50ede1881612c88d93b4e73a590b214a.ppt

- Количество слайдов: 42

Balance of Payments and Exchange Rates Ch 1/BP&ER 1

Introduction: Open vs closed economy Three kinds of openness: • Free trade in goods and services Restrictions: , etc. • Free movements of capital (financial) Restrictions: • Free movements of factors: plants, labor Restrictions: Ch 1/BP&ER 2

Various Measurements of openness • EXPORTS/GDP or IMPORTS/GDP • (EXPORTS + IMPORTS)/GDP • TRADABLES/GDP Tradables are goods that compete with foreign goods on either domestic or foreign markets e. g. This last ratio (high for the US) reflects the fact that if a country is competitive it does not need to import much. Ch 1/BP&ER 3

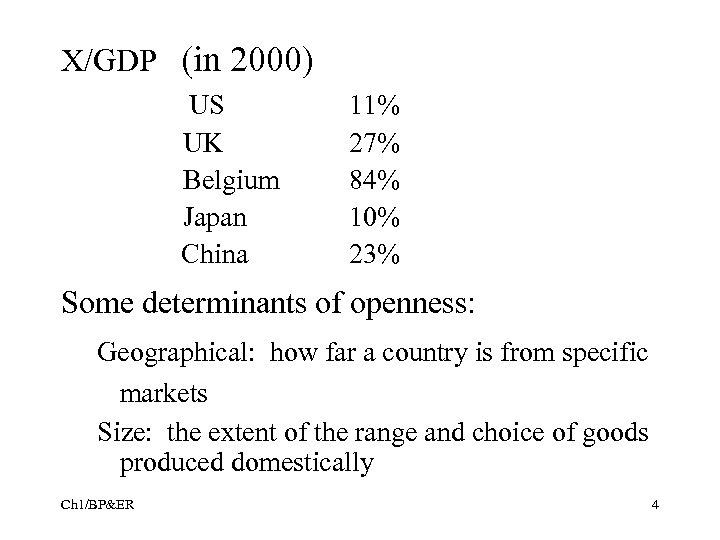

X/GDP (in 2000) US UK Belgium Japan China 11% 27% 84% 10% 23% Some determinants of openness: Geographical: how far a country is from specific markets Size: the extent of the range and choice of goods produced domestically Ch 1/BP&ER 4

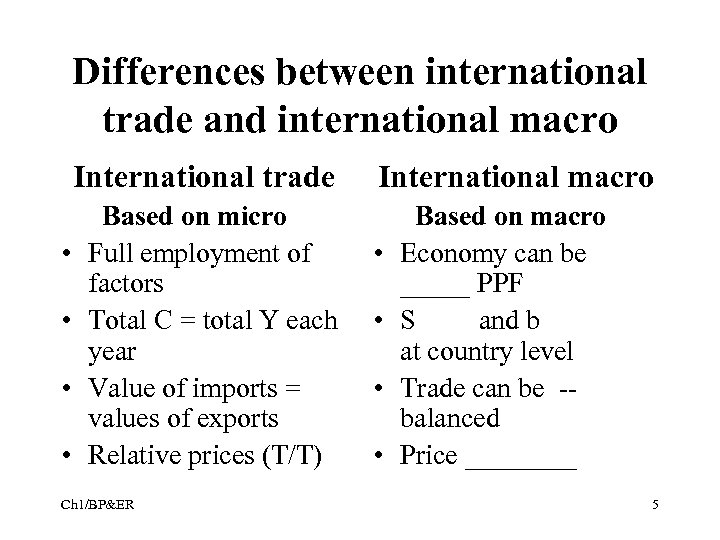

Differences between international trade and international macro International trade • • Based on micro Full employment of factors Total C = total Y each year Value of imports = values of exports Relative prices (T/T) Ch 1/BP&ER International macro • • Based on macro Economy can be _____ PPF S and b at country level Trade can be -balanced Price ____ 5

A The Balance of Payments • The national income accounts revisited (econ 301) • The balance of payments accounts Ch 1/BP&ER 6

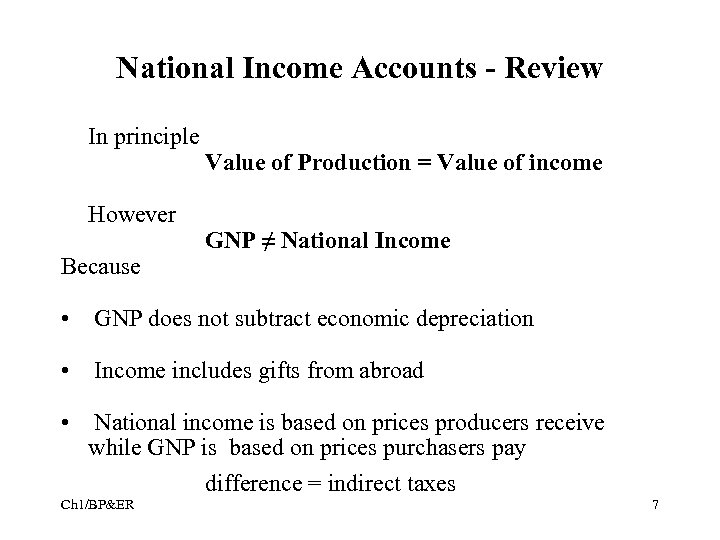

National Income Accounts - Review In principle However Because Value of Production = Value of income GNP ≠ National Income • GNP does not subtract economic depreciation • Income includes gifts from abroad • National income is based on prices producers receive while GNP is based on prices purchasers pay difference = indirect taxes Ch 1/BP&ER 7

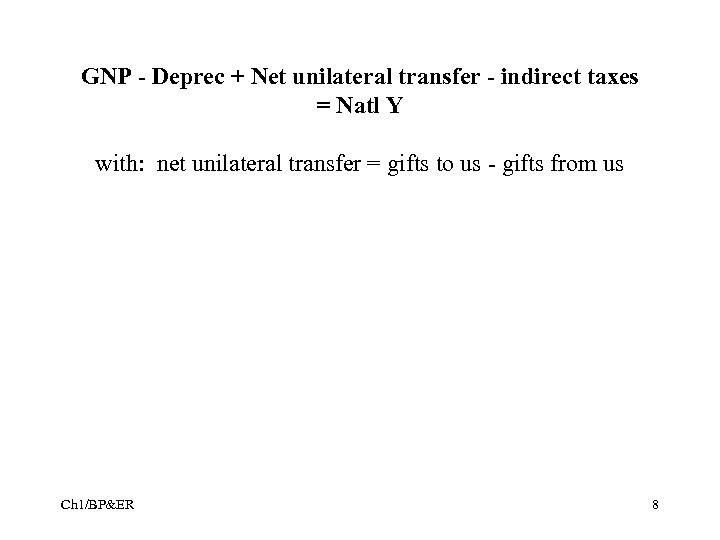

GNP - Deprec + Net unilateral transfer - indirect taxes = Natl Y with: net unilateral transfer = gifts to us - gifts from us Ch 1/BP&ER 8

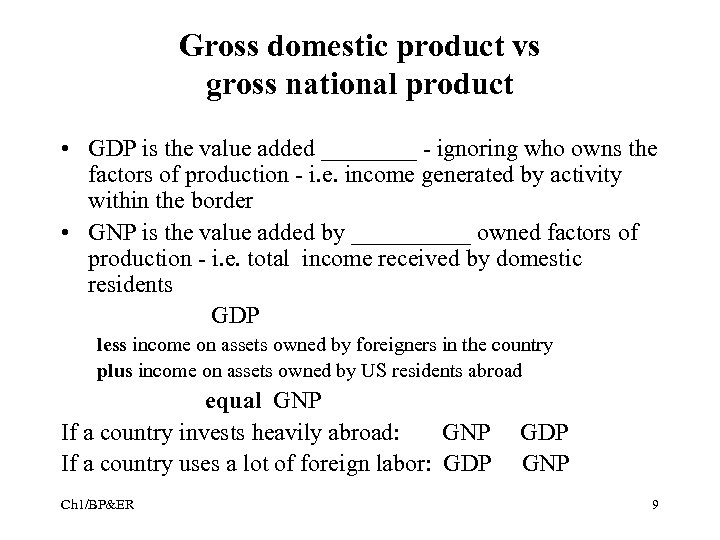

Gross domestic product vs gross national product • GDP is the value added ____ - ignoring who owns the factors of production - i. e. income generated by activity within the border • GNP is the value added by _____ owned factors of production - i. e. total income received by domestic residents GDP less income on assets owned by foreigners in the country plus income on assets owned by US residents abroad equal GNP If a country invests heavily abroad: GNP If a country uses a lot of foreign labor: GDP Ch 1/BP&ER GDP GNP 9

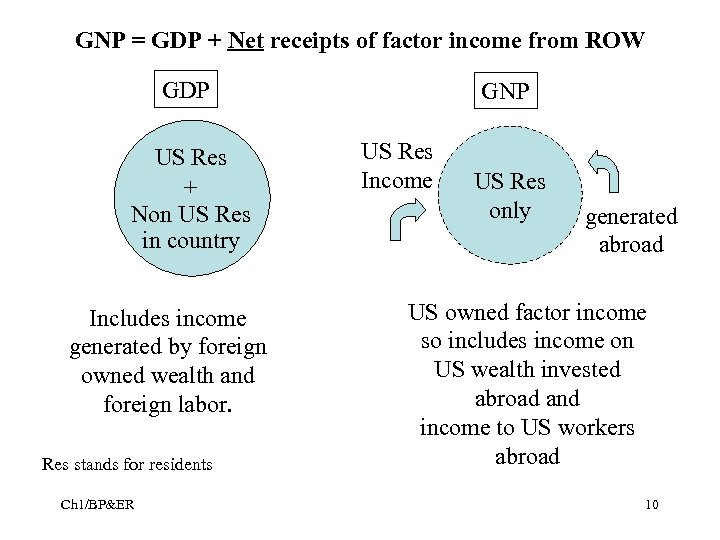

GNP = GDP + Net receipts of factor income from ROW GDP US Res + Non US Res in country Includes income generated by foreign owned wealth and foreign labor. Res stands for residents Ch 1/BP&ER GNP US Res Income US Res only generated abroad US owned factor income so includes income on US wealth invested abroad and income to US workers abroad 10

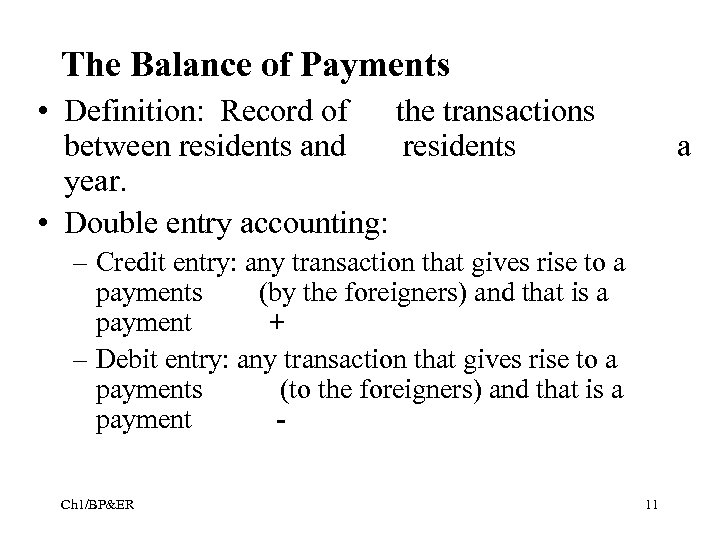

The Balance of Payments • Definition: Record of the transactions between residents and residents year. • Double entry accounting: a – Credit entry: any transaction that gives rise to a payments (by the foreigners) and that is a payment + – Debit entry: any transaction that gives rise to a payments (to the foreigners) and that is a payment Ch 1/BP&ER 11

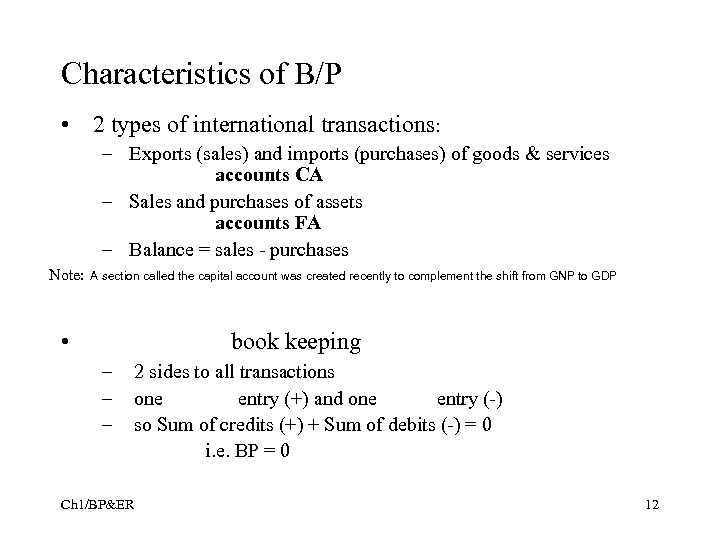

Characteristics of B/P • 2 types of international transactions: – Exports (sales) and imports (purchases) of goods & services accounts CA – Sales and purchases of assets accounts FA – Balance = sales - purchases Note: A section called the capital account was created recently to complement the shift from GNP to GDP • book keeping – – – Ch 1/BP&ER 2 sides to all transactions one entry (+) and one entry (-) so Sum of credits (+) + Sum of debits (-) = 0 i. e. BP = 0 12

I Current Account • Affects income ( as ) • Measures direction and size of CA > 0 S - country is a CA < 0 D - country is a So CA = ∆ in a country’s foreign assets (or debt) C + I + G is absorption or demand for goods (produced at home or imported) Y - (C + I + G) = i. e. if a country consumes more than it produces, it must from abroad as it runs a CA Ch 1/BP&ER 13

Intertemporal interpretation • Borrowers must repay their debt in the future • A country with a CA deficit imports present consumption and exports future consumption Other interpretations • Chronic CA deficits result in large foreign debt and high interest payments on the debt which further erode the CA • Chronic surpluses could have inflationary effects Ch 1/BP&ER 14

National saving and the CA By definition • Closed economy as Y = C + I + G in equil: Sn = • Open economy as Y = C + I + G + CA in equil: Sn = Open economy saves by building capital stock (I) by investing abroad (if CA >0) (A country can invest more than its saving by borrowing from abroad thus running a CA deficit) Ch 1/BP&ER 15

Private and government saving: The twin deficit • Sp and Sg by definition and national saving Sn Sp + Sg = Y - C - G • In equilibrium Sn = I + CA Sp + Sg = I + CA Sp = I + CA - Sg = I + (EX - IM) + (G - T) So private saving can 1. Finance private investment 2. Allow the country to invest abroad 3. Finance the budget deficit Ch 1/BP&ER 16

Current Accounts Breakdown • Exports and imports of goods and services – Exports are – Imports are entries ( ) • Services are sometimes called » Insurance - banking services - shipping • Investment income received ( ) and paid ( ) – Interest etc. – Net = investment income received less inv. inc. paid • Unilateral Transfers (net) – One sided transaction: Gifts to us ( ) and gifts from us ( ) – Net = Gifts to us - gifts from us Ch 1/BP&ER 17

Various balances • Exports of goods less imports of goods: the balance on goods so-called the trade balance • Exports of services less imports of services: the balance on services • Exports of goods and services less imports of goods and services: the balance of ( or net exports) • Balance of trade + net investment income + net unilateral transfer: the balance on or Ch 1/BP&ER 18

II Capital and Financial Account A Capital Account • capital transfers (migrant labor financial transfers and debt forgiveness) • transactions in non-produced and nonfinancial assets (transfer of ownership in natural resources, intellectual property rights, franchises and leases) Total amount is not very large. Ch 1/BP&ER 19

B Financial account • Correspond to in stock of assets - so they are (thus consistent with current accts). • Some are and other are accounts. • Some are term and some are term type of assets. • Some are and some are government transactions; – the government transactions can be broken down further into Central Bank and non Central Bank. Ch 1/BP&ER 20

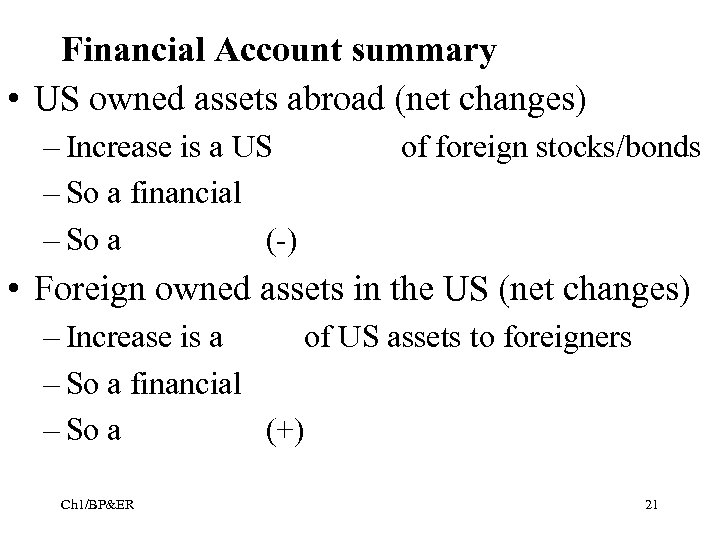

Financial Account summary • US owned assets abroad (net changes) – Increase is a US – So a financial – So a (-) of foreign stocks/bonds • Foreign owned assets in the US (net changes) – Increase is a of US assets to foreigners – So a financial – So a (+) Ch 1/BP&ER 21

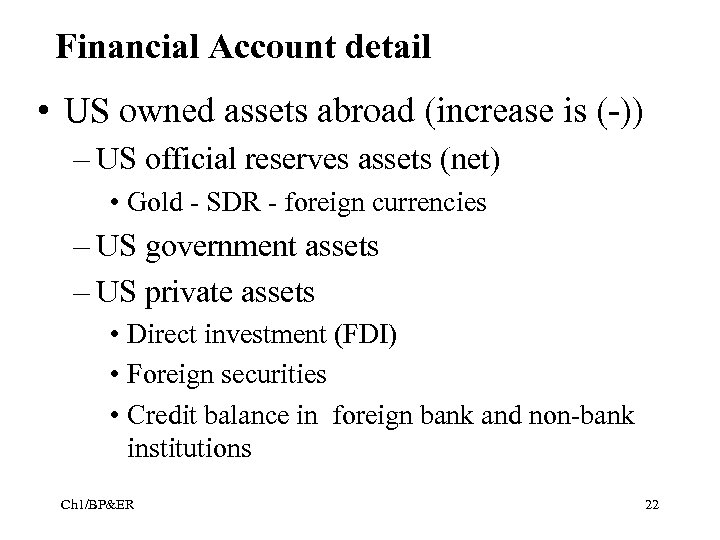

Financial Account detail • US owned assets abroad (increase is (-)) – US official reserves assets (net) • Gold - SDR - foreign currencies – US government assets – US private assets • Direct investment (FDI) • Foreign securities • Credit balance in foreign bank and non-bank institutions Ch 1/BP&ER 22

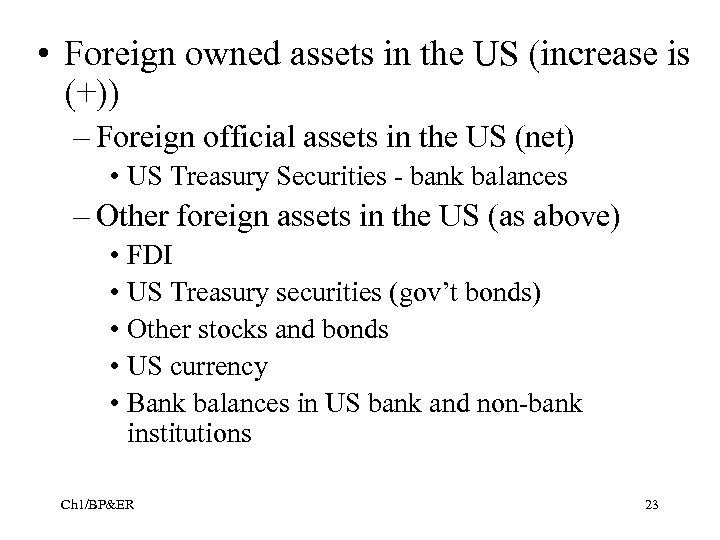

• Foreign owned assets in the US (increase is (+)) – Foreign official assets in the US (net) • US Treasury Securities - bank balances – Other foreign assets in the US (as above) • FDI • US Treasury securities (gov’t bonds) • Other stocks and bonds • US currency • Bank balances in US bank and non-bank institutions Ch 1/BP&ER 23

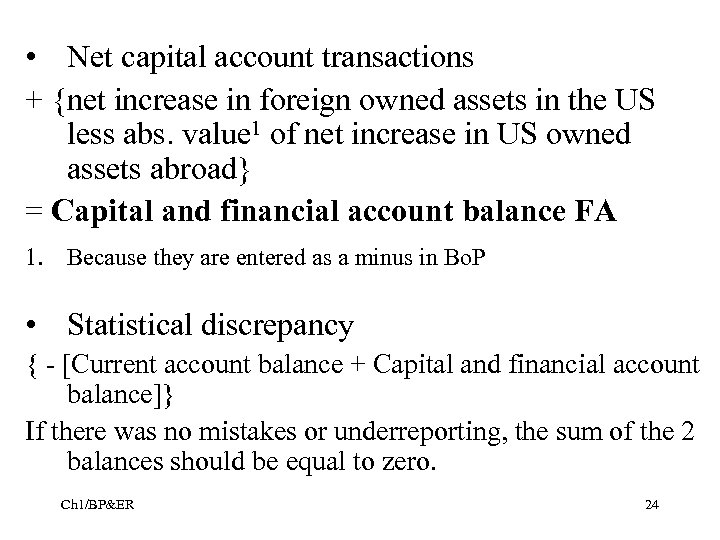

• Net capital account transactions + {net increase in foreign owned assets in the US less abs. value 1 of net increase in US owned assets abroad} = Capital and financial account balance FA 1. Because they are entered as a minus in Bo. P • Statistical discrepancy { - [Current account balance + Capital and financial account balance]} If there was no mistakes or underreporting, the sum of the 2 balances should be equal to zero. Ch 1/BP&ER 24

Overall Interpretation • CA balance measures in country’s net foreign assets (e. g. a surplus - CA > 0 corresponds to lending to ROW) • So this will be reflected in the FA balance where purchases of foreign assets will be ____ than sales of foreign assets. • In sum a positive CA balance will be matched by a FA balance of same absolute value Ch 1/BP&ER 25

Examples of US balance of payments entries Alitalia buys a Boeing 747 and pays with a check from Banco di Lavoro – Credit: of Boeing (3) accounts – Debit: in US owned private asset abroad or in US claims reported by US banks (54) accounts Ch 1/BP&ER 26

The US government sends food as relief to famine stricken Mali – Credit: – Debit: Ch 1/BP&ER of food (3) accounts (gift from us) (36) accounts 27

A French citizen buys shares of Microsoft and pays by drawing his account at the Key Bank – Credit: in foreign owned private assets in the US (64) accounts – Debit: in US liabilities reported by US banks (69) accounts Ch 1/BP&ER 28

B Exchange Rates Ch 1/BP&ER 29

Various Exchange Rates Nominal exchange rate - E • Definition: the price of the foreign currency in terms of the domestic currency so it is quoted as ____ of units of domestic currency in ____ unit of foreign currency • It fluctuates overtime – Appreciation of the domestic currency: units are needed to buy 1 unit of the foreign currency – Depreciation of the domestic currency: units are needed to buy 1 unit of the foreign currency Ch 1/BP&ER 30

Examples of ER fluctuation • • • January 1999 $1. 17/€ September 2000 $0. 85/ € May 2002 $0. 91/ € May 2003 $1. 14/ € September 2007 $1. 41/€ The euro depreciated by some 27% against the dollar in its first 18 months and appreciated by some 25% from 2002 to 2003. The euro has continued to appreciate steadily since. Ch 1/BP&ER 31

Law of One Price 2 countries - each produces one good – Switzerland produces calculator - price: 100 SF – US produces book - price: $25 – Nominal exchange rate: E = $. 50/SF • So price of Swiss calculator in $ is 100 *. 50 = $50 – The real exchange rate RER is: Ch 1/BP&ER 32

Real Exchange Rate • The real exchange rate is a relative price of 2 goods (calculator and book) indicating that Swiss calculator = US books i. e. US books can be exchanged for (or buy) Swiss calculator • With more than one good, the meaning will be slightly different. We will need to use the aggregate price of a basket of goods (the price level or CPI) in each country and the RER will become the relative price of the 2 baskets. Ch 1/BP&ER 33

RER cont. • We now have • The meaning is similar: the RER indicates how many (units of a) US basket(s) can be exchanged for 1 foreign basket (P* is the foreign price level). • If either E or P* change, we will have a real appreciation or a real depreciation. Ch 1/BP&ER 34

Real appreciation and depreciation • When the RER drops, we have a real i. e. the US needs to give up US baskets to acquire foreign basket. This is a real depreciation from the point of view of the other country. • Since A real appreciation can be caused by: a nominal (E drops) or/and an in the domestic price level (P incr) or/and a in the foreign price level (P* drops) Ch 1/BP&ER 35

Effect of the real appreciation on trade • Swiss goods become expensive for Americans (less than 2 US baskets to buy one Swiss basket) – So demand for Swiss good - US Imports • US goods become expensive for the Swiss (one Swiss basket buy fewer US baskets) – So demand for US goods - US Exports • So the US the balance of trade (exports less imports) but the Swiss balance of trade because they experience a real depreciation). Ch 1/BP&ER 36

In Sum: Effect of the real appreciation on trade: • imports are ____ and exports ______ • the balance of trade will _____ • this results in a _______ in the country’s international competitiveness A real depreciation has the opposite effect as more domestic baskets are needed to buy one foreign basket and the balance of trade improves: • this results in an _______ in the country’s Ch 1/BP&ER international competitiveness 37

Illustration • Between 1959 and 1985, inflation in Switzerland or Germany has not been as high as in France, so France (the French Franc) experienced a real appreciation with respect to these 2 currencies. However in the long run (over the years), the nominal exchange rate (F/DM or F/SF) also depreciated to account for these relative price changes. Ch 1/BP&ER 38

Multilateral or trade weighted ER Up to now we only considered bilateral exchange rate i. e. the relative price of 2 currencies. However one specific currency may appreciate with respect to another currency and depreciate with respect to a third currency: in one instance there will be a deterioration in its international competitiveness and in the other an improvement. We need to develop a way to get the whole picture. Ch 1/BP&ER 39

Construction of a trade weighted ER • The are constructed by the IMF - but there is more than one way to do it. • The basic approach is – To transform each bilateral ER into an (indeed you can’t add ER as they are expressed in different units) – Decide on a year set as 100 and calculate an index series over time for each bilateral ER. – Use a scheme to aggregate the various indices - usually the importance of trade with a specific country as a ratio of total trade. Ch 1/BP&ER 40

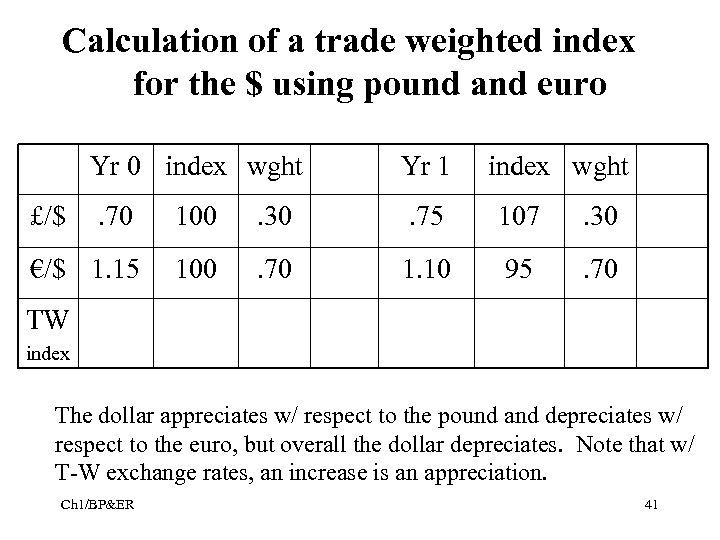

Calculation of a trade weighted index for the $ using pound and euro Yr 0 index wght Yr 1 . 70 100 . 30 . 75 107 . 30 €/$ 1. 15 100 . 70 1. 10 95 . 70 £/$ index wght TW index The dollar appreciates w/ respect to the pound and depreciates w/ respect to the euro, but overall the dollar depreciates. Note that w/ T-W exchange rates, an increase is an appreciation. Ch 1/BP&ER 41

Real multilateral or trade weighted ER Evidently, it is also possible to calculate a real multilateral or trade weighted exchange rate. It suffices to calculate the original bilateral indices with the real bilateral exchange rates. Ch 1/BP&ER 42

50ede1881612c88d93b4e73a590b214a.ppt