54b40843913b2736c7935165fe9fc50d.ppt

- Количество слайдов: 19

BA 101 Introduction to Business 5. Forms of Business Ownership

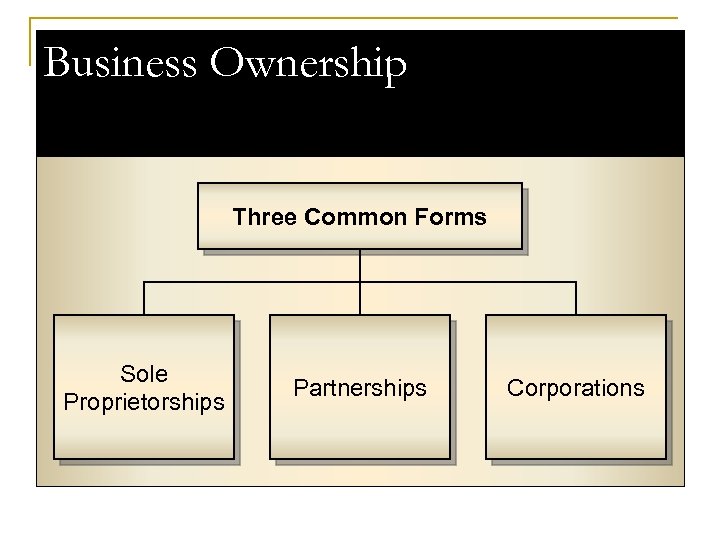

Business Ownership Three Common Forms Sole Proprietorships Partnerships Corporations

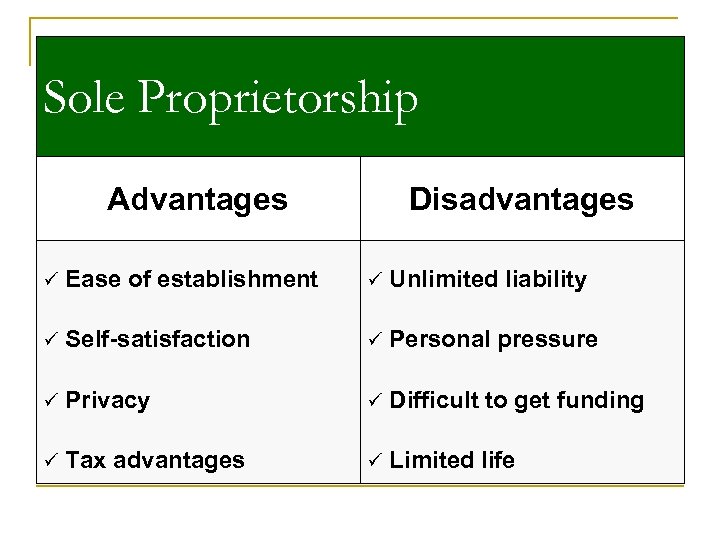

Sole Proprietorship Advantages Disadvantages ü Ease of establishment ü Unlimited liability ü Self-satisfaction ü Personal pressure ü Privacy ü Difficult to get funding ü Tax advantages ü Limited life

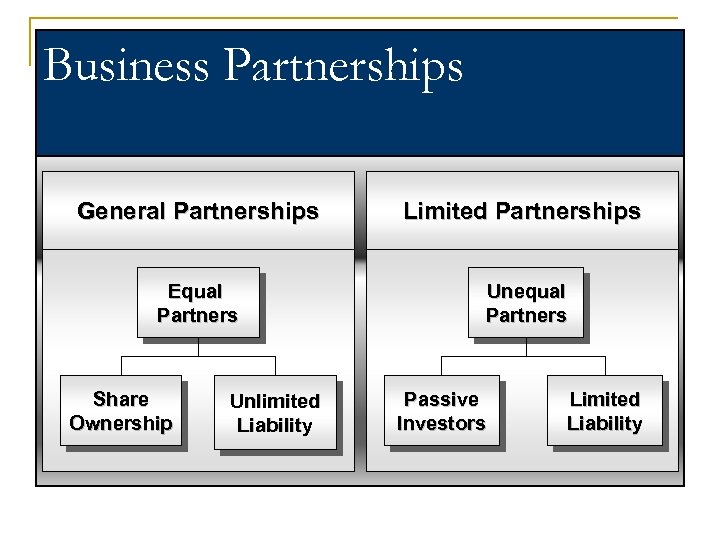

Business Partnerships General Partnerships Limited Partnerships Equal Partners Unequal Partners Share Ownership Unlimited Liability Passive Investors Limited Liability

Partnership Advantages Easy to Establish Tax Advantages Strength in Numbers Diversity of Skills Increased Capital Extended Life

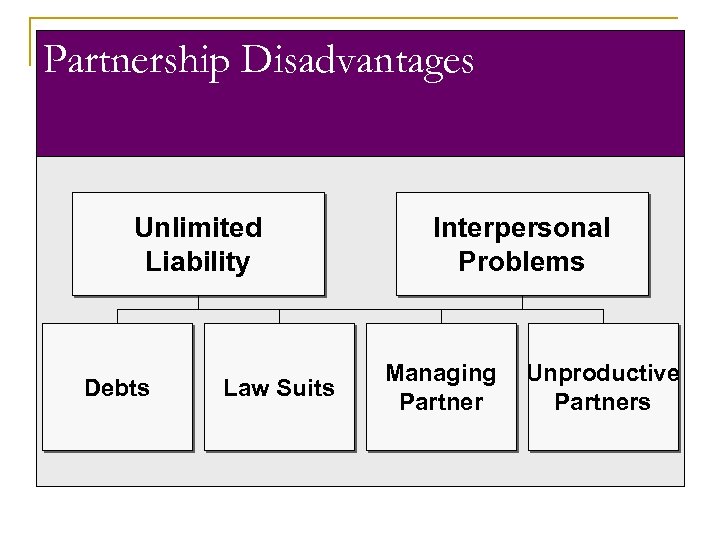

Partnership Disadvantages Unlimited Liability Debts Law Suits Interpersonal Problems Managing Partner Unproductive Partners

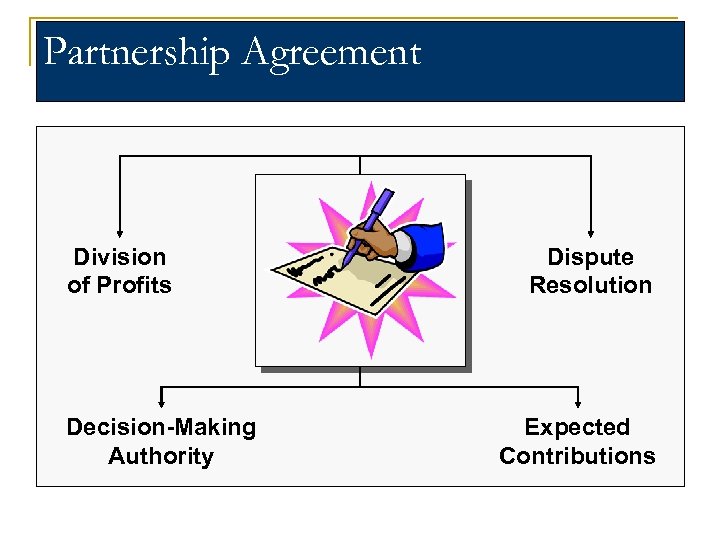

Partnership Agreement Division of Profits Decision-Making Authority Dispute Resolution Expected Contributions

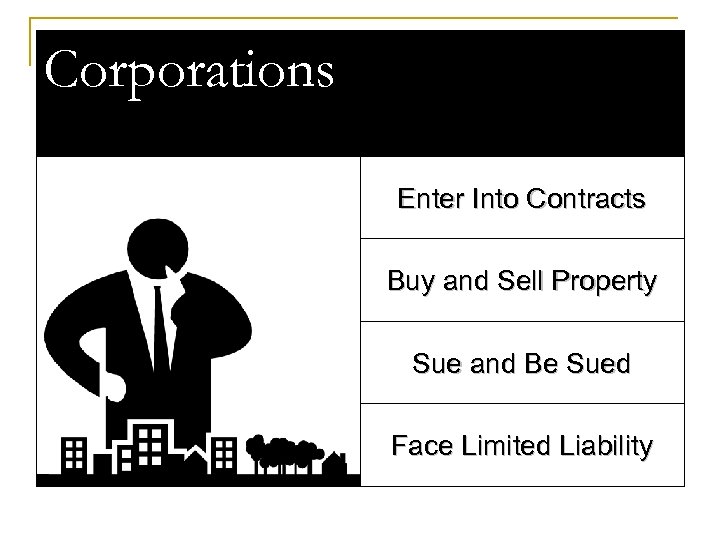

Corporations Enter Into Contracts Buy and Sell Property Sue and Be Sued Face Limited Liability

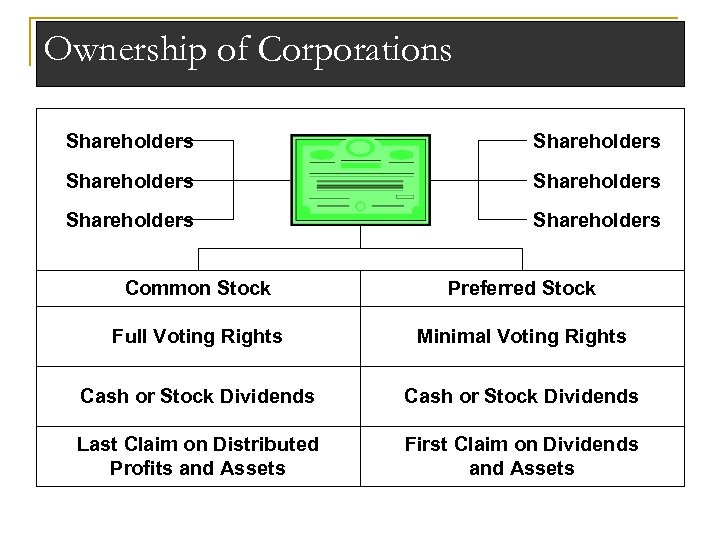

Ownership of Corporations Shareholders Shareholders Common Stock Preferred Stock Full Voting Rights Minimal Voting Rights Cash or Stock Dividends Last Claim on Distributed Profits and Assets First Claim on Dividends and Assets

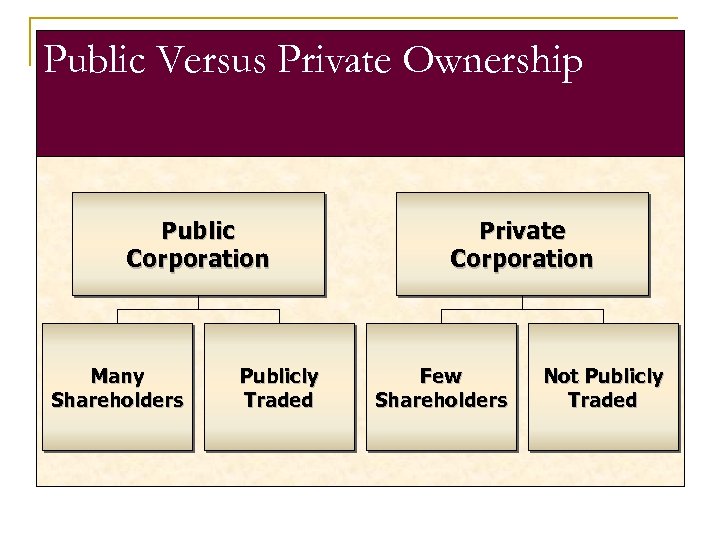

Public Versus Private Ownership Public Corporation Many Shareholders Publicly Traded Private Corporation Few Shareholders Not Publicly Traded

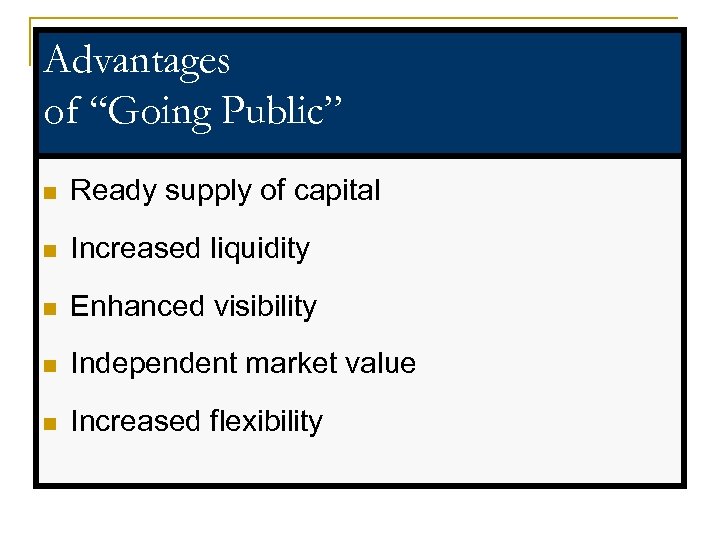

Advantages of “Going Public” n Ready supply of capital n Increased liquidity n Enhanced visibility n Independent market value n Increased flexibility

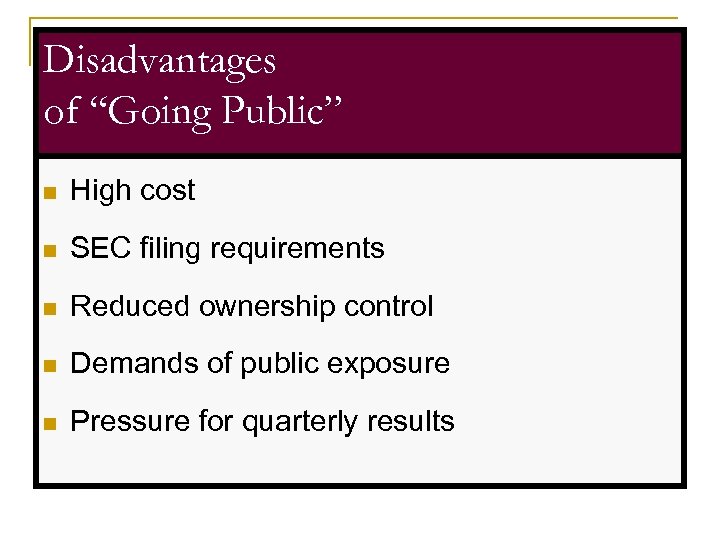

Disadvantages of “Going Public” n High cost n SEC filing requirements n Reduced ownership control n Demands of public exposure n Pressure for quarterly results

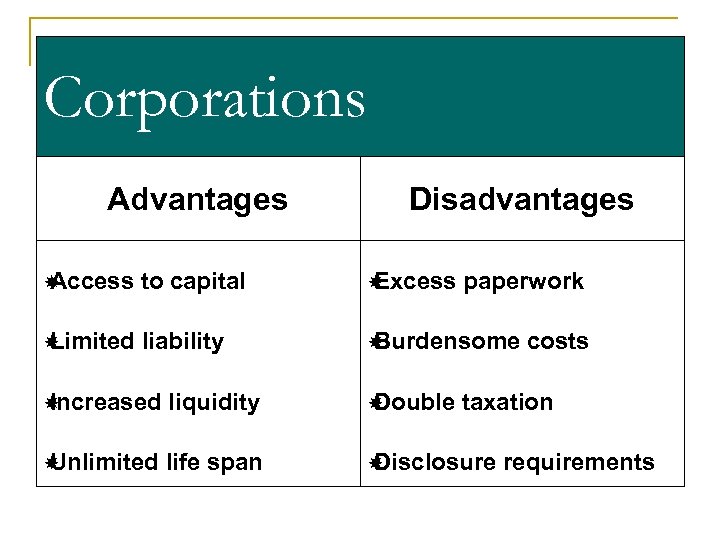

Corporations Advantages Disadvantages Access to capital Excess paperwork Limited liability Burdensome Increased liquidity Double Unlimited life span Disclosure costs taxation requirements

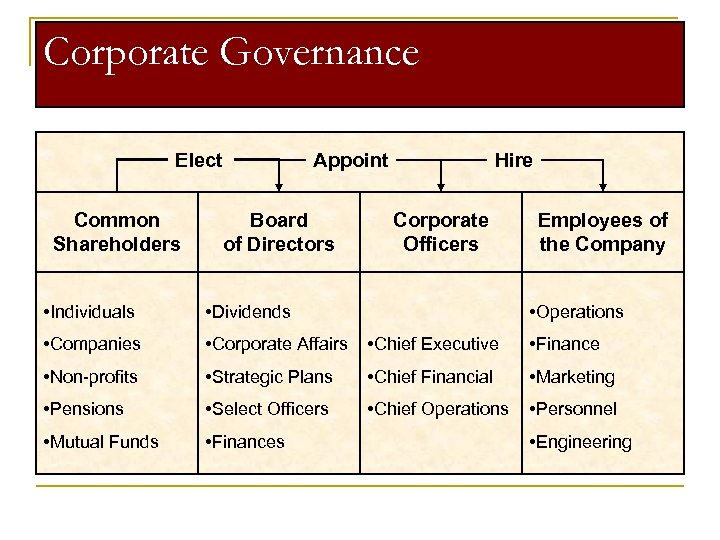

Corporate Governance Elect Common Shareholders Appoint Board of Directors Hire Corporate Officers Employees of the Company • Individuals • Dividends • Operations • Companies • Corporate Affairs • Chief Executive • Finance • Non-profits • Strategic Plans • Chief Financial • Marketing • Pensions • Select Officers • Chief Operations • Personnel • Mutual Funds • Finances • Engineering

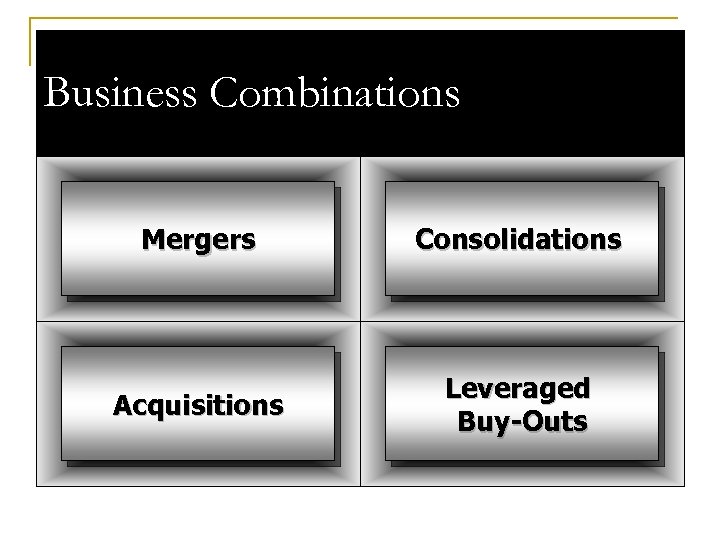

Business Combinations Mergers Consolidations Acquisitions Leveraged Buy-Outs

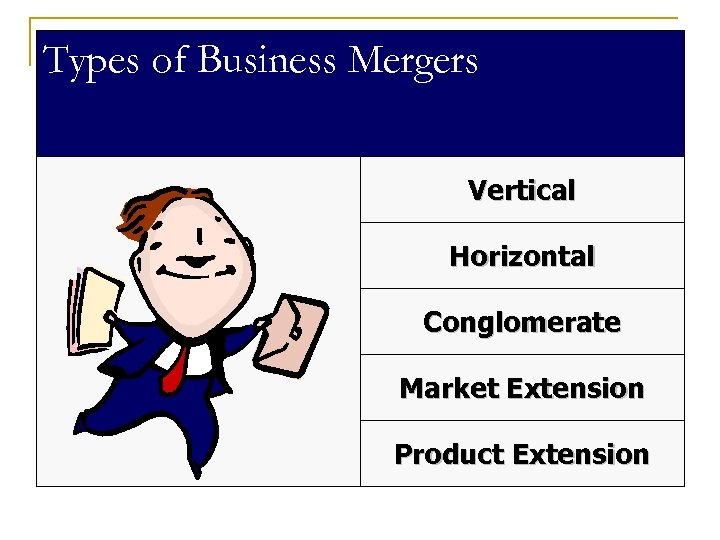

Types of Business Mergers Vertical Horizontal Conglomerate Market Extension Product Extension

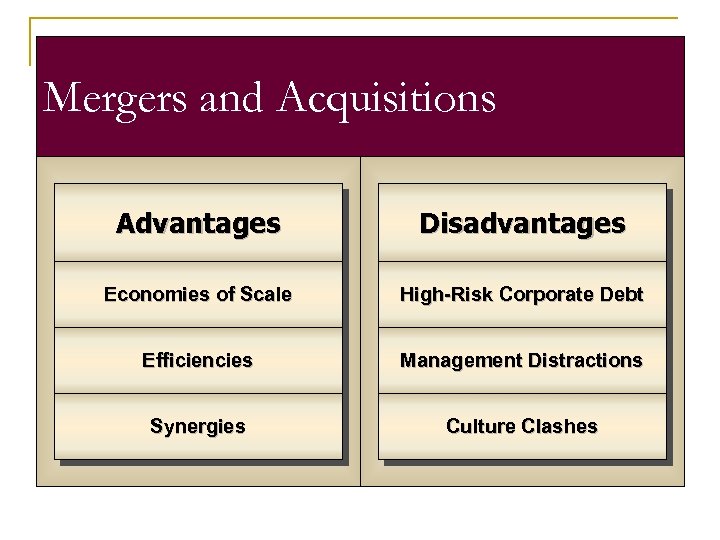

Mergers and Acquisitions Advantages Disadvantages Economies of Scale High-Risk Corporate Debt Efficiencies Management Distractions Synergies Culture Clashes

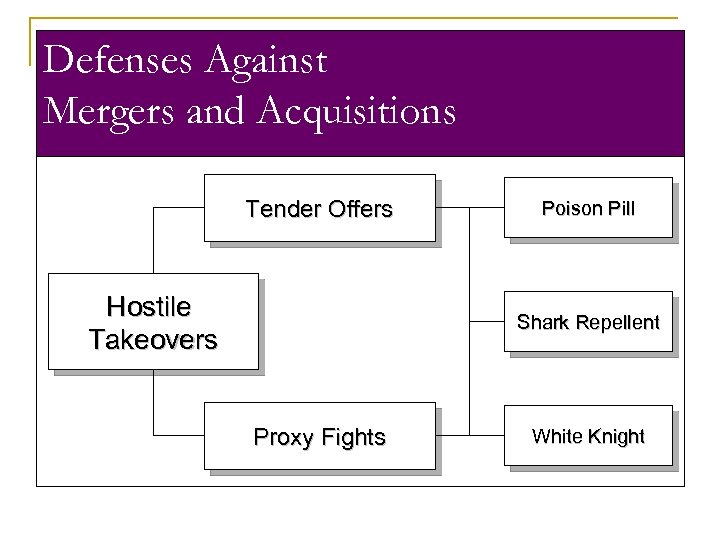

Defenses Against Mergers and Acquisitions Tender Offers Hostile Takeovers Poison Pill Shark Repellent Proxy Fights White Knight

Strategic Alliances and Joint Ventures Gain Credibility Expand Markets Access Technology Diversity Offerings Share Best Practices

54b40843913b2736c7935165fe9fc50d.ppt