c3bfc1e1092a25bba27d6360d5ad9373.ppt

- Количество слайдов: 20

Baltika Breweries H 1’ 06 Results August 10, 2006

Contents • Financial Results • Russian Beer Market and Baltika Breweries • Outlook 2

Overview of Developments in 1 H’ 06 • Excellent profit performance ― Net Sales 531. 6 MEUR, +18, 2% – EBITDA 162. 4 MEUR, +21. 5% – EBIT 124. 8 MEUR, +23. 8 % • Russian market volume growth of 6. 1% • Improvement of volume dynamics in Q 2’ 06 – Total volume of Baltika Breweries 11. 2 MHL, +4. 0 % – Export volume of Breweries Group 0. 8 MHL, +8%; with license volume in Ukraine volume growth abroad +18% – Beer Volume of Baltika Breweries in Russia in Q 2’ 06 6. 6 MHL, +8. 5% – Market share in Russia in H 1’ 06 23. 6%, -0. 4%pts. ; market share of Breweries Group 35. 6%, -0. 7%pts – Market share in Russia in Q 2’ 06 24%, -0. 1%п. п. ; market share of Breweries Group * 36%, -0. 4%п. п. *Baltika, Vena, Pikra, Yarpivo 3

Financial Results 4

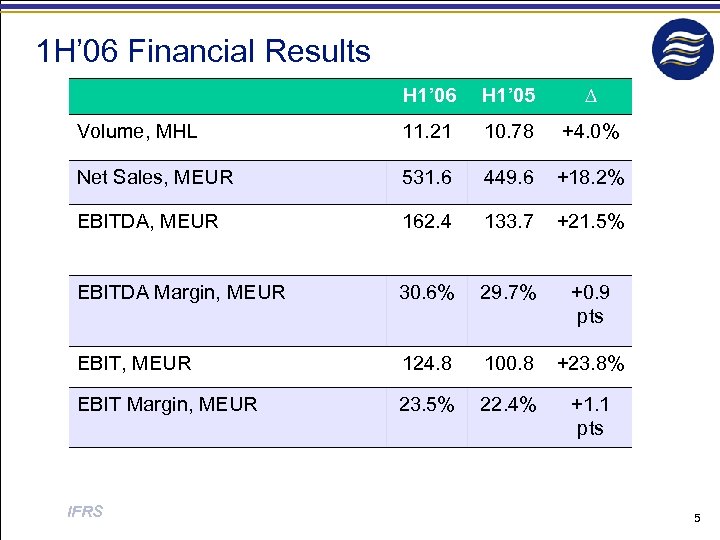

1 H’ 06 Financial Results H 1’ 06 H 1’ 05 ∆ Volume, MHL 11. 21 10. 78 +4. 0% Net Sales, MEUR 531. 6 449. 6 +18. 2% EBITDA, MEUR 162. 4 133. 7 +21. 5% EBITDA Margin, MEUR 30. 6% 29. 7% +0. 9 pts EBIT, MEUR 124. 8 100. 8 +23. 8% EBIT Margin, MEUR 23. 5% 22. 4% +1. 1 pts IFRS 5

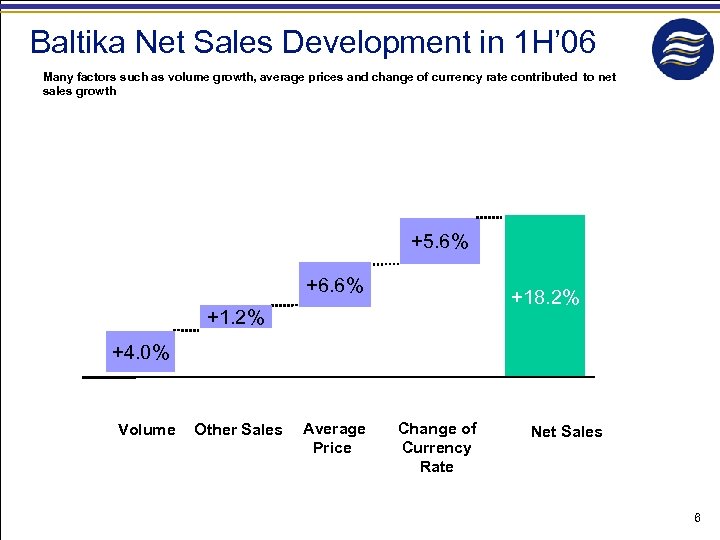

Baltika Net Sales Development in 1 H’ 06 Many factors such as volume growth, average prices and change of currency rate contributed to net sales growth +5. 6% +6. 6% +18. 2% +1. 2% +4. 0% Volume Other Sales Average Price Change of Currency Rate Net Sales 6

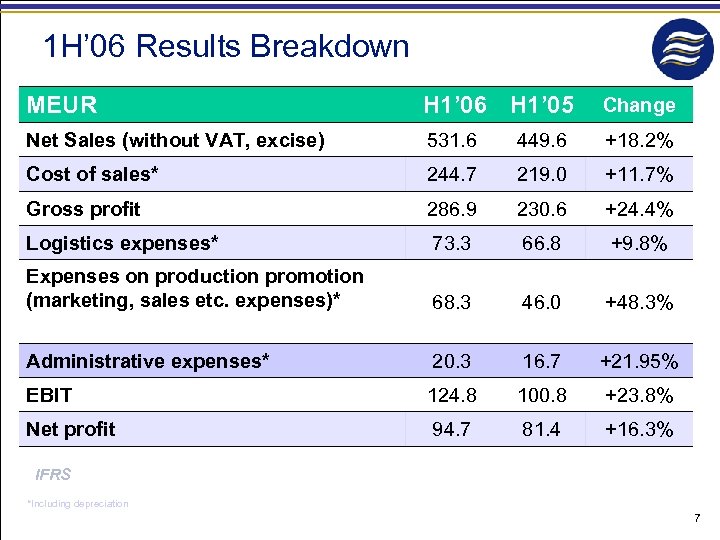

1 H’ 06 Results Breakdown MEUR H 1’ 06 H 1’ 05 Change Net Sales (without VAT, excise) 531. 6 449. 6 +18. 2% Cost of sales* 244. 7 219. 0 +11. 7% Gross profit 286. 9 230. 6 +24. 4% Logistics expenses* 73. 3 66. 8 +9. 8% Expenses on production promotion (marketing, sales etc. expenses)* 68. 3 46. 0 +48. 3% Administrative expenses* 20. 3 16. 7 +21. 95% EBIT 124. 8 100. 8 +23. 8% Net profit 94. 7 81. 4 +16. 3% IFRS *Including depreciation 7

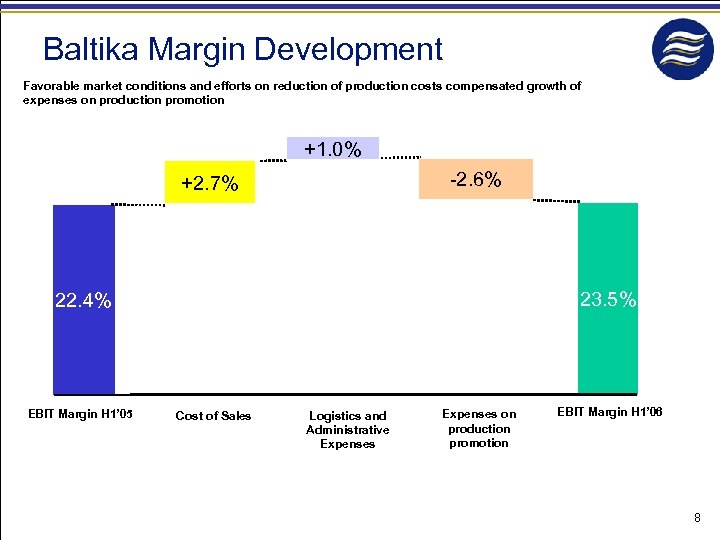

Baltika Margin Development Favorable market conditions and efforts on reduction of production costs compensated growth of expenses on production promotion +1. 0% -2. 6% +2. 7% 23. 5% 22. 4% EBIT Margin H 1’ 05 Cost of Sales Logistics and Administrative Expenses on production promotion EBIT Margin H 1’ 06 8

Russian Beer Market and Baltika Breweries 9

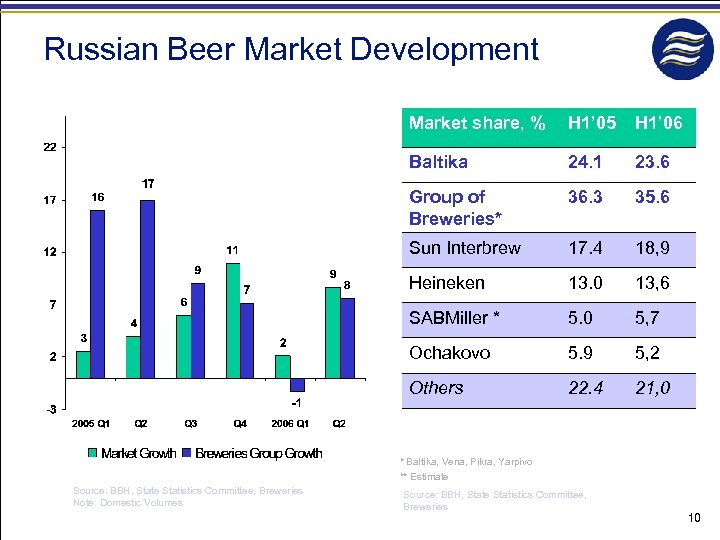

Russian Beer Market Development Market share, % H 1’ 05 H 1’ 06 Baltika 24. 1 23. 6 Group of Breweries* 36. 3 35. 6 Sun Interbrew 17. 4 18, 9 Heineken 13. 0 13, 6 SABMiller * 5. 0 5, 7 Ochakovo 5. 9 5, 2 Others 22. 4 21, 0 * Baltika, Vena, Pikra, Yarpivo ** Estimate Source: BBH, State Statistics Committee, Breweries Note: Domestic Volumes Source: BBH, State Statistics Committee, Breweries 10

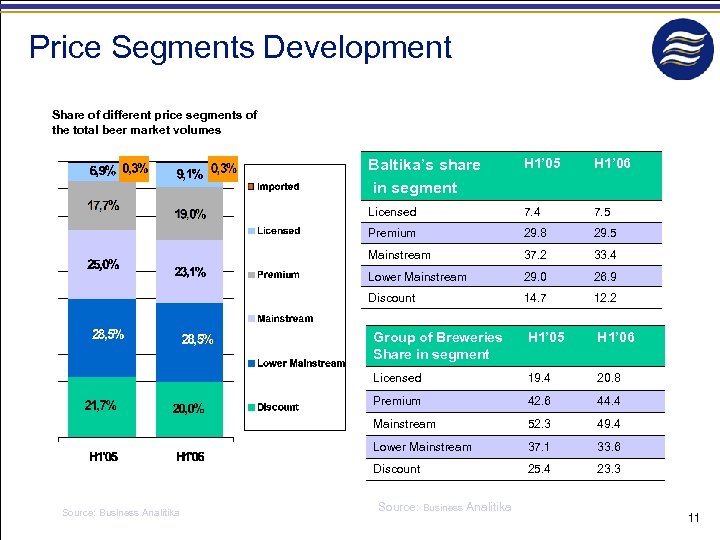

Price Segments Development Share of different price segments of the total beer market volumes Baltika’s share in segment H 1’ 05 H 1’ 06 Licensed 7. 4 7. 5 Premium 29. 8 29. 5 Mainstream 37. 2 33. 4 Lower Mainstream 29. 0 26. 9 Discount 14. 7 12. 2 Group of Breweries Share in segment H 1’ 06 Licensed 19. 4 20. 8 Premium 42. 6 44. 4 Mainstream 52. 3 49. 4 Lower Mainstream 37. 1 33. 6 Discount Source: Business Analitika H 1’ 05 25. 4 23. 3 Source: Business Analitika 11

Ø Baltika and Arsenalnoye are two leading brands in Russia Ø Volume growth of licensed brands: Tuborg – brand № 1 in licensed segment +102. 2%, Carlsberg +22. 4%, Foster’s +116. 9%, Kronenbourg 1664 +61. 8% Performance of Baltika Brands in 1 H’ 06 Ø Volume growth of premium brand Nevskoye +35. 6% Ø High volume growth of a number of regional brands: Don +24. 9%, Leningradskoye +47. 7% Ø Growth of market share of Breweries Group in licensed segment +1. 4% pts. (up to 20. 8%) Ø Growth of market share of Breweries Group in premium segment +1. 8% pts (up to 44. 4%) 12

Ø Launch of Foster’s in bottle 0. 5 l with ring-pool cork Инновации в начале 2006 года to twist-off cork Ø Launch of Kronenbourg 1664 in bottle 0. 46 l, brand transfer Ø Launch of a new brand in the Baltika portfolio – beer for young adults “Cooler” in a transparent bottle with NLL label and ring-pool cork Ø Launch of a new licensed brand Tuborg Twist in a transparent bottle with NLL label and ring-pool cork Ø Launch of Carlsberg in a new bottle format with a bottom opener Ø Launch of PET 2. 5 l for group of brands– Arsenalnoye, Kupecheskoye, DV, Uralsky Master etc. Ø Launch of a new packing mid-cone for can –brands Baltika 3, 7, Tuborg Ø Launch of Baltika 3 in PET 1. 0 l Ø Launch of Yarpivo brand in PET 1. 5 l 13

Outlook 14

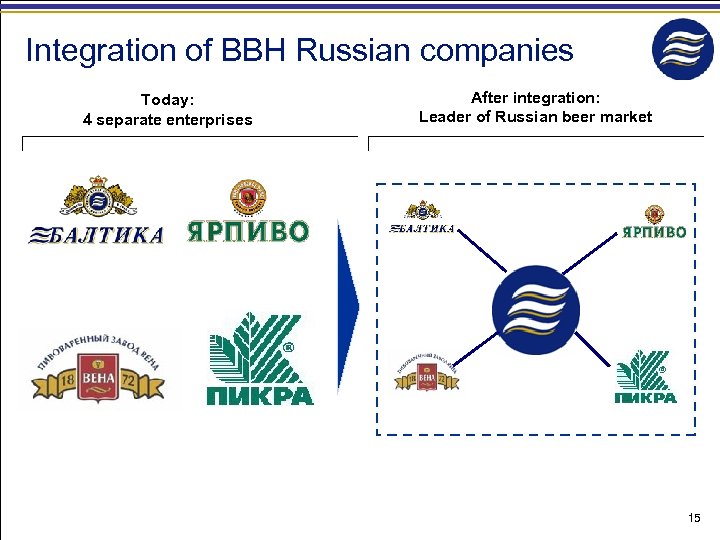

Integration of BBH Russian companies Today: 4 separate enterprises After integration: Leader of Russian beer market 15

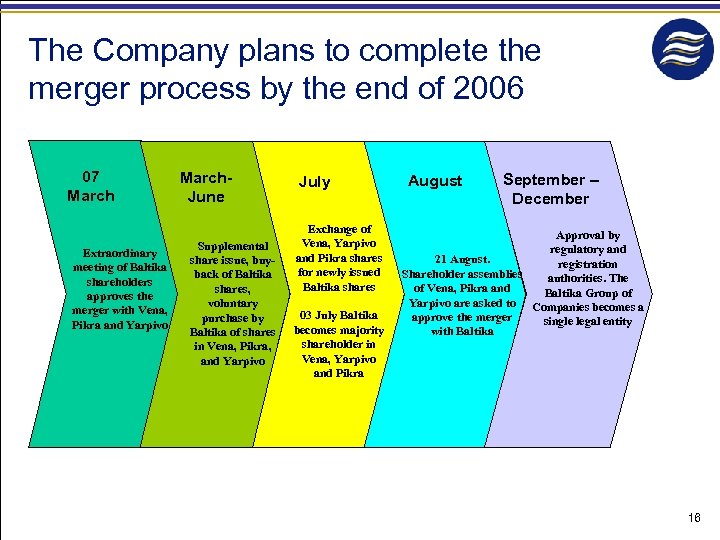

The Company plans to complete the merger process by the end of 2006 07 March Extraordinary meeting of Baltika shareholders approves the merger with Vena, Pikra and Yarpivo March. June Supplemental share issue, buyback of Baltika shares, voluntary purchase by Baltika of shares in Vena, Pikra, and Yarpivo July Exchange of Vena, Yarpivo and Pikra shares for newly issued Baltika shares 03 July Baltika becomes majority shareholder in Vena, Yarpivo and Pikra August September – December Approval by regulatory and 21 August. registration Shareholder assemblies authorities. The of Vena, Pikra and Baltika Group of Yarpivo are asked to Companies becomes a approve the merger single legal entity with Baltika 16

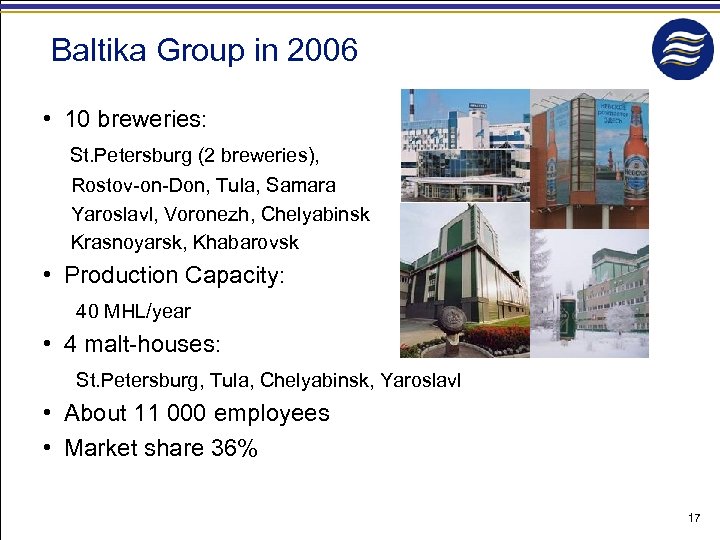

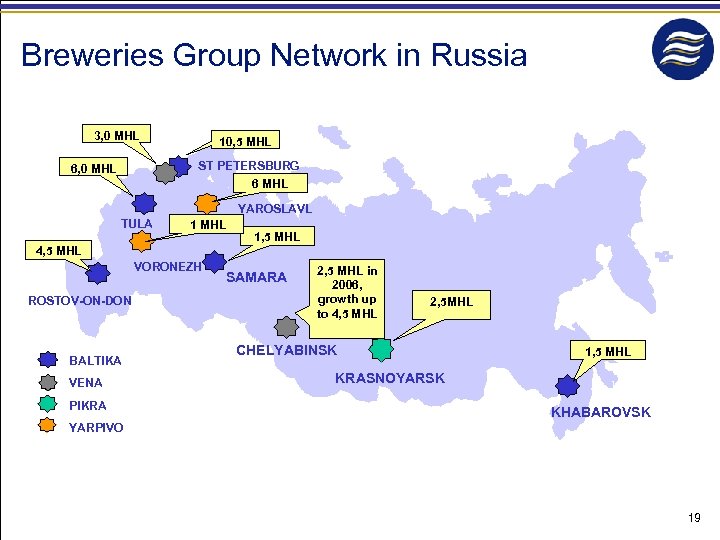

Baltika Group in 2006 • 10 breweries: St. Petersburg (2 breweries), Rostov-on-Don, Tula, Samara Yaroslavl, Voronezh, Chelyabinsk Krasnoyarsk, Khabarovsk • Production Capacity: 40 MHL/year • 4 malt-houses: St. Petersburg, Tula, Chelyabinsk, Yaroslavl • About 11 000 employees • Market share 36% 17

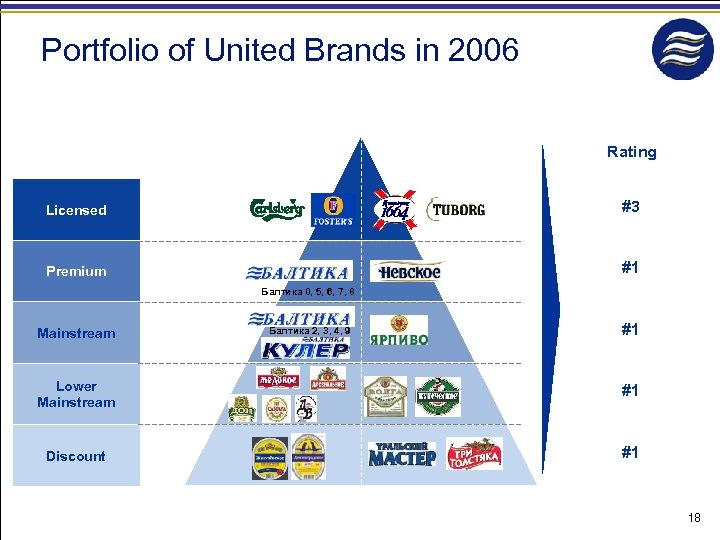

Portfolio of United Brands in 2006 Rating Licensed #3 Premium #1 Балтика 0, 5, 6, 7, 8 Mainstream Балтика 2, 3, 4, 9 #1 Lower Mainstream #1 Discount #1 18

Breweries Group Network in Russia 3, 0 МHL 10, 5 МHL ST PETERSBURG 6, 0 МHL 6 МHL YAROSLAVL TULA 1 МHL 1, 5 МHL 4, 5 МHL VORONEZH ROSTOV-ON-DON BALTIKA VENA PIKRA SAMARA 2, 5 МHL in 2006, growth up to 4, 5 МHL 2, 5 МHL CHELYABINSK 1, 5 MHL KRASNOYARSK KHABAROVSK YARPIVO 19

Baltika Breweries H 1’ 06 Results Thank you! IR: +7 812 329 40 93

c3bfc1e1092a25bba27d6360d5ad9373.ppt