5026d9951930f9452cebb5afafdae403.ppt

- Количество слайдов: 40

Balancing the market power on the supplier and creative use markets Impacts of competition law Ida Madieha bt. Abdul Ghani Azmi Civil Law Department International islamic University Malaysia

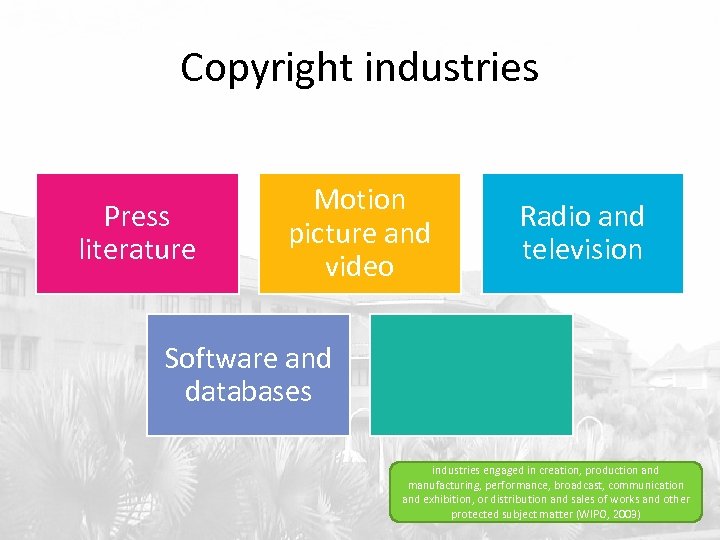

Copyright industries Press literature Motion picture and video Radio and television Software and databases industries engaged in creation, production and manufacturing, performance, broadcast, communication and exhibition, or distribution and sales of works and other protected subject matter (WIPO, 2003)

Creative market • • • Size of creative market Primary and secondary market Upstream vs downstream market Effect of digitisation Problem with licensing; cross border licensing Licensing practices of collecting societies – Territorial restrictions, discrimination in cross border distribution of royalties and membership rules

Creative industries: competition policy in the digital age • Effect of digital technology – Geographical borders cease to exist – Barriers to market = low – Traditional market definition no longer applies – Traditional market vs digital markets – Requires a broader conception of ‘market’ – More cooperation along the supply chain – Requires a revisit of the collaboration that may damage competition – Need for Simpler form of rights clearance

Nature of copyright market • Dominant players vs large number of small players • Dynamic, competitive • Conglomerate vs mergers of SMEs

Nature of IP Exclusive Rights Negativ e rights Positive rights Obtain market power!!

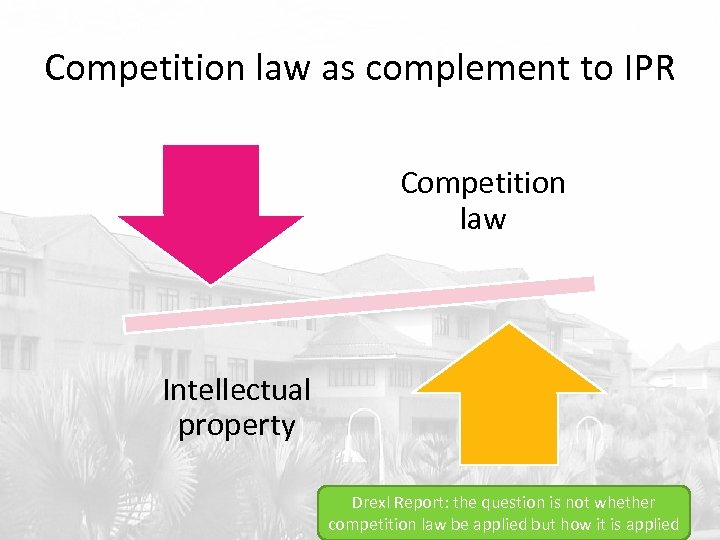

Competition law as complement to IPR Competition law Intellectual property Drexl Report: the question is not whether competition law be applied but how it is applied

Caveat • Relatively new to competition law • Cases so far on horizontal agreement but NON copyright industries • Guidelines on vertical and horizontal agreements as well as abuse of dominant position but not yet on IPR

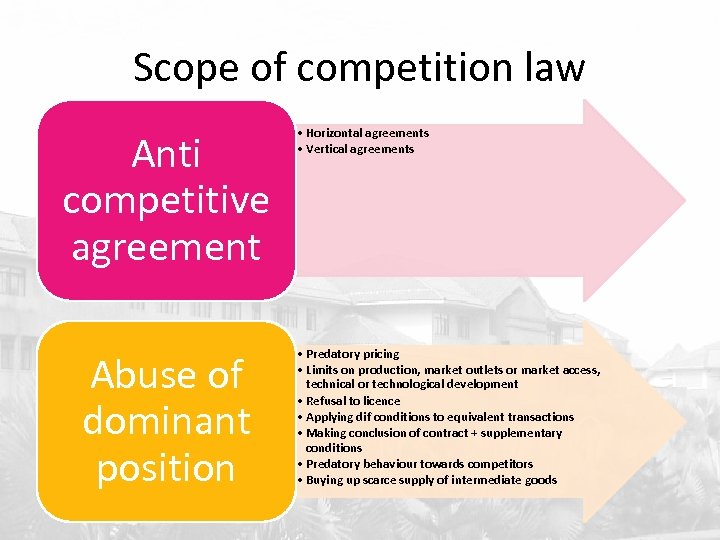

Scope of competition law Anti competitive agreement Abuse of dominant position • Horizontal agreements • Vertical agreements • Predatory pricing • Limits on production, market outlets or market access, technical or technological development • Refusal to licence • Applying dif conditions to equivalent transactions • Making conclusion of contract + supplementary conditions • Predatory behaviour towards competitors • Buying up scarce supply of intermediate goods

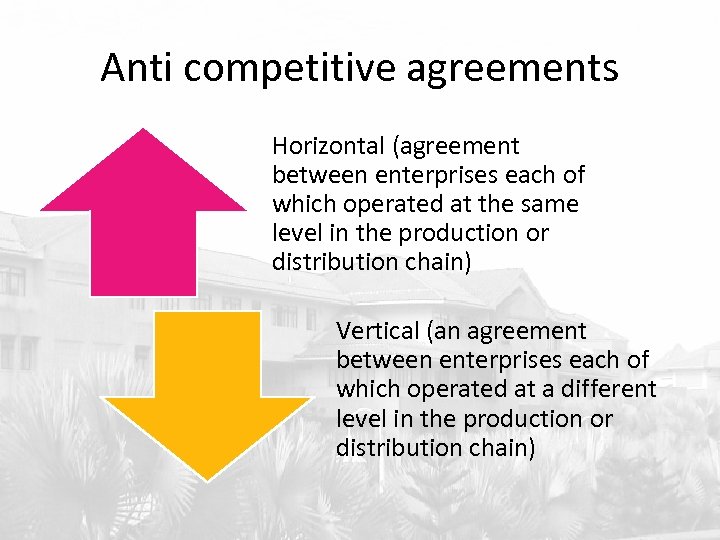

Anti competitive agreements Horizontal (agreement between enterprises each of which operated at the same level in the production or distribution chain) Vertical (an agreement between enterprises each of which operated at a different level in the production or distribution chain)

Anti competitive agreements? • Section 4(1) of the Act – prohibits agreements which has the object or effect of significantly distorting competition in the market • “a horizontal or vertical agreement between enterprises is prohibited in so far as the agreement has the object or effect of significantly preventing, restricting or distorting competition in any market for goods or services”

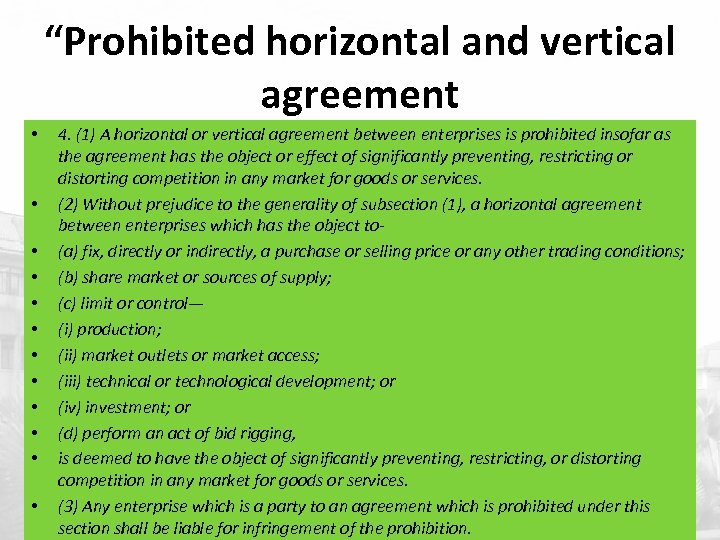

“Prohibited horizontal and vertical agreement • • • 4. (1) A horizontal or vertical agreement between enterprises is prohibited insofar as the agreement has the object or effect of significantly preventing, restricting or distorting competition in any market for goods or services. (2) Without prejudice to the generality of subsection (1), a horizontal agreement between enterprises which has the object to(a) fix, directly or indirectly, a purchase or selling price or any other trading conditions; (b) share market or sources of supply; (c) limit or control— (i) production; (ii) market outlets or market access; (iii) technical or technological development; or (iv) investment; or (d) perform an act of bid rigging, is deemed to have the object of significantly preventing, restricting, or distorting competition in any market for goods or services. (3) Any enterprise which is a party to an agreement which is prohibited under this section shall be liable for infringement of the prohibition.

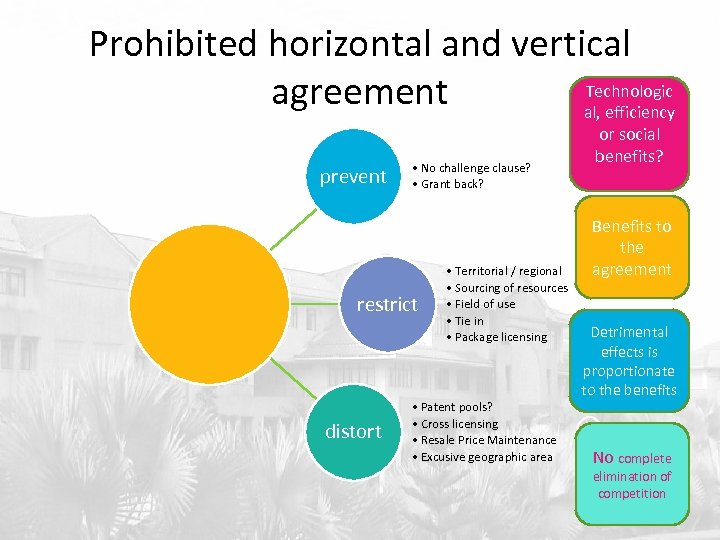

Prohibited horizontal and vertical Technologic agreement al, efficiency prevent • No challenge clause? • Grant back? restrict distort • Territorial / regional • Sourcing of resources • Field of use • Tie in • Package licensing • Patent pools? • Cross licensing • Resale Price Maintenance • Excusive geographic area or social benefits? Benefits to the agreement Detrimental effects is proportionate to the benefits No complete elimination of competition

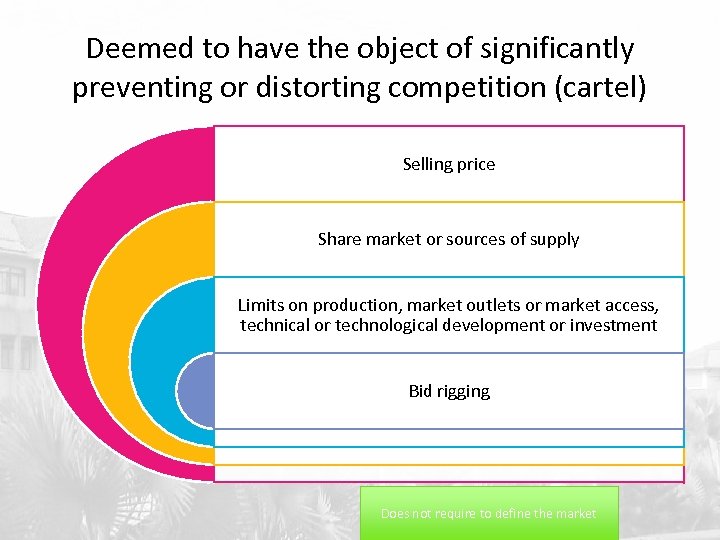

Deemed to have the object of significantly preventing or distorting competition (cartel) Selling price Share market or sources of supply Limits on production, market outlets or market access, technical or technological development or investment Bid rigging Does not require to define the market

MCC Guidelines on Market Competition • S 2: ‘a market in Malaysia or in any part of Malaysia, and when used in relation to any goods or services, includes a market for those goods or services and other goods or services that are substitutable for, or otherwise competitive with, the firstmentioned goods or services’ – Products can be substituted both on the demand supply side – 1. Market def = wh there is significant anti-competitive effect in the market – 2. determine the market shares of the competitors (HMT) • how easy to enter market – whethere are barriers to entry • Wh competition based on price of basis of the product features

Hypothetical Monopolist Test • “the smallest group of products (in a geographical area) that a hypothetical monopolist controlling that product group (in that area) could profitably sustain a price above the ‘competitive price i. e a price that is at least a small but significant amount above the competitive price • Price range of 5 -10% • Only Malaysian market; focal market

MYCC Guidelines on Ch 1 prohibition • Agreement = any form of contract, arrangement or understanding between enterprises, whether legally enforceable or not, and include decision by associations (such as trade and industry associations) and concerted practice • Agreement which has the object or effect of significantly preventing, restricting or distorting competition in any market or goods or services in Malaysia or in any part of Malaysia – Eg RPM – Exclusive geographic licence

Concerted practice • Any form of coordination between enterprises… the object of which • (a) to influence the conduct of one or more enterprises in a market; or • (b) to disclose the course of conduct which an enterprise has decided to adopt or is contemplating to adopt in a market…where such disclosure would not have been made under normal conditions of competition

Horizontal agreement • Include an agreement at any stage of production and distribution chain including an agreement between input producers and between manufacturers, wholesalers or retailers • Not Significant = if their market share of the relevant market does no exceed 20%

Vertical agreement • Eg resale price maintenance • Tying – required to buy a product from a different market that they do not want • Exclusive distribution agreement covering a geographic territory – limits intra band competition; either at wholesale or retail level

MYCC Guidelines on Ch 2 Prohibition • A market share of above 60% • “means a situation in which one or more enterprises possess such significant power in a market to adjust prices or outputs or trading terms, without effective constraint from competitors or potential competitors” • Either exploitative conduct (excessive pricing) of exclusionary conduct (predatory pricing; price discrimination; exclusive dealing; loyalty rebates and discounts; refusal to supply and sharing of essential facilities; buying up scarce intermediate goods or resources; bundling and tying

Examples of barriers to entry Economies of scale or size Economies of scope Regulated entry Limited access to necessary inputs or distribution outlets • Network effects • High sunk costs • Conduct by incumbents • •

Infringement of Section 4(2)(b) of the Competition Act 2010 by Malaysian Airline System Berhad, Air. Asia Berhad and Air. Asia X Sdn. Bhd. 31 st March 2014 NON COPYRIGHT CASES

Facts • MAS, Asia and Air. Asia X entered into a collaboration agreement • each airline to focus on their market area and will not enter into the areas specifically allocated to their competition • Intention of the parties or object of the parties is to share the market • optimise efficiency • Resulted in the withdraw Sabah and Sarawak routes

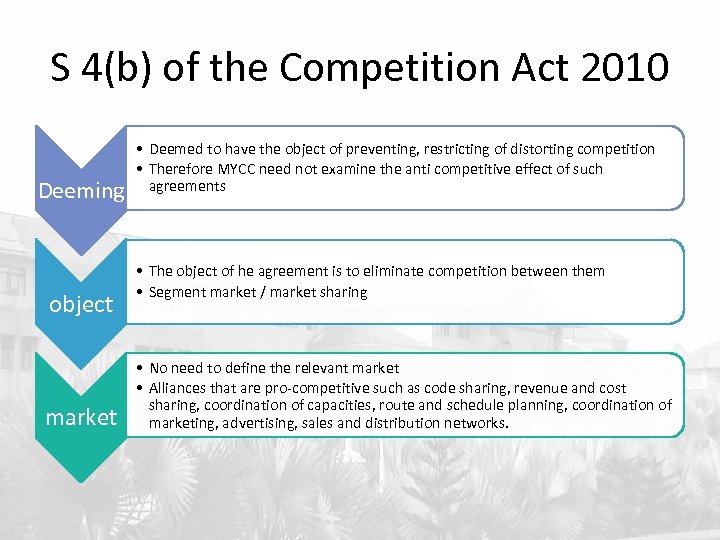

S 4(b) of the Competition Act 2010 Deeming object market • Deemed to have the object of preventing, restricting of distorting competition • Therefore MYCC need not examine the anti competitive effect of such agreements • The object of he agreement is to eliminate competition between them • Segment market / market sharing • No need to define the relevant market • Alliances that are pro-competitive such as code sharing, revenue and cost sharing, coordination of capacities, route and schedule planning, coordination of marketing, advertising, sales and distribution networks.

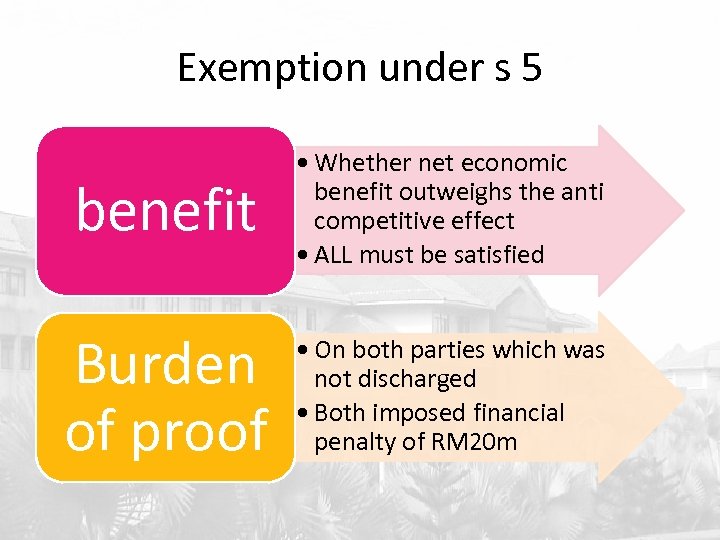

Exemption under s 5 benefit • Whether net economic benefit outweighs the anti competitive effect • ALL must be satisfied Burden of proof • On both parties which was not discharged • Both imposed financial penalty of RM 20 m

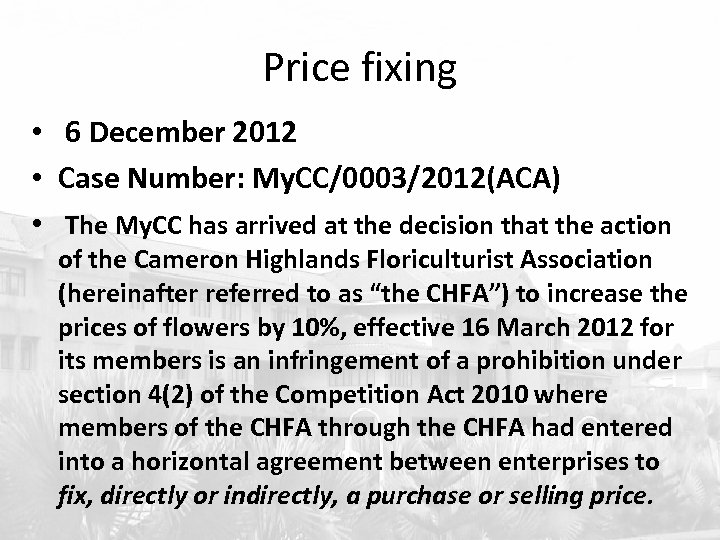

Price fixing • 6 December 2012 • Case Number: My. CC/0003/2012(ACA) • The My. CC has arrived at the decision that the action of the Cameron Highlands Floriculturist Association (hereinafter referred to as “the CHFA”) to increase the prices of flowers by 10%, effective 16 March 2012 for its members is an infringement of a prohibition under section 4(2) of the Competition Act 2010 where members of the CHFA through the CHFA had entered into a horizontal agreement between enterprises to fix, directly or indirectly, a purchase or selling price.

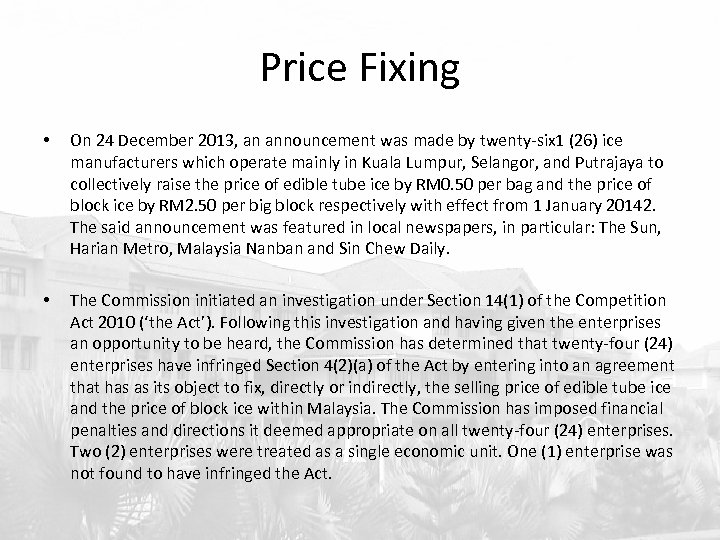

Price Fixing • On 24 December 2013, an announcement was made by twenty-six 1 (26) ice manufacturers which operate mainly in Kuala Lumpur, Selangor, and Putrajaya to collectively raise the price of edible tube ice by RM 0. 50 per bag and the price of block ice by RM 2. 50 per big block respectively with effect from 1 January 20142. The said announcement was featured in local newspapers, in particular: The Sun, Harian Metro, Malaysia Nanban and Sin Chew Daily. • The Commission initiated an investigation under Section 14(1) of the Competition Act 2010 (‘the Act’). Following this investigation and having given the enterprises an opportunity to be heard, the Commission has determined that twenty-four (24) enterprises have infringed Section 4(2)(a) of the Act by entering into an agreement that has as its object to fix, directly or indirectly, the selling price of edible tube ice and the price of block ice within Malaysia. The Commission has imposed financial penalties and directions it deemed appropriate on all twenty-four (24) enterprises. Two (2) enterprises were treated as a single economic unit. One (1) enterprise was not found to have infringed the Act.

Abuse of dominant position • Section 10 prohibits abuse of dominant position • “dominant position” means a situation in which one or more enterprises possess such significant power in a market to adjust prices or outputs or trading terms, without effective constraint from competitors or potential competitors

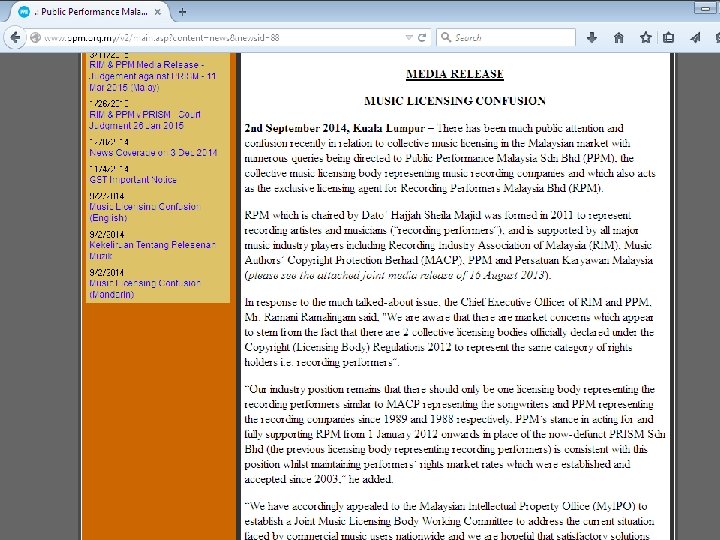

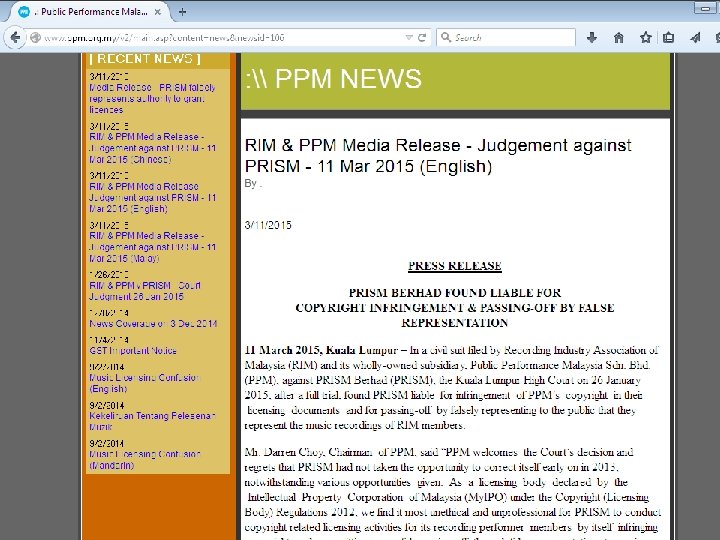

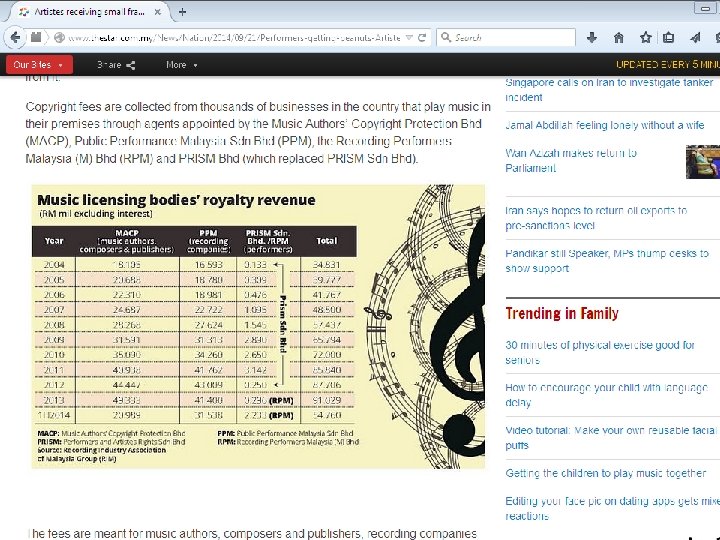

Collecting societies /Collective Rights Management Organizations • Behaviour need to be checked – abuse of dominant position • Whether rates imposed fair? The control of royalty rates among cmo • Restriction on copyright works available for licence – bundling of works on a repertoire • Cross border licensing

mergers • De-regulation of small mergers • Eg merger of music publishing and sound recording companies • Mergers of conglomerate media

Issues? challenges • Relevant market? • Having several players may not necessarily guarantee competition (Drexl 2007) • What if only one collecting society per work? Or per right? • Can be regulated through other means as well e. g. in Malaysia – answerable to the Copyright Controller • Or subject to copyright tribunal

Drexl conclusion on CMOs • Collecting societies tend to hold natural monopolies • Even if there are several CMOs, users still have to request licences from all cmos • The concept of “creative competition” argues for a system of collective administration, which obliges collecting societies to accept all users on a discriminatory basis. Such a • system will tend to lead to a monopoly of collecting societies.

5026d9951930f9452cebb5afafdae403.ppt