11a57e3d46f465a31e42cff00ab70f5f.ppt

- Количество слайдов: 29

Automated Collection System (ACS) October 2010

ACS Mission It is the mission of ACS to collect delinquent taxes and returns through the fair and equitable application of the tax laws, including the use of enforcement tools when appropriate, and provide education to customers to ensure future compliance. October 2010 2

What Is ACS? ACS is a computerized system that maintains: n n Taxpayer Delinquent Account (TDA) - Balancedue accounts; and Taxpayer Delinquent Investigation (TDI) - Return delinquency investigations. October 2010 3

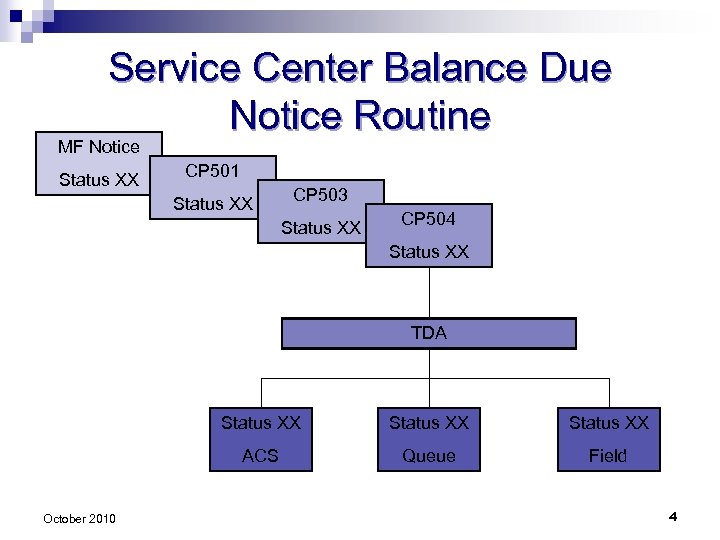

Service Center Balance Due Notice Routine MF Notice Status XX CP 501 Status XX CP 503 Status XX CP 504 Status XX TDA Status XX ACS October 2010 Status XX Queue Field 4

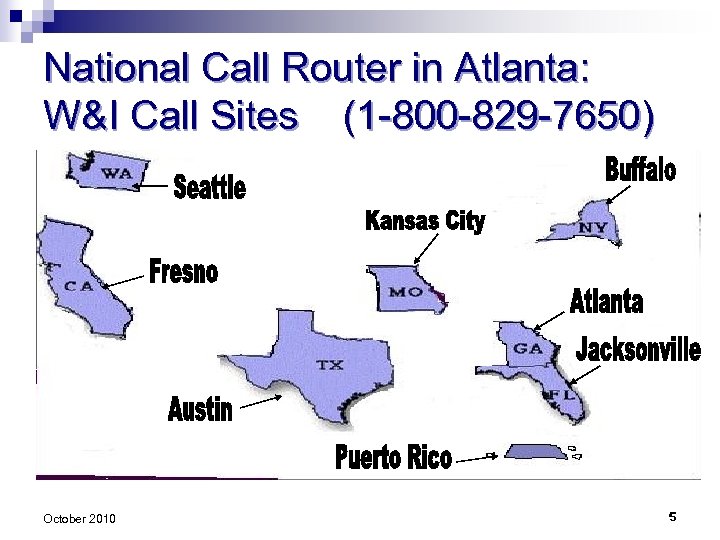

National Call Router in Atlanta: W&I Call Sites (1 -800 -829 -7650) October 2010 5

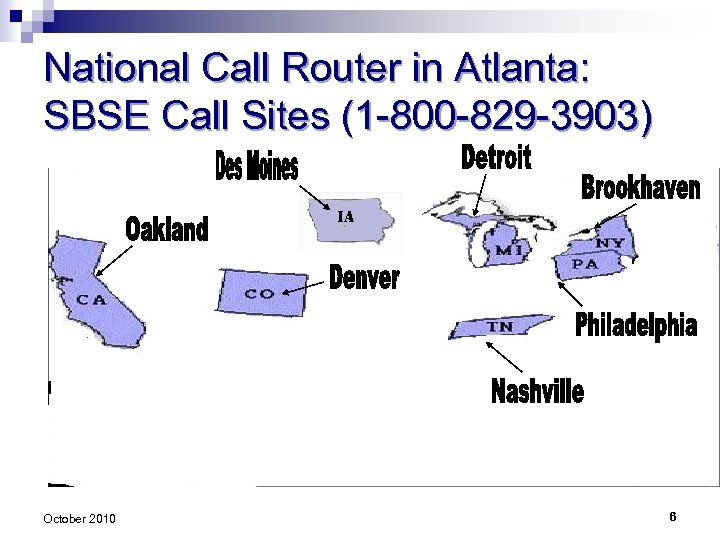

National Call Router in Atlanta: SBSE Call Sites (1 -800 -829 -3903) IA October 2010 6

Predictive Dialer n n The Predictive Dialer system calls the taxpayer’s or representative’s number(s). If someone answers, the call is transferred to the next available agent in the Buffalo NY callsite. If the call is picked up via voicemail, a message is left for a callback. October 2010 7

ACS Support Sites Two ACS Support Sites handle all correspondence (paper) generated by the W & I ACS Call Sites. Austin’s support site is Fresno. The other site is Kansas City. October 2010 8

ACS Actions n n Issues ¨ Letters ¨ Levies ¨ Liens History Codes Scheduled follow-up dates Documented case comments October 2010 9

Notification n We are required by law to notify taxpayers in writing at least annually about balance due accounts October 2010 10

Enforcement Actions ACS employees issue two types of enforcement actions: n Notice of Levy n Notice of Federal Tax Lien October 2010 11

Required Notices Before a property can be levied, the taxpayer must be sent certain notices: n Notice and Demand (CP 501) n Notification of Third Party Contact n Notice of Intention to Levy and Notice of Taxpayer’s Right to a Due Process (CDP) Hearing (LT 11) October 2010 12

Automated Levy Program (ALPs) n State Income Tax Levy Program (SITLP) n Federal Payment Levy Program (FPLP) n Alaska Permanent Fund Dividend Program (AKPFD) October 2010 13

FPLP ¨ OPM retirement income ¨ Miscellaneous vendor payments ¨ Travel advances and reimbursements ¨ Federal salaries ¨ Social Security Administration (SSA) benefits (not Supplemental Security Income—SSI) ¨ Federal contractor/vendor payments October 2010 14

Notice of Federal Tax Lien (NFTL) n Document filed in accordance with state law to make the liability public, and to protect the government’s interest. n A claim on an individual’s property for payment or satisfaction of a debt, obligation, or duty. October 2010 15

Lien Requirements n A Federal Tax Lien is created when: ¨ Assessment is made ¨ Demand for payment has been made ¨ Taxpayer has neglected or refused to pay (within 10 days) October 2010 16

Required Lien Filing Case closures: n n n October 2010 Installment Agreements Currently Not Collectible ¨ Unable to Contact ¨ Unable to Locate ¨ Hardship Reassignments to the Queue 17

Appeals n Collection Due Process (CDP) n Collection Appeals Program (CAP) October 2010 18

Payment Options n n October 2010 Full payment today Full payment within 60 days Borrow Assets 19

Payment Options cont. n October 2010 Installment Agreement (IA) ¨ Streamlined IA ¨ Regular IA ¨ Partial Pay IA (PPIA) 20

Payment Options cont. n Currently Not Collectible (CNC) n Offer In Compromise October 2010 21

Installment Agreement Payment Options n n n Direct Debit Payroll Deduction Credit Card Electronic Federal Tax Payment System (EFTPS) Pay by Check or Money Order October 2010 22

Information Requested for Financial Statement n n October 2010 Recent Pay Stubs Assets ¨ Cash ¨ Real Property ¨ Personal Property 23

Information Requested for Financial Statement cont. n n n n Housing & Utility Cost Operating Cost on Vehicles Medical Expenses Life Insurance Payroll Deductions Child Care Child Support Other Monthly Obligations - Union Dues, Court Ordered Payments, Etc… October 2010 24

Financial Analysis n n n Determine maximum ability to pay Equity in assets Debt satisfaction Substantiation National and Local standards October 2010 25

National Standards n Food, Clothing and Other Items ¨ Food ¨ Clothing ¨ Housekeeping Supplies ¨ Personal Care Products ¨ Miscellaneous n October 2010 Out-of-Pocket Health Care Expenses 26

Local Standards n n October 2010 Housing and Utilities Transportation ¨ Ownership ¨ Operating Costs ¨ Public Transportation 27

Levy Releases n n Account Resolution – Determined by the facts of the case. Creating Hardship ¨ Financial Statement ¨ Foreclosure ¨ Eviction ¨ Repossession October 2010 28

Levy Releases cont. n n Managerial Approval: ¨ Regular IA ¨ CNC ¨ PPIA If Levy Released: ¨ Fax to Employer – if Fax # provided ¨ Mail Copy to Taxpayer, Bank, and/or Employer October 2010 29

11a57e3d46f465a31e42cff00ab70f5f.ppt