62025f6516678f1abc5d75cbc40005ee.ppt

- Количество слайдов: 29

ATP Oil & Gas Corporation ATP Oil & Gas Friedland Capital’s Oil, Gas, and Energy Luncheon London January 16, 2003 NASDAQ: ATPG ATP Oil & Gas Corporation

ATP Oil & Gas Corporation ATP Oil & Gas Friedland Capital’s Oil, Gas, and Energy Luncheon London January 16, 2003 NASDAQ: ATPG ATP Oil & Gas Corporation

Forward-looking Statement This presentation contains projections and other forward looking statements within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934. These projections and statements reflect the Company’s current view with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. A discussion of these factors is included in the Company documents filed with the Securities and Exchange Commission. This presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy or an attempt to influence any voting of securities, by any person. ATP Oil & Gas Corporation

Forward-looking Statement This presentation contains projections and other forward looking statements within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934. These projections and statements reflect the Company’s current view with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. A discussion of these factors is included in the Company documents filed with the Securities and Exchange Commission. This presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy or an attempt to influence any voting of securities, by any person. ATP Oil & Gas Corporation

Company Overview Ø Development and production company Ø Offshore solution provider for exploration oriented majors and independents Ø Unique, repeatable strategy SMI 189/190 ATP Oil & Gas Corporation

Company Overview Ø Development and production company Ø Offshore solution provider for exploration oriented majors and independents Ø Unique, repeatable strategy SMI 189/190 ATP Oil & Gas Corporation

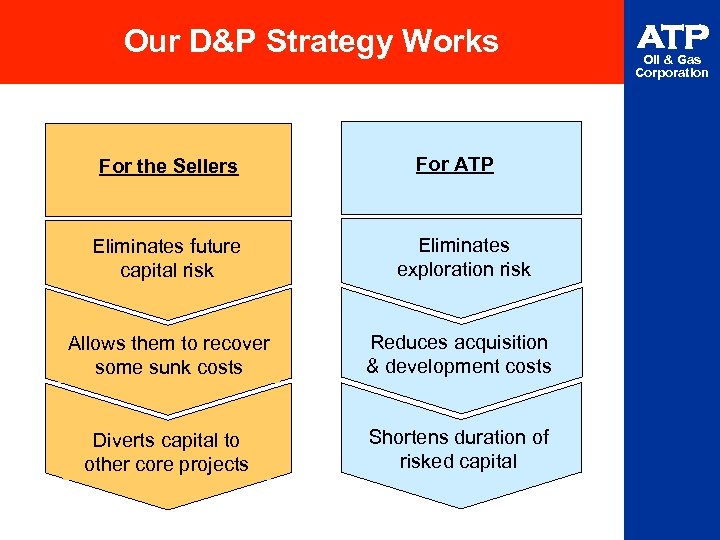

Our D&P Strategy Works For the Sellers For ATP Eliminates future capital risk Eliminates exploration risk Allows them to recover some sunk costs Reduces acquisition & development costs Diverts capital to other core projects Shortens duration of risked capital ATP Oil & Gas Corporation

Our D&P Strategy Works For the Sellers For ATP Eliminates future capital risk Eliminates exploration risk Allows them to recover some sunk costs Reduces acquisition & development costs Diverts capital to other core projects Shortens duration of risked capital ATP Oil & Gas Corporation

ATP Area of Operations Oil & Gas Corporation Over 50 blocks in Gulf of Mexico 7 blocks in North Sea 5

ATP Area of Operations Oil & Gas Corporation Over 50 blocks in Gulf of Mexico 7 blocks in North Sea 5

ATP Company Profile 3 -year reserve replacement: 3 -year F&D costs: Oil & Gas Corporation 374% $0. 96/Mcfe

ATP Company Profile 3 -year reserve replacement: 3 -year F&D costs: Oil & Gas Corporation 374% $0. 96/Mcfe

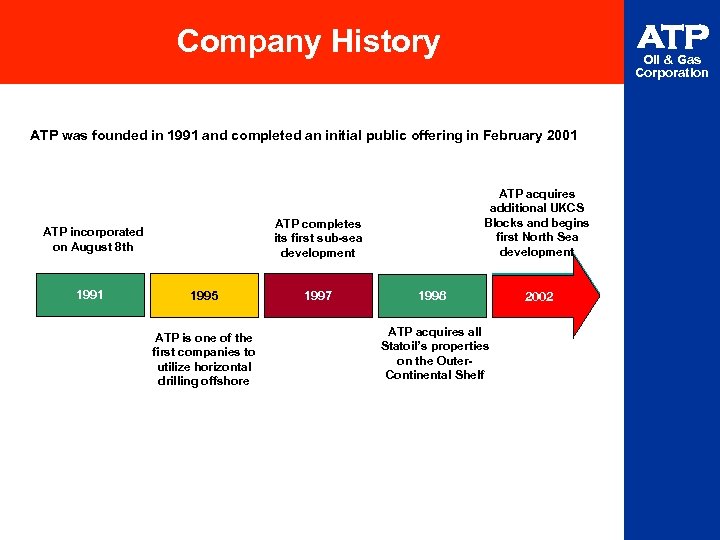

ATP Company History Oil & Gas Corporation ATP was founded in 1991 and completed an initial public offering in February 2001 ATP completes its first sub-sea development ATP incorporated on August 8 th 1991 ATP acquires additional UKCS Blocks and begins first North Sea development 1995 ATP is one of the first companies to utilize horizontal drilling offshore 1997 1998 ATP acquires all Statoil’s properties on the Outer. Continental Shelf 2002

ATP Company History Oil & Gas Corporation ATP was founded in 1991 and completed an initial public offering in February 2001 ATP completes its first sub-sea development ATP incorporated on August 8 th 1991 ATP acquires additional UKCS Blocks and begins first North Sea development 1995 ATP is one of the first companies to utilize horizontal drilling offshore 1997 1998 ATP acquires all Statoil’s properties on the Outer. Continental Shelf 2002

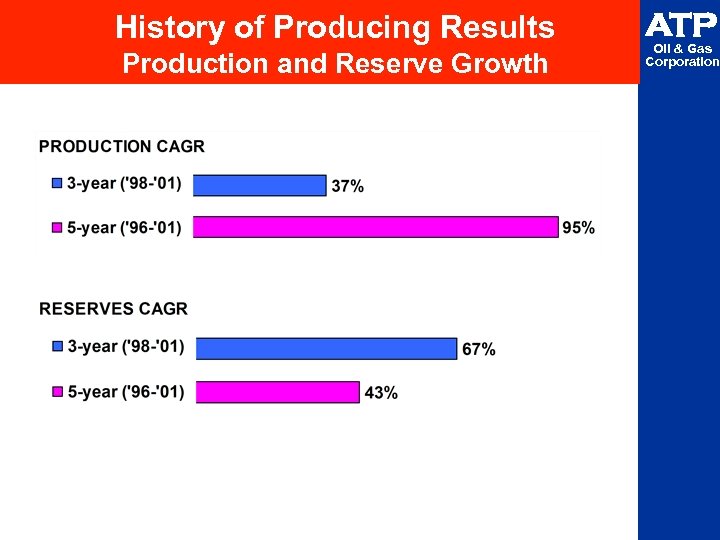

History of Producing Results Production and Reserve Growth ATP Oil & Gas Corporation

History of Producing Results Production and Reserve Growth ATP Oil & Gas Corporation

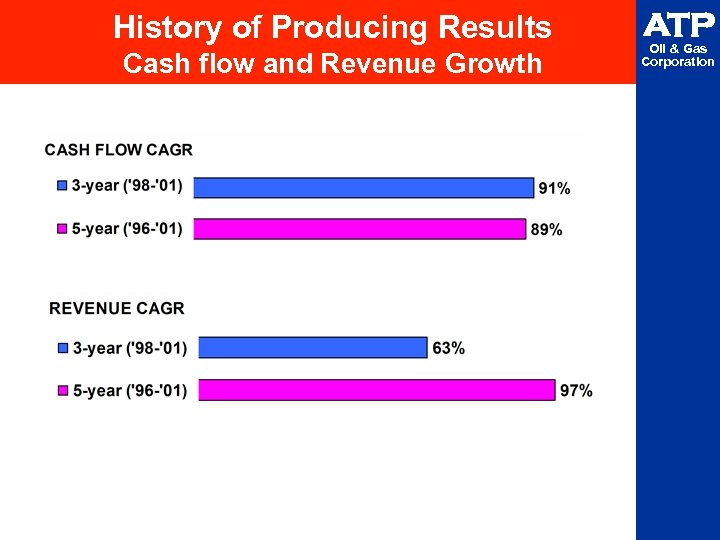

History of Producing Results Cash flow and Revenue Growth ATP Oil & Gas Corporation

History of Producing Results Cash flow and Revenue Growth ATP Oil & Gas Corporation

Focus in 2002 Increasing financial flexibility Ø Reduced bank debt $14 million in 2002 Ø Increased working capital $30 million in 2002 Ø Overall capital liquidity improvement $44 million Meeting operating goals Ø Beat first, second, and third quarter production guidance in 2002 Ø Expect to achieve full year 2002 production guidance, despite curtailed production associated with Hurricanes ATP Oil & Gas Corporation

Focus in 2002 Increasing financial flexibility Ø Reduced bank debt $14 million in 2002 Ø Increased working capital $30 million in 2002 Ø Overall capital liquidity improvement $44 million Meeting operating goals Ø Beat first, second, and third quarter production guidance in 2002 Ø Expect to achieve full year 2002 production guidance, despite curtailed production associated with Hurricanes ATP Oil & Gas Corporation

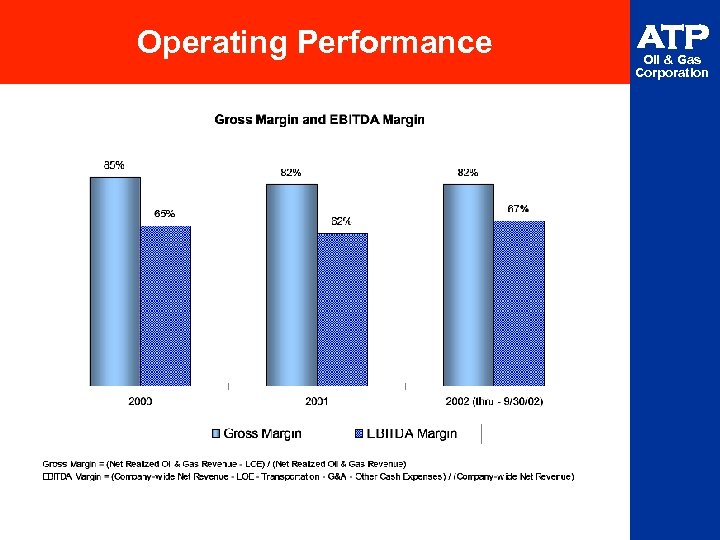

Operating Performance ATP Oil & Gas Corporation

Operating Performance ATP Oil & Gas Corporation

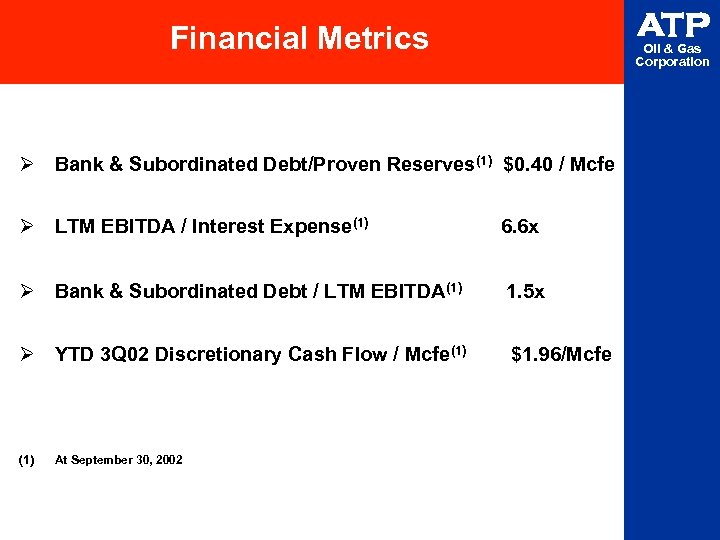

ATP Financial Metrics Oil & Gas Corporation Ø Bank & Subordinated Debt/Proven Reserves(1) $0. 40 / Mcfe Ø LTM EBITDA / Interest Expense(1) 6. 6 x Ø Bank & Subordinated Debt / LTM EBITDA(1) 1. 5 x Ø YTD 3 Q 02 Discretionary Cash Flow / Mcfe(1) $1. 96/Mcfe (1) At September 30, 2002

ATP Financial Metrics Oil & Gas Corporation Ø Bank & Subordinated Debt/Proven Reserves(1) $0. 40 / Mcfe Ø LTM EBITDA / Interest Expense(1) 6. 6 x Ø Bank & Subordinated Debt / LTM EBITDA(1) 1. 5 x Ø YTD 3 Q 02 Discretionary Cash Flow / Mcfe(1) $1. 96/Mcfe (1) At September 30, 2002

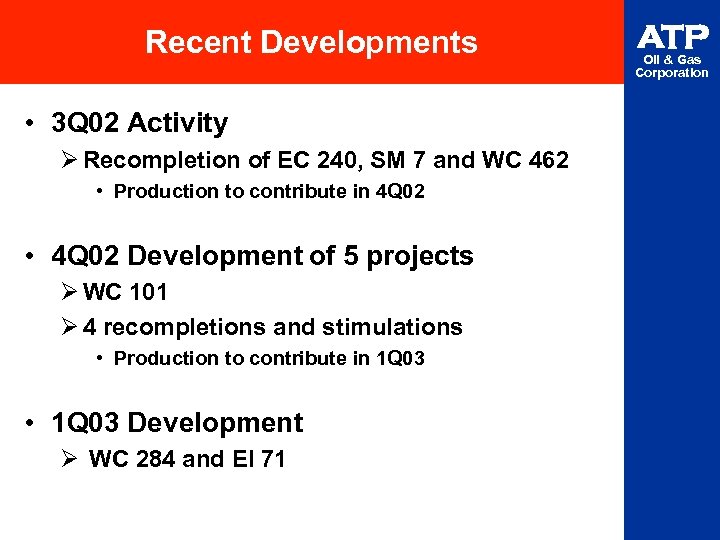

Recent Developments • 3 Q 02 Activity Ø Recompletion of EC 240, SM 7 and WC 462 • Production to contribute in 4 Q 02 • 4 Q 02 Development of 5 projects Ø WC 101 Ø 4 recompletions and stimulations • Production to contribute in 1 Q 03 • 1 Q 03 Development Ø WC 284 and EI 71 ATP Oil & Gas Corporation

Recent Developments • 3 Q 02 Activity Ø Recompletion of EC 240, SM 7 and WC 462 • Production to contribute in 4 Q 02 • 4 Q 02 Development of 5 projects Ø WC 101 Ø 4 recompletions and stimulations • Production to contribute in 1 Q 03 • 1 Q 03 Development Ø WC 284 and EI 71 ATP Oil & Gas Corporation

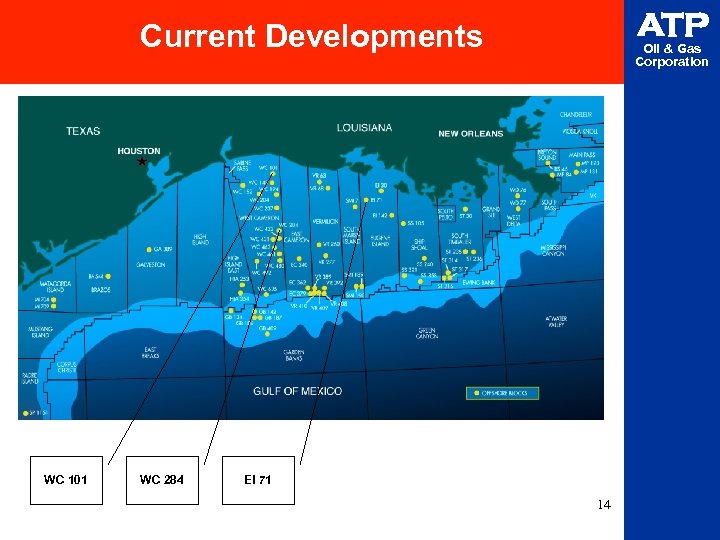

ATP Current Developments WC 101 WC 284 Oil & Gas Corporation EI 71 14

ATP Current Developments WC 101 WC 284 Oil & Gas Corporation EI 71 14

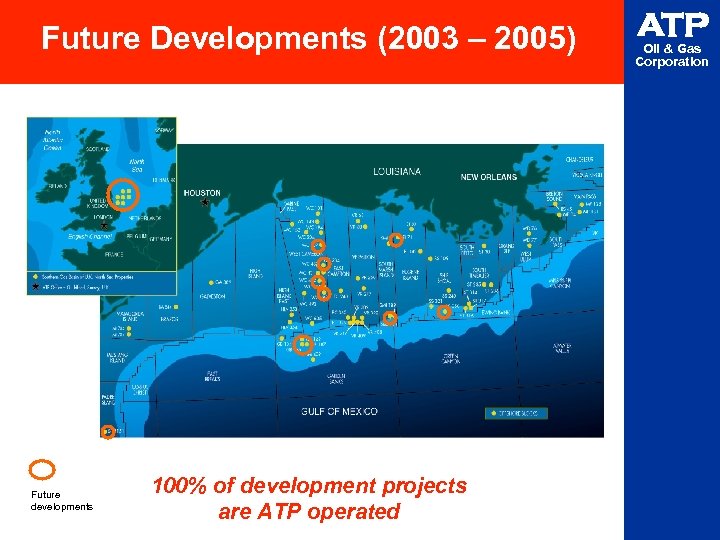

Future Developments (2003 – 2005) Future developments 100% of development projects are ATP operated ATP Oil & Gas Corporation

Future Developments (2003 – 2005) Future developments 100% of development projects are ATP operated ATP Oil & Gas Corporation

ATP North Sea Developments Oil & Gas Corporation 16

ATP North Sea Developments Oil & Gas Corporation 16

UK Southern Gas Basin The Tors Helvellyn Venture ATP Oil & Gas Corporation

UK Southern Gas Basin The Tors Helvellyn Venture ATP Oil & Gas Corporation

Helvellyn Water Depth: 90’ Working Interest: 50% Net Revenue Interest: 50% Platform/Wells: One subsea well, tied back to Amethyst Field First Production: First Half 2003 Producing Sands: Rotliegend and Carboniferous Total gas column: 200 meters Discovery well drilled: 47/10 -1 in 1985 Tested at 29. 4 MMcfpd by BP Development well: 47/10 -7 drilled 4 Q 02; 1800’ of horizontal Rotliegend and Carboniferous penetration Tested January 2003 at 60 MMcfpd by ATP Oil & Gas Corporation

Helvellyn Water Depth: 90’ Working Interest: 50% Net Revenue Interest: 50% Platform/Wells: One subsea well, tied back to Amethyst Field First Production: First Half 2003 Producing Sands: Rotliegend and Carboniferous Total gas column: 200 meters Discovery well drilled: 47/10 -1 in 1985 Tested at 29. 4 MMcfpd by BP Development well: 47/10 -7 drilled 4 Q 02; 1800’ of horizontal Rotliegend and Carboniferous penetration Tested January 2003 at 60 MMcfpd by ATP Oil & Gas Corporation

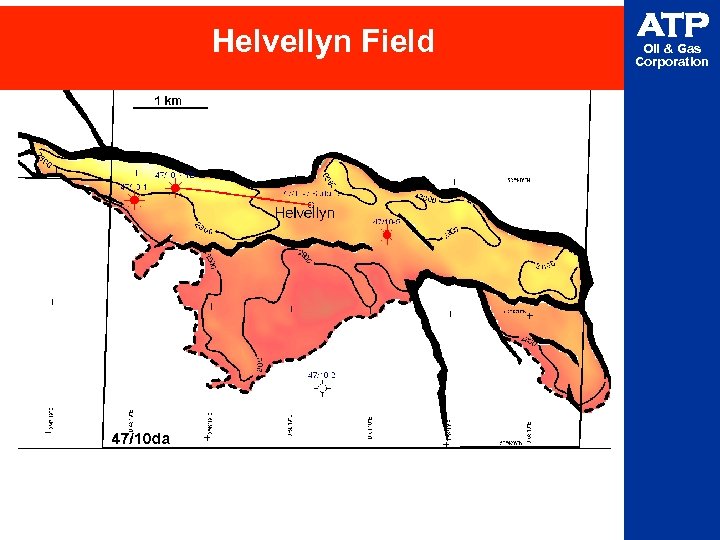

Helvellyn Field ATP Oil & Gas Corporation

Helvellyn Field ATP Oil & Gas Corporation

Helvellyn Development Wellhead Protection Structure ATP Oil & Gas Corporation

Helvellyn Development Wellhead Protection Structure ATP Oil & Gas Corporation

Helvellyn Field Tested January 2003 at 60 MMcfpd by ATP Oil & Gas Corporation

Helvellyn Field Tested January 2003 at 60 MMcfpd by ATP Oil & Gas Corporation

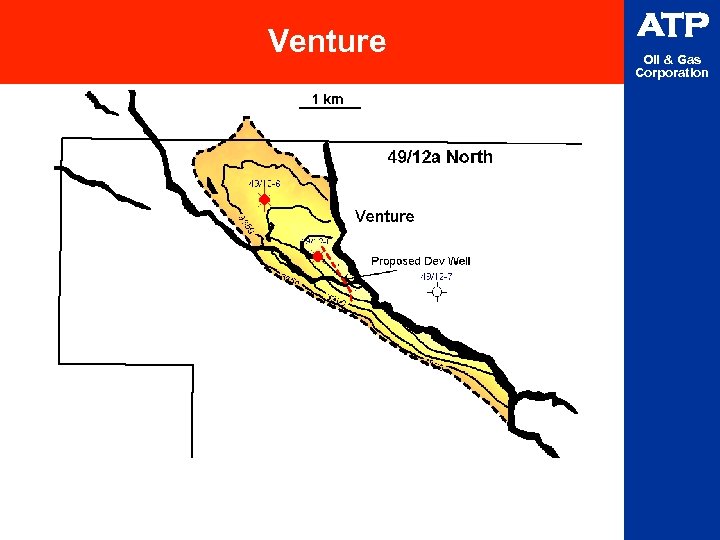

Venture Working Interest: 50% Net Revenue Interest: 50% Platform/Wells: Subsea/unmanned platform First Production: 2004 Producing Sands: Rotliegend Two wells drilled: 49/12 -6 tested 15 & 20 MMcfpd from 2 zones 49/12 -8 tested 27 & 47 MMcfpd from 2 zones Total gas column: In excess of 120 meters ATP Oil & Gas Corporation

Venture Working Interest: 50% Net Revenue Interest: 50% Platform/Wells: Subsea/unmanned platform First Production: 2004 Producing Sands: Rotliegend Two wells drilled: 49/12 -6 tested 15 & 20 MMcfpd from 2 zones 49/12 -8 tested 27 & 47 MMcfpd from 2 zones Total gas column: In excess of 120 meters ATP Oil & Gas Corporation

Venture ATP Oil & Gas Corporation

Venture ATP Oil & Gas Corporation

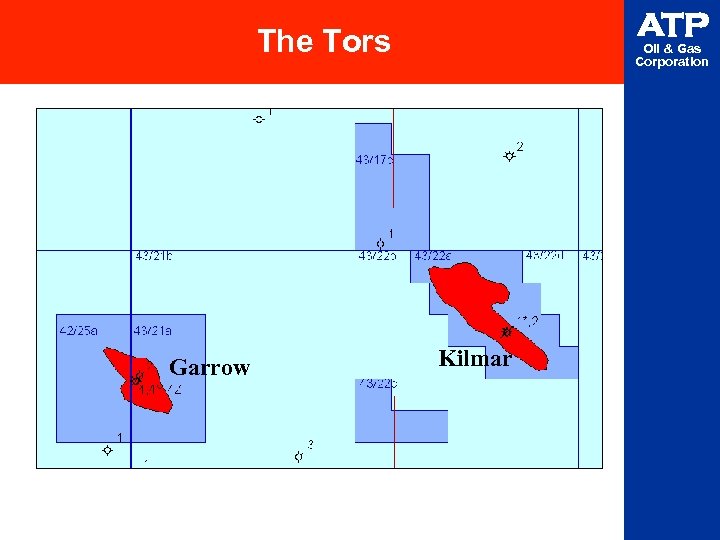

ATP The Tors Garrow Oil & Gas Corporation Kilmar

ATP The Tors Garrow Oil & Gas Corporation Kilmar

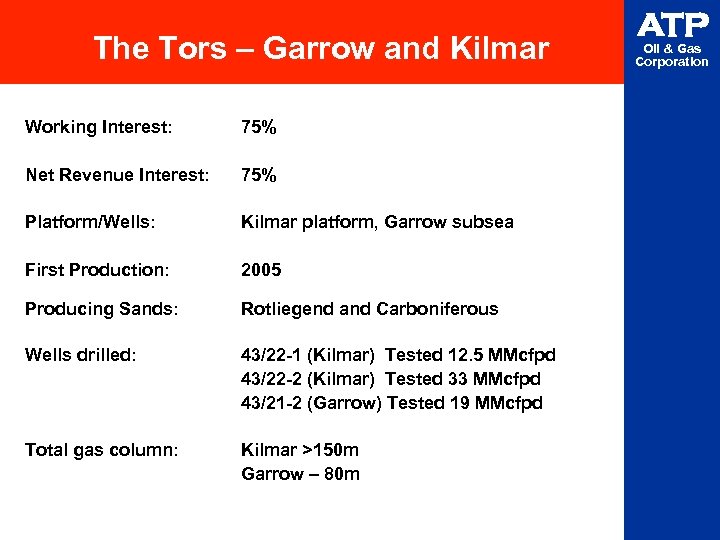

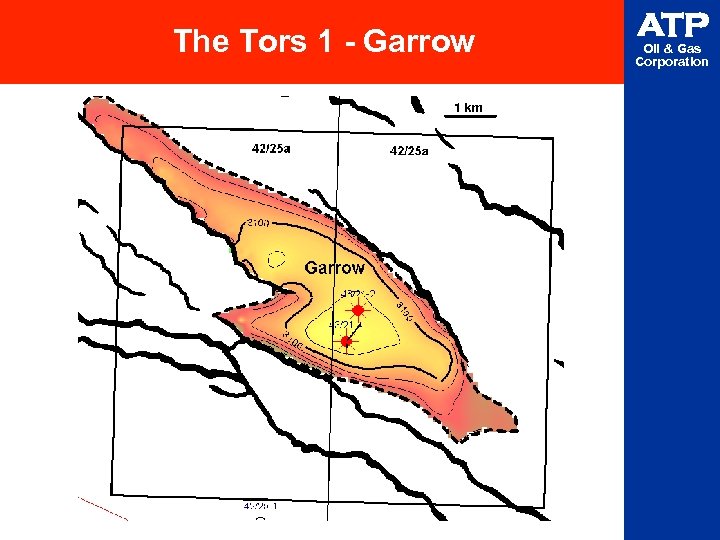

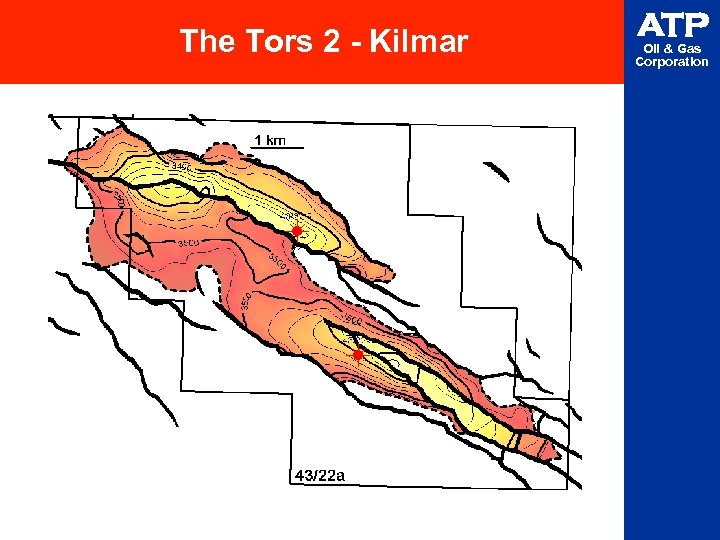

The Tors – Garrow and Kilmar Working Interest: 75% Net Revenue Interest: 75% Platform/Wells: Kilmar platform, Garrow subsea First Production: 2005 Producing Sands: Rotliegend and Carboniferous Wells drilled: 43/22 -1 (Kilmar) Tested 12. 5 MMcfpd 43/22 -2 (Kilmar) Tested 33 MMcfpd 43/21 -2 (Garrow) Tested 19 MMcfpd Total gas column: Kilmar >150 m Garrow – 80 m ATP Oil & Gas Corporation

The Tors – Garrow and Kilmar Working Interest: 75% Net Revenue Interest: 75% Platform/Wells: Kilmar platform, Garrow subsea First Production: 2005 Producing Sands: Rotliegend and Carboniferous Wells drilled: 43/22 -1 (Kilmar) Tested 12. 5 MMcfpd 43/22 -2 (Kilmar) Tested 33 MMcfpd 43/21 -2 (Garrow) Tested 19 MMcfpd Total gas column: Kilmar >150 m Garrow – 80 m ATP Oil & Gas Corporation

The Tors 1 - Garrow ATP Oil & Gas Corporation

The Tors 1 - Garrow ATP Oil & Gas Corporation

The Tors 2 - Kilmar ATP Oil & Gas Corporation

The Tors 2 - Kilmar ATP Oil & Gas Corporation

Summary Ø “D&P” strategy produces strong operational and financial results, while reducing risk Ø Successful operator in two core areas • Gulf of Mexico • U. K. Southern Gas Basin Ø Robust U. S. and U. K. development inventory Ø Rapid growth sinception in 1991 ATP Oil & Gas Corporation

Summary Ø “D&P” strategy produces strong operational and financial results, while reducing risk Ø Successful operator in two core areas • Gulf of Mexico • U. K. Southern Gas Basin Ø Robust U. S. and U. K. development inventory Ø Rapid growth sinception in 1991 ATP Oil & Gas Corporation

ATP Oil & Gas Corporation NASDAQ: ATPG ATP Oil & Gas Corporation 4600 Post Oak Place, Suite 200 Houston, TX 77027 -9726 713 -622 -3311 ATP Oil & Gas (UK) Limited Victoria House, London Square, Cross Lanes Guildford, Surrey GU 1 1 UJ United Kingdom 44 (0) 1483 307200 www. atpog. com ATP Oil & Gas Corporation

ATP Oil & Gas Corporation NASDAQ: ATPG ATP Oil & Gas Corporation 4600 Post Oak Place, Suite 200 Houston, TX 77027 -9726 713 -622 -3311 ATP Oil & Gas (UK) Limited Victoria House, London Square, Cross Lanes Guildford, Surrey GU 1 1 UJ United Kingdom 44 (0) 1483 307200 www. atpog. com ATP Oil & Gas Corporation