28a8a1bf8565386fff1ce0275f64a757.ppt

- Количество слайдов: 43

Banco Central do Brasil FTAA – Some Views Ilan Goldfajn April 2002 1

Banco Central do Brasil 1. Exchange Rate and External Flows 2. Recent Economic Developments 2

Banco Central do Brasil 1. Exchange Rate and External Flows 3

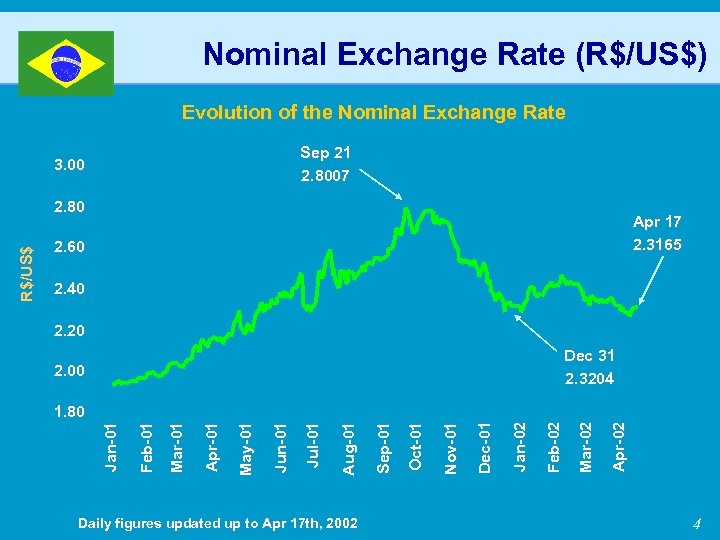

Nominal Exchange Rate (R$/US$) E v o l u ti o n o f th e N o m i n a l E x c h a n g e R a te Sep 21 2. 8007 3. 00 Apr 17 2. 3165 2. 60 2. 40 2. 20 Daily figures updated up to Apr 17 th, 2002 Apr-02 Feb-02 Jan-02 Dec-01 Nov-01 Oct-01 Sep-01 Aug-01 Jul-01 Jun-01 May-01 Apr-01 Mar-01 Feb-01 1. 80 Mar-02 Dec 31 2. 3204 2. 00 Jan-01 R$/US$ 2. 80 4

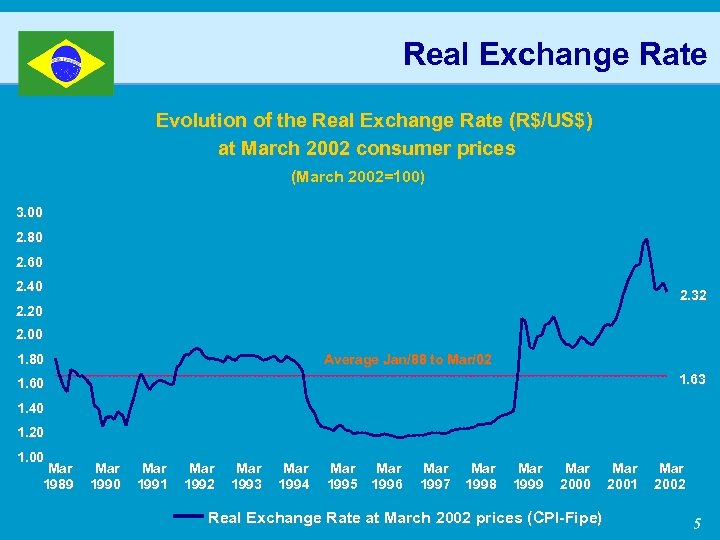

Real Exchange Rate Evolution of the Real Exchange Rate (R$/US$) a t Ma r c h 2 0 0 2 c o n s u m e r p r i c e s (Ma r c h 2 0 0 2 = 1 0 0 ) 3. 00 2. 80 2. 60 2. 40 2. 32 2. 20 2. 00 1. 80 Average Jan/88 to Mar/02 1. 63 1. 60 1. 40 1. 20 1. 00 Mar 1989 Mar 1990 Mar 1991 Mar 1992 Mar 1993 Mar 1994 Mar 1995 1996 Mar 1997 Mar 1998 Mar 1999 Mar 2000 Real Exchange Rate at March 2002 prices (CPI-Fipe) Mar 2001 Mar 2002 5

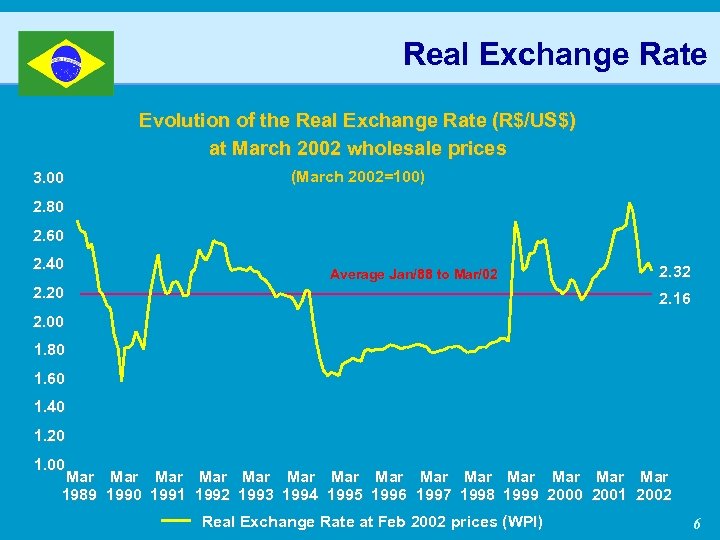

Real Exchange Rate Evolution of the Real Exchange Rate (R$/US$) a t Ma r c h 2 0 0 2 w h o l e s a l e p r i c e s 3. 00 (Ma r c h 2 0 0 2 = 1 0 0 ) 2. 80 2. 60 2. 40 Average Jan/88 to Mar/02 2. 20 2. 32 2. 16 2. 00 1. 80 1. 60 1. 40 1. 20 1. 00 Mar Mar Mar Mar 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Real Exchange Rate at Feb 2002 prices (WPI) 6

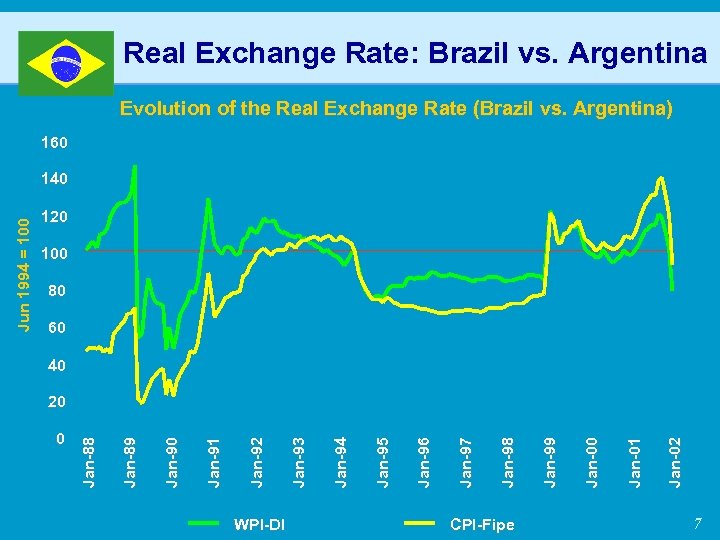

Real Exchange Rate: Brazil vs. Argentina Evolution of the Real Exchange Rate (Brazil vs. Argentina) 160 120 100 80 60 40 WPI-DI CPI-Fipe Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 Jan-90 0 Jan-89 20 Jan-88 Ju n 1994 = 100 140 7

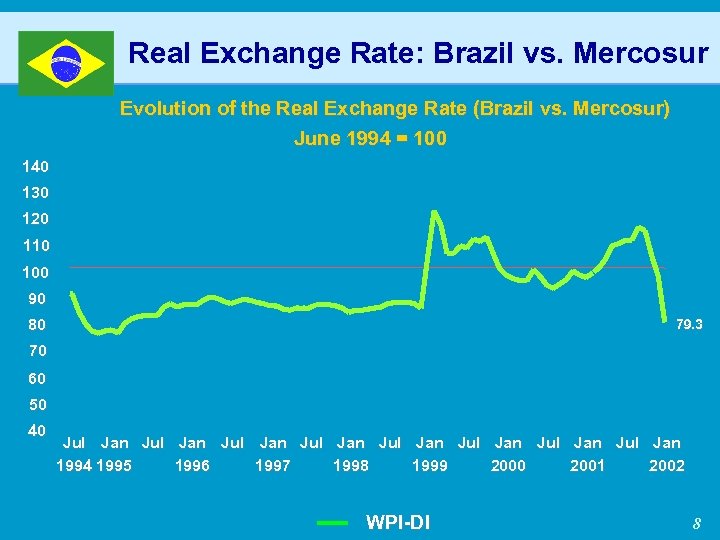

Real Exchange Rate: Brazil vs. Mercosur Evolution of the Real Exchange Rate (Brazil vs. Mercosur) June 1994 = 100 140 130 120 110 100 90 80 79. 3 70 60 50 40 Jul Jan Jul Jan 1994 1995 1996 1997 1998 1999 2000 2001 2002 WPI-DI 8

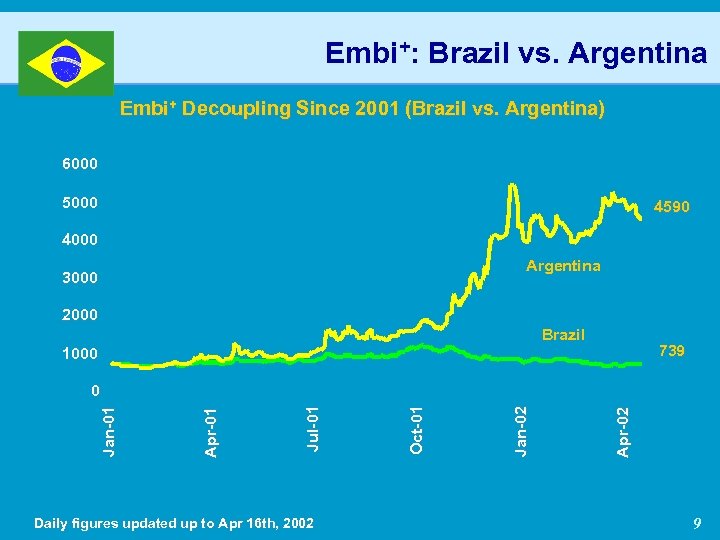

Embi+: Brazil vs. Argentina Embi+ Decoupling Since 2001 (Brazil vs. Argentina) 6000 5000 4590 4000 Argentina 3000 2000 Brazil 739 1000 Daily figures updated up to Apr 16 th, 2002 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 0 9

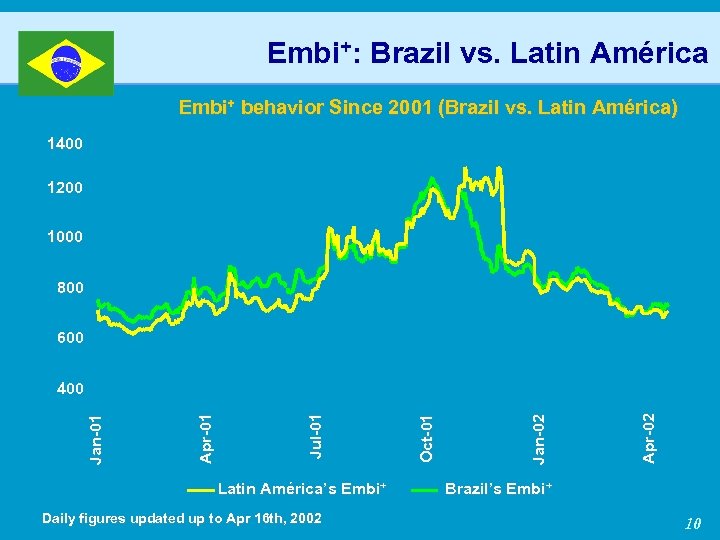

Embi+: Brazil vs. Latin América Embi+ behavior Since 2001 (Brazil vs. Latin América) 1400 1200 1000 800 600 Latin América’s Embi+ Daily figures updated up to Apr 16 th, 2002 Apr-02 Jan-02 Oct-01 Jul-01 Apr-01 Jan-01 400 Brazil’s Embi+ 10

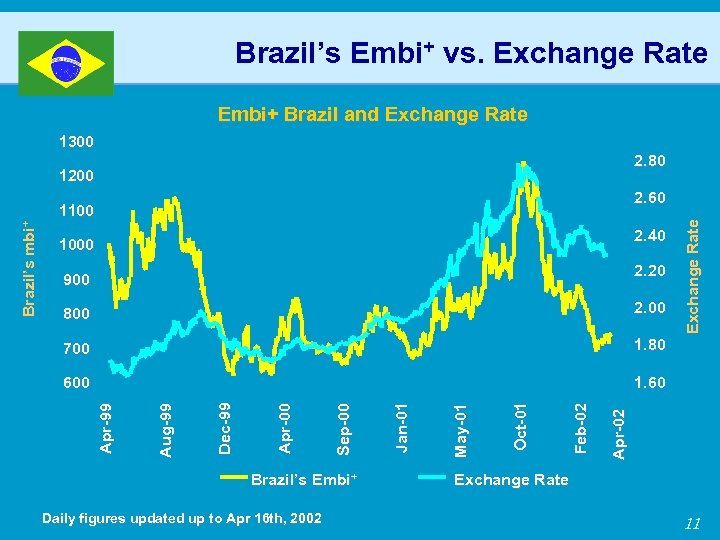

Brazil’s Embi+ vs. Exchange Rate Embi+ Brazil and Exchange Rate 1300 2. 80 1200 2. 40 1000 2. 20 900 Brazil’s Embi+ Daily figures updated up to Apr 16 th, 2002 Apr-02 Feb-02 Oct-01 May-01 1. 60 Jan-01 600 Sep-00 1. 80 Apr-00 700 Dec-99 2. 00 Aug-99 800 Apr-99 Brazil’s mbi+ 1100 Exchange Rate 2. 60 Exchange Rate 11

Brazil’s Trade Balance - Total Three Months Moving Average US$ million-Fob 800 600 400 200 0 -200 -400 -600 Mar 1999 Jul Nov Mar 2000 Jul Nov Seasonally adjusted Mar 2001 Jul Nov Mar 2002 Actual (annualized): US$ 4. 1 billion in March 2002 Seasonally adjusted (annualized): US$ 5. 7 billion in March 2002 12

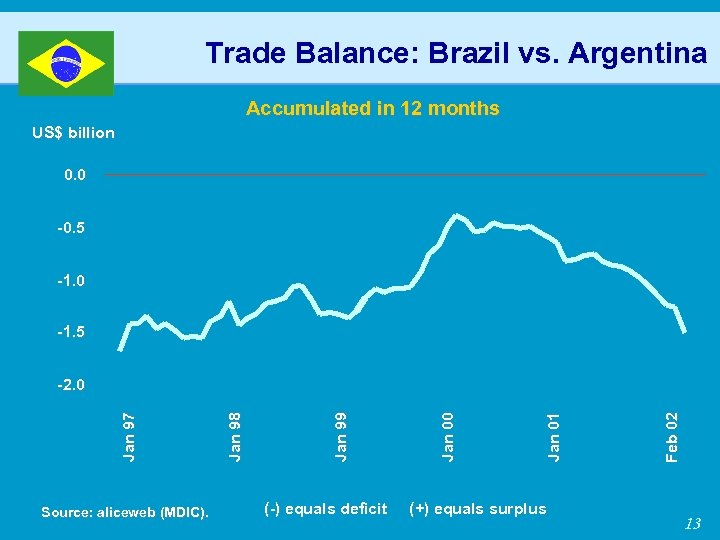

Trade Balance: Brazil vs. Argentina Accumulated in 12 months US$ billion 0. 0 -0. 5 -1. 0 -1. 5 Source: aliceweb (MDIC). (-) equals deficit (+) equals surplus Feb 02 Jan 01 Jan 00 Jan 99 Jan 98 Jan 97 -2. 0 13

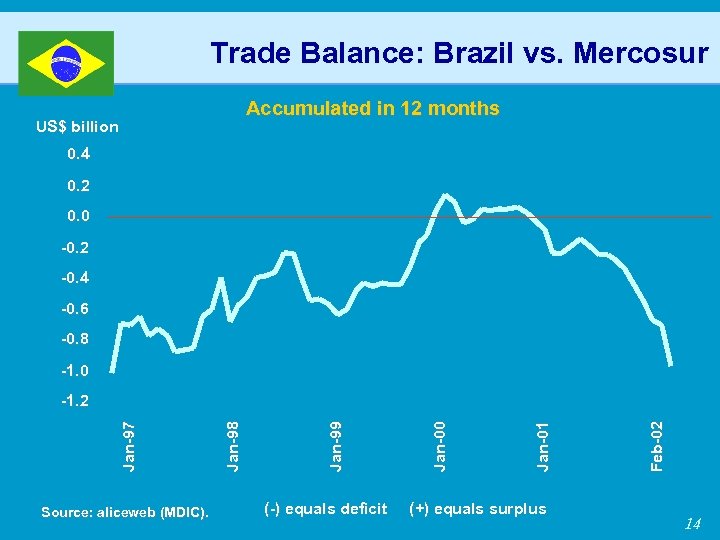

Trade Balance: Brazil vs. Mercosur Accumulated in 12 months US$ billion 0. 4 0. 2 0. 0 -0. 2 -0. 4 -0. 6 -0. 8 -1. 0 Source: aliceweb (MDIC). (-) equals deficit (+) equals surplus Feb-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 -1. 2 14

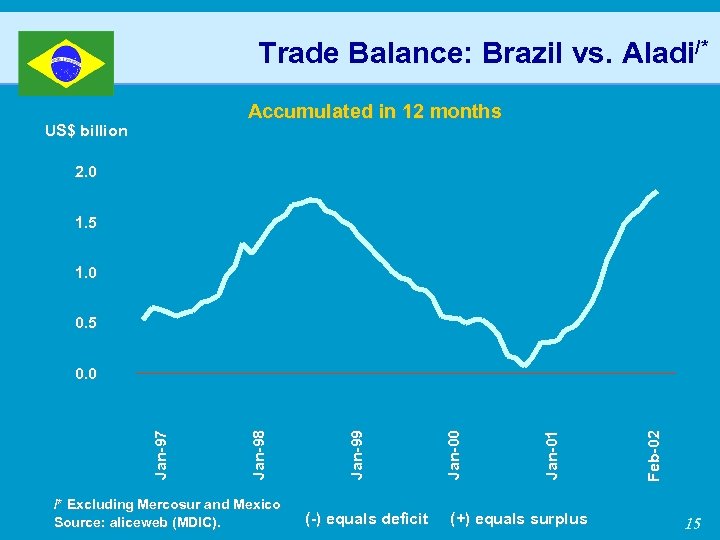

Trade Balance: Brazil vs. Aladi/* Accumulated in 12 months US$ billion 2. 0 1. 5 1. 0 0. 5 /* Excluding Mercosur and Mexico Source: aliceweb (MDIC). (-) equals deficit (+) equals surplus Feb-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 0. 0 15

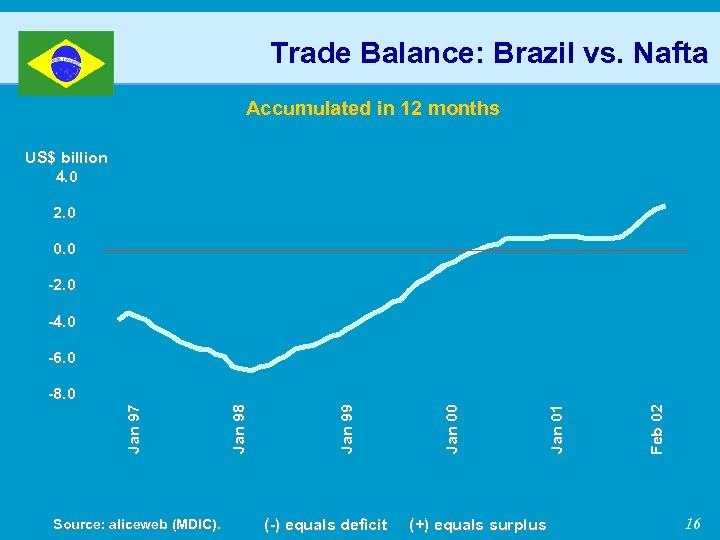

Trade Balance: Brazil vs. Nafta Accumulated in 12 months US$ billion 4. 0 2. 0 0. 0 -2. 0 -4. 0 -6. 0 Source: aliceweb (MDIC). (-) equals deficit (+) equals surplus Feb 02 Jan 01 Jan 00 Jan 99 Jan 98 Jan 97 -8. 0 16

Exports: Brazilian Exports of Steel Products US$ billion 3. 5 3. 0 2, 3 2. 5 2. 0 1. 5 0. 4* 1. 0 0. 5 1996 1997 1998 1999 2000 2001 2002 * Accumulated Jan/Feb Source: MDIC/SECEX 17

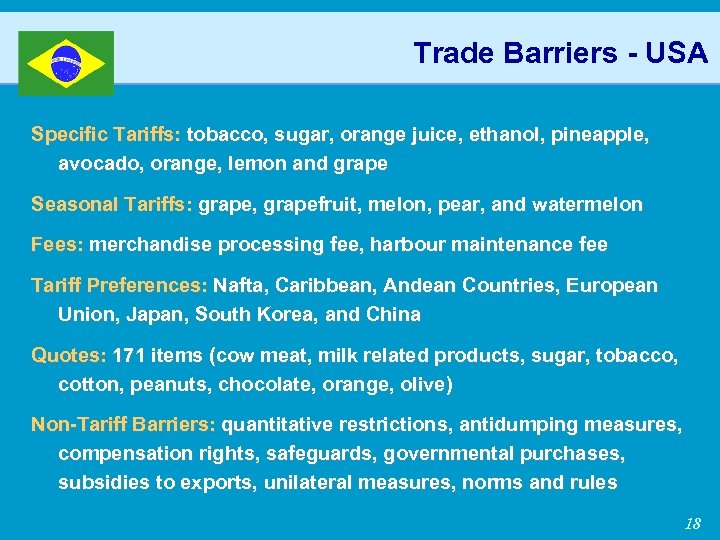

Trade Barriers - USA Specific Tariffs: tobacco, sugar, orange juice, ethanol, pineapple, avocado, orange, lemon and grape Seasonal Tariffs: grape, grapefruit, melon, pear, and watermelon Fees: merchandise processing fee, harbour maintenance fee Tariff Preferences: Nafta, Caribbean, Andean Countries, European Union, Japan, South Korea, and China Quotes: 171 items (cow meat, milk related products, sugar, tobacco, cotton, peanuts, chocolate, orange, olive) Non-Tariff Barriers: quantitative restrictions, antidumping measures, compensation rights, safeguards, governmental purchases, subsidies to exports, unilateral measures, norms and rules 18

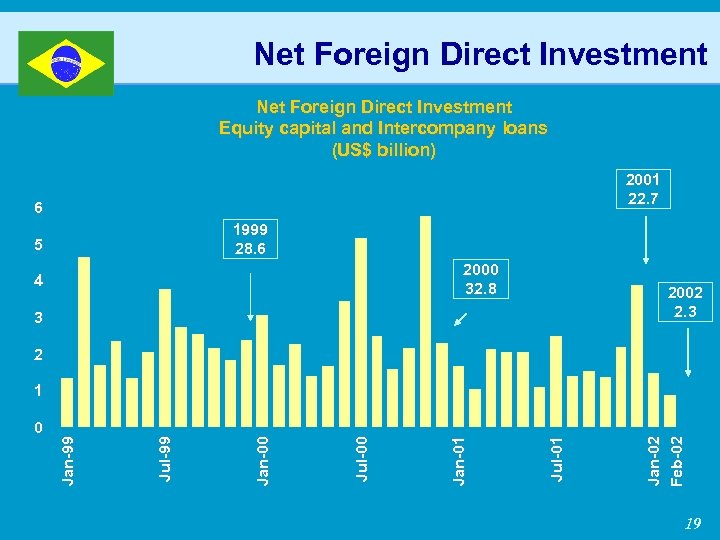

Net Foreign Direct Investment Equity capital and Intercompany loans (US$ billion) 2001 22. 7 6 1999 28. 6 5 2000 32. 8 4 2002 2. 3 3 2 Jan-02 Feb-02 Jul-01 Jan-01 Jul-00 Jan-00 Jul-99 0 Jan-99 1 19

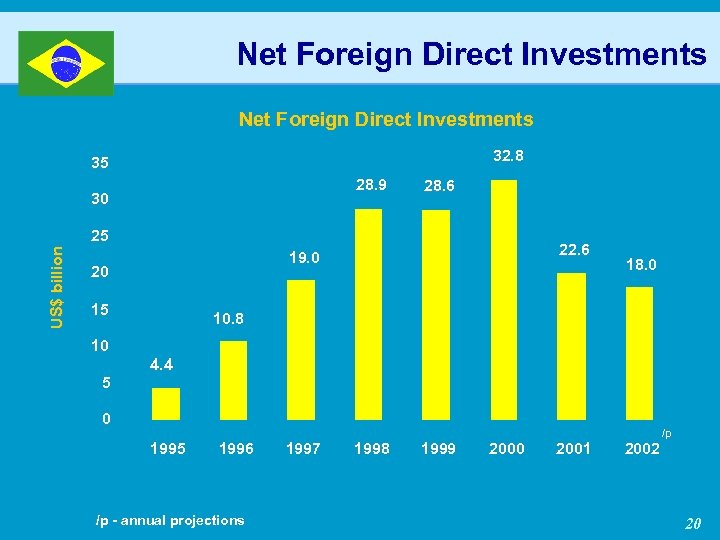

Net Foreign Direct Investments N e t F o r e i g n D i r e c t I n v e s tm e n ts 32. 8 35 28. 9 30 28. 6 US$ billion 25 22. 6 19. 0 20 15 18. 0 10. 8 10 5 4. 4 0 1995 1996 /p - annual projections 1997 1998 1999 2000 2001 2002 /p 20

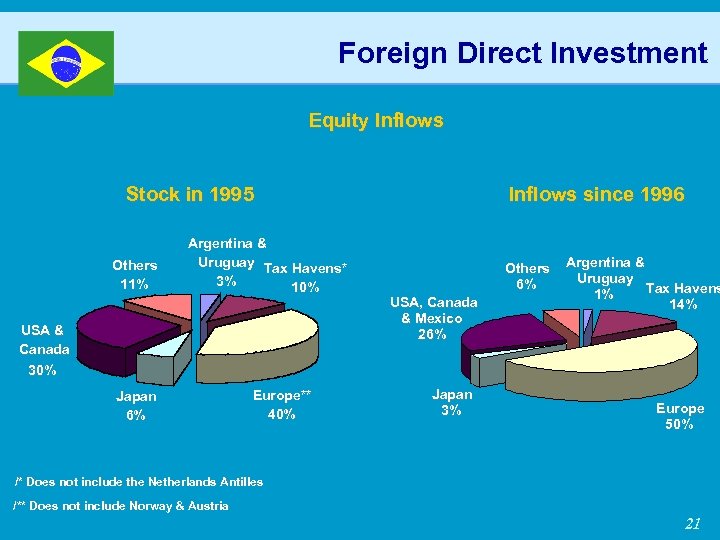

Foreign Direct Investment Equity Inflows Stock in 1995 Others 11% Argentina & Uruguay Tax Havens* 3% 10% USA & Canada 30% Japan 6% Europe** 40% Inflows since 1996 Others 6% USA, Canada & Mexico 26% Japan 3% Argentina & Uruguay Tax Havens 1% 14% Europe 50% /* Does not include the Netherlands Antilles /** Does not include Norway & Austria 21

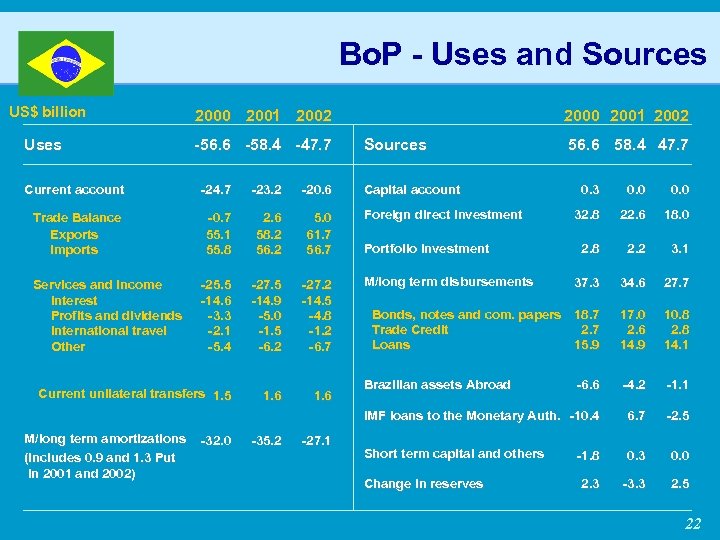

Bo. P - Uses and Sources US$ billion 2000 2001 2002 Uses -56. 6 -58. 4 -47. 7 Current account -24. 7 -23. 2 -20. 6 Trade Balance Exports Imports -0. 7 55. 1 55. 8 2. 6 58. 2 56. 2 5. 0 61. 7 56. 7 -25. 5 -14. 6 -3. 3 -2. 1 -5. 4 -27. 5 -14. 9 -5. 0 -1. 5 -6. 2 -27. 2 -14. 5 -4. 8 -1. 2 -6. 7 Current unilateral transfers 1. 5 1. 6 2000 2001 2002 Sources M/long term amortizations (includes 0. 9 and 1. 3 Put in 2001 and 2002) -32. 0 -35. 2 -27. 1 0. 3 0. 0 32. 8 22. 6 18. 0 2. 8 2. 2 3. 1 37. 3 34. 6 27. 7 Bonds, notes and com. papers 18. 7 Trade Credit 2. 7 Loans 15. 9 17. 0 2. 6 14. 9 10. 8 2. 8 14. 1 -6. 6 -4. 2 -1. 1 IMF loans to the Monetary Auth. -10. 4 Services and income Interest Profits and dividends International travel Other Capital account 56. 6 58. 4 47. 7 6. 7 -2. 5 Short term capital and others -1. 8 0. 3 0. 0 2. 3 -3. 3 2. 5 Foreign direct investment Portfolio investment M/long term disbursements Brazilian assets Abroad Change in reserves 22

Banco Central do Brasil 2. Recent Economic Developments 23

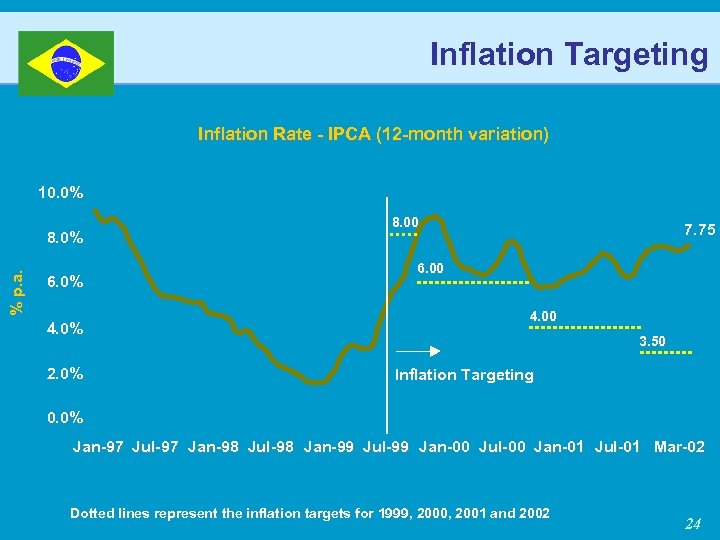

Inflation Targeting Inflation Rate - IPCA (12 -month variation) 10. 0% % p. a. 8. 0% 6. 0% 4. 0% 2. 0% 8. 00 7. 75 6. 00 4. 00 3. 50 Inflation Targeting 0. 0% Jan-97 Jul-97 Jan-98 Jul-98 Jan-99 Jul-99 Jan-00 Jul-00 Jan-01 Jul-01 Mar-02 Dotted lines represent the inflation targets for 1999, 2000, 2001 and 2002 24

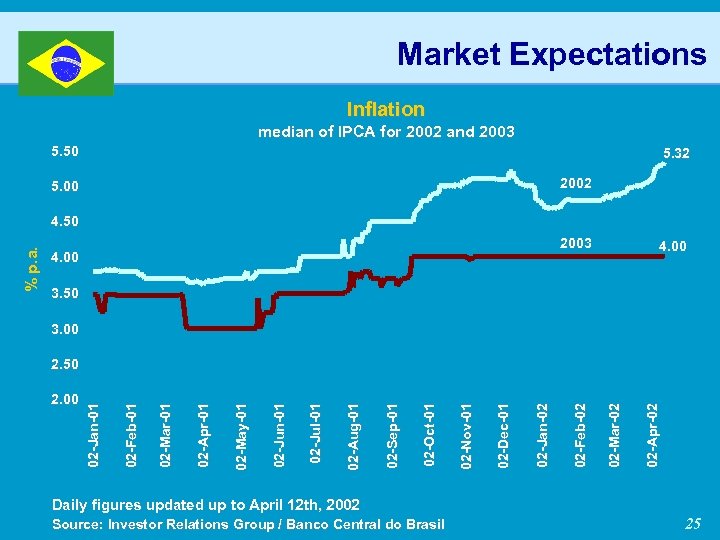

Market Expectations Inflation median of IPCA for 2002 and 2003 5. 50 5. 32 2002 5. 00 2003 4. 00 3. 50 3. 00 02 -Apr-02 02 -Mar-02 02 -Feb-02 02 -Jan-02 02 -Dec-01 02 -Nov-01 02 -Oct-01 02 -Sep-01 02 -Aug-01 02 -Jul-01 02 -Jun-01 02 -May-01 02 -Apr-01 02 -Mar-01 2. 00 02 -Feb-01 2. 50 02 -Jan-01 % p. a. 4. 50 Daily figures updated up to April 12 th, 2002 Source: Investor Relations Group / Banco Central do Brasil 25

Market Expectations IPCA Average (Aggregate) Median (Aggregate) Standard Deviation Median Top-5 (Short) Median Top-5 (Medium) Other variables - Median IGP-DI Exchange rate Over-Selic Trade Balance Current Account Deficit FDI GDP Jan 23 rd 2002 2003 2004 4. 73 3. 96 3. 72 4. 82 4. 00 3. 63 0. 41 0. 50 0. 66 4. 85 3. 75 3. 00 5. 00 4. 00 3. 50 Feb 20 th 2002 2003 2004 4. 76 3. 91 3. 68 4. 80 4. 00 3. 50 0. 34 0. 45 0. 64 4. 88 3. 75 3. 00 4. 98 4. 00 3. 50 Jan 23 rd 2002 2003 2004 Feb 20 th 2002 2003 2004 5. 91 4. 65 4. 00 2. 59 2. 70 2. 80 16. 75 14. 00 13. 00 4. 80 6. 00 6. 86 -20. 00 -19. 92 -18. 60 16. 00 16. 75 18. 00 2. 44 3. 50 4. 00 5. 73 4. 68 4. 00 2. 55 2. 70 2. 81 17. 00 14. 10 13. 00 4. 75 5. 70 7. 00 -20. 01 -19. 80 -18. 50 17. 00 18. 00 2. 40 3. 50 4. 00 26

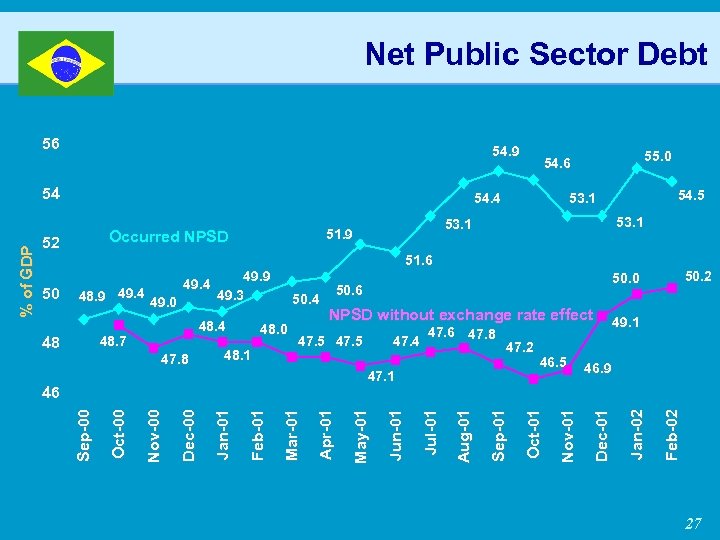

Net Public Sector Debt 56 54. 9 54. 4 47. 6 47. 8 47. 4 47. 2 47. 5 Sep-01 Aug-01 Jul-01 Apr-01 Mar-01 Feb-01 Jan-01 Dec-00 Nov-00 Oct-00 46 Jun-01 47. 1 46. 5 49. 1 46. 9 Feb-02 48. 1 NPSD without exchange rate effect Jan-02 48. 0 Dec-01 47. 8 50. 4 50. 2 50. 0 50. 6 Nov-01 48. 4 48. 7 48 49. 9 49. 3 Oct-01 48. 9 49. 4 49. 0 53. 1 51. 6 May-01 50 49. 4 54. 5 53. 1 51. 9 Occurred NPSD 52 Sep-00 % of GDP 54 55. 0 54. 6 27

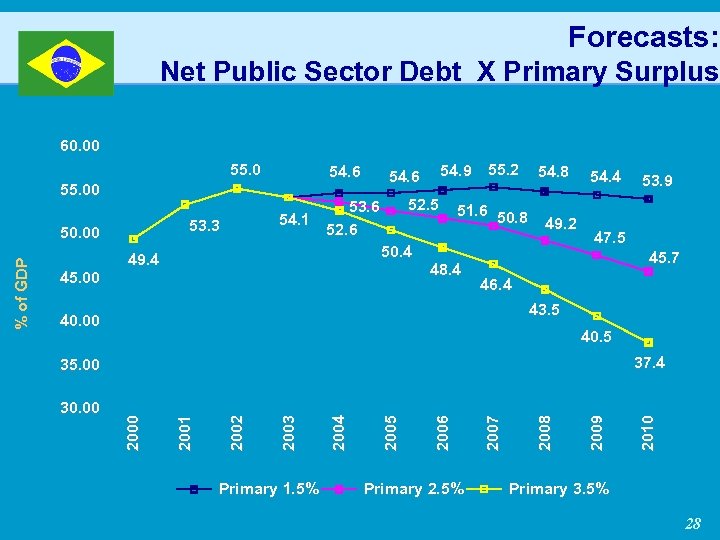

Forecasts: Net Public Sector Debt X Primary Surplus 60. 00 55. 00 51. 6 50. 8 48. 4 54. 8 49. 2 54. 4 47. 5 46. 4 43. 5 40. 5 Primary 2. 5% 2009 2008 2007 2006 2005 2004 2003 2001 2002 Primary 1. 5% 2010 37. 4 35. 00 30. 00 53. 9 45. 7 40. 00 2000 % of GDP 45. 00 52. 5 50. 4 49. 4 54. 9 55. 2 54. 6 53. 6 54. 1 52. 6 53. 3 50. 00 54. 6 Primary 3. 5% 28

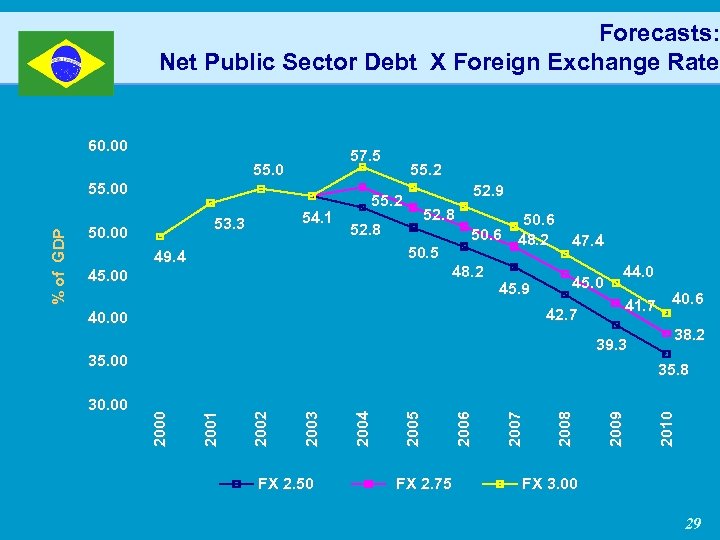

Forecasts: Net Public Sector Debt X Foreign Exchange Rate 60. 00 57. 5 55. 0 54. 1 53. 3 50. 00 52. 9 55. 2 52. 8 50. 5 49. 4 50. 6 48. 2 45. 00 45. 9 47. 4 45. 0 42. 7 40. 00 35. 00 41. 7 40. 6 38. 2 FX 2. 50 FX 2. 75 2010 2009 2008 2007 2006 2005 2004 2003 2002 35. 8 2001 30. 00 44. 0 39. 3 2000 % of GDP 55. 00 55. 2 FX 3. 00 29

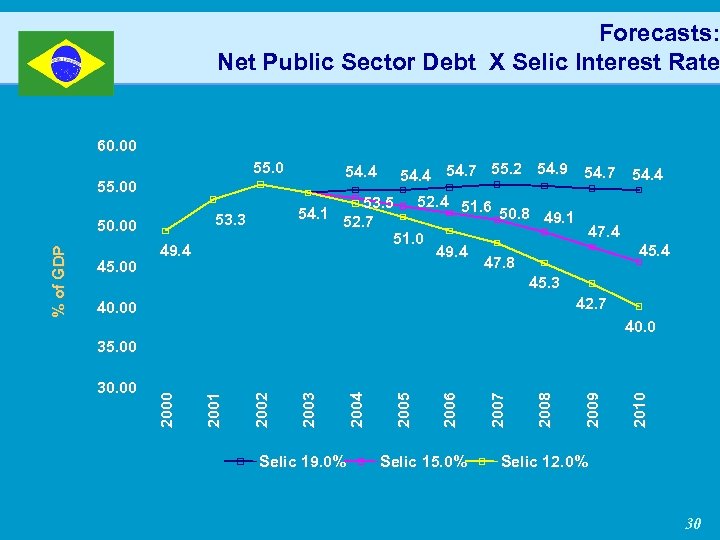

Forecasts: Net Public Sector Debt X Selic Interest Rate 60. 00 55. 00 49. 4 40. 00 45. 4 40. 0 Selic 19. 0% Selic 15. 0% 2010 2009 2008 2007 2006 2005 2004 2003 2002 30. 00 2001 35. 00 2000 % of GDP 45. 00 54. 4 54. 7 55. 2 54. 9 54. 7 54. 4 53. 5 52. 4 51. 6 54. 1 50. 8 49. 1 52. 7 47. 4 51. 0 49. 4 47. 8 45. 3 42. 7 53. 3 50. 00 54. 4 Selic 12. 0% 30

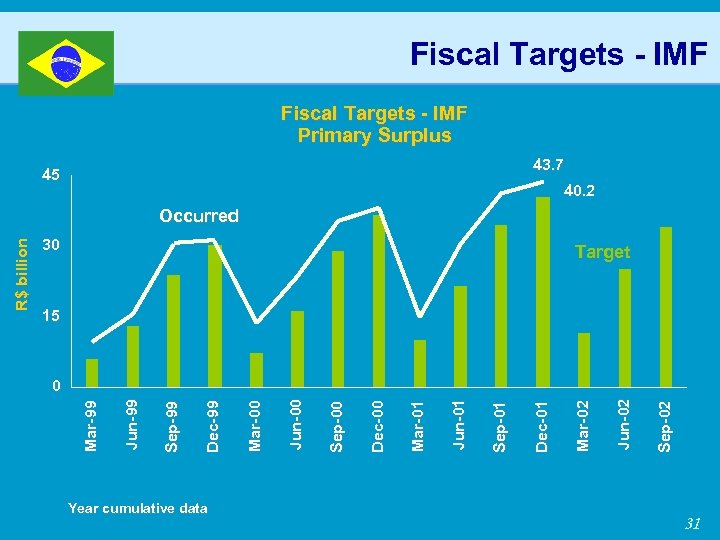

Fiscal Targets - IMF Primary Surplus 43. 7 45 40. 2 30 Target 15 Year cumulative data Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Dec-99 Sep-99 Jun-99 0 Mar-99 R$ billion Occurred 31

Structural Reforms – Monetary Responsibility Law – Payments System – Prudential Regulations – Corporate Law – Bankruptcy Law – Tax Reform (CPMF, etc. ) – Corporate Governance – Banking Spread – Transparency 32

Monetary Responsibility Law National Financial System Reform – Regulation of Article 192 of the Federal Constitution. This article was simplified by revoking the indents, paragraphs, and the provision that determines that regulations are to be defined in one single enabling legislation. The objective was to facilitate the task of introducing appropriate regulations. It will now be possible to do this on a piecemeal basis in terms of both content and time, allowing the authorities to deal separately with the different financial system markets. – Approved in the Senate and remitted to the Lower House of Representatives for deliberation. The report of the rapporteur of the Special Committee was approved on 8. 8. 2001. Awaiting voting at the full session of the Lower House. 33

Brazilian Payments System aims at reducing the systemic risk – The transactions involving bank reserves will operate in RTGS (Real Time Gross Settlement) – From April 2002 on, negative balance will not be allowed in the bank reserves – Objectives: • Reduce Central Bank exposure to credit risk; • Promote a safe and timely financial settlement; • Stimulate the competition in the financial system; • Improve the efficiency of the payment instruments. 34

Prudential Regulations Central Bank’s initiatives aim at providing a more transparent structure to the financial system – Deposit Insurance Fund - “FGC” – Internal control system – Credit risk bureau – New credit risk classification: 9 categories (AA to H) – Banking and non-banking consolidated balance sheet – Basle Agreement Principles – Banking customer’s code – Off-Site Supervision Department – Semestral Supervision Program - “PFS”: Global Consolidate Inspections (IGC) – PROER and PROES 35

Corporate Law: protection to the minority shareholders – Law 10, 303, of October 10 th, 2001: sanctioned by the President of the Republic. – Modernizes the legal framework governing publicly-held companies by expanding minority shareholder rights and by improving corporate governance, accountability and transparency – Brings the right of the tag along to the minority shareholders: mechanism that assures to all shareholders the extension of the same conditions offered to the controllers, in case of transference of the control of the company 36

Bankruptcy Law – PL n. 4376 -A/1993: stage of voting at the National Congress: approved at the Special Committee of the Lower House of Representatives. Awaiting voting in the full session for later remittance to the Federal Senate. – Institutes and regulates the recuperation and the judicial liquidation of the commercial and economic civil corporations. – The proposal broadens the objective of current legislation by extending its application - now limited to those involved in commercial activities - to all persons or legal entities involved in the economic activity. 37

Tax Reform – PEC n. 175 -A/1995: The position report of the rapporteur of the Special Committee of the Lower House of Representatives was approved on 12. 16. 1999. Awaiting remittance to the full house for voting. – Redefines the current tax structure and creates the tax on aggregate value. CPMF Term Extension – PEC n. 382/2001: approved by the Special Committee of the Lower House of Representatives on 12. 11. 2001. Approved in one round of voting at the Lower House on 20. 02. 2002. Awaiting approval in second round of voting in the Lower House of Representatives before remittance to the Federal Senate. – Extends the validity of this contribution from June 16 th, 2002 to December 31 st, 2003. 38

New Market: Corporate Governance – New rules in order to guarantee greater transparency and security to the investors – Corporate Governance: more adjusted management practices. Tightened follow-up and increased participation in the companies’ management by the investors. Canalization of the investments to the companies compromised with the practices of corporate governance – Private contract with BOVESPA: Level 1 or 2, depending on the degree of commitment assumed by the company – Aims at the development of the Brazilian capital market. 39

Banking Spread Measures that aim at the reduction of the banking spread in Brazil – Solidity of the banking system; – Tax reform; – Increase of the intermediaries; – Improvement of risk control and of banking supervision mechanisms; – Improvement of the credit instruments; competition between financial 40

Transparency at the Central Bank – Improves the two-way communication of the Central Bank with the market participants: • Investor Relations Group: Focus Report - English and Portuguese versions; Survey on Market Expectations; Meetings with foreign and domestic investors. • Periodical meetings with chief-economists (quarterly) – Working Papers e Technical Notes – Inflation Report (quarterly) – Copom Minutes (8 days after the meeting) – External auditing at the Central Bank 41

2002 prospects F 2002: Beginning of a new virtuous cycle ? Þ Weaken market focus on “elections risk”; Þ Since February, reductions of Selic rate; Þ FX presented consistent appreciation from Octoberlevel peak; Þ Trade balance recovery and lesser-than-expected fall in FDI; Þ Moody´s revised outlook and fall in sovereign-risk premium; Þ Evidence of slight recovery in economic activity; 42

Banco Central do Brasil FTAA – Some Views March 2002 43

28a8a1bf8565386fff1ce0275f64a757.ppt