f93fd42cee9b99fd9d292d37c2572f66.ppt

- Количество слайдов: 23

Balance Sheet Effects on Growth & Capital Accumulation in Emerging Markets Liliana Castilleja – Vargas BBVA - Bancomer Economic Research Department Mexico City 16 th International Conference on Panel Data Amsterdam (2 - 4 July 2010)

Introduction ü Empirical analysis ü Panel data for 20 EMs & 13 developed countries ü Annual data from 1985 to 2007 ü Relationships between capital flows, real depreciation, growth & capital accumulation in EMs vs developed countries ü Is real depreciation contractionary in EMs through valuation effects (balance sheet effects)? ü Stylized facts: Influence of specific country’s fundamentals (attenuate or magnify).

Introduction ü EMs’ aftermath of “recent” financial crisis (before the subprime mortgage crisis): Mexico in 19941995, Argentina 2001 -2002, East Asia in 1997, Russia in 1998, etc VS Mundell-Fleming model & developed countries experience. ü Common scenario: sudden stops, nominal & real ü EMs characteristic features tend to exacerbate vulnerability to shocks: countercyclical current depreciation, deep contraction in M, financial distress, output contraction. Balance of payments adjustment was the result of liquidity & borrowing constraints. accounts, high consumption volatility, sudden stops coupled & current account reversals & sharp depreciations (Aguiar & Gita, 2004; Calvo & Mishkin, 2003; Guidotti et al, 2004)

Literature Review: EMs syndromes ü “Original sin” (Eichengreen & Hausmann, 1999): high levels of liability dollarization because the inability to borrow abroad in local currency causing both currency and maturity mismatches. ü “The cycle is the trend” (Aguiar & Gopinath, 2004): permanent shocks to trend growth are the main source of fluctuations in EMs vs transitory fluctuations round a stable trend as in developed countries. ü “When-it-rains-it-pours” (Kaminsky, Reinhart & Végh, 2004): observed procyclicality between the capital flow cycle and macroeconomic cycle in EMs (expansionary in good times & viceversa) reinforcing each other.

Literature Review ü Sudden stops & current account reversals: ü Domestic liability dollarization: Eichengreen and ü Balance Sheet Effects: Frankel (2005); Guidotti, ü Influence of country fundamentals: Calvo and Calvo (1998); Calvo, Izquierdo and Mejia (2004); Guidotti, Sturzenegger and Villar (2004); Calvo and Mishkin (2003). Hausmann (1999); Calvo and Reinhart (2000). Sturzenegger and Villar (2004), Izquierdo 2002, Calvo, Izquierdo and Talvi (2003). Mishkin (2003); Calvo et al. (2004); Guidotti et al. (2004); Edwards (2004); Frankel (2005).

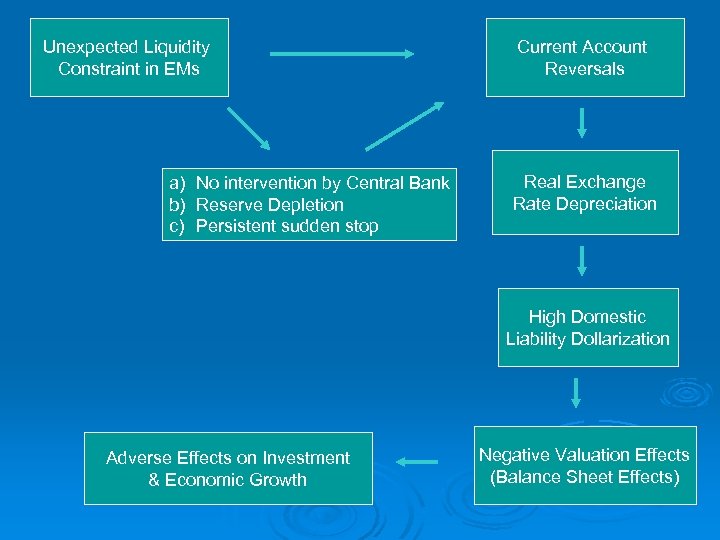

Unexpected Liquidity Constraint in EMs a) No intervention by Central Bank b) Reserve Depletion c) Persistent sudden stop Current Account Reversals Real Exchange Rate Depreciation High Domestic Liability Dollarization Adverse Effects on Investment & Economic Growth Negative Valuation Effects (Balance Sheet Effects)

Data & Methodology ü Panel of 20 EMs from 3 regions: 1. Latin America and Africa (areas rich in natural resources): Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay, Venezuela and South Africa. 2. East Asia: Indonesia, Korea, Malaysia, Philippines and Thailand. 3. West and South Asia: India, Israel, Pakistan, Sri Lanka and Turkey. ü Panel of 13 Developed Economies: Australia, Canada, Finland, France, Germany, Italy, Japan, New Zealand, Spain, Sweden, Switzerland, United Kingdom and United States.

Data & Methodology ü A debt-weighted real effective exchange rate index to focus on the real exchange rate between debtor and creditor countries in EMs (Original contribution and a better proxy than bilateral or trade-weighted rer). ü Weighted arithmetic average of the bilateral real exchange rates using the December CPI and the end-of-period nominal exchange against the US dollar, the euro (incl. German mark and French franc before 1999) and the Japanese yen. ü The weights are derived from data on annual long-term debt denominated in US dollars, euros (incl. German mark and French franc before 1999) and Japanese yen as given in the GFI of the World Bank.

Data & Methodology ü Debt-weighted real effective exchange rate for EMs & trade-weighted real exchange rate in developed countries panel. ü Financial account ratio (% of GDP): FDI, portfolio investment and other investment (as referred by the IMF). ü Country Fundamentals: Trade Openness (trade ratio to GDP), Banking Development (Domestic credit by banks to GDP) and Financial Openness (IMF’s AREAER’s dummy for restrictions on capital flows). ü Main data sources: WDI & GFI (World Bank) and IFM (IMF).

Data & Methodology ü Panel Data Methodologies: Fixed-Effects, First Difference & System Generalized Method of Moments (GMM) estimators with STATA. ü As suggested by Roodman (2008), in the estimation of GMM using STATA, the command “collapse” is used for limiting instrument proliferation. ü Whenever interaction terms with country fundamentals are introduced, the constitutive terms are also included in the specification (Brambor et al. 2005). ü All constitutive terms in the interaction variables are mean centred (de-meaned). ü The results are subjected to robustness tests to account for regional variation (incl. interaction terms) and outliers (fundamentals).

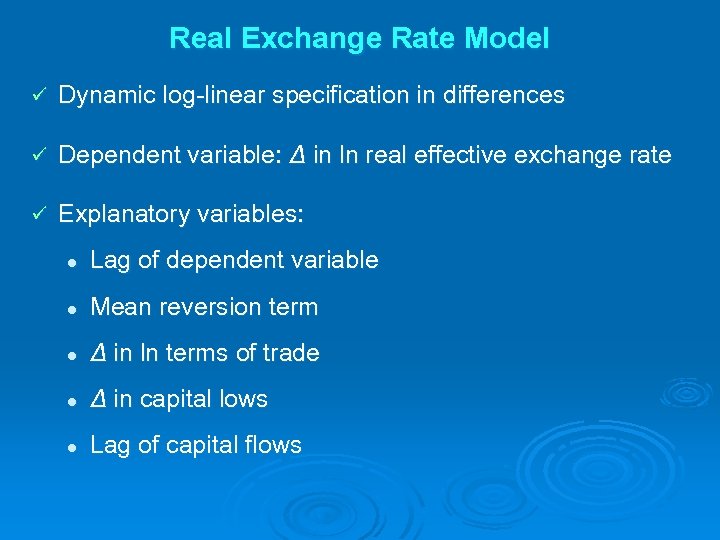

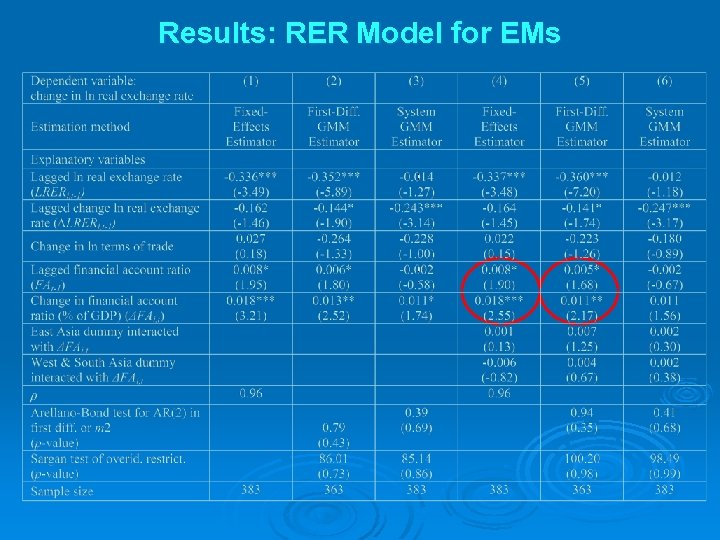

Real Exchange Rate Model ü Dynamic log-linear specification in differences ü Dependent variable: Δ in ln real effective exchange rate ü Explanatory variables: l Lag of dependent variable l Mean reversion term l Δ in ln terms of trade l Δ in capital lows l Lag of capital flows

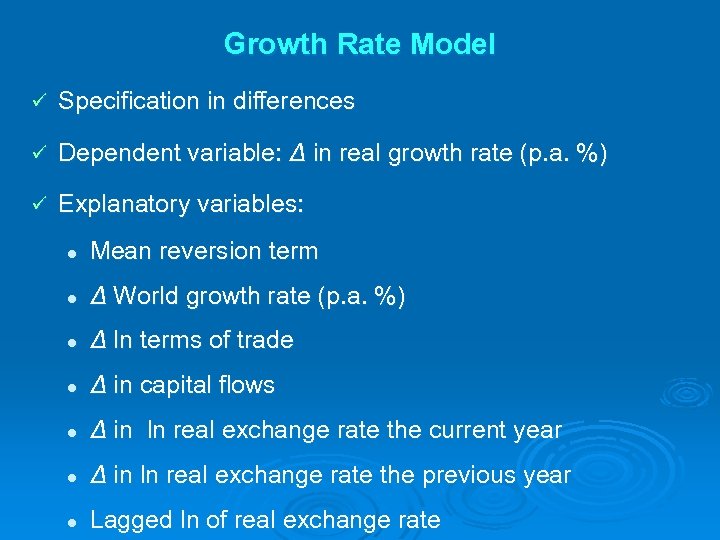

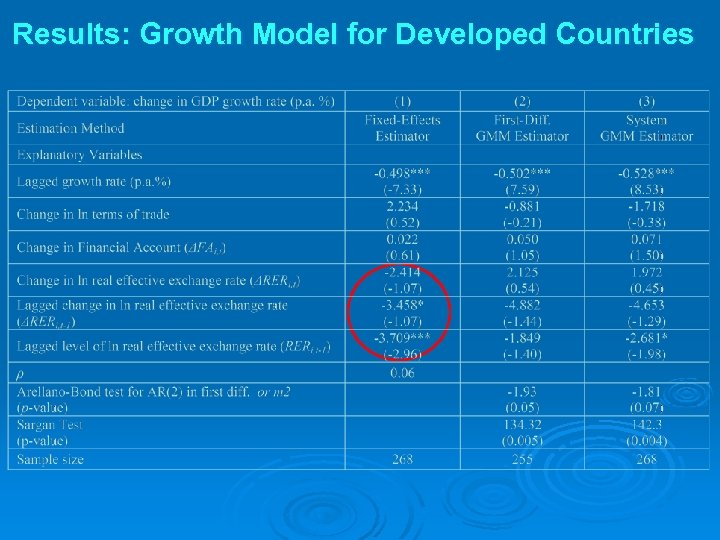

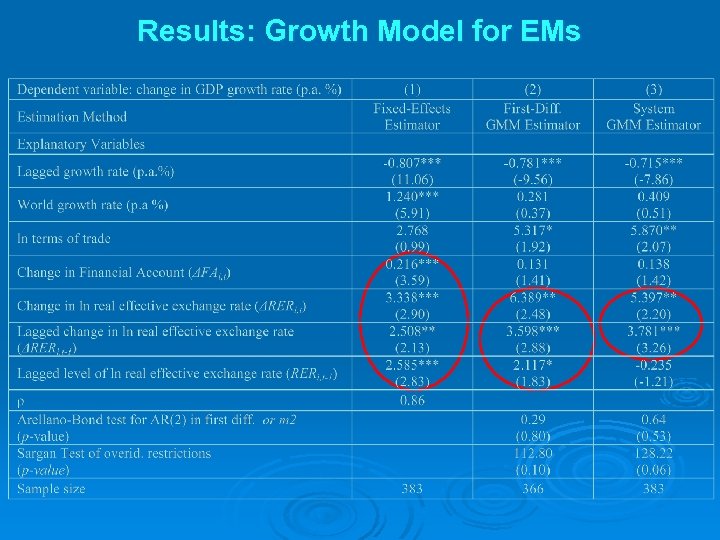

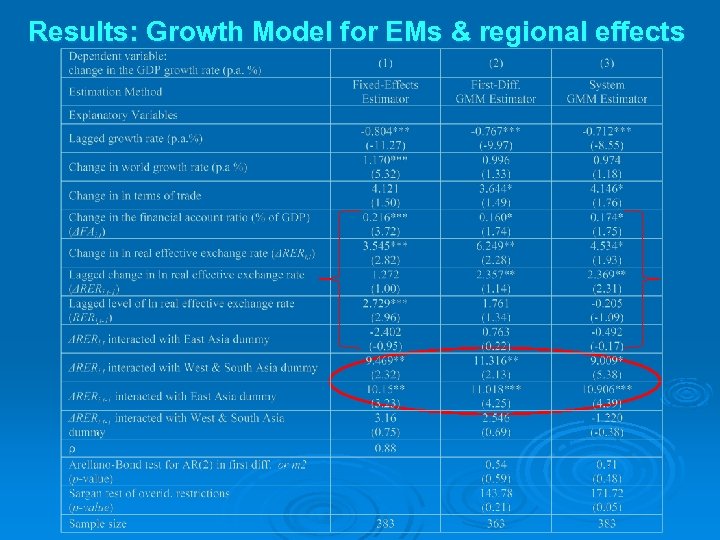

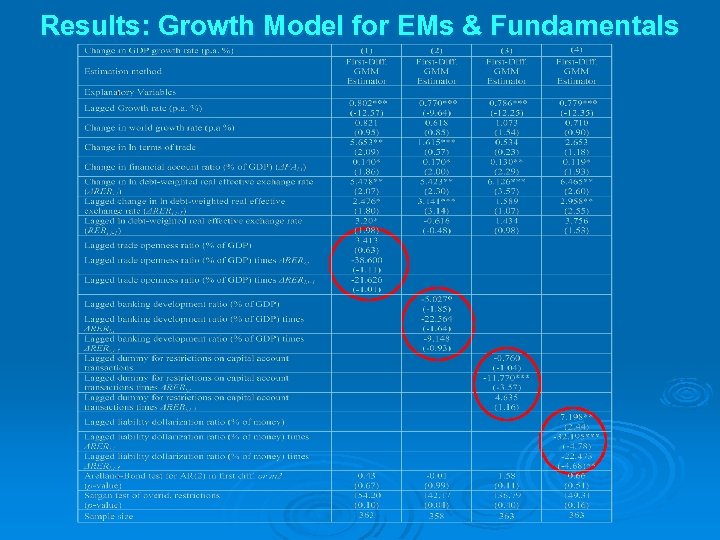

Growth Rate Model ü Specification in differences ü Dependent variable: Δ in real growth rate (p. a. %) ü Explanatory variables: l Mean reversion term l Δ World growth rate (p. a. %) l Δ ln terms of trade l Δ in capital flows l Δ in ln real exchange rate the current year l Δ in ln real exchange rate the previous year l Lagged ln of real exchange rate

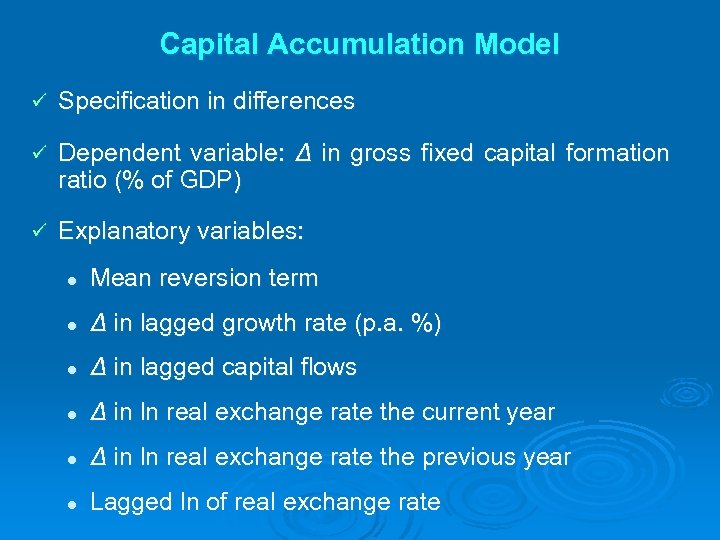

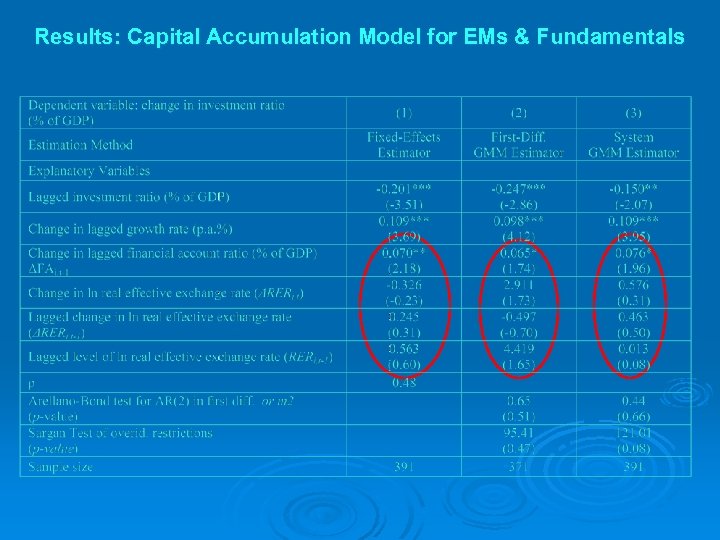

Capital Accumulation Model ü Specification in differences ü Dependent variable: Δ in gross fixed capital formation ratio (% of GDP) ü Explanatory variables: l Mean reversion term l Δ in lagged growth rate (p. a. %) l Δ in lagged capital flows l Δ in ln real exchange rate the current year l Δ in ln real exchange rate the previous year l Lagged ln of real exchange rate

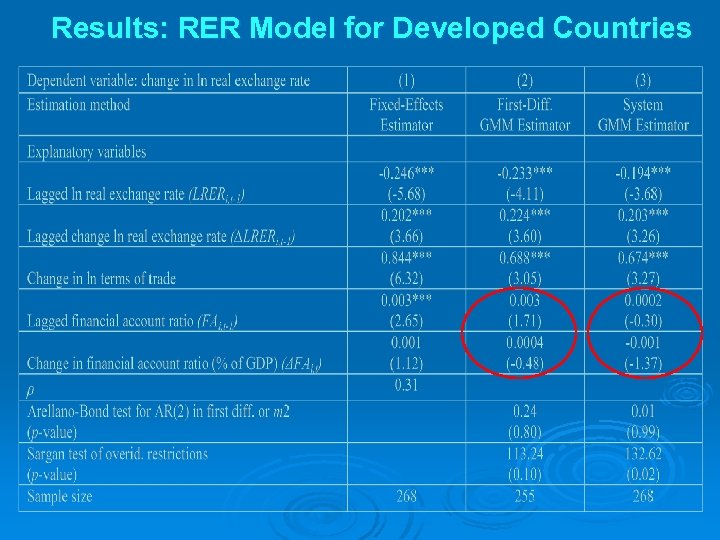

Results: RER Model for Developed Countries

Results: RER Model for EMs

Results: Growth Model for Developed Countries

Results: Growth Model for EMs

Results: Growth Model for EMs & regional effects

Results: Growth Model for EMs & Fundamentals

Results: Capital Accumulation Model for EMs & Fundamentals

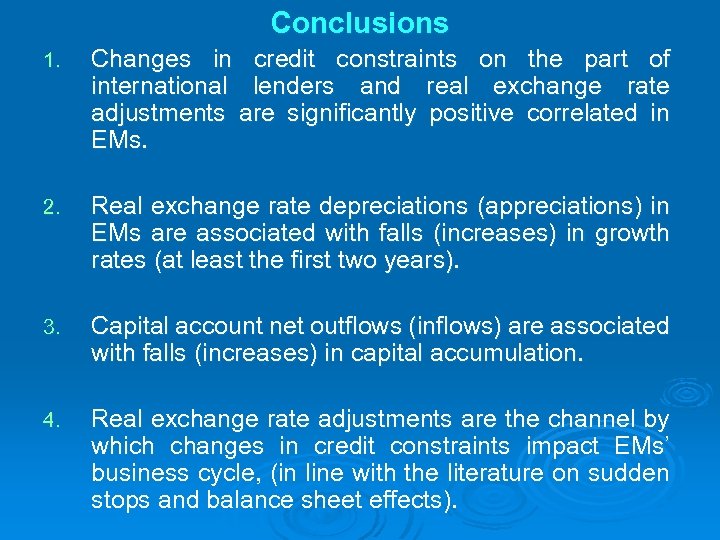

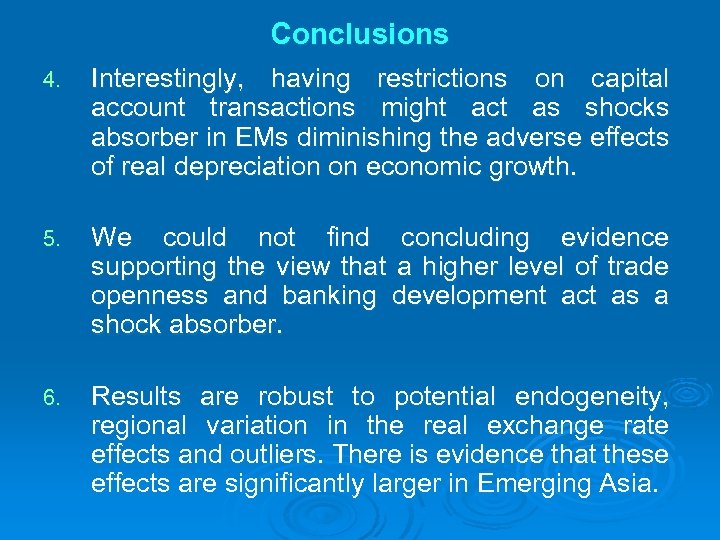

Conclusions 1. Changes in credit constraints on the part of international lenders and real exchange rate adjustments are significantly positive correlated in EMs. 2. Real exchange rate depreciations (appreciations) in EMs are associated with falls (increases) in growth rates (at least the first two years). 3. Capital account net outflows (inflows) are associated with falls (increases) in capital accumulation. 4. Real exchange rate adjustments are the channel by which changes in credit constraints impact EMs’ business cycle, (in line with the literature on sudden stops and balance sheet effects).

Conclusions 4. Interestingly, having restrictions on capital account transactions might act as shocks absorber in EMs diminishing the adverse effects of real depreciation on economic growth. 5. We could not find concluding evidence supporting the view that a higher level of trade openness and banking development act as a shock absorber. 6. Results are robust to potential endogeneity, regional variation in the real exchange rate effects and outliers. There is evidence that these effects are significantly larger in Emerging Asia.

Thank you so much!!

f93fd42cee9b99fd9d292d37c2572f66.ppt