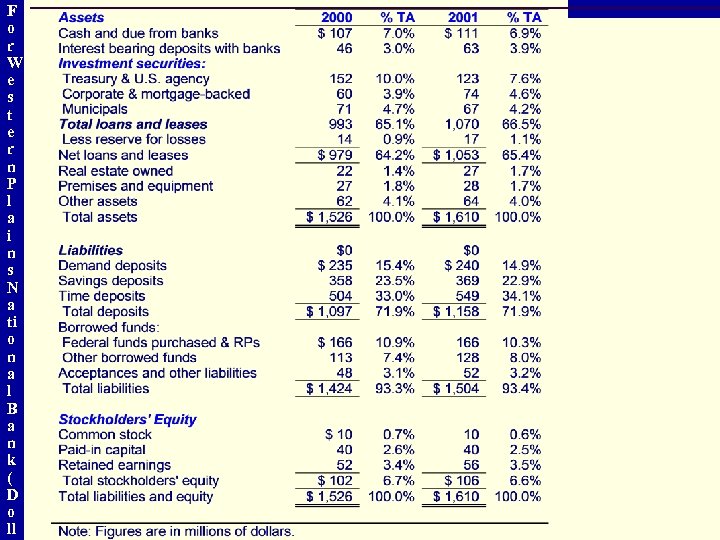

F o r W e s t e r n P l a i n s N a ti o n a l B a n k ( D o ll

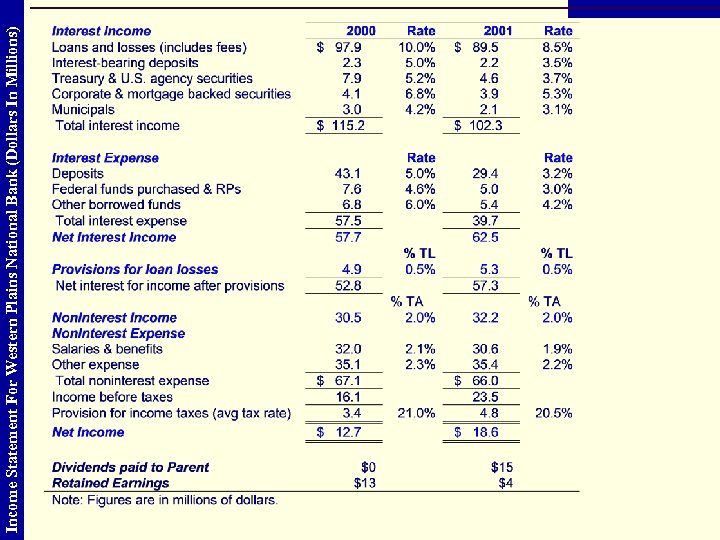

Income Statement For Western Plains National Bank (Dollars In Millions)

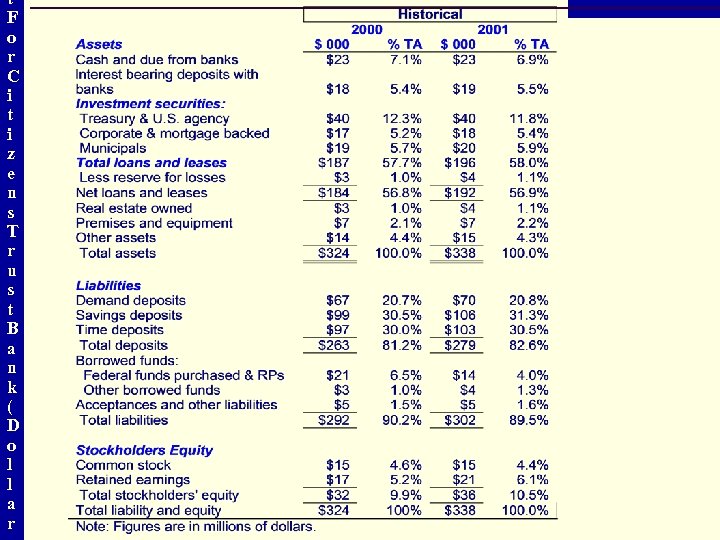

t F o r C i t i z e n s T r u s t B a n k ( D o l l a r

Income Statement for Citizens Trust Bank (Dollars in Millions)

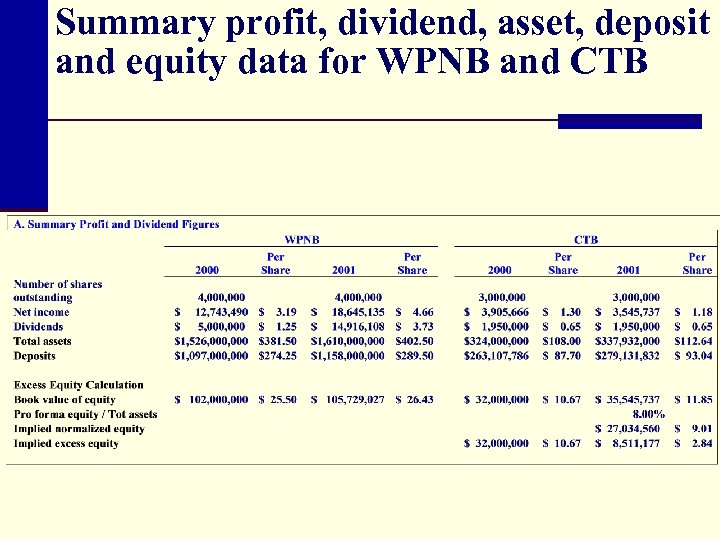

Summary profit, dividend, asset, deposit and equity data for WPNB and CTB

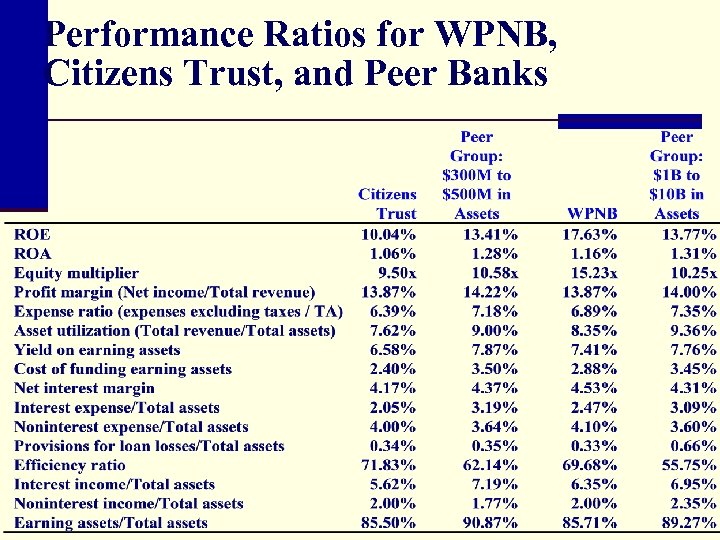

Performance Ratios for WPNB, Citizens Trust, and Peer Banks

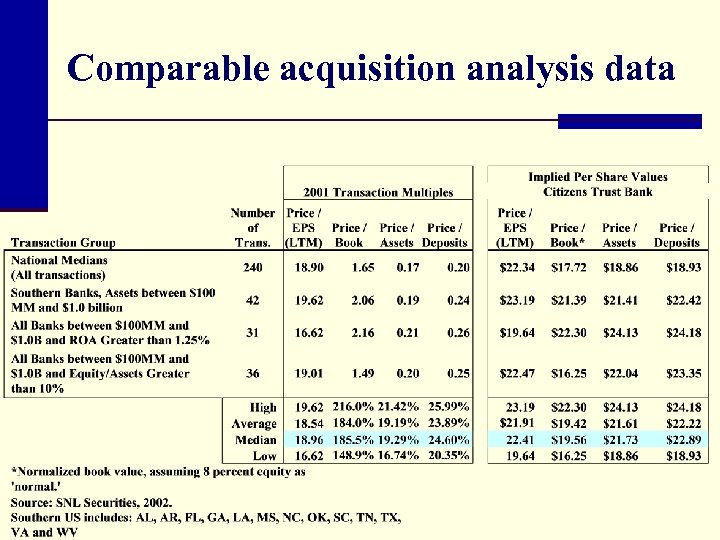

Comparable acquisition analysis data

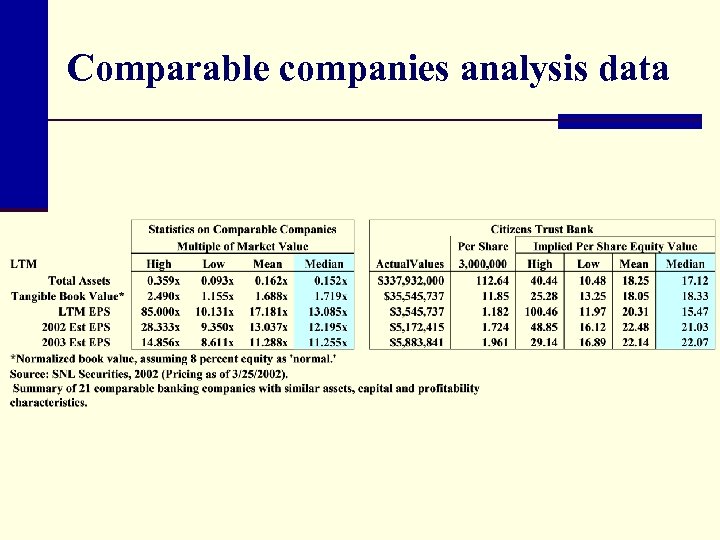

Comparable companies analysis data

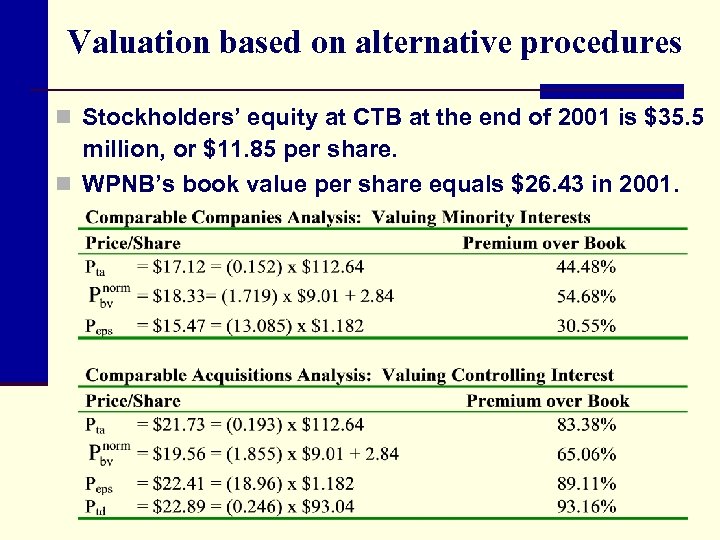

Valuation based on alternative procedures n Stockholders’ equity at CTB at the end of 2001 is $35. 5 million, or $11. 85 per share. n WPNB’s book value per share equals $26. 43 in 2001.

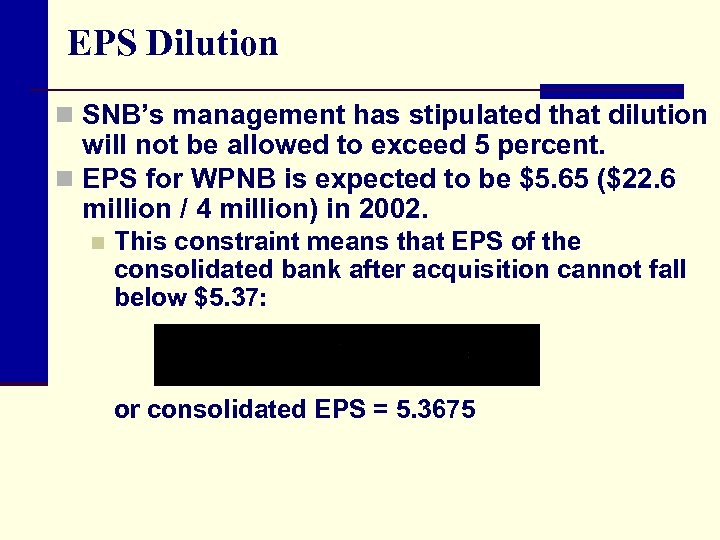

EPS Dilution n SNB’s management has stipulated that dilution will not be allowed to exceed 5 percent. n EPS for WPNB is expected to be $5. 65 ($22. 6 million / 4 million) in 2002. n This constraint means that EPS of the consolidated bank after acquisition cannot fall below $5. 37: or consolidated EPS = 5. 3675

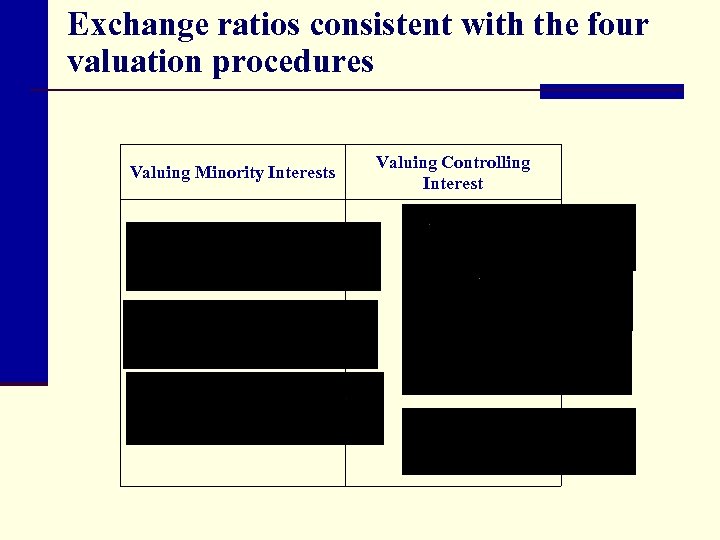

Exchange ratios consistent with the four valuation procedures Valuing Minority Interests Valuing Controlling Interest

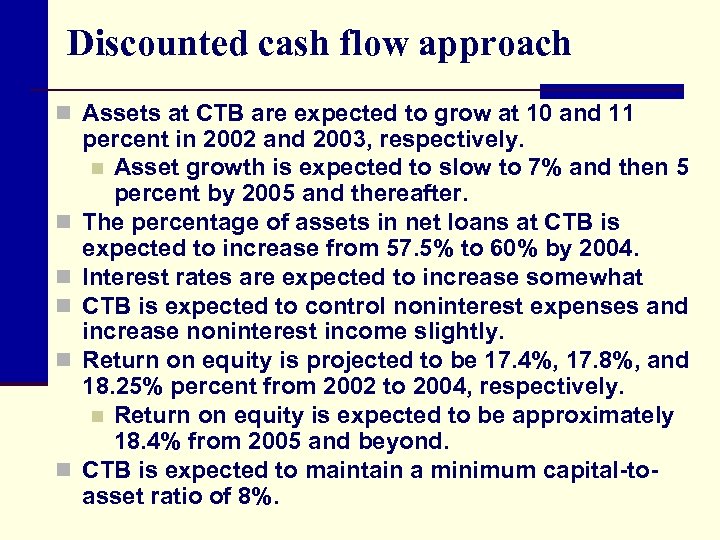

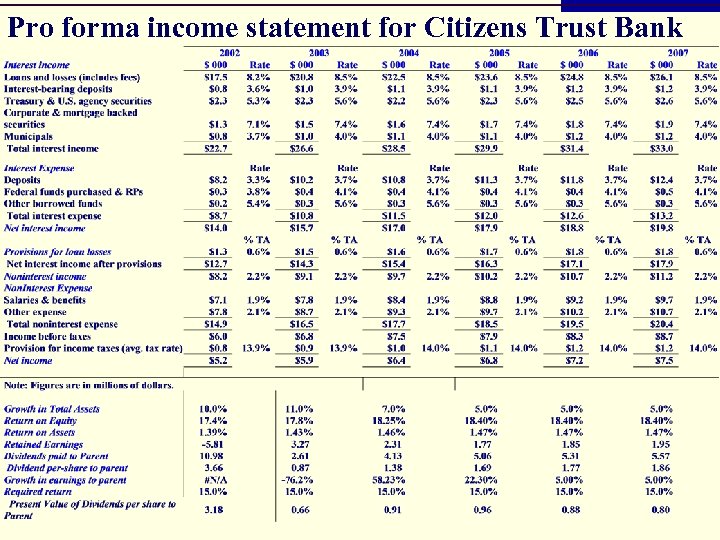

Discounted cash flow approach n Assets at CTB are expected to grow at 10 and 11 n n n percent in 2002 and 2003, respectively. n Asset growth is expected to slow to 7% and then 5 percent by 2005 and thereafter. The percentage of assets in net loans at CTB is expected to increase from 57. 5% to 60% by 2004. Interest rates are expected to increase somewhat CTB is expected to control noninterest expenses and increase noninterest income slightly. Return on equity is projected to be 17. 4%, 17. 8%, and 18. 25% percent from 2002 to 2004, respectively. n Return on equity is expected to be approximately 18. 4% from 2005 and beyond. CTB is expected to maintain a minimum capital-toasset ratio of 8%.

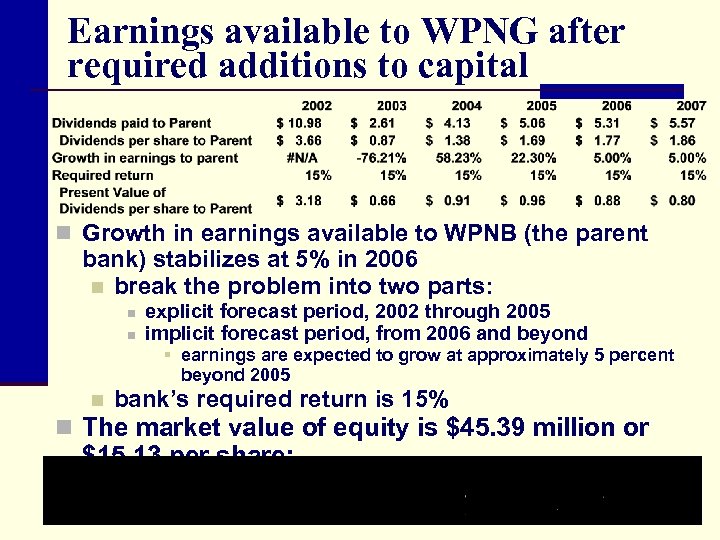

Earnings available to WPNG after required additions to capital n Growth in earnings available to WPNB (the parent bank) stabilizes at 5% in 2006 n break the problem into two parts: n n explicit forecast period, 2002 through 2005 implicit forecast period, from 2006 and beyond § earnings are expected to grow at approximately 5 percent beyond 2005 n bank’s required return is 15% n The market value of equity is $45. 39 million or $15. 13 per share:

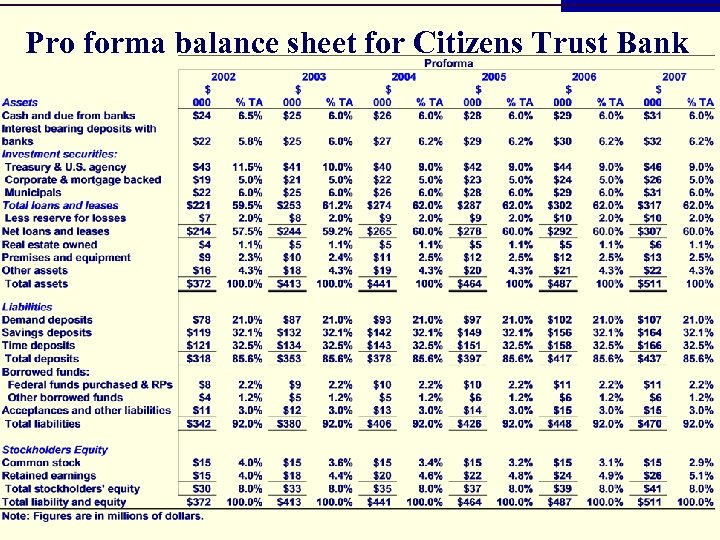

Pro forma balance sheet for Citizens Trust Bank

Pro forma income statement for Citizens Trust Bank

Merger pricing implications n The previous analysis suggests a range of potential prices for CTB stock. n The final resolution will depend on the negotiating strength of each party as well as nonfinancial considerations that have not been addressed. n The relationships observed among the various procedures are representative of results in many applications. n n n From an economic perspective, the present value approach often produces the lowest price estimate. If a transaction can be negotiated close to this price, the acquirer will experience the smallest EPS dilution and will be able to reach its earnings objectives soonest. Not surprisingly, sellers prefer to focus on historical premium-to-book value and premium-to-earnings valuation approaches.

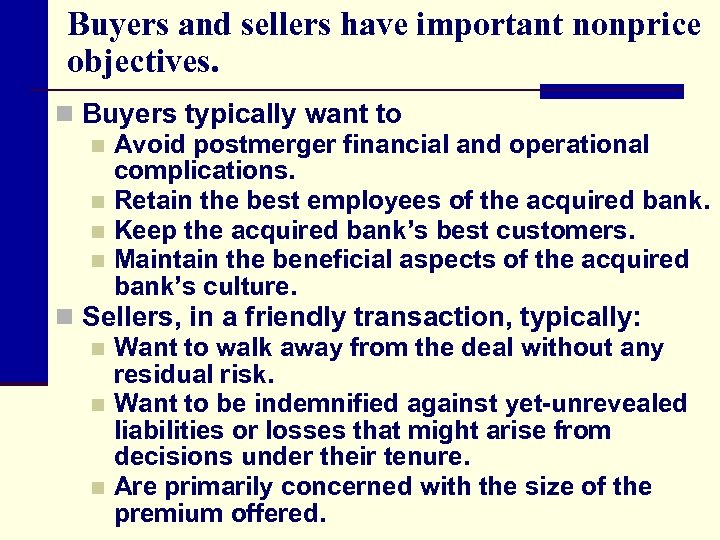

Buyers and sellers have important nonprice objectives. n Buyers typically want to n Avoid postmerger financial and operational complications. n Retain the best employees of the acquired bank. n Keep the acquired bank’s best customers. n Maintain the beneficial aspects of the acquired bank’s culture. n Sellers, in a friendly transaction, typically: n Want to walk away from the deal without any residual risk. n Want to be indemnified against yet-unrevealed liabilities or losses that might arise from decisions under their tenure. n Are primarily concerned with the size of the premium offered.

Bank Management, 5 th edition. Management Timothy W. Koch and S. Scott Mac. Donald Copyright © 2003 by South-Western, a division of Thomson Learning BANK MERGERS AND ACQUISITIONS Chapter 22

bfe161a29bc3be39859959819b334074.ppt