7c55fd24cfdcd04146330dd170f1c1fc.ppt

- Количество слайдов: 37

Bank ACATS BDUG Annual Meeting October 24, 2005 Scottsdale, AR

Bank ACATS Program • Topics: • History of Program • Primary Differences • Benefits of Participation • Current Bank/Stats • Current Initiatives 3 • Questions

History of Program • Pilot for Banks 1999 • Originally 7 Banks Participating • Good Faith Effort – Participation Not Mandated • Most Brokerage Firms Participated in Pilot 4 • DTCC Opened Program to all Banks June 1999

Primary Differences • Good Faith Effort – Not Mandated • Paperwork Required • Assets Move Free of Payment 5 • No Valued Fails

Benefits • Customer Satisfaction Reduced Timeframe to Transfer Account Initial Experience a Positive One • Competitive Advantage • Cost Reduction Follow up Process Pending & Reversal of Transactions 6 • Ability to Trade and Collect Fees Sooner

Benefits • Electronic Notification of Assets and Cash • Standardization/Automation • Ability to Accelerate Process • Residual Balances Processing 7 • Contacts within Financial Community

Current Users • Bank of America • Huntington Nat’l • Bank One Trust Co. • IBT • Bank of NY • Citigroup PVT Bank • City Nat’l Bank • Comerica • Country Trust Bank • Key Bank • Mellon Bank • Nat’l City Bank • Reliance Trust • SEI Trust Co. • State Street Bank • Sun. Trust Bank • Fleet Bank • UMB • FNB Omaha 8 • First American Trust • Union Bank of Cal • Glenmede Trust Co. • Wachovia

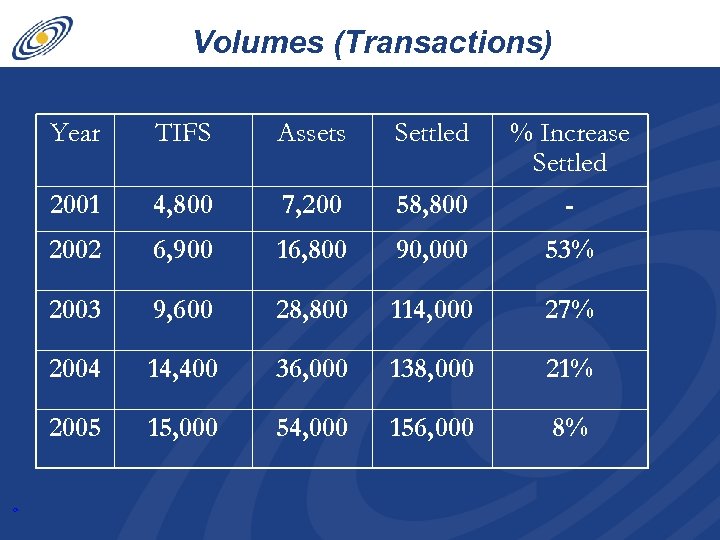

Volumes (Transactions) TIFS Assets Settled 2001 4, 800 7, 200 58, 800 % Increase Settled - 2002 6, 900 16, 800 90, 000 53% 2003 9, 600 28, 800 114, 000 27% 2004 14, 400 36, 000 138, 000 21% 2005 9 Year 15, 000 54, 000 156, 000 8%

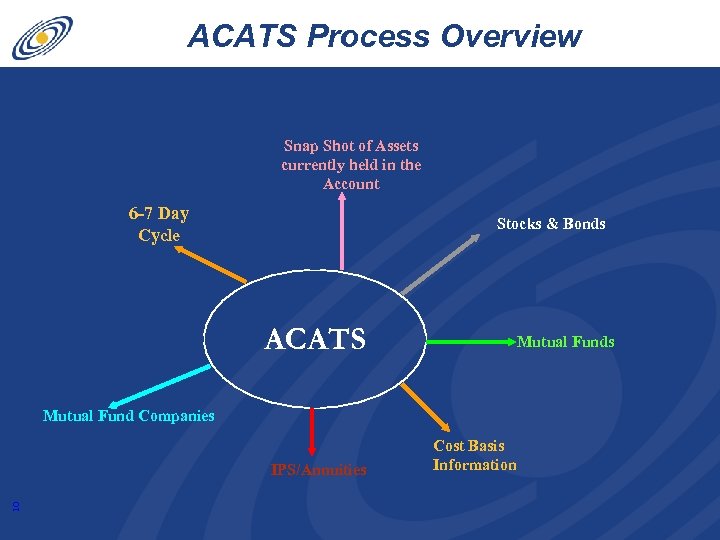

ACATS Process Overview Snap Shot of Assets currently held in the Account 6 -7 Day Cycle Stocks & Bonds ACATS Mutual Funds Mutual Fund Companies 10 IPS/Annuities Cost Basis Information

Current Initiatives • Trust System Automation • Discussions with Regulatory Agencies • Cost Basis / IPS 11 • Mutual Funds as Participants

Cost Basis Reporting Service

Cost Basis Reporting Service • Topics: • General Description of CBRS - What is it? • Benefits of CBRS • Current CBRS Users / Volume 13 • CBRS Fees

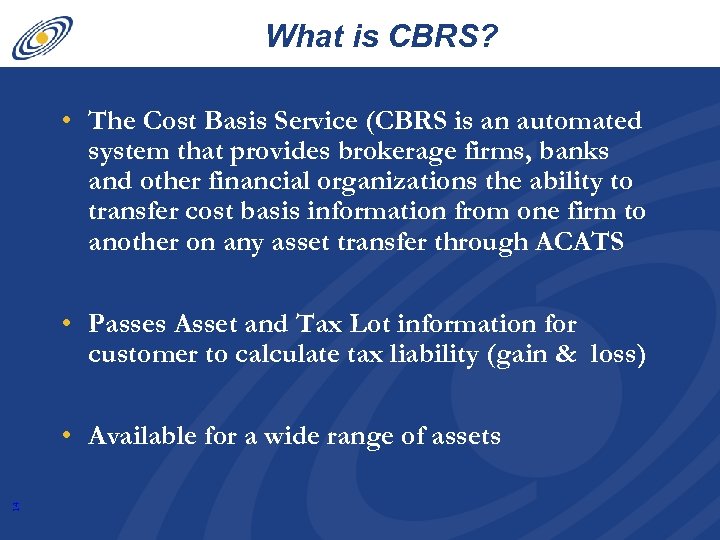

What is CBRS? • The Cost Basis Service (CBRS is an automated system that provides brokerage firms, banks and other financial organizations the ability to transfer cost basis information from one firm to another on any asset transfer through ACATS • Passes Asset and Tax Lot information for customer to calculate tax liability (gain & loss) 14 • Available for a wide range of assets

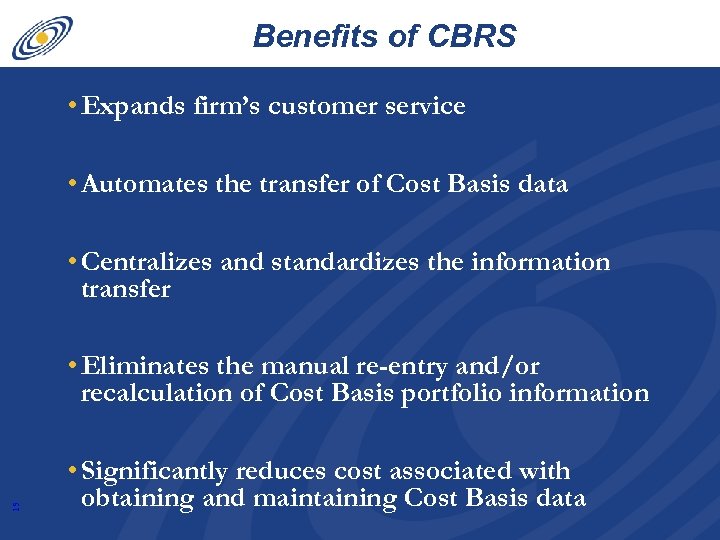

Benefits of CBRS • Expands firm’s customer service • Automates the transfer of Cost Basis data • Centralizes and standardizes the information transfer 15 • Eliminates the manual re-entry and/or recalculation of Cost Basis portfolio information • Significantly reduces cost associated with obtaining and maintaining Cost Basis data

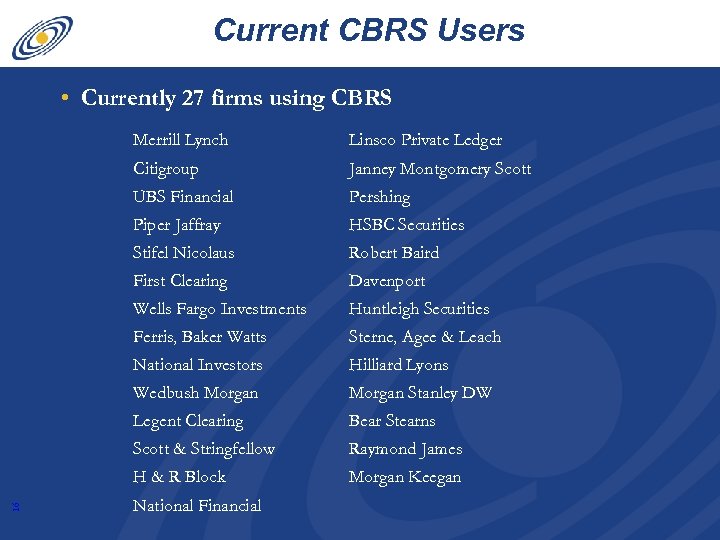

Current CBRS Users • Currently 27 firms using CBRS Linsco Private Ledger Citigroup Janney Montgomery Scott UBS Financial Pershing Piper Jaffray HSBC Securities Stifel Nicolaus Robert Baird First Clearing Davenport Wells Fargo Investments Huntleigh Securities Ferris, Baker Watts Sterne, Agee & Leach National Investors Hilliard Lyons Wedbush Morgan Stanley DW Legent Clearing Bear Stearns Scott & Stringfellow Raymond James H & R Block 16 Merrill Lynch Morgan Keegan National Financial

Current CBRS Volume • Approximately 175, 000 CBRS records processed on a daily basis • Approximately 35, 000 assets and 140, 000 tax lot records 17 • Average 4. 0 tax lots per asset

CBRS FEES • 9 cents per asset record received (Receiver firm only) 18 • Can have unlimited amount of associated Tax Lots per asset

CBRS Via PC Web • Screen Input capability available • Expanded file upload capability for CBRS 19 • Important Notice A#5999 dated March 14, 2005

ACATS/IPS Overview

What is ACATS/IPS? • A link between the ACATS system and the IPS system to allow insurance assets to be included in a ACATS transaction. • IPS will be the link to the Insurance Carriers, as Fund. Serv acts as the link for mutual fund assets in ACATS/Fund. Serv. 21 • ACATS/IPS automates broker/dealer change process between Broker/Dealers and Insurance Carriers.

ACATS/IPS - Goal 22 “To automate the Broker/Dealer change process for Annuity contracts between Broker/Dealers, Banks and Insurance Carriers” by leveraging the ACATS and IPS processing systems”

ACATS/IPS - Benefits • Elevate level of Customer Service • Eliminate “Lost” Annuity Contracts & Revenue • Automate Transaction Processing • Automate Notification of Transfer 23 • True “Paperless” Process

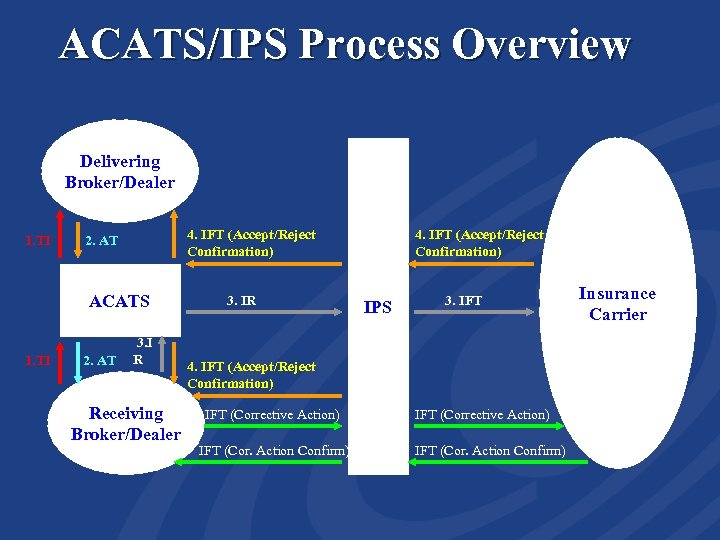

ACATS/IPS Process Overview Delivering Broker/Dealer 1. TI 4. IFT (Accept/Reject Confirmation) 2. AT ACATS 1. TI 2. AT 3. I R Receiving Broker/Dealer 3. IR 4. IFT (Accept/Reject Confirmation) IPS 3. IFT 4. IFT (Accept/Reject Confirmation) IFT (Corrective Action) IFT (Cor. Action Confirm) Insurance Carrier

ACATS/IPS – Production • Insurance Carriers: • Allstate • The Hartford • Pacific Life Insurance • Broker/Dealers: • Merrill Lynch • Piper Jaffray (Beta) • Robert W. Baird (Beta) • Stifel Nicolaus (Beta) • Wachovia Securities (Beta) 25 • Wells Fargo Investments (Beta)

ACATS/IPS – Website Info • insurance. dtcc. com • IFT Record Layouts • Standard Usage ? ? • ACATS/IPS User Guide • Selling Agreement Samples • Fact Sheets • acats. nscc. com • ACATS Record Layouts 26 • ACATS/IPS User Guide ? ? ?

Strategic Initiatives of SIA CAT Division • Increasing financial institutions participation in ACATS • Banks – Sub-committee meeting every 3 weeks • Coordinated by Bill Kapogiannis • Insurance Companies – Continue to grow ACATS/IPS interface • Mutual Funds • Liquidations 27 • Potentially shortening the ACATS cycle – 7 to 4 days

Proposed Process Change • The ACATS process for full account transfers facilitates fast and efficient transfer of client assets. Both the investor and the member firms benefit from speed and efficiency with which client transfer request can be communicated, validated and settled through ACATS. • The industry as a whole would realize significant processing efficiencies and standardization provided non-ACAT firms fully participated in the ACATS process 28 • Specifically, Mutual Fund Companies and current ACATS participants would greatly increase processing efficiencies and standardize the transfer process by leveraging the ACATS functionality currently available to Banks (and other nonbroker/dealer firms) for non-valued transfers.

Benefits • Mutual Fund Companies would be able to utilize the Partial Transfer Receive and Partial Transfer Deliver functions to move client assets. • Mutual fund companies would no longer be dependent upon instructions from the broker/dealer. 29 • Increase the level of client satisfaction through greater reliability and speed

Benefits con’t… • There would be a diminished risk of re-registered shares left unaccounted for at the fund companies; these positions become seemingly lost to the client • Retirement transfers between funds and broker/dealers would no longer require the creation of intermediary accounts 30 • Participant firms and Mutual Fund Companies would have a standardized, automated process for handling non-ACATS transfers by introducing them into existing ACAT functionality.

Next Steps Create industry committee. The following fund companies are participating: • Putnam • Fidelity • Janus 31 • Develop detailed process flow and requirements

LIQUIDATION OF MUTUAL FUNDS VIA THE ACAT SERVICE • IN TODAY’S ENVIRONMENT • SPEED AND ACCURACY IS THE KEY

ISSUES • RECEIVING AND DELIVERING FIRMS DO NOT HAVE A STANDARD OR UNIFORM PRACTICE FOR LIQUIDATING RECEIVER ADJUSTED MUTUAL FUNDS; 33 • INVESTORS HAVE LIMITED UNDERSTANDING OF WHY CERTAIN HOLDINGS CANNOT BE TRANSFERRED OR HELD AT NEW BROKER DEALER.

Branch Offices MUTUAL FUNDS Operations Depts. Processes LIQUIDATIONS

WHAT WE THINK WE NEED • Develop new mechanism/transaction type; • Only Full ACATS will be eligible; • Firms need to establish consistency; 35 • Firms will need internal control to prevent selling asset types not eligible

Next steps • WHITE PAPER NEXT MONTH 36 • Comments welcomed and encouraged

37 QUESTIONS ?

7c55fd24cfdcd04146330dd170f1c1fc.ppt