f497acd56fd3e4ecf234b21935c22b08.ppt

- Количество слайдов: 23

Bancassurance implementation in the Baltic countries National Bancassurance Conference Chisinau, November 2013 Mindaugas Jusius CEO Swedbank Life Insurance SE © Swedbank

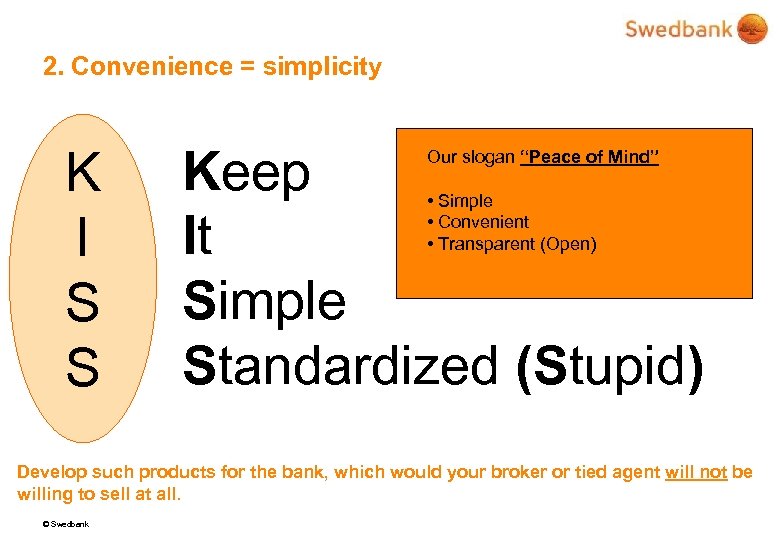

2. Convenience = simplicity K I S S Keep It Simple Standardized (Stupid) Our slogan “Peace of Mind” • Simple • Convenient • Transparent (Open) Develop such products for the bank, which would your broker or tied agent will not be willing to sell at all. © Swedbank

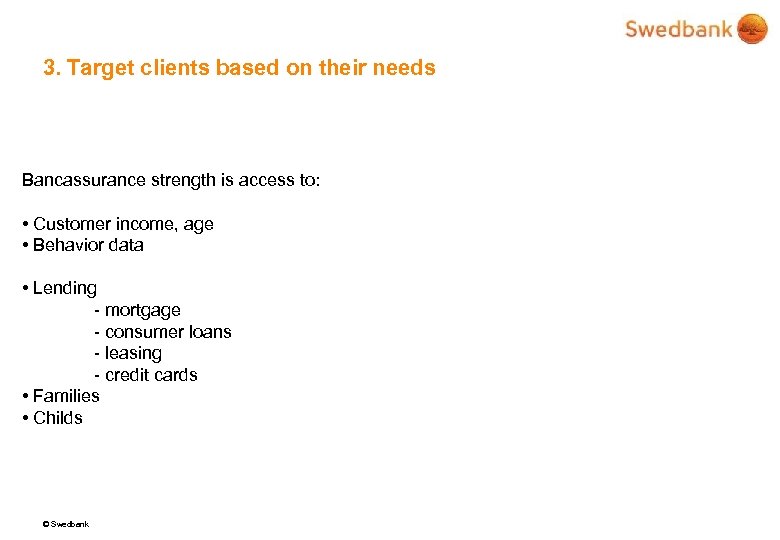

3. Target clients based on their needs Bancassurance strength is access to: • Customer income, age • Behavior data • Lending - mortgage - consumer loans - leasing - credit cards • Families • Childs © Swedbank

Products and Processes © Swedbank

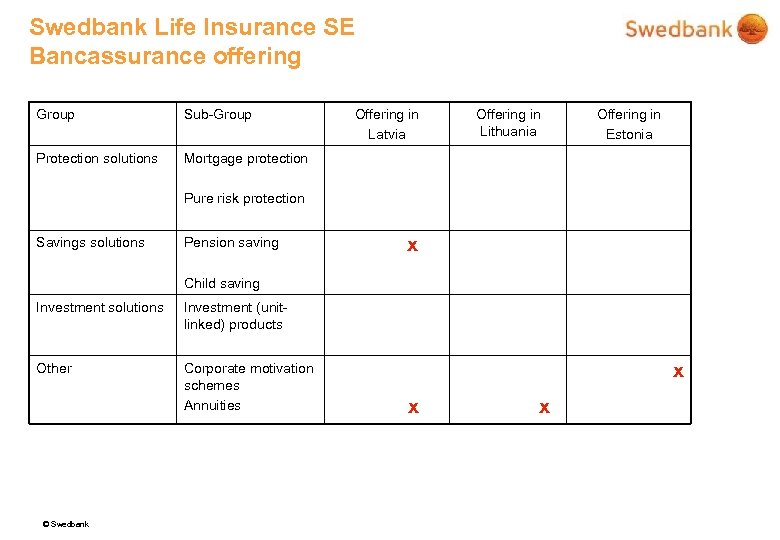

Swedbank Life Insurance SE Bancassurance offering Group Sub-Group Protection solutions Offering in Latvia Offering in Lithuania Offering in Estonia Mortgage protection Pure risk protection Savings solutions Pension saving x Child saving Investment solutions Investment (unitlinked) products Other Corporate motivation schemes Annuities © Swedbank x x x

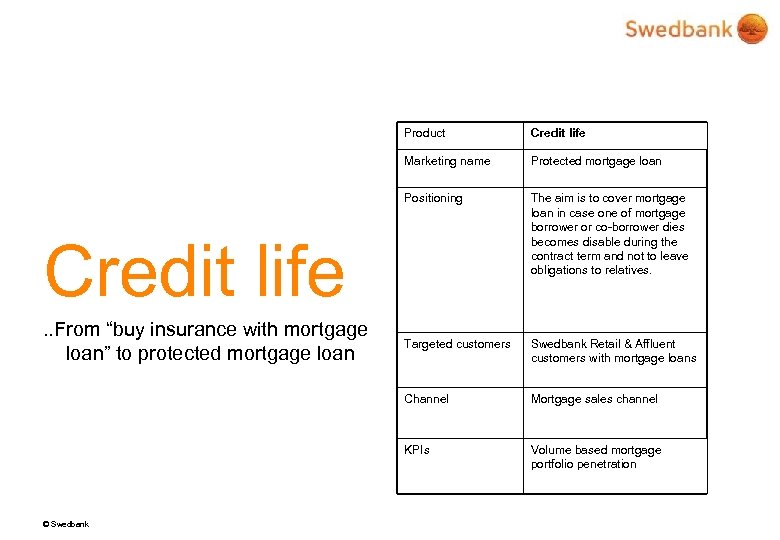

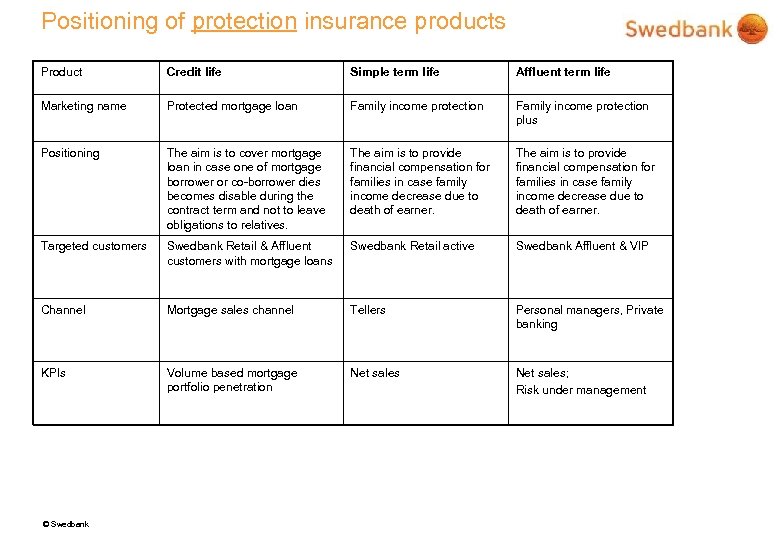

Product Credit life Marketing name Protected mortgage loan Positioning The aim is to cover mortgage loan in case one of mortgage borrower or co-borrower dies becomes disable during the contract term and not to leave obligations to relatives. Targeted customers Swedbank Retail & Affluent customers with mortgage loans Channel Mortgage sales channel KPIs Volume based mortgage portfolio penetration Credit life. . From “buy insurance with mortgage loan” to protected mortgage loan © Swedbank

Reviewed offering for the customer © Swedbank

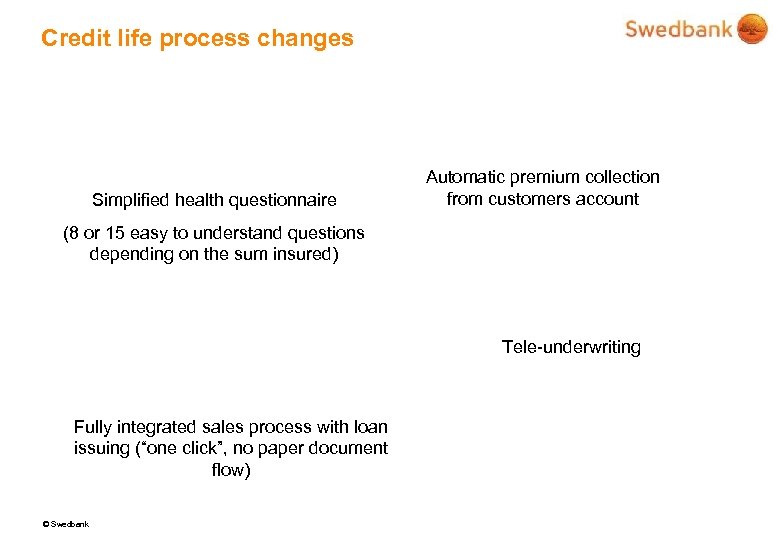

Credit life process changes Simplified health questionnaire Automatic premium collection from customers account (8 or 15 easy to understand questions depending on the sum insured) Tele-underwriting Fully integrated sales process with loan issuing (“one click”, no paper document flow) © Swedbank

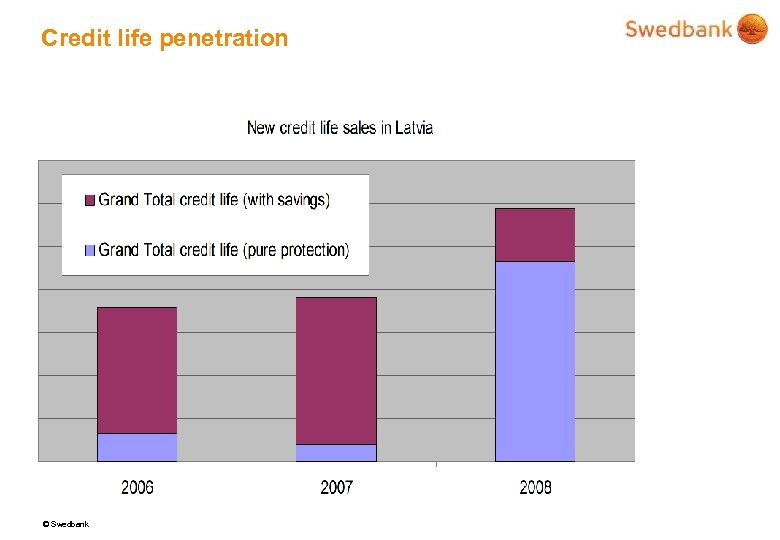

Credit life penetration Up to 80% penetration with new loans 40% penetration in the total mortgage portfolio 85% Average loan protection © Swedbank

Can price increase stimulate more sales? Pure protection product can be considered 25% more expensive due to tax system, but simplicity and easy access creates more value for sales people and customers © Swedbank

Can price increase stimulate more sales? Pure protection product price was set based on customer survey © Swedbank

Other products © Swedbank

Positioning of protection insurance products Product Credit life Simple term life Affluent term life Marketing name Protected mortgage loan Family income protection plus Positioning The aim is to cover mortgage loan in case one of mortgage borrower or co-borrower dies becomes disable during the contract term and not to leave obligations to relatives. The aim is to provide financial compensation for families in case family income decrease due to death of earner. Targeted customers Swedbank Retail & Affluent customers with mortgage loans Swedbank Retail active Swedbank Affluent & VIP Channel Mortgage sales channel Tellers Personal managers, Private banking KPIs Volume based mortgage portfolio penetration Net sales; Risk under management © Swedbank

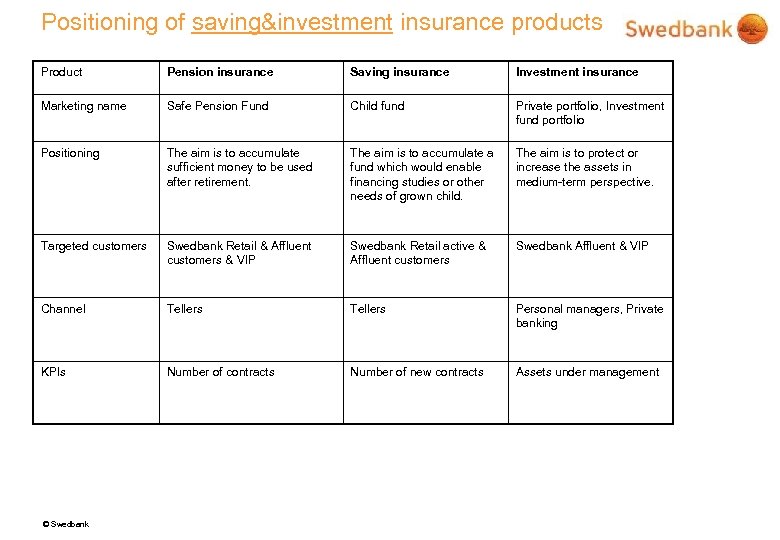

Positioning of saving&investment insurance products Product Pension insurance Saving insurance Investment insurance Marketing name Safe Pension Fund Child fund Private portfolio, Investment fund portfolio Positioning The aim is to accumulate sufficient money to be used after retirement. The aim is to accumulate a fund which would enable financing studies or other needs of grown child. The aim is to protect or increase the assets in medium-term perspective. Targeted customers Swedbank Retail & Affluent customers & VIP Swedbank Retail active & Affluent customers Swedbank Affluent & VIP Channel Tellers Personal managers, Private banking KPIs Number of contracts Number of new contracts Assets under management © Swedbank

Channels and processes. . from a stand alone solutions to fully integrated processes and systems © Swedbank

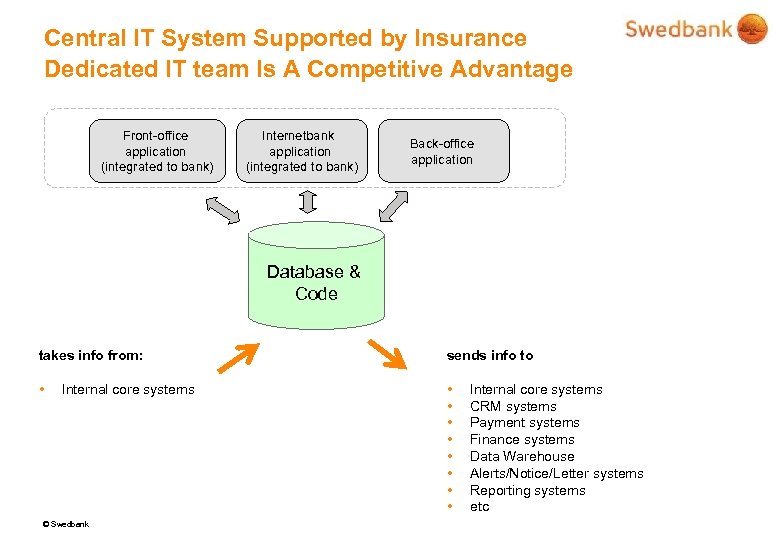

Central IT System Supported by Insurance Dedicated IT team Is A Competitive Advantage Front-office application (integrated to bank) Internetbank application (integrated to bank) Back-office application Database & Code takes info from: sends info to • • • Internal core systems © Swedbank Internal core systems CRM systems Payment systems Finance systems Data Warehouse Alerts/Notice/Letter systems Reporting systems etc

Physical and E-Channels • All products available in bank branch are also available in the Internet bank – Internet bank sales reached ca. 10% • Majority of follow-up service functionality is available in the Internet bank (changes, reporting, graphs, etc. ) – Ca. 50% of follow-up services done in the Internet bank • Quality double-check, channel integration is used for “advice-intensive” operations – e. g. pre-advice over the phone is required before canceling an agreement in the Internet bank • One application development & same interfaces – e. g. the advisor’s view is the same as the customer’s view in the Internet bank, making it easy to give advice over the phone • Straightforward processes (immediate, automatic execution) – – © Swedbank e. g. >50% credit life policies are underwritten immediately at point of sales incl policy issue e. g. ca. 80% of tele-interviews are completed within 2 working days followed usually by customer confirmation using Internet bank

Thank you! © Swedbank

Key success factors © Swedbank

1. Financial model Profit sharing, but not sales commissions Better customer selection, less claims Interest for after-sales service Open doors for integrated solutions © Swedbank

4. Act as a regular wholesaler How would you sell Santa Maria spices in ICA stores? 1 step Enter © Swedbank 2 step Make ICA customer choose you

5. Integrate systems and processes • Integrate insurance offering with other bank products • Align interface formats ”colors and fonts” © Swedbank

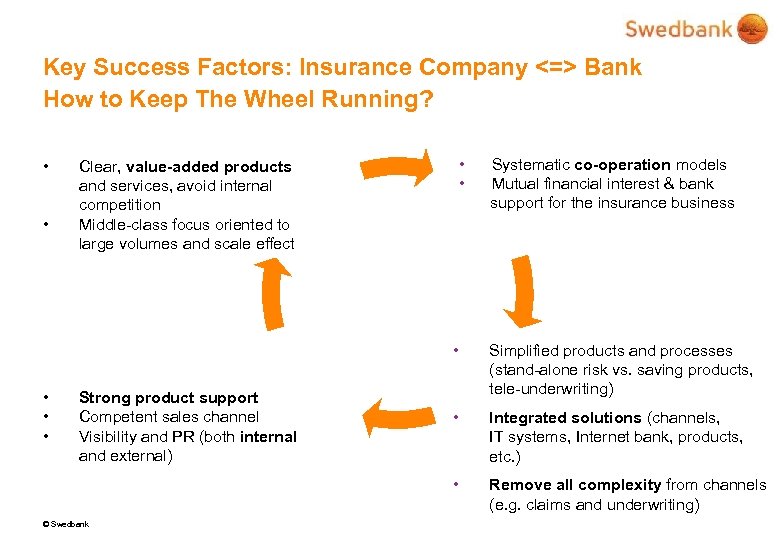

Key Success Factors: Insurance Company <=> Bank How to Keep The Wheel Running? • • Clear, value-added products and services, avoid internal competition Middle-class focus oriented to large volumes and scale effect • • Systematic co-operation models Mutual financial interest & bank support for the insurance business • Strong product support Competent sales channel Visibility and PR (both internal and external) © Swedbank • Integrated solutions (channels, IT systems, Internet bank, products, etc. ) • • Simplified products and processes (stand-alone risk vs. saving products, tele-underwriting) Remove all complexity from channels (e. g. claims and underwriting)

f497acd56fd3e4ecf234b21935c22b08.ppt