c3835ed36ceacc66b86224b947c64ae6.ppt

- Количество слайдов: 32

Baltika Breweries 2005 Results March 16, 2006

Contents • Financial Results • Russian Beer Market and Baltika Breweries • Future Developments 2

Financial Results 3

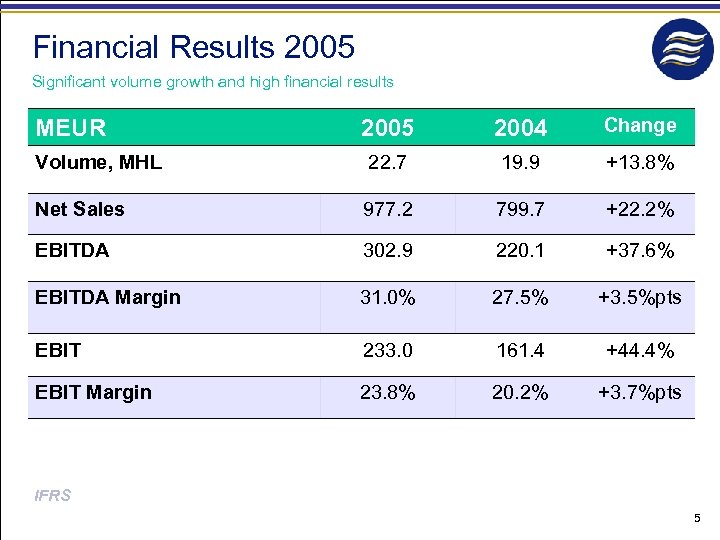

Overview of Developments in 2005 • Russian market volume growth of 6% • Strong volume growth – Total volumes 22, 7 MHL, +13. 8 % – Beer Volume 22, 4 MHL, +13. 1% – Export volume 1, 4 MHL, +23% – Market share in Russia 24. 1%, +1. 3 %pts • Excellent profit performance ― Net Sales 977. 2 MEUR, +22. 2 % – EBITDA 302. 9 MEUR, +37. 6 % – EBIT 233. 0 MEUR, +44. 4 % 4

Financial Results 2005 Significant volume growth and high financial results 2005 2004 Change Volume, MHL 22. 7 19. 9 +13. 8% Net Sales 977. 2 799. 7 +22. 2% EBITDA 302. 9 220. 1 +37. 6% EBITDA Margin 31. 0% 27. 5% +3. 5%pts EBIT 233. 0 161. 4 +44. 4% EBIT Margin 23. 8% 20. 2% +3. 7%pts MEUR IFRS 5

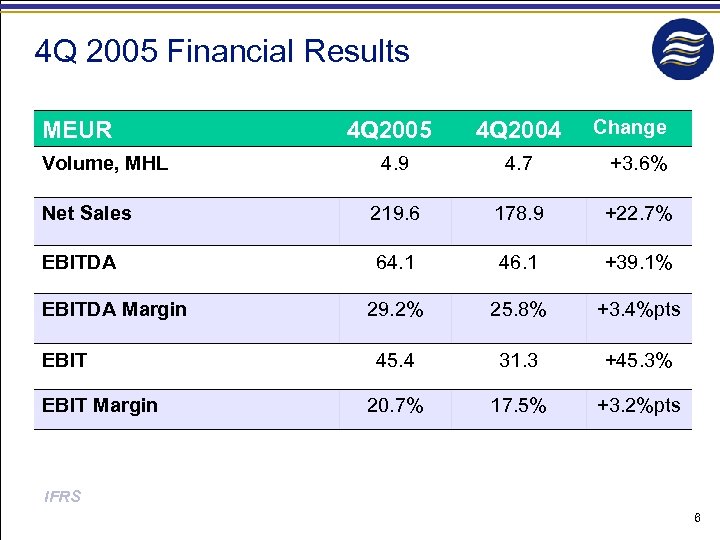

4 Q 2005 Financial Results MEUR Volume, MHL 4 Q 2005 4 Q 2004 Change 4. 9 4. 7 +3. 6% Net Sales 219. 6 178. 9 +22. 7% EBITDA 64. 1 46. 1 +39. 1% 29. 2% 25. 8% +3. 4%pts 45. 4 31. 3 +45. 3% 20. 7% 17. 5% +3. 2%pts EBITDA Margin EBIT Margin IFRS 6

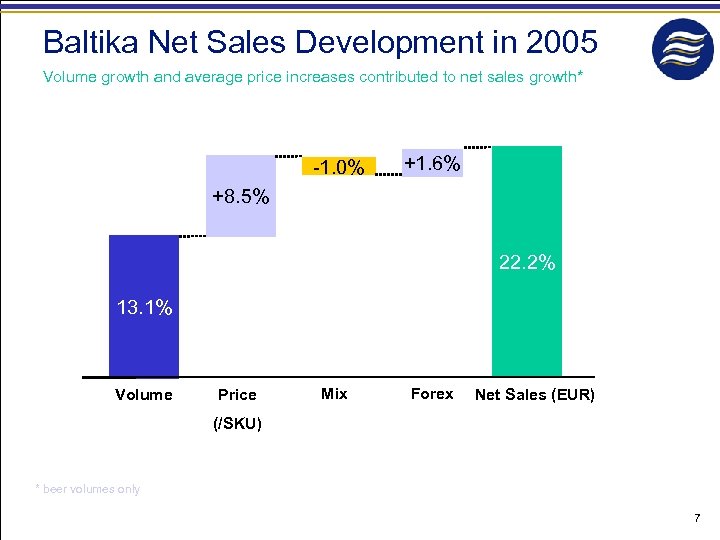

Baltika Net Sales Development in 2005 Volume growth and average price increases contributed to net sales growth* -1. 0% +1. 6% +8. 5% 22. 2% 13. 1% Volume Price Mix Forex Net Sales (EUR) (/SKU) * beer volumes only 7

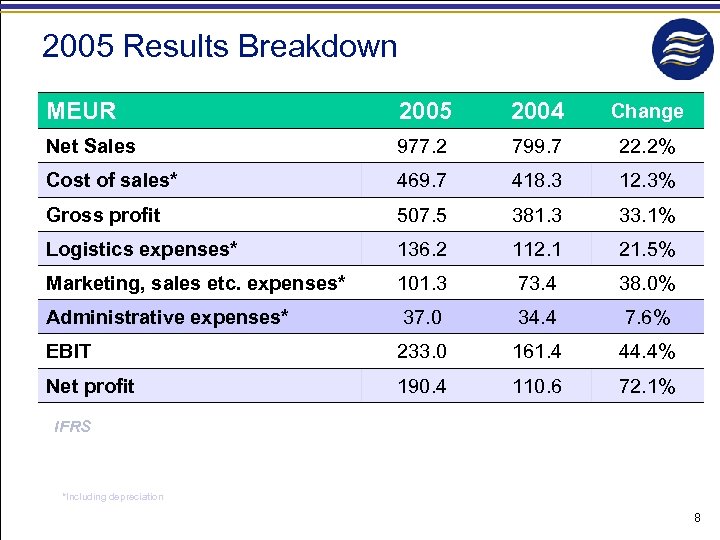

2005 Results Breakdown MEUR 2005 2004 Change Net Sales 977. 2 799. 7 22. 2% Cost of sales* 469. 7 418. 3 12. 3% Gross profit 507. 5 381. 3 33. 1% Logistics expenses* 136. 2 112. 1 21. 5% Marketing, sales etc. expenses* 101. 3 73. 4 38. 0% Administrative expenses* 37. 0 34. 4 7. 6% EBIT 233. 0 161. 4 44. 4% Net profit 190. 4 110. 6 72. 1% IFRS *Including depreciation 8

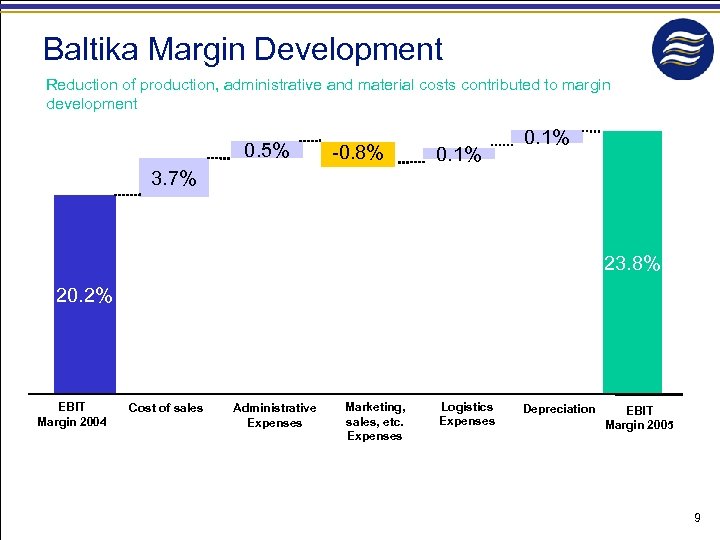

Baltika Margin Development Reduction of production, administrative and material costs contributed to margin development 0. 5% -0. 8% 0. 1% 3. 7% 23. 8% 20. 2% EBIT Margin 2004 Cost of sales Administrative Expenses Marketing, sales, etc. Expenses Logistics Expenses Depreciation EBIT Margin 2005 9

Russian Beer Market and Baltika Breweries 10

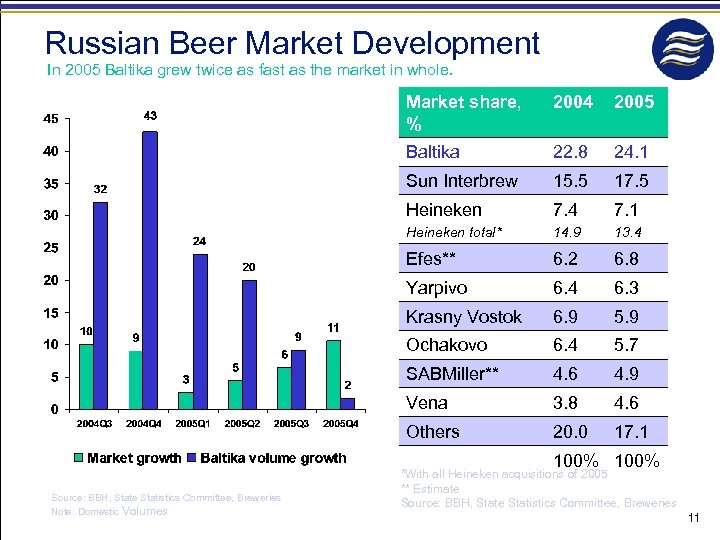

Russian Beer Market Development In 2005 Baltika grew twice as fast as the market in whole. Market share, % 2004 2005 Baltika 22. 8 24. 1 Sun Interbrew 15. 5 17. 5 Heineken 7. 4 7. 1 Heineken total* 14. 9 13. 4 Efes** 6. 2 6. 8 Yarpivo 6. 4 6. 3 Krasny Vostok 6. 9 5. 9 Ochakovo 6. 4 5. 7 SABMiller** 4. 6 4. 9 Vena 3. 8 4. 6 Others 20. 0 17. 1 100% Source: BBH, State Statistics Committee, Breweries Note: Domestic Volumes *With all Heineken acquisitions of 2005 ** Estimate Source: BBH, State Statistics Committee, Breweries 11

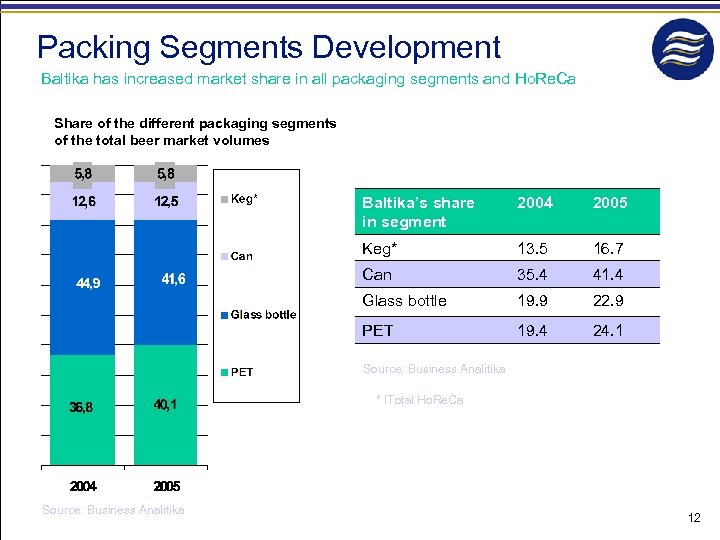

Packing Segments Development Baltika has increased market share in all packaging segments and Ho. Re. Ca Share of the different packaging segments of the total beer market volumes Baltika’s share in segment 2004 2005 Keg* 13. 5 16. 7 Can 35. 4 41. 4 Glass bottle 19. 9 22. 9 PET 19. 4 24. 1 Source: Business Analitika * ITotal Ho. Re. Ca Source: Business Analitika 12

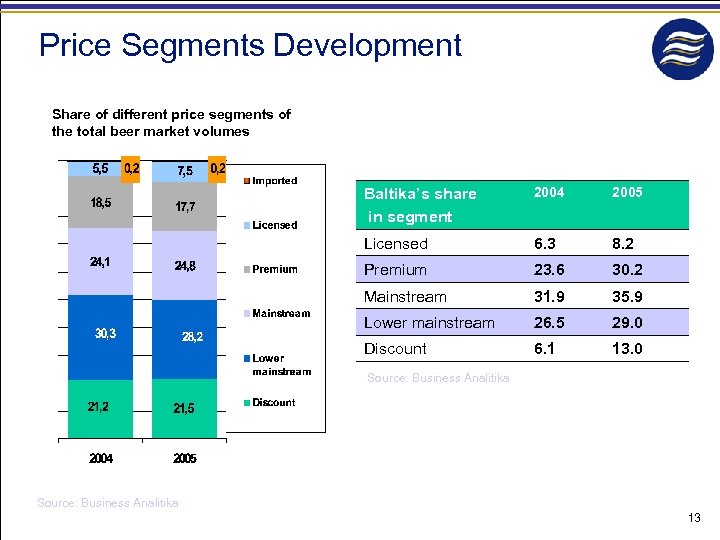

Price Segments Development Share of different price segments of the total beer market volumes Baltika’s share in segment 2004 2005 Licensed 6. 3 8. 2 Premium 23. 6 30. 2 Mainstream 31. 9 35. 9 Lower mainstream 26. 5 29. 0 Discount 6. 1 13. 0 Source: Business Analitika 13

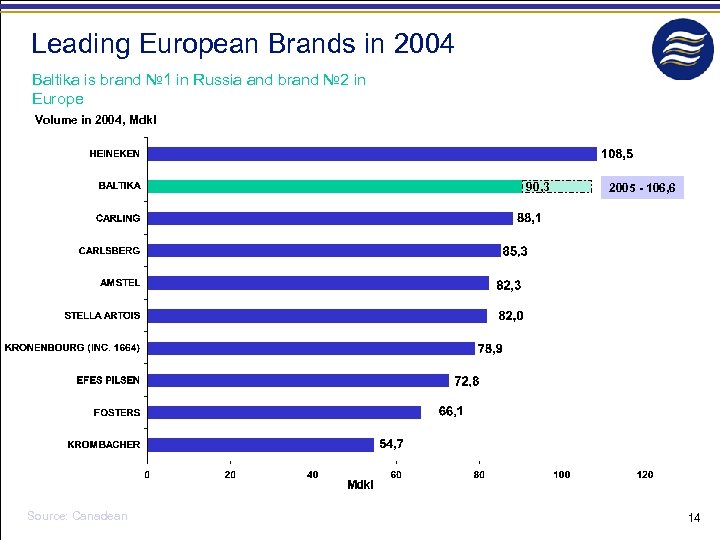

Leading European Brands in 2004 Baltika is brand № 1 in Russia and brand № 2 in Europe Volume in 2004, Mdkl 90, 3 Source: Canadean 2005 - 106, 6 14

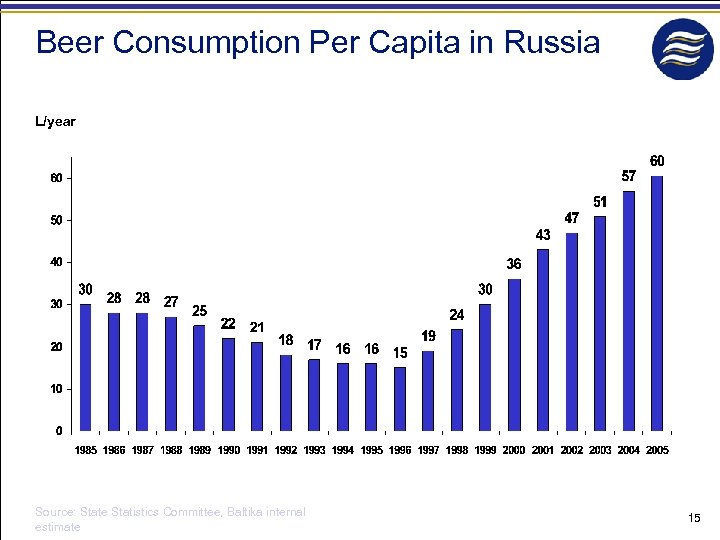

Beer Consumption Per Capita in Russia L/year Source: State Statistics Committee, Baltika internal estimate 15

Performance of Baltika Brands in 2005 • Baltika (market share 10. 9%) and Arsenalnoye (5. 4%) are the two leading brands of Russia • Baltika brand volumes growth +11. 5%, Arsenalnoye up +6. 2% • Significant growth of regional brands – Leningradskoye +49%, DV +35%, Samara + 17% • Most growth noted in segments*: premium +6. 6 %pts (market share 30. 2%), mainstream +4 %pts (35. 9%), discount +7, 0 %pts (13%) * Source: Business Analitika 16

• Re-styling of all Baltika sub-brands • Innovations“Cash-Can” (can with cash inside) for First in Russia at Baltika in 2005 Baltika brand national promo-action • Re-styling of Arsenalnoye and Medovoye brands • New sub-brand Arsenalnoye Zakalennoye with spicy chili launched • Re-styling of regional brands DV, Samara, Don • First produced brand in a bottle with transparent label Carlsberg • Baltika № 9 first produced in PET 1, 5 L 17

Future Developments 18

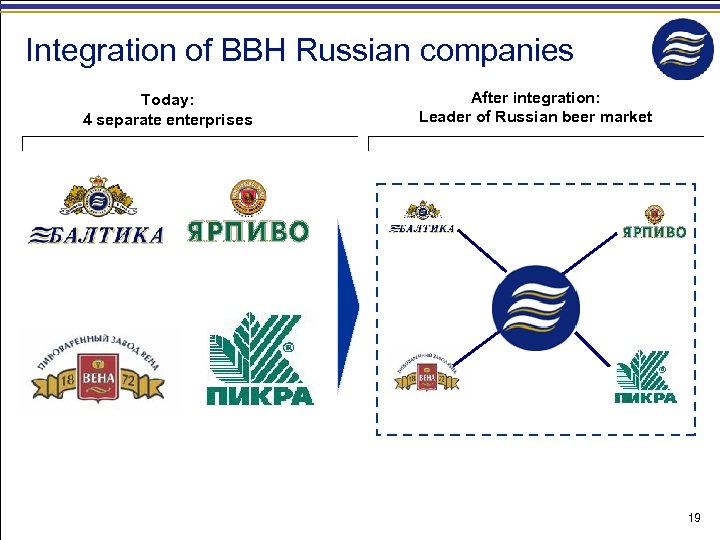

Integration of BBH Russian companies Today: 4 separate enterprises After integration: Leader of Russian beer market 19

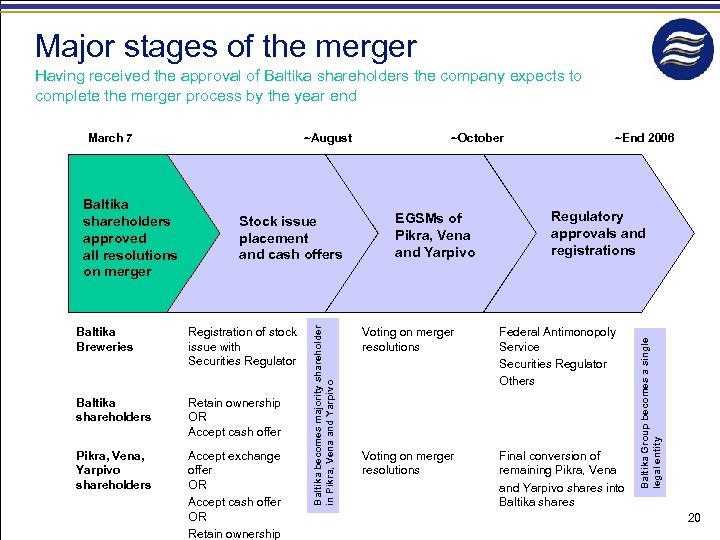

Major stages of the merger Having received the approval of Baltika shareholders the company expects to complete the merger process by the year end Stock issue placement and cash offers Baltika Breweries Registration of stock issue with Securities Regulator Baltika shareholders Retain ownership OR Accept cash offer Pikra, Vena, Yarpivo shareholders Accept exchange offer OR Accept cash offer OR Retain ownership Baltika becomes majority shareholder in Pikra, Vena and Yarpivo Baltika shareholders approved all resolutions on merger ~August ~October EGSMs of Pikra, Vena and Yarpivo ~End 2006 Regulatory approvals and registrations Voting on merger resolutions Federal Antimonopoly Service Securities Regulator Others Voting on merger resolutions Final conversion of remaining Pikra, Vena and Yarpivo shares into Baltika shares Baltika Group becomes a single legal entity March 7 20

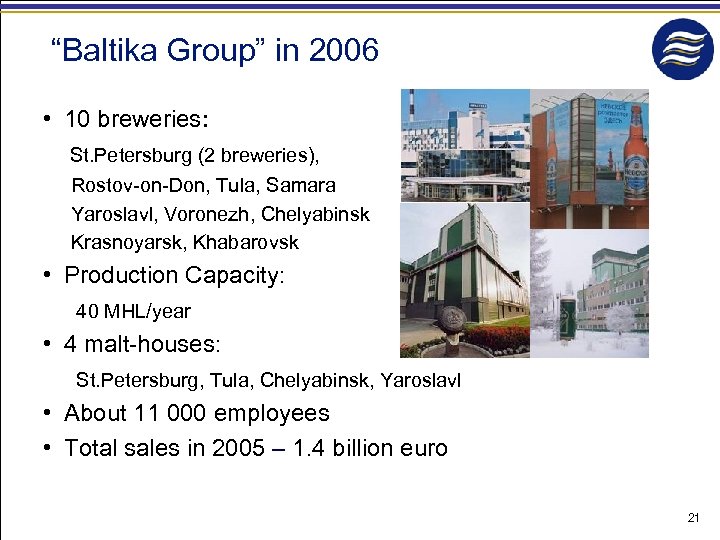

“Baltika Group” in 2006 • 10 breweries: St. Petersburg (2 breweries), Rostov-on-Don, Tula, Samara Yaroslavl, Voronezh, Chelyabinsk Krasnoyarsk, Khabarovsk • Production Capacity: 40 MHL/year • 4 malt-houses: St. Petersburg, Tula, Chelyabinsk, Yaroslavl • About 11 000 employees • Total sales in 2005 – 1. 4 billion euro 21

Group Brewery Network in Russia 3, 0 МHL 10, 5 МHL ST PETERSBURG 6, 0 МHL 6 МHL TULA YAROSLAVL 1 МHL 1, 5 МHL 4, 5 МHL VORONEZH ROSTOV-ON-DON SAMAR A 2, 5 МHL in 2006, growth up to 4, 5 МHL CHELYABINSK 2, 0 МHL in 2006, growth up to 2, 5 МHL BALTIKA VENA PIKRA 1, 5 MHL KRASNOYARSK KHABAROVSK YARPIVO 22

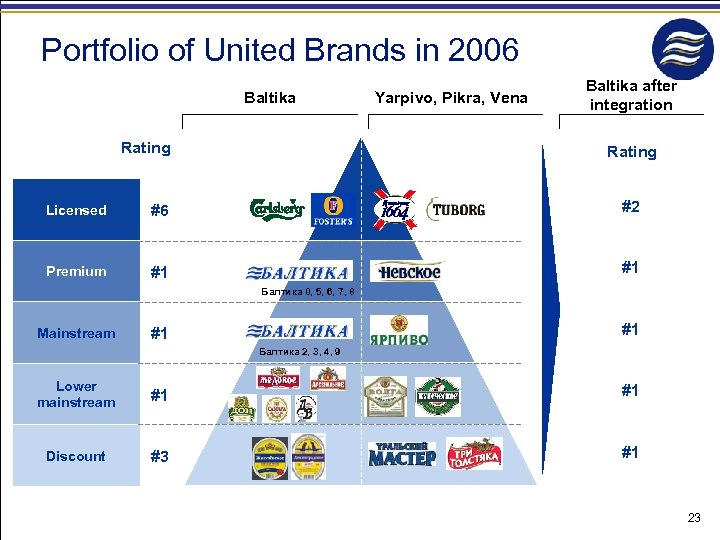

Portfolio of United Brands in 2006 Baltika Rating Yarpivo, Pikra, Vena Baltika after integration Rating Licensed #6 #2 Premium #1 #1 Балтика 0, 5, 6, 7, 8 Mainstream #1 #1 Балтика 2, 3, 4, 9 Lower mainstream #1 #1 Discount #3 #1 23

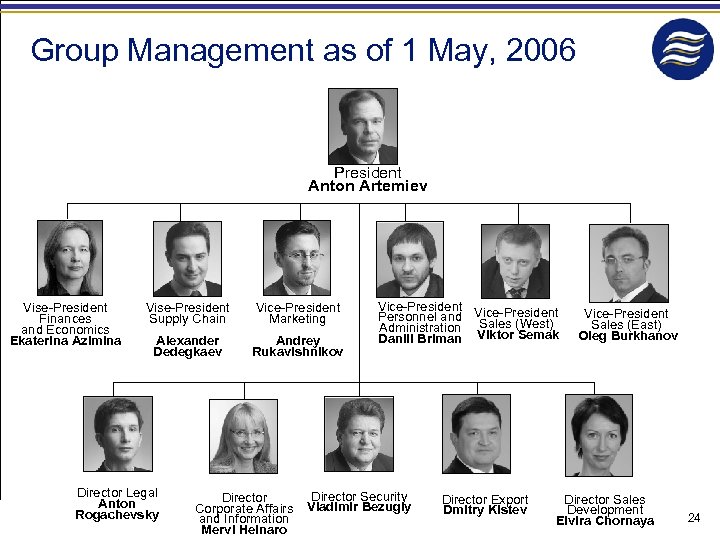

Group Management as of 1 May, 2006 President Anton Artemiev Vise-President Finances and Economics Ekaterina Azimina Vise-President Supply Chain Vice-President Marketing Alexander Dedegkaev Andrey Rukavishnikov Director Legal Anton Rogachevsky Director Corporate Affairs and Information Mervi Heinaro Vice-President Personnel and Vice-President Administration Sales (West) Daniil Briman Viktor Semak Director Security Vladimir Bezugly Director Export Dmitry Kistev Vice-President Sales (East) Oleg Burkhanov Director Sales Development Elvira Chornaya 24

Baltika Breweries 2005 Results Thank you!

Supplementary Information 26

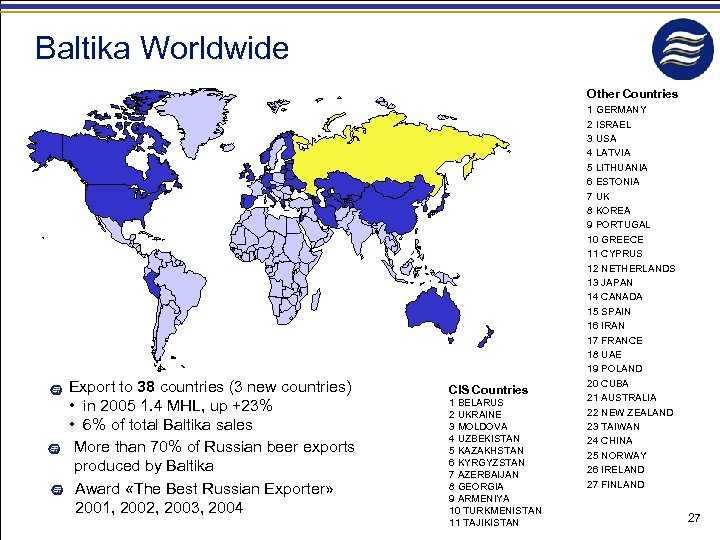

Baltika Worldwide Other Countries Export to 38 countries (3 new countries) • in 2005 1. 4 MHL, up +23% • 6% of total Baltika sales More than 70% of Russian beer exports produced by Baltika Award «The Best Russian Exporter» 2001, 2002, 2003, 2004 CIS Countries 1 BELARUS 2 UKRAINE 3 MOLDOVA 4 UZBEKISTAN 5 KAZAKHSTAN 6 KYRGYZSTAN 7 AZERBAIJAN 8 GEORGIA 9 ARMENIYA 10 TURKMENISTAN 11 TAJIKISTAN 1 GERMANY 2 ISRAEL 3 USA 4 LATVIA 5 LITHUANIA 6 ESTONIA 7 UK 8 KOREA 9 PORTUGAL 10 GREECE 11 CYPRUS 12 NETHERLANDS 13 JAPAN 14 CANADA 15 SPAIN 16 IRAN 17 FRANCE 18 UAE 19 POLAND 20 CUBA 21 AUSTRALIA 22 NEW ZEALAND 23 TAIWAN 24 CHINA 25 NORWAY 26 IRELAND 27 FINLAND 27

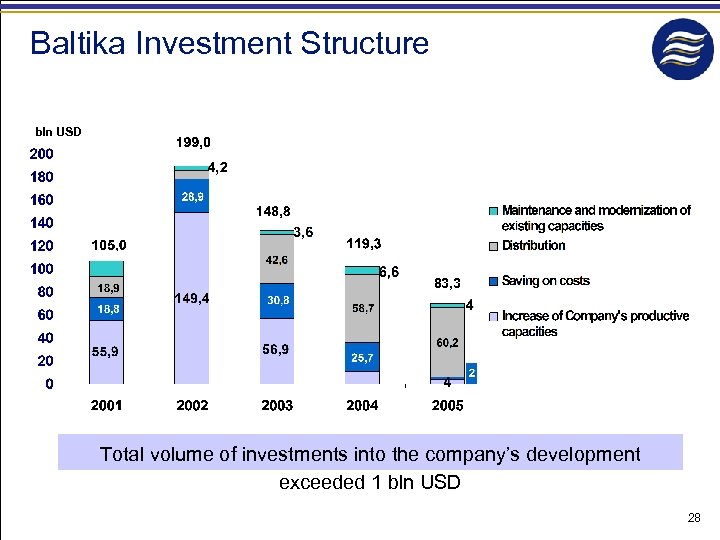

Baltika Investment Structure bln USD 83, 3 Total volume of investments into the company’s development exceeded 1 bln USD 28

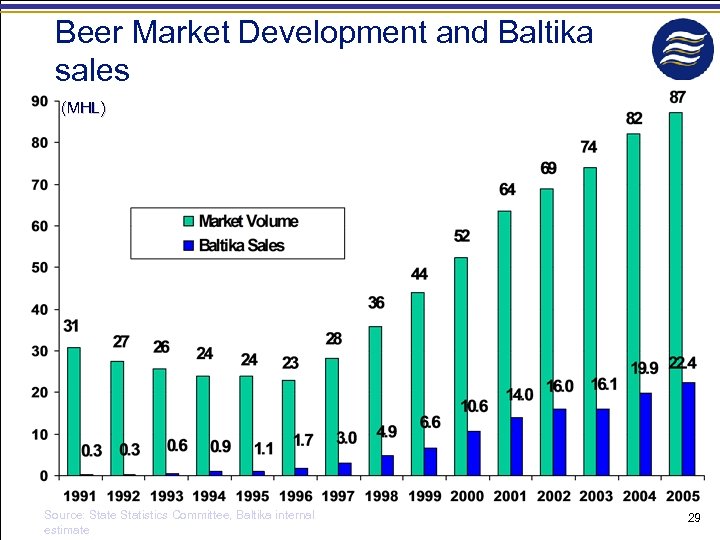

Beer Market Development and Baltika sales (MHL) Source: State Statistics Committee, Baltika internal estimate 29

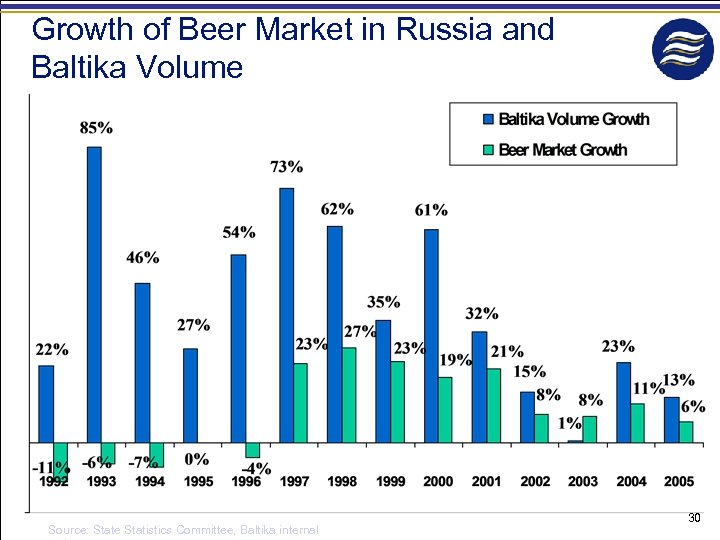

Growth of Beer Market in Russia and Baltika Volume Source: State Statistics Committee, Baltika internal 30

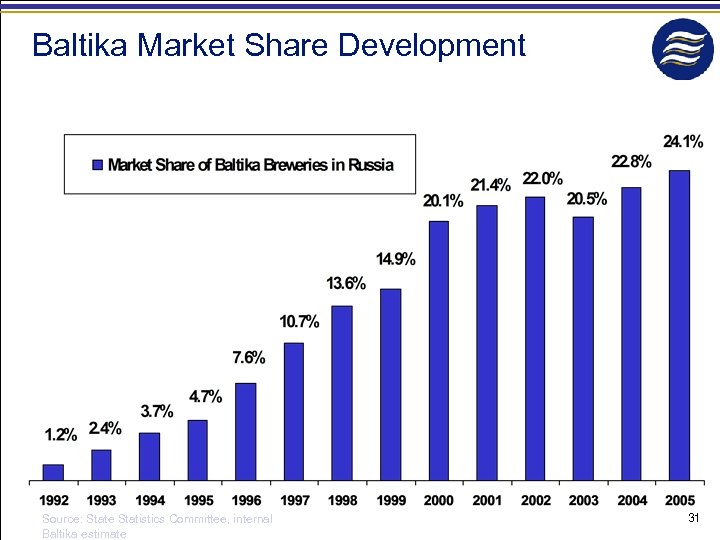

Baltika Market Share Development Source: State Statistics Committee, internal Baltika estimate 31

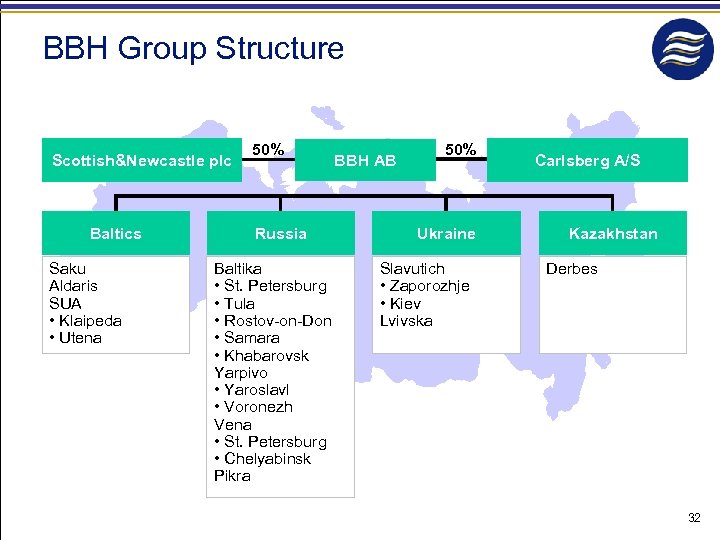

BBH Group Structure Scottish&Newcastle plc Baltics Saku Aldaris SUA • Klaipeda • Utena 50% Russia Baltika • St. Petersburg • Tula • Rostov-on-Don • Samara • Khabarovsk Yarpivo • Yaroslavl • Voronezh Vena • St. Petersburg • Chelyabinsk Pikra BBH AB 50% Ukraine Slavutich • Zaporozhje • Kiev Lvivska Carlsberg A/S Kazakhstan Derbes 32

c3835ed36ceacc66b86224b947c64ae6.ppt