6aa97e1f8dcaa3d084e2e534a22bd90f.ppt

- Количество слайдов: 59

ATC Business Case for Collaboration and/or Consolidation: Phase I Results - 1/15/08 (Final)

Business Case for Collaboration and/or Consolidation Phase I Results: Arizona Technology Council Collaboration and/or Consolidation Case Studies and Best Practices Date: January 15, 2008 (Final) Place: Phoenix, Arizona Presented By: Steven G. Zylstra, Formerly Technomic Growth Strategies President and CEO, Arizona Technology Council (T) 602. 343. 8324 ext. 101, (M) 412. 735. 9537 (E) szylstra@aztechcouncil. org URL: http: //www. axtechcouncil. org/ Mark Goldstein, President, International Research Center (T) 602. 470. 0389, (M) 602. 670. 6407 (E) markg@researchedge. com URL: http: //www. researchedge. com/

Business Case for Collaboration and/or Consolidation – Project Overview • The Arizona Technology Council has undertaken a review of considerations for strategic alignments, collaboration, and possible mergers/consolidation with other Arizona technology–focused organizations • Study authors Steven G. Zylstra, formerly Technomic Growth Strategies and Pittsburgh Technology Council, current President and CEO, Arizona Technology Council, and Mark Goldstein, International Research Center are familiar with both the Arizona technology landscape and the nationwide consolidation/collaboration activities among past and present technology organizations

Business Case for Consolidation and Collaboration – Phase I Project Detail 1. Identify Business Models - Identify known business models similar to those in the Arizona technology sector to determine the feasibility of a merger or a substantive strategic partnership. The Arizona organizations to be explored include: Arizona Technology Council (ATC), Arizona Bio. Industry Association (ABA) and Southern Arizona Technology Council (UTC) 2. Conduct Research - Conduct primary and secondary research to document business models that would facilitate consolidation, cooperation, and collaboration between the ATC, ABA and SATC, including the entire spectrum of interaction from simple mutual support on issues to complete merger. 3. Document Results - Prepare Power. Point for presentation to the ATC Sustainability Committee documenting results of business model study including preliminary recommendations. Define the strengths and weakness of each approach, especially its impact on the ATC and its members. 4. Present Conclusions - Deliver a Power. Point presentation to ATC Sustainability Committee with results of Phase I study.

Business Case for Consolidation and Collaboration – Pending Phase II Project Detail 1. Engage Partner Leadership - Using direction from the ATC Sustainability Committee and guidance provided by the Phase I study, engage volunteer leadership of ABA and SATC to discuss how to better leverage the Arizona technology-based industry strengths for the good of industry and the state. 2. Conduct Survey - Assuming interest by ABA and SATC, conduct a detailed survey of the products, services and benefits that each of the three organizations provide, looking for redundancy or duplication. Document at some level of detail, the infrastructure and assets that each organization brings to the table. 3. Propose Structure - Given the overlay of products and services from the above evaluation and business model analysis of Phase I, propose varying organizational structures that would best leverage the strengths and assets of the three organizations that delivers results and member satisfaction. 4. Prepare and Deliver Presentation - Present Phase II results to ATC Sustainability Committee.

Business Case for Consolidation and Collaboration – Phase I Results The consultants identified and profiled nationwide examples of previous collaborations/consolidations/mergers involving regional technologyfocused not-for-profit organizations resulting in a series of brief case studies, including lessons learned and best practices focusing on: • Who lead effort and what process were utilized? • Impetus for collaboration/consolidation/merger? • What benefits gained? • What structure did the governance or business model use in these combined enterprises? • What critical issues arose and how were they handled? • What was the ultimate outcome and lessons learned?

Regional Technology Association Case Studies: • Arizona Technology Council (ATC) • Pittsburgh Technology Council (PTC) • Northeast Ohio Software Association (NEOSA) • Utah Technology Council (UTC) • Mass Technology Leadership Council (Mass. TLC) • Technology Council of Maryland (TCM) • Tech. Columbus (TC) • Minnesota High Tech Association (MHTA) • Technology Council of Northwest PA (TCNWPA) • Technology Association of Georgia (TAG) • Virginia Technology Alliance (VTA)

Arizona Technology Council (ATC) Case Study – AIN HTIC Background: The Arizona Innovation Network (AIN) merged with the Arizona High Tech Industry Cluster (HTIC) in late 90’s with effort lead by Steven G. Zylstra, HTIC Chairman and Simula executive Rational/Benefits: AIN, started in 1984, had out lived its usefulness by mid-90’s, supplanted by ASPED/GSPED technology–based clusters, including software, high tech, optics, bioindustry, advanced materials, environmental, etc. Process/Issues: Both AIN and HTIC Boards agreed the time had come and accomplished with no significant issues, but process took almost 24 months Outcome/Lessons Learned: • • • Consolidation quelled noise in the marketplace New core HTIC membership adds Increased attendance and involvement at HTIC meetings Key AIN sponsors could focus resources Actual event of merger was anticlimactic

Arizona Technology Council (ATC) Case Study – HTIC Az. Soft. net ATC Background: The Arizona High Tech Industry Cluster (HTIC) merged with Arizona Software & Internet Association (Az. Soft. net) around 2002, which later became known as the Arizona Technology Council (ATC) with efforts lead by Ed Denison, President and CEO of Az. Soft. net Rationale/Benefits: • • • Follow trend of national peers, Az. Soft. net was CRITA members at this time IT Industry facing major losses with Dot. com bust Create critical mass in order to influence stakeholders Sponsors were reluctant to support multiple entitles in weak economy Combine supporters and members for more influence/results/value Process/Issues: • Az. Soft. net drove process as part of overview consolidation vision Staff/Governance: • HTIC Executive Assistant & outsourced services absorbed into Az. Soft. net operations and budget • Az. Soft. net allocated Board seat to HTIC former leadership and interests (Al Winn)

Arizona Technology Council (ATC) Case Study – HTIC Az. Soft. net ATC (Cont’d. ) Critical Success Factors: • Significant concerns of several HTIC Board members “managed” and satisfied through accommodation and engagement process • Az. Soft. net/ATC was seen as a regional “comer” and the “place to be” Outcome/Lessons Learned: • Use “champions” and “influencers” to lead the organizations to come together and court considerately, openly and flexibly • Too much of a heavy hand further pushing the consolidation may have put off some additional merger prospects at the time Website: http: //www. aztechcouncil. org/ Contact: Steve Zylstra, ATC President and CEO (T) 602. 343. 8324 ext. 101, (M) 412. 735. 9537 (E) szylstra@aztechcouncil. org Ron Schott, ATC President and CEO Emeritus (T) 602. 343. 8324 ext. 109, (M) 602. 320. 9342 (E) rschott@aztechcouncil. org Mike Berens, ATC Chairman and CEO and TGen (T) 602. 343. 8760, (M) 602. 361. 2118 (E) mberens@tgen. org

Pittsburgh Technology Council Case Study – Megastructure Background: Co-located and co-managed with Catalyst Connection, the Doyle Center for Manufacturing Technology, and the Pennsylvania Nano. Materials Commercialization Center Rationale/Benefits: • • Shared Infrastructure including Finance, Accounting, Marketing, IT, HR and Administration Synergistic missions Shared space Shared management Process/Issues: • • Council started in 1983, Catalyst added in 1988, Doyle Center in 2003, Nano Center in 2005 Council 501(c)6 trade association, others 501(c)3 economic development entities Catalyst started as an educational foundation of Council Some PTC members felt Catalyst competed with them

Pittsburgh Technology Council Case Study – Megastructure (Cont’d. ) Staff and Governance: • Separate boards, with almost no overlap • Separate legal entities • 4 x 4 (16) board meetings and exec. committee meetings per year • Council 32 FTEs, $5 M, Catalyst 34 FTEs, $6. 8 M, Doyle 6 FTEs, $3. 5 M, Nano, 2 FTEs, $2. 3 M, included in the FTEs are the one-third of shared staff Critical Success Factors: • Management assured that there was complete synergy and no redundancy between the various enterprises • Communication between Board leadership • Service agreements that clearly spell out shared services and who’s paying for what

Pittsburgh Technology Council Case Study – Megastructure (Cont’d. ) Outcome/Lessons Learned: • • • Significant savings in infrastructure costs due to shared services Able to hire much more competent/seasoned staff in infrastructure positions Viewed positively by technology/manufacturing community for savings Hard to hold together without strong leader Boards start worrying about focus of management as number of entities goes up More influence and effectiveness from sheer girth Websites: http: //www. pghtech. org/ http: //www. catalystconnection. org/ http: //www. doylecenter. org/ http: //www. pananocenter. org/ Contact: Steven G. Zylstra, Former President and CEO (T) 412. 735. 9537 (E) sgzylstra@zoominternet. net

Pittsburgh Technology Council Case Study – Macrostructure Background: The keystone of the success of Pittsburgh Technology Council is its fundamental business model which is based on its network structure. They • • • Provide forums for education and peer-to-peer interaction Train and educate members Increase awareness of best practices Provide valuable networking opportunities for members Develop cost- and time-savings services Maintain quality programming applicable to the membership The preponderance of product and service offerings emanate from and support the networks The PTC IT Network is larger than virtually all the state or regional IT associations in the U. S. and Canada

Pittsburgh Technology Council Case Study – Macrostructure (Cont’d. ) Networks: • Driven by direct input and feedback from our members Advisory Committees: • Four (4) Industry Network Advisory Committees • Six (6) Peer Network Advisory Committees • Meet quarterly at the Council Offices Annual Listening Survey: • Electronic survey – conducted each Spring Outreach Process: • In-person, on-site staff visits with our members • Goal: Minimum of 400 technology members in 2006 -07

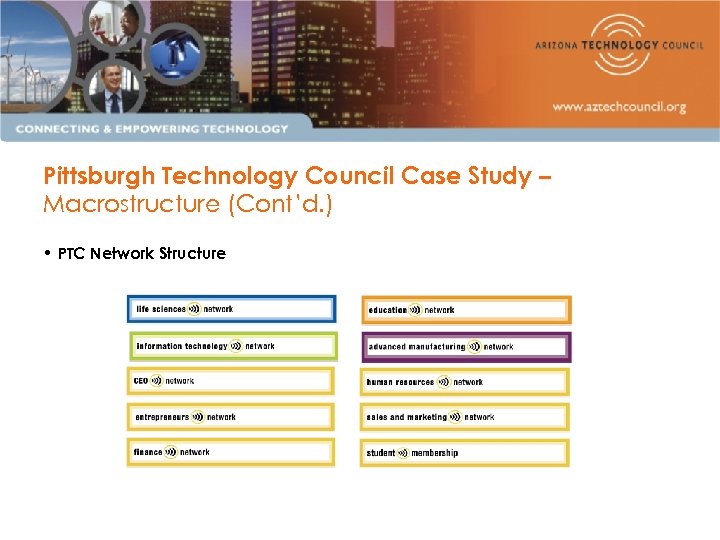

Pittsburgh Technology Council Case Study – Macrostructure (Cont’d. ) • PTC Network Structure

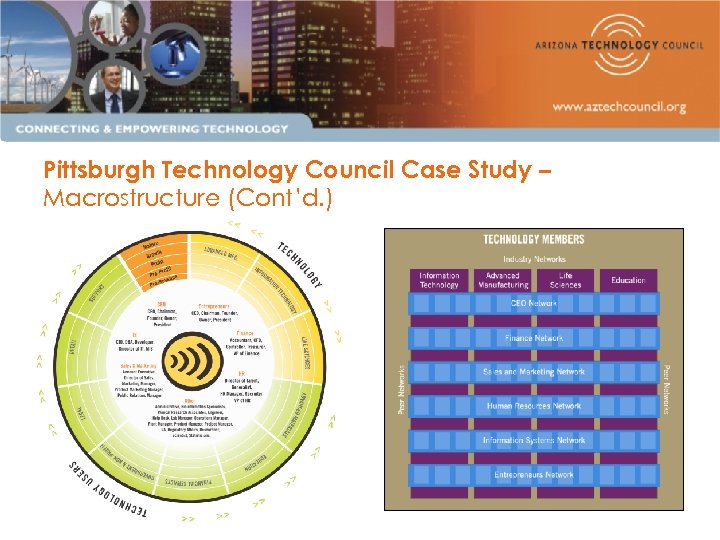

Pittsburgh Technology Council Case Study – Macrostructure (Cont’d. )

Northeast Ohio Software Association (NEOSA) Case Study Background: NEOSA merged with Council of Small Enterprises (COSE), the pre-eminent small business membership organization in northeast Ohio in 2004. The Greater Cleveland Partnership (http: //www. gcpartnership. com) was created in March 2004 by the consolidation of Cleveland Tomorrow, the Greater Cleveland Growth Association, the Greater Cleveland Roundtable and their primary affiliates COSE, the Northeast Ohio Technology Coalition (Nor. Tech), and the Commission on Economic Inclusion. Interview with Jim Cookinham, founder and former head of NEOSA, now with COSE. Rationale/Benefits: • Impetus for merger for NEOSA came from $400 K in state funding pulled, struggling with membership (500 members, $1 M budget, 5 FTEs) • Catalyst for COSE was worried about lagging membership, due to the organization's principal value is in providing low cost insurance (17, 000 members, 60 FTEs) • Not a merger of equals, but NEOSA had loyal members who attended events and are committed to their cause and added energy to COSE had services NEOSA didn't offer.

Northeast Ohio Software Association (NEOSA) Case Study (Cont’d. ) Process/Issues: • Process started as a discussion about a possible partnership Staff/Governance: • In order to create enhanced value for it’s members and to enhance member retention, COSE has adopted a network strategy similar to the Pittsburgh Technology Council (macrostructure) • NEOSA is now a network leader within COSE. I has grown membership to 700. • Ex-Chairman of NEOSA now chairs COSE for next two years, NEOSA has 3 dedicated staff, has a Board of Advisors with no fiduciary responsibility, high visibility for new CEO Critical Success Factor: • Both parties have been faithful to the concept/vision and lived up to expectations

Northeast Ohio Software Association (NEOSA) Case Study (Cont’d. ) Outcome and Lessons Learned: • After merger, COSE adopted network structure. Besides NEOSA, COSE has added an Arts Network and a Home-based Business Network • No loss of NEOSA members • NEOSA now get less media attention • Not as much fun former NEOSA head • No public whining or adverse media attention • Key take away, you must decide whether you are focused on your membership or on economic development. They drive very different strategies. Websites: http: //www. neosa. org/ http: //www. cose. org/ Contact: Jim Cookinham, VP Member Networks and Programs, (T) 216. 592. 2295 (E) JCookinham@COSE. org

Utah Technology Council (UTC) Case Study Background: UTC was formed in April 2006 by the merger of the Utah Information Technology Association (UITA) established 1991 and the Utah Life Science Association (ULSA) established 1994, after working together closely for over a decade. Interview with Richard Nelsen, former CEO of UITA, CEO of UTC. Rationale/Benefits: • • Following lead of peer organizations around the nation Encouragement from UITA board members and other civic leaders Retirement of ULSA Executive created vacuum/opportunity Several key disgruntled Board members at ULSA Process & Issues: • UITA did focus groups with members in 2002 and a bio-study in 2005 • ULSA did focus groups in 2005 • UITA believes life science represents the future and will exhibit strong growth • Sought advice of CEO’s at Pittsburgh Technology Council and New Jersey Technology Council who interacted with a UITA/ULSA task force

Utah Technology Council (UTC) Case Study (Cont’d. ) Staff and Governance: • • Large merged Board (55) Kept UITA executive to run merged UTC Hired a Life Science Director from San Diego to head-up bio efforts Formed a Life Science Advisory Council to assure appropriate representation and focus Critical Success Factors: • • Principally, the timely departure of ULSA executive predicated Key ULSA Board members unsatisfied with status quo and drove merger

Utah Technology Council (UTC) Case Study (Cont’d. ) Outcome and Lessons Learned: • • • Executive must have thick skin, before and after merger The destination was worth the journey and speed bumps manageable Life sciences companies more needy, different culture/perspective Seek outside advice and counsel to objectify and broaden considerations Buy in important from both boards Website: http: //www. utahtechcouncil. org/ Contact: Richard Nelson, President and CEO (T) 801. 568. 3500 ext. 100 (E) rnelson@utahtech. org

Mass Technology Leadership Council (Mass. TLC) Case Study Background: Formed by the combination of Massachusetts Software Council (MSC) and New England Business and Technology Association, Inc. (NEBATA) in September 2005. Interview with Tom Hopcroft, former President of NEBATA and now VP at Mass. TLC and Joyce Plotkin, Former President of MSC and now President of Mass. TLC. Rationale/Benefits: • • • Too many tech associations in Boston (8 for IT), reduce competition Combining sponsorship requests Elevate combined groups to a higher level (in eyes of tech community) Improve governance MSC board wanted growth, decided merger was good strategy NEBATA board saw MSC as strategic vehicle for IT buyer-seller dialogue

Mass Technology Leadership Council (Mass. TLC) Case Study (Cont’d. ) Process/Issues: • Initiated by two of the executives, one from each organization • Good synergy, little overlap between the organizations’ products/programs • MSC had seller’s perspective (vendors), NEBATA had buyer’s perspective (enterprise) • Both executives’ view was to do what was best for their organization. Shared a common vision • Used a lawyer as a counselor • MSC acquired NEBATA’s assets and then they renamed organization • The two boards made the strategic decision to merge organizations. Massachusetts’ nonprofit law required that one organization be dissolved and assets transferred in order to effectuate this business result Staff/Governance: • Eliminated inactive Board members from both Boards • Both executives retained a position in new organization Critical Success Factors: • Shared vision – create companies and jobs • Both organizations were fiscally healthy • No overlap in programs/products/services

Mass Technology Leadership Council (Mass. TLC) Case Study (Cont’d. ) Outcome/Lessons Learned: • • Merger process was a success because the key executives were on the same page Boston Globe tech writer gave merger good treatment in media Successful integration Boards were highly supportive Notes: Both MSC and NEBATA attempted to merge with Massachusetts Innovation and Technology Exchange (MITX) and were unsuccessful. Initiated by chair of MITX. MSC was three time to the altar and then MITX would throw them curve. Website: http: //www. masstlc. org/ Contact: Joyce Plotkin, President (T) 617. 437. 0600 ext. 11 (E) joyce@masstlc. org

Technology Council of Maryland (TCM) Case Study Background: TCM has separate Tech Alliance and Md. Bio Divisions as a result of merger with Md. Bio Foundation. Rationale/Benefits: • Md. Bio first attempted to create its own membership component, but was unsuccessful. Amounted to hostile takeover of bio members. Finally came to table • Md. Bio was well funded, but would eventfully run out of funding • Primary motivation was confusion in the community as to who spoke for life science – wanted single voice

Technology Council of Maryland (TCM) Case Study (Cont’d. ) Process and Issues: • • The merger was Board (Chairman) driven, both legacy CEOs fought it Chairs of organizations had different vision of outcome, not on same page New bylaws created that end up having far too much specificity. Done to appease Directors who were afraid of loosing identity Went to the alter three times before succeeding in merger Staff and Governance: • • New governance structure is extremely cumbersome and overly taxing on resources. Now three 501(c) 3 boards and four governing bodies in the one 501(c) 6 board with multiple divisions. At least 30 board meetings per year. Staff was unintentionally set up by board to fail. All Md. Bio staff ultimately left Success Factors: • Do better planning

Technology Council of Maryland (TCM) Case Study (Cont’d. ) Outcome/Lessons Learned: • Hire outside consultants during the negotiations process, not just after, to serve as objective experts and advisors • Do lots of advanced planning around organization structure, governance and budget before attempting integration • One year later, things are starting to settle down/work • Took personal toll on new executive hired to run overall enterprise Website: http: //www. techcouncilmd. com/ Contact: Julie Coons, CEO (T) 240. 453. 6213 (E) jcoons@techcouncilmd. com

Tech. Columbus (TC) Case Study Background: The Columbus Technology Council was created in late 2002 through a merger of the Columbus Industry and Technology Council (ITC) and Columbus Technology Leadership Council (CTLC). Then Tech. Columbus (TC) was formed through the merger of the Columbus Technology Council and the Business Technology Center (an incubator) with a close linkage to Ohio State University’s Science and Technology Corporation (Scitech). Interview with Tim Haynes, VP Member Services and Marketing Rationale/Benefits: • Realized that all organizations shared essentially the same end • Desired a common advocacy platform • All looking for funding from the same sources

Tech. Columbus (TC) Case Study (Cont’d. ) Process and Issues: • Process lead by the three Chairs of the Boards of the organizations • Took too long to integrate • Some board members from the past organizations thought they were in the dark Staff and Governance: • Brought in new executive to run TC • BTC executive retired Critical Success Factors: • Leadership - Chairs of the Boards of the three organizations committed to merger • All three entities fiscally sound at time of merger

Tech. Columbus (TC) Case Study (Cont’d. ) Outcome and Lessons Learned: • Maintained both a 501(c) 3 (state-supported) and a 501(c) 6 (member-supported) • Though continuing to do events and new business formation services, business approach and model underwent major change in the impact TC has and the momentum it’s able to generate, as well as ability to push more strategic regional initiatives • New entity now can do more – breadth of tech and entrepreneurial to mature companies • Diverse Board – Large and small companies, academic, state, legal, accounting, etc. • New bylaws • Staff of 12, $3 M budget • Recently got $15 M from state for entrepreneurial program plus local match funding • New executive brought in • Small Board – 13 now, 9 at merger • Merged organization now co-located Website: http: //www. techcolumbus. org/ Contact: Ted Ford, President and CEO (T) 614. 487. 3700 (E) tford@techcolumbus. org

Minnesota High Tech Association (MHTA) Case Study Background: MHTA adopted its current name in 1998 with the merger of the Minnesota High Technology Council (MHTC) and the Minnesota Software Association (MSA). No interview, just an email exchange with Kate Rubin, President (see below): “…I was not here when MHTC and MSA joined forces. A good idea, but little attention paid to the integration. Many say it was MHTC taking over, dropping MSA programs. On the other hand, many MSA members were sole proprietors who did not pay dues, so tell me how that is a real membership organization? In fact there were tens if not a couple hundred “companies” in this category. So any talk of how the merged organization lost so many members is also probably bogus. We have since brought back a few MSA programs, let others go completely from both MHTC and MSA, re-integrated some “real” company members, and clarified the value proposition as it were for the “new” MHTA. Working pretty well right now and growing stronger by the day…”

Minnesota High Tech Association (MHTA) Case Study (Cont’d. ) References: Rick Krueger, former MHTC/MHTA President could provide more details, as he was President at the time of the merger. Also, perhaps Dee Thibodeau, who is a former MHTA board chair, was part of MSA, and continues on MHTA board. She is at dee. thibodeau@chartersolutions. com. Website: http: //www. mhta. org/ Contact: Kate Rubin, President (T) 952. 230. 4562 (E) krubin@mhta. org

Technology Council of Northwest PA (TCNWPA) Case Study Background: Successfully merged the Erie Technology Management Association (ETMA) into the Tech Council’s IT Network. Unsuccessful merger with the Erie Network Users Group (ENUG) as too techie focused and unwilling to pay dues. Rationale/Benefits: • Eliminate competition • Enhance participation • Drive membership Process and Issues: • New Bylaws Staff and Governance: • Able to add one additional staff member – IT Network Director • Created new IT Steering Committee

Technology Council of Northwest PA (TCNWPA) Case Study (Cont’d. ) Success Factors: • Top down merger • Utilized a few community leaders that people listen to Outcome/Lessons Learned: • Went from 60 to 85 members • Association of Information Technology Professionals (AITP) chapters in Northwest PA failed because the volunteer driven model couldn’t sustain them • A former AITP group in Mc. Kean County has approached the Tech Council to have an IT Network Chapter in that county Website: http: //www. technwpa. org/ Contact: Perry Wood, Chief Executive Officer (T) 814. 451. 1173 (E) perry. wood@technwpa. org

Technology Association of Georgia (TAG) Case Study Background: TAG started through a merger of three SIGs: Women in Technology (WIT), Southeastern Software Association (SSA) and Business & Technology Alliance (B&TA) in 1997 -98 and now has 20 Societies and 6 Affiliates. Interview was with Tino Mantella, President. Rationale/Benefits: • Share infrastructure Process and Issues: • Merger driven by Chairs of three organizations Staff and Governance: • Large Board, 55 members • Each Society has an Advisory Board • Budget $1. 3 M with a staff of six, contract out accounting

Technology Association of Georgia (TAG) Case Study (Cont’d. ) Success Factors: • A TAG staff member attends every Society meeting. Staff responsible for between 2 and 8 Societies each • TAG has reached a critical mass Outcome and Lessons Learned: • TAG has 3300 members today, more than doubled in less than two years, of which approximately 2000 are company members and the remainder individual members • Dues range from $900 to $10, 500, depending on size of company • Affiliates trade their member rate for their programs to TAG members in order to have TAG promote their programs • Conduct over 100 meetings a year with an average of 55 attendees. Each Society meets on average monthly. • All but three Societies are pulling their weight • All Societies come together quarterly as part of the Leadership Council, consisting of the Chair of each Society and five members at large appointed by the President Website: http: //www. tagonline. org Contact: Tino Mantella, President (T) 404. 817. 3333, ext. 7, (E) tmantella@tagonline. org

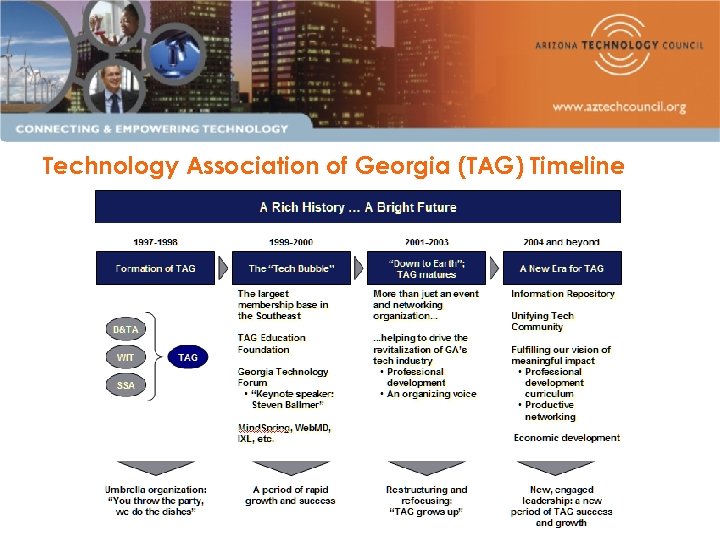

Technology Association of Georgia (TAG) Timeline

Virginia Technology Alliance (VTA) Case Study Background: Eight regional technology councils formed the Virginia Technology Alliance (VTA) in 1998 including the Northern Virginia Technology Council (NVTC). Two other councils were created after that and then inducted into the VTA. Interview with Josh Levi, Vice President for Policy, NVTC and VTA Board Member. Rationale/Benefits: • Shared interests – technology, Virginia's best interest • United support on policy issues Process and Issues: • Developed bylaws • Difficult to define common interests, small entities more interested in programs/events and larger more in policy/staff/organizational development • While the mentorship aspect of VTA tends to benefit the smaller councils exclusively (one-way street), benefits from VTA membership flows to all councils and even the larger councils gain and benefit from the networking and policy advocacy aspects • Councils have different expectations of VTA Staff and Governance: • No staff • Created governing board (executives serve with one exception, NVTC) • Use association management company for some activities

Virginia Technology Alliance (VTA) Case Study (Cont’d. ) Success Factors: • None identified • Financial contribution to VTA went from per member assessment to organizational tiered structure Outcome & Lessons Learned: • Annual strategic planning retreat – discussion goes back and forth whether VTA should be a loose alliance or have a strong central governance structure • VTA conducts an annual legislative reception in Richmond as their only event • Collaborative CFO event in partnership between Virginia, Maryland, and DC Tech Councils • Produced statewide magazine, failed after two issues, some councils publish their own • While NVTC is in Virginia, they are also part of the Greater Washington region. The Maryland DC Tech Councils are physically located closer than many of Virginia’s Tech Councils making it easier for them to collaborate and partner with DC Area Tech Councils. Website: http: //www. thevta. org/ & http: //www. nvtc. org/ Contact: Josh Levi, Director of Policy, NVTC (T) 703. 904. 7878 (E) jlevi@nvtc. org

Regional and National Supplementary Examples: • Arizona Chamber of Commerce • BC Technology Industry Association (BCTIA) • Advance Colorado Center (ACC) • Communitech (Waterloo, ON, Canada) • Ottawa Centre for Research and Innovation (OCRI) • Baton Rouge Technology Council (BTRC) • OCTANe Orange County • American Society of Association Executives (ASAE) • Internet Security Alliance (ISAlliance)

Regional and National Supplementary Examples The Arizona Chamber of Commerce and the Arizona Association of Industries (AAI) merged in late 2007 forming the Arizona Chamber of Commerce and Industry and are developing the Arizona Manufacturing Council to continue serving as the focused voice for Arizona’s manufacturers and supporting industries (http: //www. azchamber. com/) The British Columbia Technology Industry Association (BCTIA) was incorporated in 1993, joining the Electronic Manufacturers' Association of British Columbia (EMABC) and the Information Technology Association of Canada, BC Chapter (ITAC-BC) (http: //www. bctia. org/)

Regional & National Supplementary Examples (Cont’d. ) The Advance Colorado Center (ACC) provides common headquarters and logistical support for non-profit associations and organizations that, in turn, provide a variety of services and programs to companies, entrepreneurs, and individuals in order to stimulate job growth and promote a sustainable corporate environment in Colorado (http: //www. advancecoloradocenter. com/) • • Colorado Software & Internet Association (CSIA) Colorado Bio. Science Association (CBA) Colorado Association for Manufacturing and Technology (CAMT) Colorado Nanotechnology Alliance (CNA) Colorado Photonics Industry Association (CPIA) Connected Organizations for a Responsible Economy (CORE) CTEK Venture Centers Colorado Film Commission

Regional & National Supplementary Examples (Cont’d. ) Communitech started up in 1997 to support the Ontario region’s early tech cluster, Key partners include the Industrial Research Assistance Program (IRAP) program of the National Research Council (of Canada), Has a pending London, ON area organizational merger (http: //www. communitech. ca/) The Ottawa Centre for Research and Innovation (OCRI) brought together 6 non-profit tech orgs to create an organization of over 100 staff and 12 M$ budget that has now achieved the capability, critical mass, and resources to achieve significant results (http: //www. ocri. ca/) The Baton Rouge Technology Council (BRTC) merged about two years with the Chamber of Greater Baton Rouge, driving economic development in the Baton Rouge metropolitan area and serving as the voice of the business community (http: //www. brtc. org/)

Regional & National Supplementary Examples (Cont’d. ) OCTANe Orange County was formed in September 2002 and has become a fast growing IT and biomedical organization serving the Orange County, California region (http: //www. octaneoc. org/) The American Society of Association Executives (ASAE) merged with the Greater Washington Society of Association Executives (GWSAE), the ASAE Foundation, and The Center for Association Leadership in July 2004 (http: //www. asaecenter. org/) Internet Security Alliance (ISAlliance) agreed to provide financial services to the Electronic Components, Assemblies & Materials Association (ECA), Government Electronics & Information Technology Association (GEIA), JEDEC Solid State Technology Association (JEDEC), and Telecommunications Industry Association (TIA) July 2007 (http: //www. isalliance. org/)

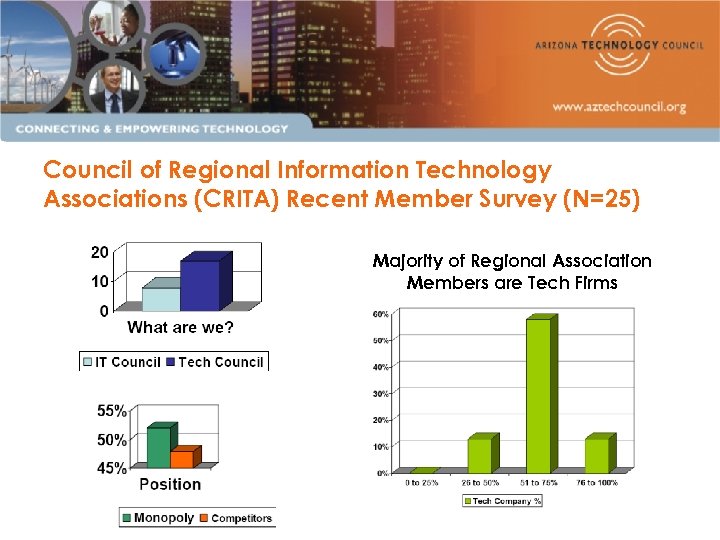

Council of Regional Information Technology Associations (CRITA) Recent Member Survey (N=25) Majority of Regional Association Members are Tech Firms

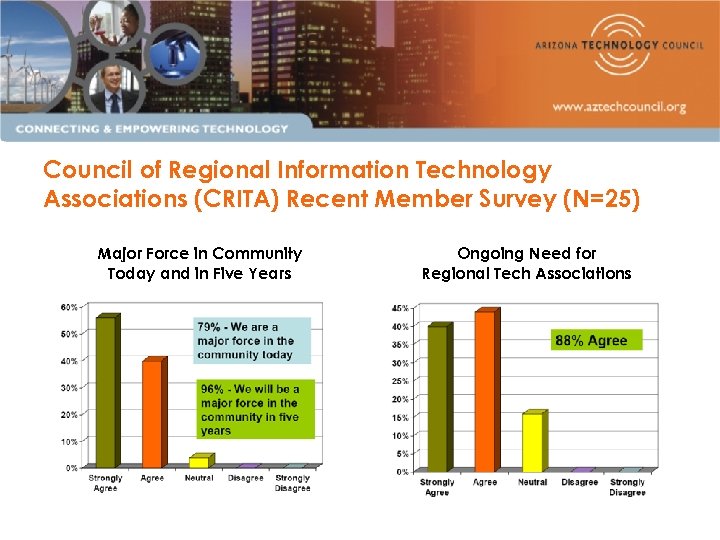

Council of Regional Information Technology Associations (CRITA) Recent Member Survey (N=25) Major Force in Community Today and in Five Years Ongoing Need for Regional Tech Associations

ATC Business Case for Collaboration and/or Consolidation – Business Models Summary • Loose Alliance – VTA, ACC • Network Structure (Macrostructure) – PTC, COSE, UTC, NWPATC • Umbrella Organization (Megastructure) – PTC et al, TCM • Society Model – TAG, IEEE • Complete Assimilation – AIN/HTIC, Mass. TLC, BCTIA, BRTC

ATC Business Case for Collaboration and/or Consolidation – Phase I Conclusions • Structure: A Network Structure is successful nationally and likely most appropriate for a ATC/ABA consolidation • Geographical Challenges: Addressing a large geographic area is a challenge everywhere, especially in states with multiple major metro centers. Phoenix and Tucson have exhibited regional cluster growth that would appear similarly challenging • Merger Recommendations: Based on this research and the experience of the consultants, a merger with SATC or an emerging GTTA would be extremely difficult. Certainly ATC should strive to build stronger linkages, however loose affiliations without mutual expectations and concrete deliverables by the parties involved and codified through a formal agreement, would most likely create more frustration • Define Clear Charter: Clarifying whether an organization is a economic development entity or a member-based trade association should guide organizational design and is a critical success factor • Plan for Success: Careful preplanning of the combined governance structure, organizational staffing and a pro forma budget is a key to assure smooth integration • Variables: Change of leadership is a common variable leading to many mergers • KPI’s: Few organizations had concise or well understood metrics about the before and after conditions

ATC Business Case for Collaboration and/or Consolidation – Phase I Conclusions (Cont’d. ) • Support Entrepreneurship: ATC should become a more visible contributor to the entrepreneurial scene by considering doing the following: Initiate a business plan competition (many to emulate), create an entrepreneurs network, collaborate with Ernst & Young to showcase the Entrepreneur of the Year winners in Tech. Connect magazine (hand out at event), support local angel network(s), consider conducting an angel capital fair, partner with Ti. E-AZ on events and outreach, create a partnership with Stealthmode Partiers/Fast. Trac to bring entrepreneurial programming to ATC members, and consider creating a biannual entrepreneurial boot camp. • Bio Integration: Biotechnology related organizations have successfully merged with technology associations in spite of being initially skeptical • Positive Results: Although many mergers were more difficult, more complex and took longer that expected, few regretted it, and stronger, more vital organizations generally resulted • Politics with a small ‘p”: Personalities and protection of turf often played a critical role in the success of a smooth merger • Seek Third Party Advice: Hiring consultants or seeking experts to help provide objective advice before and during the process, was a strong recommendation by several councils • Rejoin CRITA: The Arizona Technology Council should again be a participating member of CRITA as it represents IT and technology trade organizations in an effort to facilitate information, visibility, networking and services for IT-focused, not-for-profit business organizations in the United States and Canada

ATC Business Case for Collaboration and/or Consolidation – Pending Phase II Activity Overview • Engage Leadership: Engage volunteer and staff leadership of ABA and SATC/GTTA in discussions on how to better leverage the Arizona technology-based industry strengths for the good of industry and the state. • Conduct Survey: Assuming interest by ABA and SATC/GTTA, conduct a detailed survey of the products, services and benefits that each of the three organizations provide, looking for overlap or duplication. • Inventory Assets: Document at some level of detail, the infrastructure and assets that each organization brings to the table. Given the overlay of products and services from the above evaluation and business model analysis of Phase I, propose an organizational structure (loose to formal) that would best leverage the strengths and assets of the three organizations to deliver results and member satisfaction.

Arizona Organizational Landscape - Background • The Arizona Strategic Partnership for Economic Development (ASPED) of the late 80’s and early 90’s with SRI involvement evolved into the Governor's Strategic Partnership for Economic Development (GSPED) of industry clusters and infrastructure foundations flourishing throughout the 90’s • Several clusters and infrastructure foundations operated statewide, though a number of clusters had separate Phoenix and Tucson based organizations, and several others were only active in one metro area or the other • The Arizona Partnership for the New Economy (APNE) public/private partnership undertook a yearlong effort (2000 -2001) to assess Arizona’s current readiness and establish benchmarks for measuring progress, as well as to develop strategies for correcting any perceived deficiencies • GSPED faded during the APNE timeframe, several infrastructure foundations expired, and clusters continued to emerge and evolve in partnership with regional and statewide economic development and government groups

Arizona Organizational Landscape - Today • The Arizona Technology Council (ATC - http: //www. aztechcouncil. org/) continues to build membership, keep strong events focus, has become major public policy player, and publishes the statewide technology magazine Tech. Connect, Steve Zylstra was recently recruited from the Pittsburgh Technology Council to return to the Valley and assume leadership, Various collaboration &/or consolidation opportunities under consideration. • Arizona Department of Commerce (http: //www. azcommerce. com/) supports various groups and initiatives including the Governor’s Council on Innovation & Technology (GCIT http: //www. gcit. az. gov/), Unified economic development model with recently announced Arizona Economic Resource Organization (AERO) going forward • Strong Tri-University system (ASU, U of A, NAU) with good legislative investment in infrastructure, growing technology licensing and spin offs, and developing entrepreneurial programs • TGen, IGC, ASU Biodesign Institute, and U of A’s BIO 5 and Phoenix Medical Campus are driving Phoenix biotech cluster along with Tucson BIO-SA and Flagstaff bio component growth • Science Foundation Arizona (SFAz - http: //www. sfaz. org/) launched in 2006, now with $135 M of state funding to be augmented by matching funds and made available for grants to deepen scientific, engineering and medical infrastructure • Arizona Telecom & Information Council (ATIC – http: //www. aztele. com/atic/) continues guiding telecom policy development driving broadband deployment, convening regional stakeholders, facilitating public-private partnerships, and providing public news, outreach, and education • Greater Arizona e. Learning Association (GAZe. L - http: //www. gazel. us/) serves as an alliance between e. Learning educators, practitioners and related businesses to provide vision, share research, support learning initiatives, and gather resources for the utilization, implementation and expansion of e. Learning in business, government, and education • Venture Capital (VC) remains problematic in Arizona, especially for early stage companies

Arizona Organizational Landscape Arizona Bio. Industry Association (ABA) • The Arizona Bio. Industry Association (ABA - http: //www. azbioindustry. org/) is a not-for-profit, 501(c)6 trade association that was reorganized in 2003 to promote the growth of the bioscience industries in Arizona through member services, educational programs, business networking, public policy, and entrepreneurial endeavors • ABA is also the state affiliate of the Washington D. C. -based national Biotechnology Industry Organization (BIO - http: //www. bio. org/) and focuses on both biotechnology and medical devices • ABA has approximately 200 members and 21 Board members, Recent bylaws revision • ABA leadership and staffing were in transition in mid-2007, Robert (Bob) Eaton, who led Md. Bio, a bioscience industry support organization in Maryland for 10 years, has relocated to Phoenix and began his new position as President and CEO on 10/1/07. Natascha Hebell Fernando, formerly of the Arizona Department of Commerce has recently become COO. ATC previously initiated active discussions on C&C which should be reinvigorated under new leadership. • ABA is complemented by the closely affiliated Bioindustry Association of Southern Arizona (BIO-SA - http: //www. bio-sa. org/) and a growing Arizona Nanotechnology Cluster (http: //www. aznano. org/) collaboration • Third. Biotech (http: //www. thirdbiotech. com/) group recently launched in the Valley to foster networking and business deals within the life sciences community

Arizona Organizational Landscape Tucson Technology Organizations • Aerospace, Manufacturing and Information Technology (AMIT - http: //www. amit-az. org) was formed in 2005 through a merger of the Southern Arizona Industry and Aerospace Alliance (SAIAA) and the Information Technology Association of Southern Arizona (ITASA) • Southern Arizona Tech Council (SATC - http: //www. satc-az. com/) formed in August 2000 to promote and implement high-tech industry economic development and competitiveness in Tucson & Southern Arizona • Arizona Optics Industry Association (AOIA - http: //www. aoia. org/), Environmental Technology Industry Association (ETIC - http: //www. az-etic. com/), and Bioindustry Association of Southern Arizona (BIO-SA - http: //www. bio-sa. org/) strong here • Tucson Regional Economic Opportunities, Inc. (TREO - http: //www. treoaz. org/) is the lead economic development agency for the greater Tucson area • Cluster representatives from Tucson and Arizona Clusters have been meeting to discuss business development needs and strategies for Southern Arizona and plan to rename and repurpose SATC as the Greater Tucson Technology Alliance (GTTA) to facilitate collaboration of technology industry clusters and other business development, government and education organizations

Arizona Organizational Landscape - Entrepreneurial • The Arizona Internet Professional Association (AZIPA – http: //www. azipa. org/) arose in the late 90’s with Phoenix area meetings and an active e-mail discussion list that remains in place today. It was complemented by Tech Oasis (http: //www. techoasis. org/) meetings in the Phoenix area and Tucson which for a time had significant attendance and continue in Tempe monthly, but at a lower attendance level. Both attract a more technically oriented &/or entrepreneurial audience. • The Indus Entrepreneurs (Ti. E) have a strong regional chapter (http: //az. tie. org/) based in Phoenix to inspire, foster and support entrepreneurship in Arizona. They hold monthly dinner meetings and a popular Annual Venture Capital Conference/Panel. • The Invest Southwest (http: //www. investsouthwest. org/) in partnership with is ASU Technopolis (http: //www. asutechnopolis. org/) produces the premier capital conference in Arizona annually featuring over a dozen Arizona startups and attracting several hundred investor attendees. The Arizona Technology Council is visible as an exhibitor and publicity partner. • The Arizona Entrepreneurship Conference (http: //www. azentrepreneurship. com/), now in its second year is a day-long series of panels, workshops, speakers and networking opportunities and has proved popular. The Arizona Technology Council is visible as an exhibitor and publicity partner. • The Phoenix-area Fast. Trac Entrepreneurial Programs (http: //www. fasttrac. org/) of the Kaufman Foundation is produced by Stealthmode Partners with a recurring 12 weeks of classes with several different focuses and often subsidized rates with over 200 graduates to date. Stealthmode Partners also hosts monthly Entrepreneur Roundtables over dinner and has a large rotating base of attendees.

ATC Business Case for Collaboration and/or Consolidation – Potential Next Steps PHASE II • Utilize Feedback: Get direction from Sustainability Committee on appropriate direction for next steps based on Phase I results • Conduct Phase II: Execute Phase II statement of work as modified by above PHASE III/IV • At the discretion of the Sustainability Committee, the consultants will execute Phase III for preparation of a detailed strategic and operational plan for specific targeted collaborations and/or consolidations, and if necessary, execute Phase IV to repeat the assessment and planning process with other targeted organizations

ATC Business Case for Collaboration and/or Consolidation – Questions and Answers Thank you for the opportunity to conduct this project. Presented By: Steven G. Zylstra, Arizona Technology Council (T) 602. 343. 8324 ext. 101, (M) 412. 735. 9537 (E) szylstra@aztechcouncil. org URL: http: //www. aztechcouncil. org/ Mark Goldstein, International Research Center (T) 602. 470. 0389, (M) 602. 670. 6407 (E) markg@researchedge. com URL: http: //www. researchedge. com/

6aa97e1f8dcaa3d084e2e534a22bd90f.ppt