c18d77daf3abf6da197d58e222a4ddeb.ppt

- Количество слайдов: 30

ASX Trading Process

ASX Trading Process

Outline Stock Exchange? SIRCA’s Role in ASX Data Order Book Explained Examples of Order Book Transactions Order Types and Qualifier Codes Order Duration ASX Market Phases Typical order book stats and trends 2

Outline Stock Exchange? SIRCA’s Role in ASX Data Order Book Explained Examples of Order Book Transactions Order Types and Qualifier Codes Order Duration ASX Market Phases Typical order book stats and trends 2

Stock Exchange? • What is it? – Venue to exchange ownership in shares of a publicly listed companies – Alternative forms • Street corner/coffee shop, organised club, listed company • Mutual agreement/open outcry/electronic platform • Why do they exist? – Help fund large investments and spread risk by • Secondary market activities – provides liquidity and reduces risk • Creating trust through regulation of brokers, public companies and information they release • Transfer share ownership (CHESS) 3

Stock Exchange? • What is it? – Venue to exchange ownership in shares of a publicly listed companies – Alternative forms • Street corner/coffee shop, organised club, listed company • Mutual agreement/open outcry/electronic platform • Why do they exist? – Help fund large investments and spread risk by • Secondary market activities – provides liquidity and reduces risk • Creating trust through regulation of brokers, public companies and information they release • Transfer share ownership (CHESS) 3

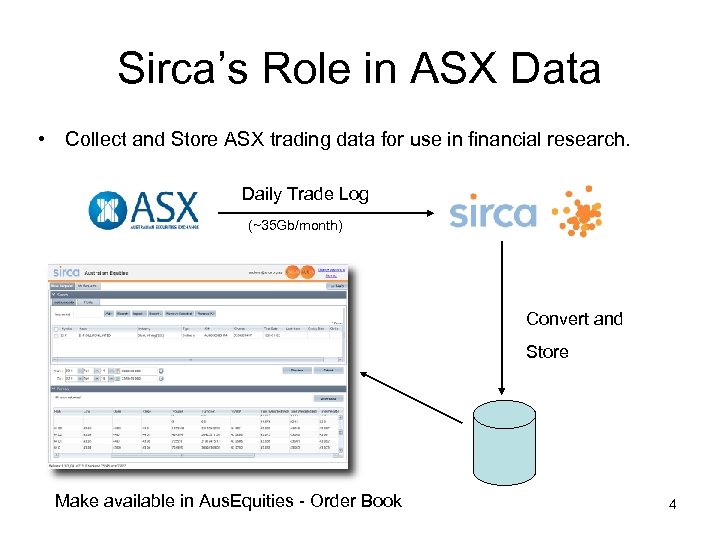

Sirca’s Role in ASX Data • Collect and Store ASX trading data for use in financial research. Daily Trade Log (~35 Gb/month) Convert and Store Make available in Aus. Equities - Order Book 4

Sirca’s Role in ASX Data • Collect and Store ASX trading data for use in financial research. Daily Trade Log (~35 Gb/month) Convert and Store Make available in Aus. Equities - Order Book 4

What is an Order Book? • A prioritized list of the currently outstanding offers to buy or sell securities. • Order entry time and price matter. • The ASX trading system (called SEATS (Stock Exchange Automated Trading System) – 10 Sep 2006, then ITS (Integrated Trading System) – 28 Nov 2010, now NASDAQ OMX Genium INET (Trade. Match, Pure. Match from November 2011, Volume. Match)) uses an order book to match orders and create trades. 5

What is an Order Book? • A prioritized list of the currently outstanding offers to buy or sell securities. • Order entry time and price matter. • The ASX trading system (called SEATS (Stock Exchange Automated Trading System) – 10 Sep 2006, then ITS (Integrated Trading System) – 28 Nov 2010, now NASDAQ OMX Genium INET (Trade. Match, Pure. Match from November 2011, Volume. Match)) uses an order book to match orders and create trades. 5

Order Transaction Types • ENTER: Enters and order into the order book. • AMEND: Modifies an existing order in the order book. • TRADE: Trade between two orders in the order book. • DELETE: Removes an order from the order book • OFFTR: Off-market trade not conducted through order book. 6

Order Transaction Types • ENTER: Enters and order into the order book. • AMEND: Modifies an existing order in the order book. • TRADE: Trade between two orders in the order book. • DELETE: Removes an order from the order book • OFFTR: Off-market trade not conducted through order book. 6

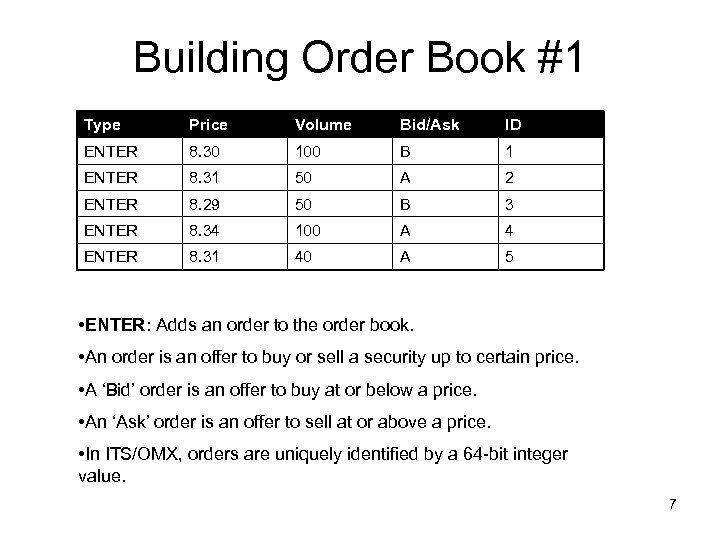

Building Order Book #1 Type Price Volume Bid/Ask ID ENTER 8. 30 100 B 1 ENTER 8. 31 50 A 2 ENTER 8. 29 50 B 3 ENTER 8. 34 100 A 4 ENTER 8. 31 40 A 5 • ENTER: Adds an order to the order book. • An order is an offer to buy or sell a security up to certain price. • A ‘Bid’ order is an offer to buy at or below a price. • An ‘Ask’ order is an offer to sell at or above a price. • In ITS/OMX, orders are uniquely identified by a 64 -bit integer value. 7

Building Order Book #1 Type Price Volume Bid/Ask ID ENTER 8. 30 100 B 1 ENTER 8. 31 50 A 2 ENTER 8. 29 50 B 3 ENTER 8. 34 100 A 4 ENTER 8. 31 40 A 5 • ENTER: Adds an order to the order book. • An order is an offer to buy or sell a security up to certain price. • A ‘Bid’ order is an offer to buy at or below a price. • An ‘Ask’ order is an offer to sell at or above a price. • In ITS/OMX, orders are uniquely identified by a 64 -bit integer value. 7

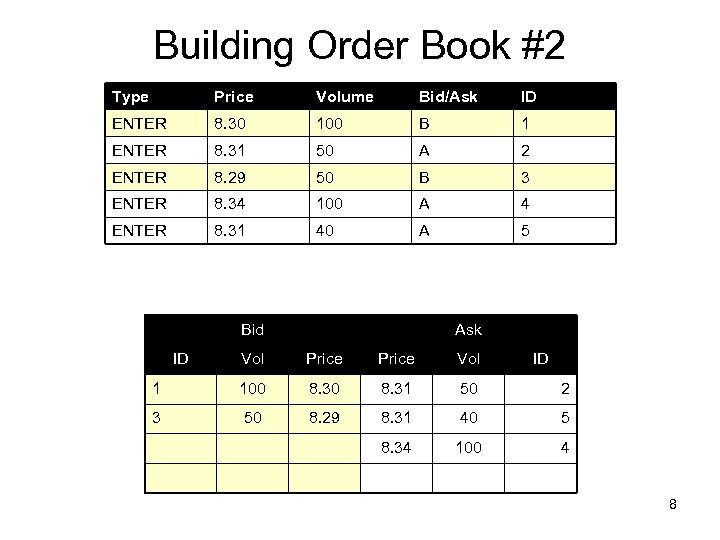

Building Order Book #2 Type Price Volume Bid/Ask ID ENTER 8. 30 100 B 1 ENTER 8. 31 50 A 2 ENTER 8. 29 50 B 3 ENTER 8. 34 100 A 4 ENTER 8. 31 40 A 5 Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 8

Building Order Book #2 Type Price Volume Bid/Ask ID ENTER 8. 30 100 B 1 ENTER 8. 31 50 A 2 ENTER 8. 29 50 B 3 ENTER 8. 34 100 A 4 ENTER 8. 31 40 A 5 Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 8

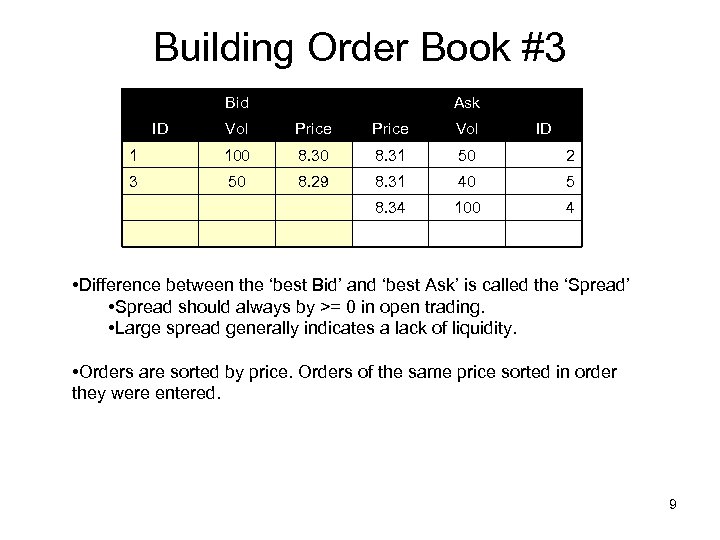

Building Order Book #3 Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 • Difference between the ‘best Bid’ and ‘best Ask’ is called the ‘Spread’ • Spread should always by >= 0 in open trading. • Large spread generally indicates a lack of liquidity. • Orders are sorted by price. Orders of the same price sorted in order they were entered. 9

Building Order Book #3 Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 • Difference between the ‘best Bid’ and ‘best Ask’ is called the ‘Spread’ • Spread should always by >= 0 in open trading. • Large spread generally indicates a lack of liquidity. • Orders are sorted by price. Orders of the same price sorted in order they were entered. 9

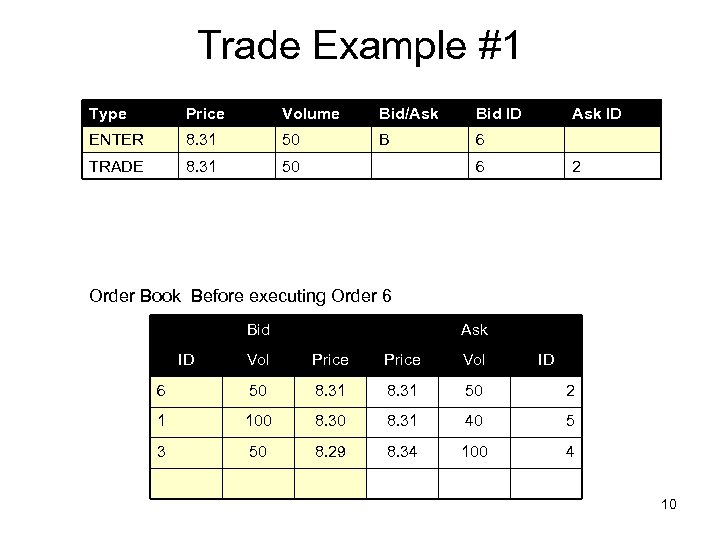

Trade Example #1 Type Price Volume Bid/Ask Bid ID ENTER 8. 31 50 B 6 TRADE 8. 31 50 Ask ID 6 2 Order Book Before executing Order 6 Bid ID Ask Vol Price Vol ID 6 50 8. 31 50 2 1 100 8. 31 40 5 3 50 8. 29 8. 34 100 4 10

Trade Example #1 Type Price Volume Bid/Ask Bid ID ENTER 8. 31 50 B 6 TRADE 8. 31 50 Ask ID 6 2 Order Book Before executing Order 6 Bid ID Ask Vol Price Vol ID 6 50 8. 31 50 2 1 100 8. 31 40 5 3 50 8. 29 8. 34 100 4 10

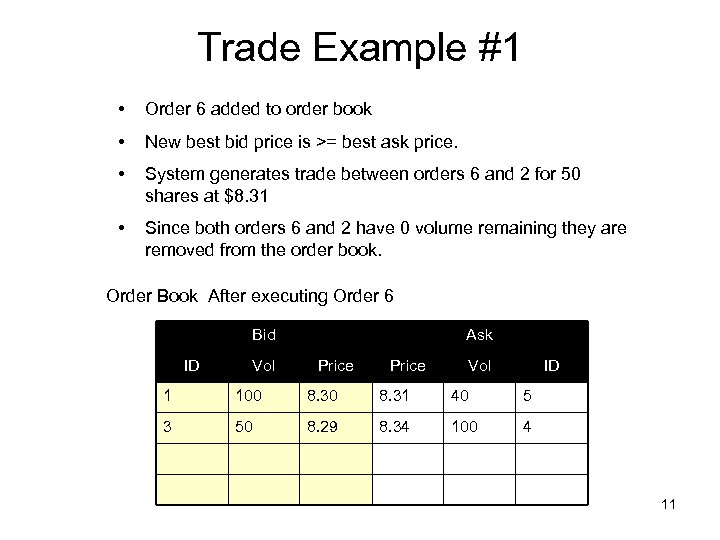

Trade Example #1 • Order 6 added to order book • New best bid price is >= best ask price. • System generates trade between orders 6 and 2 for 50 shares at $8. 31 • Since both orders 6 and 2 have 0 volume remaining they are removed from the order book. Order Book After executing Order 6 Bid ID Vol Ask Price Vol ID 1 100 8. 31 40 5 3 50 8. 29 8. 34 100 4 11

Trade Example #1 • Order 6 added to order book • New best bid price is >= best ask price. • System generates trade between orders 6 and 2 for 50 shares at $8. 31 • Since both orders 6 and 2 have 0 volume remaining they are removed from the order book. Order Book After executing Order 6 Bid ID Vol Ask Price Vol ID 1 100 8. 31 40 5 3 50 8. 29 8. 34 100 4 11

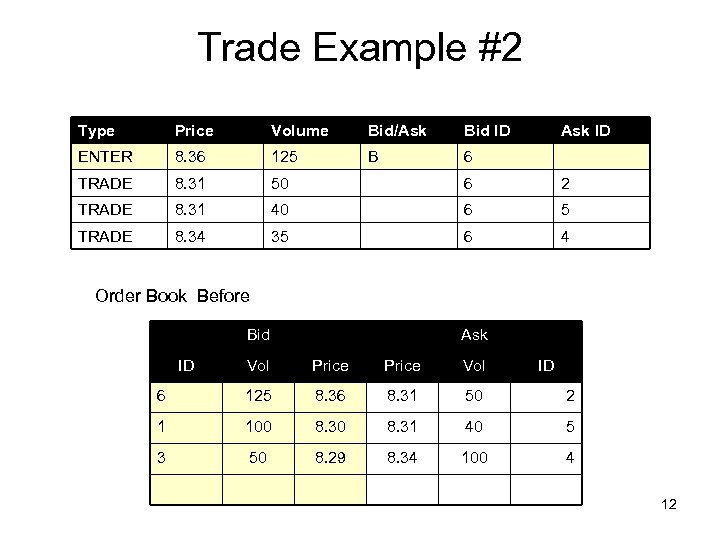

Trade Example #2 Type Price Volume Bid/Ask Bid ID Ask ID ENTER 8. 36 125 B 6 TRADE 8. 31 50 6 2 TRADE 8. 31 40 6 5 TRADE 8. 34 35 6 4 Order Book Before Bid ID Ask Vol Price Vol ID 6 125 8. 36 8. 31 50 2 1 100 8. 31 40 5 3 50 8. 29 8. 34 100 4 12

Trade Example #2 Type Price Volume Bid/Ask Bid ID Ask ID ENTER 8. 36 125 B 6 TRADE 8. 31 50 6 2 TRADE 8. 31 40 6 5 TRADE 8. 34 35 6 4 Order Book Before Bid ID Ask Vol Price Vol ID 6 125 8. 36 8. 31 50 2 1 100 8. 31 40 5 3 50 8. 29 8. 34 100 4 12

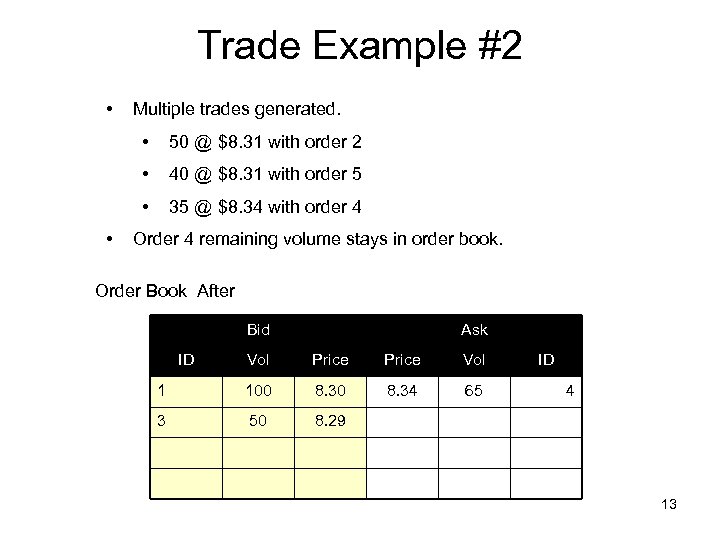

Trade Example #2 • Multiple trades generated. • • 40 @ $8. 31 with order 5 • • 50 @ $8. 31 with order 2 35 @ $8. 34 with order 4 Order 4 remaining volume stays in order book. Order Book After Bid ID Ask Vol Price Vol 1 100 8. 34 65 3 50 ID 8. 29 4 13

Trade Example #2 • Multiple trades generated. • • 40 @ $8. 31 with order 5 • • 50 @ $8. 31 with order 2 35 @ $8. 34 with order 4 Order 4 remaining volume stays in order book. Order Book After Bid ID Ask Vol Price Vol 1 100 8. 34 65 3 50 ID 8. 29 4 13

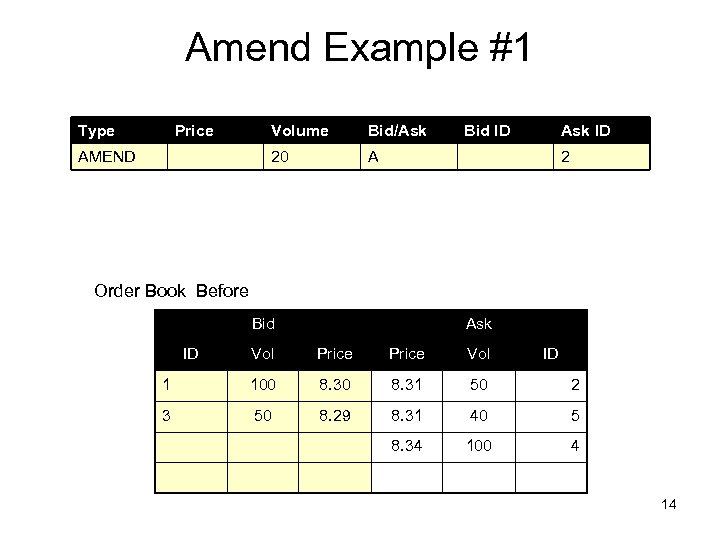

Amend Example #1 Type Price Bid/Ask 20 AMEND Volume Bid ID Ask ID A 2 Order Book Before Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 14

Amend Example #1 Type Price Bid/Ask 20 AMEND Volume Bid ID Ask ID A 2 Order Book Before Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 14

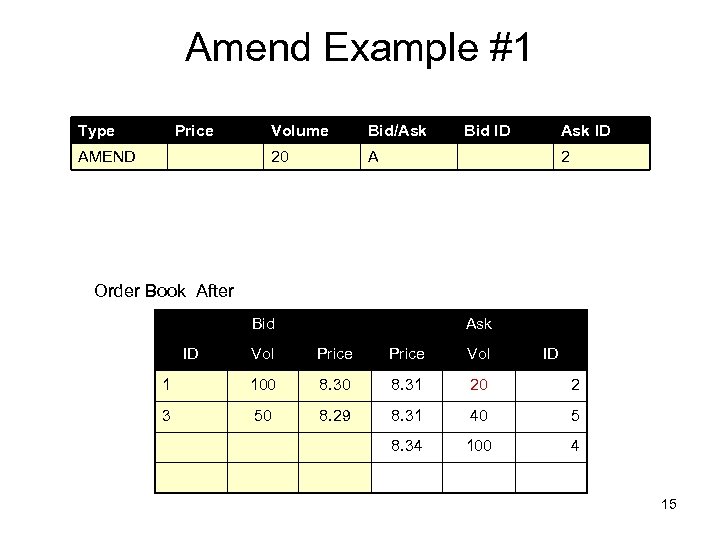

Amend Example #1 Type Price Bid/Ask 20 AMEND Volume Bid ID Ask ID A 2 Order Book After Bid ID Ask Vol Price Vol ID 1 100 8. 31 20 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 15

Amend Example #1 Type Price Bid/Ask 20 AMEND Volume Bid ID Ask ID A 2 Order Book After Bid ID Ask Vol Price Vol ID 1 100 8. 31 20 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 15

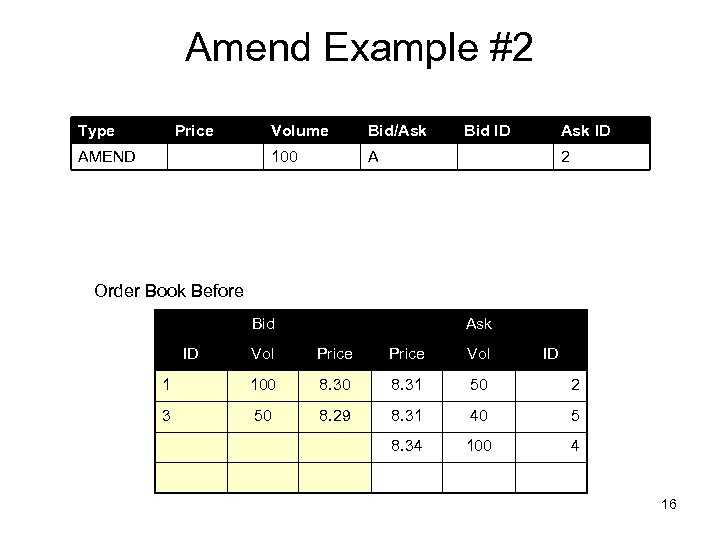

Amend Example #2 Type Price Bid/Ask 100 AMEND Volume Bid ID Ask ID A 2 Order Book Before Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 16

Amend Example #2 Type Price Bid/Ask 100 AMEND Volume Bid ID Ask ID A 2 Order Book Before Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 16

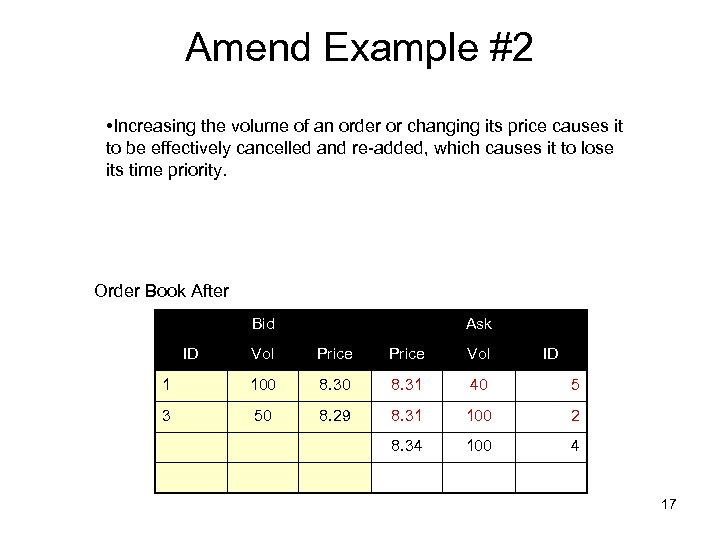

Amend Example #2 • Increasing the volume of an order or changing its price causes it to be effectively cancelled and re-added, which causes it to lose its time priority. Order Book After Bid ID Ask Vol Price Vol ID 1 100 8. 31 40 5 3 50 8. 29 8. 31 100 2 8. 34 100 4 17

Amend Example #2 • Increasing the volume of an order or changing its price causes it to be effectively cancelled and re-added, which causes it to lose its time priority. Order Book After Bid ID Ask Vol Price Vol ID 1 100 8. 31 40 5 3 50 8. 29 8. 31 100 2 8. 34 100 4 17

Delete Example Type Price Volume Bid ID B DELETE Bid/Ask ID 1 Order Book Before Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 18

Delete Example Type Price Volume Bid ID B DELETE Bid/Ask ID 1 Order Book Before Bid ID Ask Vol Price Vol ID 1 100 8. 31 50 2 3 50 8. 29 8. 31 40 5 8. 34 100 4 18

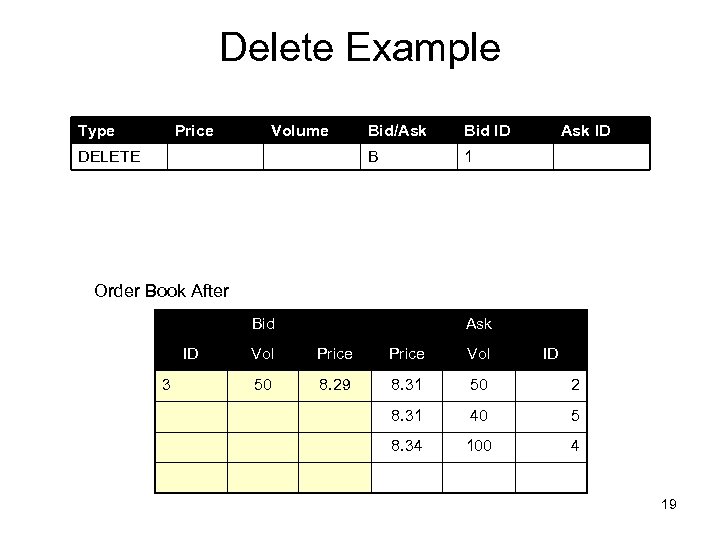

Delete Example Type Price Volume Bid ID B DELETE Bid/Ask ID 1 Order Book After Bid ID 3 Ask Vol Price Vol ID 50 8. 29 8. 31 50 2 8. 31 40 5 8. 34 100 4 19

Delete Example Type Price Volume Bid ID B DELETE Bid/Ask ID 1 Order Book After Bid ID 3 Ask Vol Price Vol ID 50 8. 29 8. 31 50 2 8. 31 40 5 8. 34 100 4 19

Order Types • LIMIT – Order entered with a specified price. – For Bid order: Buy at this price or lower. – For Ask order: Sell at this price or higher. – Most orders are of this type. – No Qualifier. • BEST – Automatically entered at current best price. – Entered at best bid if a bid order, best ask if an ask order. – No Qualifier (looks like a Limit order). 20

Order Types • LIMIT – Order entered with a specified price. – For Bid order: Buy at this price or lower. – For Ask order: Sell at this price or higher. – Most orders are of this type. – No Qualifier. • BEST – Automatically entered at current best price. – Entered at best bid if a bid order, best ask if an ask order. – No Qualifier (looks like a Limit order). 20

Order Types • MARKET – Order entered at best prices on opposite side of market. – Bid order entered at current best Ask price. S, Ask order entered at current best Bid price. S. – A Market order does not have a price limit and is traded at any price available in the market. – Several price levels can be traded in order to fill as much as possible of the order quantity. – Qualifier: MK 21

Order Types • MARKET – Order entered at best prices on opposite side of market. – Bid order entered at current best Ask price. S, Ask order entered at current best Bid price. S. – A Market order does not have a price limit and is traded at any price available in the market. – Several price levels can be traded in order to fill as much as possible of the order quantity. – Qualifier: MK 21

Order Types • MARKET TO LIMIT – Order entered at best price on opposite side of market. – Bid order entered at current best Ask price, Ask order entered at current best Bid price. – Any part of order not immediately traded converted to a Limit order. – Qualifier: ML 22

Order Types • MARKET TO LIMIT – Order entered at best price on opposite side of market. – Bid order entered at current best Ask price, Ask order entered at current best Bid price. – Any part of order not immediately traded converted to a Limit order. – Qualifier: ML 22

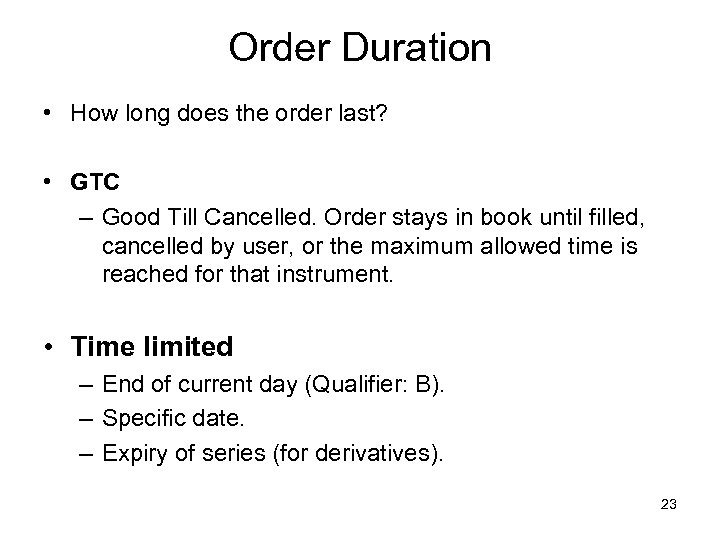

Order Duration • How long does the order last? • GTC – Good Till Cancelled. Order stays in book until filled, cancelled by user, or the maximum allowed time is reached for that instrument. • Time limited – End of current day (Qualifier: B). – Specific date. – Expiry of series (for derivatives). 23

Order Duration • How long does the order last? • GTC – Good Till Cancelled. Order stays in book until filled, cancelled by user, or the maximum allowed time is reached for that instrument. • Time limited – End of current day (Qualifier: B). – Specific date. – Expiry of series (for derivatives). 23

Order Duration • Fill and Kill – Trade as much of the order as can be traded immediately, cancel the rest. – Qualifier: FK • Fill or Kill (All or Nothing) – Trade the entire balance of the order immediately if possible, otherwise cancel the order before trading any. – Qualifier: AK • Fa. K and Fo. K typically used with Market Orders 24

Order Duration • Fill and Kill – Trade as much of the order as can be traded immediately, cancel the rest. – Qualifier: FK • Fill or Kill (All or Nothing) – Trade the entire balance of the order immediately if possible, otherwise cancel the order before trading any. – Qualifier: AK • Fa. K and Fo. K typically used with Market Orders 24

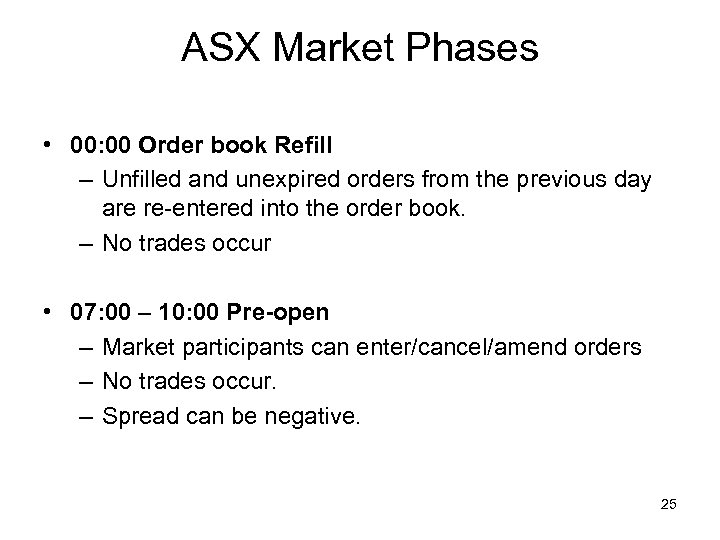

ASX Market Phases • 00: 00 Order book Refill – Unfilled and unexpired orders from the previous day are re-entered into the order book. – No trades occur • 07: 00 – 10: 00 Pre-open – Market participants can enter/cancel/amend orders – No trades occur. – Spread can be negative. 25

ASX Market Phases • 00: 00 Order book Refill – Unfilled and unexpired orders from the previous day are re-entered into the order book. – No trades occur • 07: 00 – 10: 00 Pre-open – Market participants can enter/cancel/amend orders – No trades occur. – Spread can be negative. 25

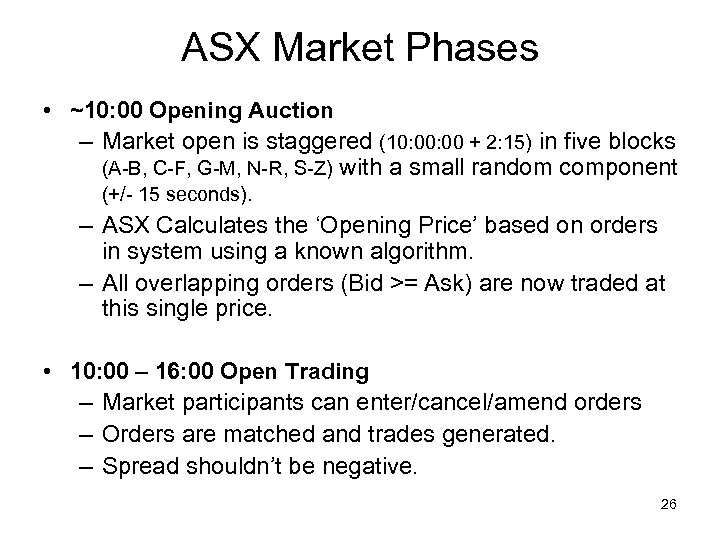

ASX Market Phases • ~10: 00 Opening Auction – Market open is staggered (10: 00 + 2: 15) in five blocks (A-B, C-F, G-M, N-R, S-Z) with a small random component (+/- 15 seconds). – ASX Calculates the ‘Opening Price’ based on orders in system using a known algorithm. – All overlapping orders (Bid >= Ask) are now traded at this single price. • 10: 00 – 16: 00 Open Trading – Market participants can enter/cancel/amend orders – Orders are matched and trades generated. – Spread shouldn’t be negative. 26

ASX Market Phases • ~10: 00 Opening Auction – Market open is staggered (10: 00 + 2: 15) in five blocks (A-B, C-F, G-M, N-R, S-Z) with a small random component (+/- 15 seconds). – ASX Calculates the ‘Opening Price’ based on orders in system using a known algorithm. – All overlapping orders (Bid >= Ask) are now traded at this single price. • 10: 00 – 16: 00 Open Trading – Market participants can enter/cancel/amend orders – Orders are matched and trades generated. – Spread shouldn’t be negative. 26

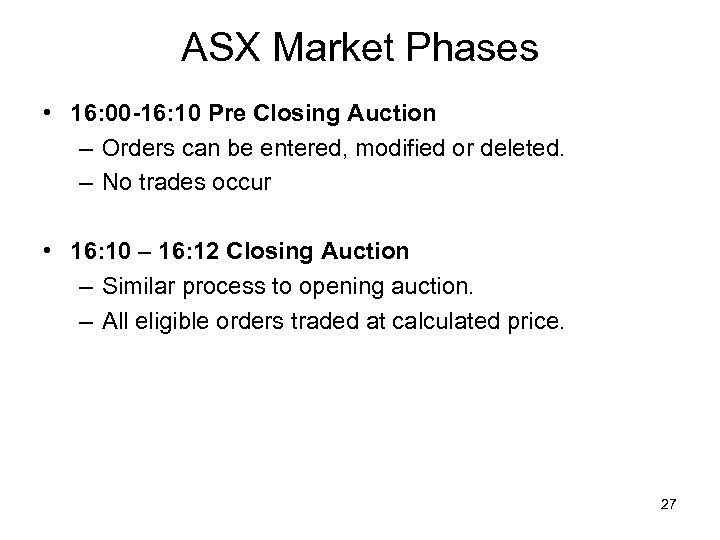

ASX Market Phases • 16: 00 -16: 10 Pre Closing Auction – Orders can be entered, modified or deleted. – No trades occur • 16: 10 – 16: 12 Closing Auction – Similar process to opening auction. – All eligible orders traded at calculated price. 27

ASX Market Phases • 16: 00 -16: 10 Pre Closing Auction – Orders can be entered, modified or deleted. – No trades occur • 16: 10 – 16: 12 Closing Auction – Similar process to opening auction. – All eligible orders traded at calculated price. 27

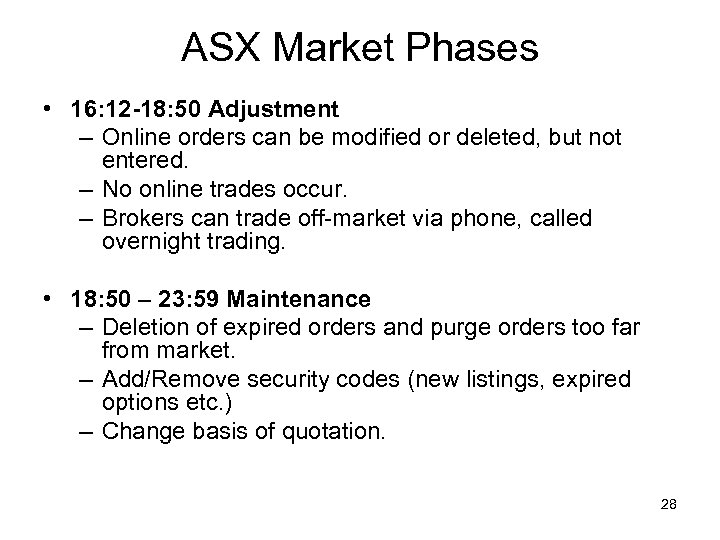

ASX Market Phases • 16: 12 -18: 50 Adjustment – Online orders can be modified or deleted, but not entered. – No online trades occur. – Brokers can trade off-market via phone, called overnight trading. • 18: 50 – 23: 59 Maintenance – Deletion of expired orders and purge orders too far from market. – Add/Remove security codes (new listings, expired options etc. ) – Change basis of quotation. 28

ASX Market Phases • 16: 12 -18: 50 Adjustment – Online orders can be modified or deleted, but not entered. – No online trades occur. – Brokers can trade off-market via phone, called overnight trading. • 18: 50 – 23: 59 Maintenance – Deletion of expired orders and purge orders too far from market. – Add/Remove security codes (new listings, expired options etc. ) – Change basis of quotation. 28

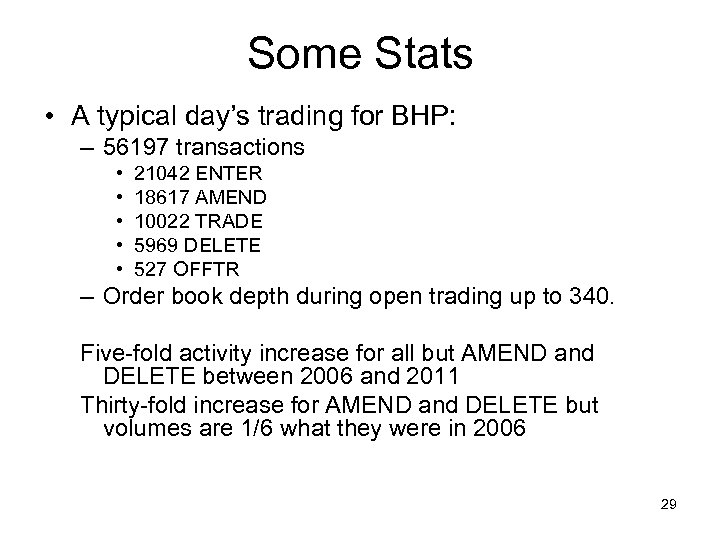

Some Stats • A typical day’s trading for BHP: – 56197 transactions • • • 21042 ENTER 18617 AMEND 10022 TRADE 5969 DELETE 527 OFFTR – Order book depth during open trading up to 340. Five-fold activity increase for all but AMEND and DELETE between 2006 and 2011 Thirty-fold increase for AMEND and DELETE but volumes are 1/6 what they were in 2006 29

Some Stats • A typical day’s trading for BHP: – 56197 transactions • • • 21042 ENTER 18617 AMEND 10022 TRADE 5969 DELETE 527 OFFTR – Order book depth during open trading up to 340. Five-fold activity increase for all but AMEND and DELETE between 2006 and 2011 Thirty-fold increase for AMEND and DELETE but volumes are 1/6 what they were in 2006 29

Links • ITS Reference Manual: – https: //www. asxonline. com/intradoccgi/idcplg? Idc. Service=ASX_COLLECTION_DISPLAY&has. Collec tion. ID=true&d. Collection. ID=739 • ASX Market Phases: – http: //www. asx. com. au/products/ASX-Trading%20 hours-Marketphases. htm • Auction Pricing Algorithm: – http: //www. asx. com. au/products/calculate-open-close-prices. htm • ASX Qualifiers: – https: //ausequities. sirca. org. au/Aus. Equities/doc/qualifiers. jsp 30

Links • ITS Reference Manual: – https: //www. asxonline. com/intradoccgi/idcplg? Idc. Service=ASX_COLLECTION_DISPLAY&has. Collec tion. ID=true&d. Collection. ID=739 • ASX Market Phases: – http: //www. asx. com. au/products/ASX-Trading%20 hours-Marketphases. htm • Auction Pricing Algorithm: – http: //www. asx. com. au/products/calculate-open-close-prices. htm • ASX Qualifiers: – https: //ausequities. sirca. org. au/Aus. Equities/doc/qualifiers. jsp 30