d5c9d7a31813ff74aa1aa7c40cf330c2.ppt

- Количество слайдов: 24

Bangladesh Bank Role and Responsibilities

Contents Role and Responsibilities of Bangladesh Bank - Formulation and Implementation of Monetary Policy – Management of Foreign Exchange – Clearing Arrangement of Checks/Bills – Supervision of Financial Sector – Advising Government on various macro policy issues/measures. 2

Functions of Bangladesh Bank: Bangladesh Bank Order 1972 l l l 3 To formulate and implement monetary policy; To formulate and implement intervention policies in the foreign exchange market; To manage the official foreign exchange reserves; To promote, regulate and ensure a secure and efficient payment system, including the issue of bank notes; To regulate and supervise banking companies and financial institutions; To play the role of advisor to the government on the impact of various policy measures on the economy.

Two Other Responsibilities Entrusted with Bangladesh Bank l l 4 Applies Exchange Regulation Act, 1947 on behalf of the government; Exercises the authority given on BB by the Money Laundering Prevention Act 2003.

Targets and Formulation of Monetary Policy 1. Targets of Monetary Policy -Growth of money supply has to be consistent with GDP growth rate to ensure a stable inflation rate; - Credit flow has to be channeled to productive activities to ensure faster economic growth. 2. Formulation of Monetary Policy l l 5 Growth rate of broad money (total of currency, demand time deposits) is programmed considering projected GDP growth, inflation and income velocity of money [GDP to broad money supply (M 2) ratio]; In line with this, annual levels of foreign assets and domestic credit to public and private sector are also programmed.

Implementation of Monetary Policy To keep broad money supply on desired growth path, Money and Credit Program is implemented by different ways: - Changes in the broad money supply is effected by increasing/decreasing reserve money (total of currency issued both by government and the BB, and balances of banks with the BB); - Auctions of government treasury bills and bonds and auction of repo and reverse repo are used; - Supply of broad money can be influenced through changing cash reserve ratio (CRR) and effecting market interest rates by varying discount rate of central bank. 6

Deepening of Money Market – Recent Measures l l l l Introduction of Repo (July 2002) and Reverse Repo (April 03); Secondary market activities of government securities in the inter-bank repo market; Electronic registry of treasury bills and bonds; Introduction of bonds with 5 -year and 10 -year tenure (28 Dec 2003); it will facilitate introduction of private sector bonds; Primary dealership system of government securities has started working (11 Dec 2003); Private commercial papers are now allowed in the markets; SLR reduced to 16 percent from 20 percent ( 8 Nov. , 2003); As a result: Interest rates are coming down/ 7

Exchange Rate, Intervention in the Foreign Exchange Market 1. Successful and stable introduction of market based floating exchange rate of Bangladesh Taka from 31 May 2003; This system has enabled the economy to face shocks without seriously hampering productive activities; 2. Exchange rate of Taka is indirectly influenced by changing liquidity supply in the call money market through repo and reverse repo. Bangladesh Bank, from time to time, buys US dollar at prevailing rate from local market in the interest of keeping exchange rate competitive for exports and raising level of foreign exchange reserves. 8

Foreign Exchange Reserve Management 9 1. Rising trend in reserve position achieved (reserves rose from low level of $ 1305 million in Dec. 2001, to $ 2727 million on 8 April 2004); 2. In the interest of investment liquidity and security, Bangladesh Bank, like other central banks, carefully invests it reserves only in major convertible currencies with important central banks and some international commercial banks with high credit ratings; 3. Like other central banks, Bangladesh Bank avoids earning profit through risky currency trading arising from exchange fluctuations of different currencies.

Supply of Notes/Currencies - 1 Bangladesh Bank and chest branches of Sonali Bank supply Notes/currencies as per demand of the public; l Withdrawal of soiled and torn notes from circulation has been made easier and quicker; - Acceptance of torn and soiled notes from the public is now mandatory for the banks; - Banks are instructed to bring reissuable and non-reissuable notes sorted separately while depositing them in BB; - Printing of new notes and their supply increased along with quicker withdrawal of torn and soiled notes. l 10

Supply of Notes/Currencies - 2 l To reduce the risk of being cheated by counterfeit notes - Several security features have been introduced including watermark in notes, security thread, intaglio print, values printed in Optically Variable Ink etc. ; - Public awareness about security features of genuine notes are created through press releases, colorful posters and television video clips. 11

Management of Clearing System of Check/Bill etc. l l l 12 Bangladesh Bank manages daily clearing of checks/bill/drafts etc. In cities/towns where BB has no Offices, Sonali Bank performs the function on behalf of BB. Clearing functions in Dhaka and Chittagong are partly computerized. Similar system is being introduced in Rajshahi by the first half of 2004. Bogra, Sylhet and Khulna will follow shortly; ‘Same day Clearing’ services for checks valued Tk. 5 lakhs or more is available in Dhaka since 4 Oct. 2003; Mechanism for clearing of checks/bills drawn on a bank of a different town within shortest possible time is being processed; Introduction of credit card/debit card by banks are being encouraged; Automated check clearing system using machine readable check would be introduced soon, as a part of the new IT platform of BB.

Financial and Banking Sectors of Bangladesh 13

Main Problems of the Banking Sector l l l 14 Low quality of assets: 22% of total credit is classified. The ratio of classified loans of NCBs is 29%, Private Commercial Banks 12%, Foreign Commercial Banks 3% and Specialized Banks 47%; Lack of good governance, accountability and transparency: Illegal credit facilities taken by directors in false names; interference of directors in routine matters of the bank; Inadequacy of effective risk management system: Increased credit risk, inappropriate management of assets and liabilities, weaknesses in exchange transactions, absence of effective internal control and compliance culture have caused weak accountability.

Financial Sector Reform l l l 15 Reform program was initiated in early 1990 s with World Bank assistance; The pace of reform has accelerated during the past two years; On-going reforms are home-grown, introduced after discussions with banks and financial institutions and with local experts.

Reduction of Non Performing Loans: Regulatory and Legal Reforms - 1 l l 16 Enactment of Financial Loan Court Act 2003: Setting up of special courts dealing exclusively with default loans; prescribing time limits for courts to give judgment on original and appeal suits; mandating banks to sell collaterized security before filing cases; provision for alternative dispute resolution mechanism; Loan rescheduling criteria spelled out and rationalized by making successive rescheduling more costly; Guidelines for loan write-off issued; The single borrower/single group-borrowers credit limit fixed; large loan limit tagged to bank’s NPL ratio.

Reduction of Non Performing Loans: Regulatory and Legal Reforms - 2 l l l 17 Encouraging syndication of several banks for large loans and issuance of guidelines for restructuring such loans; Announcing incentives for loan recovery to encourage bank employees to put extra effects for recovery. Signing of MOUs with the nationalized commercial banks; limiting annual credit growth rate, fixation of single borrower limit, restriction on capital expenditure;

Good Governance, Accountability and Transparency l l l l 18 Redefining and clarifying the roles and functions of the Board and management; Limiting number of Directors to 13; Debarring a person to be a director for a bank for more than six years at a stretch; Restriction on near relations to be directors for a bank; Appointment of two directors to protect depositors’ interest; Meeting ‘fit and proper test’ for Bank Directors and the Managing Directors; Preparation and disclosure of financial information in accordance with International Audit Standard; Stricter enforcement of banking laws/ regulations by the Bangladesh Bank. (so far 3 MDs and 1 Chairman have been removed and 26 bank officials fined).

Better Risk management Practices 19 Quality of assets have been poor and classification rate was high because of absence of good risk management policies, practice, processes and structure in the banks. In this backdrop – l BB took initiative to take a set of recommendations on best practice for five core-risk areas, e. g. , credit risk management, asset-liability management, exchange risk management, internal control and compliance and anti-money laundering; l Banks given directives to introduce with implementation deadline the processes, policies and structures based on the recommendations; l Trainings organized to establish effective risk management system; l On-site supervision strengthened to enable risk based audits;

Reform of Nationalized Commercial Banks l l l 20 MOUs signed with Bangladesh Bank for the first time; Completion of Special Audits to assess assets quality by local audit firms with international affiliation; Appointment of a Financial Advisor to help privatize one NCB; Hiring of a CEO and a management team for another NCB; Recruitment of Experts to assist management of other two NCBs;

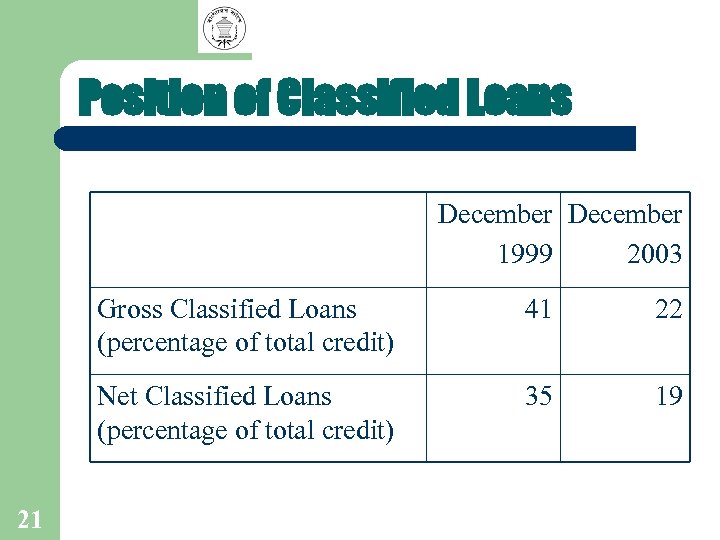

Position of Classified Loans December 1999 2003 Gross Classified Loans (percentage of total credit) 22 Net Classified Loans (percentage of total credit) 21 41 35 19

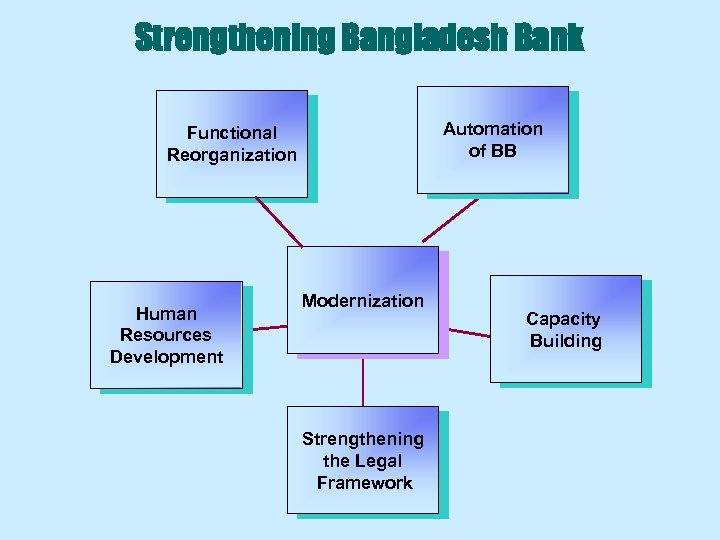

Strengthening Bangladesh Bank Automation of BB Functional Reorganization Human Resources Development Modernization Strengthening the Legal Framework 22 Capacity Building

Strengthening Bangladesh Bank l l l 23 Amendment of BB Order 1972: Board of Directors is empowered to formulate and implement all regulations without government approval; Reorganization and modernization: modernization of structure and working system of BB; Computerization of functions of Bangladesh Bank; Human Resources Development: Training of Officers/staff and reforming policy supporting promotion and employment purely on the basis of talent; Capacity Building: Strengthening Research Department, prudential regulation and supervision and accounting and audit standards.

Thank You 24

d5c9d7a31813ff74aa1aa7c40cf330c2.ppt