Balance of Payments Topic #9

Key issues: • The Balance of Payments: why to have it • The components of the Balance of Payments • Ukrainian Balance of Payments • Factors influencing the balance of payment

The National Income Accounts • GNP is calculated by adding up the market value of all expenditures on final output: – Consumption • The amount consumed by private domestic residents – Investment • The amount put aside by private firms to build new plant and equipment for future production – Government purchases • The amount used by the government – Current account balance • The amount of net exports of goods and services to foreigners

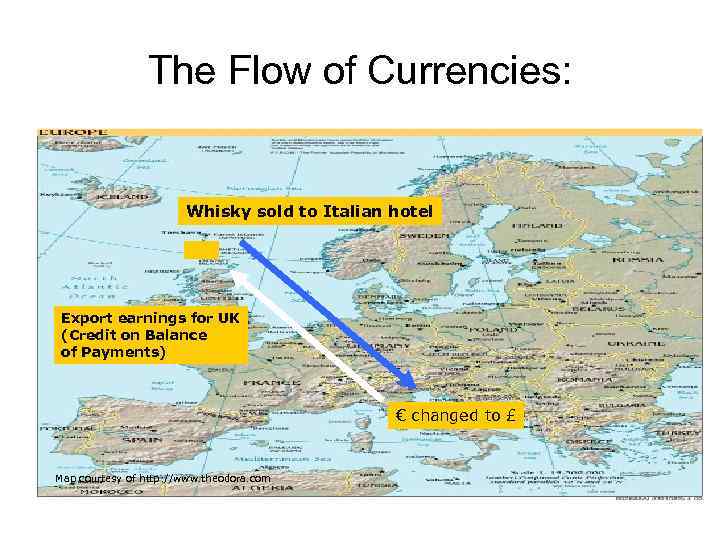

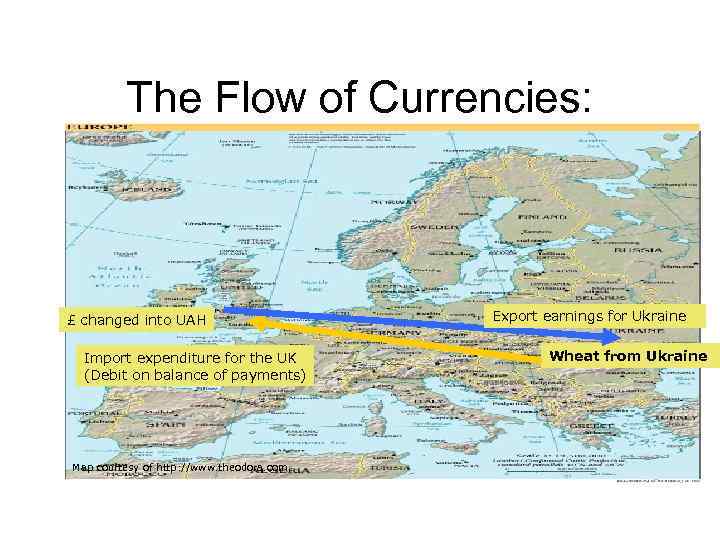

The Flow of Currencies: Whisky sold to Italian hotel Export earnings for UK (Credit on Balance of Payments) € changed to £ Map courtesy of http: //www. theodora. com

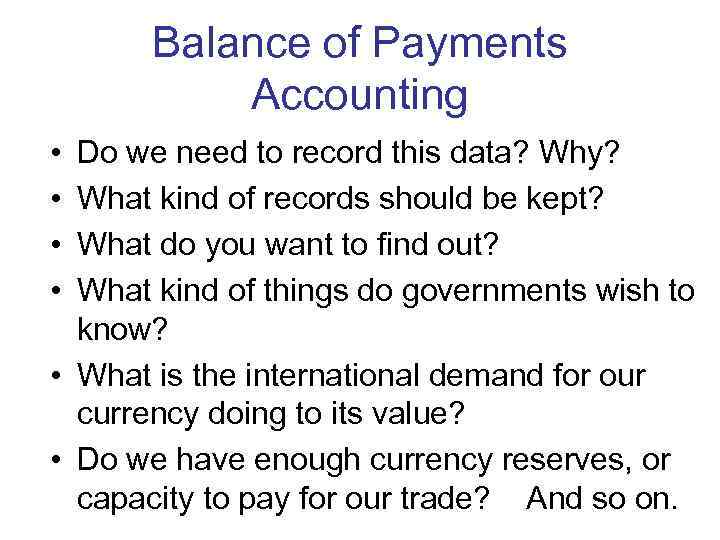

The Flow of Currencies: £ changed into UAH Import expenditure for the UK (Debit on balance of payments) Map courtesy of http: //www. theodora. com Export earnings for Ukraine Wheat from Ukraine

Balance of Payments Accounting • • Do we need to record this data? Why? What kind of records should be kept? What do you want to find out? What kind of things do governments wish to know? • What is the international demand for our currency doing to its value? • Do we have enough currency reserves, or capacity to pay for our trade? And so on.

The Balance of Payments • A record of international transactions between a country and the rest of the world for a given period of time • Trade in goods • Trade in services • Income flows = Current Account • Transfer of funds and sale of assets and liabilities = Capital Account

Balance of Payments • Record of Payments to & Receipts from Foreign Entities – Double-entry bookkeeping system. • Every transaction has two entries – a credit (+) and a debit (-)! – Payment = Debit (-) – Receipt = Credit (+) – Multiple Accounts • Current Account (CA) and Capital/Financial Account (KA) – Is a summary (net) record of flows, not stocks

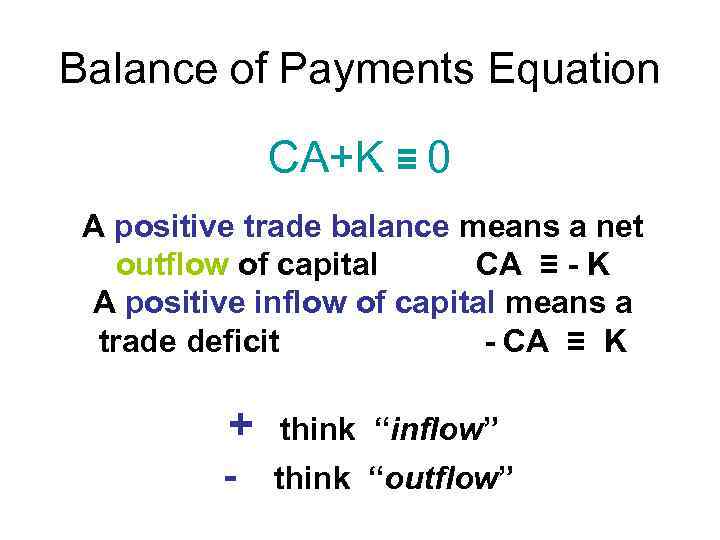

Balance of Payments Equation CA+K ≡ 0 CA is the current account (mostly trade) K is a capital and financial account (investment and other payments)

Balance of Payments Equation CA+K ≡ 0 A positive trade balance means a net outflow of capital CA ≡ - K A positive inflow of capital means a trade deficit - CA ≡ K + think “inflow” - think “outflow”

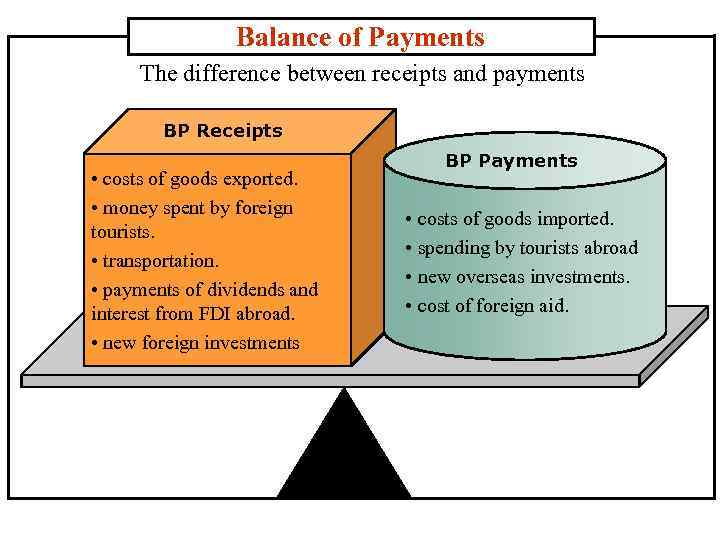

Balance of Payments The difference between receipts and payments BP Receipts • costs of goods exported. • money spent by foreign tourists. • transportation. • payments of dividends and interest from FDI abroad. • new foreign investments BP Payments • costs of goods imported. • spending by tourists abroad • new overseas investments. • cost of foreign aid.

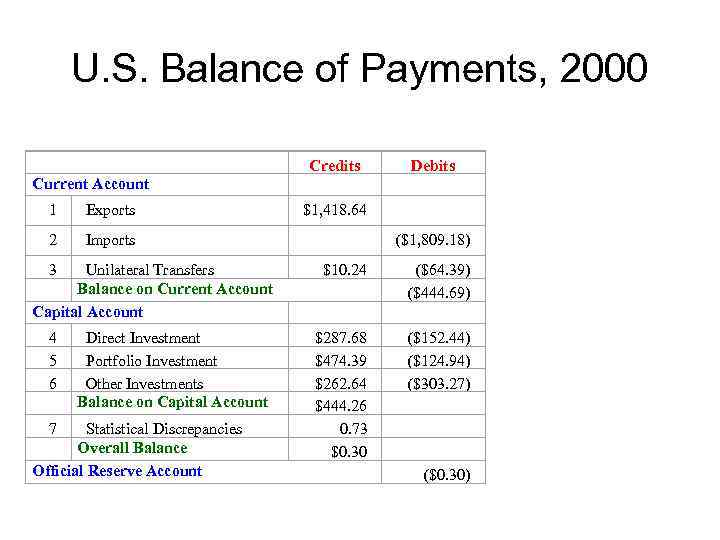

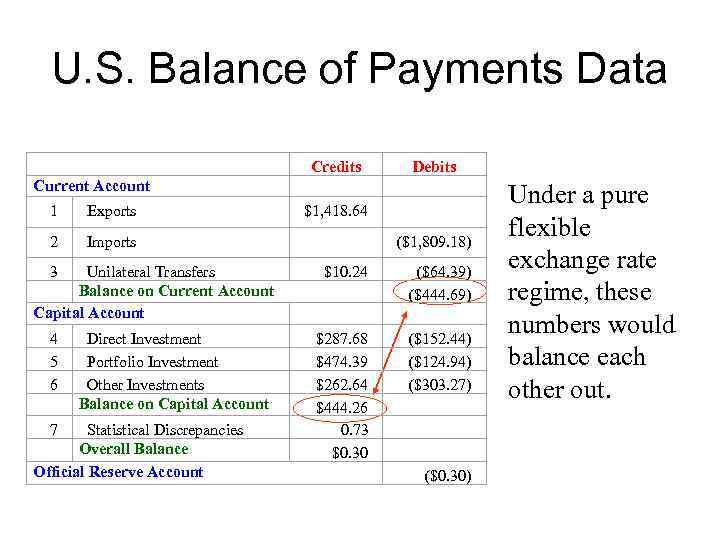

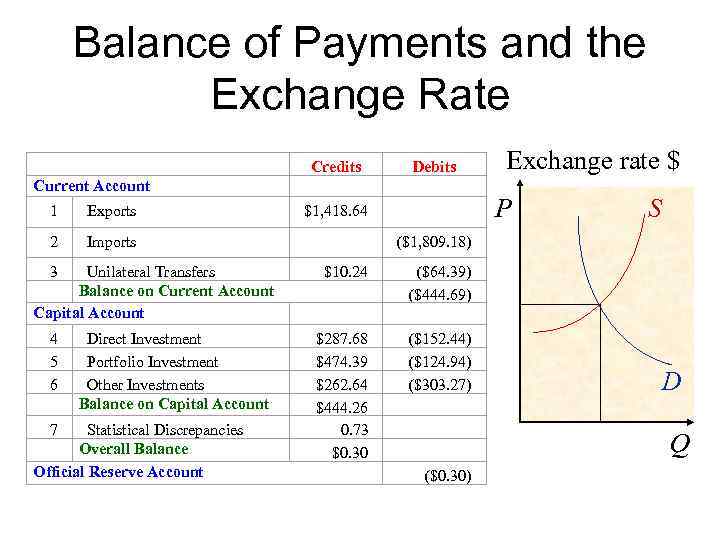

U. S. Balance of Payments, 2000 Current Account Credits Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30)

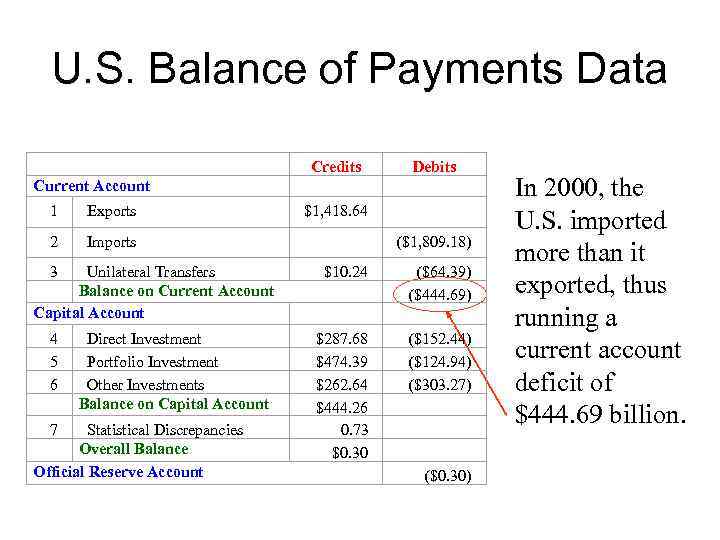

U. S. Balance of Payments Data Current Account Credits Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) In 2000, the U. S. imported more than it exported, thus running a current account deficit of $444. 69 billion.

U. S. Balance of Payments Data Current Account Credits Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) During the same year, the U. S. attracted net investment of $444. 26 billion —clearly the rest of the world found the U. S. to be a good place to invest.

U. S. Balance of Payments Data Current Account Credits Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) Under a pure flexible exchange rate regime, these numbers would balance each other out.

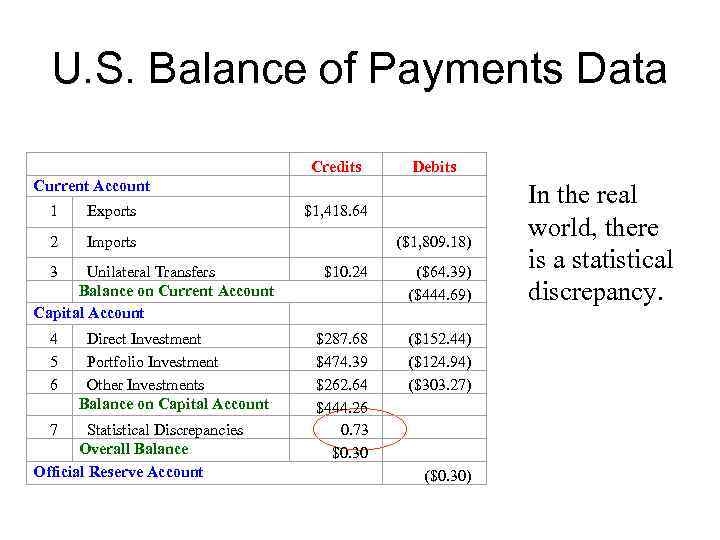

U. S. Balance of Payments Data Current Account Credits Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) In the real world, there is a statistical discrepancy.

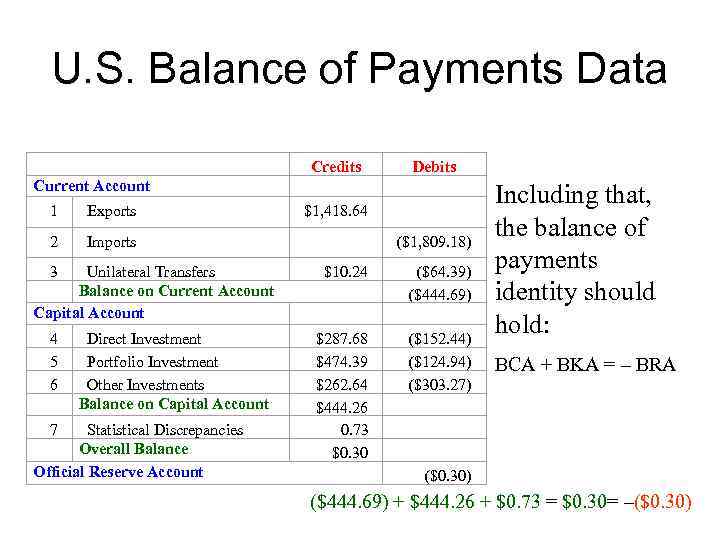

U. S. Balance of Payments Data Current Account Credits Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account Including that, the balance of payments identity should hold: BCA + BKA = – BRA ($0. 30) ($444. 69) + $444. 26 + $0. 73 = $0. 30= –($0. 30)

See the real data: • The US Balance of payments • Ukrainian Balance of Payments

The role of Recording International Payments • to inform government authorities of the international position of the country to assist them with monetary-fiscal questions as well as trade and payments policies; • other?

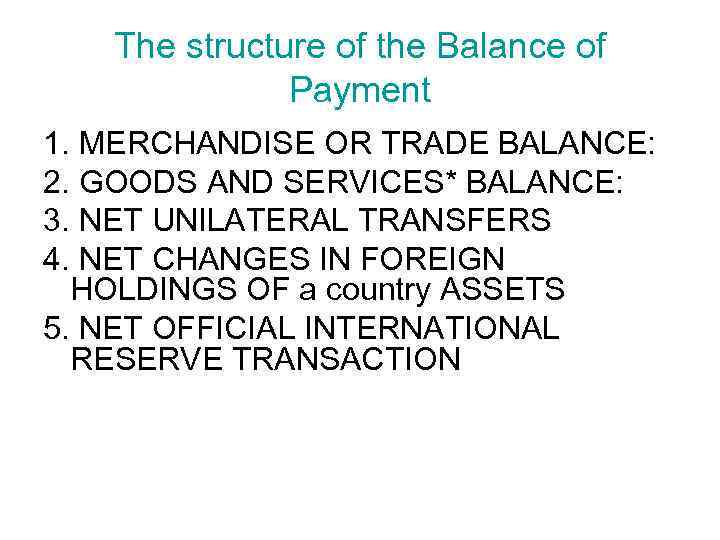

The structure of the Balance of Payment 1. MERCHANDISE OR TRADE BALANCE: 2. GOODS AND SERVICES* BALANCE: 3. NET UNILATERAL TRANSFERS 4. NET CHANGES IN FOREIGN HOLDINGS OF a country ASSETS 5. NET OFFICIAL INTERNATIONAL RESERVE TRANSACTION

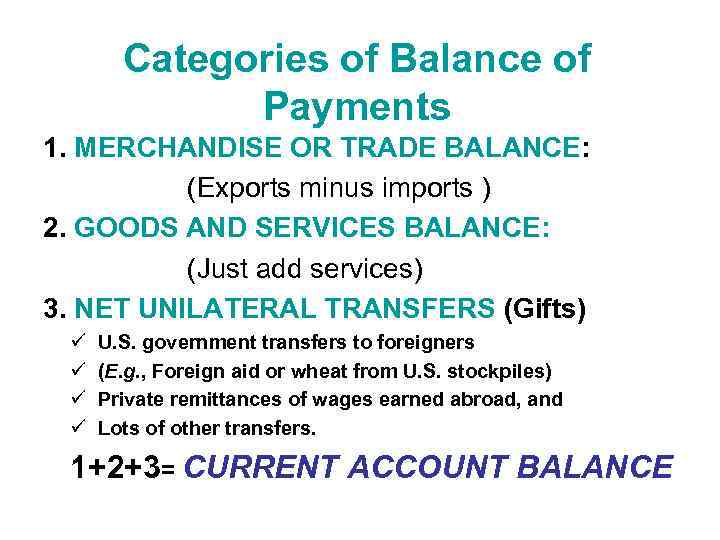

Categories of Balance of Payments 1. MERCHANDISE OR TRADE BALANCE: (Exports minus imports ) 2. GOODS AND SERVICES BALANCE: (Just add services) 3. NET UNILATERAL TRANSFERS (Gifts) ü ü U. S. government transfers to foreigners (E. g. , Foreign aid or wheat from U. S. stockpiles) Private remittances of wages earned abroad, and Lots of other transfers. 1+2+3= CURRENT ACCOUNT BALANCE

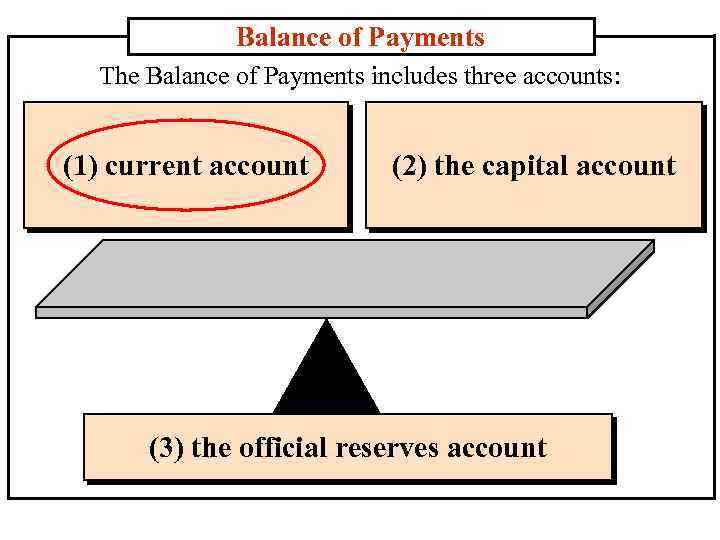

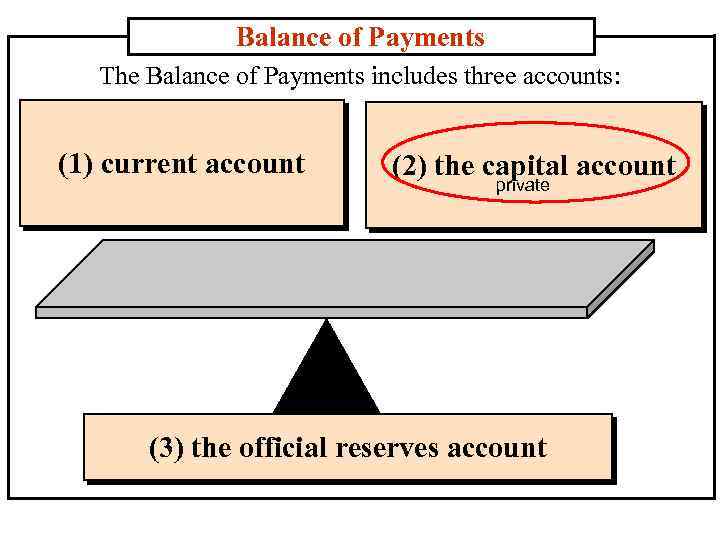

Balance of Payments The Balance of Payments includes three accounts: (1) current account (2) the capital account (3) the official reserves account

Balance of Payments The Balance of Payments includes three accounts: (1) current account (2) the capital account private (3) the official reserves account

Categories of Balance of Payments 1+2+3= CURRENT ACCOUNT BALANCE. 4. NET CHANGES IN FOREIGN HOLDINGS OF U. S. ASSETS Flows of financial assets and similar claims, or Foreign direct and other investments in the U. S. , or “Private capital flows. ” (Note that we are talking direct and portfolio investments here). 5. NET OFFICIAL INTERNATIONAL RESERVE TRANSACTION Foreign official holdings of U. S. assets, U. S. holdings of official reserve (gold and foreign exchange) assets or, “Official asset flows. ” 4+5 = CAPITAL ACCOUNT BALANCE

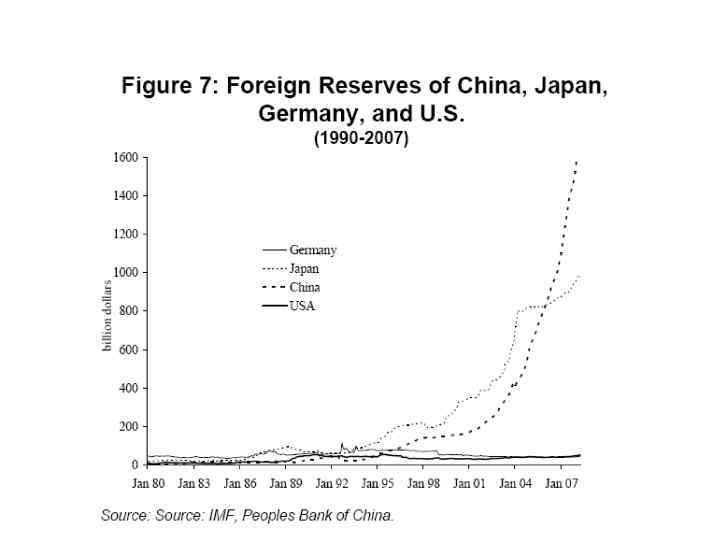

The Balance of Payments Accounts • Official Reserve Transactions – Central bank • The institution responsible for managing the supply of money – Official international reserves • Foreign assets held by central banks as a cushion against national economic misfortune – Official foreign exchange intervention • Central banks often buy or sell international reserves in private asset markets to affect macroeconomic conditions in their economies.

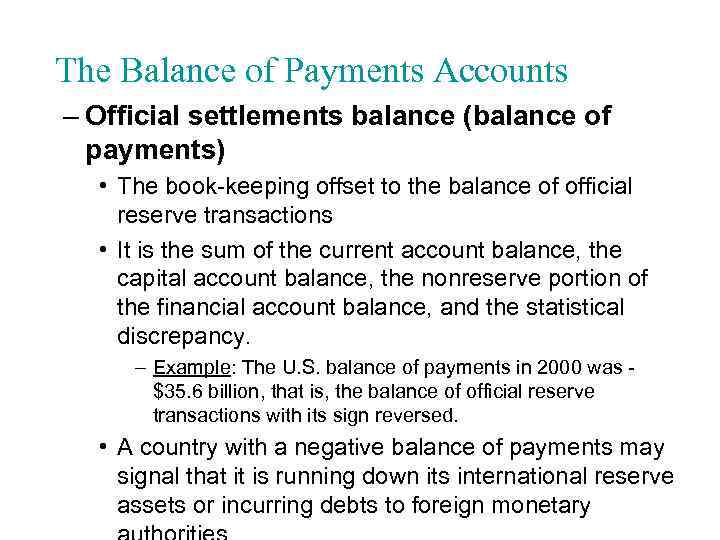

The Balance of Payments Accounts – Official settlements balance (balance of payments) • The book-keeping offset to the balance of official reserve transactions • It is the sum of the current account balance, the capital account balance, the nonreserve portion of the financial account balance, and the statistical discrepancy. – Example: The U. S. balance of payments in 2000 was $35. 6 billion, that is, the balance of official reserve transactions with its sign reversed. • A country with a negative balance of payments may signal that it is running down its international reserve assets or incurring debts to foreign monetary

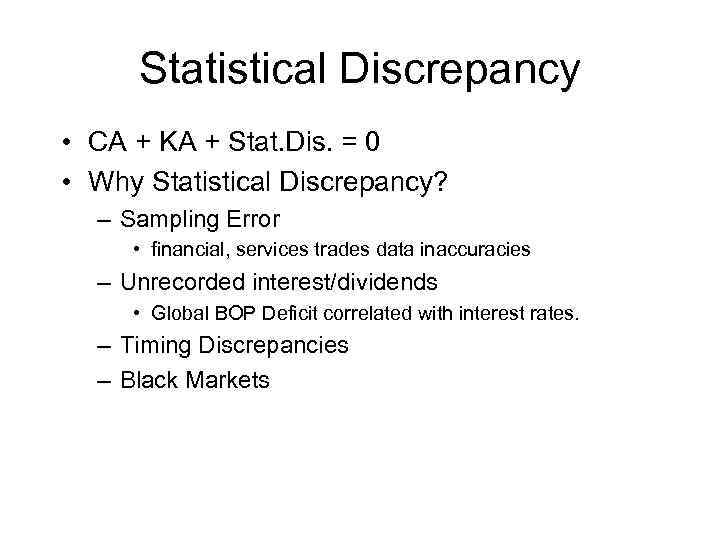

Statistical Discrepancy • CA + KA + Stat. Dis. = 0 • Why Statistical Discrepancy? – Sampling Error • financial, services trades data inaccuracies – Unrecorded interest/dividends • Global BOP Deficit correlated with interest rates. – Timing Discrepancies – Black Markets

Ukraine economic performance indicators, 2001 -2008 Sigma. Bleyzer Foundation

Define a type of transaction • A family member from Kharkov works in EU, and sends money monthly to Ukraine • Ukrainian citizen earns honorarium for her consulting service from the US organization • French citizen holds bonds of Ukrainian government/business and gets interest payments • Your relatives go to Vienna for a weekend • A German tourist visits friends in Poltava • Your friend buys Porsche car • Turboatom sells its’ turbines to Turkmenistan • China’s investors build a new restaurant in Lviv • Mittal steel buys a factory in Ukraine

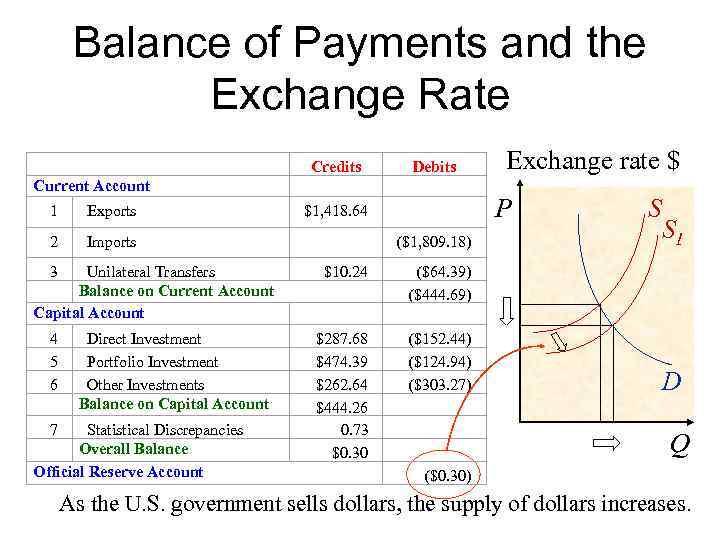

Balance of Payments and the Exchange Rate Current Account Credits Exchange rate $ Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) P S D Q

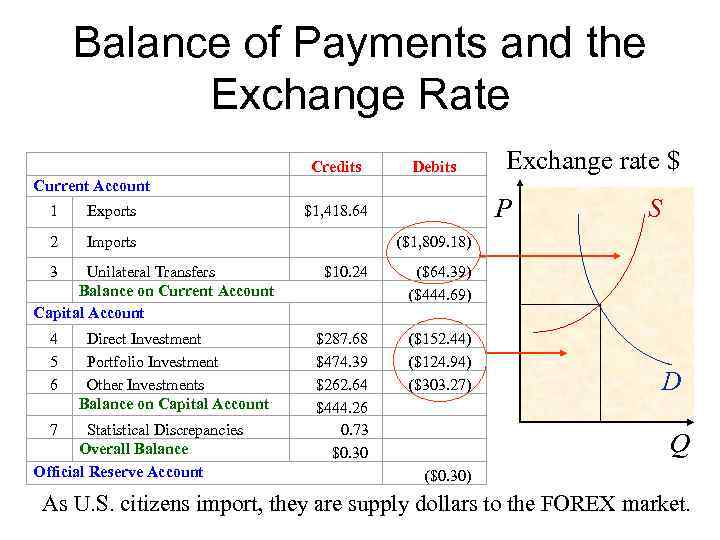

Balance of Payments and the Exchange Rate Current Account Credits Exchange rate $ Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) P S D Q As U. S. citizens import, they are supply dollars to the FOREX market.

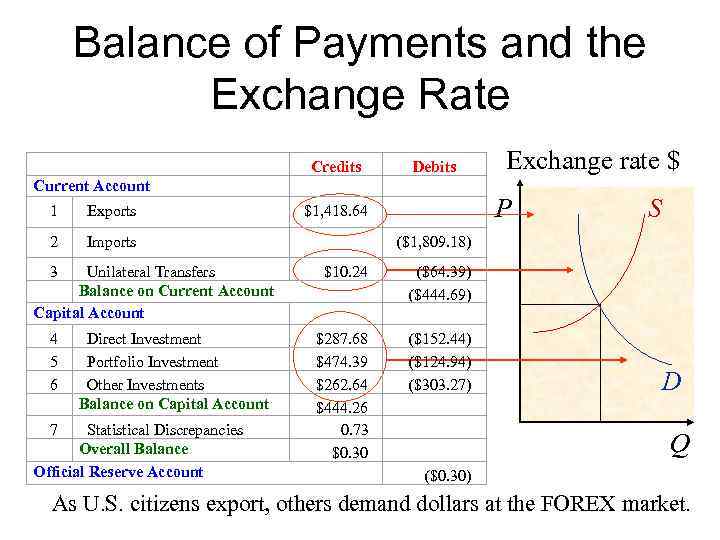

Balance of Payments and the Exchange Rate Current Account Credits Exchange rate $ Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) P S D Q As U. S. citizens export, others demand dollars at the FOREX market.

Balance of Payments and the Exchange Rate Current Account Credits Exchange rate $ Debits 1 Exports $1, 418. 64 2 Imports ($1, 809. 18) 3 $10. 24 4 5 6 7 $287. 68 $474. 39 $262. 64 $444. 26 0. 73 $0. 30 ($64. 39) ($444. 69) ($152. 44) ($124. 94) ($303. 27) Unilateral Transfers Balance on Current Account Capital Account Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account ($0. 30) P S S 1 D Q As the U. S. government sells dollars, the supply of dollars increases.

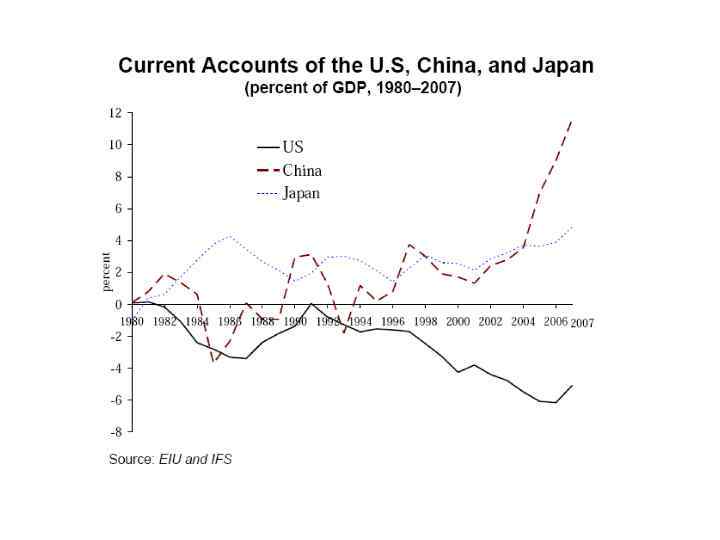

Summary • All transactions between a country and the rest of the world are recorded in its balance of payments accounts. • The current account equals the country’s net lending to foreigners. – National saving equals domestic investment plus the current account. – Transactions involving goods and services appear in the current account of the balance of payments, while international sales or purchases of assets appear in the financial account.

Summary • The capital account records asset transfers. • Any current account deficit must be matched by an equal surplus in the other two accounts of the balance of payments, and any current account surplus by a deficit somewhere else. • International asset transactions carried out by central banks are included in the financial account.