8f71c1b70ad8e4764b996d8fee2b5e63.ppt

- Количество слайдов: 43

AV China Expense Report Guideline 费用报告操作指南 Finance Department November,2012

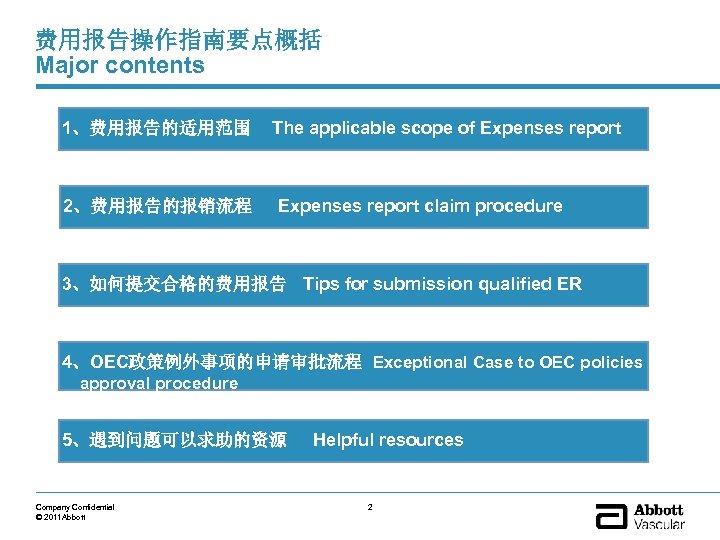

费用报告操作指南要点概括 Major contents 1、费用报告的适用范围 2、费用报告的报销流程 The applicable scope of Expenses report claim procedure 3、如何提交合格的费用报告 Tips for submission qualified ER 4、OEC政策例外事项的申请审批流程 Exceptional Case to OEC policies approval procedure 5、遇到问题可以求助的资源 Company Confidential © 2011 Abbott Helpful resources 2

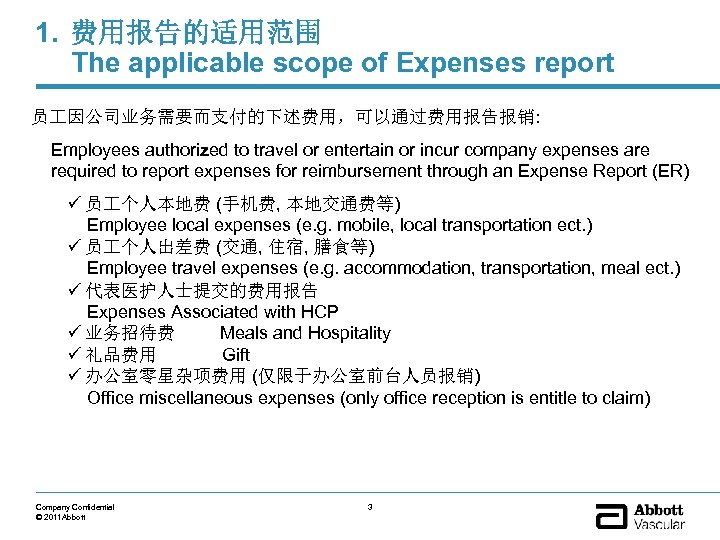

1. 费用报告的适用范围 The applicable scope of Expenses report 员 因公司业务需要而支付的下述费用,可以通过费用报告报销: Employees authorized to travel or entertain or incur company expenses are required to report expenses for reimbursement through an Expense Report (ER) ü 员 个人本地费 (手机费, 本地交通费等) Employee local expenses (e. g. mobile, local transportation ect. ) ü 员 个人出差费 (交通, 住宿, 膳食等) Employee travel expenses (e. g. accommodation, transportation, meal ect. ) ü 代表医护人士提交的费用报告 Expenses Associated with HCP ü 业务招待费 Meals and Hospitality ü 礼品费用 Gift ü 办公室零星杂项费用 (仅限于办公室前台人员报销) Office miscellaneous expenses (only office reception is entitle to claim) Company Confidential © 2011 Abbott 3

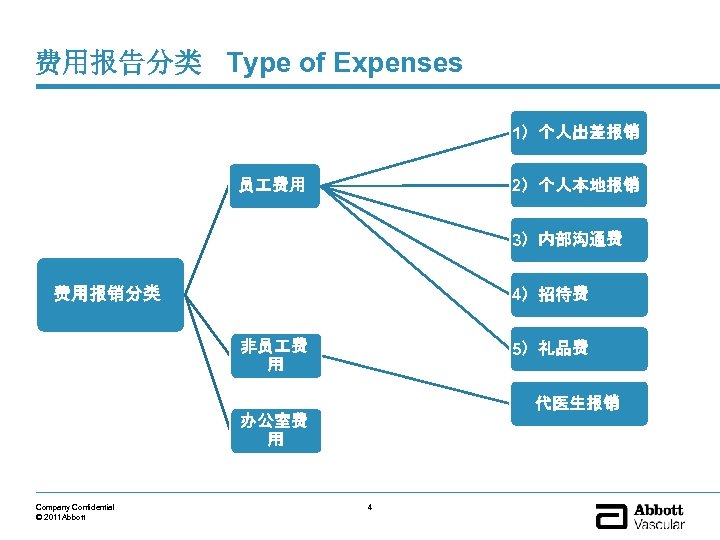

费用报告分类 Type of Expenses 1)个人出差报销 员 费用 2)个人本地报销 3)内部沟通费 费用报销分类 4)招待费 非员 费 用 5)礼品费 代医生报销 办公室费 用 Company Confidential © 2011 Abbott 4

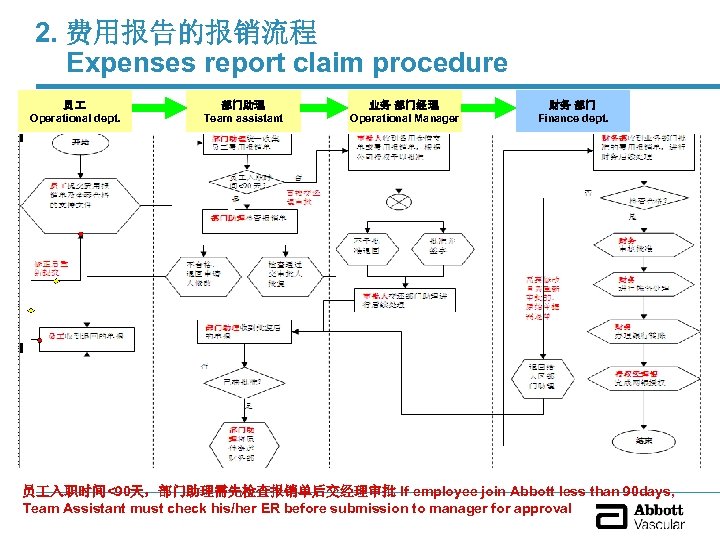

2. 费用报告的报销流程 Expenses report claim procedure 员 Operational dept. 部门助理 Team assistant 业务 部门经 理 Operational Manager 财务 部门 Finance dept. 员 入职时间<90天,部门助理需先检查报销单后交经理审批 If employee join Abbott less than 90 days, Team Assistant must check his/her ER before submission to manager for approval

3. 如何确保提交合格的费用报告 Tips for submission qualified ER A. 填报费用报告的基本原则 Basic rules for Expenses Report B. 费用报告具体项目详解 Detail interpretation for Expenses Report items C. 费用报告填报方法 Specific guideline for Expenses Report preparation Company Confidential © 2011 Abbott 6

3 -A 填报费用报告的基本原则 Basic rules for Expenses Report v 真实性:报销申请人应根据实际的业务开支,据实报销 要求:尽量避免采用现金形式支付。支付金额大于RMB 500元必须刷卡 支付 ,且报销时必须同时提交刷卡单。大于RMB 500元的现金支付, 需在发票旁附注说明,经由主管经理签字特批后方可报销。 v 及时性:报销申请人应于业务差旅或业务费用发生完成后30天内递交报 销申请单 要求:对于经常出差的业务人员最迟必须在业务差旅或业务费用发生完 成后60天内提交报销单。如因特殊情况超过60天提交,必须提交情况说 明,除了直线主管批准外,还必须得到本运营部门最高级别经理、财务 总监、总经理的签字批准。 v 有效性:报销申请人应取得真实有效的税务发票 要求:不得以收据,假发票或未盖公章的发票报销。如员 初次遗失发 票,填特别事项申请表,获得本部门经理及财务总监批准后,可予以报 销。如再次遗失发票,则损失由员 个人承担。 v 完整性:报销申请人应按照费用报销规定、OEC政策提供完整的支持文 件 Company Confidential © 2011 Abbott 7

3 -A 填报费用报告的基本原则 Basic rules for Expenses Report v Authenticity:Employee can only claim expenses for reasonable actual expenses which result from transacting company business Request:Try to avoid cash payment. Payment > RMB 500 require payment by credit card, and bank slip is required to present as supporting documentation. Reasonable explanation and Manager sign-off beside the invoice are required for any exceptions. v Timeliness:Expense Reports should be submitted immediately upon the completion of the business activity or event, but no later than one month after the expenses incurred Request:Expense claim applicant shall submit the completed Expense Claim Form within 30 days of completion of travel or incurring a business expense , 60 days may be granted to employee who has frequent business trips. Any expenses report submitted after 60 days of the business expense occurred, the company has the right to reject the payment unless special approval is obtained, and it should be approved by highest level of own department manager, AV China General Manager and Financial Controller v Validity:Authentic and valid tax invoice must be obtained as supporting of ER Request:Receipts, invoices without supplier’s company chop, or fake invoice are not acceptable. In case, tax invoice is unavailable or lost for first time, the employee must prepare an “TE Special Case Application Form” and get special approval from department manager and Finance Controller, attach it to the expense report. If lost invoice again, no more reimbursement. v Completeness:Employee must comply with Policy on Expense Reporting and OEC policies to provide complete and sufficient supporting documents. Company Confidential © 2011 Abbott 8

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 1)个人出差报销 Travel expense Ø 出差申请---应于出差前提交申请。因此经理审批时间应早于出差时间,如有特殊情况也可使 用邮件批复 Travel Application---If the business request requires airfare, a travel request should be approved by the manager and be obtained prior to departure. Email approval is acceptable. Ø 乘坐飞机——登机牌要保留作为报销附件,升仓或自行购买机票需填写TE表 Travel by air---Boarding pass is required as supporting documentation to claim travel expenses. If upgrade or self purchasing air-ticket need to fill in “TE Special Case Application Form”, and get special approval from department manager and Finance Controller. 登机牌遗失怎么办? What if I lost the boarding pass? 解决方案1. 填写TE表,获得部门经理和财务总监签字批准 Solution 1: fill in “TE Special Case Application Form”, and get special approval from department manager and Finance Controller. 解决方案2. 通过电子行程单,在信天游网站上查找客票使用信息 使用状态显示为“客票已使用”的页面可打印出来替代登机牌作为已乘机凭证 Logon “www. travelsky. com”, enquire status of an air ticket by input required information of electronic air ticket. If the status shown as “ticket used”, the screen can be printed out as substitution of boarding pass Company Confidential © 2011 Abbott 9

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Ø 乘坐火车——火车票的日期、出发地与目的地应与出差申请表一致。如实际出差日程变更导致不一致,应在车票旁加注说明, 由经理加签确认 Travel by train---The train ticket date, departure and destination city should be consistent with travel application. If nonconsistency due to travel schedule change, explanation and manager sign-off beside the ticket is required. Ø 交通费—— 1. 出租车费,每张出租车票应写明业务目的及上下车地点 2. 租车费,对应租车发票并写明业务目的及上下车地点 (由于租车金额较大,建议使用公司签约公司,通过公司转 账付款) Transportation---1. Taxi fee; 2. Car rental fee Date, time, place on board and destination should be marked on the invoice. Usually the Car rental fee is expensive, strongly suggest to use AV China engaged car rental company, and pay the rental fee via wire transfer. Ø 不建议员 自行开车出差 Privately-owned vehicles NOT suggest to be used for travel 出于对员 安全的考虑,雅培公司从不鼓励员 自驾车出差。业务需要出差,员 应按公司政策选择恰当的公共交通 具。 Considering from employee’s safety point of view, travel by privately-owned vehicle is never encouraged by Abbott. Appropriate public means of transport should be selected as per company policy for any business travel. 如因特殊情况,自驾车出差确有必要,申请人应该在出差申请表上写清原因,除了直线主管批准外,必须事先得到本运营部 门最高级别经理、财务总监、总经理、高级人事经理的签字批准。In case any specific situation and travel by own car is really necessary, applicant must clearly address the reason on Travel Application, in this case, besides line manager’s approval on TA as normal, special pre-approval from highest level of operational manager, Finance Controller, General Manager and Senior HR manager will be required as mandatory. The TA must be approved prior to departure. Company Confidential © 2011 Abbott 10

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Ø 酒店住宿费 Accommodation 住宿标准:RMB 800元/天/人(包括房间服务费,税费) Accommodation limit: General limit for hotel room cost is RMB 800/day 住宿酒店:必须通过BCD安排酒店 Hotel Arrangement: must be booked thru the locally approved travel agency—BCD 报销凭据:提供原始发票及宾馆明细帐单,账单需按日期和性质标明各项费用 支付金额超过500元需要提供刷卡单,否则需要在发票旁加注说明并获得经理批准 Supporting doc required: Original tax invoice with itemized hotel bill showing breakdown of expenses by date and nature. Payment >500 RMB require payment by credit card and bank slip is required to present as supporting documentation. Reasonable explanation and Manager sign-off beside the invoice are required for any exceptions. 房费超标怎么办? What if my accommodation cost is over standard limitation? 在发票旁加注解释,说明合理的理由,经理在发票旁签字批准 Reasonable explanation and Manager sign-off beside the invoice 酒店没有明细账单怎么办? What if the hotel can’t provide itemized bill beside tax invoice? 让酒店提供说明并盖章,或自行说明获得部门经理批准 Get written explanation doc with hotel’s chop from hotel, or Reasonable explanation and Manager sign-off beside the invoice 我把发票或明细账单弄丢了怎么办?What if I lost invoice or itemized bill? 填TE表,获得部门经理及财务总监批准 fill in “TE Special Case Application Form”, and get special approval from department manager and Finance Controller. Company Confidential © 2011 Abbott 11

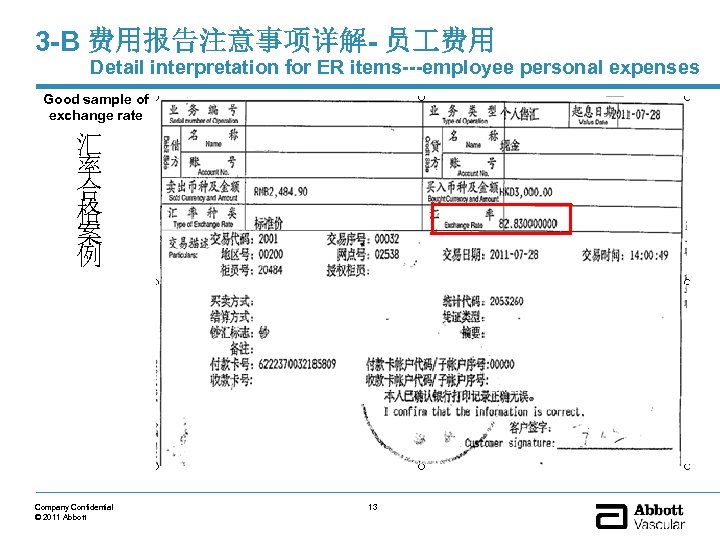

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Ø 出差期间个人餐费——限额RMB 200元/人/餐,应提供出差期间内相应就餐日期、地点的餐饮发票, 通常为一日三餐,如果有其他特殊情况,需要另外写说明,由部门经理特批 Personal meal during travel: Normal maximum budget is RMB 200 per meal counted by the number of days staying in hotel (except collective training and annual meeting of the Company). Usually 3 meals per day, any exceptions, need Reasonable explanation and Manager sign-off beside the invoice. Ø 出差期间个人其他杂费——在出差时发生的其他费用,如上网、洗衣、打印费,需提供相应发票 Other expenses during travel: like internet fee in hotel, laundry, printing etc, tax invoices are must. Ø 外币折算——出差期间使用外币应提供对应的汇率证明,以支持费用报销时采用的外币折算汇率 Exchange rate: if foreign currency incurred during travel, qualified evidence of exchange rate must be presented with ER. 什么样的汇率证明是可以接受的? What is qualified supporting for exchange rate? 1. 在银行购买外币的银行兑换水单. 注:所购外汇金额应不少于在境外的现金开支金额 Bank slip for exchanging foreign currency (The FX amount should cover cash expenditure abroad) 2. 出差期间内中国人民银行等官方机构发布的外汇牌价表 During travel period, the official exchange rate which is published by authoritative organization, like Bank of China 3. 直接刷卡的,可提供银行对账单以显示汇率 Payment by credit card, bank statement of credit card can be served as supporting to 12 exchange rate Company Confidential © 2011 Abbott

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Good sample of exchange rate 汇 率 合 格 案 例 Company Confidential © 2011 Abbott 13

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 2)个人本地报销 Local expenses Ø 餐费 Meals – 如与其他同事共同就餐,支付金额超过500元,应在提供发票的同时提供银行刷卡单和明细菜单。否则需要在发 票旁加注说明并获得经理批准 Payment >RMB 500, bank slip and Itemized receipt for meal are required. No bank slip for payment above RMB 500, need reasonable explanation and Manager sign-off beside the invoice. No Itemized receipt for meal, need to fill in “TE Special Case Application Form”, and get special approval from department manager and Finance Controller. – 报销申请人应该在餐费及招待费明细表中,列名时间、地点、目的、出席/参与人员的姓名 Detail list must be provided within the expense report, should include event date, venue, purpose, full name of attendees. – 明细菜单、餐费及招待费明细表所列示的人数必须与实际参加人数一致。如不一致,需要在发票旁加注说明并 获得经理批准。 The number of participants must be reported according to actual status, and the number shown on Itemized receipt for meal must be consistent with detail list within expense report. If not consistent, reasonable explanation and Manager sign-off beside the invoice are required. – 对于饭店在明细菜单上所作的更正,必须由饭店在更正处加盖公章。不允许自制、手 涂改或剪切明细菜单。 Self made or manual alteration for the Itemized receipt for meal is Not Allowed. If alteration is made by restaurant, restaurant's company chop should be affixed on the corrected number. Company Confidential © 2011 Abbott 14

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Ø 交通费——非销售/市场部人员 Transportation----Non- Sales Force and Non- Marketing function employee 1. 办理公司业务发生的交通费:按实际发生的合理的交通费据实报销 Transportation fee which result from transacting company business: will be reimbursed for reasonable actual expenses 2. 加班交通费: 作日晚 8点以后及节假日加班交通费可据实报销 Transportation fee for OT: Employees may reimburse taxi fare for overtime work on holidays and for going home after 8: 00 pm on normal working days except for Wai. Gao. Qian employees may reimburse taxi fare to Lu. Jia. Zui Metro Station for overtime work after 6: 00 pm 报销凭据:应提供相应的原始发票,并写明上下车的时间、地点 Supporting doc required: Original tax invoice with remark of date, time, place on board and destination. 注意:员 个人上下班的交通费不在报销范围 Note: Employee own commute between office and home is not eligible for reimbursement Company Confidential © 2011 Abbott 15

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Ø 交通费——销售/市场部人员 Transportation----Sales Force and Marketing function employee 应提交“本地交通费报销模式申请表”,在下列 3种选项中任选一种。一旦选择的报销方式被批准,6个月内不得变更,如需变更, 可在 6个月期满前重新提交申请 选项 1. 根据为办理公司业务发生的合理的公共交通费用,据实报销 报销凭据:当月实际发生的公共交通费用发票,必须提供每笔发票的详细信息,包括日期、时间、上下车 地点,公司业务目的 选项 2. 使用公共交通或自驾车代替公共交通,每月最高可报销人民币1800元的出租车费、汽油费及停车费 (此选项下必须首先填写私车公用资格表( 见附件),按要求应提供驾驶执照、车辆行驶证复印件。(如车辆所有人非员 本人,需 提供与本人的关系证明) 报销凭据:当月实际发生的出租车费、汽油费及停车费发票。无须提供每笔发票的详细信息 选项 3. 使用自驾车代替公共交通,申请每公里人民币3元的补贴。 (此选项下必须首先填写私车公用资格表( 见附件),按要求应提供驾驶执照、车辆行驶证复印件和里程数证明(如里程表照片)且不 能同时再报销其他市内交通费) 报销凭据:当月实际发生的出车的公里数乘以每公里补贴标准。应填报当月实际业务出车记录表 由经理审批,必须提供当月私车里程证明文件(如里程表照片)及每次出车的详细信息,包括 日期、时间、业务目的、出发地、目的地及实际公里数。因每公里人民币3元的补贴,已涵 盖了因公司业务目的使用自驾车的所有相关费用,故当月汽油费、停车费及修理费等与个人 私车相关的发票的有效税务发票,可以作为补贴金额的支持凭证,无须提供每笔发票的详细 信息。 注意:员 个人上下班的交通费不在报销范围 Note: Employee own commute between office and home is not eligible for reimbursement Company Confidential © 2011 Abbott 16

Ø 3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Transportation----Sales Force and Marketing function employee Must submit “Local Transportation Reimbursement Method Application Form”,select 1 from below 3 options. Once the applied method is approved, it will be valid and can’t be changed within 6 months. Option 1. Reimburse reasonable and actually incurred local transportation expenses due to business purpose ER supporting: – Must provide actual valid tax invoice of public means of transport (bus, metro, taxi ticket) during reimbursement period; – Must provide detail information for each invoice: Date, time, place on board and destination, business purpose. Option 2. Use of public transportation or privately-owned vehicles for local business purpose, with monthly reimbursement ceiling RMB 1800 Applicant must fill in “Application Form for Use of a Privately-owned Vehicle for Business” to get qualification for this option, supply driver license copy and evidence of mileage (like photo of mileage meter) ER supporting: – Must provide actual valid tax invoice of public means of transport (bus, metro, taxi ticket), parking fee and gasoline fee during reimbursement period; – No need to provide detail information for each invoice. Option 3. Use of privately-owned vehicles for local business purpose, apply RMB 3. 00 per kilometer to cover relevant cost incurred for each individual business trip. (Not allow to claim any other local taxi fee) Applicant must fill in “Application Form for Use of a Privately-owned Vehicle for Business” to get qualification for this option, supply driver license copy and evidence of mileage (like photo of mileage meter) ER supporting: – – RMB 3. 00 per kilometer as per actual driven for each individual business trip; Must provide detail information for each individual business trip: Date, time, business purpose, departure place and destination, distance (total kilometers) in stand form---Monthly Travel Record; Must provide evidence of mileage beginning and ending balance for the reimbursement period (like photo of mileage meter); Valid tax invoices related to vehicle during reimbursement period are acceptable, and no need to provide detail information for each invoice. Company Confidential © 2011 Abbott 17

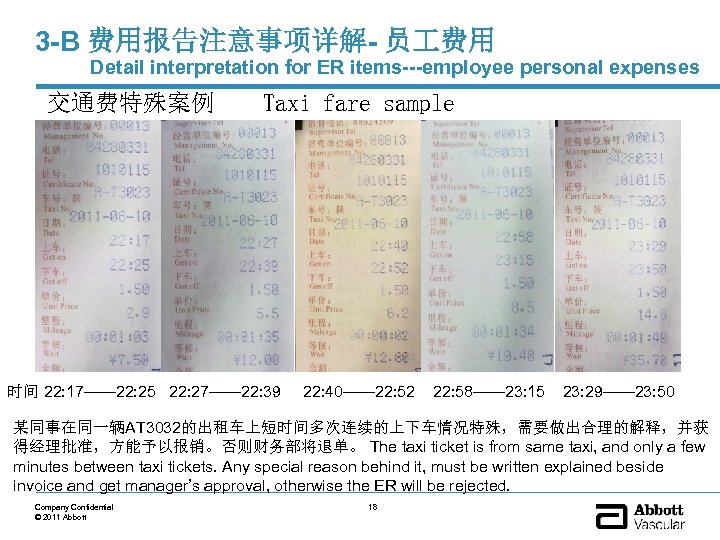

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 交通费特殊案例 Taxi fare sample 时间 22: 17—— 22: 25 22: 27—— 22: 39 22: 40—— 22: 52 22: 58—— 23: 15 23: 29—— 23: 50 某同事在同一辆AT 3032的出租车上短时间多次连续的上下车情况特殊,需要做出合理的解释,并获 得经理批准,方能予以报销。否则财务部将退单。 The taxi ticket is from same taxi, and only a few minutes between taxi tickets. Any special reason behind it, must be written explained beside invoice and get manager’s approval, otherwise the ER will be rejected. Company Confidential © 2011 Abbott 18

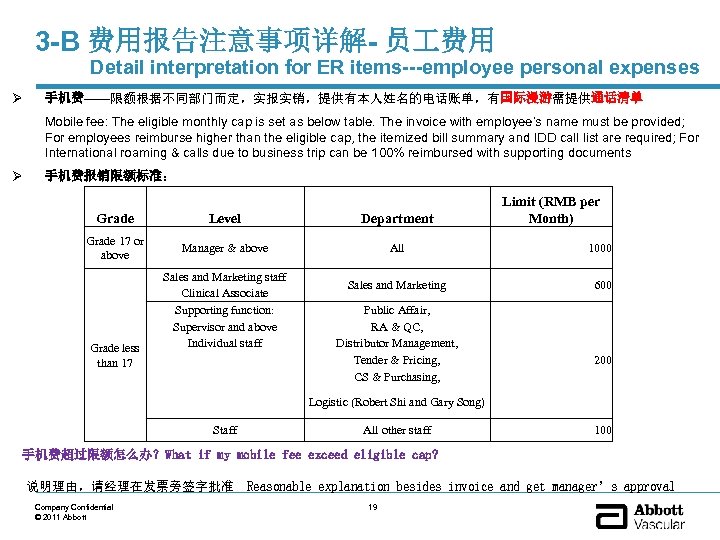

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses Ø 手机费——限额根据不同部门而定,实报实销,提供有本人姓名的电话账单,有国际漫游需提供通话清单 Mobile fee: The eligible monthly cap is set as below table. The invoice with employee’s name must be provided; For employees reimburse higher than the eligible cap, the itemized bill summary and IDD call list are required; For International roaming & calls due to business trip can be 100% reimbursed with supporting documents Ø 手机费报销限额标准: Limit (RMB per Month) Grade Level Department Grade 17 or above Manager & above All 1000 Sales and Marketing 600 Sales and Marketing staff Clinical Associate Supporting function: Supervisor and above Individual staff Logistic (Robert Shi and Gary Song) Staff Grade less than 17 Public Affair, RA & QC, Distributor Management, Tender & Pricing, CS & Purchasing, All other staff 200 100 手机费超过限额怎么办?What if my mobile fee exceed eligible cap? 说明理由,请经理在发票旁签字批准 Company Confidential © 2011 Abbott Reasonable explanation besides invoice and get manager’s approval 19

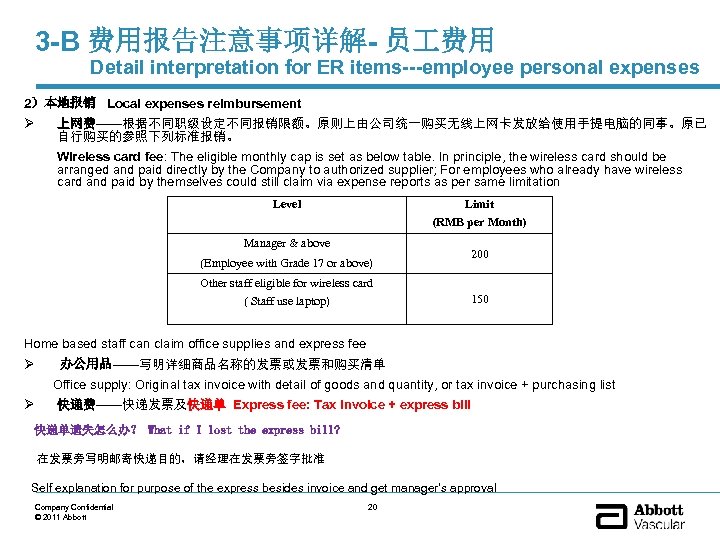

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 2)本地报销 Local expenses reimbursement Ø 上网费——根据不同职级设定不同报销限额。原则上由公司统一购买无线上网卡发放给使用手提电脑的同事。原已 自行购买的参照下列标准报销。 Wireless card fee: The eligible monthly cap is set as below table. In principle, the wireless card should be arranged and paid directly by the Company to authorized supplier; For employees who already have wireless card and paid by themselves could still claim via expense reports as per same limitation Level Limit (RMB per Month) Manager & above (Employee with Grade 17 or above) 200 Other staff eligible for wireless card 150 ( Staff use laptop) Home based staff can claim office supplies and express fee Ø 办公用品——写明详细商品名称的发票或发票和购买清单 Office supply: Original tax invoice with detail of goods and quantity, or tax invoice + purchasing list Ø 快递费——快递发票及快递单 Express fee: Tax invoice + express bill 快递单遗失怎么办? What if I lost the express bill? 在发票旁写明邮寄快递目的,请经理在发票旁签字批准 Self explanation for purpose of the express besides invoice and get manager’s approval Company Confidential © 2011 Abbott 20

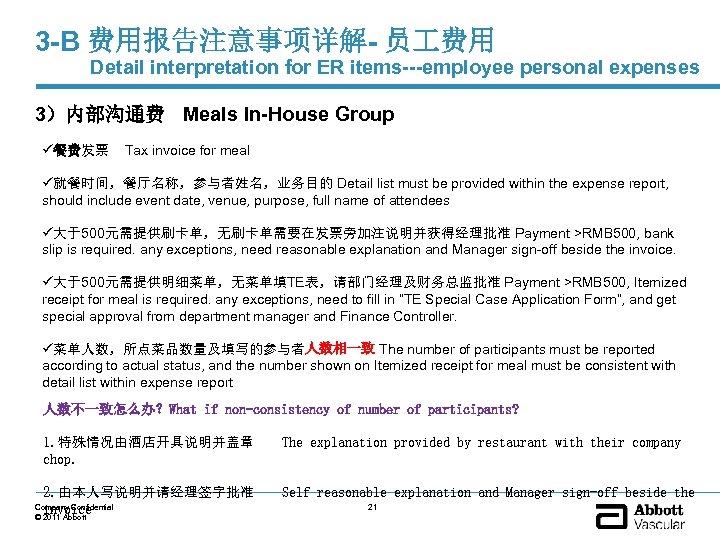

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 3)内部沟通费 Meals In-House Group ü餐费发票 Tax invoice for meal ü就餐时间,餐厅名称,参与者姓名,业务目的 Detail list must be provided within the expense report, should include event date, venue, purpose, full name of attendees ü大于500元需提供刷卡单,无刷卡单需要在发票旁加注说明并获得经理批准 Payment >RMB 500, bank slip is required. any exceptions, need reasonable explanation and Manager sign-off beside the invoice. ü大于500元需提供明细菜单,无菜单填TE表,请部门经理及财务总监批准 Payment >RMB 500, Itemized receipt for meal is required. any exceptions, need to fill in “TE Special Case Application Form”, and get special approval from department manager and Finance Controller. ü菜单人数,所点菜品数量及填写的参与者人数相一致 The number of participants must be reported according to actual status, and the number shown on Itemized receipt for meal must be consistent with detail list within expense report 人数不一致怎么办?What if non-consistency of number of participants? 1. 特殊情况由酒店开具说明并盖章 chop. The explanation provided by restaurant with their company 2. 由本人写说明并请经理签字批准 invoice Self reasonable explanation and Manager sign-off beside the Company Confidential © 2011 Abbott 21

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 4)招待费 Meals and hospitality with customers and/or 3 rd parties ü餐费发票 Tax invoice for meal ü就餐时间,餐厅名称,业务目的,参与者姓名全称,职务和供职单位 Event date, venue, purpose, full name, title, and associated company/institution of attendees. ü大于500元需提供刷卡单,无刷卡单需要在发票旁加注说明并获得经理批准 Payment >RMB 500, bank slip is required. any exceptions, need reasonable explanation and Manager sign-off beside the invoice. ü大于500元需提供明细菜单,无菜单填TE表,请部门经理及财务总监批准 Payment >RMB 500, Itemized receipt for meal is required. any exceptions, need to fill in “TE Special Case Application Form”, and get special approval from department manager and Finance Controller. ü菜单人数,所点菜品数量及填写的参与者人数相一致 The number of participants must be reported according to actual status, and the number shown on Itemized receipt for meal must be consistent with detail list within expense report 人数不一致怎么办?What if non-consistency of number of participants? 1. 特殊情况由酒店开具说明并盖章 chop. The explanation provided by restaurant with their company 2. 由本人写说明并请经理签字批准 invoice Self reasonable explanation and Manager sign-off beside the Company Confidential © 2011 Abbott 22

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 4)招待费 Meals and hospitality with customers and/or 3 rd parties 一般情况下,招待费是发生在酒店、餐厅的就餐费用,发票内容应为“餐饮费“ Normally, hospitality or entertainment with customers or 3 rd parties are meals in hotel, restaurant, therefore, description on tax invoice should be “meal” 不是餐饮发票怎么办?What if the invoice is not meal? 如果是销售人员到医院跟台或是科室会,按行业操作惯例,通常不会外出就餐,而是外购食品。发票内容应为购买的具体名称, 如矿泉水、饮料、水果、餐盒等。如商家只能开”食品“,则需提供商家的小票,销售清单,如清单上不能显示商家信息,可请商 家加盖公章或发票章。Sales follow up operation or arrange department meeting in hospital, according to industrial practice, instead of going out for lunch/dinner, usually food will be brought to hospital as meal. In this case, detail description and quantity should be shown on tax invoice. If only lump-sum invoice is available, shopping list obtained from shop must be supplied. If shop name can’t be identified from the shopping list, company’s chop or invoice chop is required to affix on the shopping list. 为避免产生变相送礼违反OEC政策之嫌,故需在报销时应做到下列要求:To avoid potential violation of OEC policies, i. e. the food is sent to HCP as gift, pls pay attention following when submit ER. (1) 写明情况说明: 根据业务发生的实际情况说明招待费发生的目的,为何不外出就餐,而是外购食品的具体原因 Reasonable explanation, like the purpose of the hospitality, the reason buying food as substitution of going out for meals. (2) 提交充分的支持证明文件:例如业务活动或科室会的日程安排,参加人员的签到表等 Provide sufficient proof documents, like event agenda, signing list of participants etc. (3) 由部门经理加签。 Signed by manager besides the explanation 如通过邮件审批,应该在邮件中写明上述信息,并注明提交的报销单号 Email approval from manager is acceptable. Above request should be stated in email and ER reference number should be mention in email as well. Company Confidential © 2011 Abbott 23

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 4)招待费 Meals and hospitality with customers and/or 3 rd parties 一般情况下,就餐时消费的酒水费用应该包括在当次的就餐费用中,发票应为消费总额。通常不应产生单独的酒水发票 Normally, liquid, wine and beverage should be incurred together with meal, and covered by tax invoice. As such, there should be no separate liquid/wine invoice to be reimbursed. 如果酒水不是在就餐的酒店/餐厅购买,而需要单独购买怎么办? What if liquid/wine need to be bought separately? 为避免产生变相送礼违反OEC政策之嫌,必须事前向部门最高级别经理和财务总监申请,可通过邮件申请审批,报销时 应附上该批准邮件作为支持文件。 To avoid potential violation of OEC policies, i. e. the liquid/wine is sent to HCP as gift. The special request must be approved before event by highest level of operational manager and Finance Controller. Email approval is acceptable. The pre-approval doc. must be supplied as supporting for ER. 请注意:单独购买的酒水与在酒店的餐饮支出不应超过公司规定的人均限额,即RMB 300元/人。 Attention: the total cost of separately purchased wine/liquid and meal can not exceed the limitation RMB 300/person 申请时,应提供特别申请事项的具体内容,如:Detail information should be provided for management pre-approval, like: 1、就餐日期 Date of hospitality 2、宴请的目的 Purpose of hospitality 3、预计就餐人数 Estimated participants 4、申请单独购买酒水的原因,例如:在酒店就餐如果同时购买酒水的预计开支将达到多少,或其他原因,等等 Reason for separate purchasing of wine/liquid Company Confidential © 2011 Abbott 24

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 5)礼品费——定义 Ø Gift--- definition 礼品种类: • 同办公室/ 作有关的物品” (为同医护人士的 作有关的物品)-见附件类别A • 病人/教育有关的物品(为向病人提供健康利益或具教育功能)-见附件类别B • 同节日如新年和中秋节等传统节日有关的礼品。-见附件类别C • 作为当地风俗,婚礼或葬礼的礼品。-见附件类别D • 礼品作为市场活动的一部分 ,该礼品需要由市场部批准并统一制作。如果可能, 礼品上应标有雅培心 血管/雅培心血管产品的标签 。-见附件类别E。 OEC/ACC已经批准的礼品清单及权限表如附件。 Refer to Policy on Promotional Practices-Sponsorships, Gifts, Meals and Hospitality Appendix A Approved Items/Gifts List Matrix Ø 巧克力,蛋糕,糖果,水果,茶叶,咖啡等在会议中作为早餐/午餐/晚餐/点心给与会者一起分享时不视为 礼品. 此类情况作为膳食与娱乐处理. . 故此注意在费用报告上注明合理的解释和支持性文件. Chocolates, Cakes, Candy, Fruits, Tea, Coffee, etc provided during group meetings as part of breakfast / lunch / dinner / snacks are not considered gifts if they are for group consumption. Such items should be classified as meals and hospitality. Ensure that appropriate explanation / documentation is provided within expense reports. Company Confidential © 2011 Abbott 25

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 5)礼品费——特别注意 Gift---attention points 下述礼品类型是禁止的: Following are prohibit as gift: 1. 不得赠送客户现金,礼品卡,食品券作为礼品. Cash substitution coupon or article that can be used to convert into cash are not allowed. 2. 具私人性质的礼品不得赠送. Personal gifts are not allowed. 3. 不得把礼品赠予医护人士的配偶, 家庭成员或朋友. Not allowed to send gift to HCP’s spouse, family members or friends. 可在行业规范允许的范围内赠送礼品的五大节日: 1. 新年 2. 春节 3. 劳动节 4. 国庆节 5. 中秋节 Gifts related to gift-giving holidays, such as New Year, Spring Festival, Labor Day, Mid-Autumn Festival and National Holiday may be given, provided that these are generally within the scope of accepted industry practice. 注意:Attention 端午节并非批准的可派送礼品的五大节日之一,虽然C类节日批准的礼品清单中有粽子,但是大家不 要因此把端午节误当作已批准的五大节日,即:在端午节不得向医疗专业人士赠送“类别C”的礼品。 Dragon Boat Festival is not an approved gift-giving holiday listed in the promotional policy although Zong Zi is an approved gift in Category C. That is, gifts in "Category C" may not be given to HCPs during "The Dragon Boat Festival". Company Confidential © 2011 Abbott 26

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 5)礼品费——报销支持文件 Gift---- Supporting required for ER Ø 如果总金额<4000,礼品可以由销售采购并通过费用报告报销 Purchasing amount < RMB 4000, could go thru ER for reimbursement • • 必须提供有具体礼品名称的税务发票 Detail description and quantity should be shown on tax invoice. If only lump-sum invoice is available, shopping list obtained from shop must be supplied. If shop name can’t be identified from the shopping list, company’s chop or invoice chop is required to affixed on the shopping list. • 任何付款>500元需要用银行卡付款,并提供刷卡单。如无法刷卡,应在相应的发票加注解释说明, 经理需要签字批准 Payment >RMB 500, bank slip is required. If any exceptions, need reasonable explanation and Manager sign-off beside the invoice. • Ø 在费用报告中必须写明: 礼品名称,收件人及其职称和所在单位名称 Within ER, Details of gifts including Description of Gift, Cost Per Gift, Recipients, and Title of Recipients must be provided 若礼品是随同会议发放,则相应的支持性文件(证明会议发生的)需一同提交 If gifts are distributed during meeting, corresponding supporting doc for meeting need to be provided. 总金额 > 4, 000 RMB,需要通过公司转帐直接支付给供应商 Purchasing amount > 4, 000 RMB should be paid directly to vendor via wire transfer from Abbott bank account. 礼品应尽可能印有雅培公司或雅培产品标志,强烈建议通过采购部统一购买并由公司转账支付礼品款 Where possible, gifts must have Abbott Logo or Product Logo, strongly suggest to centrally purchased by purchasing department, and pay to vendor directly via wire transfer. Company Confidential © 2011 Abbott 27

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 5)礼品费 Gift 拿不到符合标准的发票怎么办?What if the tax invoice for gifts is not up to standard? 1. 提供购买时的小票,证明实际购买商品在已批准的礼品清单内 If only lump-sum invoice is available, shopping list obtained from shop must be supplied. 2. 没有小票可由商场提供说明注明实际购买商品名称并盖章 If no shopping list, company’s chop or invoice chop is required to affixed on the detail list provided by shop. 3. 都没有的话需要自己在发票旁写说明,由经理签字批准 If above 2 are all not available, self reasonable explanation and Manager sign-off beside the invoice are mandatory. (建议提出采购需求向采购部申请,统一采购) Strongly suggest to initiate PR to purchasing department for sourcing Company Confidential © 2011 Abbott 28

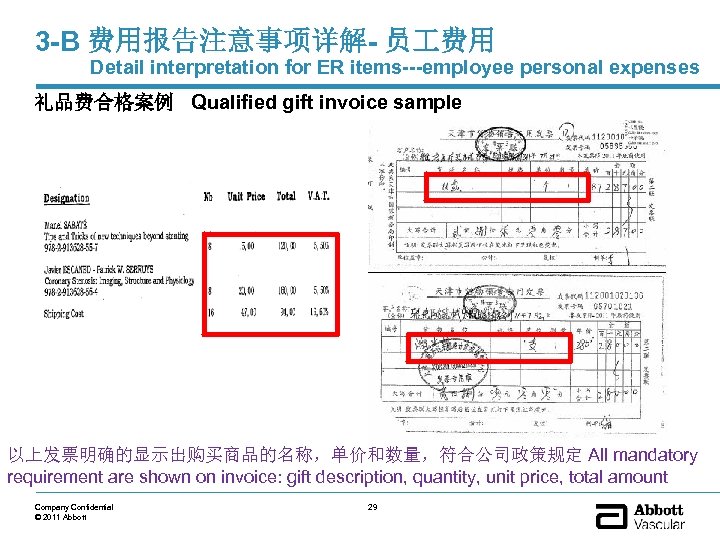

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 礼品费合格案例 Qualified gift invoice sample 以上发票明确的显示出购买商品的名称,单价和数量,符合公司政策规定 All mandatory requirement are shown on invoice: gift description, quantity, unit price, total amount Company Confidential © 2011 Abbott 29

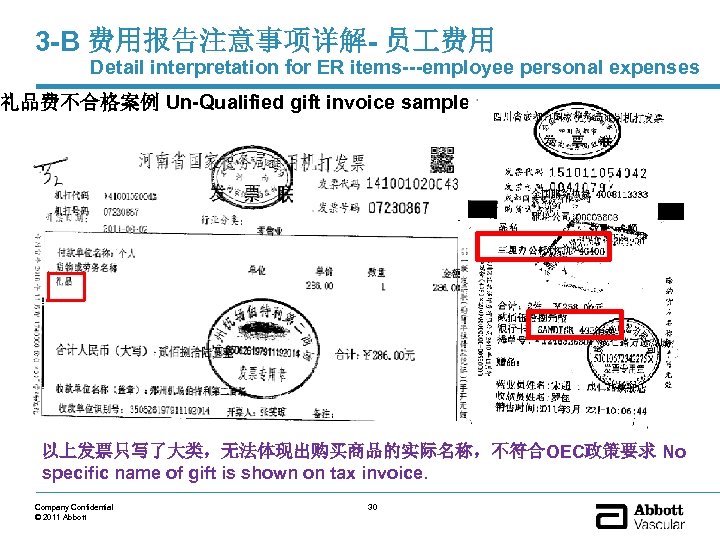

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 礼品费不合格案例 Un-Qualified gift invoice sample 以上发票只写了大类,无法体现出购买商品的实际名称,不符合OEC政策要求 No specific name of gift is shown on tax invoice. Company Confidential © 2011 Abbott 30

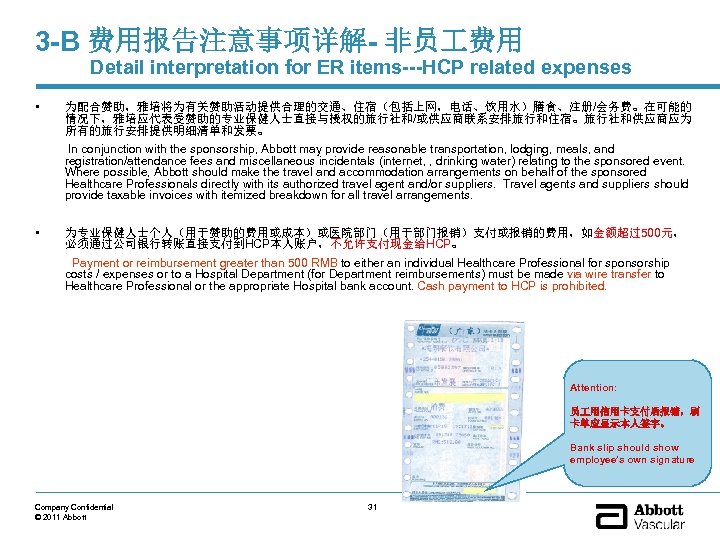

3 -B 费用报告注意事项详解- 非员 费用 Detail interpretation for ER items---HCP related expenses • 为配合赞助,雅培将为有关赞助活动提供合理的交通、住宿(包括上网,电话、饮用水)膳食、注册/会务费。在可能的 情况下,雅培应代表受赞助的专业保健人士直接与授权的旅行社和/或供应商联系安排旅行和住宿。旅行社和供应商应为 所有的旅行安排提供明细清单和发票。 In conjunction with the sponsorship, Abbott may provide reasonable transportation, lodging, meals, and registration/attendance fees and miscellaneous incidentals (internet, , drinking water) relating to the sponsored event. Where possible, Abbott should make the travel and accommodation arrangements on behalf of the sponsored Healthcare Professionals directly with its authorized travel agent and/or suppliers. Travel agents and suppliers should provide taxable invoices with itemized breakdown for all travel arrangements. • 为专业保健人士个人(用于赞助的费用或成本)或医院部门(用于部门报销)支付或报销的费用,如金额超过500元, 必须通过公司银行转账直接支付到HCP本人账户,不允许支付现金给HCP。 Payment or reimbursement greater than 500 RMB to either an individual Healthcare Professional for sponsorship costs / expenses or to a Hospital Department (for Department reimbursements) must be made via wire transfer to Healthcare Professional or the appropriate Hospital bank account. Cash payment to HCP is prohibited. Attention: 员 用信用卡支付后报销,刷 卡单应显示本人签字。 Bank slip should show employee’s own signature Company Confidential © 2011 Abbott 31

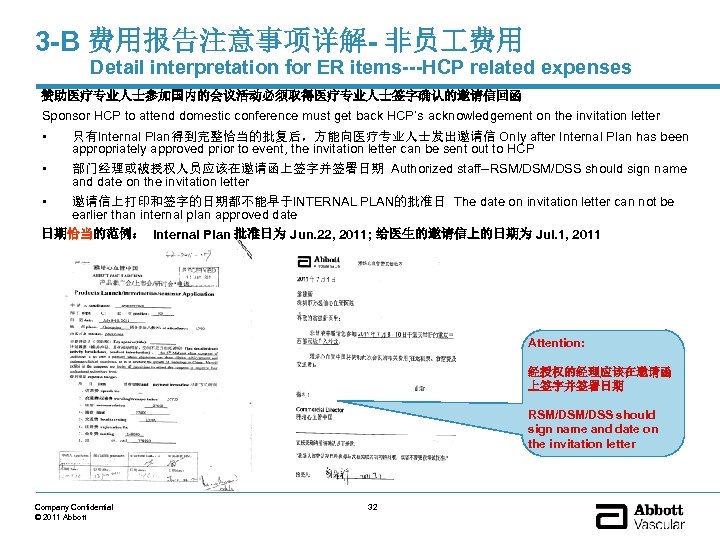

3 -B 费用报告注意事项详解- 非员 费用 Detail interpretation for ER items---HCP related expenses 赞助医疗专业人士参加国内的会议活动必须取得医疗专业人士签字确认的邀请信回函 Sponsor HCP to attend domestic conference must get back HCP’s acknowledgement on the invitation letter • 只有Internal Plan得到完整恰当的批复后,方能向医疗专业人士发出邀请信 Only after Internal Plan has been appropriately approved prior to event, the invitation letter can be sent out to HCP • 部门经理或被授权人员应该在邀请函上签字并签署日期 Authorized staff--RSM/DSS should sign name and date on the invitation letter • 邀请信上打印和签字的日期都不能早于INTERNAL PLAN的批准日 The date on invitation letter can not be earlier than internal plan approved date 日期恰当的范例: Internal Plan 批准日为 Jun. 22, 2011; 给医生的邀请信上的日期为 Jul. 1, 2011 Attention: 经授权的经理应该在邀请函 上签字并签署日期 RSM/DSS should sign name and date on the invitation letter Company Confidential © 2011 Abbott 32

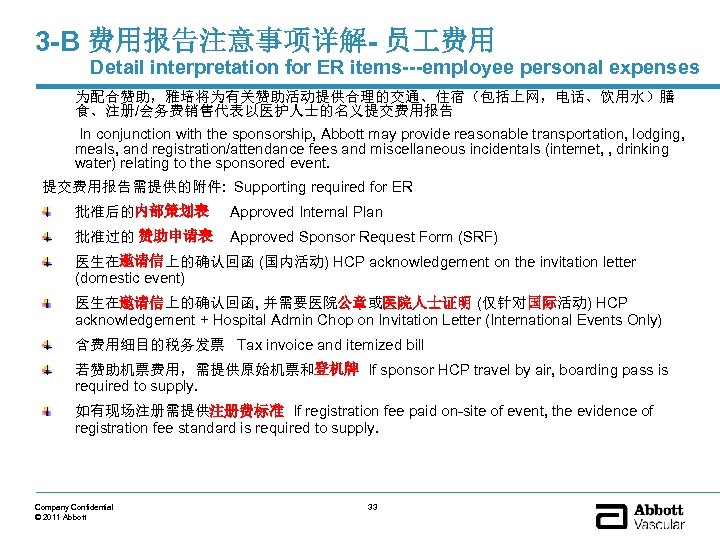

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 为配合赞助,雅培将为有关赞助活动提供合理的交通、住宿(包括上网,电话、饮用水)膳 食、注册/会务费销售代表以医护人士的名义提交费用报告 In conjunction with the sponsorship, Abbott may provide reasonable transportation, lodging, meals, and registration/attendance fees and miscellaneous incidentals (internet, , drinking water) relating to the sponsored event. 提交费用报告需提供的附件: Supporting required for ER 批准后的内部策划表 Approved Internal Plan 批准过的 赞助申请表 Approved Sponsor Request Form (SRF) 医生在邀请信上的确认回函 (国内活动) HCP acknowledgement on the invitation letter (domestic event) 医生在邀请信上的确认回函, 并需要医院公章或医院人士证明 (仅针对国际活动) HCP acknowledgement + Hospital Admin Chop on Invitation Letter (International Events Only) 含费用细目的税务发票 Tax invoice and itemized bill 若赞助机票费用,需提供原始机票和登机牌 If sponsor HCP travel by air, boarding pass is required to supply. 如有现场注册需提供注册费标准 If registration fee paid on-site of event, the evidence of registration fee standard is required to supply. Company Confidential © 2011 Abbott 33

3 -B 费用报告注意事项详解- 员 费用 Detail interpretation for ER items---employee personal expenses 赞助医疗专业人士海外活动必须取得书面批准书,并加盖公章 对于海外活动的赞助,雅培必须得到指定部门(如直接上司)的直接书面批准书,可以是以 下两种形式: For sponsorships to overseas events, Abbott must obtain direct written approval from requisite authority (e. g. Direct Supervisor) by obtaining either: • (i) 雇主方或医院指定部门某个人(如直接上司)的信件,请求雅培为某专业保健人士参加特 定活动提供资助;或者, A letter from an individual with requisite authority (e. g. , direct supervisor) at the employerhospital requesting Abbott to sponsor a Healthcare Professional to a particular event; or • (ii) 获得雇主方或医院指定部门(如直接上司)的书面认可的雅培邀请信。 对于海外活动的赞助,上述两种批准书的形式都需要加盖雇主方或医院的公章。如被邀请人的 直接上司在雅培邀请信上签字,要注明签字人的职务,且需要加盖雇主方或医院的公章。 An invitation letter from Abbott, with written acknowledgement from the requisite authority (e. g. , Direct Supervisor) at the employer-hospital. If direct supervisor signs on invitation letter, the signer’s title should be clearly stated, and Hospital’s chop is still required. Company Confidential © 2011 Abbott 34

3 -B 费用报告注意事项详解- 非员 费用 Detail interpretation for ER items---HCP related expenses 赞助医疗专业人士机票费用 Sponsorship of HCP’s airfare 如专医疗业人士需航空旅行,除非旅行目的地在中国境外且航程超过4小时,否则应向参加者提供经济舱机票。 学术带头人或其他保健专业人士可例外,但应事先提出申请,获得批准后,可乘坐商务舱。” If air travel is required, attendees should be provided economy class tickets, unless air travel is to a location outside China and exceeds four (4) hours in length. Exceptions may be granted, with pre-approval, for Key Opinion Leaders, or other Healthcare Professionals that request business class ticket. 具体应如何申请?How to apply? 在推广活动政策后有专门的政策例外申请表,如果有例外申请,必须填写该表,写清具体申请事项和合理的 理由,然后交由总经理和OEC签字审批。 Any exception must be approved in advance via exception requests by General Manager and OEC Director. 医疗专业人士应提供登机牌作为证明参加雅培公司赞助活动及具体时间的依据 Boarding pass must be supplied as evidence of attendance of the event 医生登机牌合格案例 Boarding pass sample Company Confidential © 2011 Abbott 35

3 -B 费用报告注意事项详解- 非员 费用 Detail interpretation for ER items---HCP related expenses 赞助医疗专业人士参加国内/国际会议活动的住宿费 • 在可能的情况下,雅培应代表受赞助的专业保健人士直接与授权的旅行社和/或供应商联系 安排旅行和住宿。 Where possible, transportation/accommodation for HCP’s must be arranged and purchased by Abbott, and paid directly to to authorized travel agents/suppliers via wire transfer. • 大于500元需提供刷卡单,无刷卡单需要在发票旁加注说明并获得经理签字批准 Payment • 报销时住宿费明细清单应与发票同时提供,客人姓名应与雅培赞助信上所赞助的医疗专业 人士的姓名一致。如不相符,需要解释说明原因并获得经理签字批准 Itemized accommodation bill must be supplied together with tax invoice. The guest name on bill should be consistent with Abbott invitation letter. If any consistency, need reasonable >RMB 500, bank slip is required. If any exceptions, need reasonable explanation and Manager sign-off beside the invoice. • 如果医疗专业人士的住宿费用转至销售人员房间名下统一结账,该医疗专业人士的房间的 明细账单也必须同时提供。 If HCP’s accommodation cost is transferred and centrally settled by Abbott sales staff, the itemized bill for HCP’s room must be supplied as well. Company Confidential © 2011 Abbott 36

3 -B 费用报告注意事项详解- 非员 费用 Detail interpretation for ER items---HCP related expenses 赞助医疗专业人士因应邀异地参会时因协调AV的 作产生额外的漫游费及长途费 Claim ER on behalf of HCP for additional IDD due to coordinate Abbott’s activity 不论是员 还是客户的手机费用的报销必须是实报实销的,不允许购买充值卡来 报销。如代客户报销额外的漫游费及长途费,需提交会议或AV 作安排日程表, 情况说明,有客户姓名的明细电话账单,由大区经理加签批准。 For International roaming & IDD calls due to HCP coordinate Abbott’s activities can be reimbursed with supporting documents, i. e. meeting/event agenda, Abbott activities arrangement, explanation, the invoice with HCP’s name and itemized bill, additional approval from RSM is required. PEP或科室会 PEP or department meeting in hospital 1. 只有招待费,需要提供签到表或其它证明文件 If only hospitalities cost incurred, attendance list or other evidence should be provided. 2. 发生招待费以外的费用需要提供医生邀请信,或相应文件(邮件)证明是因什么 原因邀请哪位医生 If other cost beside hospitalities incurred, invitation letter or other evidence should be provided. Company Confidential © 2011 Abbott 37

3 -C. 费用报告填报方法 Specific guideline for Expenses Report preparation 1. 应正确完整地填写标准费用报销表 Standard Expense Claim Form shall be used. 2. 申请人名字可从列表中选择,如报销非员 费用需填写非员 的姓名,承担此费用的成本中心 Applicant should select own employee name from the list. If the payee is non- employee, please enter non-employee payee name and cost center to absorb this cost. 3. 出差或业务活动项目内容需明确填写 Business Purpose for claim shall be detailed and specific. E. g. Claim for travel to Beijing attending CIT convention. Business Purpose shall be as ‘Travel to Beijing for CIT meeting’ instead of ‘Travel’. 4. 报销申请按出差或业务活动分次提交,不得合并。本地交通费应按月递交。Claim shall be made per event. No combination of multiple events shall be allowed. 5. 报销申请需在出差或业务完成后的30天内提交。经常出差的业务人员最迟必须在业务差旅或业务费 用发生完成后60天内提交报销单。如因特殊情况超过60天提交,必须提交情况说明,除了直线主管 批准外,还必须得到本运营部门最高级别经理、财务总监、总经理的签字批准。Expense claim applicant shall submit the completed Expense Claim Form within 30 days of completion of travel or incurring a business expense. 60 days may be granted to employee who has frequent business trips. Any expenses report submitted after 60 days of the business expense occurred, the company has the right to reject the payment unless the reason is valid and special approval is obtained. Besides highest level of operational manager’s approval, it should be approved by AV China General Manager; and Financial Controller as well. 6. 为避免原始凭证在传递过程中遗失,应用胶水将发票平铺或以阶梯形粘贴在纸上。不得用订书机装 订,因订书钉易锈蚀而导致原始票据散失。In order to avoid missing original documents, original invoices and receipts should be pasted on the papers by glue or sticker firmly. Please DO NOT use the staples and stick in a pile. 7. 每个明细项目的发票上需标明相对应的申请表上的序列号 Reference number for each claim line automatically generated on Claim Summary shall be marked on relatively attached invoice. 8. 报销申请每页右下角需标明页码 Page number shall be marked on right bottom of each page. Company Confidential © 2011 Abbott 38

3 -C. 费用报告填报方法 Specific guideline for Expenses Report preparation 9. 员 差旅费需按类别填在相应的栏目内 (以下内容提及的栏目为现行纸质报销单的表单格式,所有的雅 培心血管部的同事都必须从2013年 1月1日全面使用CTE系统来做费用报销。纸质的费用报销申请在 2013年 1月1日将不再被接受。) For employee travel, each cost item should be entered into relevant column. a. 机票或火车票(I 列): 员 个人购买的机票或火车票,个人购买机票需提交特别申请单TE, 由部门经 理及财务总监特批后方可予以报销 Air-ticket or train ticket: Ticket purchased and paid by employee should be entered into Air-ticket or train ticket column. Airfare for personally purchased air ticket shall not be allowed to reimburse unless it’s in reasonable necessity. TE Special Case Application Form should be filled out in all required fields by providing the explanation, and obtain special approval from operational manager and AV China Finance Controller. b. 住宿(J列): 按天填写 Hotel: Hotel charge shall be entered on daily basis. c. 当地交通(K列): 注明发生原因,起始地和目的地 Local transportation: Taxi expense occurred during the trip. The purpose and journey departure & destination for taxi expense shall be clearly indicated on claim form. d. 个人餐费(L列): 按次填写 Meal-self: Cost occurred for self-meal. One line one meal, even there are several invoices for 1 meal. e. 其他(M列): 仅限于出差过程中发生的不属于上述类别的费用,如上网,洗衣等费用,按项目填写 Others: Cost occurred during the trip can’t be classified into the categories listed in ER form should be entered into this column. The charge shall be itemized in each line by each invoice and no combination and subtotal shall be allowed. Reasonable personal call during traveling is reimbursable. In general, a 10 -minute call home per night is considered reasonable. All calls/internet charge/business center charge occurred during traveling shall be categorized under Employee Travel. Company Confidential © 2011 Abbott 39

3 -C. 费用报告填报方法 Specific guideline for Expenses Report preparation 10. 非员 差旅费(N列),每个项目都填在此列,需附上批准后的内部策划表等其他要求的 文件,参见费用报告-非员 费用 For Non-employee travel, detail internal travel plan and supporting documents should be provided. 11. 员 聚餐或宴请客户需在附表“餐费及招待费明细表”中填写详细内容,包括日期、场所、 目的,参加者的全名、职务及供职机构/公司 If there is any cost occurred for Meals-in house group or Entertainment-customer attended, meals or entertainment form shall be filled in. Event date, venue, purpose, full name, title, and associated company/institution of attendees. 12. 国外出差可报销合理的小费 Employee oversea travel, tips will be reimbursed if reasonable in nature 13 未能取得或初次遗失发票的费用需填写特别事项申请表TE,得到部门经理和财务总监 的签字批准后方能予以报销。如再次遗失发票,则损失由员 个人承担。 Applicant should obtain official tax invoice or receipts for expenses claim. In case, tax invoice is unavailable or lost for first time, the employee must prepare an “TE Special Case Application Form” and get special approval from department manager and Finance Controller, attach it to the expense report. If lost invoice again, no more reimbursement. Company Confidential © 2011 Abbott 40

4. OEC政策例外事项申请及审批流程 Exceptional Case to OEC policies approval procedure OEC政策例外事项具体应如何申请?What if any exception to OEC policies? 在推广活动政策后有专门的政策例外申请表,如果有例外申请,必须填写该表,写清 具体申请事项和合理的理由,然后交由总经理和OEC签字审批。 Exception to OEC policy must be approved in advance. Exception requests (Appendix F to CN-OP-01 Policy on Promotional Practices-Sponsorships, Gifts, Meals and Hospitality) must be reviewed and approved by General Manager and OEC Director. 政策例外申请表见附件,或登陆AV公共盘获取,路径P: PublicAV policiesUpdated PoliciesOEC policiesPromotionForms The Exception Request Form as attached, it’s also available on AV public drive Company Confidential © 2011 Abbott 41

5. 遇到问题可以求助的资源 Helpful resources 向您的直线经理请示 Consult with your manager 向其他同事咨询 (包括OEC部门和财务部门同事) Consult with other colleagues, e. g. OEC officer and finance colleague 通过OEC网站 (雅培内部网站) http: //oec. web. abbott. com/international/ 点击 “Select Country”下拉框,点击相应的国家/地区名称,您就可以获相应国家/地区的 OEC政策文本。 Access OEC web-site 进入E-HR系统: http: //www. Abbott. HR. com Access E-HR system 点击页面的“员 自助”图标,进入一个新的页 点击此页面“OEC政策”图标,即可进入含有所有相关政策的页面 点击欲查询政策的名称,即可显示该政策的内容。 进入雅培中国心血管事业部公共盘: P: PublicAV policiesUpdated Policies ,进入 下设的各类文件的子文件夹内即可查找到您需要的政策文件 Access AV China public drive P: PublicAV policiesUpdated Policies Company Confidential © 2011 Abbott 42

The End Company Confidential © 2011 Abbott 43

8f71c1b70ad8e4764b996d8fee2b5e63.ppt