5c8e2986dd67a0dedf7ad1ae6f3c3ef9.ppt

- Количество слайдов: 28

Baker Tilly in South East Europe Bulgaria, Cyprus, Greece, Romania, Moldova Company Profile Sofia, 2017 BULGARIA www. bakertillyklitou. bg

Baker Tilly International Latest data: • One of the world’s leading networks of • • • Our Mission: To operate a network whose members deliver, with integrity and objectivity, superior independent audit, accounting, tax and financial services to clients through global resources and relationship. independently owned and managed accountancy and business advisory firms 30. 490 employees in 147 countries 126 Independent Member Firms across four geographical areas 9 th largest accountancy firm worldwide in terms of fees earned with an annual turnover of $3, 2 bn. Commitments: • Lead by example • Provide high quality standards services with • • emphasis on integrity Communicate with transparency and honesty Act ethically Promote cooperation and teamwork Create a collaborative work environment where each one evolves and give the best of themselves BULGARIA www. bakertillyklitou. bg

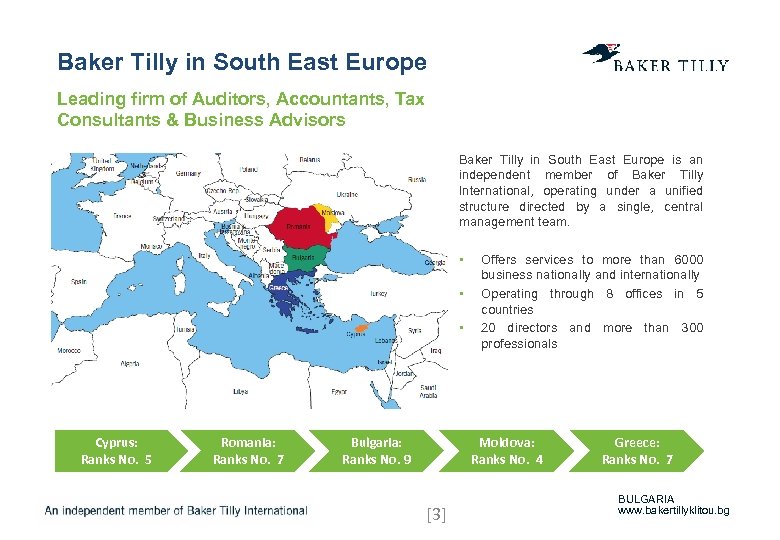

Baker Tilly in South East Europe Leading firm of Auditors, Accountants, Tax Consultants & Business Advisors Baker Tilly in South East Europe is an independent member of Baker Tilly International, operating under a unified structure directed by a single, central management team. • • • Cyprus: Ranks No. 5 Romania: Ranks No. 7 Bulgaria: Ranks No. 9 Offers services to more than 6000 business nationally and internationally Operating through 8 offices in 5 countries 20 directors and more than 300 professionals Moldova: Ranks No. 4 [3] Greece: Ranks No. 7 BULGARIA www. bakertillyklitou. bg

Our vision One step ahead In order to maintain the quality of our services to the highest standards and to cater to our clients’ needs, we are constantly looking for ways to enhance our expertise and presence in the financial and geographical areas in which our clients operate. What sets Baker Tilly apart from the rest? • Our strong geographical presence allows complete coverage of the Balkan region gives us in-house expertise in the countries where our clients do business • Our highly specialized staff in the areas of accounting, payroll, audit, internal audit and risk management, tax consulting and compliance services, transfer pricing, VAT, corporate finance, technical training and other specialist offerings work together under the same umbrella, sharing their knowledge and expertise to offer outstanding service to clients • Our one-stop shop approach. A complete range of services is offered through a single point of contact to ensure quick, proactive response in all areas of service • Excellent links with our strong international network. We can help clients no matter where in the world they do business, offering seamless service all through a single point of contact BULGARIA www. bakertillyklitou. bg

Our vision One culture, one team Our strong single-firm culture enables us to: ü Provide a seamless, holistic service to all our clients ü Apply uniform procedures and practices internally ü Adhere to the same, stringent quality control procedures in accordance with Baker Tilly International and Baker Tilly in South East Europe requirements ü Develop our diverse team of high-calibre staff so that each of them is an expert in their field, all working together to exceed client expectations BULGARIA www. bakertillyklitou. bg

Baker Tilly Bulgaria Our services • • • Audit, assurance and related services Accounting and payroll Tax services Legal Consulting 2 local partners and a team of 35 highly motivated and dedicated professionals provide: • a full range of services of the highest standard • to both local and international clients • across all industries and sectors of the economy BULGARIA www. bakertillyklitou. bg

Accounting Bookkeeping, payroll and tax services Bookkeeping services Payroll Services and HR Administration Management reporting, Interim Reporting, Annual closing Involvement of our Tax Department • Monthly book-keeping • Monthly reconciliation of the bank accounts and cash • Reconciliation of fixed assets and inventories • Reconciliation of balances between debtors and creditors (incl. IC balances) • Preparation and submission of monthly VAT ledgers and VAT returns, Monthly VAT computation • Preparation and submitting of on-going tax returns • Preparation and submitting of the reports to the Bulgarian National Bank for loans and payables to foreign entities • Preparation of payment orders • Communication with the Management for information and clarifications Payroll Services • Monthly payroll processing • Preparation of the payroll statements, including computation of the social contributions and payroll taxes • Submission of monthly declaration to NRA and NSSI • Illness certificates processing and submission • Preparation of Payroll Certificates • Payroll reports and analysis HR Administration • Collection of HR relevant documents for new joiners, organizing signing of new contracts or termination of existing contracts • Keeping the HR files person • Handling leave requests • Sick leave administration Management reporting • Preparation of Reporting Packages in a Client’s template • Reconciliation, breakdowns, explanations • Assistance to audit Interim reporting and Annual closing of accounts • Preparation of the Interim/Annual Financial Statements under IFRS or Local GAAP • Preparation and submitting of the Annual Statistics Report • Preparation and submission of the Annual Tax Return • Assistance to Audit • Organizing the corporate documents for approval of the Annual Financial Statement and submission to the Trade Register • Assistance in the event of tax inspections: communication with the NRA and the Company management, reviewing documents, drafting requests, explanations and other requested documents • Assistance in case of tax disputes: communication with the NRA aiming at dispute resolution prior to additional tax assessment, preparation of appeals, assistance in course of tax litigation • Tax analysis and advisory on specific tax issues • Expatriate tax advice and compliance • Full range of Transfer pricing services: advice and documentation preparation BULGARIA www. bakertillyklitou. bg

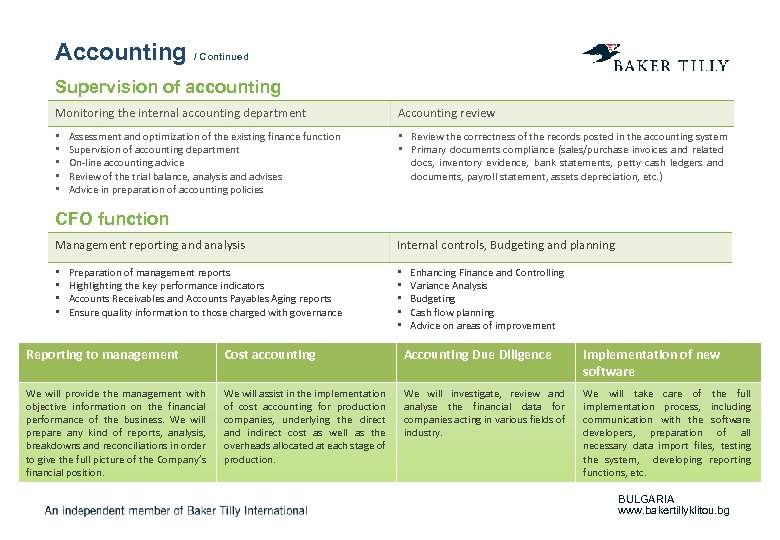

Accounting / Continued Supervision of accounting Monitoring the internal accounting department • • • Assessment and optimization of the existing finance function Supervision of accounting department On-line accounting advice Review of the trial balance, analysis and advises Advice in preparation of accounting policies Accounting review • Review the correctness of the records posted in the accounting system • Primary documents compliance (sales/purchase invoices and related docs, inventory evidence, bank statements, petty cash ledgers and documents, payroll statement, assets depreciation, etc. ) CFO function Management reporting and analysis • • Preparation of management reports Highlighting the key performance indicators Accounts Receivables and Accounts Payables Aging reports Ensure quality information to those charged with governance Internal controls, Budgeting and planning • • • Enhancing Finance and Controlling Variance Analysis Budgeting Cash flow planning Advice on areas of improvement Reporting to management Cost accounting Accounting Due Diligence Implementation of new software We will provide the management with objective information on the financial performance of the business. We will prepare any kind of reports, analysis, breakdowns and reconciliations in order to give the full picture of the Company’s financial position. We will assist in the implementation of cost accounting for production companies, underlying the direct and indirect cost as well as the overheads allocated at each stage of production. We will investigate, review and analyse the financial data for companies acting in various fields of industry. We will take care of the full implementation process, including communication with the software developers, preparation of all necessary data import files, testing the system, developing reporting functions, etc. BULGARIA www. bakertillyklitou. bg

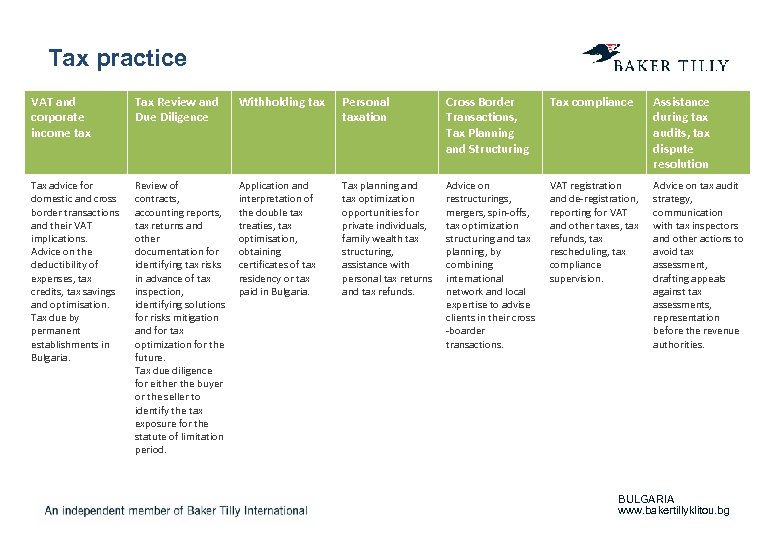

Tax practice VAT and corporate income tax Tax Review and Due Diligence Withholding tax Personal taxation Cross Border Transactions, Tax Planning and Structuring Tax compliance Assistance during tax audits, tax dispute resolution Tax advice for domestic and cross border transactions and their VAT implications. Advice on the deductibility of expenses, tax credits, tax savings and optimisation. Tax due by permanent establishments in Bulgaria. Review of contracts, accounting reports, tax returns and other documentation for identifying tax risks in advance of tax inspection, identifying solutions for risks mitigation and for tax optimization for the future. Tax due diligence for either the buyer or the seller to identify the tax exposure for the statute of limitation period. Application and interpretation of the double tax treaties, tax optimisation, obtaining certificates of tax residency or tax paid in Bulgaria. Tax planning and tax optimization opportunities for private individuals, family wealth tax structuring, assistance with personal tax returns and tax refunds. Advice on restructurings, mergers, spin-offs, tax optimization structuring and tax planning, by combining international network and local expertise to advise clients in their cross -boarder transactions. VAT registration and de-registration, reporting for VAT and other taxes, tax refunds, tax rescheduling, tax compliance supervision. Advice on tax audit strategy, communication with tax inspectors and other actions to avoid tax assessment, drafting appeals against tax assessments, representation before the revenue authorities. BULGARIA www. bakertillyklitou. bg

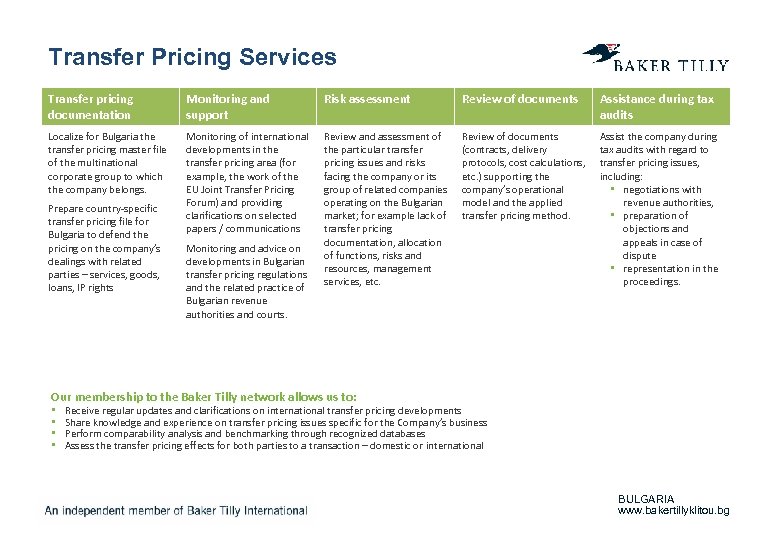

Transfer Pricing Services Transfer pricing documentation Monitoring and support Risk assessment Review of documents Assistance during tax audits Localize for Bulgaria the transfer pricing master file of the multinational corporate group to which the company belongs. Monitoring of international developments in the transfer pricing area (for example, the work of the EU Joint Transfer Pricing Forum) and providing clarifications on selected papers / communications Review and assessment of the particular transfer pricing issues and risks facing the company or its group of related companies operating on the Bulgarian market; for example lack of transfer pricing documentation, allocation of functions, risks and resources, management services, etc. Review of documents (contracts, delivery protocols, cost calculations, etc. ) supporting the company’s operational model and the applied transfer pricing method. Assist the company during tax audits with regard to transfer pricing issues, including: • negotiations with revenue authorities, • preparation of objections and appeals in case of dispute • representation in the proceedings. Prepare country-specific transfer pricing file for Bulgaria to defend the pricing on the company’s dealings with related parties – services, goods, loans, IP rights Monitoring and advice on developments in Bulgarian transfer pricing regulations and the related practice of Bulgarian revenue authorities and courts. Our membership to the Baker Tilly network allows us to: • • Receive regular updates and clarifications on international transfer pricing developments Share knowledge and experience on transfer pricing issues specific for the Company’s business Perform comparability analysis and benchmarking through recognized databases Assess the transfer pricing effects for both parties to a transaction – domestic or international BULGARIA www. bakertillyklitou. bg

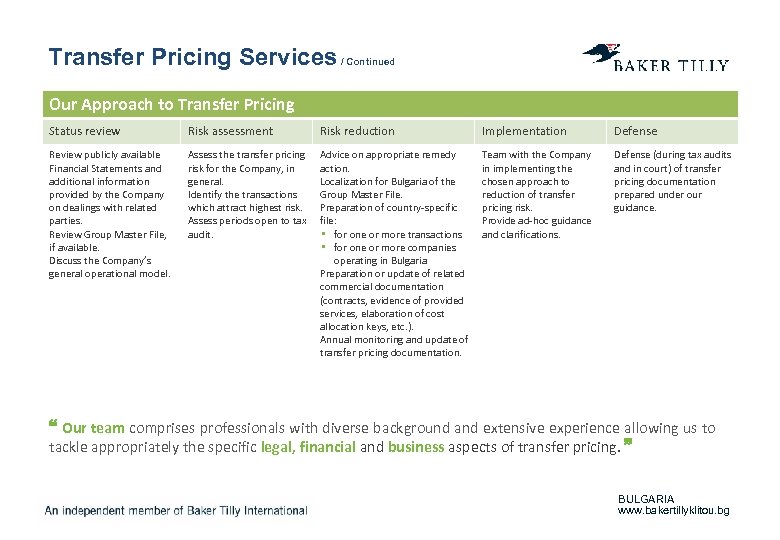

Transfer Pricing Services / Continued Our Approach to Transfer Pricing Status review Risk assessment Risk reduction Implementation Defense Review publicly available Financial Statements and additional information provided by the Company on dealings with related parties. Review Group Master File, if available. Discuss the Company’s general operational model. Assess the transfer pricing risk for the Company, in general. Identify the transactions which attract highest risk. Assess periods open to tax audit. Advice on appropriate remedy action. Localization for Bulgaria of the Group Master File. Preparation of country-specific file: • for one or more transactions • for one or more companies operating in Bulgaria Preparation or update of related commercial documentation (contracts, evidence of provided services, elaboration of cost allocation keys, etc. ). Annual monitoring and update of transfer pricing documentation. Team with the Company in implementing the chosen approach to reduction of transfer pricing risk. Provide ad-hoc guidance and clarifications. Defense (during tax audits and in court) of transfer pricing documentation prepared under our guidance. Our team comprises professionals with diverse background and extensive experience allowing us to tackle appropriately the specific legal, financial and business aspects of transfer pricing. BULGARIA www. bakertillyklitou. bg

Corporate and legal services tailored for clients’ needs Advice and assistance Corporate and Commercial Mergers and Acquisitions Real Estate Labor issues Finance Residence and work permits, citizenship Advise in company formation, restructuring and dissolution, corporate governance, contracts, registrations with the Trade Register, Bulstat registration and other relevant to the particular business, dayto-day corporate and commercial support. Advise, preparation of relevant documents and full scope implementation of various mergers and acquisitions with an interdisciplinary approach that takes into consideration tax implications, employment law, etc. Advise on acquisition and sale of properties, constructions, property management and leases. Preparation of relevant documents. Representation in negotiations and before relevant governmental and municipal bodies, notaries, etc. Advise on options for employment and working hours, drafting labor contracts, job descriptions and other labor law documents, assistance in employer / employee disputes, staff reorganizations and restructuring, drafting internal procedures under the Labor Code, day-to-day labor law issues. Legal advice in aspects related to project finance, operations finance and EU finance. Advice, preparation of documents and representation before the relevant authorities for obtaining Bulgarian residence permits, work permits or citizenship. BULGARIA www. bakertillyklitou. bg

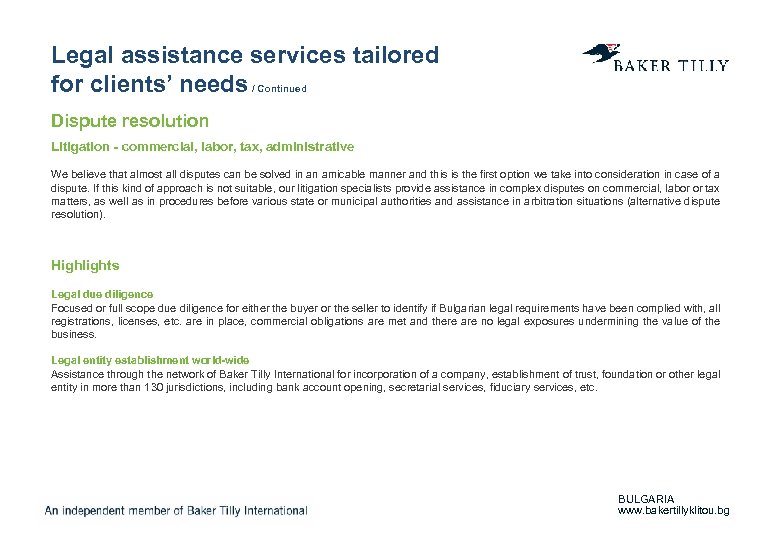

Legal assistance services tailored for clients’ needs / Continued Dispute resolution Litigation - commercial, labor, tax, administrative We believe that almost all disputes can be solved in an amicable manner and this is the first option we take into consideration in case of a dispute. If this kind of approach is not suitable, our litigation specialists provide assistance in complex disputes on commercial, labor or tax matters, as well as in procedures before various state or municipal authorities and assistance in arbitration situations (alternative dispute resolution). Highlights Legal due diligence Focused or full scope due diligence for either the buyer or the seller to identify if Bulgarian legal requirements have been complied with, all registrations, licenses, etc. are in place, commercial obligations are met and there are no legal exposures undermining the value of the business. Legal entity establishment world-wide Assistance through the network of Baker Tilly International for incorporation of a company, establishment of trust, foundation or other legal entity in more than 130 jurisdictions, including bank account opening, secretarial services, fiduciary services, etc. BULGARIA www. bakertillyklitou. bg

Audit, assurance and other related services External audit services Review services Agreed upon procedures services Compliance services Other assurance services Audit of financial statements prepared in accordance with International Financial Reporting Standards (IFRS), adopted by EU and National Financial Reporting Standards for Small and Medium Enterprises. Audit of Group Reporting Packages prepared in accordance with IFRS and other applicable frameworks. Review of the financial statements and/or of other special purpose financial statements prepared in accordance with various types of frameworks (i. e. IFRS, accounting policies, loan requirements, etc. ). Analysis and reports on different sections of financial statements based on the requirements of the client following International Standard on Related Services 4400: Engagements to perform Agreed-Upon Procedures regarding Financial Information. Preparation of the financial statements in accordance with various types of frameworks (i. e. IFRS, accounting policies, loan requirements, etc. ) following the requirements of International Standard on Related Services 4410 Engagements to compile Financial Statements. Assurance on different financial / operational items other than historical financial statements based on the specific needs. BULGARIA www. bakertillyklitou. bg

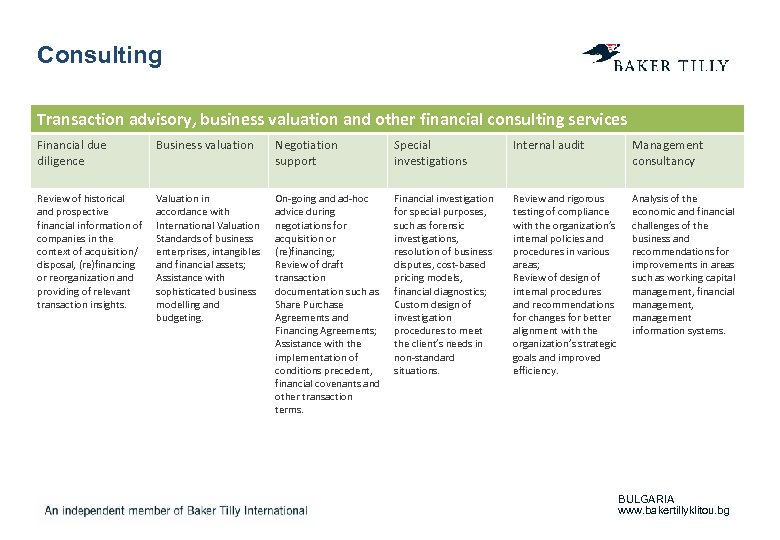

Consulting Transaction advisory, business valuation and other financial consulting services Financial due diligence Business valuation Negotiation support Special investigations Internal audit Management consultancy Review of historical and prospective financial information of companies in the context of acquisition/ disposal, (re)financing or reorganization and providing of relevant transaction insights. Valuation in accordance with International Valuation Standards of business enterprises, intangibles and financial assets; Assistance with sophisticated business modelling and budgeting. On-going and ad-hoc advice during negotiations for acquisition or (re)financing; Review of draft transaction documentation such as Share Purchase Agreements and Financing Agreements; Assistance with the implementation of conditions precedent, financial covenants and other transaction terms. Financial investigation for special purposes, such as forensic investigations, resolution of business disputes, cost-based pricing models, financial diagnostics; Custom design of investigation procedures to meet the client’s needs in non-standard situations. Review and rigorous testing of compliance with the organization’s internal policies and procedures in various areas; Review of design of internal procedures and recommendations for changes for better alignment with the organization’s strategic goals and improved efficiency. Analysis of the economic and financial challenges of the business and recommendations for improvements in areas such as working capital management, financial management, management information systems. BULGARIA www. bakertillyklitou. bg

Awards & Accreditations Our company is a top 10 player on the audit market. Among the local statutory requirements we also have the following titles: ICAEW (The Institute of Chartered Accountants in England Wales) The audit company is an approved training employer. ACCA (The Association of Chartered Certified Accountants) – Platinum level Baker Tilly Cyprus is a platinum level approved employer for trainee development. World Bank The audit company is on the list of fully approved auditors for all WB financed projects. BULGARIA www. bakertillyklitou. bg

Management Team Krassimira Radeva Role • Krassimira Radeva is the Managing Director of Baker Tilly in Bulgaria. • Krassimira is a Fellow of the Association of Chartered Certified Accountants (ACCA) of UK, member of the Institute of Certified Public Accountants of Bulgaria (IDES) and specialist in the implementation of the International Standards on Auditing (ISA) and IFRS. • Krassimira is also a Member of the Disciplinary Council at Bulgarian Institute of Certified Public Accountants (IDES). Managing Director k. radeva@bakertillyklitou. bg Experience • Krassimira has 22 years overall professional experience, including more than 16 years audit experience with leading international accounting firms (6 years in PWC and 10 years in Deloitte). In charge of the activities of Baker Tilly in Bulgaria for Audit, Accounting, Tax, Legal and Consulting Departments. • She is holding various responsibilities for IFRS and Audit Training of staff, professional practice matters, quality control, financial reporting and business development for all business lines. • She is Partner in charge of Companies listed on Bulgarian and Spanish Stock exchange. She is Partner in charge and has extensive experience in engagements including: external audit, financial and operational due diligences, IFRS conversions and other advisory engagements of international and local clients. She is Partner in charge of clients in various industries, including financial institutions, leasing companies, energy sector, trade, manufacturing, real estate and other. • Krassimira has specialization mainly in the following industries: Manufacturing, Trade, Foods and Beverages, Energy and Utilities, Real estate and Public Sector. BULGARIA www. bakertillyklitou. bg

Management Team Svetla Marinova Role • Svetla Marinova is leading the tax and legal practice of Baker Tilly in Bulgaria. • Svetla holds a Master’s degree in Law from the University of Sofia, as well as an ACCA Diploma in Financial Management. • She was a member of the EU Joint Transfer Pricing Forum in Brussels (2007 -2011). Director, Tax & Legal s. marinova@bakertillyklitou. bg Experience • Svetla has 21 years of professional experience including 12 years as a tax and legal consultant with Deloitte and EY; 4 years as a Senior Tax Manager; 4 years as a Head of the in-house tax department of Bulgaria’s largest telecommunications company; 1 year with the Legal department of a major European bank’s Bulgarian branch. • Svetla has specialization mainly in the following industries: Telecommunications, IT, Services, Manufacturing, Wholesale, Retail, Pharmaceuticals, Foods and Beverages, Real Estate. BULGARIA www. bakertillyklitou. bg

Management Team Stela Ivancheva Role • Stela Ivancheva is the Director of the Consulting Department of Baker Tilly in Bulgaria. • Stela holds a Bachelor’s degree in Applied Economics and Business Administration from the American University in Bulgaria. • Stela is a qualified appraiser of business enterprises and receivables, certified by the Chamber of Independent Valuers in Bulgaria. Director, Consulting s. ivancheva@bakertillyklitou. bg Experience • Stela has more than 19 years overall professional audit and financial advisory experience including 17 years with Big 4 accounting firms and 2 years with an investment bank with significant presence in Southeast Europe. • Stela has been involved in a large number of audit, due diligence and other advisory projects, mainly for international clients. • Stela is the key expert in 6 projects for financial due diligence and other types of advisory for insurance businesses, Asset Quality Review project in Bulgaria, valuation, special investigations, internal audit, management consulting, etc. • Stela has specialization mainly in the following industries: Financial Services, Telecommunications, Energy & Utilities, Pharmaceuticals, Manufacturing, Real Estate, Business Services. BULGARIA www. bakertillyklitou. bg

Management Team Maria Karagyozova Role • Maria Karagyozova is the Manager of the Business Accounting Department at Baker Tilly in Bulgaria. • Maria holds an ACCA Diploma in International Financial Reporting (ACCA DIPIFR). • Maria holds a Master’s degree in Accounting and control from Plovdiv University. Accounting Manager m. karagyozova@bakertillyklitou. bg Experience • Maria has 16 years of overall professional experience in financial management, team management, preparation of financial statements under IFRS, budgeting, management reporting, analysis, accounting, payroll and tax compliance. • Maria's major responsibilities are day-to-day managing and coordinating the accounting team; Providing full range of accounting and payroll services as well as providing full range of reporting and analysis to Bulgarian and multinational companies. • Maria has specialization mainly in the following industries: Manufacturing, Retail, Real estate, IT, Construction, Healthcare, Non government organization. BULGARIA www. bakertillyklitou. bg

Management Team Ivaylo Yanchev Role • Ivaylo Yanchev is an Audit Manager at Baker Tilly in Bulgaria, leading a team of audit professionals. • Ivaylo is a member of the Association of Chartered Certified Accountants (ACCA) of UK. He has a Master’s and a Bachelor’s degree in Accounting and Audit from the University of Economics, Varna. • Ivaylo is a specialist in IFRS and NFRSSME. Manager, Audit & Assurance i. yanchev@bakertillyklitou. bg Experience • Ivaylo has 10 years of audit professional experience with leading international accounting firms. • Ivaylo's major responsibilities are Audit of individual and consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and National Financial Reporting Standards for Small and Medium Enterprises (NFRSSME). • Ivaylo is also involved in Financial Due Diligence, Examination of Prospective Financial Information, Internal Audit and Agreed upon Procedure Engagements. • Ivaylo has specialization mainly in the following industries: Manufacturing, Trade, Foods and Beverages, Energy and Utilities, Real estate. BULGARIA www. bakertillyklitou. bg

Management Team Svilena Todorova Role • Svilena Todorova is an Audit Manager at Baker Tilly in Bulgaria, leading a team of audit professionals. • Svilena is a member of the Association of Chartered Certified Accountants (ACCA) of UK. Manager, Audit & Assurance s. todorova@bakertillyklitou. bg • She has a Master’s degree in Accounting from the University of National and World Economy, Sofia and is a Bachelor of Science in Economics from the Trinity College, Hartford CT, USA. • Svilena is a specialist in IFRS and NFRSSME. Experience • Svilena has 8 years of audit professional experience with leading international accounting firms. • Svilena has major responsibilities in Audit of financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and National Financial Reporting Standards for Small and Medium Enterprises (NFRSSME). • Svilena is also involved in Financial Due Diligence, Examination of Prospective Financial Information, Internal Audit and Agreed upon Procedure Engagements. • Svilena has specialization mainly in the following industries: Manufacturing, Trade, Energy and Utilities, IT and Public Sector. BULGARIA www. bakertillyklitou. bg

Management Team Georgi Gergov Role • Georgi Gergov is an Audit Supervisor at Baker Tilly in Bulgaria. • Georgi is a student of the Association of Chartered Certified Accountants (ACCA) of UK. • Georgi holds a Master’s and a Bachelor’s degree in Accounting from the University of National and World Economy, Sofia. Supervisor, Audit & Assurance g. gergov@bakertillyklitou. bg Experience • Georgi has 5 years of audit professional experience with leading international accounting firms. • Georgi's major responsibilities are Audit of financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and National Financial Reporting Standards for Small and Medium Enterprises (NFRSSME) from planning to finalization stage, supervision of the audit team and fieldwork, review of annual tax declarations and other tax issues relevant to statutory audits, comprehensive analysis of financial and nonfinancial information. • Georgi has specialization mainly in the following industries: Manufacturing, Trade, Construction, Foods and Beverages, IT, Energy and Utilities, Real estate and other. BULGARIA www. bakertillyklitou. bg

Management Team Svetlana Dermendjieva Role • Svetlana Dermendjieva is Supervisor and Tax Consultant at Baker Tilly in Bulgaria, leading the tax compliance and tax audit assistance services provided to Bulgarian and foreign companies. • Svetlana holds a Master’s degree in Economics from the University of National and World Economy in Sofia. Pursuing a second Master‘s degree in Accounting. Supervisor, Tax Advisory Services s. dermendjieva@bakertillyklitou. bg Experience • Svetlana has 20 years of experience including: 8 years as a Tax Inspector with the National Revenue Agency, 3 years as a Head of in-house accounting and tax compliance department of a private company, 8 years in a firm providing outsourced accounting and tax compliance services to Bulgarian and foreign clients. • Svetlana has specialization mainly in the following industries: Real Estate, IT, Services, Manufacturing, Wholesale, Retail, Pharmaceuticals, Foods and Beverages. BULGARIA www. bakertillyklitou. bg

Key experts Kristiyan Kolev Role • Kristiyan Kolev is a Senior Audit Assistant at Baker Tilly in Bulgaria. • Kristiyan is a student of the Association of Chartered Certified Accountants (ACCA) of UK. • He has a Master’s degree in Accounting and a Bachelor’s degree in Macroeconomics from the University of National and World Economy, Sofia. Supervisor, Audit & Assurance k. kolev@bakertillyklitou. bg Experience • Kristiyan has 5 years of audit professional experience with leading accounting firms. • Kristiyan's major responsibilities are Audit of financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and National Financial Reporting Standards (NFRS). Senior Assistant for main customers: Megatron PLC (dealer of John Deere), New Glass Corp. , Transimport Ltd. , Muvio Logistics Ltd. , Interfoods Bulgaria Ltd. and others. • Kristiyan has specialization mainly in the following industries: Manufacturing, Trade, Foods and Beverages, Energy and Public Utilities, Real estate, Public sector and others. BULGARIA www. bakertillyklitou. bg

Key experts Sofiya Nikolova Role • Sofiya Nikolova is a Senior Audit Assistant at Baker Tilly in Bulgaria. • Sofiya is an affiliate of the Association of Chartered Certified Accountants (ACCA) of UK. • She has a Bachelor’s degree in Accounting and Finance from the University of Manchester, UK. Supervisor, Audit & Assurance s. nikolova@bakertillyklitou. bg Experience • Sofiya has 5 years of audit professional experience with leading accounting firms. • Sofiya`s major responsibilities are Audit of financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and National Financial Reporting Standards (NFRS). Senior Assistant responsible for major clients: Bella Bulgaria AD, Peek and Cloppenburg Ltd. , A Team Ltd. , MIT Press Ltd. , QBE Distributions Ltd. and others. • Sofiya has specialization mainly in the following industries: Manufacturing, Trade, Foods and Beverages, Energy and Public Utilities, Real estate, Public sector and others. BULGARIA www. bakertillyklitou. bg

Our Offices BULGARIA Sofia Office 104, Akad. Ivan E. Geshov Blvd. Entrance A, 7 th floor, 1612 Sofia, Bulgaria T: +359 2 9580980 F: +359 2 8592139 info@bakertillyklitou. bg www. bakertillyklitou. bg CYPRUS Nicosia Office Corner Hatzopoulou & 30 Griva Digheni Avenue 1066 Nicosia, Cyprus T: +357 22 458500 F: +357 22 751648 info@bakertillyklitou. com www. bakertillyklitou. com CYPRUS Larnaca Office 24 Spyrou Kyprianou Avenue Yiannis-Maria Building, 2 nd floor, Office 203 6058 Larnaca, Cyprus T: +357 26 663299 F: +357 26 662910 larnaca@bakertillyklitou. com www. bakertillyklitou. com GREECE Athens Office 57 Alexandras Avenue & Calligas Str. 114 73 Athens, Greece Τ: +30 215 500 6060 F: +30 215 500 6061 info@bakertillygreece. com www. bakertillygreece. com MOLDOVA Chisinau Office 65 Stefan cel Mare şi Sfânt Blvd. 5 th Floor, office 507 2001 Chisinau, Moldova T: +373 22 233003 F: +373 22 234044 info@bakertilly. md www. bakertilly. md ROMANIA Bucharest Office 4 B Gara Herastrau Street, 10 th Fl. , 2 nd Sector, 020334 Bucharest, Romania T: +40 21 3156100 F: +40 21 3156102 info@bakertilly. ro www. bakertilly. ro CYPRUS Limassol Office 163 Leontiou Street Clerimos Building 3022 Limassol, Cyprus T: +357 25 591515 F: +357 25 591545 limassol@bakertillyklitou. com www. bakertillyklitou. com GREECE Thessaloniki Office 24 Andrianoupoleos Str, 6 th Floor, Kalamaria, 55133, Thessaloniki, Greece T: +30 215 500 6060 F: +30 215 500 6061 info@bakertillygreece. com www. bakertillygreece. com BULGARIA www. bakertillyklitou. bg

Contact us Krassimira Radeva Managing Director Baker Tilly Bulgaria Tel. +359 2 9580980, Fax. +359 2 8592139 Email: info@bakertillyklitou. bg This presentation has been prepared for general guidance on matters of interest only, and does not constitute professional advice. Do not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication. Τo the extent permitted by law, Baker Tilly Klitou and Partners Ltd, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of anyone acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. © 2017 Baker Tilly in Bulgaria is an independent member of Baker Tilly International Limited is an English company. Baker Tilly International provides no professional services to clients. Each member firm is a separate and independent legal entity and each describes itself as such. Baker Tilly in Bulgaria is not Baker Tilly International’s agent and does not have the authority to bind Baker Tilly International or act on Baker Tilly International’s behalf. None of Baker Tilly International, Baker Tilly in Bulgaria, nor any of the other member firms of Baker Tilly International has any liability for each other’s acts or omissions. The name Baker Tilly and its associated logo is used under licence from Baker Tilly International Limited. BULGARIA www. bakertillyklitou. bg

5c8e2986dd67a0dedf7ad1ae6f3c3ef9.ppt