4f42f2bf88303d817b81c8784668a8fc.ppt

- Количество слайдов: 54

Balance of Payments Week 2 Copyright © 2012 by the Mc. Graw-Hill Companies, Inc. All rights reserved.

Balance of Payments Accounting § The balance of payments is the statistical record of a country’s international transactions over a certain period of time presented in the form of double-entry bookkeeping. Note: When we say “a country’s balance of payments” we are referring to the transactions of its citizens and government. 3 -2

Balance of Payments Example § Suppose that Maplewood Bicycle in Maplewood, Missouri, USA imports $100, 000 worth of bicycle frames from Mercian Bicycles in Darby, England. § There will exist a $100, 000 credit recorded by Mercian that offsets a $100, 000 debit at Maplewood’s bank account. § This will lead to a rise in the supply of dollars and the demand for British pounds. 3 -3

Balance of Payments Accounts § The balance of payments accounts are those that record all transactions between the residents of a country and residents of all foreign nations. § They are composed of the following: – The Current Account – The Capital Account – The Official Reserves Account – Statistical Discrepancy 3 -4

The Current Account § Includes all imports and exports of goods and services. § Includes unilateral transfers of foreign aid. § If the debits exceed the credits, then a country is running a trade deficit. § If the credits exceed the debits, then a country is running a trade surplus. 3 -5

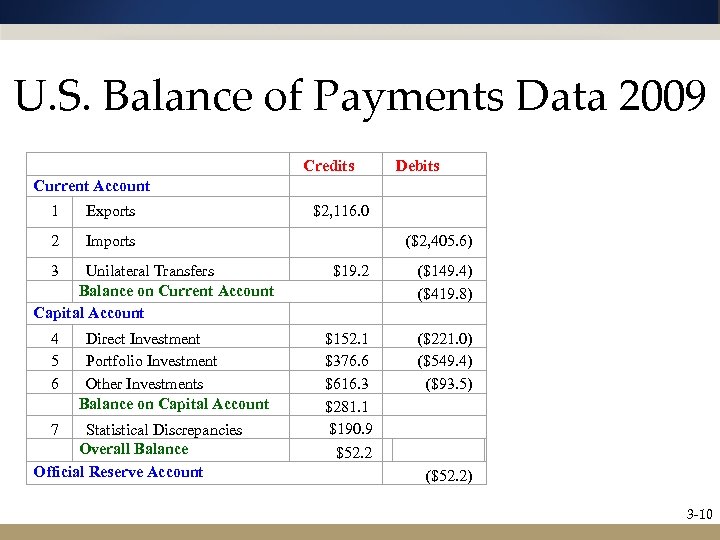

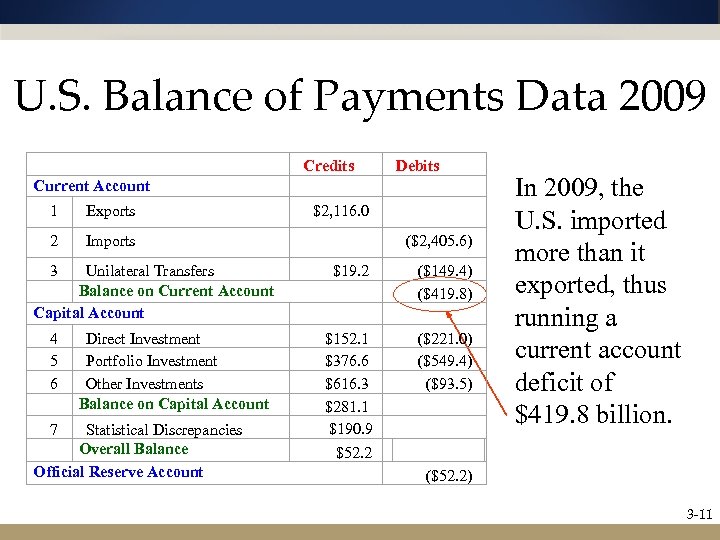

The Capital Account § The capital account measures the difference between U. S. sales of assets to foreigners and U. S. purchases of foreign assets. § In 2009, the U. S. enjoyed a $281. 1 billion capital account surplus—absent of U. S. borrowing from foreigners, this “finances” our trade deficit. § The capital account is composed of Foreign Direct Investment (FDI), portfolio investments, and other investments. 3 -6

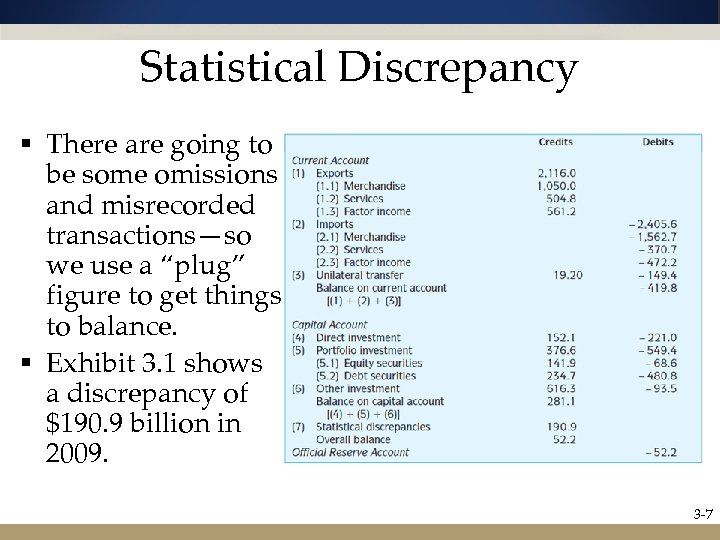

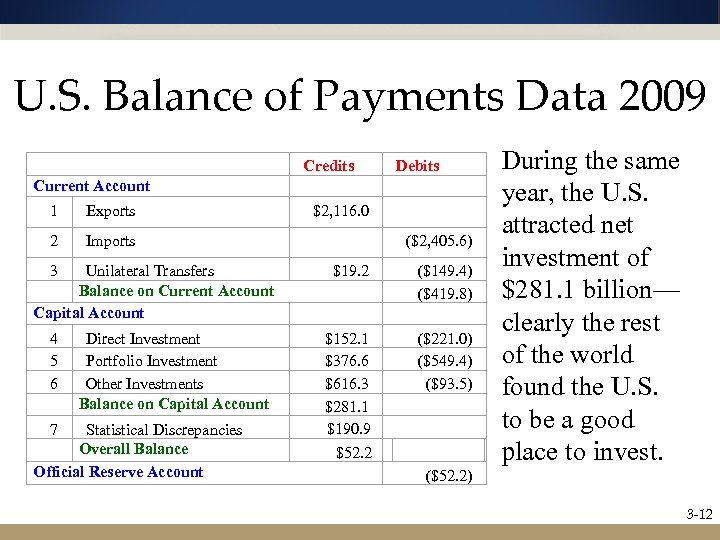

Statistical Discrepancy § There are going to be some omissions and misrecorded transactions—so we use a “plug” figure to get things to balance. § Exhibit 3. 1 shows a discrepancy of $190. 9 billion in 2009. 3 -7

The Official Reserves Account § Official reserves assets include gold, foreign currencies, SDRs, and reserve positions in the IMF. 3 -8

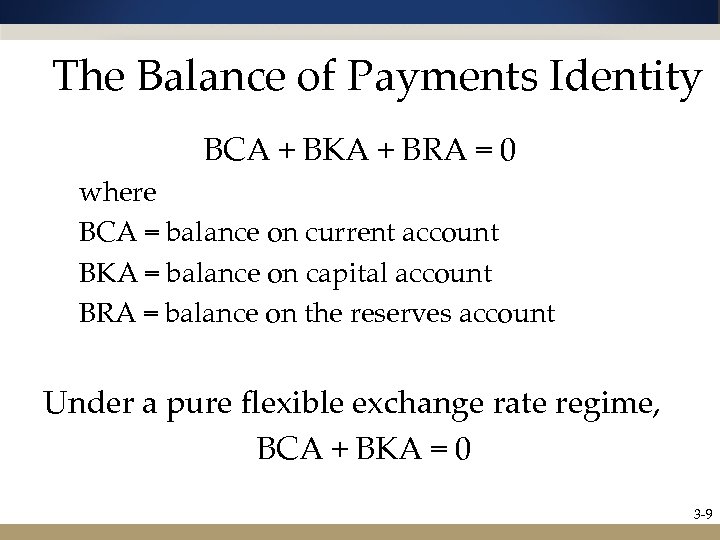

The Balance of Payments Identity BCA + BKA + BRA = 0 where BCA = balance on current account BKA = balance on capital account BRA = balance on the reserves account Under a pure flexible exchange rate regime, BCA + BKA = 0 3 -9

U. S. Balance of Payments Data 2009 Current Account 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits ($52. 2) 3 -10

U. S. Balance of Payments Data 2009 Current Account 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits In 2009, the U. S. imported more than it exported, thus running a current account deficit of $419. 8 billion. ($52. 2) 3 -11

U. S. Balance of Payments Data 2009 Current Account 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits ($52. 2) During the same year, the U. S. attracted net investment of $281. 1 billion— clearly the rest of the world found the U. S. to be a good place to invest. 3 -12

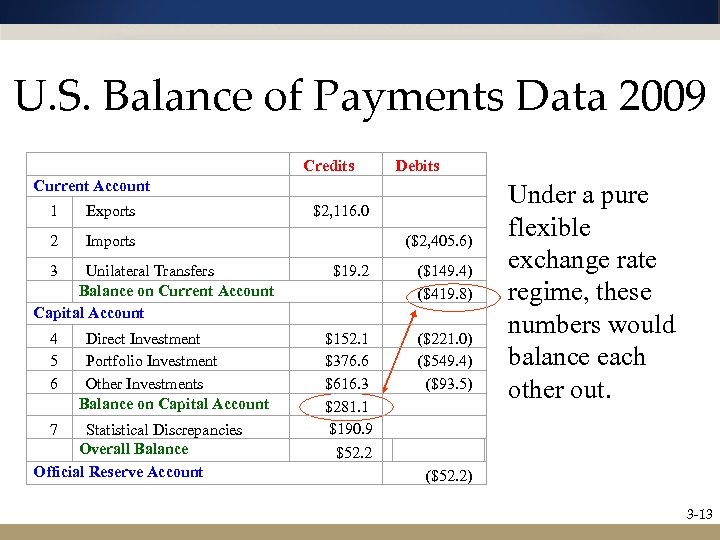

U. S. Balance of Payments Data 2009 Current Account 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits Under a pure flexible exchange rate regime, these numbers would balance each other out. ($52. 2) 3 -13

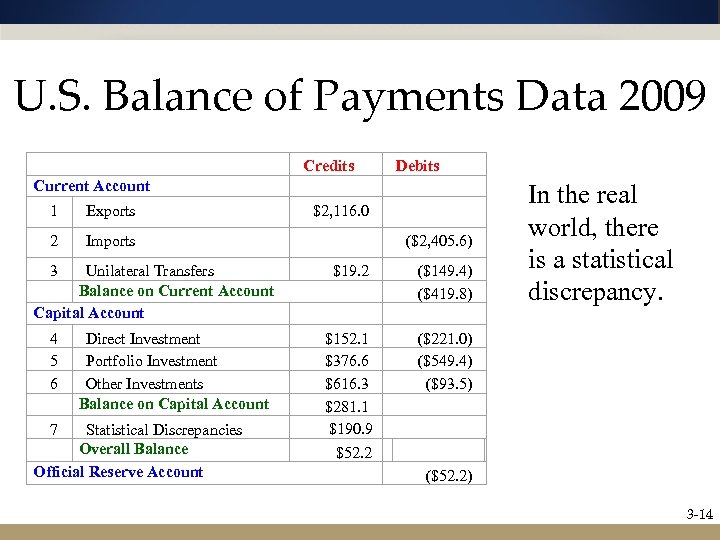

U. S. Balance of Payments Data 2009 Current Account 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits In the real world, there is a statistical discrepancy. ($52. 2) 3 -14

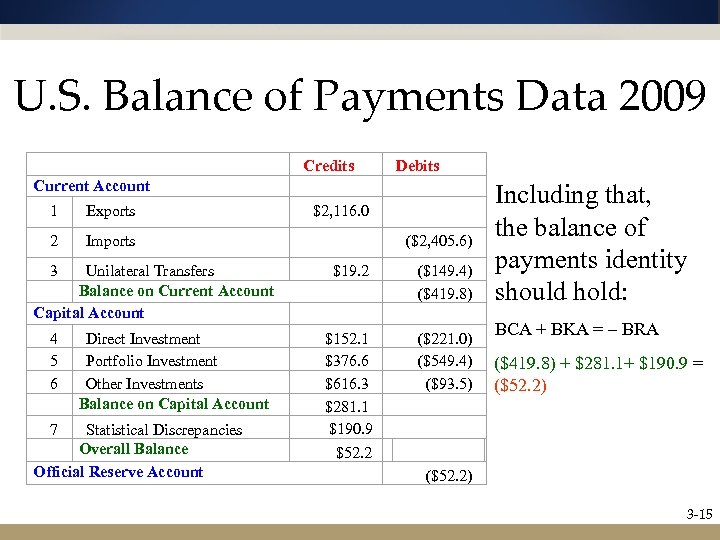

U. S. Balance of Payments Data 2009 Current Account 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits Including that, the balance of payments identity should hold: BCA + BKA = – BRA ($419. 8) + $281. 1+ $190. 9 = ($52. 2) 3 -15

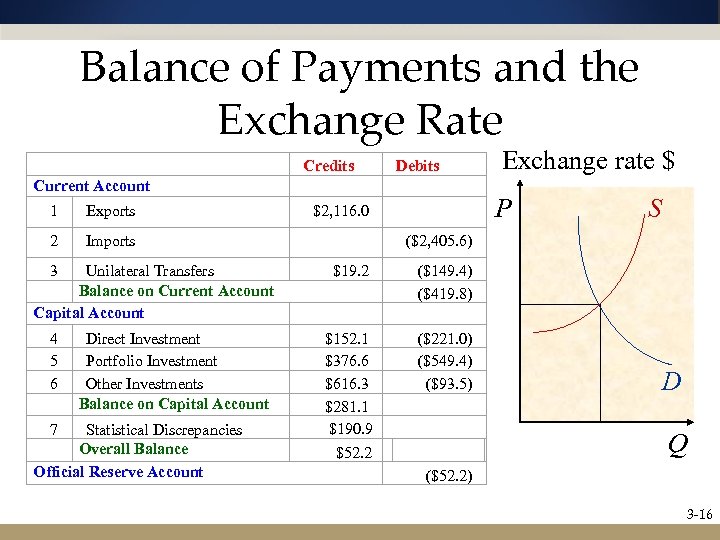

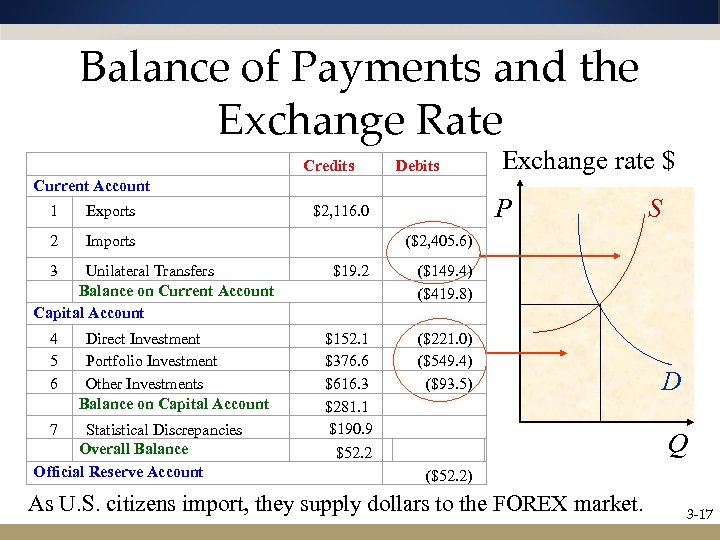

Balance of Payments and the Exchange Rate Current Account Exchange rate $ 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits ($52. 2) P S D Q 3 -16

Balance of Payments and the Exchange Rate Current Account Exchange rate $ 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits P ($52. 2) As U. S. citizens import, they supply dollars to the FOREX market. S D Q 3 -17

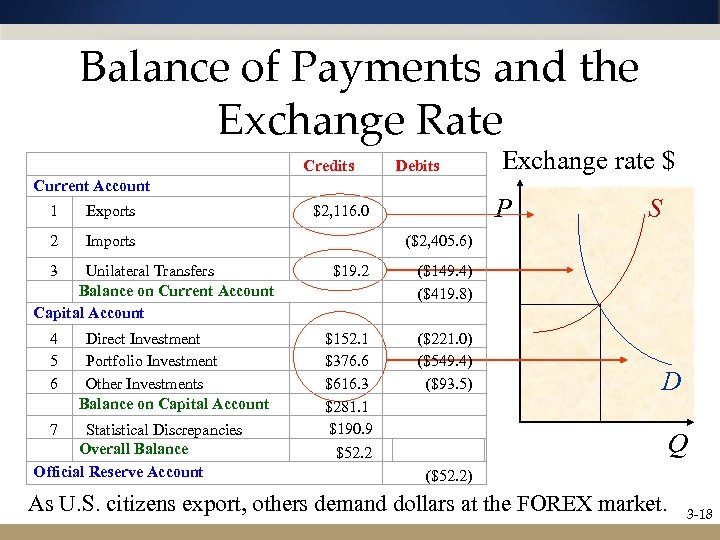

Balance of Payments and the Exchange Rate Current Account Exchange rate $ 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits P S D ($52. 2) As U. S. citizens export, others demand dollars at the FOREX market. Q 3 -18

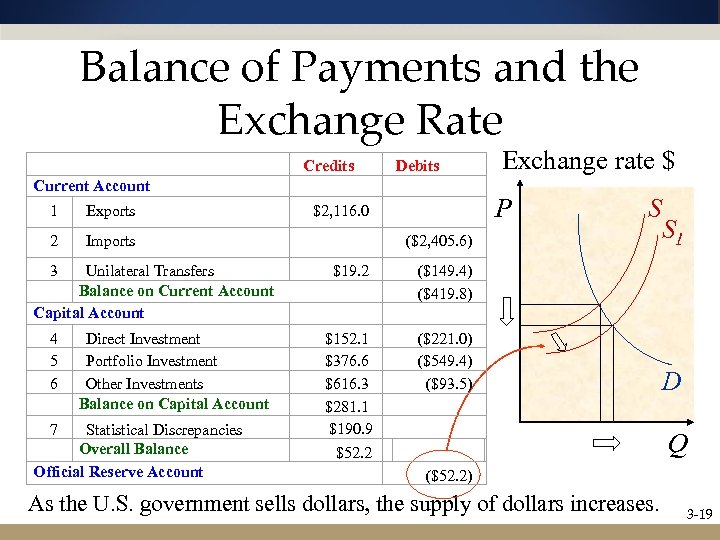

Balance of Payments and the Exchange Rate Current Account Exchange rate $ 1 Exports Credits $2, 116. 0 2 Imports ($2, 405. 6) 3 $19. 2 4 5 6 7 $152. 1 $376. 6 $616. 3 $281. 1 $190. 9 $52. 2 ($149. 4) ($419. 8) ($221. 0) ($549. 4) ($93. 5) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Debits P S S 1 ($52. 2) As the U. S. government sells dollars, the supply of dollars increases. D Q 3 -19

Sovereign Wealth Funds § Government-controlled investment funds are playing an increasingly visible role in international investments. § SWFs are mostly domiciled in Asian and Mid-East countries and usually are responsible for recycling foreign exchange reserves of these countries swelled by trade surpluses and oil revenues. 3 -20

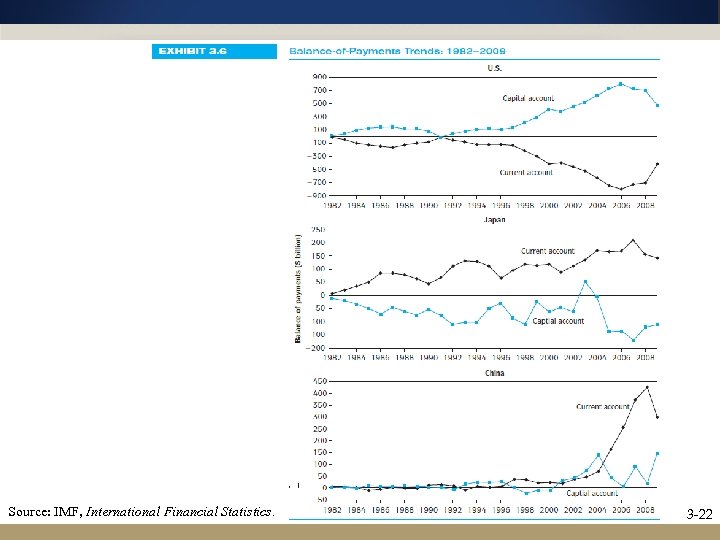

Balance of Payments Trends § Since 1982 the U. S. has experienced continuous deficits on the current account and continuous surpluses on the capital account. § During the same period, Japan has experienced the opposite. 3 -21

Source: IMF, International Financial Statistics. 3 -22

Balance of Payments Trends § The U. S. and the U. K. tend to realize current account deficits, whereas China, Japan, and Germany tend to realize current account surpluses. § This “global imbalance” implies that the U. S. and U. K. generally use up more outputs than they produce, while the opposite holds for China, Japan, and Germany. 3 -23

Mercantilism and the Balance of Payments § Mercantilism holds that a country should avoid trade deficits at all costs, even to imposing various restrictions on imports. § Mercantilist ideas were criticized in the 18 th century by such British thinkers as Adam Smith, David Ricardo, and David Hume. § They argued that the main source of wealth in a country is its productive capacity not its trade surpluses. 3 -24

Relationship between Balance of Payments and National Income Accounting § National income (Y), or gross domestic product (GDP), is equal to the sum of the nominal consumption of goods and services (C), private investment (I), government spending (G), and the difference between exports (X) and imports (M): Y ≡ GDP ≡ C + I + G + (X – M) 3 -25

Relationship between Balance of Payments and National Income Accounting § Private savings is defined as the amount left from national income after consumption and taxes (T) are paid: S ≡ Y – C – T or S ≡ C + I + G + (X – M) – C – T § Note that BCA ≡ X – M; we can rearrange the last equation as (S – I) + (T – G) ≡ X – M ≡ BCA 3 -26

Relationship between Balance of Payments and National Income Accounting (S – I) + (T – G) ≡ X – M ≡ BCA § This shows that there is an intimate relationship between a country’s BCA and how it finances its domestic investment and pays for government spending. § If (S – I) < 0, then a country’s domestic savings is insufficient to finance domestic investment. § Similarly, if (T – G) < 0, then tax revenue is insufficient to cover government spending and a government budget deficit exists. 3 -27

Relationship between Balance of Payments and National Income Accounting (S – I) + (T – G) ≡ X – M ≡ BCA § When BCA < 0, government budget deficits and/or part of domestic investment are being financed by foreign-controlled capital. § To reduce a BCA deficit, one of the following must occur: – For a given level of S and I, the government budget deficit (T – G) must be reduced. – For a given level of I and (T – G), S must be increased. – For a given level S and (T – G), I must fall. 3 -28

Governance and the Public Corporation: Key Issues § The public corporation, which is jointly owned by a multitude of shareholders protected with limited liability, is a major organizational innovation of vast economic consequences. § It is an efficient risk sharing mechanism that allows corporations to raise large amounts of capital.

Governance and the Public Corporation: Key Issues § A key weakness is the conflict of interest between managers and shareholders. § In principle, shareholders elect a board of directors, who in turn hire and fire the managers who actually run the company. § In reality, management-friendly insiders often dominate the board of directors, with relatively few outside directors who can independently monitor the management.

Governance and the Public Corporation: Key Issues § In the case of Enron and other dysfunctional corporations, the boards of directors grossly failed to safeguard shareholder interests. § Furthermore, with diffused ownership, most shareholders have strong enough incentive to incur the costs of monitoring management themselves. – It’s easier to just sell your shares, a. k. a. “The Wall Street Walk. ”

The Agency Problem § Shareholders allocate decision-making authority to the managers. § That’s why the managers are hired in the first place. § Many shareholders are not qualified to make complex business decisions. § A shareholder with a diversified portfolio would not have the time to devote to making the numerous decisions at each of his many companies anyway.

The Agency Problem § Having short-term control of the firm’s assets, managers might be tempted to act in the manager’s short-term best interest instead of the shareholder’s long-term best interest. – Consumption of lavish benefits is one example. – Outright stealing is another example. • Some Russian oil companies are known to sell oil to manager-owned trading companies at belowmarket prices. • Even at that, they don’t always bother to collect the bills!

The Agency Problem at Enron § Enron had about 3, 500 subsidiaries and affiliates. Many of these were run and partly owned by Enron executives. § In retrospect, conflict of interest should have been an obvious concern. – The partnerships performed hundreds of millions of dollars of transactions with Enron itself, in some cases buying assets from the company or selling assets to it. § The problem is this: Where did the executives' loyalties lie? Are they trying to negotiate the best deal for the company that employs them and the shareholders who own the company, or the best deal for the partnership where they had an ownership

The Agency Problem at Enron § The board of directors claimed that these partnerships with executive ownership allowed the firm to speed up contracting. § To protect itself in dealings with these partnerships, the company supposedly set up safeguards that required top company officers and the board to review and approve deals between Enron and the partnerships. § Clearly these safeguards were insufficient.

Remedies for the Agency Problem § In the U. S. , shareholders have the right to elect the board of directors. § If the board remains independent of management, it can serve as an effective mechanism for curbing the agency problem.

Corporate Boards § The structure and legal charge of corporate boards vary greatly across counties. – In Germany the board is not legally charged with representing the interests of shareholders, but is instead charged with representing the interests of stakeholders (e. g. workers, creditors, etc. ).

Corporate Boards § The structure and legal charge of corporate boards vary greatly across counties. – In England, the majority of public companies voluntarily abide by the Code of Best Practice on corporate governance. It recommends that there should be at least three outside directors and that the board chairman and the CEO should be different individuals.

Corporate Boards § The structure and legal charge of corporate boards vary greatly across counties. – In Japan, most corporate boards are insiderdominated and primarily concerned with the welfare of the keiretsu to which the company belongs.

Incentive Contracts § It is difficult to design a compensation scheme that gives executives an incentive to work hard at increasing shareholder wealth. § Accounting-based schemes are subject to manipulation. – Arthur Andersen’s involvement with the Enron debacle is an egregious example. § Executive stock options are an increasingly popular form of incentive compatible compensation.

Concentrated Ownership § Another way to alleviate the agency problem is to concentrate shareholdings. § In the United States and the United Kingdom, concentrated ownership is relatively rare. § Elsewhere in the world, however, concentrated ownership is the norm.

Debt § If managers fail to pay interest and principal to creditors, the company can be forced into bankruptcy and managers may lose their jobs. § Borrowing can have a major disciplinary effect on managers, motivating them to curb private benefits and wasteful investments and trim bloated organizations. § However, excessive debt creates its own agency problems.

Overseas Stock Listing § Companies domiciled in countries with weak investor protection can bond themselves credibly to better investor protection by listing their stocks in countries with strong investor protection.

The Market for Corporate Control § If a management team is really out-of-control, over time the share price will decline. § At some point, a corporate raider will buy up enough shares to gain control of the board. § Then the raider either fires the incompetent managers and turns the firm around or he sells everything in sight for the break-up value. § Either way, the old managers are out of a job. § The threat of this unemployment may keep them in line.

Law and Corporate Governance § Commercial legal systems of most countries derive from a relatively few legal origins. – English common law – French civil law – German civil law – Scandinavian civil law § Thus the content of law protecting investors’ rights varies a great deal across countries. § It should also be noted that the quality of law enforcement varies a great deal across countries.

Consequences of Law § Protection of investors’ rights has major economic consequences. § These consequences include: – The pattern of corporate ownership and valuation. – Development of capital markets. – Economic growth.

Consequences of Law: Italy vs. the United Kingdom § Italy has a French civil law tradition with weak shareholder protection, whereas the United Kingdom, with its English common law tradition, provides strong investor protection. § In Italy the three largest shareholders own 58 percent of the company, on average. In the U. K. the three largest shareholders own 19 percent of the company, on average. – Company ownership is thus highly concentrated in Italy and more diffuse in the United Kingdom.

Consequences of Law: Italy vs. the United Kingdom § In addition, as of 1999 only 247 companies are listed on the stock exchange in Italy, whereas 2, 292 companies are listed in the United Kingdom. § In the same year, the stock market capitalization as a proportion of the annual GDP was 71 percent in Italy but 248 percent in the United Kingdom. § The stark contrast between the two countries suggests that protection of investors has significant economic consequences.

Ownership and Control § Companies domiciled in countries with weak investor protection many need to have concentrated ownership as a substitute for legal protection. § This is not without costs. In companies with concentrated ownership, large shareholders can abuse smaller shareholders.

Capital Markets and Valuation § Investor protection promotes the development of external capital markets. § When investors are assured of receiving fair returns on their funds, they will be willing to pay more for securities. § Thus, strong investor protection will be conducive to large capital markets. § Weak investor protection can be a factor in sharp market declines during a financial crisis.

Economic Growth § The existence of well-developed financial markets, promoted by strong investor protection, may stimulate economic growth by making funds readily available for investment at low cost. § Several studies document this link. § Financial development can contribute to economic growth in three ways: – It enhances savings. – It channels savings toward real investments in productive capacities. – It enhances the efficiency of investment allocation.

Corporate Governance Reform § Scandal-weary investors around the world are demanding corporate governance reform. § It’s not just the companies’ internal governance mechanisms that failed; auditors, regulators, banks, and institutional investors also failed in their respective roles. § Failure to reform corporate governance will damage investor confidence, stunt the development of capital markets, raise the cost of capital, distort capital allocation, and even shake confidence in the capitalist system itself.

The Sarbanes-Oxley Act § Major components of the Sarbanes-Oxley Act include: – Accounting regulation. – Audit committee. – Internal control assessment. – Executive responsibility. § Many companies find compliance burdensome, costing millions of dollars. § Some foreign firms have chosen to list their shares on the London Stock Exchange instead of U. S. exchanges to avoid costly compliance.

CFA Institute Ethical and Professional Standards of Corporate Governance § The Board: Are they “cozy” with Mgmt? – Is it largely independent? – Are the directors qualified? – Do they have access to outside resources? – How are they elected? – Do any directors have cross-company relationships? § Management: Are they vendors or customers? – Do they have a code of ethics? – Are there lots of perquisites? – How is their compensation structured?

4f42f2bf88303d817b81c8784668a8fc.ppt