bbf38131a174d11509e99c99bf918bab.ppt

- Количество слайдов: 22

BAF 3 M 1 THE WORKSHEET AND FINANCIAL STATEMENTS Chapter 8, Section 8. 1

The Six-Column Worksheet Accountants use a form called a work sheet instead of relying on a trial balance alone. The work sheet is prepared _____ the trial balance is prepared. A work sheet is an informal business paper used to organize and plan the information for _____________________. The work sheet is prepared on columnar accounting paper, usually in _______, so that changes can be made easily. The columns are Trial Balance (DR, CR), Income Statement (DR, CR), and Balance Sheet (DR, CR)

Steps in preparing a work sheet Refer to page 253 for an image of a work sheet 1. Write in the heading, horizontally, across the top of the work sheet paper. (Who? What? When? ) Vulcan Rentals Work Sheet Year ended December 31, 2009 2. Enter all accounts with their balances in the first two columns. The first two columns are for the trial balance – DR & CR. 3. Extend each of the amounts from the trial balance columns into one of the four columns to the right. Revenue and expense items are extended into the income statement columns; Assets, liabilities, capital, and drawings are extended into the balance sheet columns. Be careful to transfer amounts accurately and to record debit amounts in debit columns and credit amounts in credit columns.

Steps in preparing a work sheet cont’d 4. Balance the work sheet. There are 4 steps to this: (a) Total each of the four right-hand money columns (Income statement – DR & CR, Balance sheet – DR & CR) (b) Calculate the difference between the two income statement columns (DR & CR). Calculate the difference between the two balance sheet columns (DR & CR). The two differences should be equal. The figure is referred to as the balancing figure. If the difference is not equal, the work sheet is not correct and you cannot proceed.

Steps in preparing a work sheet cont’d (c) Record the balancing figure on the work sheet in two places. If revenues are greater than expenses, the balancing figure represents a net income. It is recorded on the debit side of the income statement & the credit side of the balance sheet (an increase in capital). If expenses are greater than revenues, the balancing figure represents a net loss. It is recorded on the credit side of the income statement & the debit side of the balance sheet (a decrease in capital). (d) Calculate and double-underline the final column totals

The work sheet & financial statements Owners and business executives rarely look at the raw data of actual financial records. They rely on the accounting department to produce finished accounting reports and financial statements. A completed work sheet _______of the ___________ needed to ________ the income statement and the balance sheet. Preparing the income statement and the balance sheet is the next step. You already have the skills to do so! Transactions occur Journalizing Posting Trial balance Work sheet Income statement & Balance sheet

BAF 3 M 1 THE WORKSHEET AND FINANCIAL STATEMENTS Chapter 8, Section 8. 2

How accountants use income statements We’ve learned that the balance sheet and income statement are essential documents a businessperson needs in order to _________ the _________ and _______ of a business. To make it easier to extract essential information, accountants use a variety of ___________when preparing financial statements. Let’s explore some of these tools.

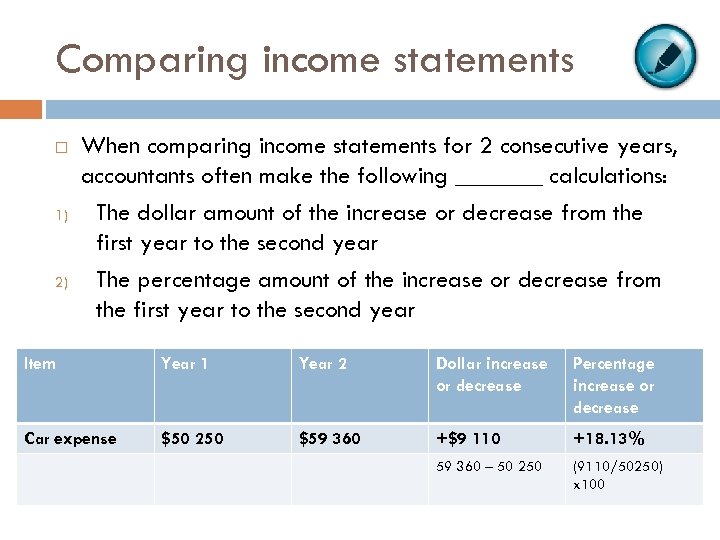

Comparing income statements 1) 2) When comparing income statements for 2 consecutive years, accountants often make the following _______ calculations: The dollar amount of the increase or decrease from the first year to the second year The percentage amount of the increase or decrease from the first year to the second year Item Year 1 Year 2 Dollar increase or decrease Percentage increase or decrease Car expense $50 250 $59 360 +$9 110 +18. 13% 59 360 – 50 250 (9110/50250) x 100

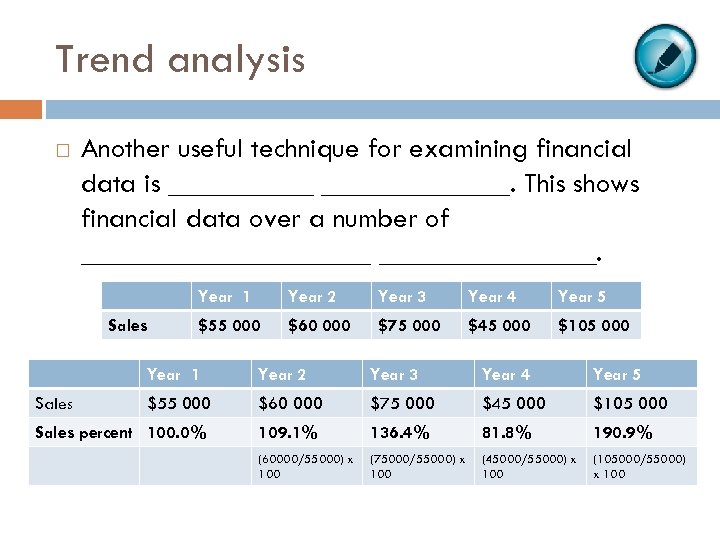

Trend analysis Another useful technique for examining financial data is _____________. This shows financial data over a number of __________. Year 1 Sales Year 2 Year 3 Year 4 Year 5 $55 000 $60 000 $75 000 $45 000 $105 000 Percentages Year 1 Sales & Year 2 Graphs Year 3 Year 4 Year 5 $55 000 $60 000 $75 000 $45 000 $105 000 Sales percent 100. 0% 109. 1% 136. 4% 81. 8% 190. 9% (60000/55000) x 100 (75000/55000) x 100 (45000/55000) x 100 (105000/55000) x 100

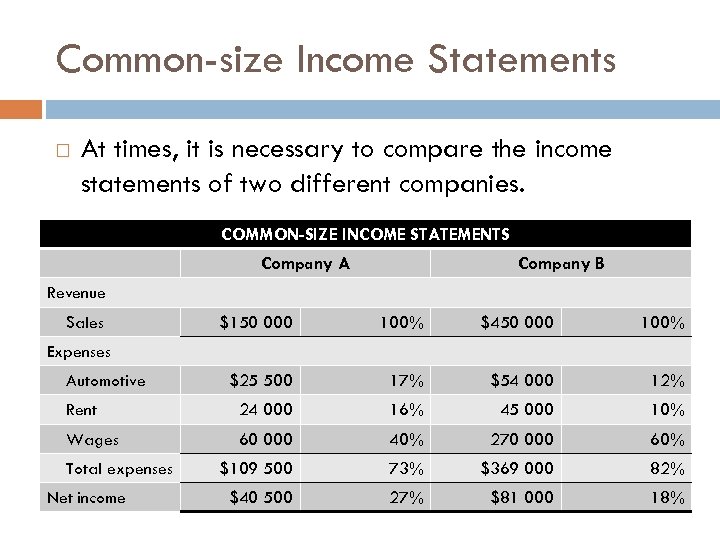

Common-size Income Statements At times, it is necessary to compare the income statements of two different companies. COMMON-SIZE INCOME STATEMENTS Company A Company B Revenue Sales $150 000 100% $450 000 100% $25 500 17% $54 000 12% Rent 24 000 16% 45 000 10% Wages 60 000 40% 270 000 60% $109 500 73% $369 000 82% $40 500 27% $81 000 18% Expenses Automotive Total expenses Net income

BAF 3 M 1 THE WORKSHEET AND FINANCIAL STATEMENTS Chapter 8, Section 8. 3

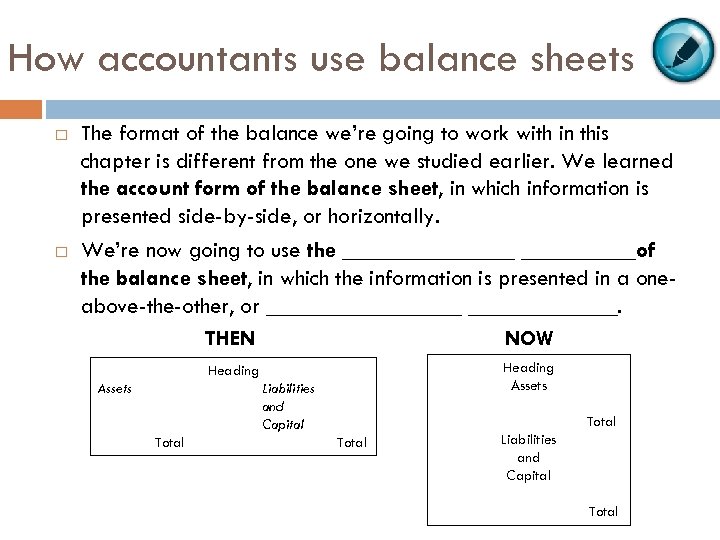

How accountants use balance sheets The format of the balance we’re going to work with in this chapter is different from the one we studied earlier. We learned the account form of the balance sheet, in which information is presented side-by-side, or horizontally. We’re now going to use the ________of the balance sheet, in which the information is presented in a oneabove-the-other, or _________. THEN NOW Heading Assets Liabilities and Capital Total Liabilities and Capital Total

Classified Balance Sheet Refer to page 270 in your textbook for an image of a classified balance sheet. Accountants prefer to organize balance sheet data in a format called a classified balance sheet. This format has the data grouped according to major categories. It makes it easier to analyze information. Major categories are: ____________ assets, ______ liabilities, __________ liabilities.

The Classified Balance Sheet Major categories, defined Current assets – assets that will be converted into cash (or used up) during the next year Fixed assets (or plant and equipment) – long-term assets held for their usefulness in producing goods or services Total Assets Current liabilities – short-term debts, payment of which is expected to occur within one year of the date of the balance sheet Long-term liabilities – debts of the business that are not due within one year Capital – owner’s claim on the assets, shows the beginning balance, increase or decrease through profit or loss, decrease from drawings, and the ending balance (The Equity Equation!) Total Liabilities and Owner’s equity

Analyzing statements The _____________ used to analyze the income statement can also be applied to the _______– comparative statements, trend analysis, and common-size statements. A comparative statement presents figures for successive years in side-by-side columns. _____ income statements and balance sheets may be shown in _________ form. Refer to page 272 in your textbook

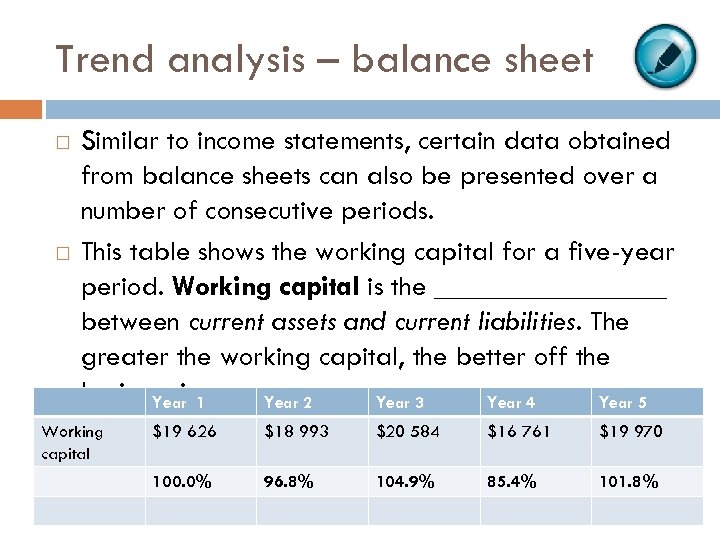

Trend analysis – balance sheet Similar to income statements, certain data obtained from balance sheets can also be presented over a number of consecutive periods. This table shows the working capital for a five-year period. Working capital is the ________ between current assets and current liabilities. The greater the working capital, the better off the business is. Year 1 Year 2 Year 3 Year 4 Year 5 Working capital $19 626 $18 993 $20 584 $16 761 $19 970 100. 0% 96. 8% 104. 9% 85. 4% 101. 8%

Common-size statements – balance sheet When preparing common-size income statements, every figure is expressed as a percentage of sales. If rent expense is 46%, one can assume that for each dollar of sales, $0. 46 goes to pay for rent) For common-size balance sheets, every figure is expressed as a percentage of total assets. Refer to page 274 in your textbook for an image of a common-size balance sheet

BAF 3 M 1 THE WORKSHEET AND FINANCIAL STATEMENTS Chapter 8, Section 8. 4

GAAP – The Consistency Principle The consistency principle requires that a business must _____ the ______ accounting ________ and procedures from __________. This GAAP prevents people from manipulating figures on financial statements by changing methods of accounting. For example, a company that records revenues when payments are received, not when invoices are issued. If the company has a bad year, it would be wrong to make the results look better by including revenue for invoices issued for which payment has not been received.

GAAP – The Materiality principle The materiality principle requires accountants to follow generally accepted accounting principles ______ when to do so would be expensive or difficult, and where it makes no real difference if the rules are ignored. An error for $50 was discovered by a company after it received its financial statements from the printer. Assume that the error affected the net income of $350 000. In this case, no effort would be made to correct the error because $50 is not significant to the net income figure of $350 000.

GAAP – The Full Disclosure Principle The full-disclosure principle states that ______ information needed for a _____________ of the company’s financial affairs _________ in the _________. This information would be presented in the form of a note accompanied by the financial statements. For example, the company is being sued for millions of dollars. This lawsuit may affect the company’s financial position, therefore, users of financial statements must be made aware.

bbf38131a174d11509e99c99bf918bab.ppt