98e15652a4d1eb7d0cf7f3016955a797.ppt

- Количество слайдов: 23

Automated Negotiation and Bundling of Information Goods Koye Somefun, Enrico Gerding, and Han La Poutré Center for Mathematics and Computer Science (CWI) Amsterdam, The Netherlands

Outline talk • Describe the system • Negotiate about subscription fee • Agent system • Customer and shop agent • Bilateral bargaining • Multi-issue bargaining • Pareto-search method • results

Overview System • Sell subscriptions through negotiation èHigh degree of flexibility • Automated by autonomous agents èDelegate time consuming process • Application: Financial News • Broadly applicable (e. g. , software, music, and video clips)

Setting System • Monopolistic setting: one seller many customers • Subscriptions for short periods, e. g. 1 day: • Micro-payment • Learning • Changing preferences

Subscription Terms of subscription specify: • News categories, e. g. , banks, ICT, telecommunication • Fixed price or subscription fee • Variable price: purchase of single additional news items

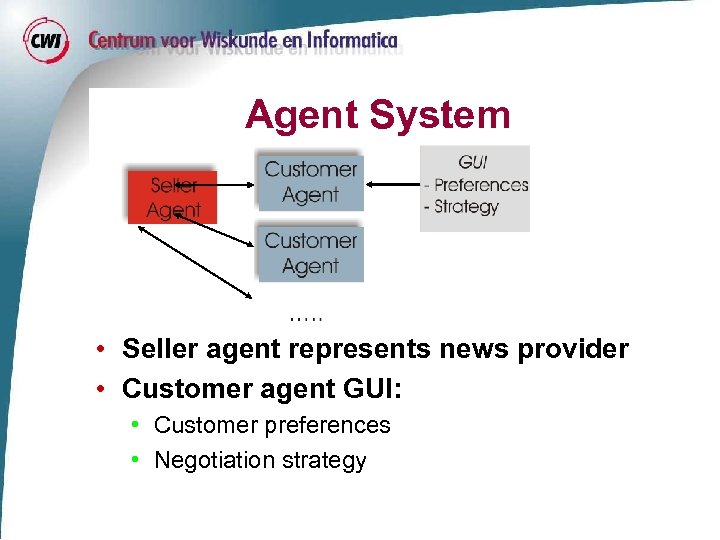

Agent System • Seller agent represents news provider • Customer agent GUI: • Customer preferences • Negotiation strategy

Customer Preferences • Select the news categories • Utility function is Uc=bmax-(pf+pv· c) • • Bmax is maximum budget pf is fixed price pv is variable price and c is the customer’s estimation of the articles read (for the specified news categories) • Customer specifies bmax and c • Agent will negotiate pf and pv

Seller Agent • Maximize expected utility: Us=pf+pv· s(pv) • pf is fixed price, • pv is variable price, and • s(pv) is the shop’s estimation of the articles read • Shop specifies s(pv): • assume the higher pv the lower s (law of demand) • Shop could use average customer behavior data to predict s(pv) • Agent will negotiate pf and pv

Bilateral Bargaining Process

Bilateral Bargaining Process

Bilateral Bargaining Process

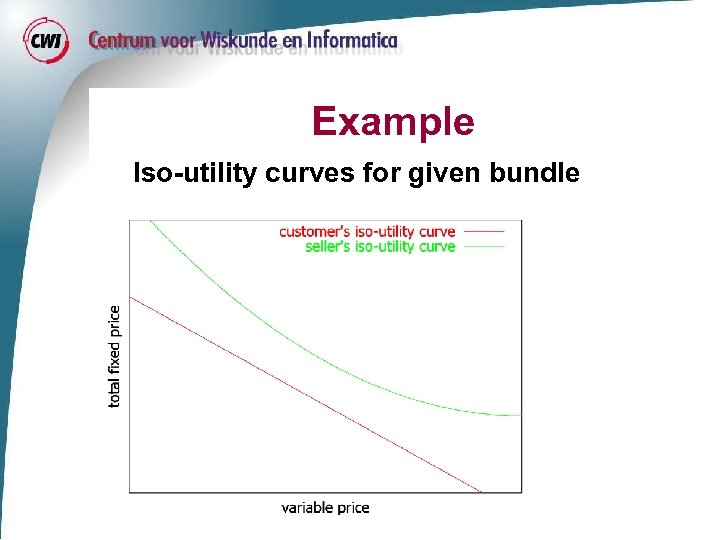

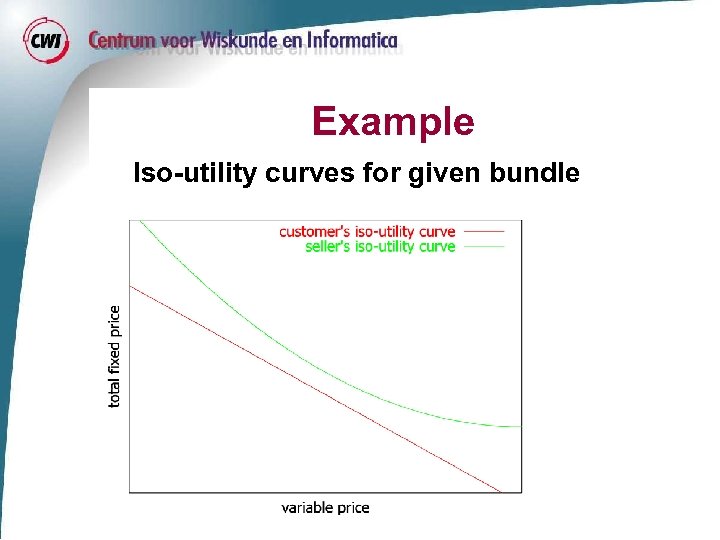

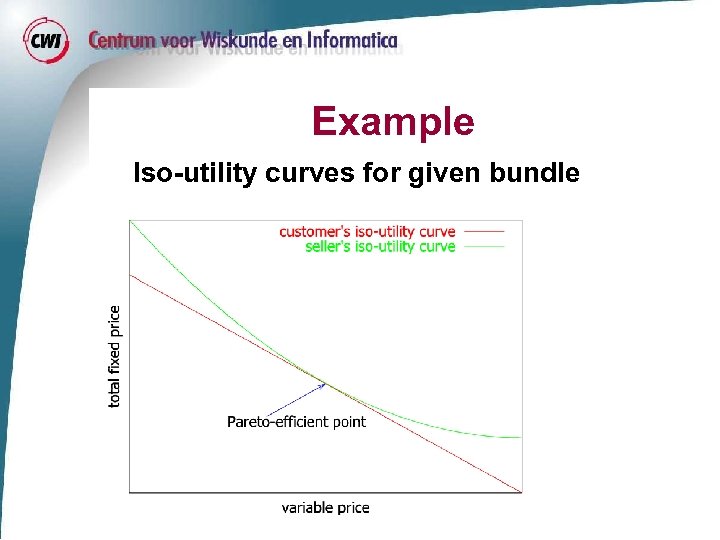

Multi-Issue Bilateral Bargaining • Issues fixed and variable price (pf, pv) • Competitive aspect: `tug-of-war’ • Aspiration level at time t èConcession Strategy • Cooperative, multi-issue aspect • Find Pareto-efficient outcomes • Beneficial for seller and consumer(win-win) èPareto-search Strategy • We develop techniques for the multiissue aspect

Example Iso-utility curves for given bundle

Example Iso-utility curves for given bundle

Example Iso-utility curves for given bundle

Example Iso-utility curves for given bundle

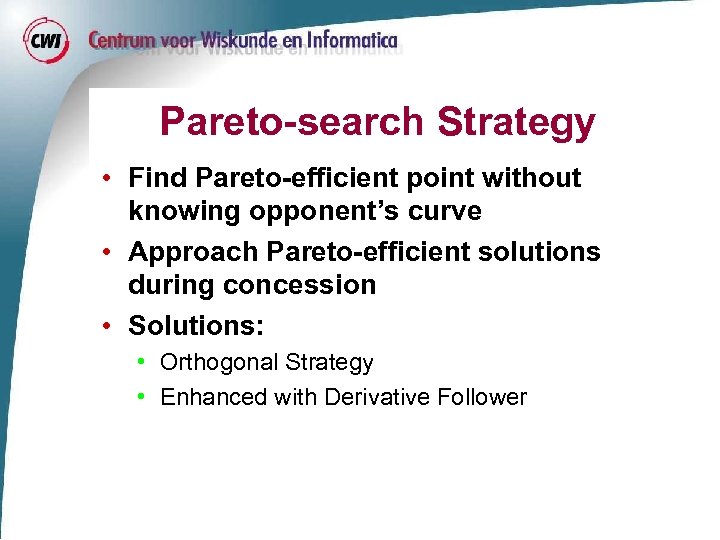

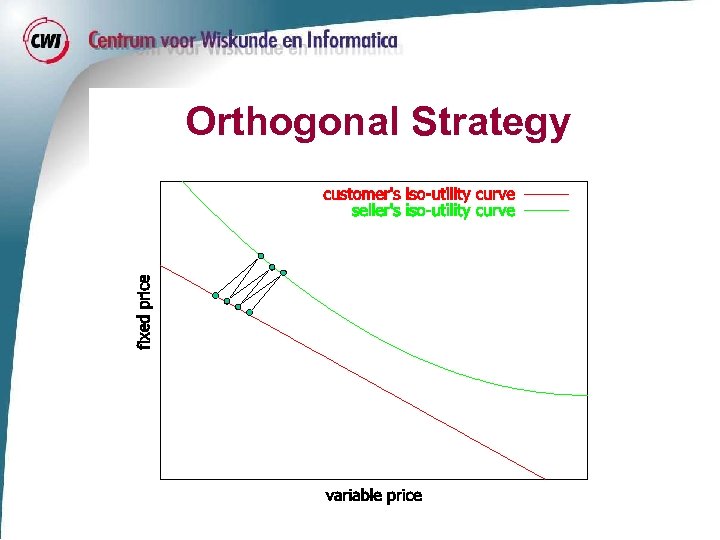

Pareto-search Strategy • Find Pareto-efficient point without knowing opponent’s curve • Approach Pareto-efficient solutions during concession • Solutions: • Orthogonal Strategy • Enhanced with Derivative Follower

Orthogonal Strategy

Derivative Follower Extension Distance 1 Distance 2 < Distance 1? Increase step-size Distance 2

Derivative Follower Extension Distance 1 Distance k > Distance k-1? decrease step-size and turn Distance 2 Distance k-1 Distance k

Computational Experiments • Evaluate efficiency and robustness of the Pareto-search strategies • Seller agent: • Convex preferences • Concession strategy with fixed concession • Customer agent • Linear preferences • Hardhead, Fixed, Fraction, Tit-for-tat • Compare to random search strategy

Results Concession Strategy Pareto-distance (random) Pareto-distance (orthogonal/DF) Pareto-distance (+DF/+DF) Hardhead 18. 92 8. 03 18. 63 Fixed (20) 26. 52 10. 43 28. 82 Fixed (40) 38. 91 16. 21 44. 29 Fixed (80) 42. 12 25. 61 48. 84 Fraction (0. 025) 30. 26 10. 07 32. 25 Fraction (0. 05) 31. 53 11. 52 28. 52 Fraction (0. 1) 37. 81 16. 91 26. 28 Tit-for-tat 72. 78 59. 60 56. 64

Conclusion • Agent system for selling information bundles through automated negotiation • Orthogonal Strategy enhanced with Derivative Follower for approaching Pareto efficiency • Works well for different concession strategies and preferences Questions?

98e15652a4d1eb7d0cf7f3016955a797.ppt