e5ab3af667e92da437389f201561a3fe.ppt

- Количество слайдов: 20

Automotive Industry and its Results in Hungary „Innovation in automotive industry in the Centrope region and in Hungary” INNO-AUTO 2012 8 th November 2012 Sára Font, Consultant – sara. font@hita. hu Department of Supplier Programs Investment Promotion Directorate Hungarian Investment and Trade Agency - HITA

Automotive Industry and its Results in Hungary „Innovation in automotive industry in the Centrope region and in Hungary” INNO-AUTO 2012 8 th November 2012 Sára Font, Consultant – sara. font@hita. hu Department of Supplier Programs Investment Promotion Directorate Hungarian Investment and Trade Agency - HITA

Hungary: Home of automotive investments • Audi in Győr produces engines for all brands in the VW Group. (The second largest engine production plant in the World. ) • Mercedes has picked Hungary as its first manufacturing facility outside Germany. • Suzuki has assembly line since 1992 in Esztergom. • GM’s Global Recognition Award went to the Hungarian plant, Szentgotthárd, in 2008.

Hungary: Home of automotive investments • Audi in Győr produces engines for all brands in the VW Group. (The second largest engine production plant in the World. ) • Mercedes has picked Hungary as its first manufacturing facility outside Germany. • Suzuki has assembly line since 1992 in Esztergom. • GM’s Global Recognition Award went to the Hungarian plant, Szentgotthárd, in 2008.

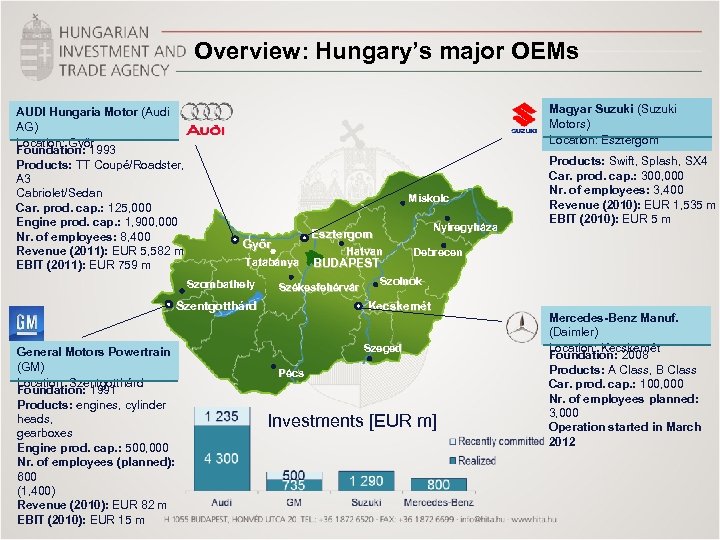

Overview: Hungary’s major OEMs AUDI Hungaria Motor (Audi AG) Location: Győr Foundation: 1993 Products: TT Coupé/Roadster, A 3 Cabriolet/Sedan Car. prod. cap. : 125, 000 Engine prod. cap. : 1, 900, 000 Nr. of employees: 8, 400 Revenue (2011): EUR 5, 582 m EBIT (2011): EUR 759 m Miskolc Győr Tatabánya Szombathely Hatvan BUDAPEST Székesfehérvár Szentgotthárd General Motors Powertrain (GM) Location: Szentgotthárd Foundation: 1991 Products: engines, cylinder heads, gearboxes Engine prod. cap. : 500, 000 Nr. of employees (planned): 600 (1, 400) Revenue (2010): EUR 82 m EBIT (2010): EUR 15 m Nyíregyháza Esztergom Magyar Suzuki (Suzuki Motors) Location: Esztergom Foundation: 1991 Products: Swift, Splash, SX 4 Car. prod. cap. : 300, 000 Nr. of employees: 3, 400 Revenue (2010): EUR 1, 535 m EBIT (2010): EUR 5 m Debrecen Szolnok Kecskemét Szeged Pécs Investments [EUR m] Mercedes-Benz Manuf. (Daimler) Location: Kecskemét Foundation: 2008 Products: A Class, B Class Car. prod. cap. : 100, 000 Nr. of employees planned: 3, 000 Operation started in March 2012

Overview: Hungary’s major OEMs AUDI Hungaria Motor (Audi AG) Location: Győr Foundation: 1993 Products: TT Coupé/Roadster, A 3 Cabriolet/Sedan Car. prod. cap. : 125, 000 Engine prod. cap. : 1, 900, 000 Nr. of employees: 8, 400 Revenue (2011): EUR 5, 582 m EBIT (2011): EUR 759 m Miskolc Győr Tatabánya Szombathely Hatvan BUDAPEST Székesfehérvár Szentgotthárd General Motors Powertrain (GM) Location: Szentgotthárd Foundation: 1991 Products: engines, cylinder heads, gearboxes Engine prod. cap. : 500, 000 Nr. of employees (planned): 600 (1, 400) Revenue (2010): EUR 82 m EBIT (2010): EUR 15 m Nyíregyháza Esztergom Magyar Suzuki (Suzuki Motors) Location: Esztergom Foundation: 1991 Products: Swift, Splash, SX 4 Car. prod. cap. : 300, 000 Nr. of employees: 3, 400 Revenue (2010): EUR 1, 535 m EBIT (2010): EUR 5 m Debrecen Szolnok Kecskemét Szeged Pécs Investments [EUR m] Mercedes-Benz Manuf. (Daimler) Location: Kecskemét Foundation: 2008 Products: A Class, B Class Car. prod. cap. : 100, 000 Nr. of employees planned: 3, 000 Operation started in March 2012

Facts and figures • Production value : 19. 4% of total industrial production (€ 15. 9 bn) • Automotive industry gives 20% of Hungary’s total exports (€ 80 bn in 2011 ) • • Main export market: EU (75 %) No. of companies: cca. 600 No. of employees: cca. 100, 000 Average gross salary: 794 EUR/month Source: Hungarian Central Statistical Office, AHAI

Facts and figures • Production value : 19. 4% of total industrial production (€ 15. 9 bn) • Automotive industry gives 20% of Hungary’s total exports (€ 80 bn in 2011 ) • • Main export market: EU (75 %) No. of companies: cca. 600 No. of employees: cca. 100, 000 Average gross salary: 794 EUR/month Source: Hungarian Central Statistical Office, AHAI

Top reasons for Hungary I. • • Central location At the cross roads of 4 main European transportation corridors - I deal logistical center for the automotive industry (More than 90% of Hungary’s automotive production goes for export) Cost efficiency Competitive wages and labor cost/value ratio in European comparison in the CEE region. Tradition of innovation Long and successful tradition of cooperation between the universities and the producers in R&D. Long-term planning According to the sectorial estimations from 2013 400 000 passenger cars will be manufactured in Hungary.

Top reasons for Hungary I. • • Central location At the cross roads of 4 main European transportation corridors - I deal logistical center for the automotive industry (More than 90% of Hungary’s automotive production goes for export) Cost efficiency Competitive wages and labor cost/value ratio in European comparison in the CEE region. Tradition of innovation Long and successful tradition of cooperation between the universities and the producers in R&D. Long-term planning According to the sectorial estimations from 2013 400 000 passenger cars will be manufactured in Hungary.

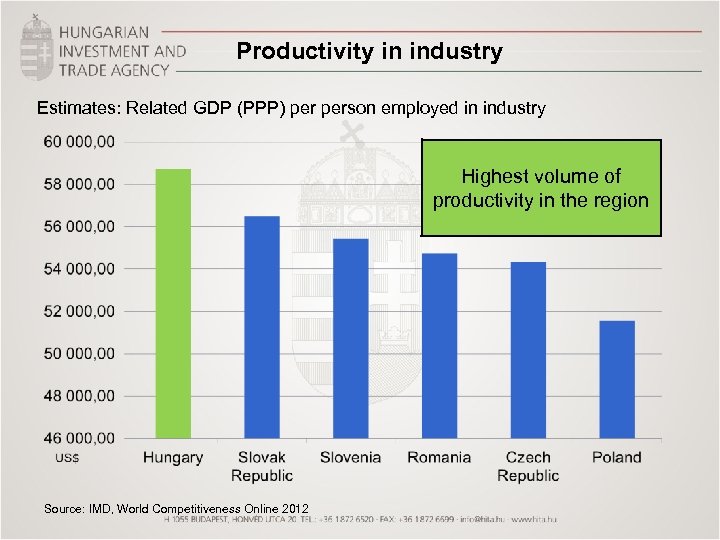

Productivity in industry Estimates: Related GDP (PPP) person employed in industry Highest volume of productivity in the region Source: IMD, World Competitiveness Online 2012

Productivity in industry Estimates: Related GDP (PPP) person employed in industry Highest volume of productivity in the region Source: IMD, World Competitiveness Online 2012

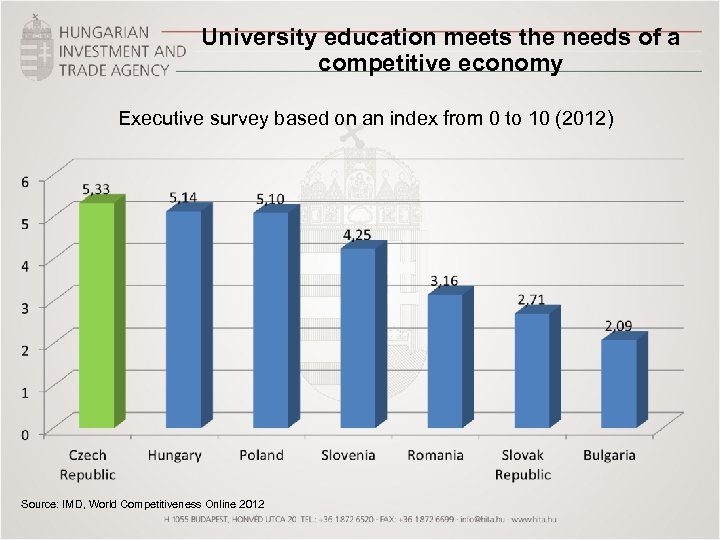

University education meets the needs of a competitive economy Executive survey based on an index from 0 to 10 (2012) Source: IMD, World Competitiveness Online 2012

University education meets the needs of a competitive economy Executive survey based on an index from 0 to 10 (2012) Source: IMD, World Competitiveness Online 2012

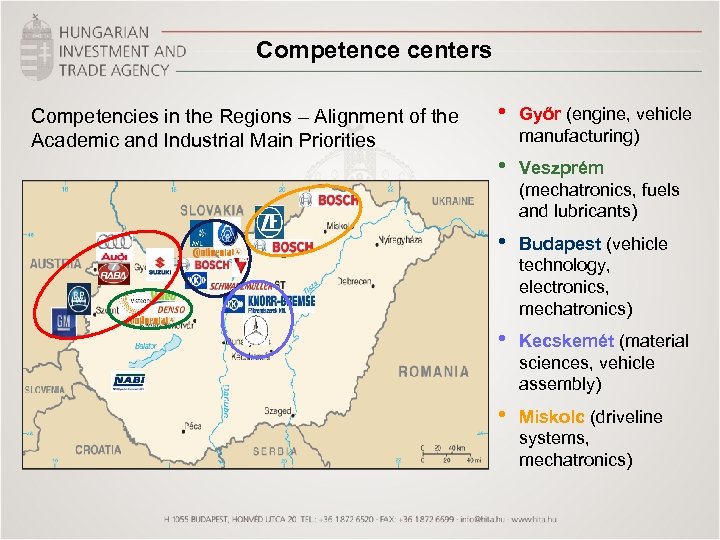

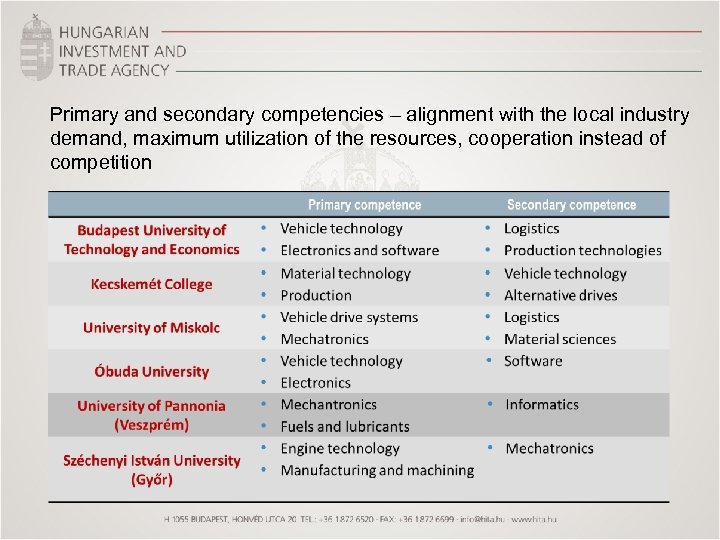

Competence centers Competencies in the Regions – Alignment of the Academic and Industrial Main Priorities • Győr (engine, vehicle manufacturing) • Veszprém (mechatronics, fuels and lubricants) • Budapest (vehicle technology, electronics, mechatronics) • Kecskemét (material sciences, vehicle assembly) • Miskolc (driveline systems, mechatronics)

Competence centers Competencies in the Regions – Alignment of the Academic and Industrial Main Priorities • Győr (engine, vehicle manufacturing) • Veszprém (mechatronics, fuels and lubricants) • Budapest (vehicle technology, electronics, mechatronics) • Kecskemét (material sciences, vehicle assembly) • Miskolc (driveline systems, mechatronics)

Primary and secondary competencies – alignment with the local industry demand, maximum utilization of the resources, cooperation instead of competition

Primary and secondary competencies – alignment with the local industry demand, maximum utilization of the resources, cooperation instead of competition

Top reasons for Hungary II. Strong supplier base: • Over 600 companies in the automotive sector • 12 of the 15 leading Tier 1 company settled down in Hungary • Hungarian automotive suppliers have several years of experience supplying OEMs & Tier 1 s • Strong governmental supplier development activity • Extended vertical and horizontal supplier connections

Top reasons for Hungary II. Strong supplier base: • Over 600 companies in the automotive sector • 12 of the 15 leading Tier 1 company settled down in Hungary • Hungarian automotive suppliers have several years of experience supplying OEMs & Tier 1 s • Strong governmental supplier development activity • Extended vertical and horizontal supplier connections

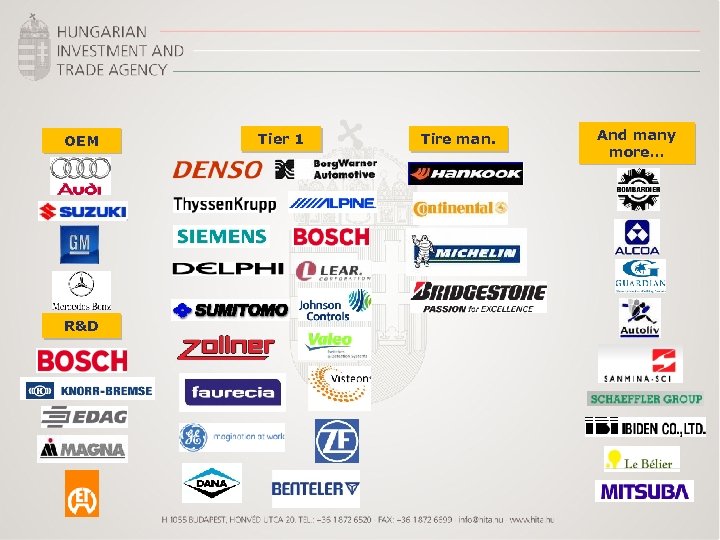

OEM R&D Tier 1 Tire man. And many more…

OEM R&D Tier 1 Tire man. And many more…

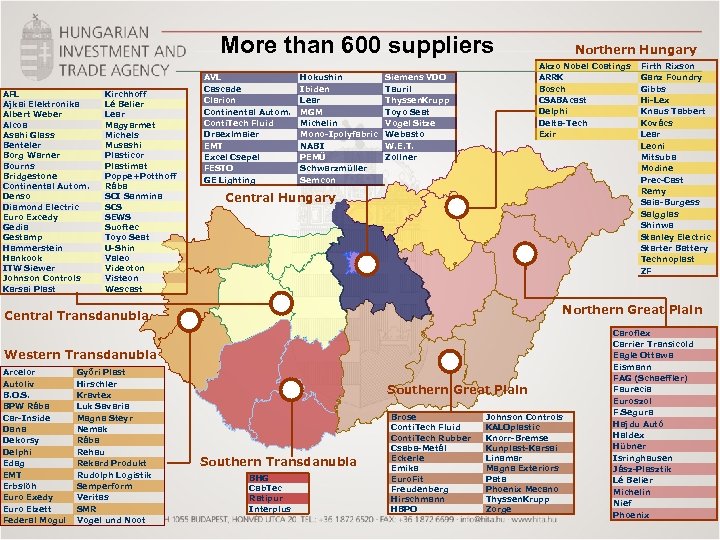

More than 600 suppliers AFL Ajkai Elektronika Albert Weber Alcoa Asahi Glass Benteler Borg Warner Bourns Bridgestone Continental Autom. Denso Diamond Electric Euro Excedy Gedia Gestamp Hammerstein Hankook ITW Siewer Johnson Controls Karsai Plast Kirchhoff Lé Belier Lear Magyarmet Michels Musashi Plasticor Plastimat Poppe+Potthoff Rába SCI Sanmina SCS SEWS Suoftec Toyo Seat U-Shin Valeo Videoton Visteon Wescast AVL Cascade Clarion Continental Autom. Conti. Tech Fluid Draexlmaier EMT Excel Csepel FESTO GE Lighting Hokushin Ibiden Lear MGM Michelin Mono-Ipolyfabric NABI PEMÜ Schwarzmüller Semcon Northern Hungary Akzo Nobel Coatings ARRK Bosch CSABAcast Delphi Delta-Tech Exir Siemens VDO Tauril Thyssen. Krupp Toyo Seat Vogel Sitze Webasto W. E. T. Zollner Central Hungary Northern Great Plain Central Transdanubia Western Transdanubia Arcelor Autoliv B. O. S. BPW Rába Car-Inside Dana Dekorsy Delphi Edag EMT Erbslöh Euro Exedy Euro Elzett Federal Mogul Győri Plast Hirschler Kravtex Luk Savaria Magna Steyr Nemak Rába Rehau Rekard Produkt Rudolph Logistik Semperform Veritas SMR Vogel und Noot Firth Rixson Ganz Foundry Gibbs Hi-Lex Knaus Tabbert Kovács Lear Leoni Mitsuba Modine Prec-Cast Remy Saia-Burgess Salgglas Shinwa Stanley Electric Starter Battery Technoplast ZF Southern Great Plain Southern Transdanubia BHG Cab. Tec Ratipur Interplus Brose Conti. Tech Fluid Conti. Tech Rubber Csaba-Metál Eckerle Emika Euro. Fit Freudenberg Hirschmann HBPO Johnson Controls KALOplastic Knorr-Bremse Kunplast-Karsai Linamar Magna Exteriors Pata Phoenix Mecano Thyssen. Krupp Zorge Caroflex Carrier Transicold Eagle Ottawa Eismann FAG (Schaeffler) Faurecia Euroszol F. Segura Hajdu Autó Haldex Hübner Isringhausen Jász-Plasztik Lé Belier Michelin Nief Phoenix

More than 600 suppliers AFL Ajkai Elektronika Albert Weber Alcoa Asahi Glass Benteler Borg Warner Bourns Bridgestone Continental Autom. Denso Diamond Electric Euro Excedy Gedia Gestamp Hammerstein Hankook ITW Siewer Johnson Controls Karsai Plast Kirchhoff Lé Belier Lear Magyarmet Michels Musashi Plasticor Plastimat Poppe+Potthoff Rába SCI Sanmina SCS SEWS Suoftec Toyo Seat U-Shin Valeo Videoton Visteon Wescast AVL Cascade Clarion Continental Autom. Conti. Tech Fluid Draexlmaier EMT Excel Csepel FESTO GE Lighting Hokushin Ibiden Lear MGM Michelin Mono-Ipolyfabric NABI PEMÜ Schwarzmüller Semcon Northern Hungary Akzo Nobel Coatings ARRK Bosch CSABAcast Delphi Delta-Tech Exir Siemens VDO Tauril Thyssen. Krupp Toyo Seat Vogel Sitze Webasto W. E. T. Zollner Central Hungary Northern Great Plain Central Transdanubia Western Transdanubia Arcelor Autoliv B. O. S. BPW Rába Car-Inside Dana Dekorsy Delphi Edag EMT Erbslöh Euro Exedy Euro Elzett Federal Mogul Győri Plast Hirschler Kravtex Luk Savaria Magna Steyr Nemak Rába Rehau Rekard Produkt Rudolph Logistik Semperform Veritas SMR Vogel und Noot Firth Rixson Ganz Foundry Gibbs Hi-Lex Knaus Tabbert Kovács Lear Leoni Mitsuba Modine Prec-Cast Remy Saia-Burgess Salgglas Shinwa Stanley Electric Starter Battery Technoplast ZF Southern Great Plain Southern Transdanubia BHG Cab. Tec Ratipur Interplus Brose Conti. Tech Fluid Conti. Tech Rubber Csaba-Metál Eckerle Emika Euro. Fit Freudenberg Hirschmann HBPO Johnson Controls KALOplastic Knorr-Bremse Kunplast-Karsai Linamar Magna Exteriors Pata Phoenix Mecano Thyssen. Krupp Zorge Caroflex Carrier Transicold Eagle Ottawa Eismann FAG (Schaeffler) Faurecia Euroszol F. Segura Hajdu Autó Haldex Hübner Isringhausen Jász-Plasztik Lé Belier Michelin Nief Phoenix

Ernst & Young’s 2012 European attractiveness survey Europe's future attractiveness Excellence, clustering and market dominance can combat industrial outflow. Europe’s manufacturing strength can be seen in Germany, Hungary and Poland where large automotive companies are expanding operations’. Some CEE countries and regions, including Poland, Hungary, the Czech Republic and the Baltic states, continue to attract good FDI inflows from investors seeking relatively favorable labor costs and skills availability to maximize returns’.

Ernst & Young’s 2012 European attractiveness survey Europe's future attractiveness Excellence, clustering and market dominance can combat industrial outflow. Europe’s manufacturing strength can be seen in Germany, Hungary and Poland where large automotive companies are expanding operations’. Some CEE countries and regions, including Poland, Hungary, the Czech Republic and the Baltic states, continue to attract good FDI inflows from investors seeking relatively favorable labor costs and skills availability to maximize returns’.

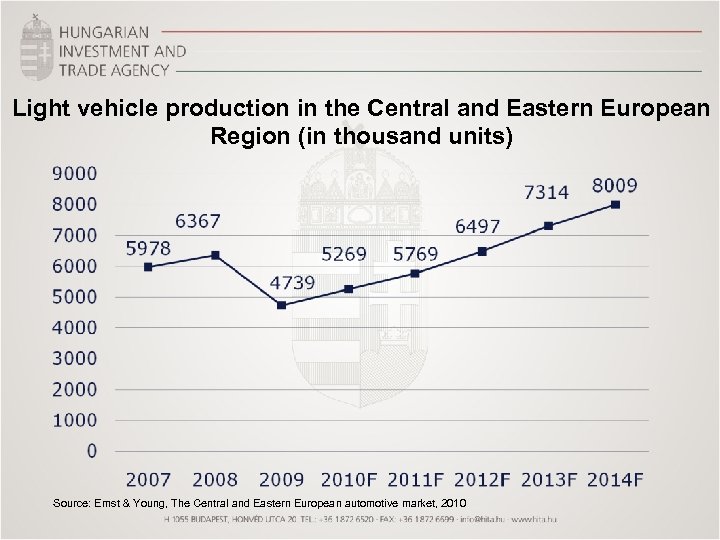

Light vehicle production in the Central and Eastern European Region (in thousand units) Source: Ernst & Young, The Central and Eastern European automotive market, 2010

Light vehicle production in the Central and Eastern European Region (in thousand units) Source: Ernst & Young, The Central and Eastern European automotive market, 2010

About the Hungarian Investment and Trade Agency - HITA • Founded by the Hungarian Government in 2011, in order to assist in achieving its external economic policy goals • The supervising body of HITA is the Ministry for National Economy • 150 employees, mainly consultants on sectorial basis Main tasks are: • promote and facilitate foreign investments • develope international trade • help the SMEs to enter in to multinational companies’ supply chain • develope the EU integration-oriented SMEs

About the Hungarian Investment and Trade Agency - HITA • Founded by the Hungarian Government in 2011, in order to assist in achieving its external economic policy goals • The supervising body of HITA is the Ministry for National Economy • 150 employees, mainly consultants on sectorial basis Main tasks are: • promote and facilitate foreign investments • develope international trade • help the SMEs to enter in to multinational companies’ supply chain • develope the EU integration-oriented SMEs

Our services for successful investments Pre-decision ü ü ü Tailored and comprehensive information packages on the economy, financial incentives, business environment, tax Assistance in location search and evaluation, site visits organized Partner meetings organized Ramp-up ü ü ü Project partner and project financing advisory Supplying information on permitting procedures Assistance in applications for incentives Operations ü ü Expansion assistance Advocacy to improve the business climate

Our services for successful investments Pre-decision ü ü ü Tailored and comprehensive information packages on the economy, financial incentives, business environment, tax Assistance in location search and evaluation, site visits organized Partner meetings organized Ramp-up ü ü ü Project partner and project financing advisory Supplying information on permitting procedures Assistance in applications for incentives Operations ü ü Expansion assistance Advocacy to improve the business climate

Our services for successful investments: Incentives Services of the Incentives Department: • EU co-financed tenders • Subsidy based on individual government decision • Development tax allowance • Job creation subsidies – 2 options • Training subsidy

Our services for successful investments: Incentives Services of the Incentives Department: • EU co-financed tenders • Subsidy based on individual government decision • Development tax allowance • Job creation subsidies – 2 options • Training subsidy

Our services for succesfull investments: Supplier Department (I. ) • Regular personal meetings with management for setting up and reviewing supply strategy and project plan • Longlisting business contacts about possible Hungarian suppliers • Parametering the possible Hungarian suppliers • Prefiltering business contacts for the OEMs • Shortlist business contacts to maximize the chance of the successful cooperation

Our services for succesfull investments: Supplier Department (I. ) • Regular personal meetings with management for setting up and reviewing supply strategy and project plan • Longlisting business contacts about possible Hungarian suppliers • Parametering the possible Hungarian suppliers • Prefiltering business contacts for the OEMs • Shortlist business contacts to maximize the chance of the successful cooperation

Our services for succesfull investments: Supplier Department (II. ) • Match-making between the OEM and the suppliers • Business seminar, Conference, Supplier Day, Shows & Exhibitions • On request establishing business relationship • On request consultancy with other governmental organs • Follow-up meetings • Building interactive supplier database and e-market service

Our services for succesfull investments: Supplier Department (II. ) • Match-making between the OEM and the suppliers • Business seminar, Conference, Supplier Day, Shows & Exhibitions • On request establishing business relationship • On request consultancy with other governmental organs • Follow-up meetings • Building interactive supplier database and e-market service

Thank you for your attention! Contact us: www. hita. hu E-mail: investment@hita. hu Phone: +36 1 872 -6520

Thank you for your attention! Contact us: www. hita. hu E-mail: investment@hita. hu Phone: +36 1 872 -6520