4234a87f3c441c624924a91d51157261.ppt

- Количество слайдов: 20

Aviva flood model Embedding GIS in day to day decision making Simon Black Head of Data & Statistics, Aviva Plc

How did it all start? • Autumn 2000 • £ 200 m Storm and flood claims • Similar events expected to be more frequent and more costly • Wanted something to help predict which properties were most at risk • Nothing available

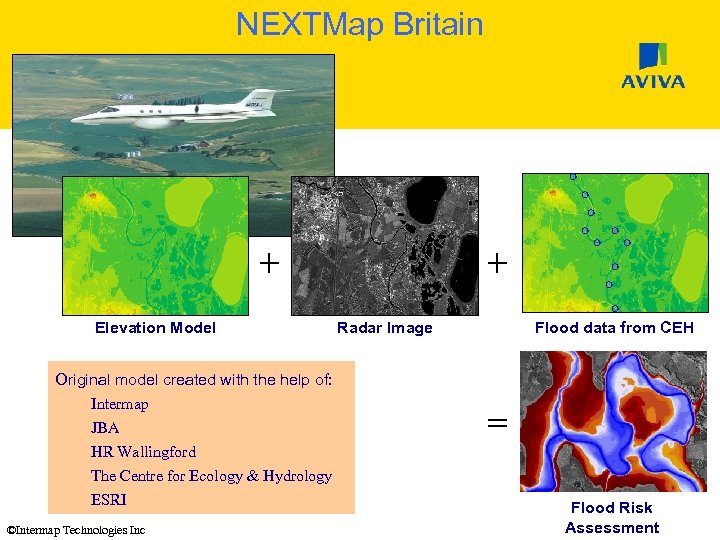

NEXTMap Britain + Elevation Model Original model created with the help of: Intermap JBA HR Wallingford The Centre for Ecology & Hydrology ESRI ©Intermap Technologies Inc + Radar Image Flood data from CEH = Flood Risk Assessment

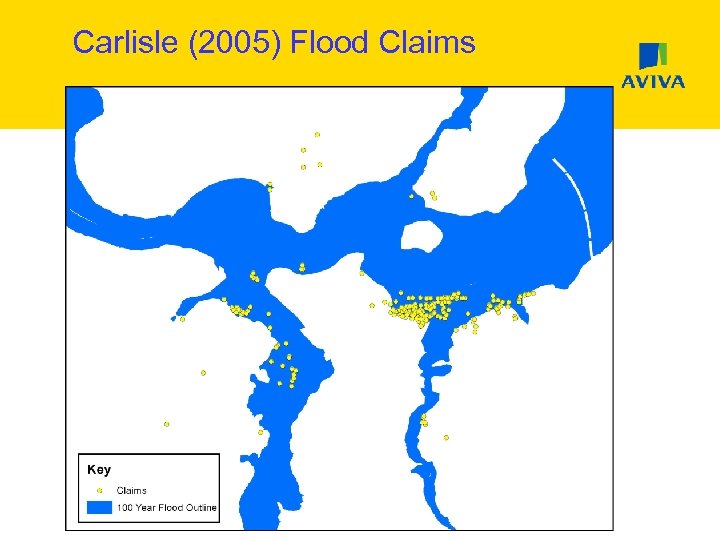

Stakeholder Management Introducing GIS was a major leap forward for the insurance industry but came at a cost Having invested the money it was essential to share successes with internal and external stakeholders Carlisle (2005) and the widespread floods of 2007 demonstrated model accuracy and, more importantly, the financial benefit of embedding GIS saved at least £ 25 m from just one event

Carlisle (2005) Flood Claims

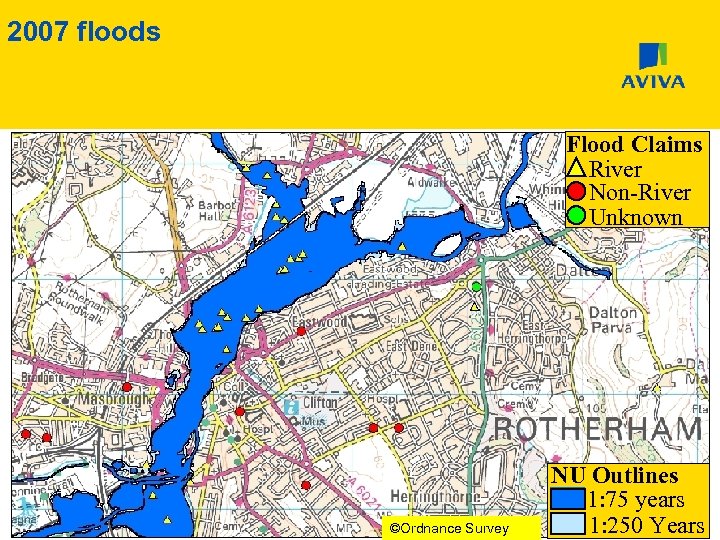

2007 floods Flood Claims River Non-River Unknown ©Ordnance Survey NU Outlines 1: 75 years 1: 250 Years

Lessons / Enhancements River model was predictive – it worked! BUT over 50% of claims in 2007 were from surface water rather than from river flooding – a major wake up call to the insurance / hydrological industries Aviva signs long-term deal with JBA New river Surface water Coastal flood models (all with extensive use of Lidar) Significant multivariate analysis to ensure hydrological output is integrated into underwriting and pricing processes

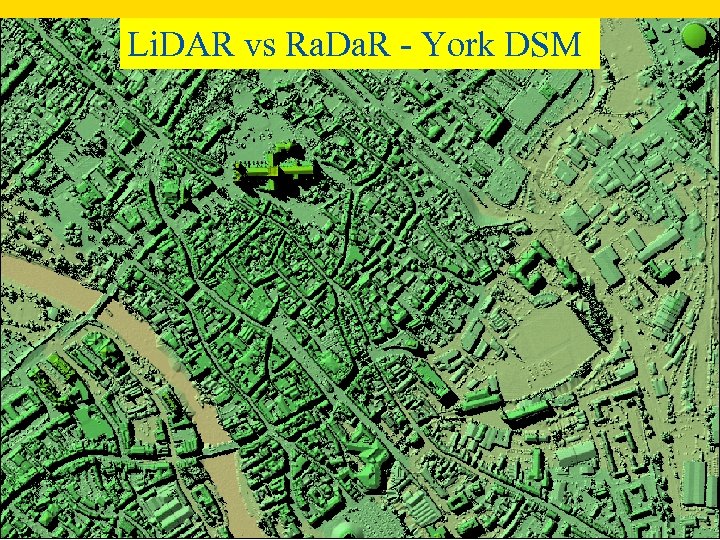

Li. DAR vs Ra. Da. R - York DSM

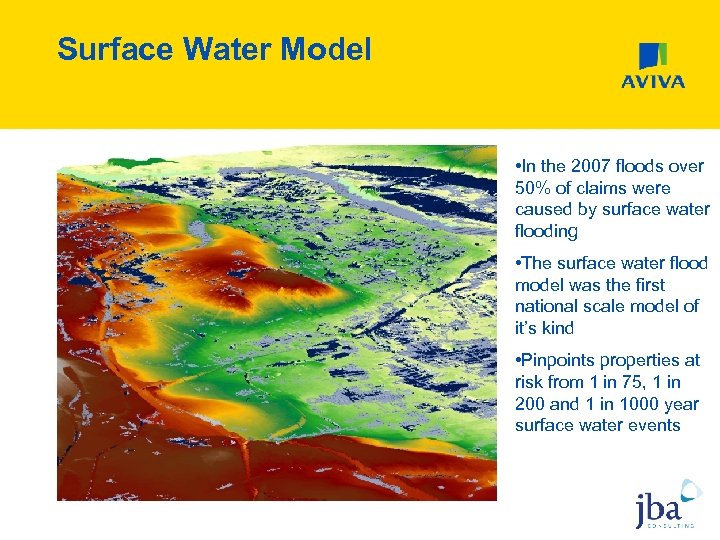

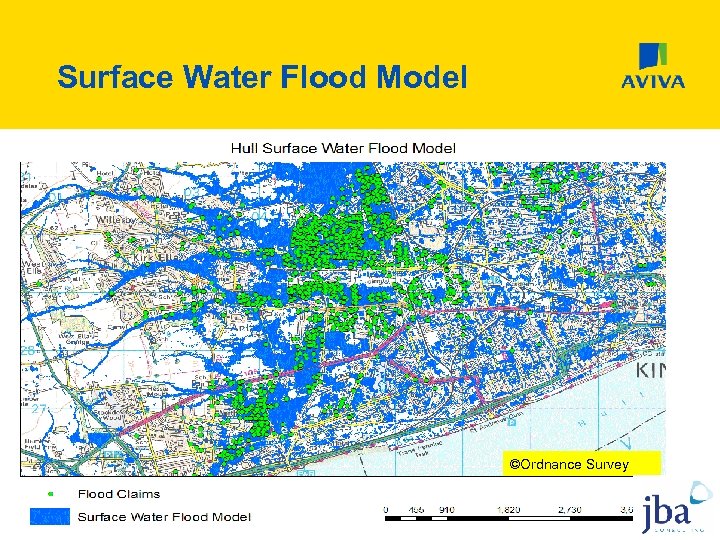

Surface Water Model • In the 2007 floods over 50% of claims were caused by surface water flooding • The surface water flood model was the first national scale model of it’s kind • Pinpoints properties at risk from 1 in 75, 1 in 200 and 1 in 1000 year surface water events

Surface Water Flood Model ©Ordnance Survey

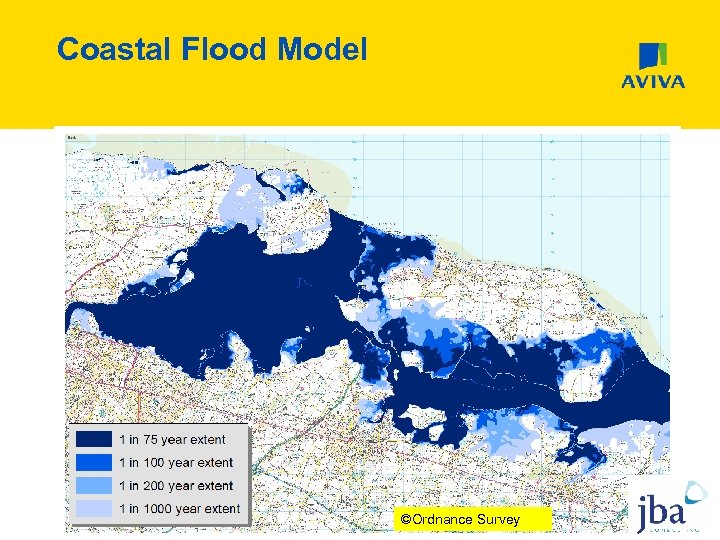

Coastal Flood Model ©Ordnance Survey

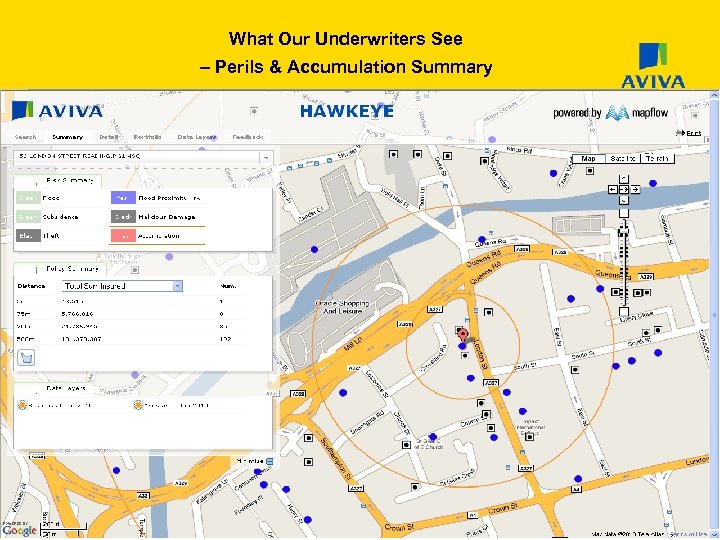

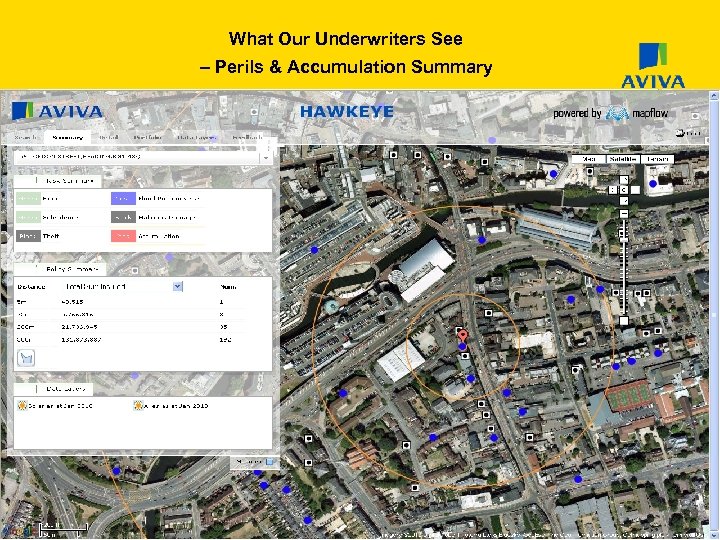

What Our Underwriters See – Perils & Accumulation Summary 12

What Our Underwriters See – Perils & Accumulation Summary 13

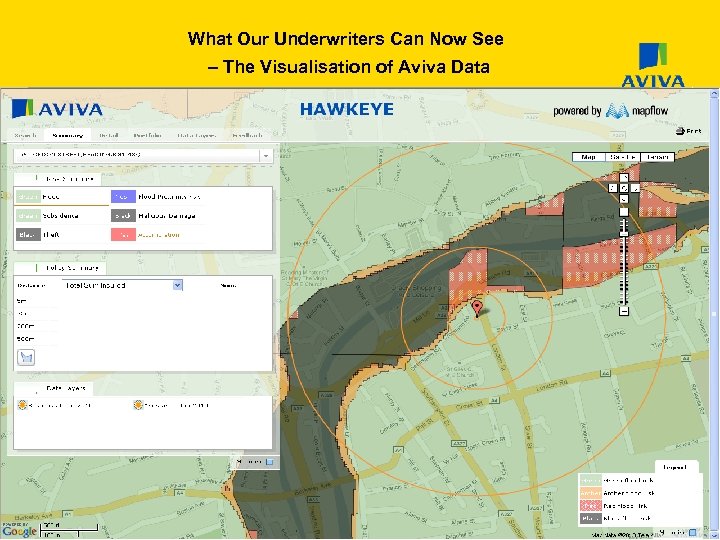

What Our Underwriters Can Now See – The Visualisation of Aviva Data 14

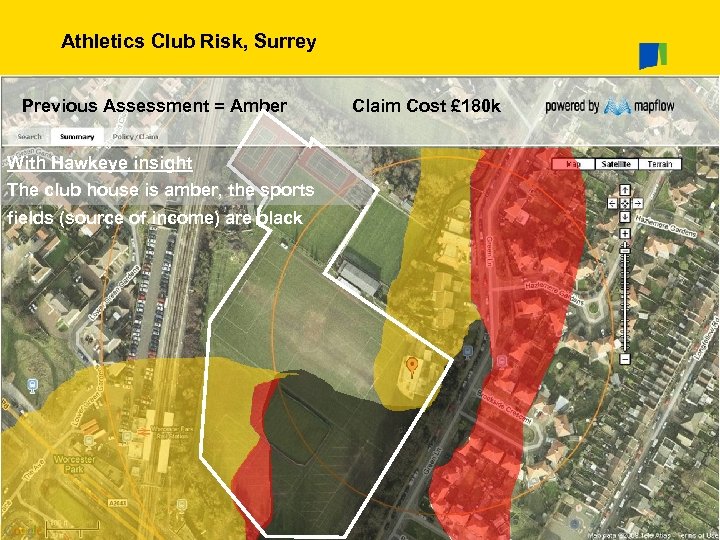

Athletics Club Risk, Surrey Previous Assessment = Amber Claim Cost £ 180 k With Hawkeye insight The club house is amber, the sports fields (source of income) are black 15

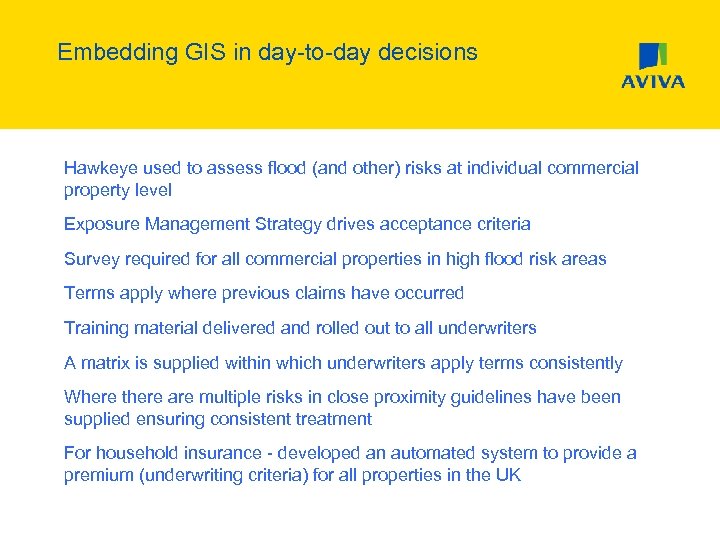

Embedding GIS in day-to-day decisions • Hawkeye used to assess flood (and other) risks at individual commercial property level • Exposure Management Strategy drives acceptance criteria • Survey required for all commercial properties in high flood risk areas • Terms apply where previous claims have occurred • Training material delivered and rolled out to all underwriters • A matrix is supplied within which underwriters apply terms consistently • Where there are multiple risks in close proximity guidelines have been supplied ensuring consistent treatment • For household insurance - developed an automated system to provide a premium (underwriting criteria) for all properties in the UK

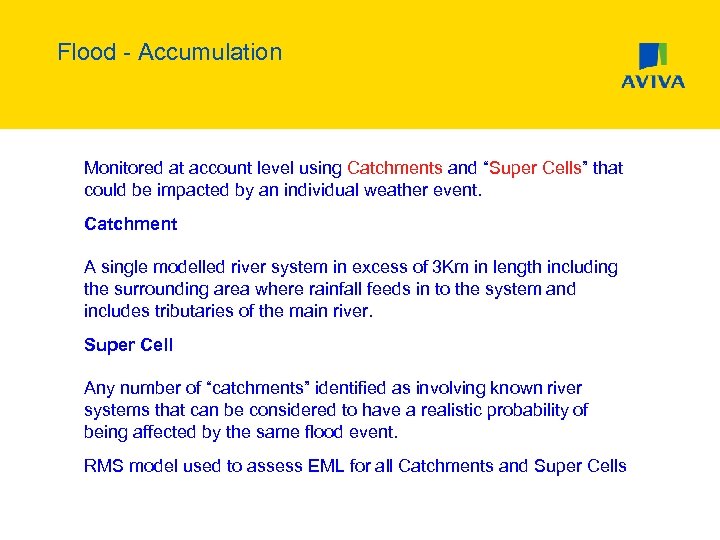

Flood - Accumulation • Monitored at account level using Catchments and “Super Cells” that could be impacted by an individual weather event. • Catchment A single modelled river system in excess of 3 Km in length including the surrounding area where rainfall feeds in to the system and includes tributaries of the main river. • Super Cell Any number of “catchments” identified as involving known river systems that can be considered to have a realistic probability of being affected by the same flood event. • RMS model used to assess EML for all Catchments and Super Cells

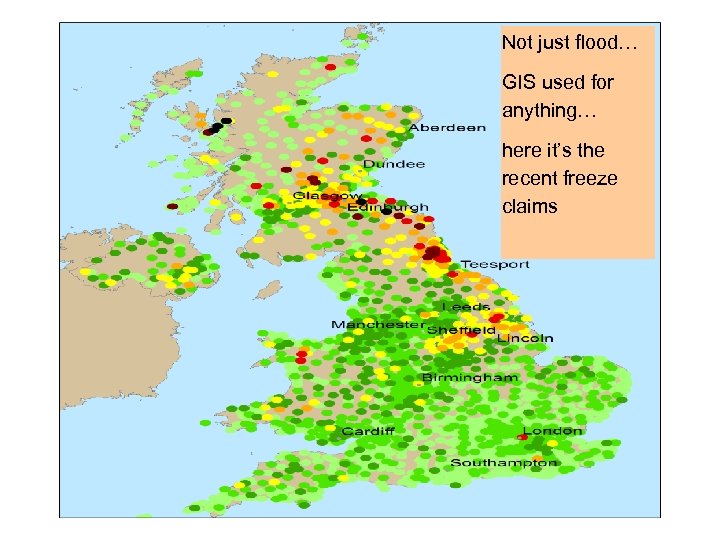

Not just flood… GIS used for anything… here it’s the recent freeze claims

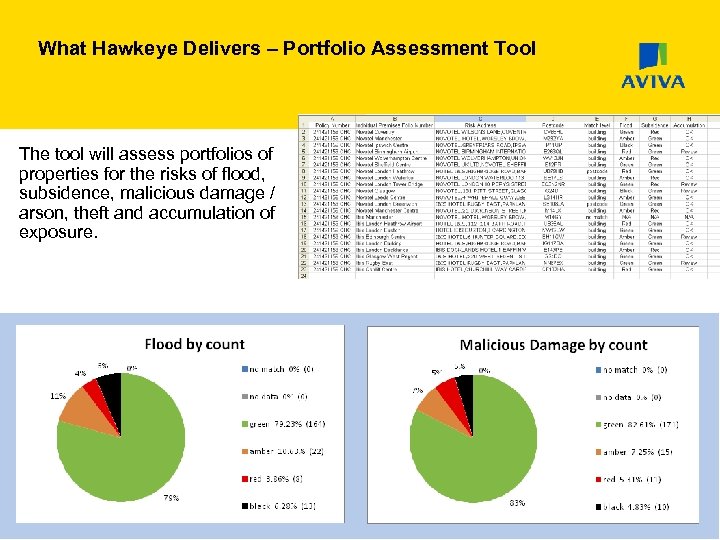

What Hawkeye Delivers – Portfolio Assessment Tool The tool will assess portfolios of properties for the risks of flood, subsidence, malicious damage / arson, theft and accumulation of exposure. 19

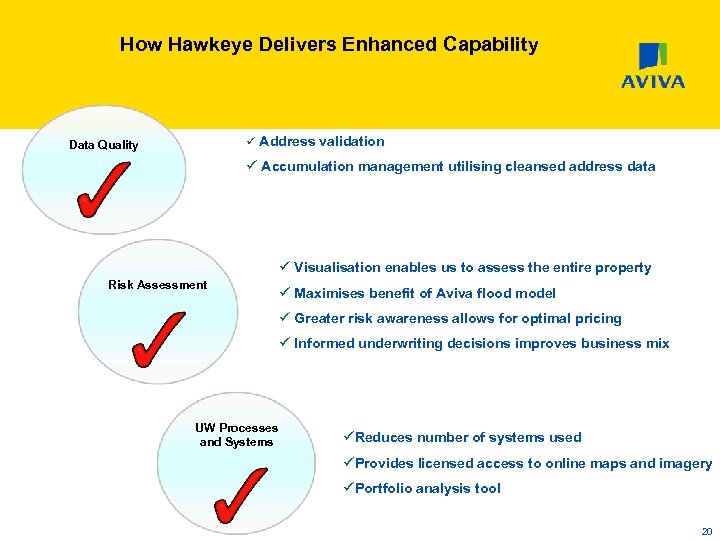

How Hawkeye Delivers Enhanced Capability ü Address validation Data Quality ü Accumulation management utilising cleansed address data ü Visualisation enables us to assess the entire property Risk Assessment ü Maximises benefit of Aviva flood model ü Greater risk awareness allows for optimal pricing ü Informed underwriting decisions improves business mix UW Processes and Systems üReduces number of systems used üProvides licensed access to online maps and imagery üPortfolio analysis tool 20

4234a87f3c441c624924a91d51157261.ppt