c44b011308d1d053e333ee0599f2a25f.ppt

- Количество слайдов: 18

Balance Sheet Ratios Roger Betz, Sherrill Nott and Gerald Schwab Day 2 1: 00 p. m. to 1: 30 p. m.

Ratios Defined: • One number divided by another to express a relationship • You already know ratios like – – Tons hay per acre Bu. corn per acre Pigs per litter Milk sold per cow, etc. • The above illustrates production ratios

Ratios Be Selective • Now is the time to become familiar with financial ratios • Select ratios that help focus attention on the most critical areas. • Ratio analysis can be done on – Historical – Current – Projected information

Balance Sheet Discussion questions Judgments are made based on balance sheets. • What is a “good” balance sheet? • What is a “good” financial situation?

Balance Sheet Analysis To remember. . . • Basic equations Assets = Debt + Equity Assets minus debts = equity Assets - equity = debt

Balance Sheet Ratio Analysis FINPACK Balance Sheet (Schedule W) Will now define the ratios FINPACK prints out (must be important!) Your balance sheet may or may not have a number for all the ratios discussed.

Balance Sheet Ratios • Schedule W from Finpack 99 • Note both Cost and Market value columns

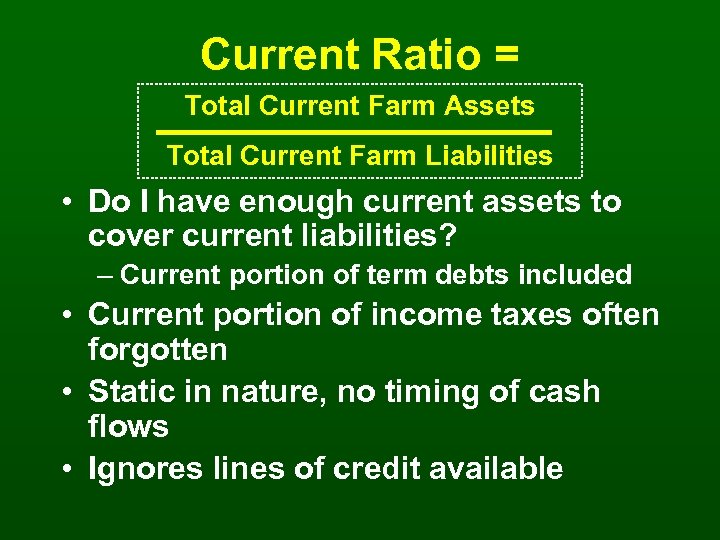

Current Ratio = Total Current Farm Assets Total Current Farm Liabilities • Do I have enough current assets to cover current liabilities? – Current portion of term debts included • Current portion of income taxes often forgotten • Static in nature, no timing of cash flows • Ignores lines of credit available

Current Ratio = Total Current Farm Assets Total Current Farm Liabilities • 12 month planning horizon • Value of current assets may change when sold • Desired level varies by type of farm – Dairy versus fruit or cash crop • Value can vary during production cycle

Farm Working Capital = Total Current Farm Assets Total Current Farm Liabilities • Similar to Current Ratio, is dollar amount, not a percentage or ratio • Difficult to compare to other farms • Depends on size of business

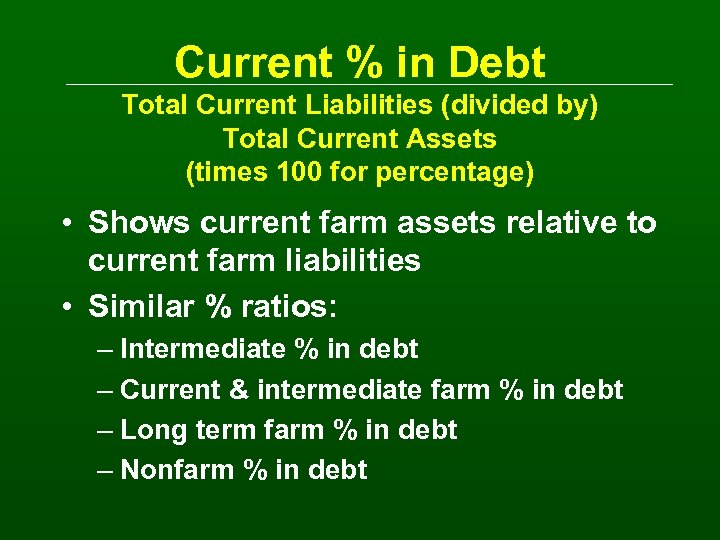

Current % in Debt Total Current Liabilities (divided by) Total Current Assets (times 100 for percentage) • Shows current farm assets relative to current farm liabilities • Similar % ratios: – Intermediate % in debt – Current & intermediate farm % in debt – Long term farm % in debt – Nonfarm % in debt

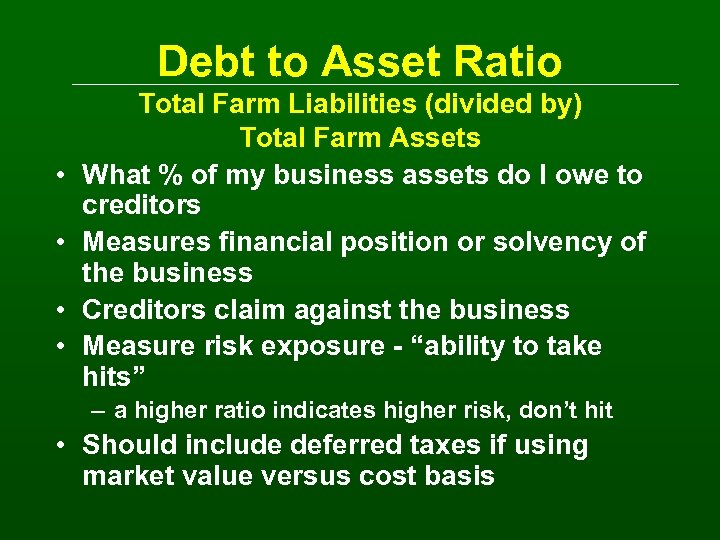

Debt to Asset Ratio • • Total Farm Liabilities (divided by) Total Farm Assets What % of my business assets do I owe to creditors Measures financial position or solvency of the business Creditors claim against the business Measure risk exposure - “ability to take hits” – a higher ratio indicates higher risk, don’t hit • Should include deferred taxes if using market value versus cost basis

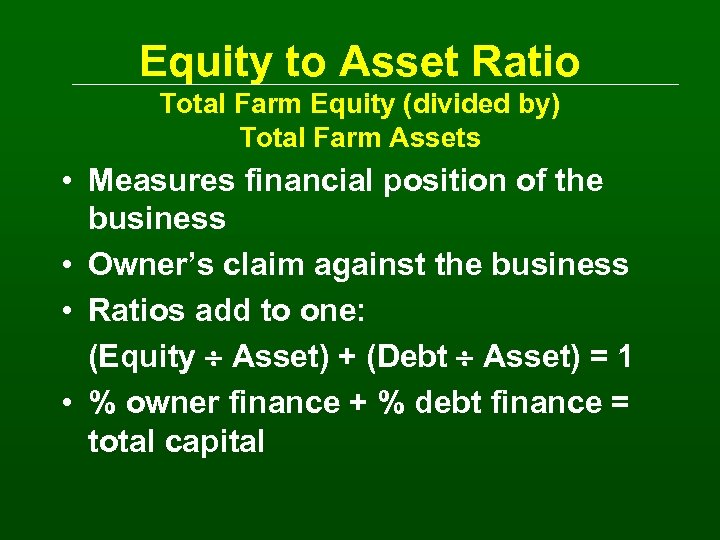

Equity to Asset Ratio Total Farm Equity (divided by) Total Farm Assets • Measures financial position of the business • Owner’s claim against the business • Ratios add to one: (Equity Asset) + (Debt Asset) = 1 • % owner finance + % debt finance = total capital

Debt to Equity Ratio Total Farm Liabilities (divided by) Total Farm Equity • Measures financial position of the business • Ratio gets high rapidly as debt increases • Also called Financial Leverage Ratio • Lenders tend to use it

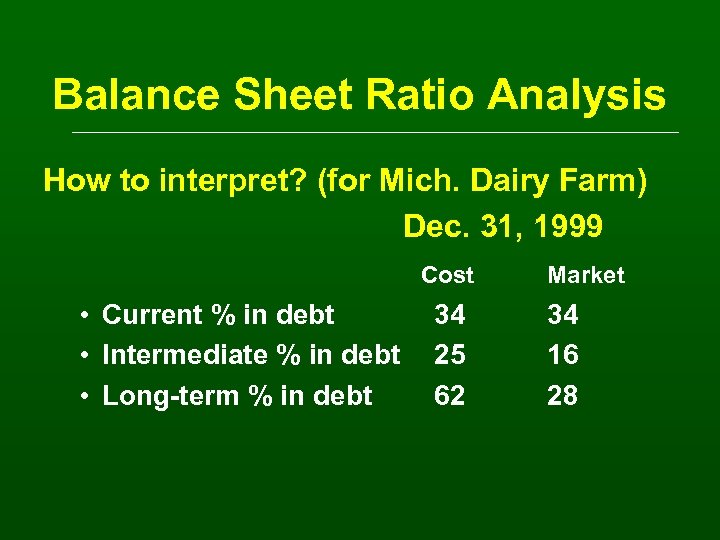

Balance Sheet Ratio Analysis How to interpret? (for Mich. Dairy Farm) Dec. 31, 1999 Cost • Current % in debt • Intermediate % in debt • Long-term % in debt 34 25 62 Market 34 16 28

Balance Sheet Ratios Finpack Balance Sheet Sch. W: be selective! • Current Ratio – Lenders love it! – Understand how it can vary by month – 2. 0 or higher is nice • % in debt: current, intermediate, long, terms – Borrow long-term to buy long-term-- i. e. , match maturities – Look at trend over time

• Debt to Asset Ratio – Lots of folks talk about it – At 0. 5, you own half, lenders “own” half – 0. 70 and higher --- danger • You own 30 % • Earnings can’t meet debt service plus everything else

What’s Next? • Examine the case study farm balance sheet • Quality check and interpret your balance sheet.

c44b011308d1d053e333ee0599f2a25f.ppt