a3cc9b6aeee070bdf8906dc87b21c9f9.ppt

- Количество слайдов: 43

B 2 B • E-Procurement • Metamediaries • Intermediation Opportunities 1

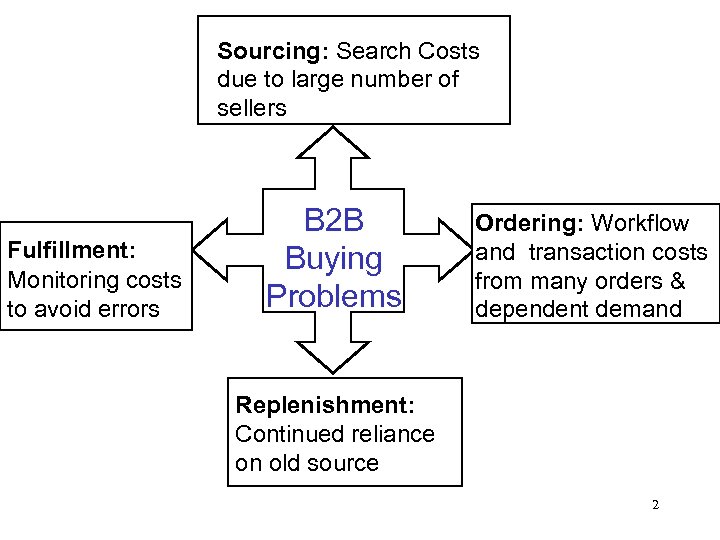

Sourcing: Search Costs due to large number of sellers Fulfillment: Monitoring costs to avoid errors B 2 B Buying Problems Ordering: Workflow and transaction costs from many orders & dependent demand Replenishment: Continued reliance on old source 2

Electronic Data Interchange (EDI) Definition. - First developed in the late 1960 s - Business to Business exchange of standardized documents in electronic form (e. g. , Invoice, Purchase order) Background. • Early barriers: lack of standards, telecom infrastructure • New national (X. 12), international (EDIFACT) standards • Used heavily by large companies (e. g. , Fortune 1000) • Enables re-structuring business relationships 3

Common EDI Applications in B 2 B Commerce • Quick Response (QR): POS data to supplier • Model Stock Replenishment: Supplier manages inventory • Materials Management: JIT systems • Efficient Customer Response (ECR): Grocery industry chain • Evaluated Receipt Settlement: No invoice • Collaborative Forecasting and Replenishment: Sharing forecast 4

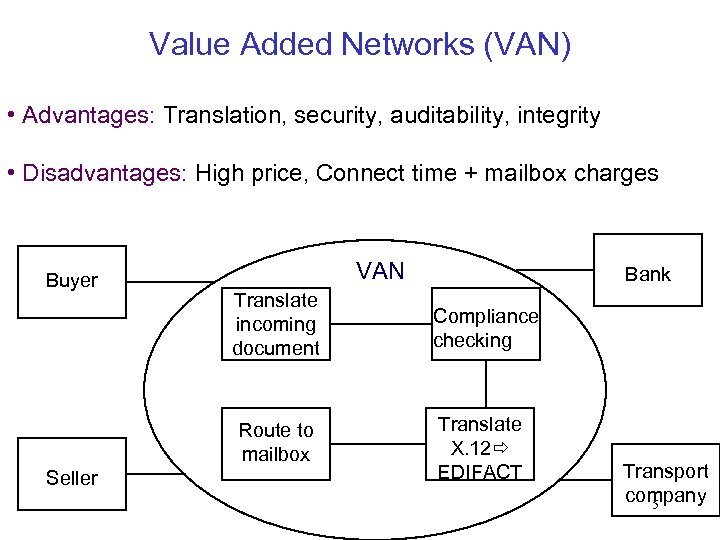

Value Added Networks (VAN) • Advantages: Translation, security, auditability, integrity • Disadvantages: High price, Connect time + mailbox charges Buyer VAN Translate incoming document Route to mailbox Seller Bank Compliance checking Translate X. 12 EDIFACT Transport company 5

Why EDI was not sufficient? • • • 6

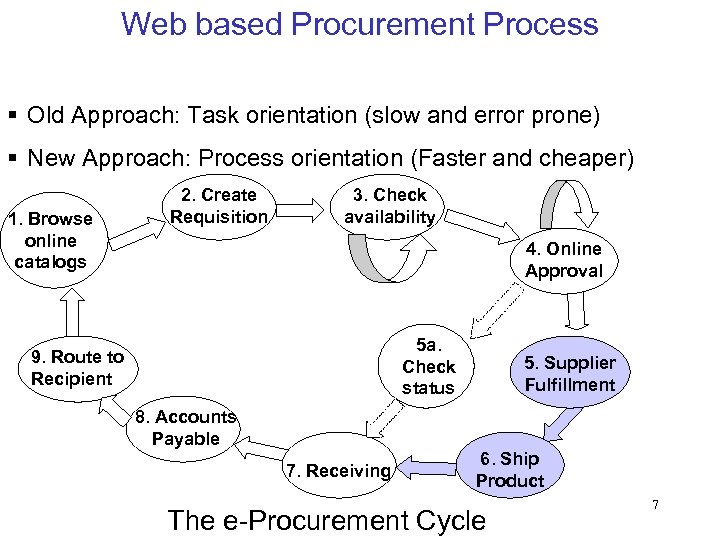

Web based Procurement Process § Old Approach: Task orientation (slow and error prone) § New Approach: Process orientation (Faster and cheaper) 1. Browse online catalogs 2. Create Requisition 3. Check availability 4. Online Approval 5 a. Check status 9. Route to Recipient 5. Supplier Fulfillment 8. Accounts Payable 7. Receiving 6. Ship Product The e-Procurement Cycle 7

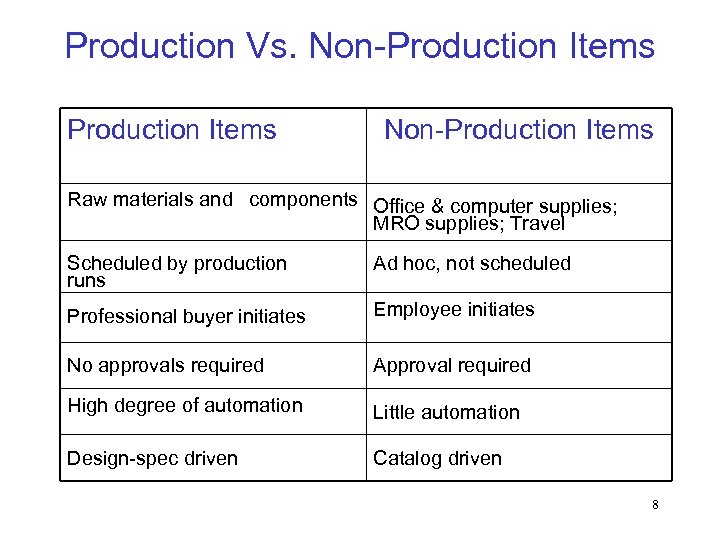

Production Vs. Non-Production Items Raw materials and components Office & computer supplies; MRO supplies; Travel Scheduled by production runs Ad hoc, not scheduled Professional buyer initiates Employee initiates No approvals required Approval required High degree of automation Little automation Design-spec driven Catalog driven 8

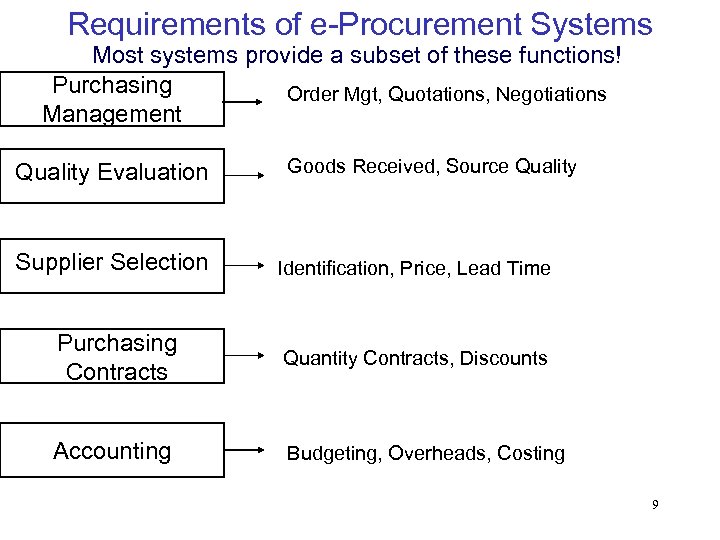

Requirements of e-Procurement Systems Most systems provide a subset of these functions! Purchasing Order Mgt, Quotations, Negotiations Management Quality Evaluation Goods Received, Source Quality Supplier Selection Identification, Price, Lead Time Purchasing Contracts Quantity Contracts, Discounts Accounting Budgeting, Overheads, Costing 9

B 2 B • E-Procurement • Metamediaries • Intermediation Opportunities 10

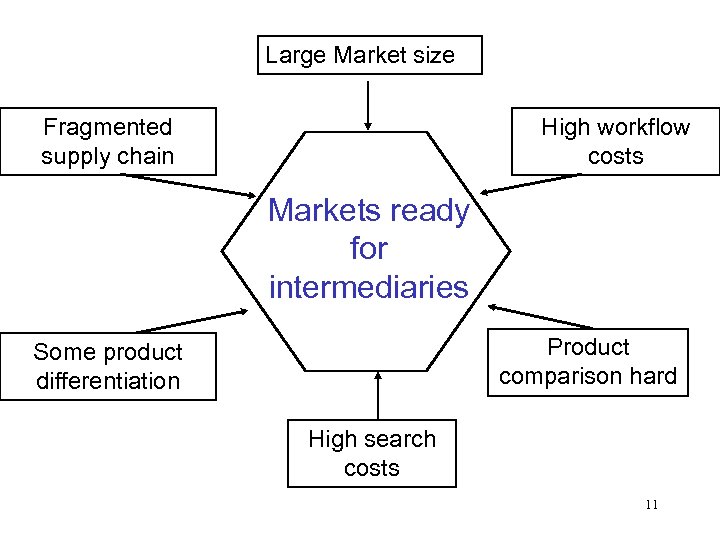

Large Market size Fragmented supply chain High workflow costs Markets ready for intermediaries Product comparison hard Some product differentiation High search costs 11

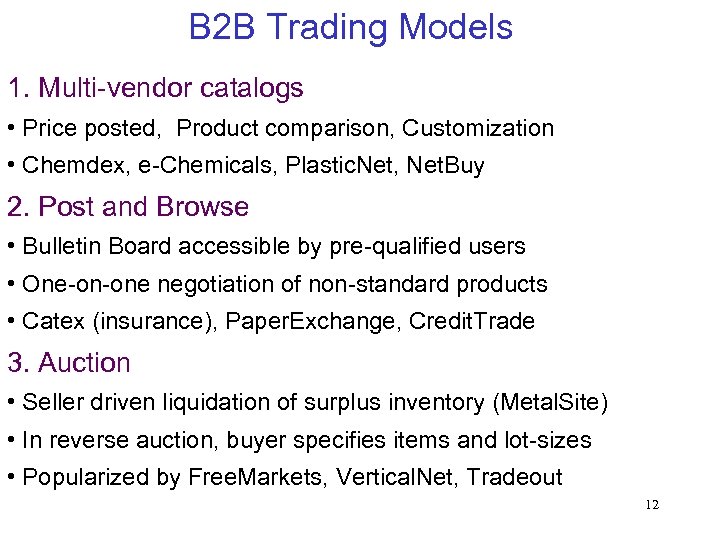

B 2 B Trading Models 1. Multi-vendor catalogs • Price posted, Product comparison, Customization • Chemdex, e-Chemicals, Plastic. Net, Net. Buy 2. Post and Browse • Bulletin Board accessible by pre-qualified users • One-on-one negotiation of non-standard products • Catex (insurance), Paper. Exchange, Credit. Trade 3. Auction • Seller driven liquidation of surplus inventory (Metal. Site) • In reverse auction, buyer specifies items and lot-sizes • Popularized by Free. Markets, Vertical. Net, Tradeout 12

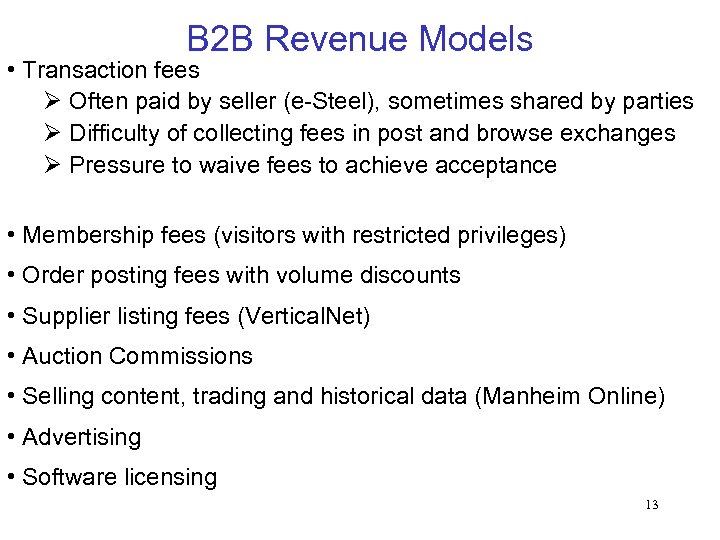

B 2 B Revenue Models • Transaction fees Ø Often paid by seller (e-Steel), sometimes shared by parties Ø Difficulty of collecting fees in post and browse exchanges Ø Pressure to waive fees to achieve acceptance • Membership fees (visitors with restricted privileges) • Order posting fees with volume discounts • Supplier listing fees (Vertical. Net) • Auction Commissions • Selling content, trading and historical data (Manheim Online) • Advertising • Software licensing 13

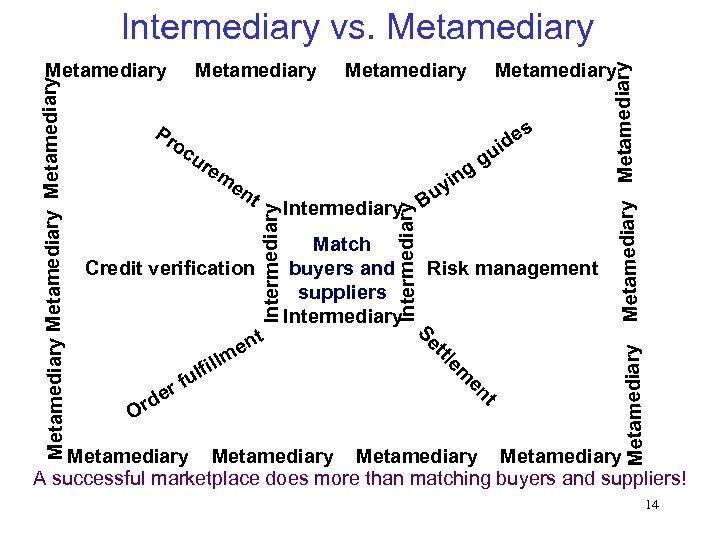

Intermediary vs. Metamediary g in y m en t Credit verification t Match buyers and suppliers Intermediary Risk management t en O u Intermediary B em r e rd lfil fu s de i gu ttl l en m Metamediary re Intermediary cu Intermediary Pr o Metamediary Se Metamediary Metamediary A successful marketplace does more than matching buyers and suppliers! 14

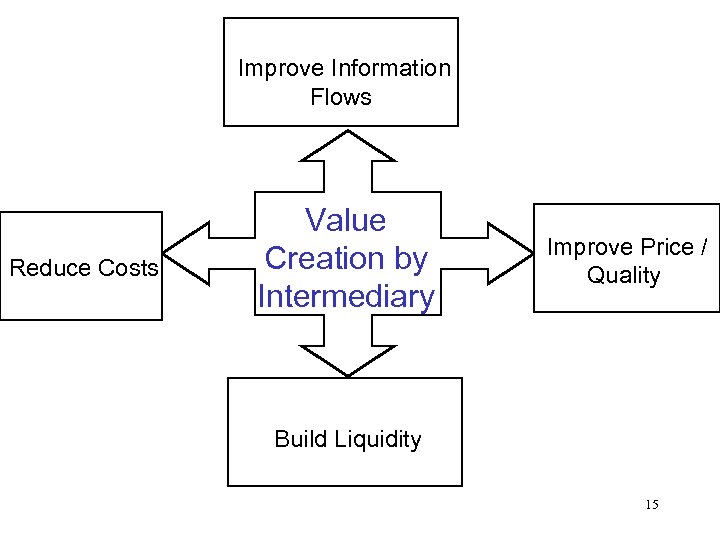

Improve Information Flows Reduce Costs Value Creation by Intermediary Improve Price / Quality Build Liquidity 15

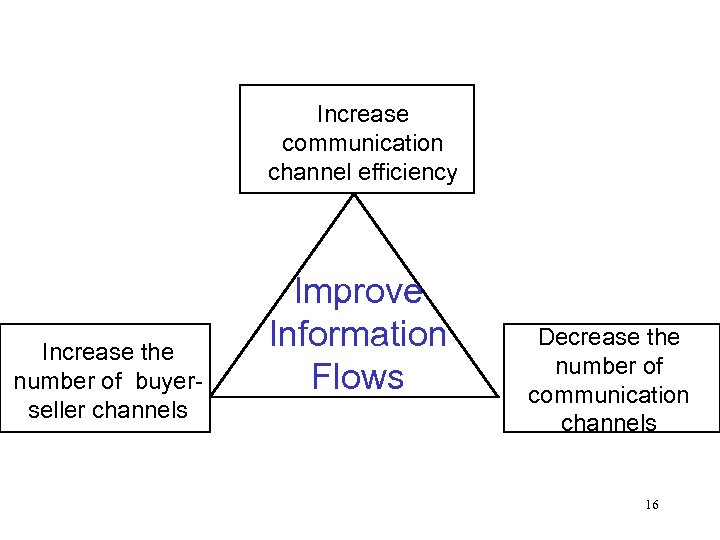

Increase communication channel efficiency Increase the number of buyerseller channels Improve Information Flows Decrease the number of communication channels 16

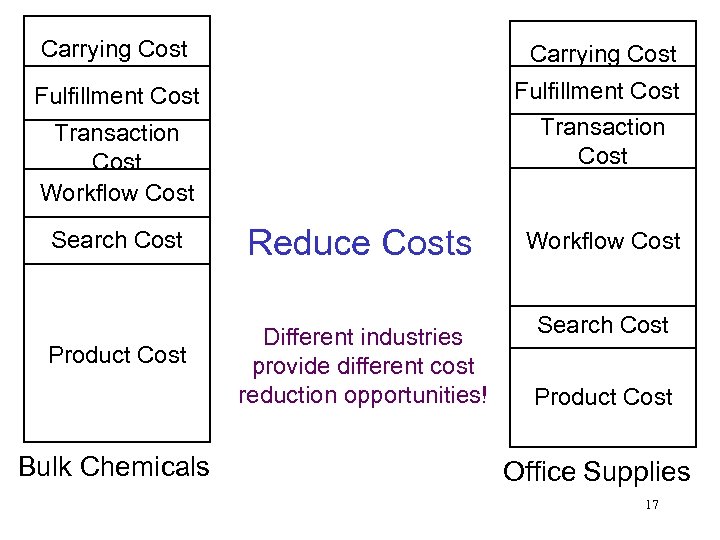

Carrying Cost Fulfillment Cost Transaction Cost Workflow Cost Search Cost Reduce Costs Workflow Cost Search Cost Product Cost Different industries provide different cost reduction opportunities! Bulk Chemicals Product Cost Office Supplies 17

Improve Price / Quality Savings from more sellers Traditional cost of search Internet cost of search Value Added Number of Sellers 18

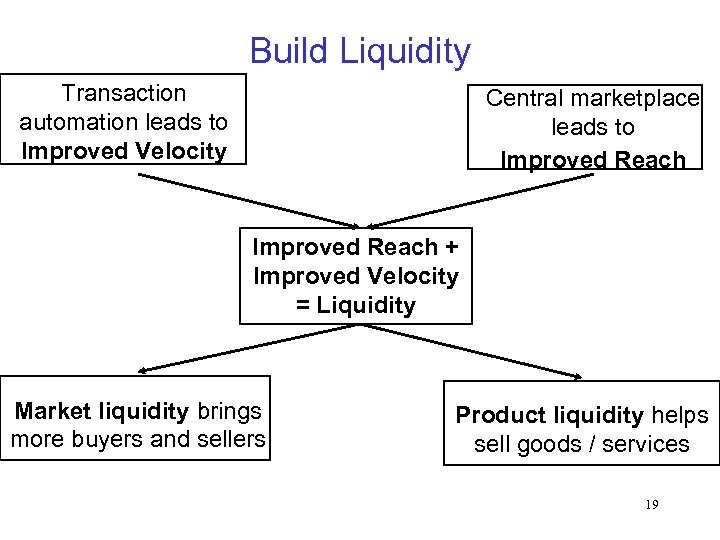

Build Liquidity Transaction automation leads to Improved Velocity Central marketplace leads to Improved Reach + Improved Velocity = Liquidity Market liquidity brings more buyers and sellers Product liquidity helps sell goods / services 19

B 2 B • E-Procurement • Metamediaries • Intermediation Opportunities 20

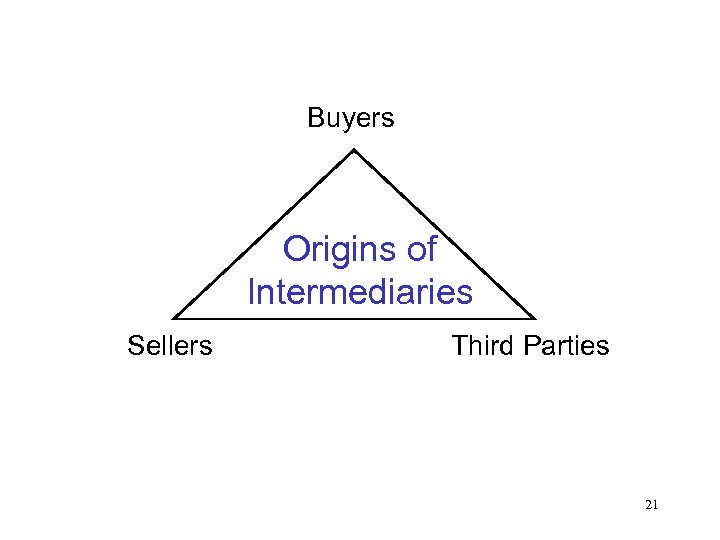

Buyers Origins of Intermediaries Sellers Third Parties 21

Origins of Intermediaries: Sellers n Electronic catalog, transaction capabilities n Access to product information and transaction automation n Migration from one seller to multi-vendor catalogs n Global Healthcare Exchange (J&J, GE Medical, Baxter, Abbott) n Metal. Site by steel producers 22

Sellers Initiated Exchange: Metal. Site Industry World market over 750 million tons, US Share 10% Founders: Weirton Steel, LTV Steel, Steel Dynamics, Bethlehem Steel, Ryerson Tull History - First provided industry news and product information - Next introduced e-commerce capabilities - New services (banking, logistics, billing, …) added later - 2000 Results: 50, 000 transactions; 22000 users; 2 million tons; 30, 000 products listed - Closed June 2001, MSA buys Metalsite in August 2001 23

Rules • Open, neutral marketplace, confidentiality • Users must register, Metal. Site to check legitimacy Sellers’ Goals • Expand customer base • Improve selling efficiency • Increase inventory turnover • Reduce non-value added tasks Buyers’ Incentives • Locate and purchase products effectively • Cut costs and time 24

Major Functions • Marketplace Products: Auction, Product guide, Quote. Finder • System Integration services • e-Business consulting services • Fulfillment products (Transportation, Financing, Collaborative forecasting, Advance order status notification) Revenue Model • Transaction fees 0. 25%-2% on auctions and product guide, small fee to use Quote. Finder • Difficulty in collecting transaction fees 25

Origins of Intermediaries: Buyers n Buyers want catalogs or reverse auction n Gain access to product information and availability n Migration from one buyer to multi-buyer market place n GEIS TPN procurement to marketplace n Automakers’ Covisint 26

Buyers Initiated Exchange: Covisint Industry • Procurement market for Automakers, over $350 billion • Major Players: Daimler. Chrysler AG, Ford, GM, Nissan, Renault History • Announced in Feb 2000 • 200 catalogs; 1000 users; 20, 000 transactions by June 2001 • Total volume in 2001 is expected to be $129 Billions Major Functions • Procurement • Catalogs • Buyer / Seller auction 27

Auto makers’ Goals ü Cut time and costs ü Exchange engineering data ü More suppliers ü Custom cars Tier-1 Suppliers’ Incentives • Cut costs • Buyer pressure 28

Regulatory Issues - Auto makers not to combine requirements - Auto makers can’t see needs of others - Export regulations enforcement - No loss in tax revenue Requirements - Currency conversion - Language translation - Supplier order management capabilities 29

Industry Aviation ($500 Billion) Major Players: Nine airlines and three aerospace manufacturers History • Airlines announced Air. Newco as their B 2 B marketplace in 4/00 • Suppliers announced My. Aircraft. com in 2/00 • Air. Newco and My. Aircraft merge to become Cordiem in 3/01 • First major B 2 B marketplace supported by buyers and sellers • Partners - i 2 Technologies, Ariba • Competes with Exostar led by Boeing, Lockheed & Raytheon • More than two dozen aerospace marketplaces 30

Major Functions • Online catalogs • Reverse and forward auctions • Inventory and supply chain management tools • Transaction support Revenue Model • Transaction fees on auctions, small fee for catalog listing • Subscription fees for supply chain management services • Both buyers and suppliers pay 31

Rules – Neutral, global e-marketplace – Open to any airline and supplier – No requirement on membership or exclusive use Sellers’ Goals • Focus on selling after-market products and services • Reduce inventory, errors, costs Buyers’ Incentives • Maintenance & engineering, fuel & fuel services, catering & cabin services, airport support services & general procurement • Locate and purchase products quickly • Cut costs and time 32

3 rd Party Intermediaries – Exploit inertia in product markets – Speed, neutrality, but acceptance? – Internet players: (e-Steel, Chemdex, Free. Markets) – Infomediaries: Create virtual community, no procurement experience (Asian Sources, Sea. Fax) – Software Provider: Trusted name, but no market experience (Ariba, Commerce One, Oracle Exchange) 33

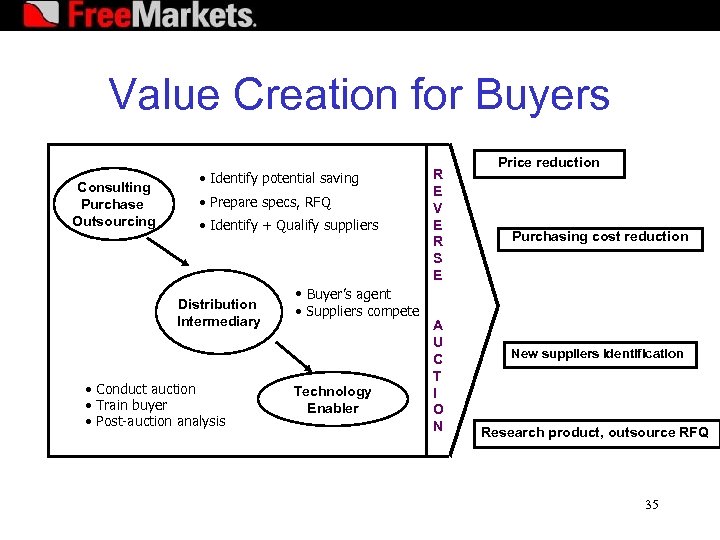

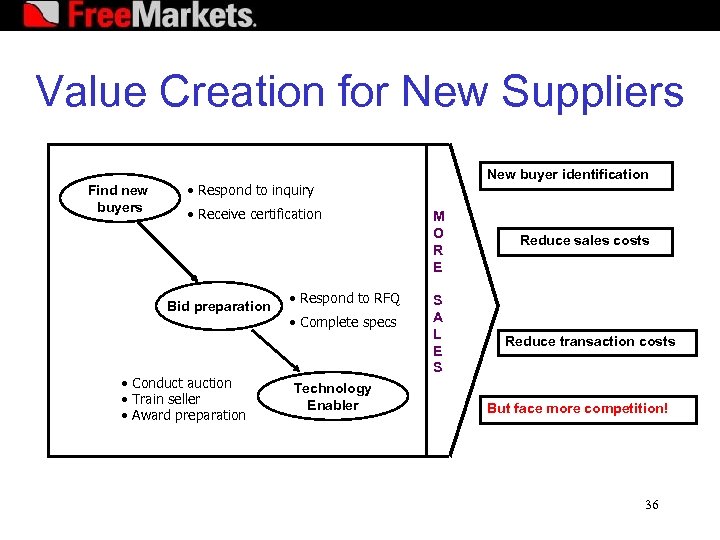

3 rd Party Initiated Exchange: Free. Markets Industry Initial market - industrial intermediate components ($600 Billion) Large order size - $3 million per transaction History • Launched in 1995 as an independent B 2 B marketplace • Reduce price and transaction costs • Worldwide expansion in 55 countries Score Card 2000 – Market volume $9. 9 B, saved $2. 7 B – 9200 auctions, 9300 suppliers – Revenue $91. 3 m, loss $44 m 34

Value Creation for Buyers Consulting Purchase Outsourcing • Identify potential saving • Prepare specs, RFQ • Identify + Qualify suppliers Distribution Intermediary • Conduct auction • Train buyer • Post-auction analysis • Buyer’s agent • Suppliers compete Technology Enabler R E V E R S E A U C T I O N Price reduction Purchasing cost reduction New suppliers identification Research product, outsource RFQ 35

Value Creation for New Suppliers Find new buyers New buyer identification • Respond to inquiry • Receive certification Bid preparation • Conduct auction • Train seller • Award preparation • Respond to RFQ • Complete specs Technology Enabler M O R E S A L E S Reduce sales costs Reduce transaction costs But face more competition! 36

Challenges Facing Intermediaries Ø Acceptance by buyers and sellers Ø Revenue generation Ø Sales and marketing costs Ø infrastructure and operating costs Ø Intense competition! 37

B 2 B Myths • The middleman must go! • Speed is everything! • EDI will vanish! • Old economy companies don’t get it! • Throw away your old systems! 38

Private Exchanges • Limited access! • Pre-existing business relationship • Higher level of integration • Order confirmation, tracking • Seller / buyer auctions • More volume than public exchanges ($b 242 > 43 in 2000)! • Example: Buyer GE $ 20 b 39

What went wrong with Public Exchanges? – Bias. Many exchanges required standardized product descriptions by sellers, and often allowed price comparison by buyers. – Funding. Many independent exchanges were funded by the financial community who pulled the plug when they did not sufficient revenue. – Technology. Lack of integration between the exchange and supplier ERP system. Buyers had to call the supplier anyway! – Complexity. Too many terms (specs, pricing, availability, delivery dates) require direct negotiation between buyers and sellers. 40

Its not the technology, stupid! • Its about redesigning workflows, processes and structures (BPR / Change Management)! • Its about collaboration between various parties inside and outside the company! Its about the cross-functional approach. • Its about changing decision making! Multimillion dollar contracts today are decided by higher ups who act in weeks! • The cost of training and process redesign exceeds technology costs. 41

Market Dynamics of connection proportional to participants Cost Value of market proportional to buyer-seller relationships Value increases if each participant can be either buyer or seller Value accelerates if multiple transactions occur before consumption 42

Key Points • E-Procurement is a must! • Searching for a B 2 B revenue model! • More online business, fewer exchanges? 43

a3cc9b6aeee070bdf8906dc87b21c9f9.ppt