b7c713fc66a7248ef5933ab505984103.ppt

- Количество слайдов: 23

BA 950 Policy Formulation and Administration Lecture 7 Corporate Strategy: Vertical Integration, Diversification, and Strategic Alliances

Outline v. Organizing the firm v. Transaction costs analysis v. Vertical integration - VI v Types of VI v Creating value through VI v Vertical relationships and outsourcing v. Diversification v Related and unrelated diversification v Entering new markets © Ram Mudambi, Temple University and University of Reading, 2006. 2

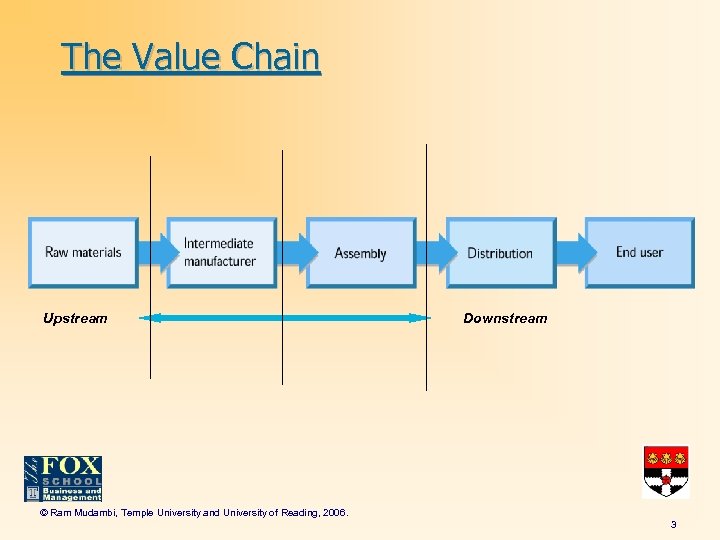

The Value Chain Upstream Downstream © Ram Mudambi, Temple University and University of Reading, 2006. 3

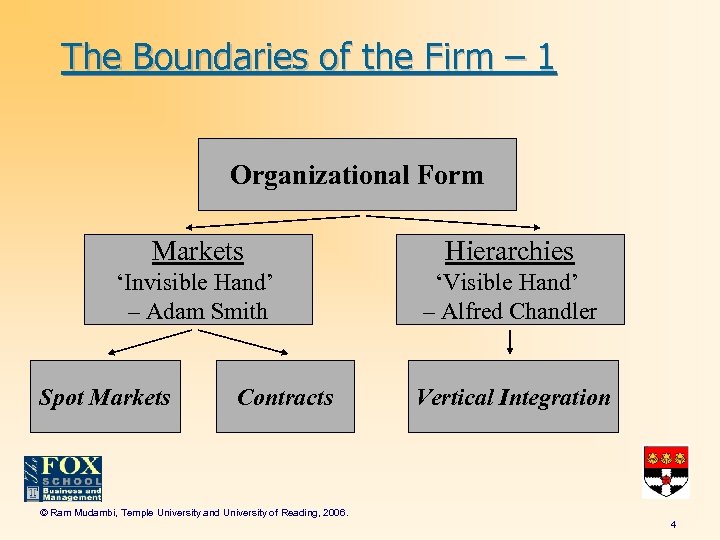

The Boundaries of the Firm – 1 Organizational Form Markets Hierarchies ‘Invisible Hand’ – Adam Smith ‘Visible Hand’ – Alfred Chandler Spot Markets Contracts Vertical Integration © Ram Mudambi, Temple University and University of Reading, 2006. 4

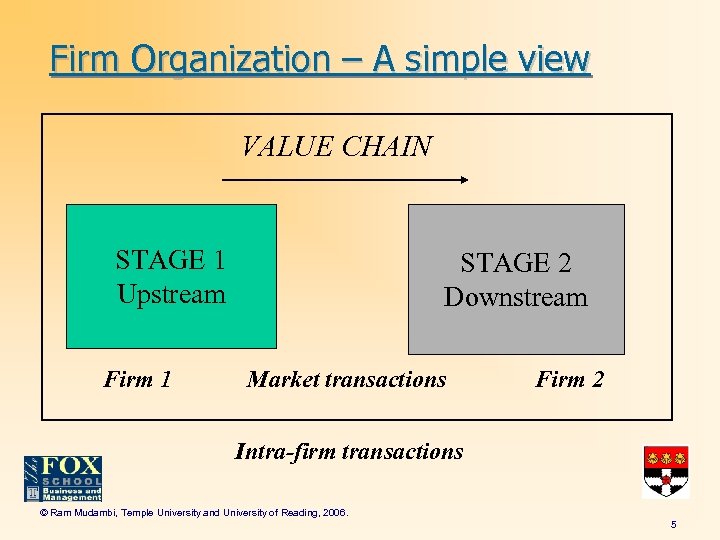

Firm Organization – A simple view VALUE CHAIN STAGE 1 Upstream Firm 1 STAGE 2 Downstream Market transactions Firm 2 Intra-firm transactions © Ram Mudambi, Temple University and University of Reading, 2006. 5

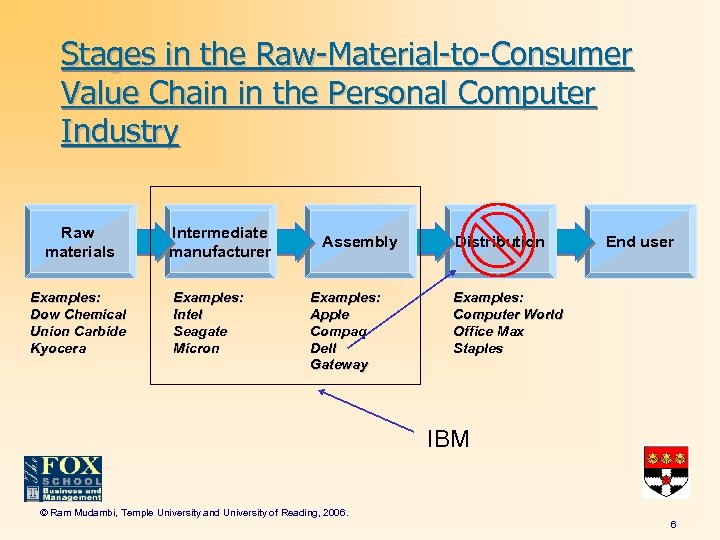

Stages in the Raw-Material-to-Consumer Value Chain in the Personal Computer Industry Raw materials Examples: Dow Chemical Union Carbide Kyocera Intermediate manufacturer Examples: Intel Seagate Micron Assembly Examples: Apple Compaq Dell Gateway Distribution End user Examples: Computer World Office Max Staples IBM © Ram Mudambi, Temple University and University of Reading, 2006. 6

The Boundaries of the Firm – 2 Spot Markets v When the buyer and seller of an input meet, exchange, and then go their separate ways Contracts v A legal document that creates an extended relationship between a buyer and a seller Vertical Integration v When a firm shuns other suppliers and chooses to produce an input internally © Ram Mudambi, Temple University and University of Reading, 2006. 7

Transaction Costs – 1 The costs of using the market mechanism Coordination costs v Process C & C (inventories, information) Costs based on asymmetric information v Policing costs v Bargaining costs © Ram Mudambi, Temple University and University of Reading, 2006. 8

Transaction Costs – 2 Asymmetric Information Policing costs: Moral hazard & adverse selection v. Effort; Quality; Property rights; Restrictive agreements Bargaining costs v. Asset specificity and hold-up v. New products and processes v. Economies of scope © Ram Mudambi, Temple University and University of Reading, 2006. 9

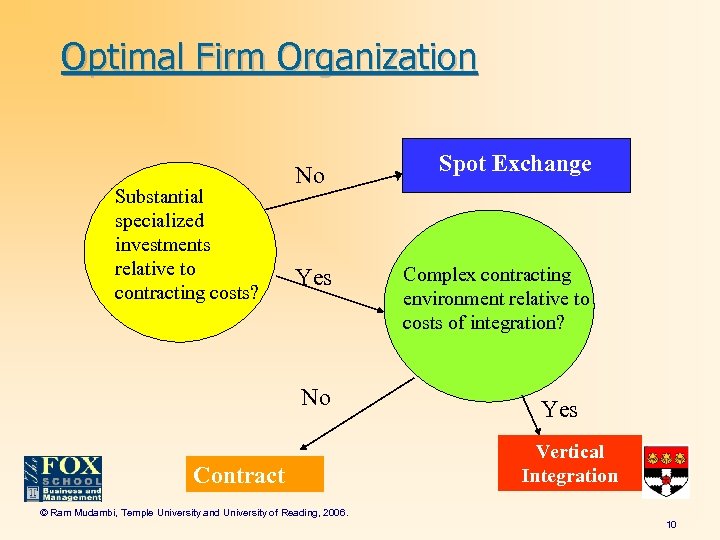

Optimal Firm Organization Substantial specialized investments relative to contracting costs? No Yes No Contract Spot Exchange Complex contracting environment relative to costs of integration? Yes Vertical Integration © Ram Mudambi, Temple University and University of Reading, 2006. 10

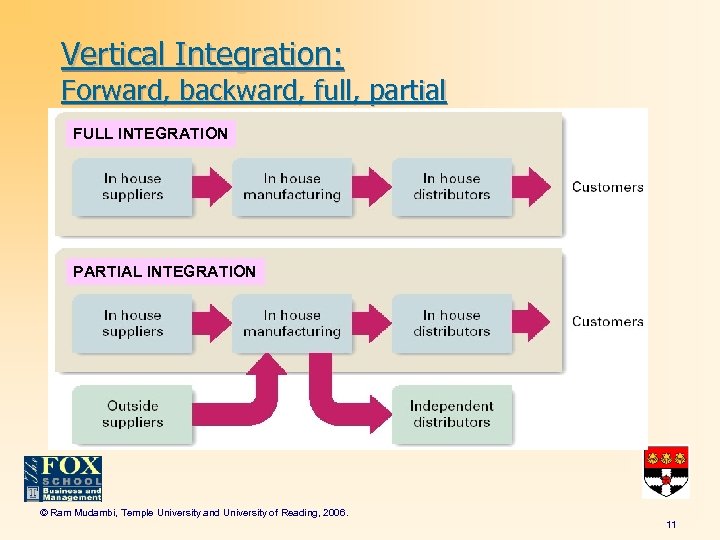

Vertical Integration: Forward, backward, full, partial FULL INTEGRATION PARTIAL INTEGRATION © Ram Mudambi, Temple University and University of Reading, 2006. 11

Vertical Integration Greater attraction of VI when v Thin markets; TSAs necessary; Demand uncertainty Difficulty of monitoring/writing contracts VI v Limited information; Environmental uncertainty Taxes/regulations on market contracts v VI to circumvent taxes/regulations VI difficult when v Scale differential in stages; Strategic dissimilarities in resources/capabilities/success factors © Ram Mudambi, Temple University and University of Reading, 2006. 12

Creating Value Through Vertical Integration Advantages of a vertical integration strategy: v Builds entry barriers to new competitors by denying them inputs and customers. v Facilitates investment in efficiencyenhancing assets that solve internal mutual dependence problems. v Protects product quality through control of input quality and distribution and service of outputs. v Improves internal scheduling (e. g. , JIT inventory systems) responses to changes in demand. © Ram Mudambi, Temple University and University of Reading, 2006. 13

Creating Value Through Vertical Integration Disadvantages of vertical integration v Cost disadvantages of internal supply purchasing. v Remaining tied to obsolescent technology. v Aligning input and output capacities with uncertainty in market demand is difficult for integrated companies. © Ram Mudambi, Temple University and University of Reading, 2006. 14

Bureaucratic Costs and the Limits of Vertical Integration The costs of running an organization rise with integration due to: v The lack of an incentive for internal suppliers to reduce their operating costs. v The lack of strategic flexibility in times of changing technology or uncertain demand. Bureaucratic costs reduce the value of vertical integration. © Ram Mudambi, Temple University and University of Reading, 2006. 15

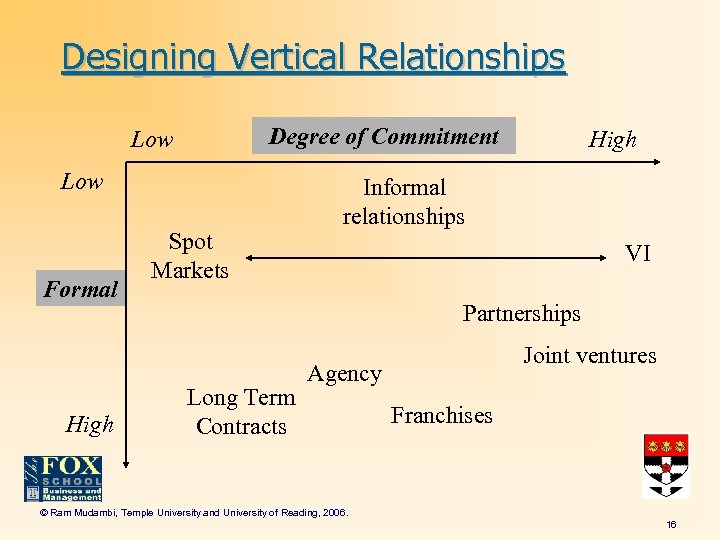

Designing Vertical Relationships Degree of Commitment Low Formal High Spot Markets High Informal relationships VI Partnerships Long Term Contracts Joint ventures Agency Franchises © Ram Mudambi, Temple University and University of Reading, 2006. 16

Alternatives to Vertical Integration: Cooperative Relationships and Strategic Outsourcing Short-term contracts and competitive bidding v Strong competitors attempt to control supplier costs with minimal-length contracts. Poor treatment of suppliers raises competitor input costs. Strategic alliances and long-term contracting v Long-term contracts foster cooperative relationships. v Alliances reduce the need for vertical integration. © Ram Mudambi, Temple University and University of Reading, 2006. 17

Building Long-Term Cooperative Relationships • Discourage opportunism Hostage taking • Maintain dynamic efficiency v Both parties arrange to become mutually dependent on each other, fostering a cooperative relationship. v A believable commitment to support the long-term relationship (a credible commitment). Maintaining market discipline requires: v Periodic renegotiation of the contractual relationship. v Developing a parallel sourcing policy with © Ram Mudambi, Temple University and University of Reading, 2006. 18

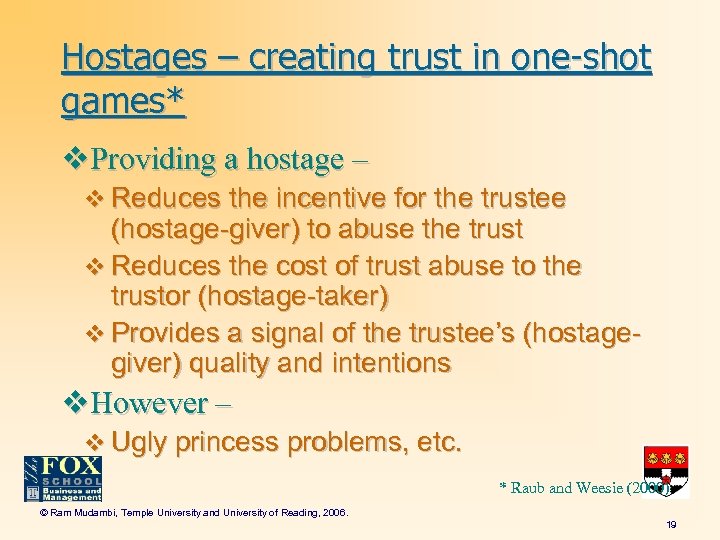

Hostages – creating trust in one-shot games* v. Providing a hostage – v Reduces the incentive for the trustee (hostage-giver) to abuse the trust v Reduces the cost of trust abuse to the trustor (hostage-taker) v Provides a signal of the trustee’s (hostagegiver) quality and intentions v. However – v Ugly princess problems, etc. * Raub and Weesie (2000) © Ram Mudambi, Temple University and University of Reading, 2006. 19

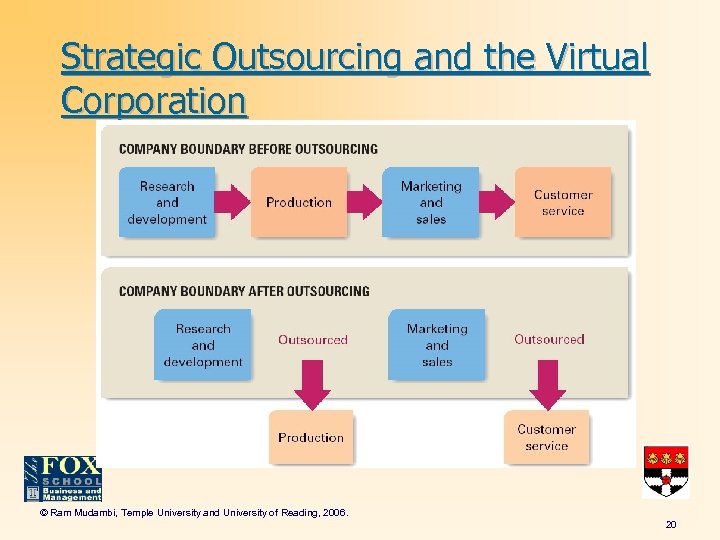

Strategic Outsourcing and the Virtual Corporation © Ram Mudambi, Temple University and University of Reading, 2006. 20

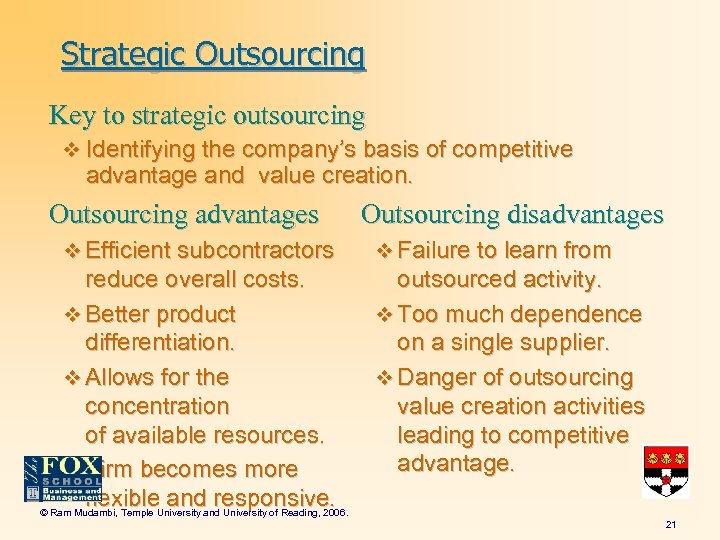

Strategic Outsourcing Key to strategic outsourcing v Identifying the company’s basis of competitive advantage and value creation. Outsourcing advantages v Efficient subcontractors reduce overall costs. v Better product differentiation. v Allows for the concentration of available resources. v Firm becomes more flexible and responsive. © Ram Mudambi, Temple University and University of Reading, 2006. Outsourcing disadvantages v Failure to learn from outsourced activity. v Too much dependence on a single supplier. v Danger of outsourcing value creation activities leading to competitive advantage. 21

Diversification Related diversification v Entry into new business activity based on shared commonalities in the components of the value chains of the firms – good strategic or resource fit v A strategy-driven approach to creating shareholder value Unrelated diversification v Entry into a new business area that has no obvious relationship with any area of the existing business. v A finance-driven approach to creating © Ram Mudambi, Temple University and University of Reading, 2006. 22

Summary v Corporate strategy – an application of Transactions Cost Economics (TCE) v The boundaries of the firm v The make-or-buy decision v The value chain and Vertical integration v Strategic outsourcing v. Diversification © Ram Mudambi, Temple University and University of Reading, 2006. 23

b7c713fc66a7248ef5933ab505984103.ppt