7af7978859960581b3e82b9a087b488f.ppt

- Количество слайдов: 71

BAF 3 M Accounting Chapter 8 – Completing the Accounting Cycle

8. 1 The Adjustment Process • Accountants need to ensure that the statements they produce are: • Up to Date, Accurate, Consistent Adjustments are necessary to ensure • Accounts are brought up to date • All late transactions are taken into account • All calculations are correct • All accounting standards have been complied with

8. 1 The Adjustment Process • During the course of the fiscal period, things are allowed to get out of date • Adjusting entries get everything up-to-date and accurate again • Why allowed to go inaccurate? – Saves time, money, effort

8. 1 The Adjustment Process • We will look at the adjusting entries for four main areas – Supplies – Prepaid Expenses – Late Arriving Invoices – Unearned Revenue

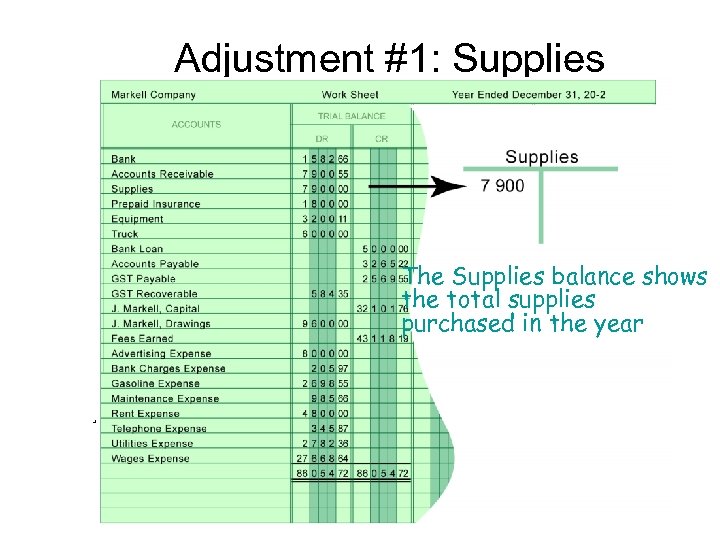

Adjustment #1: Supplies The Supplies balance shows the total supplies purchased in the year Adjusting Entries

What is the Balance? What the balance is

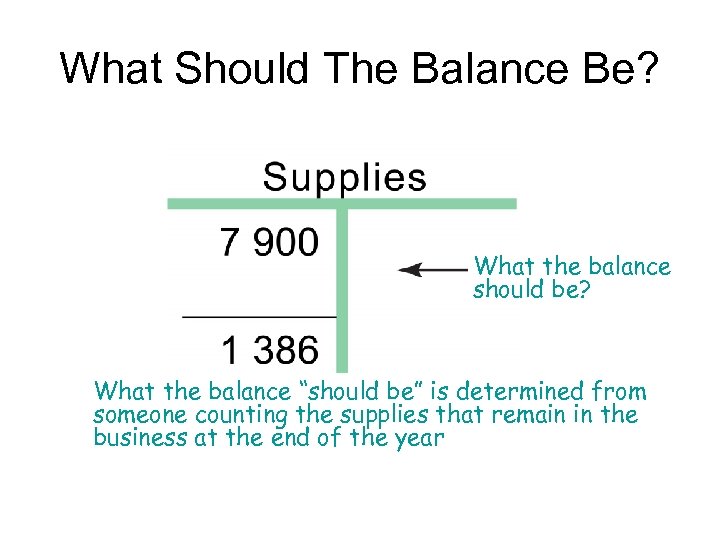

What Should The Balance Be? What the balance should be? What the balance “should be” is determined from someone counting the supplies that remain in the business at the end of the year

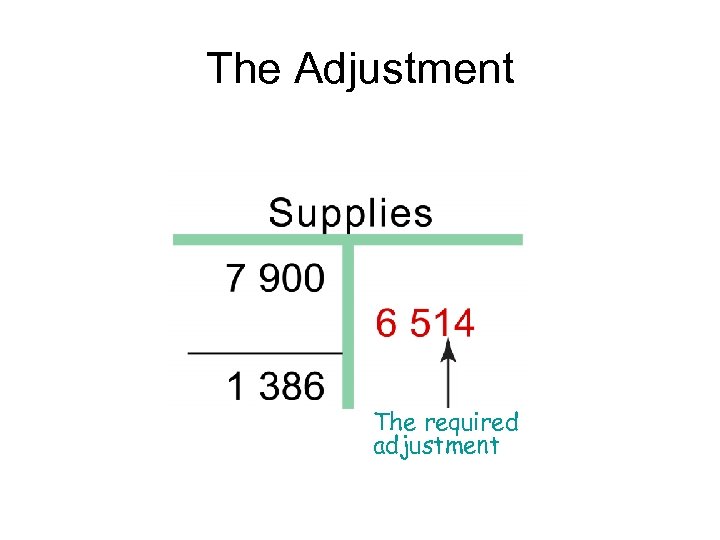

The Adjustment The required adjustment

Introducing a New Account What the balance is The income statement account related to Supplies is shown above The accounting clerk has not used this account during the year

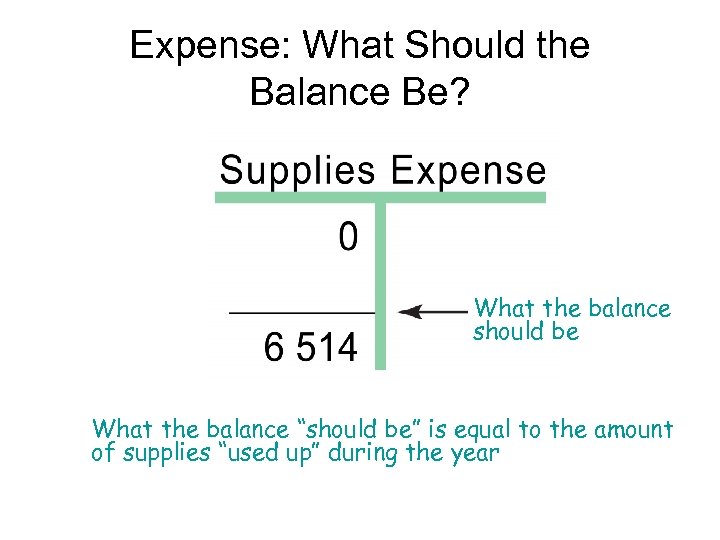

Expense: What Should the Balance Be? What the balance should be What the balance “should be” is equal to the amount of supplies “used up” during the year

What the Adjustment Would Be The required adjustment

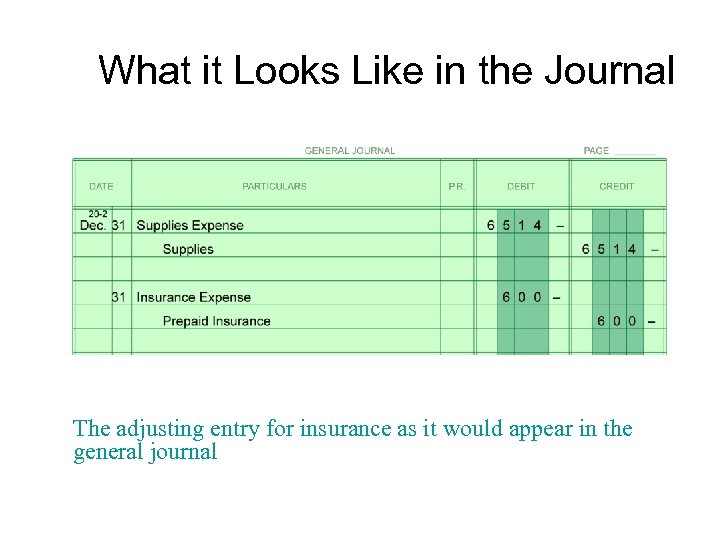

What that Looks Like in the Journal The adjusting entry as it would appear in the general journal

Adjustment #2: Prepaid Expenses The Prepaid Insurance balance shows the total cost of insurance bought in the year Adjusting Entries

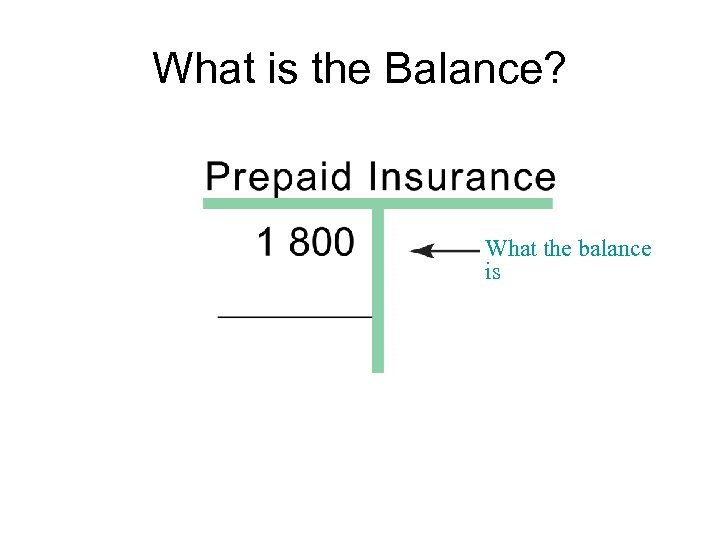

What is the Balance? What the balance is

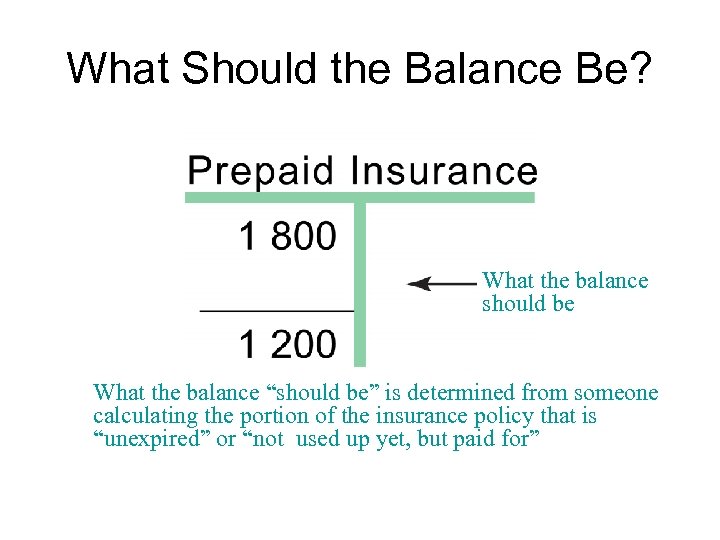

What Should the Balance Be? What the balance should be What the balance “should be” is determined from someone calculating the portion of the insurance policy that is “unexpired” or “not used up yet, but paid for”

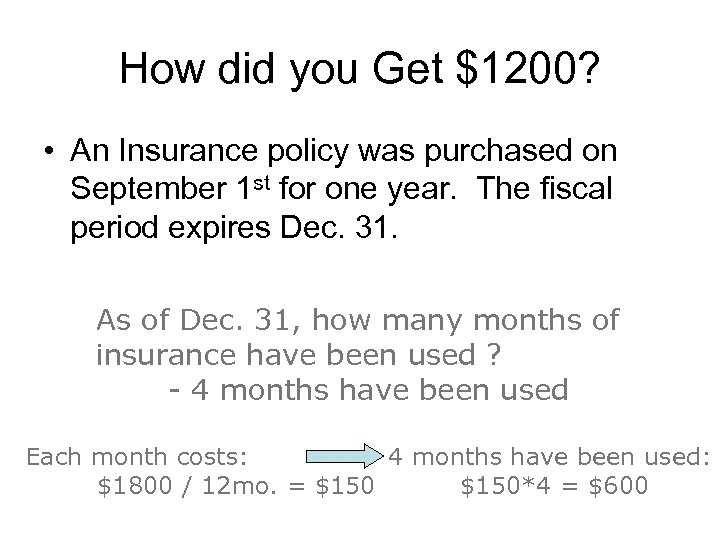

How did you Get $1200? • An Insurance policy was purchased on September 1 st for one year. The fiscal period expires Dec. 31. As of Dec. 31, how many months of insurance have been used ? - 4 months have been used Each month costs: 4 months have been used: $1800 / 12 mo. = $150*4 = $600

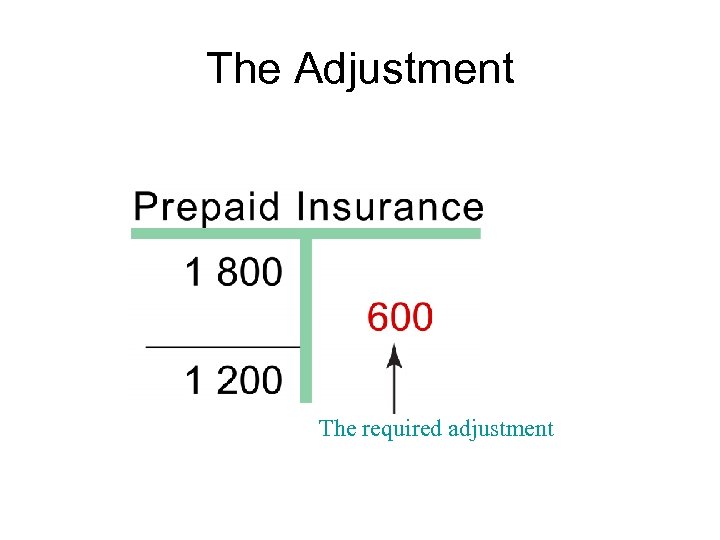

The Adjustment The required adjustment

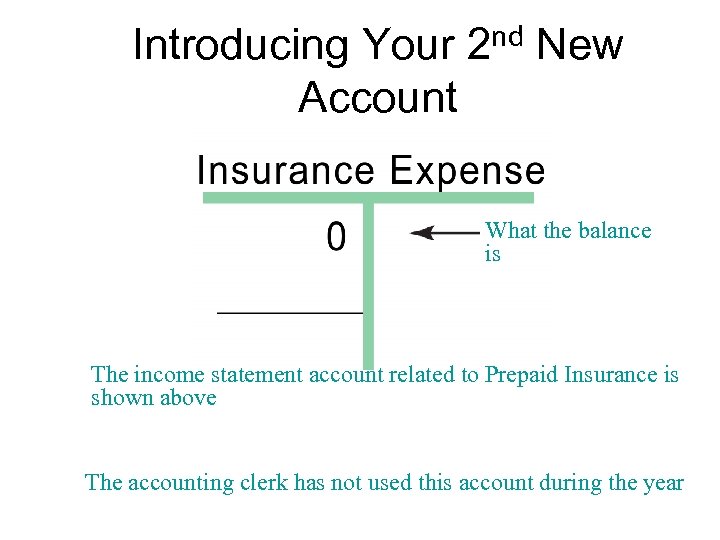

Introducing Your 2 nd New Account What the balance is The income statement account related to Prepaid Insurance is shown above The accounting clerk has not used this account during the year

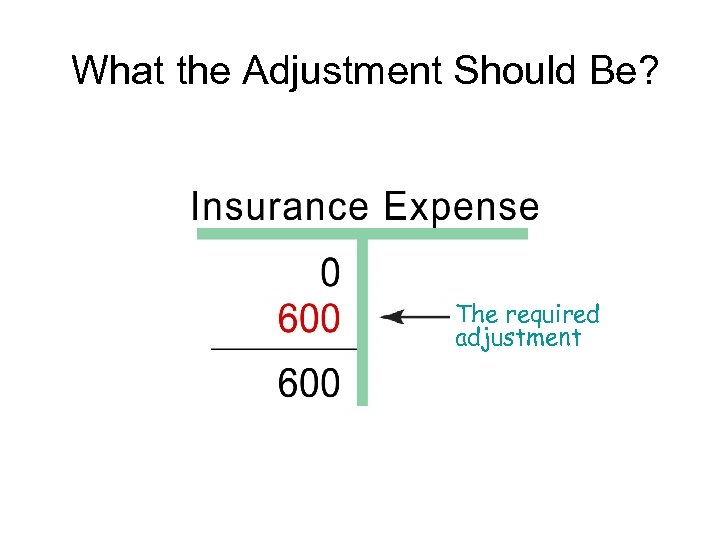

Expense: What Should the Balance Be? What the balance should be What the balance “should be” is the amount of the insurance policy that has expired at year’s end

What the Adjustment Should Be? The required adjustment

What it Looks Like in the Journal The adjusting entry for insurance as it would appear in the general journal

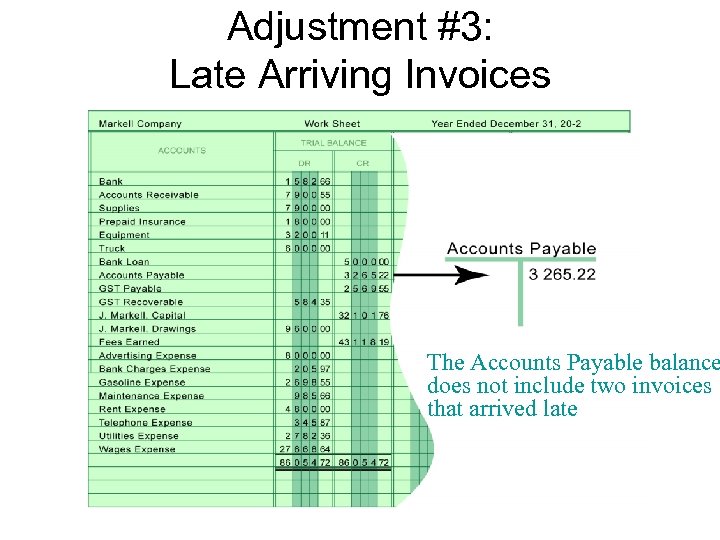

Adjustment #3: Late Arriving Invoices Adjusting Entries The Accounts Payable balance does not include two invoices that arrived late

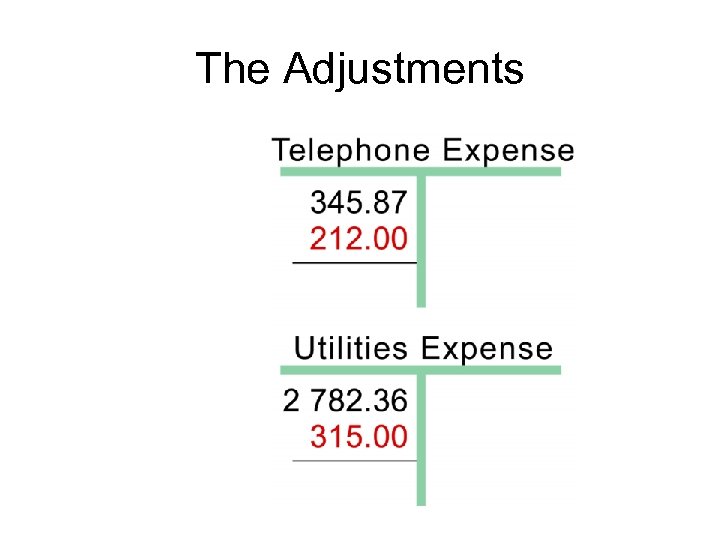

• Two late invoices have arrived – $212 for the Telephone Bill – $315 for the Utilities Bill

What is the Balance? Little analysis is needed for this adjustment

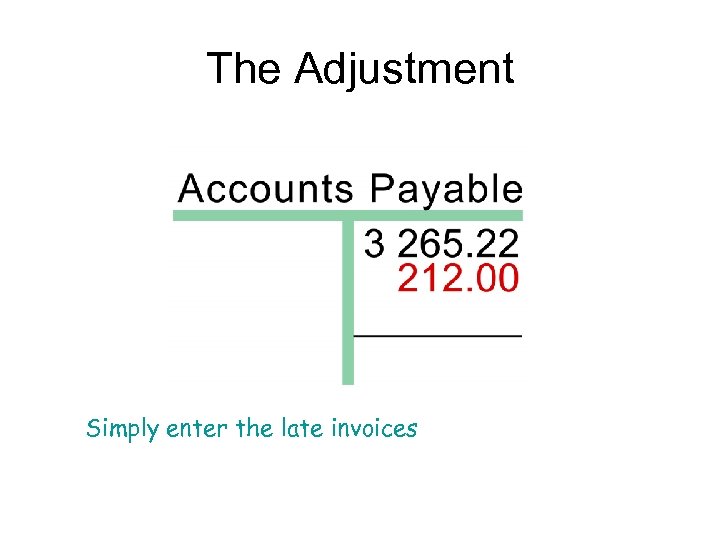

The Adjustment Simply enter the late invoices

The Adjustment contd. Simply enter the late invoices

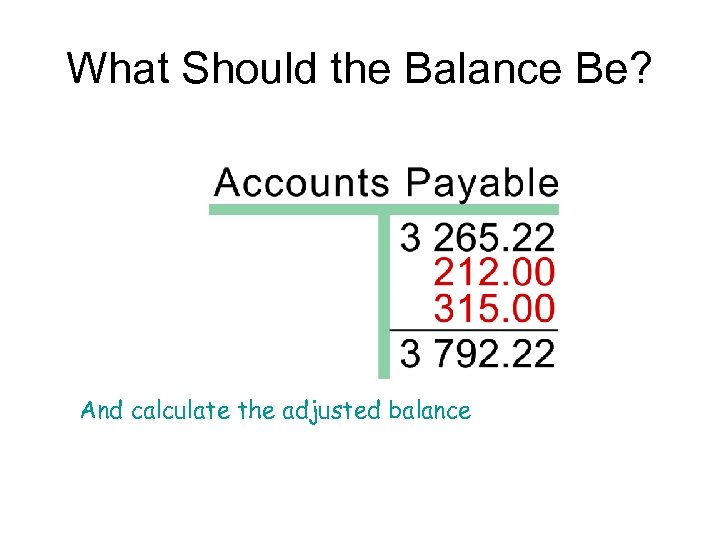

What Should the Balance Be? And calculate the adjusted balance

Expense: What is the Balance?

The Adjustments

The What Should the Balance Be?

What that Looks Like in the Journal The adjusting entry for late invoices as it would appear in the general journal

Adjusting Entries—Summary 1 Balance Sheet The adjusting entries have brought balance sheet accounts up to date

Adjusting Entries—Summary 2 Balance Sheet Income Statement And have recorded expenses in related accounts on the income statement

Adjusting for Unearned Revenue • Unearned Revenue is a liability – it occurs when you are paid in advance of providing a service. • If the accounting department puts advance payments into Revenue, this is an error that needs to be corrected: • DR Revenue (to reduce it); CR Unearned Revenue (to increase it)

Check your Understanding • See Textbook Tracker Sheet for the required Questions and Exercises for section 8. 1

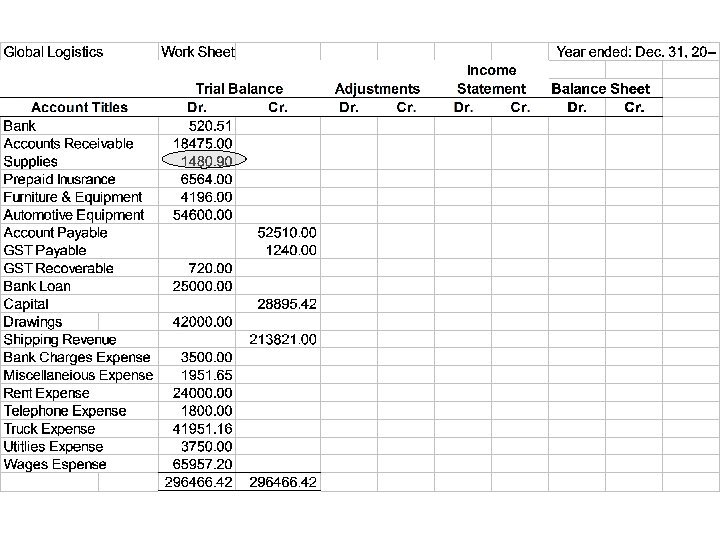

8. 2 Adjusting Entries and the Work Sheet • The work sheet is an informal accounting form used to help organize all of the financial data • There are 8 columns – Trial Balance DR/CR – Adjustments DR/CR – Income Statement DR/CR – Balance Sheet DR/CR

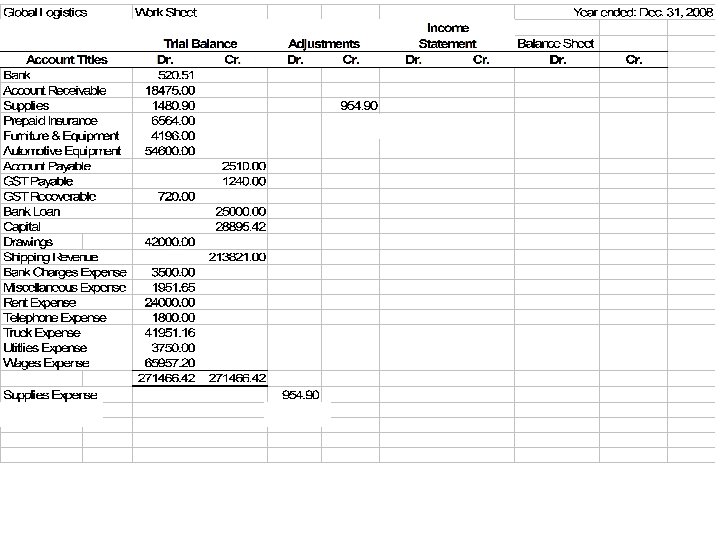

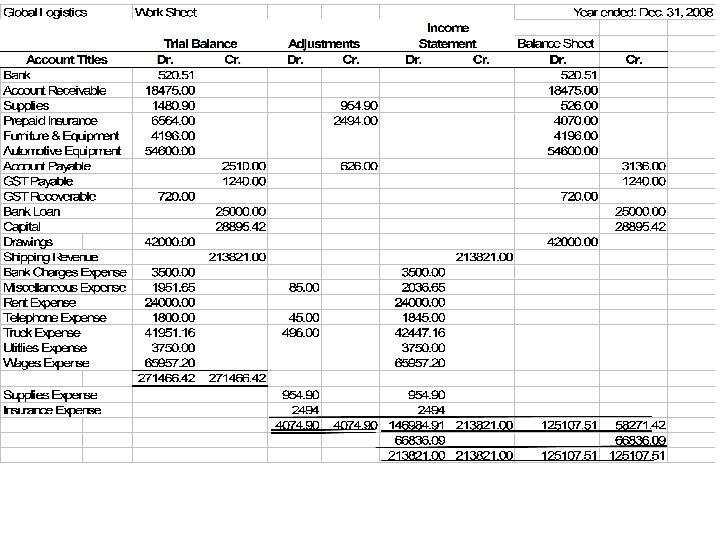

8. 2 Adjusting Entries and the Work Sheet ADJUSTING FOR SUPPLIES • According to Global Logistics’ trial balance they have $1480. 90 worth of supplies • However, once a physical inventory was completed on December 31, 2008 they discovered that they only had $526. 00 worth of supplies on hand

8. 2 Adjusting Entries and the Work Sheet ADJUSTING FOR SUPPLIES 20 -Dec. 31 Supplies Expense Supplies 964. 90

8. 2 Adjusting Entries and the Work Sheet ADJUSTING FOR INSURANCE USED • According to Global Logistics’ trial balance they have $6564 in prepaid insurance • They have$4070 remaining in unused insurance

8. 2 Adjusting Entries and the Work Sheet ADJUSTING FOR INSURANCE USED 20 -Dec. 31 Insurance Expense 2494 Prepaid Insurance 2494

8. 2 Adjusting Entries and the Work Sheet ADJUSTING FOR LATE ARRIVING INVOICES • Three late invoices in this example Telephone Truck Repair Printer Repair Total $ 45 496 85 $626

8. 2 Adjusting Entries and the Work Sheet 20 -Dec. 31 Telephone expense Truck expense Miscellaneous expense Accounts Payable 45 496 85 626

COMPLETING THE SHEET • From this point you complete the 8 -column worksheet just as you completed the 6 -column worksheet – Except as you transfer numbers to the correct column you may need to add or subtract the adjustments into the totals as necessary • Balance the columns using the “magical” number • Underline where necessary

8. 2 Adjusting Entries and the Work Sheet • Journalizing and Posting the Adjusting Entries – All the adjusting entries need to be properly journalized and posted to the ledger

8. 3 Preparing for New Fiscal Years • REAL ACCOUNTS – balances that continue into the next fiscal period ex. Bank, trucks, accounts payable etc. • NOMINAL ACCOUNTS – have balances that do not continue into the next fiscal period ONLY Expenses, drawing and revenue

8. 3 Preparing for New Fiscal Years • CLOSING OUT AN ACCOUNT – means to make it have no balance. Nominal accounts are closed out at the end of the fiscal period. • INCOME SUMMARY ACCOUNT – summarizes the revenues and expenses of the period. Represents either the net income or net loss for the fiscal period

8. 3 Preparing for New Fiscal Years WHY DO WE CLOSE OUT ACCOUNTS? Closing these accounts allows us to plainly observe the previous year's effect on our revenue, expense, and drawings accounts. You can well imagine that if we did not close these accounts, their balances would build to outrageous amounts.

8. 3 Preparing for New Fiscal Years HOW DO WE DO THIS? The Order in Which we Close Out Accounts (p 293) 1. Close out the revenue account(s) to the Income Summary account 2. Close out the expense account(s) to the Income Summary account 3. Close out the Income Summary account to the Capital account 4. Close out the Drawing account to the Capital account

8. 3 Preparing for New Fiscal Years • Closing Entry #1: Close out the revenue account(s) to the Income Summary account Journal Dec 31 Shipping Revenue 213821 Income Summary 213821 Because revenue is a CR balance account, a DR entry is needed to close it off

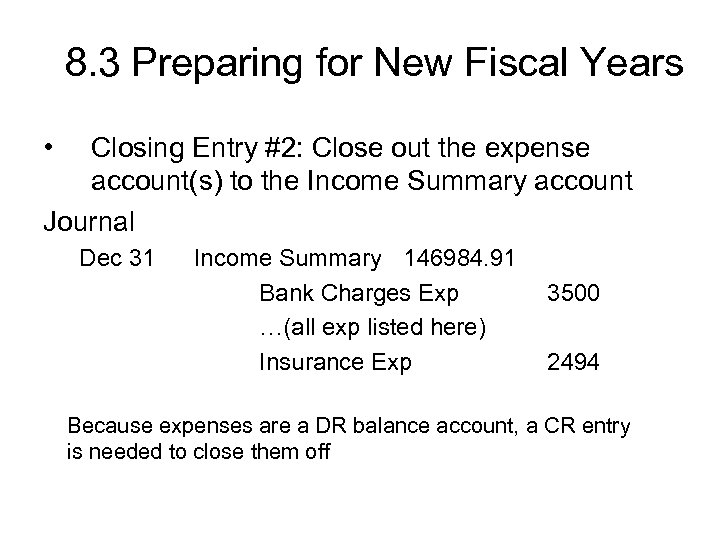

8. 3 Preparing for New Fiscal Years • Closing Entry #2: Close out the expense account(s) to the Income Summary account Journal Dec 31 Income Summary 146984. 91 Bank Charges Exp …(all exp listed here) Insurance Exp 3500 2494 Because expenses are a DR balance account, a CR entry is needed to close them off

8. 3 Preparing for New Fiscal Years • Closing Entry #3: Close out the Income Summary account to the Capital account Journal Dec 31 Income Summary 66836. 09 P. Marshall, Capital 66836. 09 If the Income Summary account has a CR balance, then a DR entry is needed to close it. (profit capital increases) If the Income Summary account has a DR balance, then a CR entry is needed to close it. (loss capital decreases)

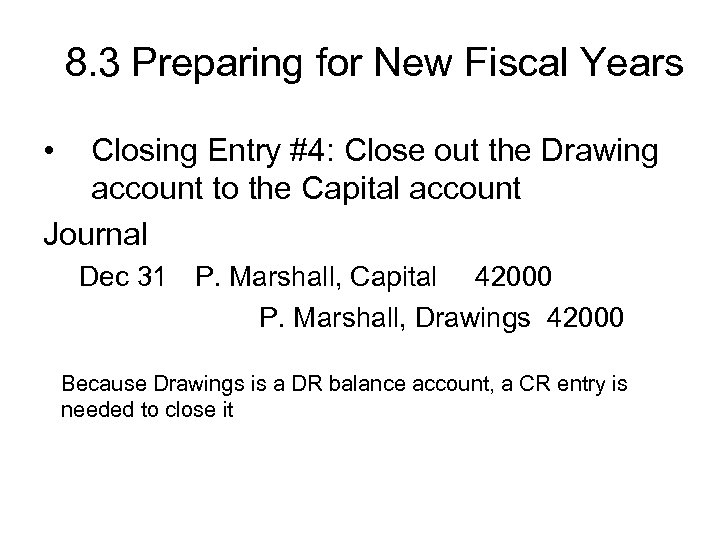

8. 3 Preparing for New Fiscal Years • Closing Entry #4: Close out the Drawing account to the Capital account Journal Dec 31 P. Marshall, Capital 42000 P. Marshall, Drawings 42000 Because Drawings is a DR balance account, a CR entry is needed to close it

8. 3 Preparing for New Fiscal Years • Post-Closing Trial Balance – Checks the accuracy of the ledger after the adjusting and closing entries have been done – Example shown in Fig 8 -10, Page 290

8. 4 Adjusting for Depreciation • What is it? • First let’s remember our definition for an expense – Something that we spend money on to make money • Based on this definition shouldn’t things like equipment or cars be expenses? We use these things to make money do we not?

8. 4 Adjusting for Depreciation • However, items such as a car don’t suddenly become worthless – it loses some of it’s value each year • So a portion of the cost of the equipment should be allocated as an expense in each year of the item’s life • This process meets the matching principle

8. 4 Adjusting for Depreciation an allowance made for the decrease in value of an asset over time Depreciation is an expense so it appears on the INCOME STATEMENT

8. 4 Adjusting for Depreciation • An anecdotal example – Read p. 301 -302 about the depreciation of a company’s delivery van

8. 4 Adjusting for Depreciation • Methods – 2 most common are: – Straight Line – Declining Balance

8. 4 Adjusting for Depreciation • Straight Line Method – Divides up the net cost of the asset equally over the years of the assets life Straight Line for 1 yr = (orig cost - estimated salvage value) Estimated # of periods in the asset’s life

8. 4 Adjusting for Depreciation • Straight line Example • Tip Top Trucking purchased a truck for $78000 on Jan 1. 20 --. Truck could be used for 6 years, and be sold at that time for $7800. • Therefore: Estimated Annual Depreciation is ($78000 – $7800) / 6 = $11700 The truck will depreciate $11700 each year.

8. 4 Adjusting for Depreciation • Recording Depreciation Journal Depreciation Expense – Truck 11700 The above work is correct, but not used by larger, computerized businesses…they use a new account called “Accumulated Depreciation”

8. 4 Adjusting for Depreciation • So the entry will look like this: Journal Depreciation Expense – Truck Accumulated Depreciation - Truck 11700 The use of the accumulated depreciation account provides 2 types of information: 1) By not taking the depreciation right off of the asset account we can still find the original cost of the asset 2) We can quickly calculate the total amount of depreciation recorded over the years

8. 4 Adjusting for Depreciation • Accumulated Depreciation is a CONTRA account – A contra account is one that is displayed alongside an associated account and has a balance that is opposite to that account

8. 4 Adjusting for Depreciation • Accumulated Depreciation is also a VALUATION account – One that is used together with an asset account to show the true net value of an asset

8. 4 Adjusting for Depreciation • Adjusting Entry for Depreciation 1) records the depreciation for the period in the depreciation expense account 2)Increases the appropriate accumulated depreciation account for the asset, which reduces the asset’s net book value Journalized as… Depreciation Exp $$$$ Acc. Dep. (Asset) $$$$

8. 4 Adjusting for Depreciation Declining-balance Method • Allocates a greater amount of depreciation to the first years of an asset’s life • This is the method the government requires for income tax purposes • To find the depreciated amount you take the undepreciated cost of the asset and multiply it by a fixed % – This % is set by the gov’t – See schedule on p. 308

7af7978859960581b3e82b9a087b488f.ppt