5bbbe9f22fd4bc2d45e03f646438d598.ppt

- Количество слайдов: 82

AXA EQUITABLE PROTECTION REPORT Life Insurance needs and realities Results for USA (with international comparison) AXA Equitable. Protection Report – December 2007 - 1

Table of content § Introduction to the AXA Equitable Protection Report § Methodology § Analysis § Life stage explanation § Part 1: Sample description § Part 2. A: Attitudes towards Life risks § Part 2. B: Behaviors and habits against Life risks § Part 3: Product ownership and habits § Part 4: Theoretical insurance gap § Part 5: Conclusions § Appendices AXA Equitable Protection Report –December 2007 - 2

Introduction to the AXA Equitable Protection Report An international survey of Life Insurance needs and realities § Life Insurance habits vary in function of population segments and countries. Ø Ø Which are attitudes towards life risks? What are the usages and habits? How properly are people insured against what they call “life risks”? How are particular segments not insured? § The AXA Equitable Protection Report analyses these phenomena and tries to bring insights into a subject which might be of crucial importance for large parts of population AXA Equitable Protection Report –December 2007 - 3

Methodology § People aged 25 -65, working and not working (students being excluded)For Non-working, additional question to know if there is at least one income earner in the household (QI: Do you have an income in your household). If not the respondent was excluded. § Sample is national representative in terms of gender, age, occupation status and region. § Next to the USA, 10 countries were involved: Australia, Belgium, France, Germany, Hong. Kong, Italy, Japan, Spain, Switzerland, and the UK. Interviews are comparable. § Fieldwork: Computer Assisted Telephone Interviews (CATI) methodology. § Fieldwork dates: from the 28 th March to the 24 th of May 2007. § In this survey we introduced the notion of “life risks”, under which we mean: serious illness, disability, death, long-term unemployment, serious car accidents, etc… § By Life insurance we mean an insurance that pays a lump sum or periodic payments as from an agreed age and/or a lump sum or periodic payments to specified beneficiaries when you die = term-life insurance. AXA Equitable Protection Report –December 2007 - 4

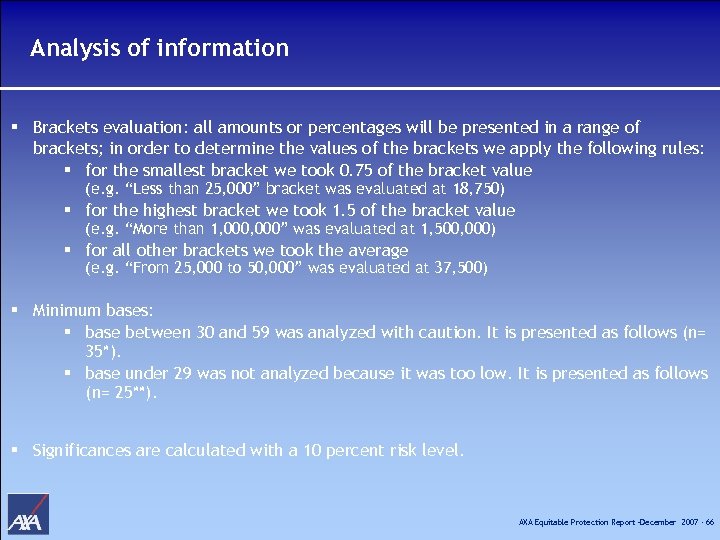

Analysis § Brackets evaluation: all amount or percentage will be presented on a range of brackets; in order to determine the values of the bracket we apply the following rules: § for the smallest bracket we took 0. 75 of the bracket value (e. g. “Less than 25, 000” bracket was evaluated at 18, 750) § for the highest bracket we took 1. 5 of the bracket value (e. g. “More than 1, 000” was evaluated at 1, 500, 000) § for all other brackets we took the average (e. g. “From 25, 000 to 50, 000” was evaluated at 37, 500) § Minimum bases: § base between 30 and 59 will have to be analysed with caution, we will present it as follows (n= 35*). § base under 29 will not be analysed because of too low base, and we will present it as follows (n= 25**). § Significances are calculated with a 10% risk level. AXA Equitable Protection Report –December 2007 - 5

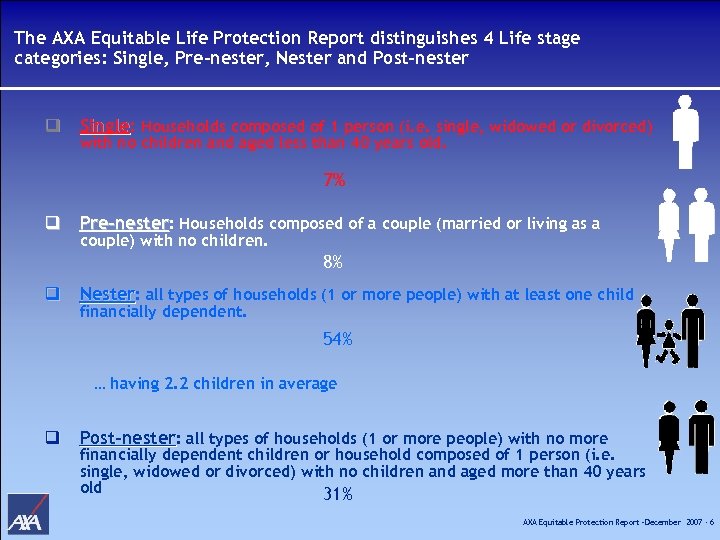

The AXA Equitable Life Protection Report distinguishes 4 Life stage categories: Single, Pre-nester, Nester and Post-nester q Single: Households composed of 1 person (i. e. single, widowed or divorced) Single with no children and aged less than 40 years old. 7% q Pre-nester: Households composed of a couple (married or living as a couple) with no children. 8% q Nester: all types of households (1 or more people) with at least one child financially dependent. 54% … having 2. 2 children in average q Post-nester: all types of households (1 or more people) with no more financially dependent children or household composed of 1 person (i. e. single, widowed or divorced) with no children and aged more than 40 years old 31% AXA Equitable Protection Report –December 2007 - 6

Part 1: Sample description: national representation of population aged 25 -65 AXA Equitable Protection Report –December 2007 - 7

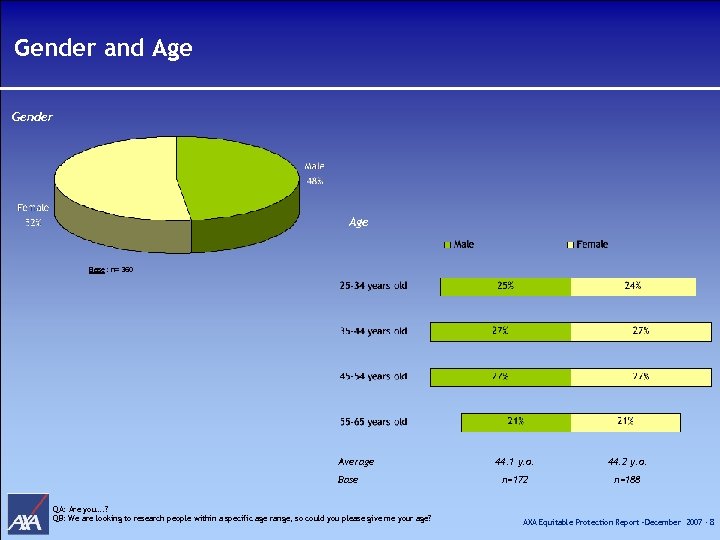

Gender and Age Gender Age Base : n= 360 Average Base QA: Are you…. ? QB: We are looking to research people within a specific age range, so could you please give me your age? 44. 1 y. o. 44. 2 y. o. n=172 n=188 AXA Equitable Protection Report –December 2007 - 8

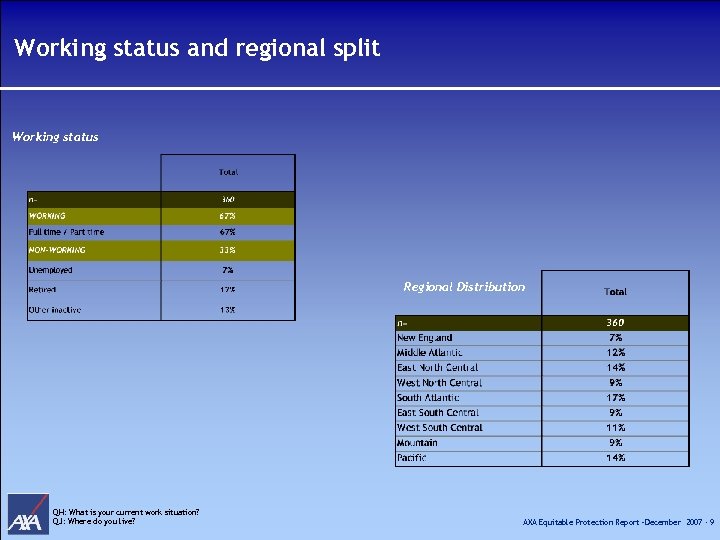

Working status and regional split Working status Regional Distribution QH: What is your current work situation? QJ: Where do you live? AXA Equitable Protection Report –December 2007 - 9

Part 2: Attitudes & Behaviors 2. A Attitudes towards Life risks AXA Equitable Protection Report –December 2007 - 10

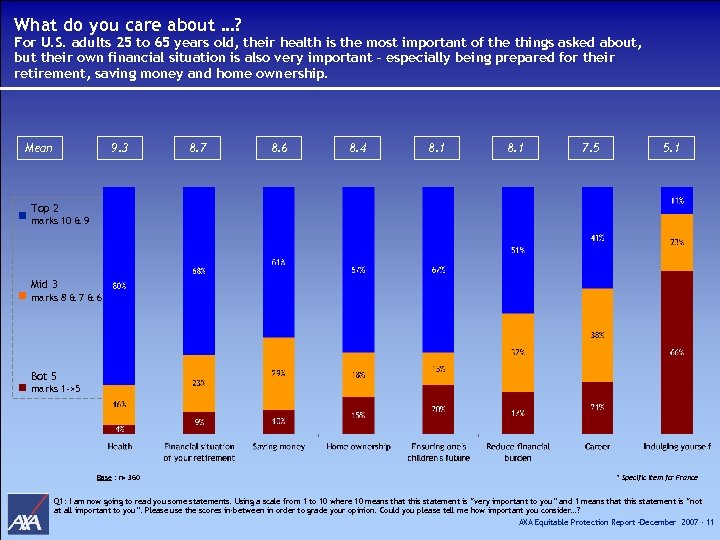

What do you care about …? For U. S. adults 25 to 65 years old, their health is the most important of the things asked about, but their own financial situation is also very important – especially being prepared for their retirement, saving money and home ownership. Mean 9. 3 8. 7 8. 6 8. 4 8. 1 7. 5 5. 1 Top 2 marks 10 & 9 Mid 3 marks 8 & 7 & 6 Bot 5 marks 1 ->5 Base : n= 360 * Specific item for France Q 1: I am now going to read you some statements. Using a scale from 1 to 10 where 10 means that this statement is “very important to you” and 1 means that this statement is “not at all important to you”. Please use the scores in-between in order to grade your opinion. Could you please tell me how important you consider…? AXA Equitable Protection Report –December 2007 - 11

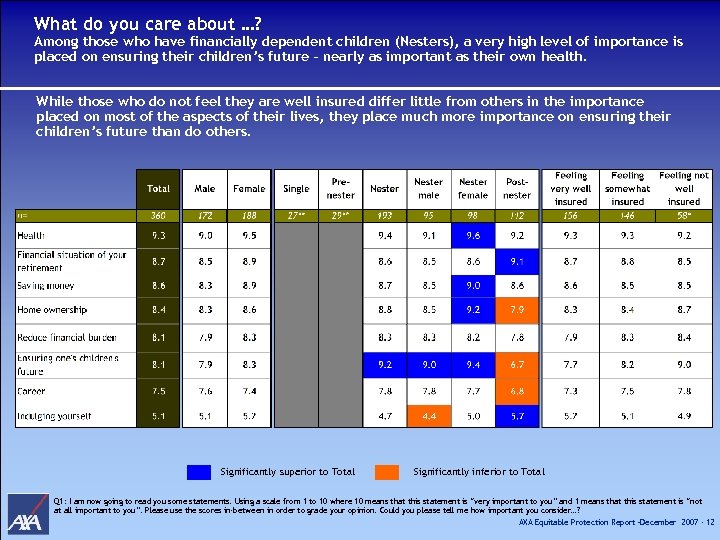

What do you care about …? Among those who have financially dependent children (Nesters), a very high level of importance is placed on ensuring their children’s future – nearly as important as their own health. While those who do not feel they are well insured differ little from others in the importance placed on most of the aspects of their lives, they place much more importance on ensuring their children’s future than do others. Significantly superior to Total Significantly inferior to Total Q 1: I am now going to read you some statements. Using a scale from 1 to 10 where 10 means that this statement is “very important to you” and 1 means that this statement is “not at all important to you”. Please use the scores in-between in order to grade your opinion. Could you please tell me how important you consider…? AXA Equitable Protection Report –December 2007 - 12

What do you care about …? § Overall, their own health is most important to all, although other aspects of their lives are also important and differ by life stage. § Those with financially dependent children place a high level of importance on ensuring their children’s future. § Home ownership and saving money also rank high on most people’s priority lists. § In contrast, self-indulgence has much lower importance across all lifestages. AXA Equitable Protection Report –December 2007 - 13

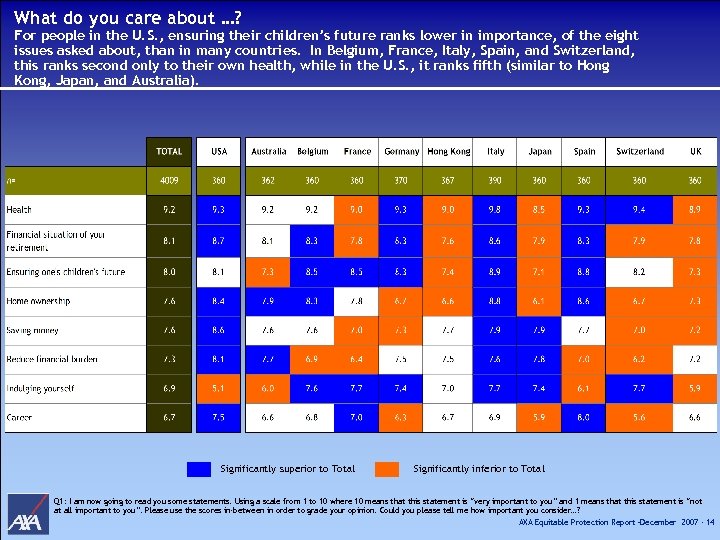

What do you care about …? For people in the U. S. , ensuring their children’s future ranks lower in importance, of the eight issues asked about, than in many countries. In Belgium, France, Italy, Spain, and Switzerland, this ranks second only to their own health, while in the U. S. , it ranks fifth (similar to Hong Kong, Japan, and Australia). Significantly superior to Total Significantly inferior to Total Q 1: I am now going to read you some statements. Using a scale from 1 to 10 where 10 means that this statement is “very important to you” and 1 means that this statement is “not at all important to you”. Please use the scores in-between in order to grade your opinion. Could you please tell me how important you consider…? AXA Equitable Protection Report –December 2007 - 14

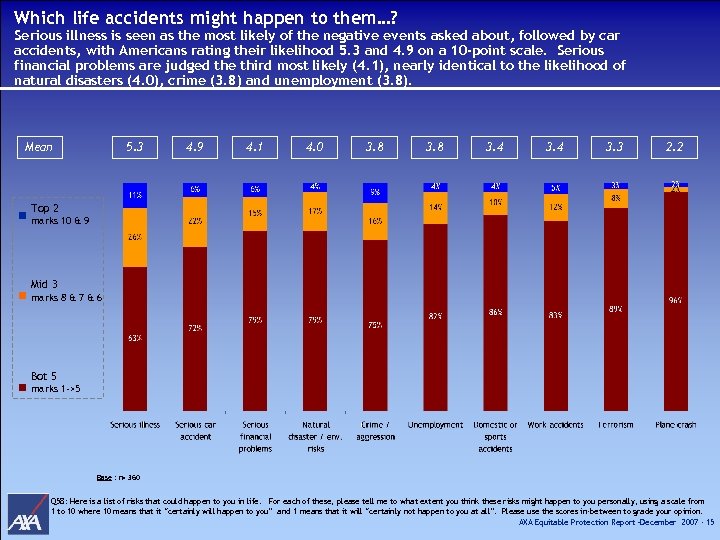

Which life accidents might happen to them…? Serious illness is seen as the most likely of the negative events asked about, followed by car accidents, with Americans rating their likelihood 5. 3 and 4. 9 on a 10 -point scale. Serious financial problems are judged the third most likely (4. 1), nearly identical to the likelihood of natural disasters (4. 0), crime (3. 8) and unemployment (3. 8). Mean 5. 3 4. 9 4. 1 4. 0 3. 8 3. 4 3. 3 2. 2 Top 2 marks 10 & 9 Mid 3 marks 8 & 7 & 6 Bot 5 marks 1 ->5 Base : n= 360 Q 58: Here is a list of risks that could happen to you in life. For each of these, please tell me to what extent you think these risks might happen to you personally, using a scale from 1 to 10 where 10 means that it “certainly will happen to you” and 1 means that it will “certainly not happen to you at all”. Please use the scores in-between to grade your opinion. AXA Equitable Protection Report –December 2007 - 15

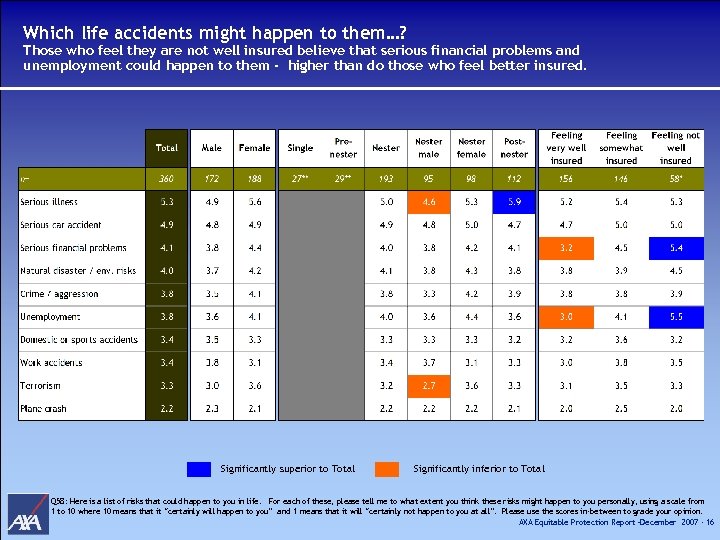

Which life accidents might happen to them…? Those who feel they are not well insured believe that serious financial problems and unemployment could happen to them - higher than do those who feel better insured. Significantly superior to Total Significantly inferior to Total Q 58: Here is a list of risks that could happen to you in life. For each of these, please tell me to what extent you think these risks might happen to you personally, using a scale from 1 to 10 where 10 means that it “certainly will happen to you” and 1 means that it will “certainly not happen to you at all”. Please use the scores in-between to grade your opinion. AXA Equitable Protection Report –December 2007 - 16

Which life accidents might happen to them? § Health, which ranks first in importance, is a source of worry for people. Serious illness ranks first in terms of likelihood of the negative events asked about in the survey, followed by serious car accidents. Financial problems, natural disasters, crime and unemployment rank next in the likelihood people attach to these events. § Feelings about the adequacy of their insurance coverage are related to Americans beliefs about the likelihood of serious financial problems and unemployment. The less well insured they feel they are, the more likely they believe that one of these two things will happen to them. AXA Equitable Protection Report –December 2007 - 17

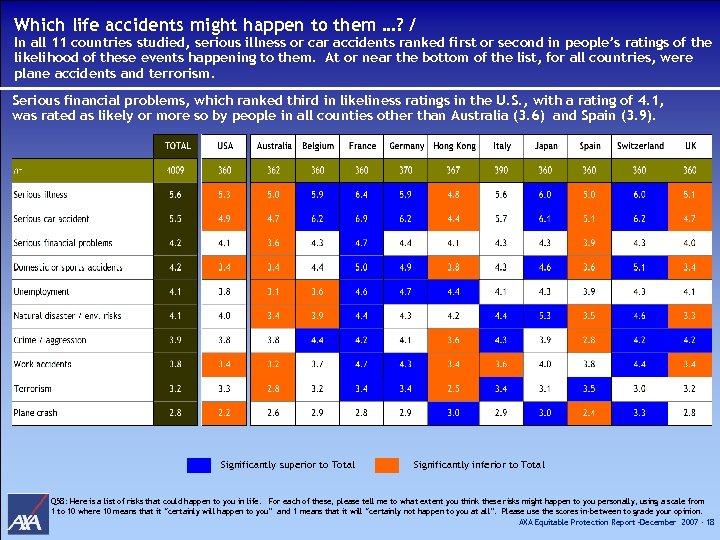

Which life accidents might happen to them …? / In all 11 countries studied, serious illness or car accidents ranked first or second in people’s ratings of the likelihood of these events happening to them. At or near the bottom of the list, for all countries, were plane accidents and terrorism. Serious financial problems, which ranked third in likeliness ratings in the U. S. , with a rating of 4. 1, was rated as likely or more so by people in all counties other than Australia (3. 6) and Spain (3. 9). Significantly superior to Total Significantly inferior to Total Q 58: Here is a list of risks that could happen to you in life. For each of these, please tell me to what extent you think these risks might happen to you personally, using a scale from 1 to 10 where 10 means that it “certainly will happen to you” and 1 means that it will “certainly not happen to you at all”. Please use the scores in-between to grade your opinion. AXA Equitable Protection Report –December 2007 - 18

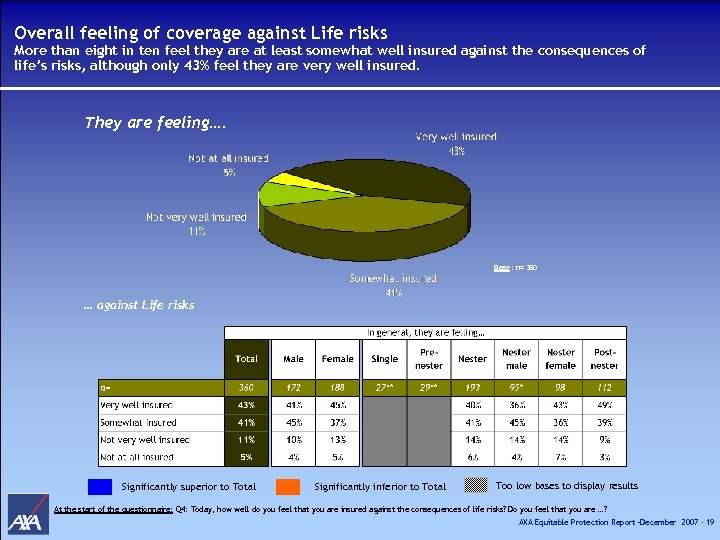

Overall feeling of coverage against Life risks More than eight in ten feel they are at least somewhat well insured against the consequences of life’s risks, although only 43% feel they are very well insured. They are feeling…. Base : n= 360 … against Life risks Significantly superior to Total Significantly inferior to Total Too low bases to display results At the start of the questionnaire: Q 4: Today, how well do you feel that you are insured against the consequences of life risks? Do you feel that you are …? AXA Equitable Protection Report –December 2007 - 19

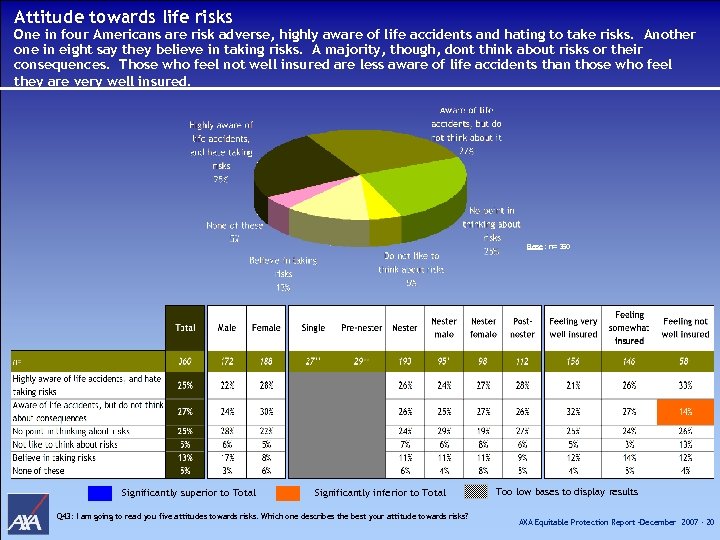

Attitude towards life risks One in four Americans are risk adverse, highly aware of life accidents and hating to take risks. Another one in eight say they believe in taking risks. A majority, though, dont think about risks or their consequences. Those who feel not well insured are less aware of life accidents than those who feel they are very well insured. Base : n= 360 Significantly superior to Total Significantly inferior to Total Q 43: I am going to read you five attitudes towards risks. Which one describes the best your attitude towards risks? Too low bases to display results AXA Equitable Protection Report –December 2007 - 20

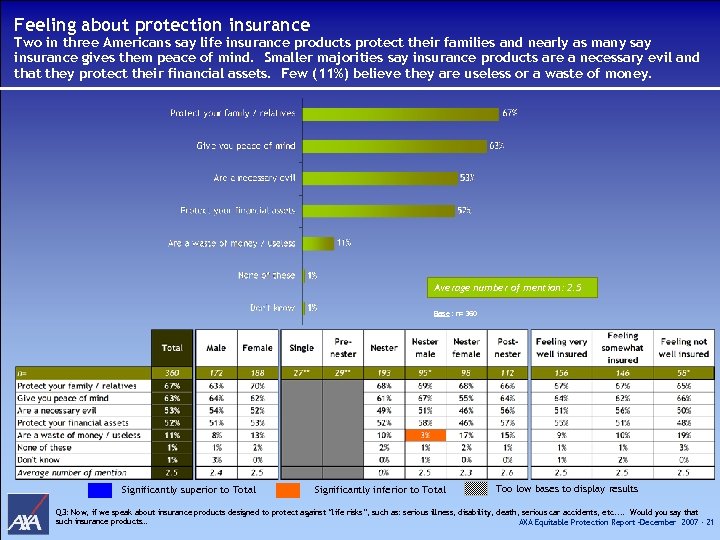

Feeling about protection insurance Two in three Americans say life insurance products protect their families and nearly as many say insurance gives them peace of mind. Smaller majorities say insurance products are a necessary evil and that they protect their financial assets. Few (11%) believe they are useless or a waste of money. Average number of mention: 2. 5 Base : n= 360 Significantly superior to Total Significantly inferior to Total Too low bases to display results Q 3: Now, if we speak about insurance products designed to protect against “life risks”, such as: serious illness, disability, death, serious car accidents, etc. . Would you say that such insurance products… AXA Equitable Protection Report –December 2007 - 21

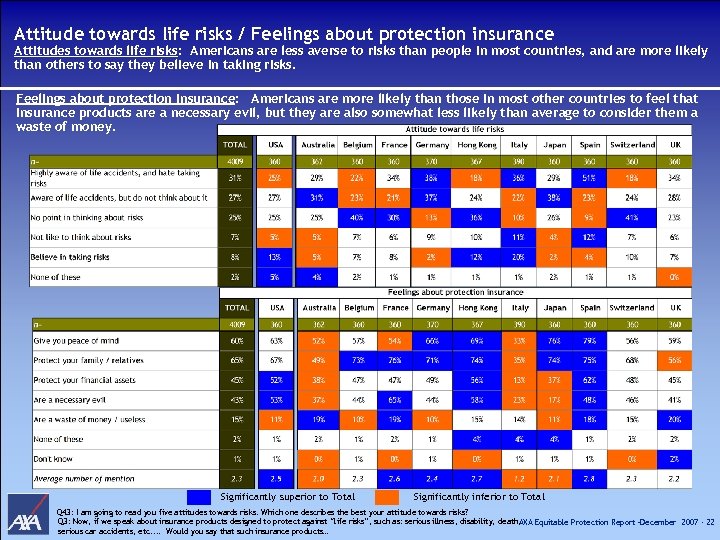

Attitude towards life risks / Feelings about protection insurance Attitudes towards life risks: Americans are less averse to risks than people in most countries, and are more likely than others to say they believe in taking risks. Feelings about protection insurance: Americans are more likely than those in most other countries to feel that insurance products are a necessary evil, but they are also somewhat less likely than average to consider them a waste of money. Significantly superior to Total Significantly inferior to Total Q 43: I am going to read you five attitudes towards risks. Which one describes the best your attitude towards risks? Q 3: Now, if we speak about insurance products designed to protect against “life risks”, such as: serious illness, disability, death, AXA Equitable Protection Report –December 2007 - 22 serious car accidents, etc. . Would you say that such insurance products…

Part 2: Attitudes & Behaviors 2. B Behaviors and habits against Life risks AXA Equitable Protection Report –December 2007 - 23

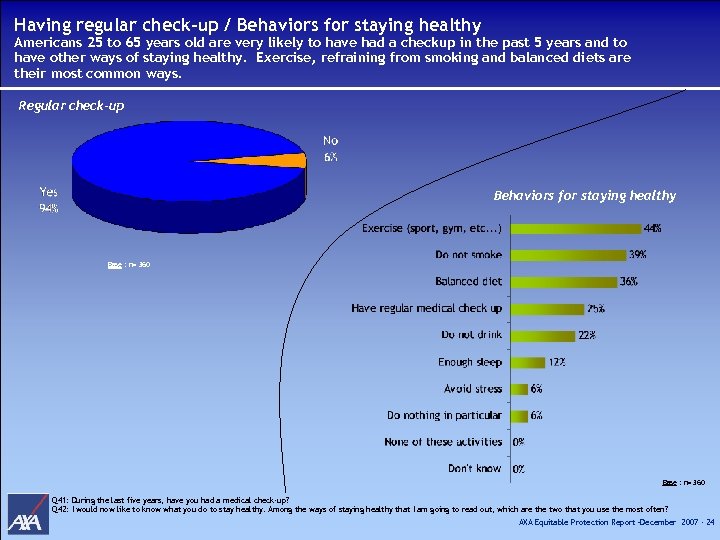

Having regular check-up / Behaviors for staying healthy Americans 25 to 65 years old are very likely to have had a checkup in the past 5 years and to have other ways of staying healthy. Exercise, refraining from smoking and balanced diets are their most common ways. Regular check-up Behaviors for staying healthy Base : n= 360 Q 41: During the last five years, have you had a medical check-up? Q 42: I would now like to know what you do to stay healthy. Among the ways of staying healthy that I am going to read out, which are the two that you use the most often? AXA Equitable Protection Report –December 2007 - 24

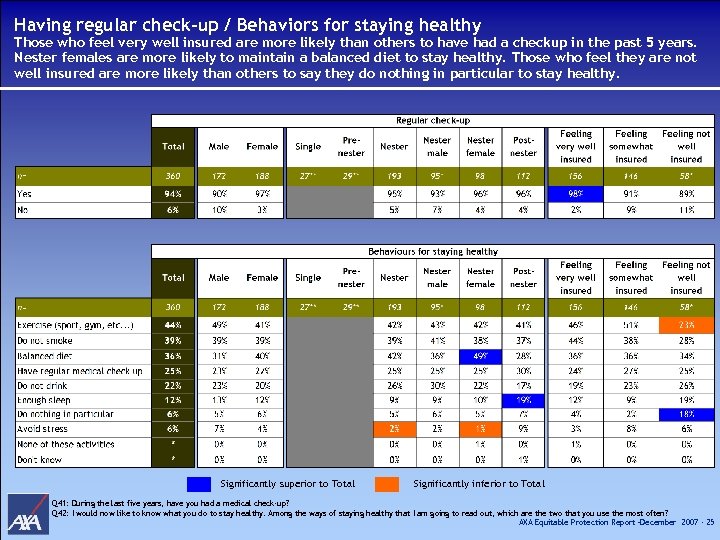

Having regular check-up / Behaviors for staying healthy Those who feel very well insured are more likely than others to have had a checkup in the past 5 years. Nester females are more likely to maintain a balanced diet to stay healthy. Those who feel they are not well insured are more likely than others to say they do nothing in particular to stay healthy. Significantly superior to Total Significantly inferior to Total Q 41: During the last five years, have you had a medical check-up? Q 42: I would now like to know what you do to stay healthy. Among the ways of staying healthy that I am going to read out, which are the two that you use the most often? AXA Equitable Protection Report –December 2007 - 25

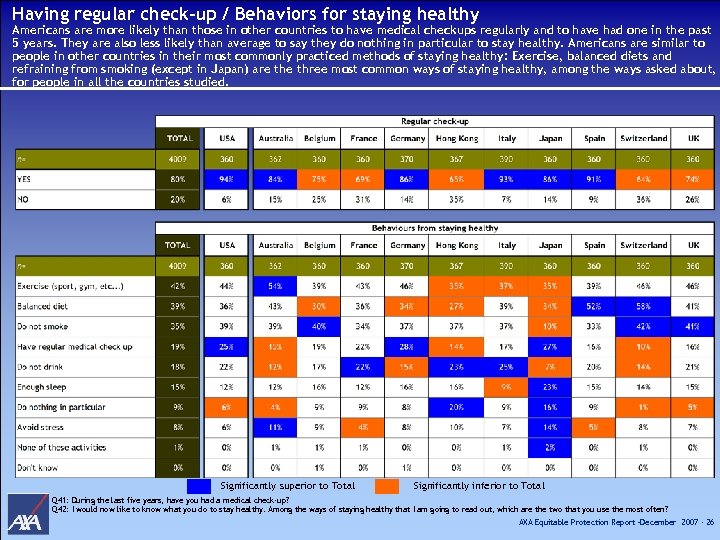

Having regular check-up / Behaviors for staying healthy Americans are more likely than those in other countries to have medical checkups regularly and to have had one in the past 5 years. They are also less likely than average to say they do nothing in particular to stay healthy. Americans are similar to people in other countries in their most commonly practiced methods of staying healthy: Exercise, balanced diets and refraining from smoking (except in Japan) are three most common ways of staying healthy, among the ways asked about, for people in all the countries studied. Significantly superior to Total Significantly inferior to Total Q 41: During the last five years, have you had a medical check-up? Q 42: I would now like to know what you do to stay healthy. Among the ways of staying healthy that I am going to read out, which are the two that you use the most often? AXA Equitable Protection Report –December 2007 - 26

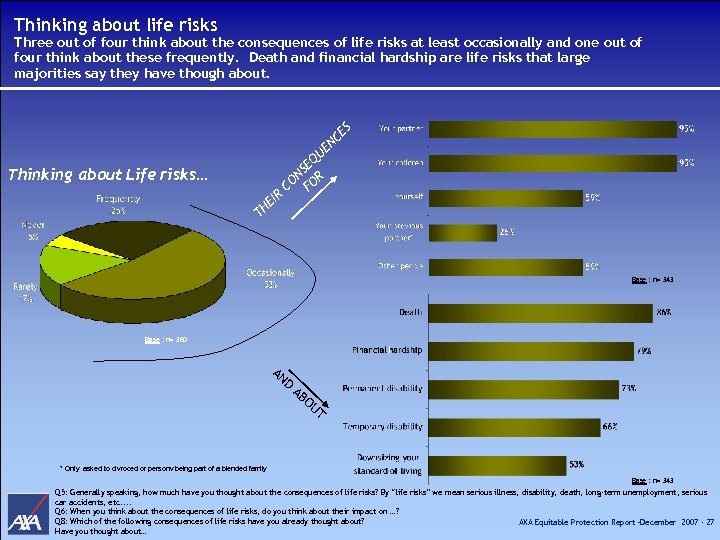

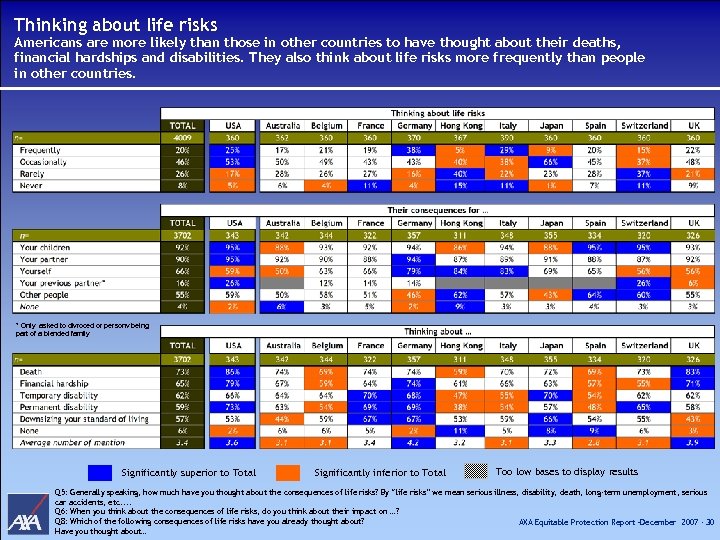

Thinking about life risks Three out of four think about the consequences of life risks at least occasionally and one out of four think about these frequently. Death and financial hardship are life risks that large majorities say they have though about. S E NC E Thinking about Life risks… R I HE U EQ S ON FOR C T Base : n= 343 Base : n= 360 AN D AB OU T * Only asked to divroced or personv being part of a blended family Base : n= 343 Q 5: Generally speaking, how much have you thought about the consequences of life risks? By “life risks” we mean serious illness, disability, death, long-term unemployment, serious car accidents, etc. . Q 6: When you think about the consequences of life risks, do you think about their impact on …? Q 8: Which of the following consequences of life risks have you already thought about? AXA Equitable Protection Report –December 2007 - 27 Have you thought about…

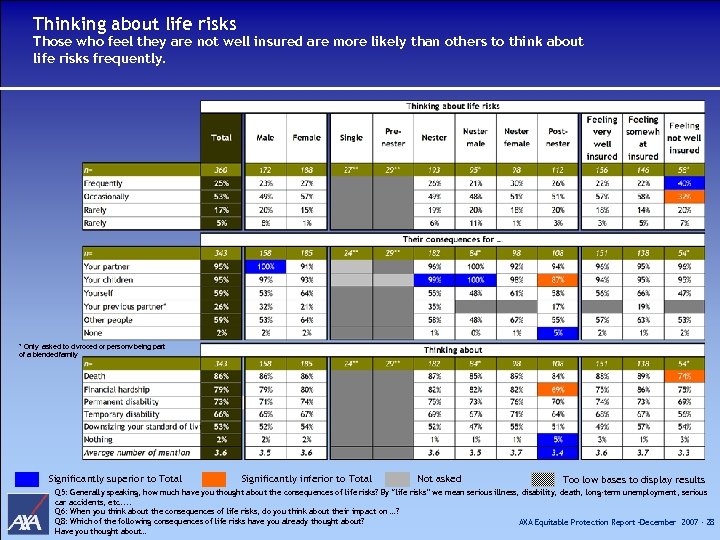

Thinking about life risks Those who feel they are not well insured are more likely than others to think about life risks frequently. * Only asked to divroced or personv being part of a blended family Significantly superior to Total Significantly inferior to Total Not asked Too low bases to display results Q 5: Generally speaking, how much have you thought about the consequences of life risks? By “life risks” we mean serious illness, disability, death, long-term unemployment, serious car accidents, etc. . Q 6: When you think about the consequences of life risks, do you think about their impact on …? Q 8: Which of the following consequences of life risks have you already thought about? AXA Equitable Protection Report –December 2007 - 28 Have you thought about…

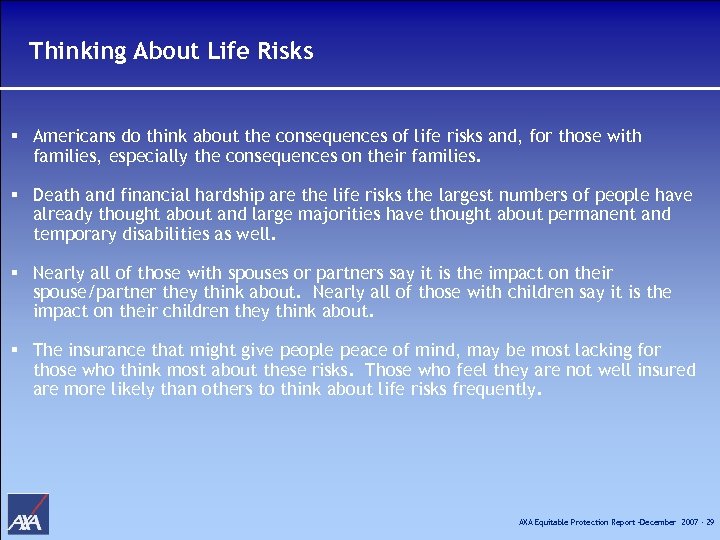

Thinking About Life Risks § Americans do think about the consequences of life risks and, for those with families, especially the consequences on their families. § Death and financial hardship are the life risks the largest numbers of people have already thought about and large majorities have thought about permanent and temporary disabilities as well. § Nearly all of those with spouses or partners say it is the impact on their spouse/partner they think about. Nearly all of those with children say it is the impact on their children they think about. § The insurance that might give people peace of mind, may be most lacking for those who think most about these risks. Those who feel they are not well insured are more likely than others to think about life risks frequently. AXA Equitable Protection Report –December 2007 - 29

Thinking about life risks Americans are more likely than those in other countries to have thought about their deaths, financial hardships and disabilities. They also think about life risks more frequently than people in other countries. * Only asked to divroced or personv being part of a blended family Significantly superior to Total Significantly inferior to Total Too low bases to display results Q 5: Generally speaking, how much have you thought about the consequences of life risks? By “life risks” we mean serious illness, disability, death, long-term unemployment, serious car accidents, etc. . Q 6: When you think about the consequences of life risks, do you think about their impact on …? Q 8: Which of the following consequences of life risks have you already thought about? AXA Equitable Protection Report –December 2007 - 30 Have you thought about…

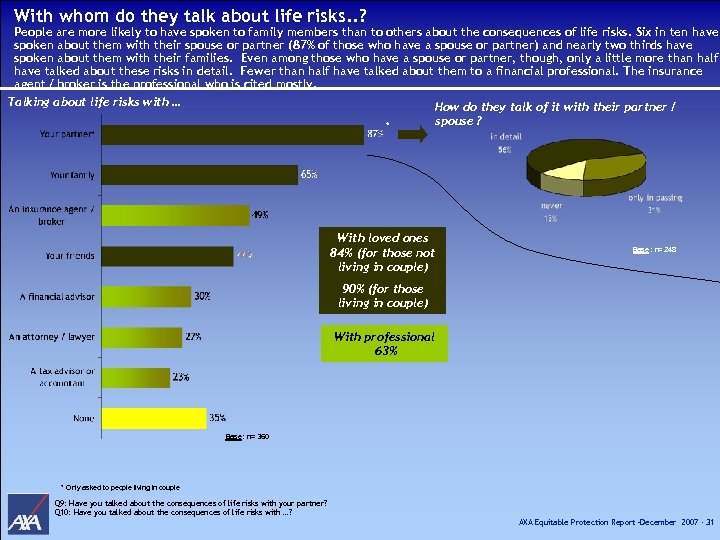

With whom do they talk about life risks. . ? People are more likely to have spoken to family members than to others about the consequences of life risks. Six in ten have spoken about them with their spouse or partner (87% of those who have a spouse or partner) and nearly two thirds have spoken about them with their families. Even among those who have a spouse or partner, though, only a little more than half have talked about these risks in detail. Fewer than half have talked about them to a financial professional. The insurance agent / broker is the professional who is cited mostly. Talking about life risks with … How do they talk of it with their partner / * spouse ? With loved ones 84% (for those not living in couple) Base : n= 248 90% (for those living in couple) With professional 63% Base : n= 360 * Only asked to people living in couple Q 9: Have you talked about the consequences of life risks with your partner? Q 10: Have you talked about the consequences of life risks with …? AXA Equitable Protection Report –December 2007 - 31

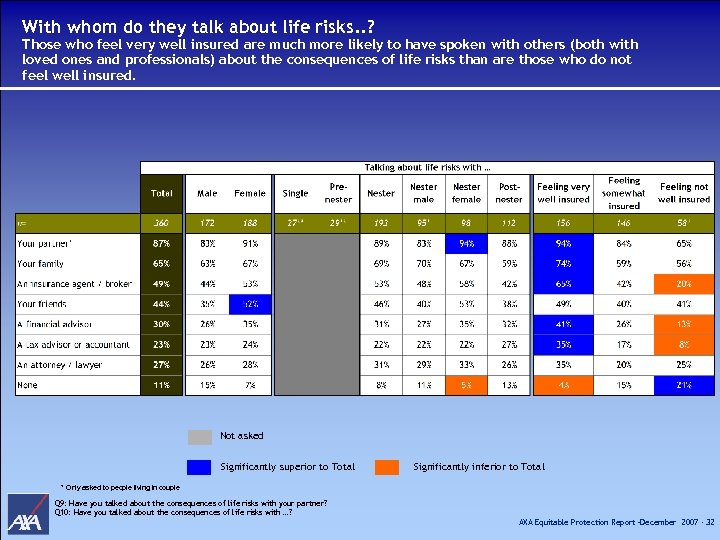

With whom do they talk about life risks. . ? Those who feel very well insured are much more likely to have spoken with others (both with loved ones and professionals) about the consequences of life risks than are those who do not feel well insured. Not asked Significantly superior to Total Significantly inferior to Total * Only asked to people living in couple Q 9: Have you talked about the consequences of life risks with your partner? Q 10: Have you talked about the consequences of life risks with …? AXA Equitable Protection Report –December 2007 - 32

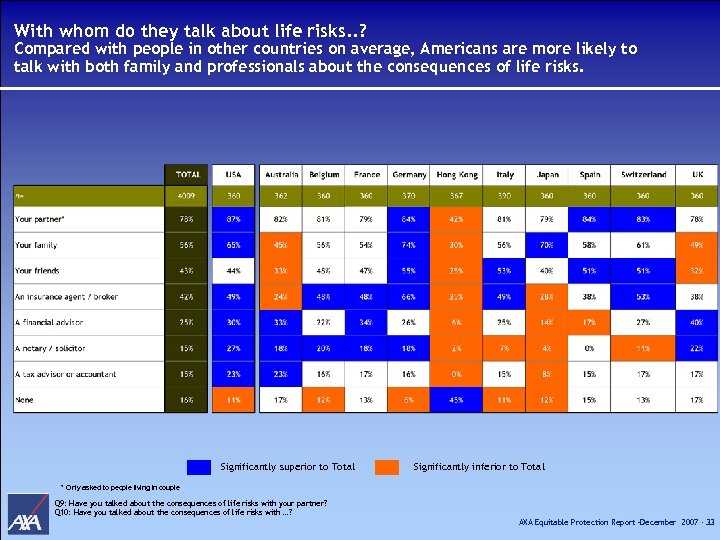

With whom do they talk about life risks. . ? Compared with people in other countries on average, Americans are more likely to talk with both family and professionals about the consequences of life risks. Significantly superior to Total Significantly inferior to Total * Only asked to people living in couple Q 9: Have you talked about the consequences of life risks with your partner? Q 10: Have you talked about the consequences of life risks with …? AXA Equitable Protection Report –December 2007 - 33

Part 3: Product ownership & habits AXA Equitable Protection Report –December 2007 - 34

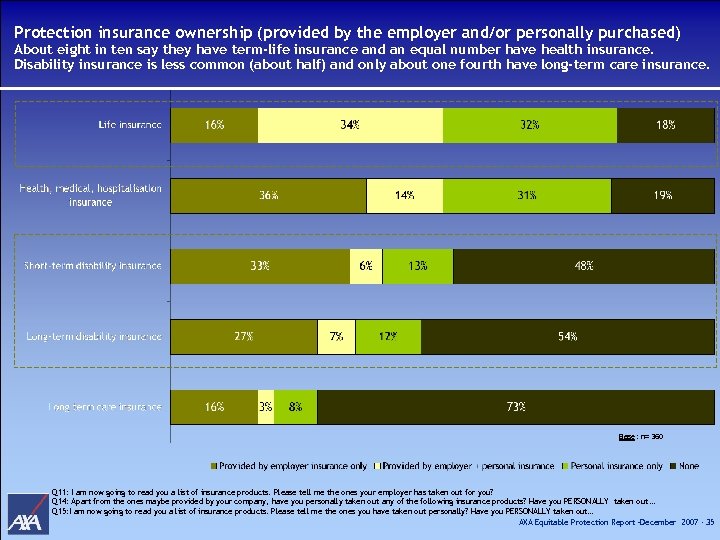

Protection insurance ownership (provided by the employer and/or personally purchased) About eight in ten say they have term-life insurance and an equal number have health insurance. Disability insurance is less common (about half) and only about one fourth have long-term care insurance. Base : n= 360 Q 11: I am now going to read you a list of insurance products. Please tell me the ones your employer has taken out for you? Q 14: Apart from the ones maybe provided by your company, have you personally taken out any of the following insurance products? Have you PERSONALLY taken out … Q 15: I am now going to read you a list of insurance products. Please tell me the ones you have taken out personally? Have you PERSONALLY taken out… AXA Equitable Protection Report –December 2007 - 35

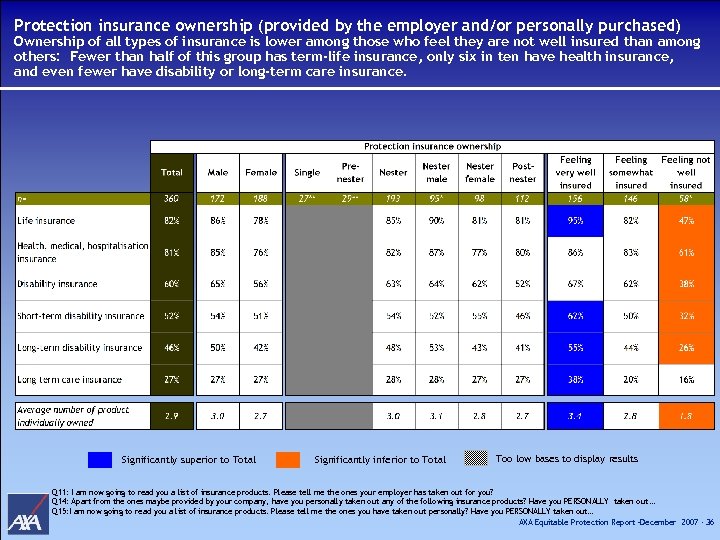

Protection insurance ownership (provided by the employer and/or personally purchased) Ownership of all types of insurance is lower among those who feel they are not well insured than among others: Fewer than half of this group has term-life insurance, only six in ten have health insurance, and even fewer have disability or long-term care insurance. Significantly superior to Total Significantly inferior to Total Too low bases to display results Q 11: I am now going to read you a list of insurance products. Please tell me the ones your employer has taken out for you? Q 14: Apart from the ones maybe provided by your company, have you personally taken out any of the following insurance products? Have you PERSONALLY taken out … Q 15: I am now going to read you a list of insurance products. Please tell me the ones you have taken out personally? Have you PERSONALLY taken out… AXA Equitable Protection Report –December 2007 - 36

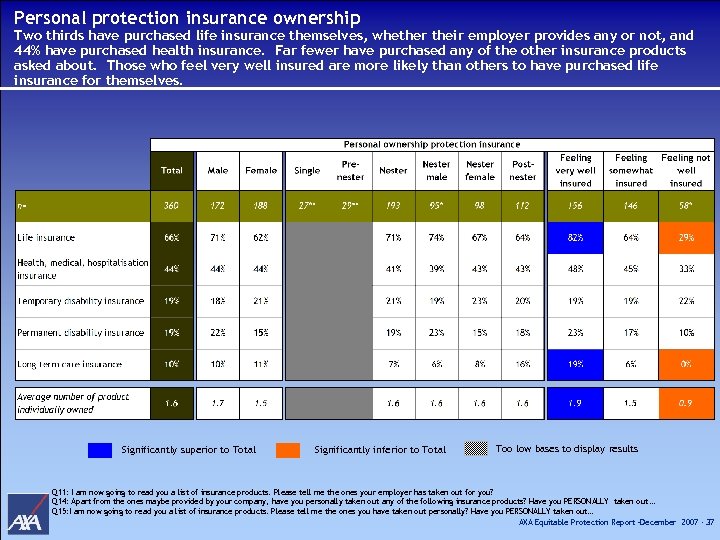

Personal protection insurance ownership Two thirds have purchased life insurance themselves, whether their employer provides any or not, and 44% have purchased health insurance. Far fewer have purchased any of the other insurance products asked about. Those who feel very well insured are more likely than others to have purchased life insurance for themselves. Significantly superior to Total Significantly inferior to Total Too low bases to display results Q 11: I am now going to read you a list of insurance products. Please tell me the ones your employer has taken out for you? Q 14: Apart from the ones maybe provided by your company, have you personally taken out any of the following insurance products? Have you PERSONALLY taken out … Q 15: I am now going to read you a list of insurance products. Please tell me the ones you have taken out personally? Have you PERSONALLY taken out… AXA Equitable Protection Report –December 2007 - 37

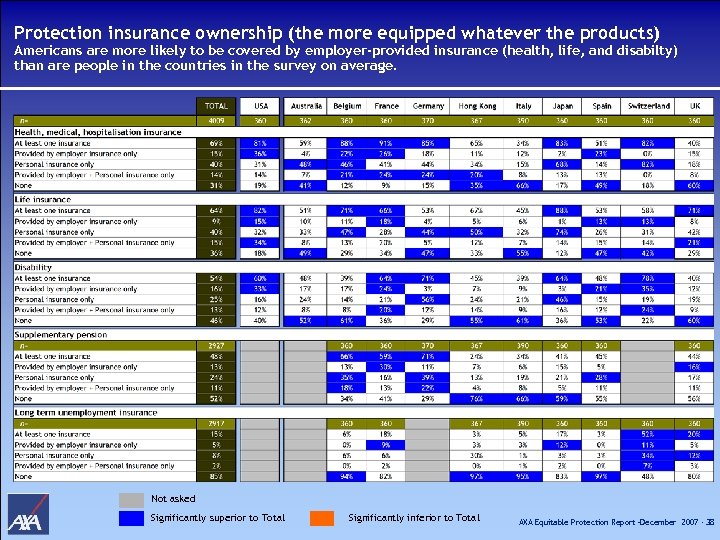

Protection insurance ownership (the more equipped whatever the products) Americans are more likely to be covered by employer-provided insurance (health, life, and disabilty) than are people in the countries in the survey on average. Not asked Significantly superior to Total Significantly inferior to Total AXA Equitable Protection Report –December 2007 - 38

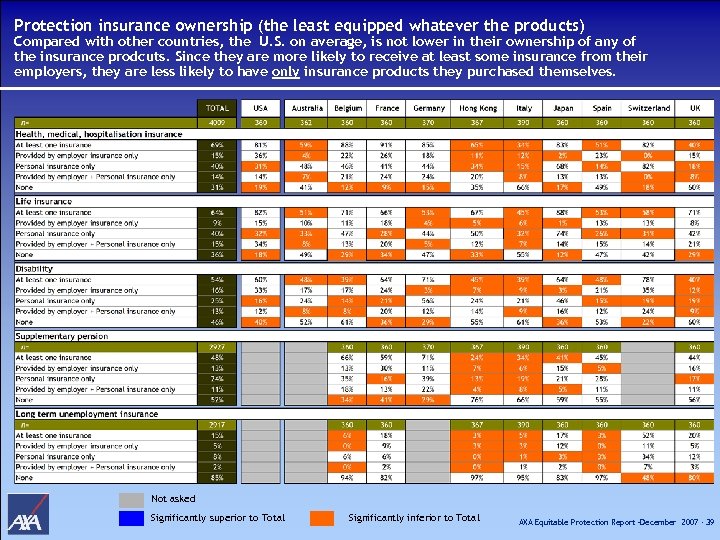

Protection insurance ownership (the least equipped whatever the products) Compared with other countries, the U. S. on average, is not lower in their ownership of any of the insurance prodcuts. Since they are more likely to receive at least some insurance from their employers, they are less likely to have only insurance products they purchased themselves. Not asked Significantly superior to Total Significantly inferior to Total AXA Equitable Protection Report –December 2007 - 39

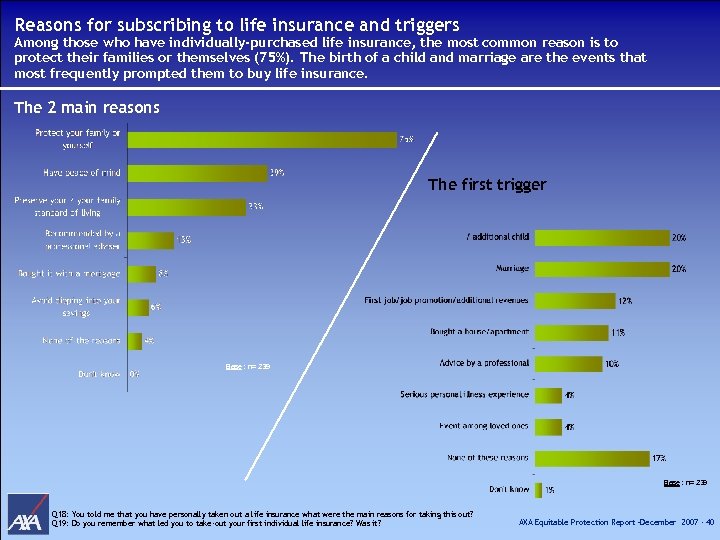

Reasons for subscribing to life insurance and triggers Among those who have individually-purchased life insurance, the most common reason is to protect their families or themselves (75%). The birth of a child and marriage are the events that most frequently prompted them to buy life insurance. The 2 main reasons The first trigger Base : n= 239 Q 18: You told me that you have personally taken out a life insurance what were the main reasons for taking this out? Q 19: Do you remember what led you to take-out your first individual life insurance? Was it? AXA Equitable Protection Report –December 2007 - 40

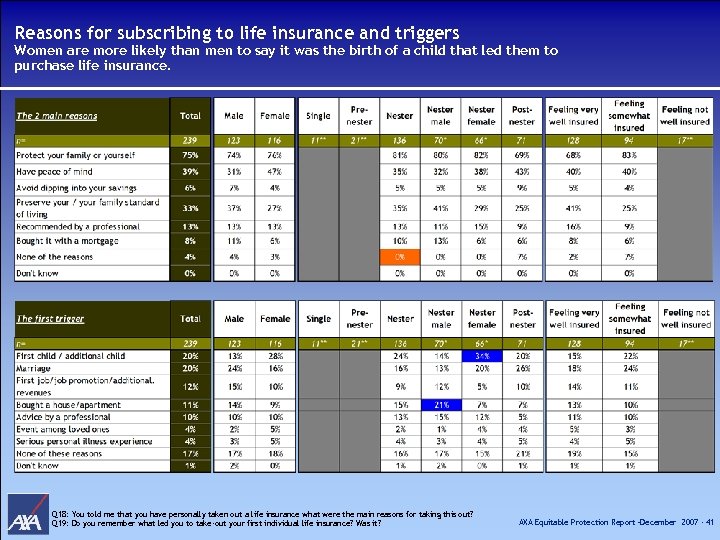

Reasons for subscribing to life insurance and triggers Women are more likely than men to say it was the birth of a child that led them to purchase life insurance. Q 18: You told me that you have personally taken out a life insurance what were the main reasons for taking this out? Q 19: Do you remember what led you to take-out your first individual life insurance? Was it? AXA Equitable Protection Report –December 2007 - 41

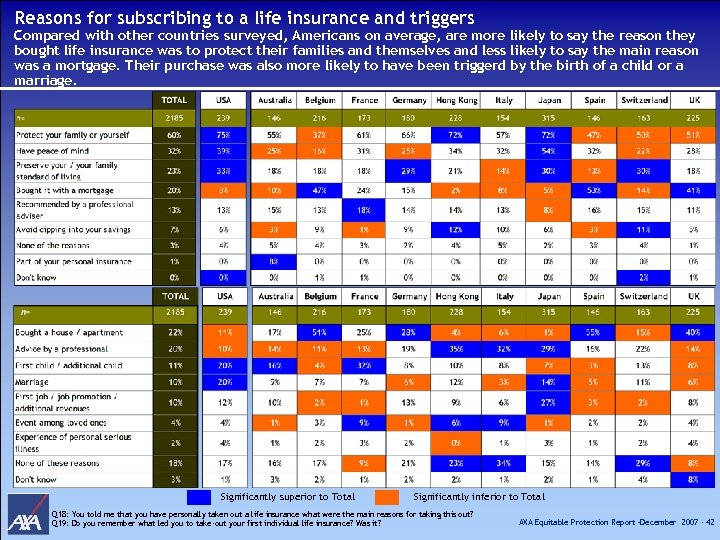

Reasons for subscribing to a life insurance and triggers Compared with other countries surveyed, Americans on average, are more likely to say the reason they bought life insurance was to protect their families and themselves and less likely to say the main reason was a mortgage. Their purchase was also more likely to have been triggerd by the birth of a child or a marriage. Significantly superior to Total Significantly inferior to Total Q 18: You told me that you have personally taken out a life insurance what were the main reasons for taking this out? Q 19: Do you remember what led you to take-out your first individual life insurance? Was it? AXA Equitable Protection Report –December 2007 - 42

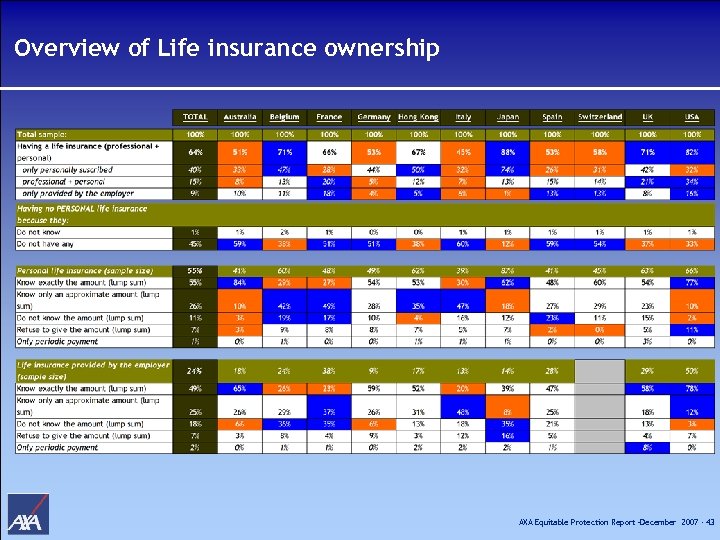

Overview of Life insurance ownership AXA Equitable Protection Report –December 2007 - 43

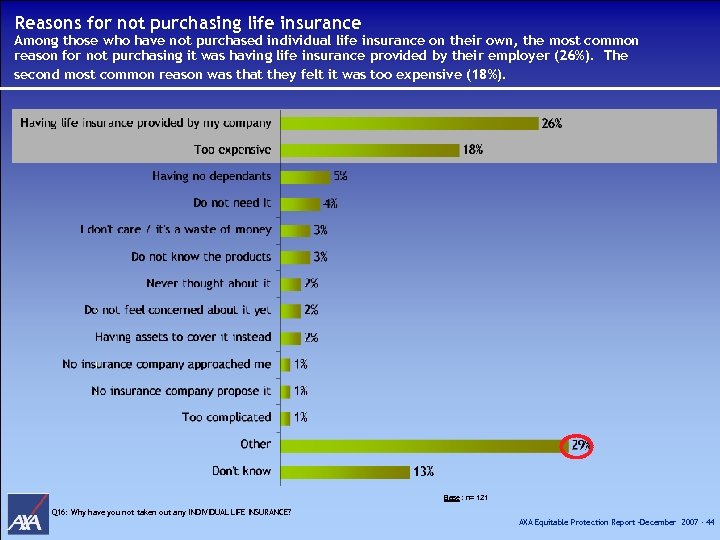

Reasons for not purchasing life insurance Among those who have not purchased individual life insurance on their own, the most common reason for not purchasing it was having life insurance provided by their employer (26%). The second most common reason was that they felt it was too expensive (18%). Base : n= 121 Q 16: Why have you not taken out any INDIVIDUAL LIFE INSURANCE? AXA Equitable Protection Report –December 2007 - 44

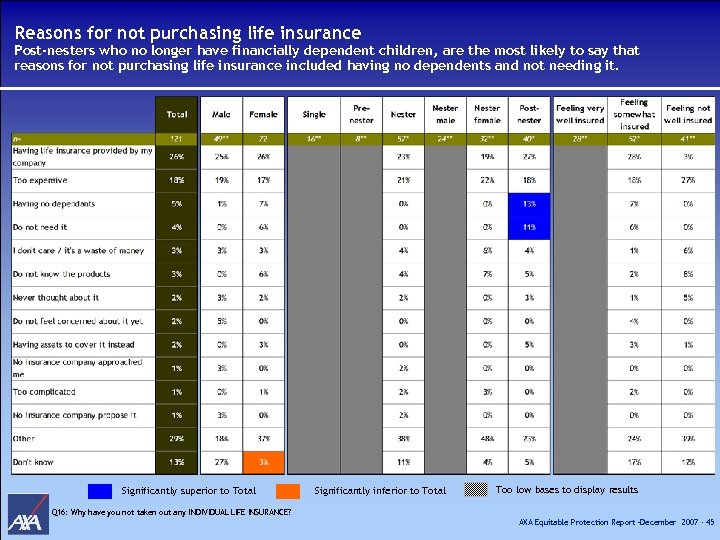

Reasons for not purchasing life insurance Post-nesters who no longer have financially dependent children, are the most likely to say that reasons for not purchasing life insurance included having no dependents and not needing it. Significantly superior to Total Significantly inferior to Total Too low bases to display results Q 16: Why have you not taken out any INDIVIDUAL LIFE INSURANCE? AXA Equitable Protection Report –December 2007 - 45

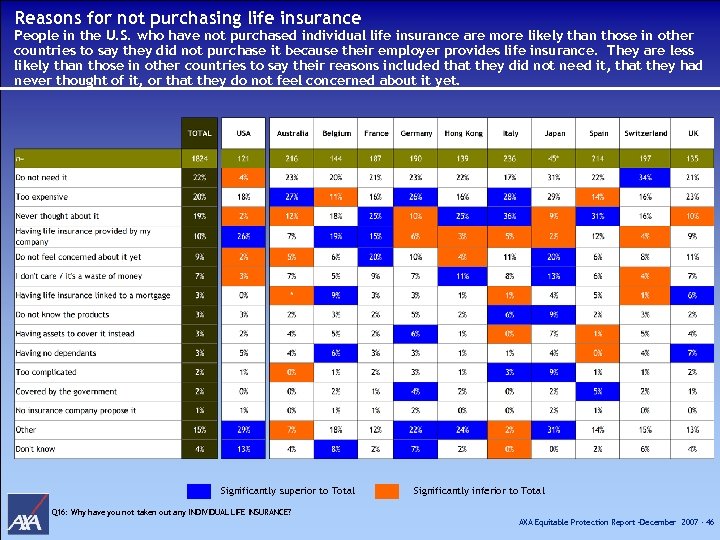

Reasons for not purchasing life insurance People in the U. S. who have not purchased individual life insurance are more likely than those in other countries to say they did not purchase it because their employer provides life insurance. They are less likely than those in other countries to say their reasons included that they did not need it, that they had never thought of it, or that they do not feel concerned about it yet. Significantly superior to Total Significantly inferior to Total Q 16: Why have you not taken out any INDIVIDUAL LIFE INSURANCE? AXA Equitable Protection Report –December 2007 - 46

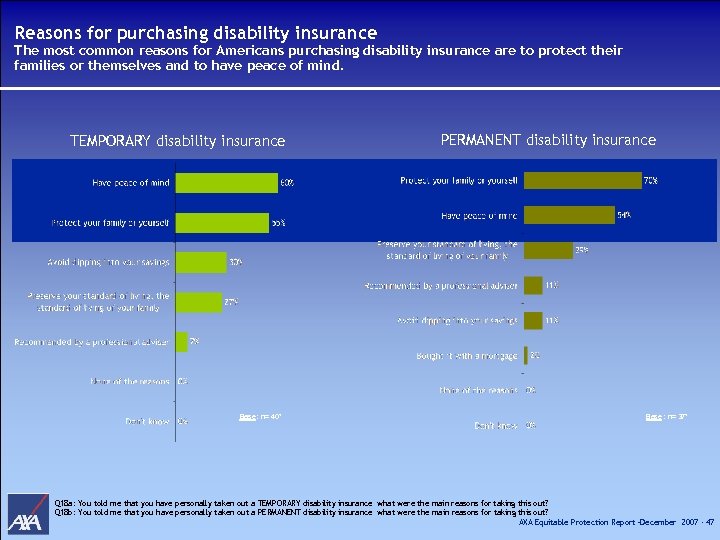

Reasons for purchasing disability insurance The most common reasons for Americans purchasing disability insurance are to protect their families or themselves and to have peace of mind. TEMPORARY disability insurance Base : n= 40* PERMANENT disability insurance Base : n= 37* Q 18 a: You told me that you have personally taken out a TEMPORARY disability insurance what were the main reasons for taking this out? Q 18 b: You told me that you have personally taken out a PERMANENT disability insurance what were the main reasons for taking this out? AXA Equitable Protection Report –December 2007 - 47

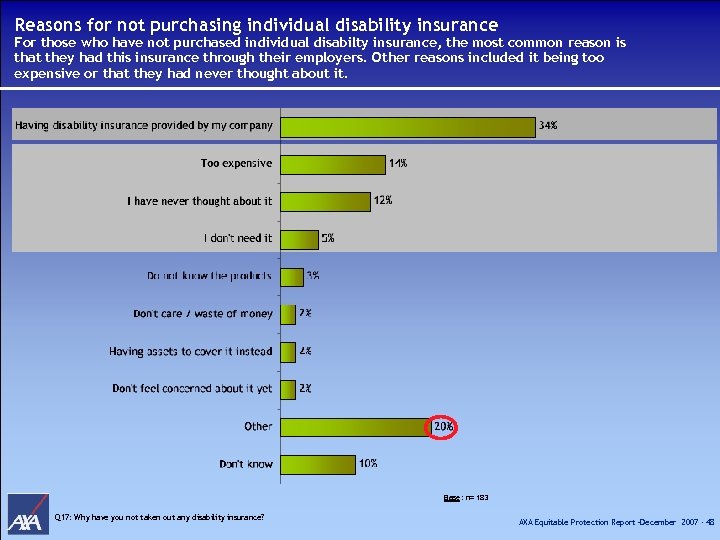

Reasons for not purchasing individual disability insurance For those who have not purchased individual disabilty insurance, the most common reason is that they had this insurance through their employers. Other reasons included it being too expensive or that they had never thought about it. Base : n= 183 Q 17: Why have you not taken out any disability insurance? AXA Equitable Protection Report –December 2007 - 48

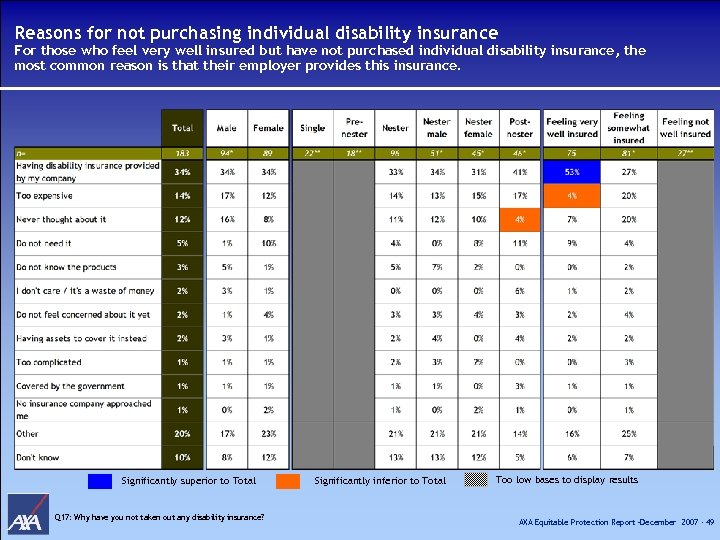

Reasons for not purchasing individual disability insurance For those who feel very well insured but have not purchased individual disability insurance, the most common reason is that their employer provides this insurance. Significantly superior to Total Q 17: Why have you not taken out any disability insurance? Significantly inferior to Total Too low bases to display results AXA Equitable Protection Report –December 2007 - 49

Part 4: Theoretical Insurance Gap In order to allow for international comparison, a common Gap formula was designed to be applicable for all respondents AXA Equitable Protection Report –December 2007 - 50

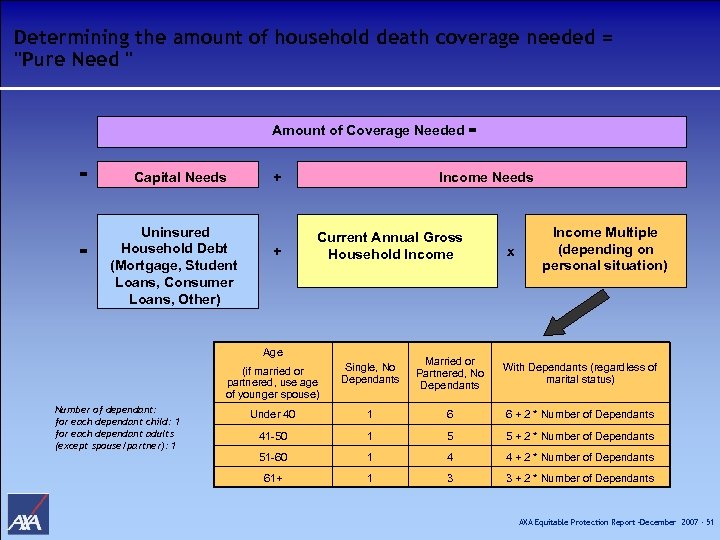

Determining the amount of household death coverage needed = "Pure Need " Amount of Coverage Needed = = = Capital Needs Uninsured Household Debt (Mortgage, Student Loans, Consumer Loans, Other) + + Income Needs Current Annual Gross Household Income Age x Income Multiple (depending on personal situation) (if married or partnered, use age of younger spouse) Number of dependant: for each dependant child: 1 for each dependant adults (except spouse/partner): 1 Single, No Dependants dependants Married or Partnered, No Dependants With Dependants (regardless of marital status) Under 40 1 6 6 + 2 * Number of dependants Dependants 41 -50 1 5 5 + 2 * Number of dependants Dependants 51 -60 1 4 4 + 2 * Number of dependants Dependants 61+ 1 3 3 + 2 * Number of dependants Dependants AXA Equitable Protection Report –December 2007 - 51

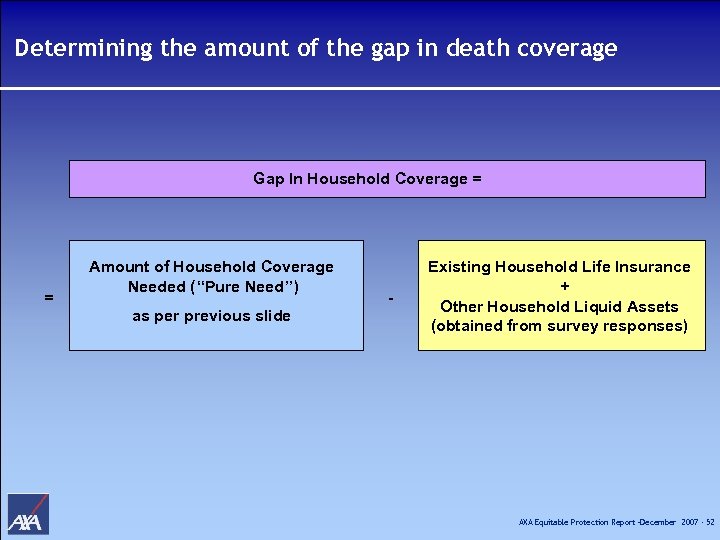

Determining the amount of the gap in death coverage Gap In Household Coverage = = Amount of Household Coverage Needed (“Pure Need”) as per previous slide - Existing Household Life Insurance + Other Household Liquid Assets (obtained from survey responses) AXA Equitable Protection Report –December 2007 - 52

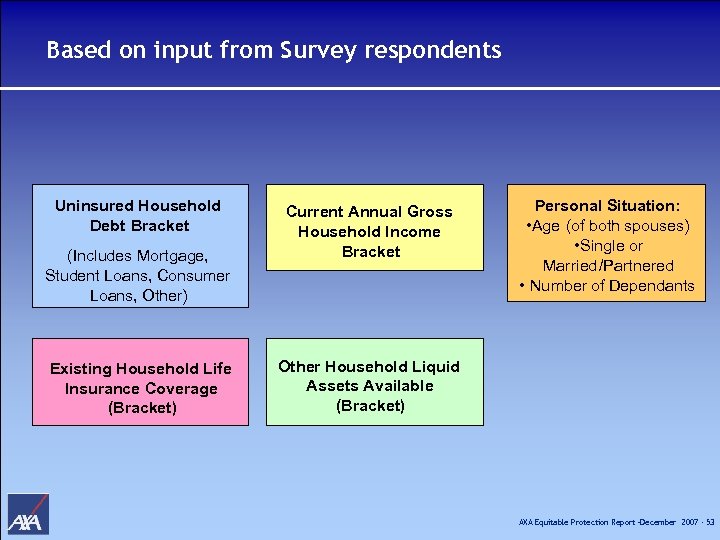

Based on input from Survey respondents Uninsured Household Debt Bracket (Includes Mortgage, Student Loans, Consumer Loans, Other) Existing Household Life Insurance Coverage (Bracket) Current Annual Gross Household Income Bracket Personal Situation: • Age (of both spouses) • Single or Married /Partnered • Number of Dependants Other Household Liquid Assets Available (Bracket) AXA Equitable Protection Report –December 2007 - 53

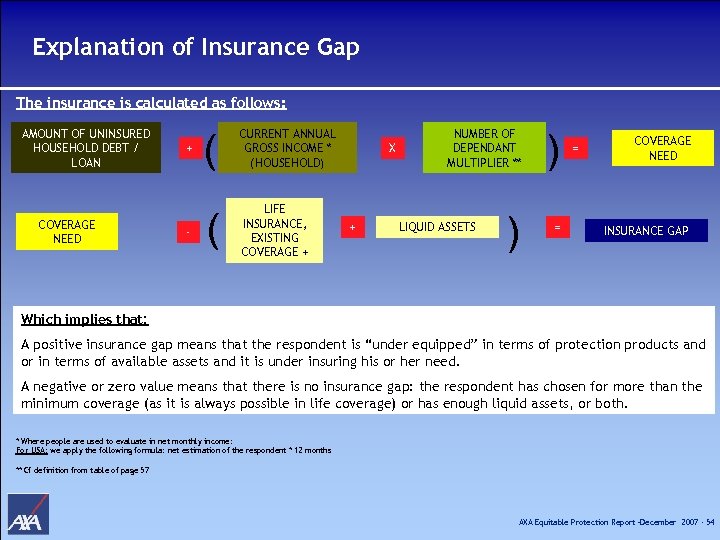

Explanation of Insurance Gap The insurance is calculated as follows: AMOUNT OF UNINSURED HOUSEHOLD DEBT / LOAN COVERAGE NEED + - ( CURRENT ANNUAL GROSS INCOME * (HOUSEHOLD) ( LIFE INSURANCE, EXISTING COVERAGE + X + NUMBER OF DEPENDANT MULTIPLIER ** ) ) = LIQUID ASSETS = COVERAGE NEED INSURANCE GAP Which implies that: A positive insurance gap means that the respondent is “under equipped” in terms of protection products and or in terms of available assets and it is under insuring his or her need. A negative or zero value means that there is no insurance gap: the respondent has chosen for more than the minimum coverage (as it is always possible in life coverage) or has enough liquid assets, or both. * Where people are used to evaluate in net monthly income: For USA: we apply the following formula: net estimation of the respondent * 12 months ** Cf definition from table of page 57 AXA Equitable Protection Report –December 2007 - 54

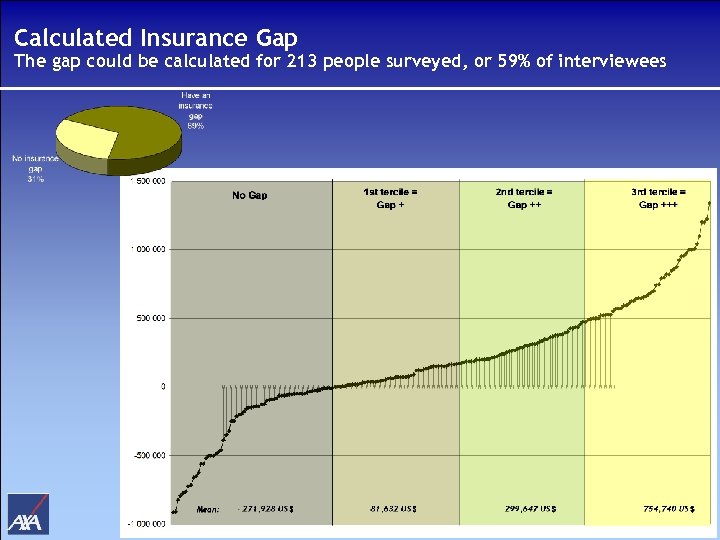

Calculated Insurance Gap The gap could be calculated for 213 people surveyed, or 59% of interviewees AXA Equitable Protection Report –December 2007 - 55

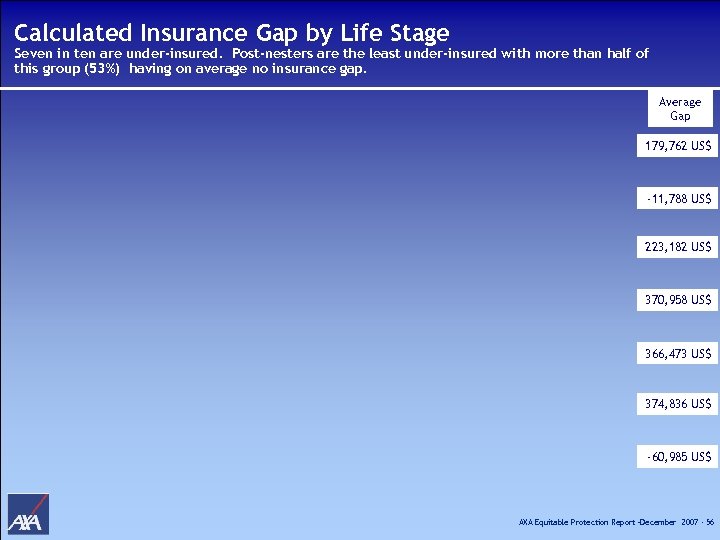

Calculated Insurance Gap by Life Stage Seven in ten are under-insured. Post-nesters are the least under-insured with more than half of this group (53%) having on average no insurance gap. Average Gap 179, 762 US$ -11, 788 US$ 223, 182 US$ 370, 958 US$ 366, 473 US$ 374, 836 US$ -60, 985 US$ AXA Equitable Protection Report –December 2007 - 56

Calculated Insurance Gap by Life Stage AXA Equitable Protection Report –December 2007 - 57

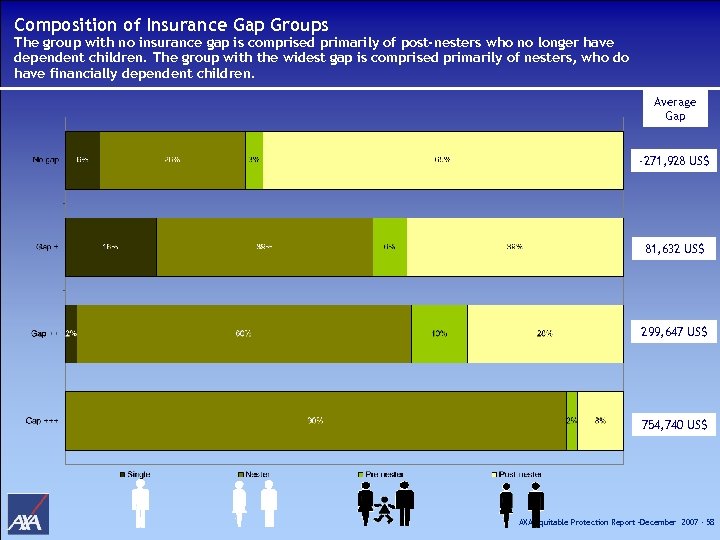

Composition of Insurance Gap Groups The group with no insurance gap is comprised primarily of post-nesters who no longer have dependent children. The group with the widest gap is comprised primarily of nesters, who do have financially dependent children. Average Gap -271, 928 US$ 81, 632 US$ 299, 647 US$ 754, 740 US$ AXA Equitable Protection Report –December 2007 - 58

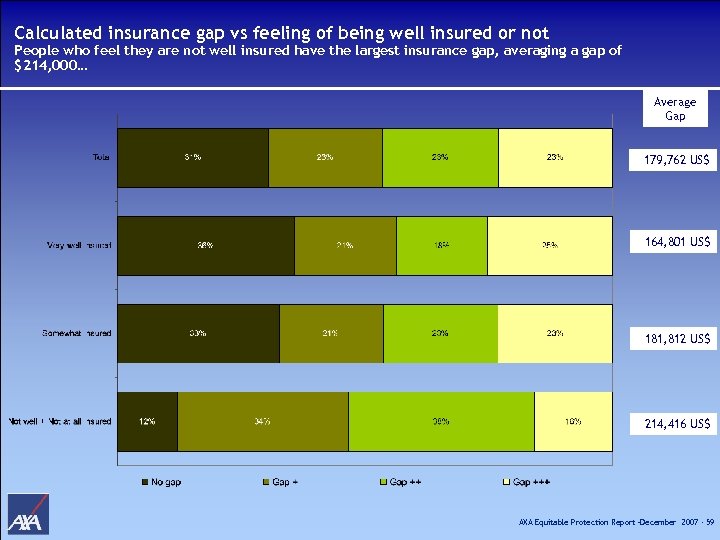

Calculated insurance gap vs feeling of being well insured or not People who feel they are not well insured have the largest insurance gap, averaging a gap of $214, 000… Average Gap 179, 762 US$ 164, 801 US$ 181, 812 US$ 214, 416 US$ AXA Equitable Protection Report –December 2007 - 59

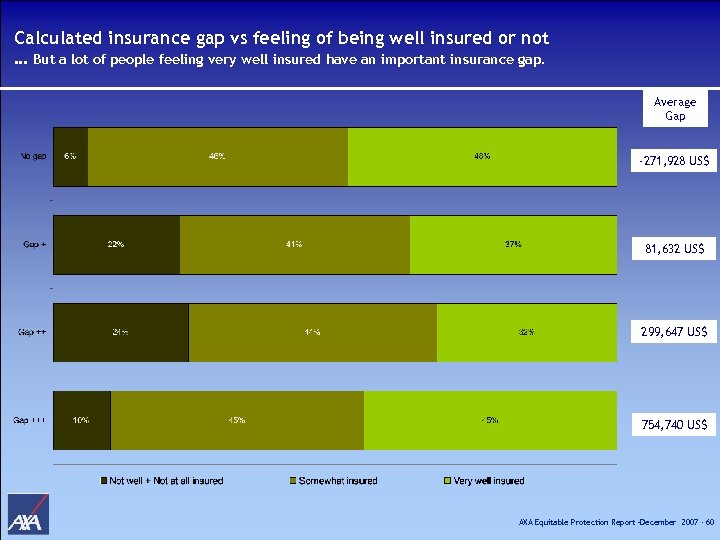

Calculated insurance gap vs feeling of being well insured or not … But a lot of people feeling very well insured have an important insurance gap. Average Gap -271, 928 US$ 81, 632 US$ 299, 647 US$ 754, 740 US$ AXA Equitable Protection Report –December 2007 - 60

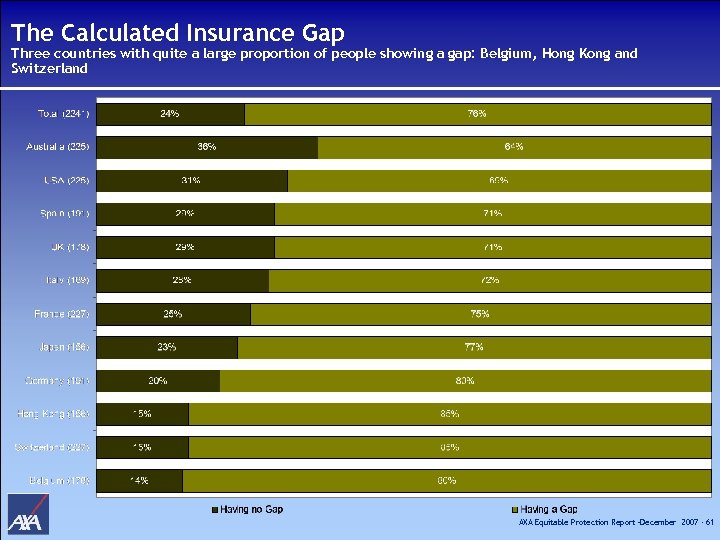

The Calculated Insurance Gap Three countries with quite a large proportion of people showing a gap: Belgium, Hong Kong and Switzerland AXA Equitable Protection Report –December 2007 - 61

Overall analysis for the Gap § On average, Americans 25 to 65 years of age have an insurance gap of $179, 762, though the size of that gap varies across life stages. § Nesters, who have dependent children, have on average the highest gap ($370, 958) while post-nesters have none on average. AXA Equitable Protection Report –December 2007 - 62

Part 5: Conclusions AXA Equitable Protection Report –December 2007 - 63

Key Findings in America A. There is a serious lack of knowledge regarding financial coverage needs in case of death. B. There is still an high level of underinsurance on individual’s most precious assets: life. Close to 70 percent of Americans have an insurance gap (which compares favorably to the survey average of 76 percent), and it averages an amount of $180, 000 or 127. 000 € which is somewhat lower than the survey average of 150, 000 € C. The level of underinsurance is particularly high among the most needing segment, i. e. the nesters with an average gap of $371, 000. D. A dissonance was observed between feeling and being actually very well covered, as still 64 percent of those claiming to feel very well insured do have an insurance gap. AXA Equitable Protection Report –December 2007 - 64

Appendices § Statistical differences rules § Details about Gap profiles § Details about Gap calculation elements AXA Equitable Protection Report –December 2007 - 65

Analysis of information § Brackets evaluation: all amounts or percentages will be presented in a range of brackets; in order to determine the values of the brackets we apply the following rules: § for the smallest bracket we took 0. 75 of the bracket value (e. g. “Less than 25, 000” bracket was evaluated at 18, 750) § for the highest bracket we took 1. 5 of the bracket value (e. g. “More than 1, 000” was evaluated at 1, 500, 000) § for all other brackets we took the average (e. g. “From 25, 000 to 50, 000” was evaluated at 37, 500) § Minimum bases: § base between 30 and 59 was analyzed with caution. It is presented as follows (n= 35*). § base under 29 was not analyzed because it was too low. It is presented as follows (n= 25**). § Significances are calculated with a 10 percent risk level. AXA Equitable Protection Report –December 2007 - 66

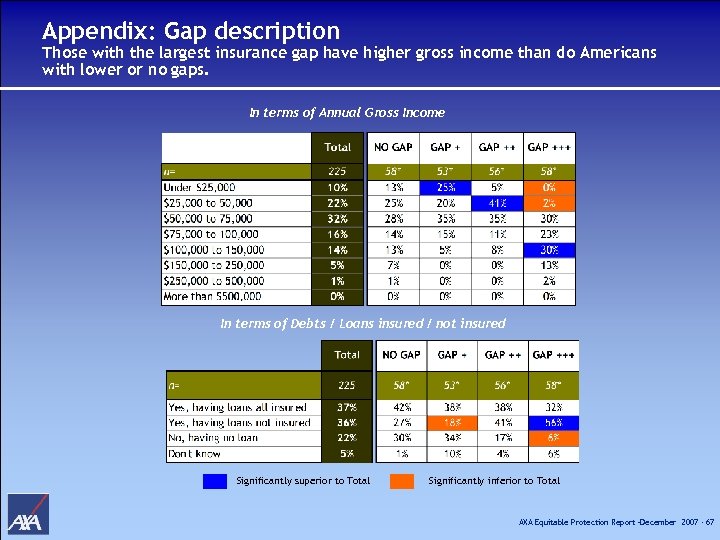

Appendix: Gap description Those with the largest insurance gap have higher gross income than do Americans with lower or no gaps. In terms of Annual Gross Income In terms of Debts / Loans insured / not insured Significantly superior to Total Significantly inferior to Total AXA Equitable Protection Report –December 2007 - 67

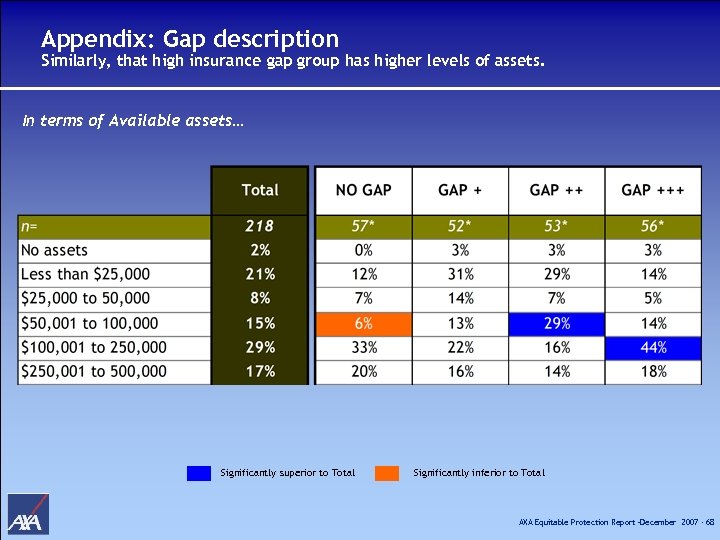

Appendix: Gap description Similarly, that high insurance gap group has higher levels of assets. In terms of Available assets… Significantly superior to Total Significantly inferior to Total AXA Equitable Protection Report –December 2007 - 68

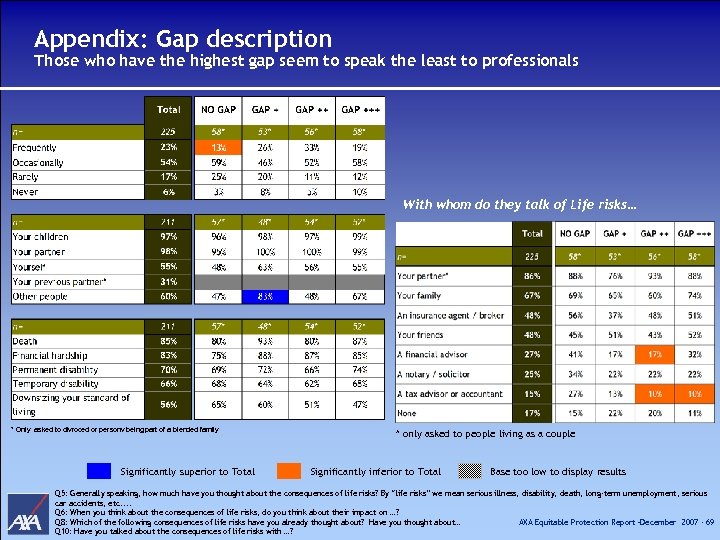

Appendix: Gap description Those who have the highest gap seem to speak the least to professionals With whom do they talk of Life risks… * Only asked to divroced or personv being part of a blended family Significantly superior to Total * only asked to people living as a couple Significantly inferior to Total Base too low to display results Q 5: Generally speaking, how much have you thought about the consequences of life risks? By “life risks” we mean serious illness, disability, death, long-term unemployment, serious car accidents, etc. . Q 6: When you think about the consequences of life risks, do you think about their impact on …? Q 8: Which of the following consequences of life risks have you already thought about? Have you thought about… AXA Equitable Protection Report –December 2007 - 69 Q 10: Have you talked about the consequences of life risks with …?

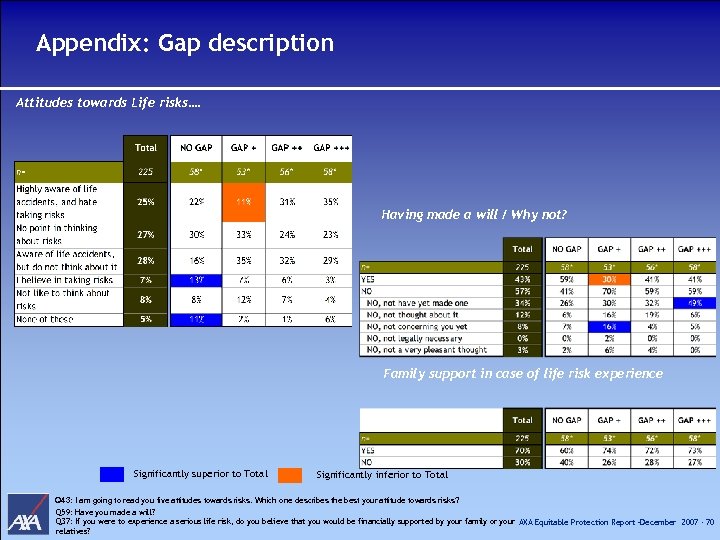

Appendix: Gap description Attitudes towards Life risks…. Having made a will / Why not? Family support in case of life risk experience Significantly superior to Total Significantly inferior to Total Q 43: I am going to read you five attitudes towards risks. Which one describes the best your attitude towards risks? Q 59: Have you made a will? Q 37: If you were to experience a serious life risk, do you believe that you would be financially supported by your family or your AXA Equitable Protection Report –December 2007 - 70 relatives?

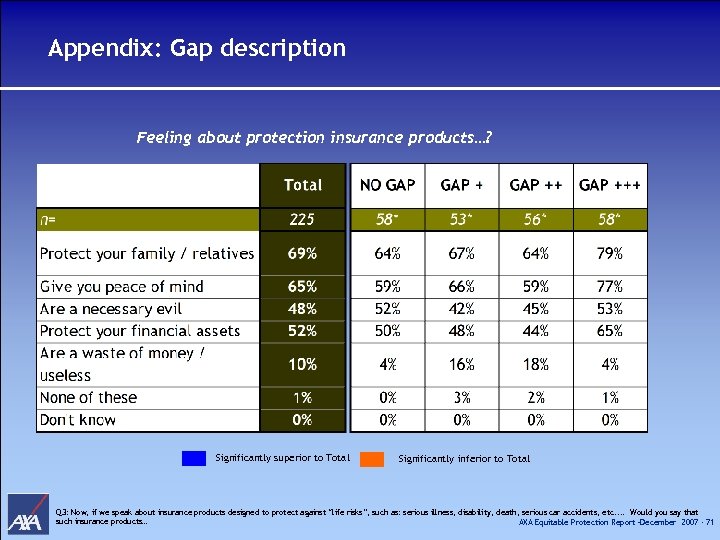

Appendix: Gap description Feeling about protection insurance products…? Significantly superior to Total Significantly inferior to Total Q 3: Now, if we speak about insurance products designed to protect against “life risks”, such as: serious illness, disability, death, serious car accidents, etc. . Would you say that such insurance products… AXA Equitable Protection Report –December 2007 - 71

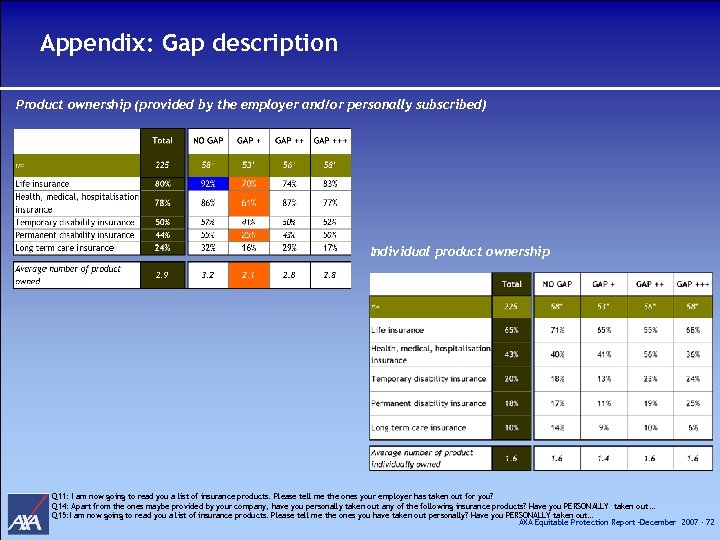

Appendix: Gap description Product ownership (provided by the employer and/or personally subscribed) Individual product ownership Q 11: I am now going to read you a list of insurance products. Please tell me the ones your employer has taken out for you? Q 14: Apart from the ones maybe provided by your company, have you personally taken out any of the following insurance products? Have you PERSONALLY taken out … Q 15: I am now going to read you a list of insurance products. Please tell me the ones you have taken out personally? Have you PERSONALLY taken out… AXA Equitable Protection Report –December 2007 - 72

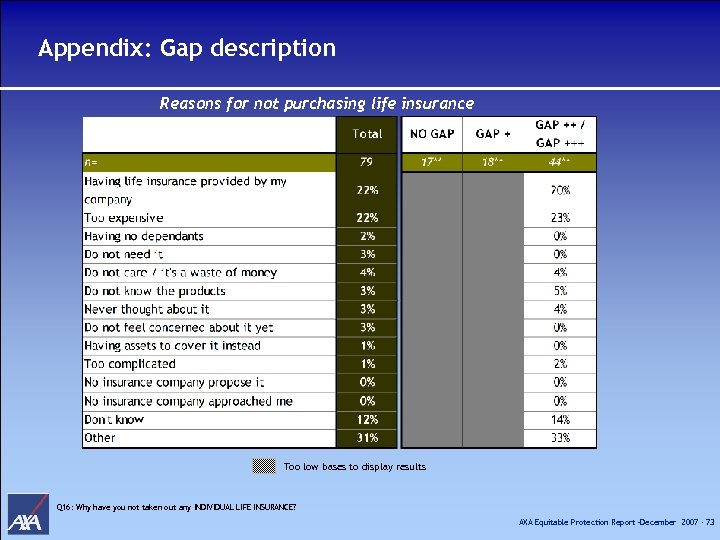

Appendix: Gap description Reasons for not purchasing life insurance Too low bases to display results Q 16: Why have you not taken out any INDIVIDUAL LIFE INSURANCE? AXA Equitable Protection Report –December 2007 - 73

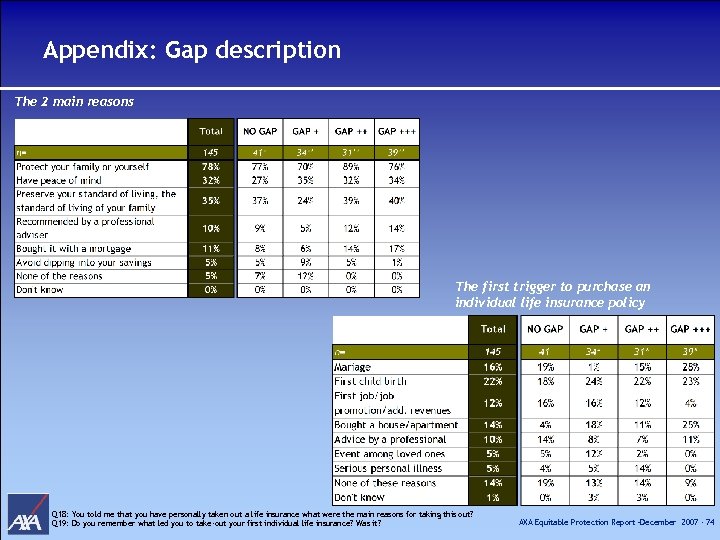

Appendix: Gap description The 2 main reasons The first trigger to purchase an individual life insurance policy Q 18: You told me that you have personally taken out a life insurance what were the main reasons for taking this out? Q 19: Do you remember what led you to take-out your first individual life insurance? Was it? AXA Equitable Protection Report –December 2007 - 74

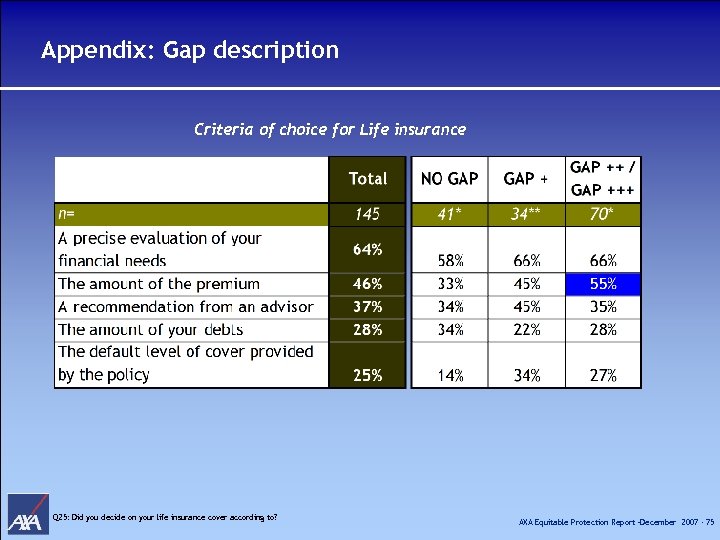

Appendix: Gap description Criteria of choice for Life insurance Q 25: Did you decide on your life insurance cover according to? AXA Equitable Protection Report –December 2007 - 75

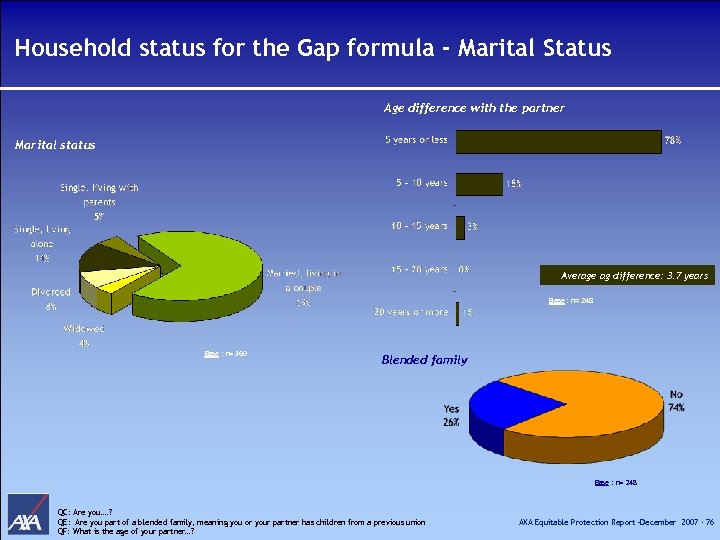

Household status for the Gap formula - Marital Status Age difference with the partner Marital status Average ag difference: 3. 7 years Base : n= 248 Base : n= 360 Blended family Base : n= 248 QC: Are you…. ? QE: Are you part of a blended family, meaning you or your partner has children from a previous union QF: What is the age of your partner…? AXA Equitable Protection Report –December 2007 - 76

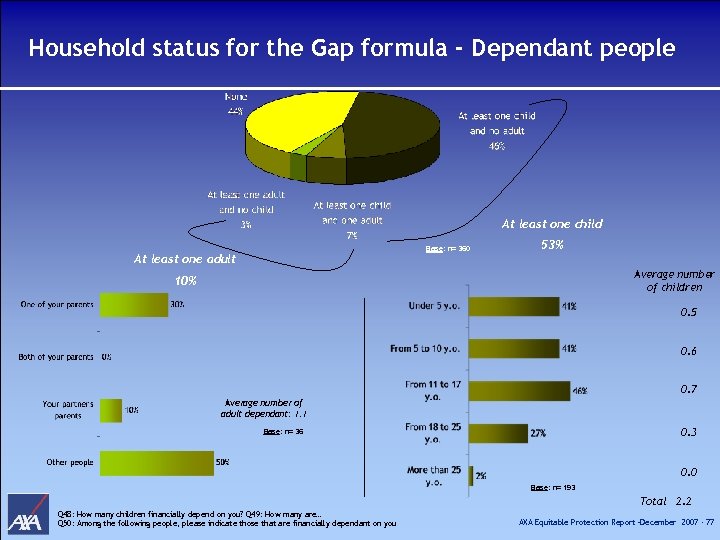

Household status for the Gap formula - Dependant people At least one child Base : n= 360 At least one adult 53% Average number of children 10% 0. 5 0. 6 0. 7 Average number of adult dependant: 1. 1 0. 3 Base : n= 36 0. 0 Base : n= 193 Total 2. 2 Q 48: How many children financially depend on you? Q 49: How many are… Q 50: Among the following people, please indicate those that are financially dependant on you AXA Equitable Protection Report –December 2007 - 77

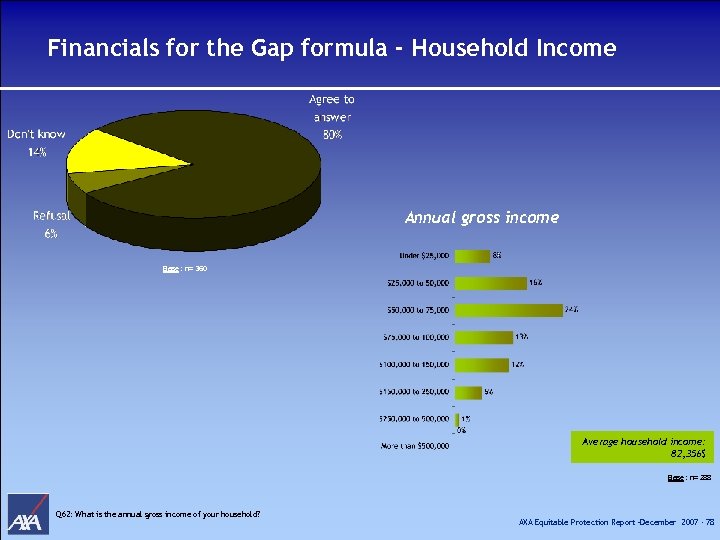

Financials for the Gap formula - Household Income Annual gross income Base : n= 360 Average household income: 82, 356$ Base : n= 288 Q 62: What is the annual gross income of your household? AXA Equitable Protection Report –December 2007 - 78

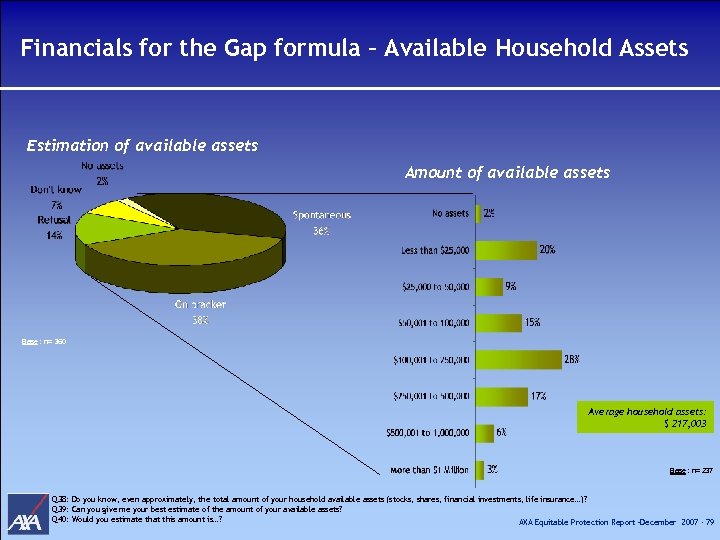

Financials for the Gap formula – Available Household Assets Estimation of available assets Amount of available assets Base : n= 360 Average household assets: $ 217, 003 Base : n= 237 Q 38: Do you know, even approximately, the total amount of your household available assets (stocks, shares, financial investments, life insurance…)? Q 39: Can you give me your best estimate of the amount of your available assets? Q 40: Would you estimate that this amount is…? AXA Equitable Protection Report –December 2007 - 79

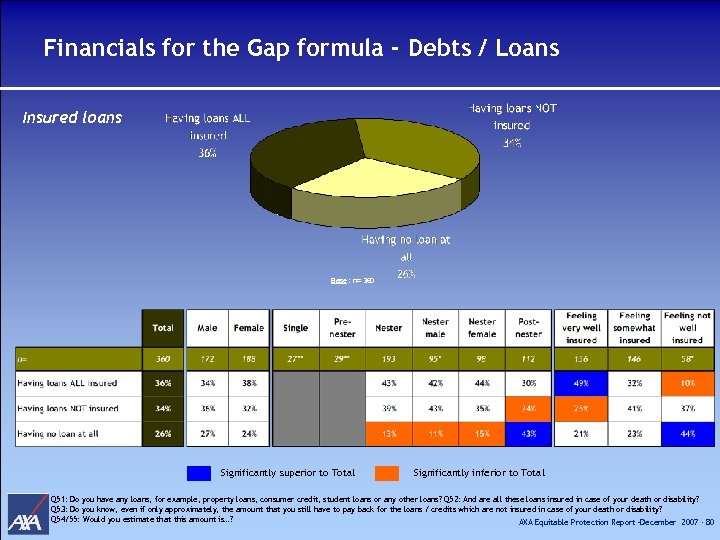

Financials for the Gap formula - Debts / Loans Insured loans Base : n= 360 Significantly superior to Total Significantly inferior to Total Q 51: Do you have any loans, for example, property loans, consumer credit, student loans or any other loans? Q 52: And are all these loans insured in case of your death or disability? Q 53: Do you know, even if only approximately, the amount that you still have to pay back for the loans / credits which are not insured in case of your death or disability? Q 54/55: Would you estimate that this amount is…? AXA Equitable Protection Report –December 2007 - 80

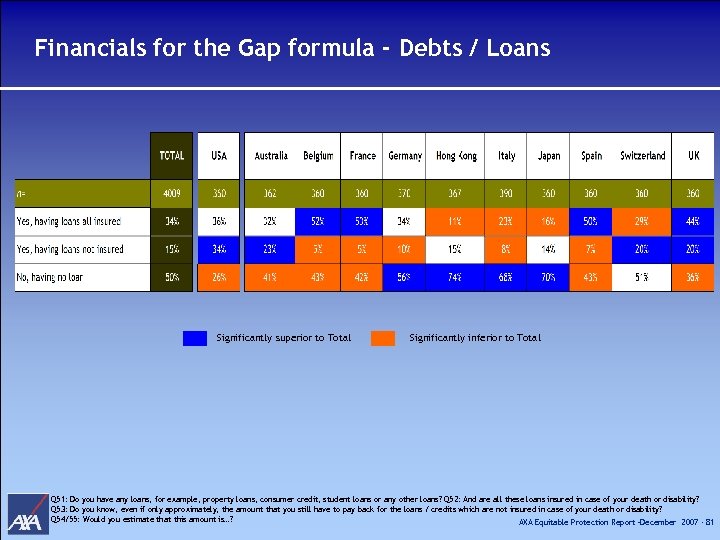

Financials for the Gap formula - Debts / Loans Significantly superior to Total Significantly inferior to Total Q 51: Do you have any loans, for example, property loans, consumer credit, student loans or any other loans? Q 52: And are all these loans insured in case of your death or disability? Q 53: Do you know, even if only approximately, the amount that you still have to pay back for the loans / credits which are not insured in case of your death or disability? Q 54/55: Would you estimate that this amount is…? AXA Equitable Protection Report –December 2007 - 81

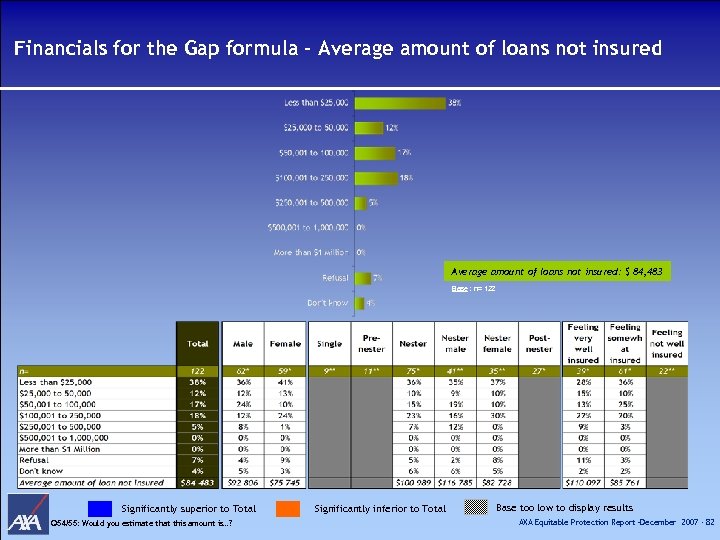

Financials for the Gap formula - Average amount of loans not insured: $ 84, 483 Base : n= 122 Significantly superior to Total Q 54/55: Would you estimate that this amount is…? Significantly inferior to Total Base too low to display results AXA Equitable Protection Report –December 2007 - 82

5bbbe9f22fd4bc2d45e03f646438d598.ppt