18dd4fc72eac42a0f2fa78e73d7d6434.ppt

- Количество слайдов: 16

BA 580 -Interest Rates Offsetting & Predicting Rate Movements

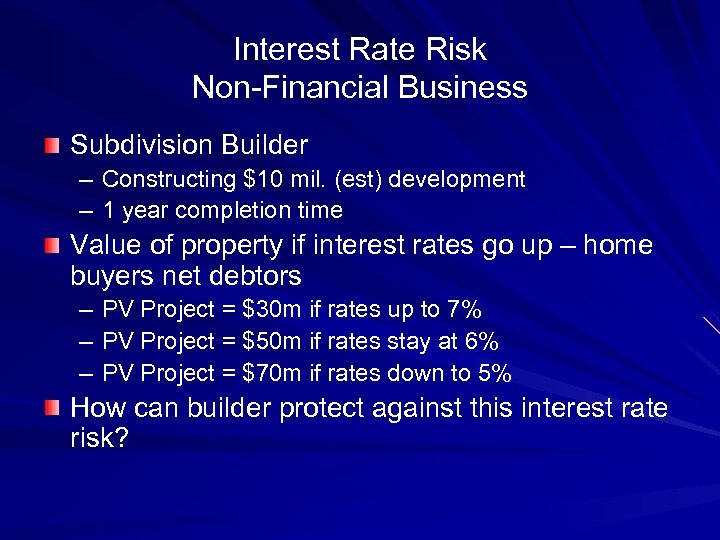

Interest Rate Risk Non-Financial Business Subdivision Builder – Constructing $10 mil. (est) development – 1 year completion time Value of property if interest rates go up – home buyers net debtors – PV Project = $30 m if rates up to 7% – PV Project = $50 m if rates stay at 6% – PV Project = $70 m if rates down to 5% How can builder protect against this interest rate risk?

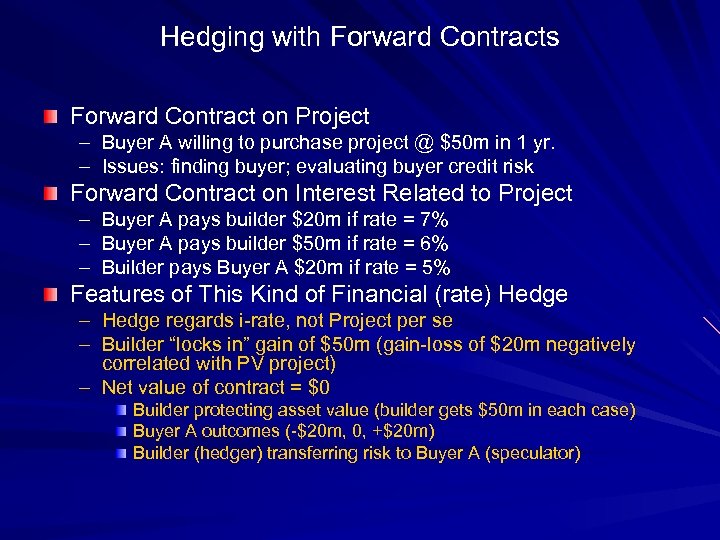

Hedging with Forward Contracts Forward Contract on Project – Buyer A willing to purchase project @ $50 m in 1 yr. – Issues: finding buyer; evaluating buyer credit risk Forward Contract on Interest Related to Project – Buyer A pays builder $20 m if rate = 7% – Buyer A pays builder $50 m if rate = 6% – Builder pays Buyer A $20 m if rate = 5% Features of This Kind of Financial (rate) Hedge – Hedge regards i-rate, not Project per se – Builder “locks in” gain of $50 m (gain-loss of $20 m negatively correlated with PV project) – Net value of contract = $0 Builder protecting asset value (builder gets $50 m in each case) Buyer A outcomes (-$20 m, 0, +$20 m) Builder (hedger) transferring risk to Buyer A (speculator)

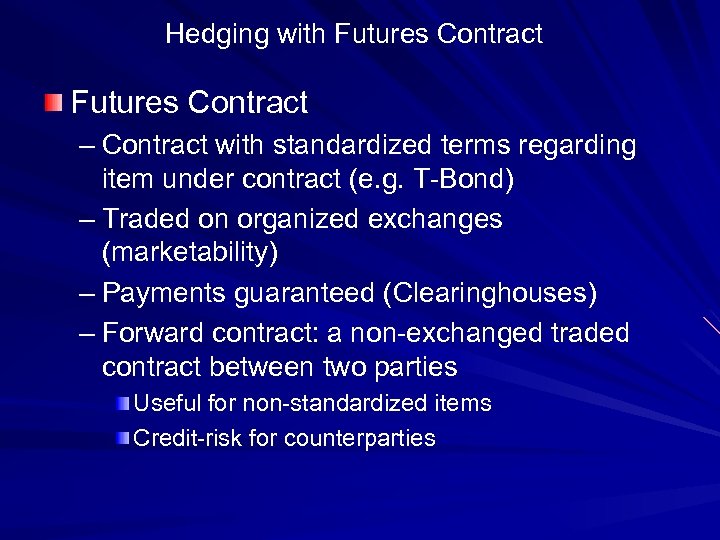

Hedging with Futures Contract – Contract with standardized terms regarding item under contract (e. g. T-Bond) – Traded on organized exchanges (marketability) – Payments guaranteed (Clearinghouses) – Forward contract: a non-exchanged traded contract between two parties Useful for non-standardized items Credit-risk for counterparties

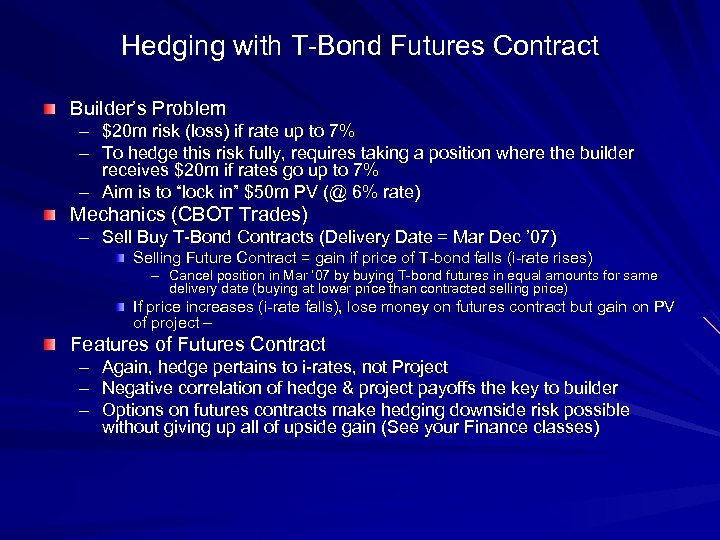

Hedging with T-Bond Futures Contract Builder’s Problem – $20 m risk (loss) if rate up to 7% – To hedge this risk fully, requires taking a position where the builder receives $20 m if rates go up to 7% – Aim is to “lock in” $50 m PV (@ 6% rate) Mechanics (CBOT Trades) – Sell Buy T-Bond Contracts (Delivery Date = Mar Dec ’ 07) Selling Future Contract = gain if price of T-bond falls (i-rate rises) – Cancel position in Mar ’ 07 by buying T-bond futures in equal amounts for same delivery date (buying at lower price than contracted selling price) If price increases (i-rate falls), lose money on futures contract but gain on PV of project – Features of Futures Contract – Again, hedge pertains to i-rates, not Project – Negative correlation of hedge & project payoffs the key to builder – Options on futures contracts make hedging downside risk possible without giving up all of upside gain (See your Finance classes)

Additional Points on Futures Options on Futures – Builder could pay fee (premium) to buy options on the amount of T-Bond futures contracts Warnings – You must have title or claim to an asset to hedge, otherwise, you are speculating – To hedge rate risk accurately, your estimates of the PV of the project must be correct

Hedging with Interest Rate Options CBOE markets interest rate options – Simpler than futures (trading explicitly in terms of interest rates) – Right v. obligation (but pay for this) – Interest rate options markets not nearly as heavily traded as Treasury futures

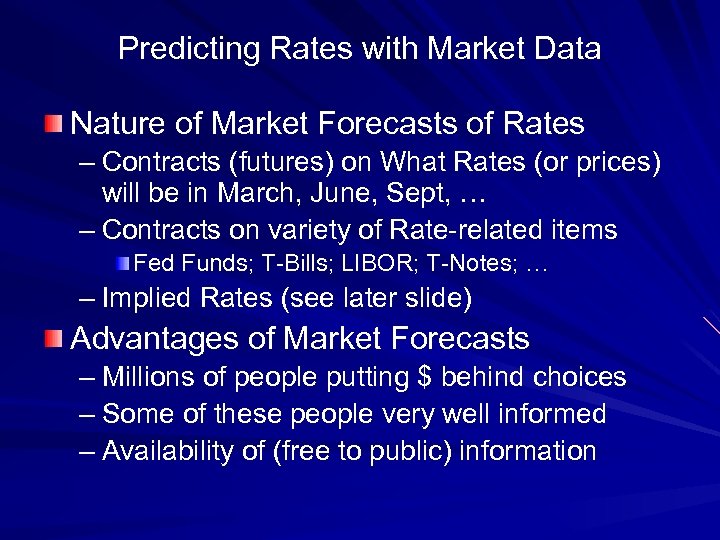

Predicting Rates with Market Data Nature of Market Forecasts of Rates – Contracts (futures) on What Rates (or prices) will be in March, June, Sept, … – Contracts on variety of Rate-related items Fed Funds; T-Bills; LIBOR; T-Notes; … – Implied Rates (see later slide) Advantages of Market Forecasts – Millions of people putting $ behind choices – Some of these people very well informed – Availability of (free to public) information

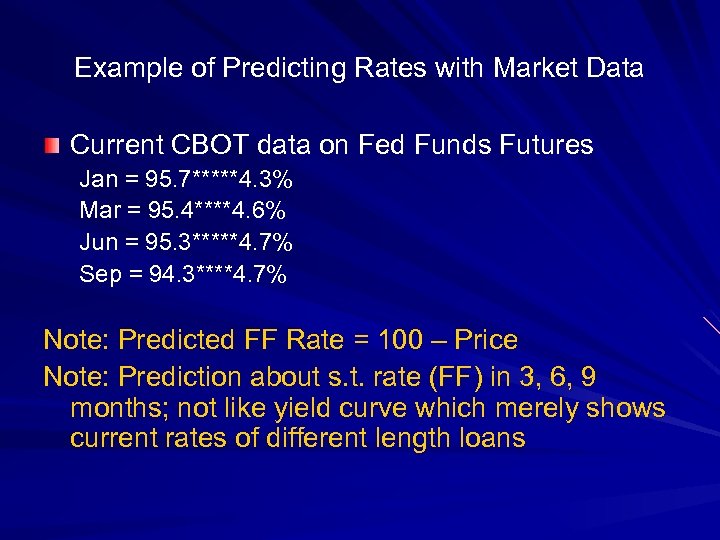

Example of Predicting Rates with Market Data Current CBOT data on Fed Funds Futures Jan = 95. 7*****4. 3% Mar = 95. 4****4. 6% Jun = 95. 3*****4. 7% Sep = 94. 3****4. 7% Note: Predicted FF Rate = 100 – Price Note: Prediction about s. t. rate (FF) in 3, 6, 9 months; not like yield curve which merely shows current rates of different length loans

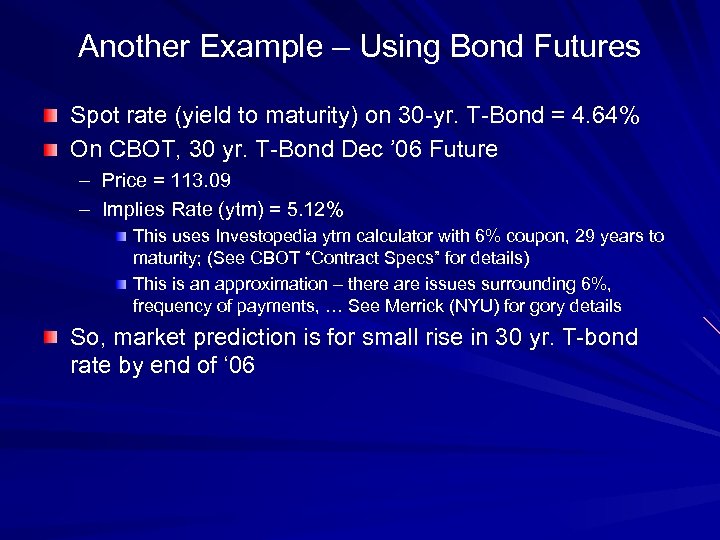

Another Example – Using Bond Futures Spot rate (yield to maturity) on 30 -yr. T-Bond = 4. 64% On CBOT, 30 yr. T-Bond Dec ’ 06 Future – Price = 113. 09 – Implies Rate (ytm) = 5. 12% This uses Investopedia ytm calculator with 6% coupon, 29 years to maturity; (See CBOT “Contract Specs” for details) This is an approximation – there are issues surrounding 6%, frequency of payments, … See Merrick (NYU) for gory details So, market prediction is for small rise in 30 yr. T-bond rate by end of ‘ 06

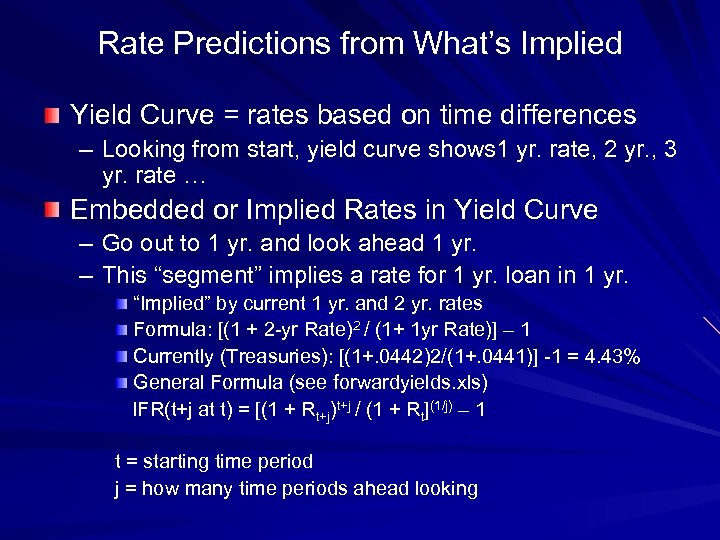

Rate Predictions from What’s Implied Yield Curve = rates based on time differences – Looking from start, yield curve shows 1 yr. rate, 2 yr. , 3 yr. rate … Embedded or Implied Rates in Yield Curve – Go out to 1 yr. and look ahead 1 yr. – This “segment” implies a rate for 1 yr. loan in 1 yr. “Implied” by current 1 yr. and 2 yr. rates Formula: [(1 + 2 -yr Rate)2 / (1+ 1 yr Rate)] – 1 Currently (Treasuries): [(1+. 0442)2/(1+. 0441)] -1 = 4. 43% General Formula (see forwardyields. xls) IFR(t+j at t) = [(1 + Rt+j)t+j / (1 + Rt](1/j) – 1 t = starting time period j = how many time periods ahead looking

Market Rate Forecasts Good News! – St. Louis Fed (and others) calculate and publish IFR – Also provide FF Rate Futures Data – Also Show Inflation-Indexed Yield – See St. Louis Fed Monetary Trends (page 11)

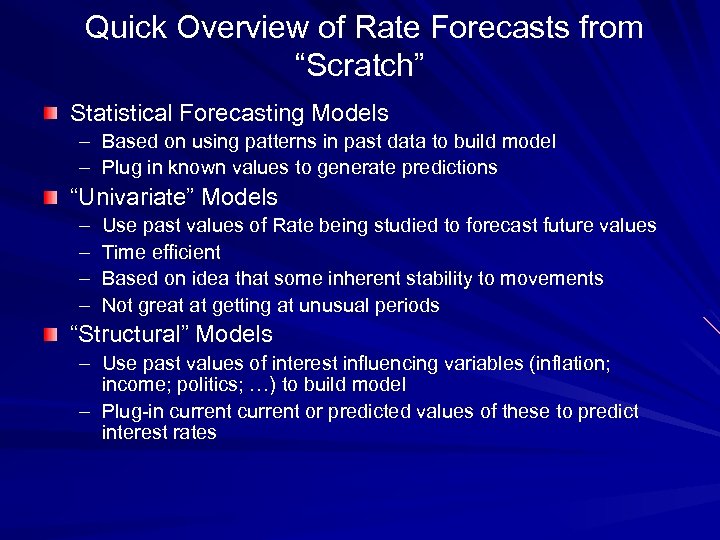

Quick Overview of Rate Forecasts from “Scratch” Statistical Forecasting Models – Based on using patterns in past data to build model – Plug in known values to generate predictions “Univariate” Models – – Use past values of Rate being studied to forecast future values Time efficient Based on idea that some inherent stability to movements Not great at getting at unusual periods “Structural” Models – Use past values of interest influencing variables (inflation; income; politics; …) to build model – Plug-in current or predicted values of these to predict interest rates

Awareness of Interest Rate Influencing Events What Moves the Bond Market – (NY Fed Article www. ny. frb. org) – Announcements (“News”) Employment; PPI; Fed Funds Target; retail sales Political Economy – Who’s Running the Fed – Who’s Confirming Fed Nominees?

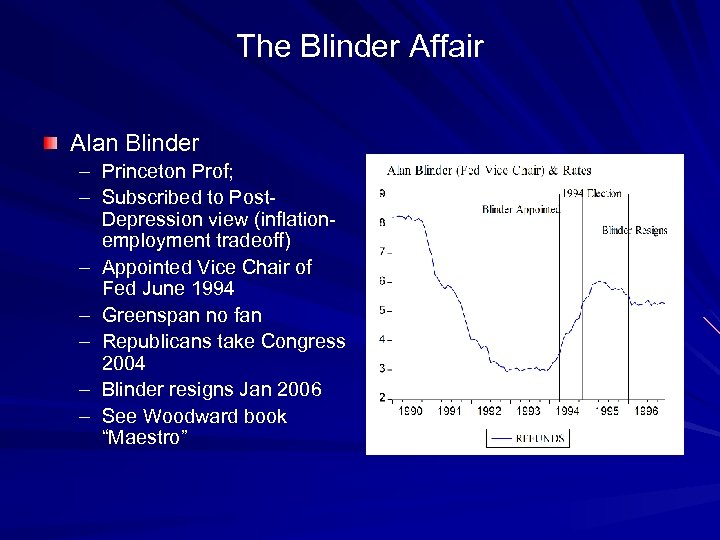

The Blinder Affair Alan Blinder – Princeton Prof; – Subscribed to Post. Depression view (inflationemployment tradeoff) – Appointed Vice Chair of Fed June 1994 – Greenspan no fan – Republicans take Congress 2004 – Blinder resigns Jan 2006 – See Woodward book “Maestro”

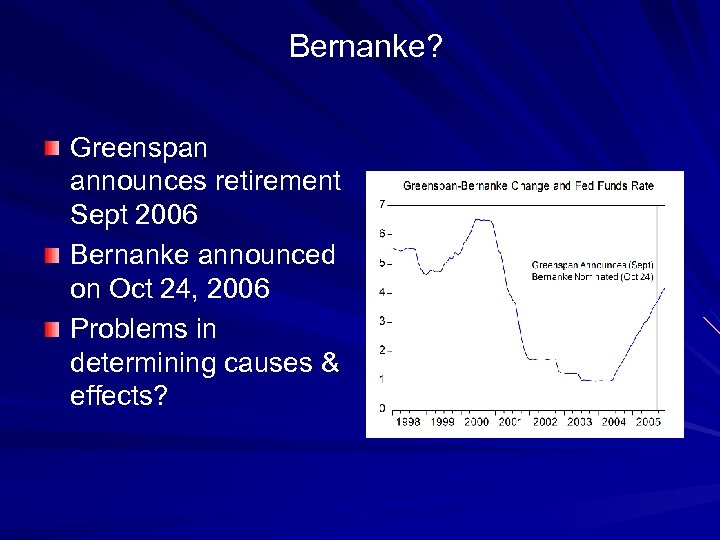

Bernanke? Greenspan announces retirement Sept 2006 Bernanke announced on Oct 24, 2006 Problems in determining causes & effects?

18dd4fc72eac42a0f2fa78e73d7d6434.ppt