a1b155bea87d5c8aedf79c5dd20d7ce3.ppt

- Количество слайдов: 54

Assurant Health Access. SM Having Access Pays® For agent use only Not for use in AZ

Assurant Health Access. SM Having Access Pays® For agent use only Not for use in AZ

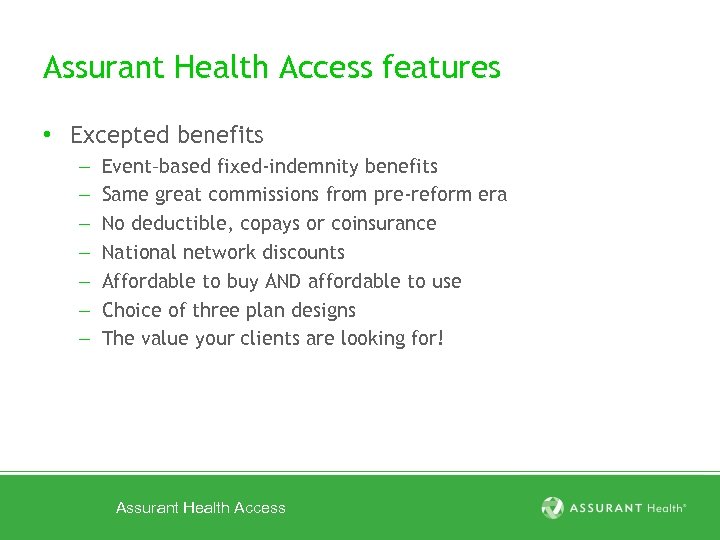

Assurant Health Access features • Excepted benefits – – – – Event–based fixed-indemnity benefits Same great commissions from pre-reform era No deductible, copays or coinsurance National network discounts Affordable to buy AND affordable to use Choice of three plan designs The value your clients are looking for! Assurant Health Access

Assurant Health Access features • Excepted benefits – – – – Event–based fixed-indemnity benefits Same great commissions from pre-reform era No deductible, copays or coinsurance National network discounts Affordable to buy AND affordable to use Choice of three plan designs The value your clients are looking for! Assurant Health Access

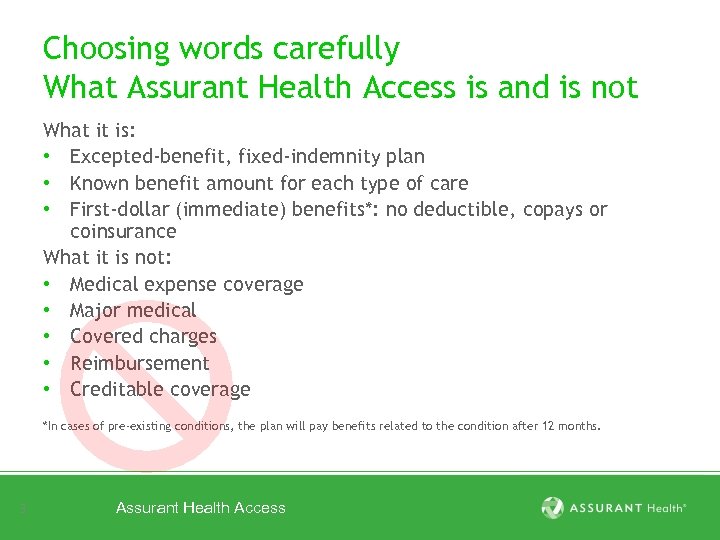

Choosing words carefully What Assurant Health Access is and is not What it is: • Excepted-benefit, fixed-indemnity plan • Known benefit amount for each type of care • First-dollar (immediate) benefits*: no deductible, copays or coinsurance What it is not: • Medical expense coverage • Major medical • Covered charges • Reimbursement • Creditable coverage *In cases of pre-existing conditions, the plan will pay benefits related to the condition after 12 months. 3 Assurant Health Access

Choosing words carefully What Assurant Health Access is and is not What it is: • Excepted-benefit, fixed-indemnity plan • Known benefit amount for each type of care • First-dollar (immediate) benefits*: no deductible, copays or coinsurance What it is not: • Medical expense coverage • Major medical • Covered charges • Reimbursement • Creditable coverage *In cases of pre-existing conditions, the plan will pay benefits related to the condition after 12 months. 3 Assurant Health Access

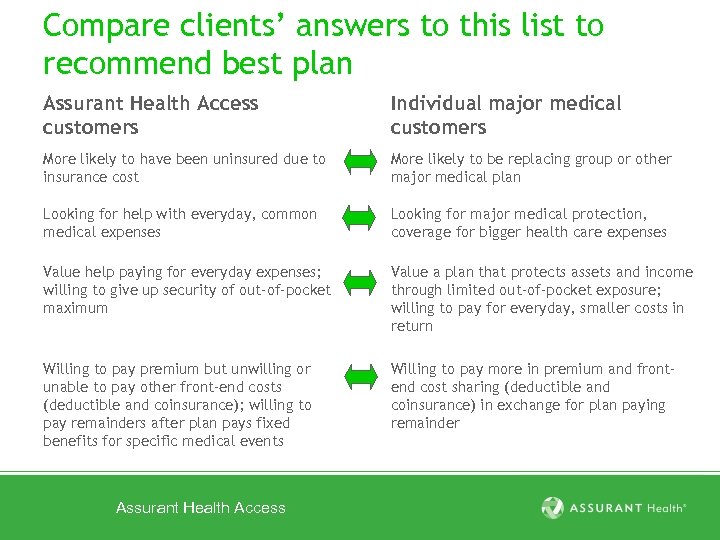

Compare clients’ answers to this list to recommend best plan Assurant Health Access customers Individual major medical customers More likely to have been uninsured due to insurance cost More likely to be replacing group or other major medical plan Looking for help with everyday, common medical expenses Looking for major medical protection, coverage for bigger health care expenses Value help paying for everyday expenses; willing to give up security of out-of-pocket maximum Value a plan that protects assets and income through limited out-of-pocket exposure; willing to pay for everyday, smaller costs in return Willing to pay premium but unwilling or unable to pay other front-end costs (deductible and coinsurance); willing to pay remainders after plan pays fixed benefits for specific medical events Willing to pay more in premium and frontend cost sharing (deductible and coinsurance) in exchange for plan paying remainder Assurant Health Access

Compare clients’ answers to this list to recommend best plan Assurant Health Access customers Individual major medical customers More likely to have been uninsured due to insurance cost More likely to be replacing group or other major medical plan Looking for help with everyday, common medical expenses Looking for major medical protection, coverage for bigger health care expenses Value help paying for everyday expenses; willing to give up security of out-of-pocket maximum Value a plan that protects assets and income through limited out-of-pocket exposure; willing to pay for everyday, smaller costs in return Willing to pay premium but unwilling or unable to pay other front-end costs (deductible and coinsurance); willing to pay remainders after plan pays fixed benefits for specific medical events Willing to pay more in premium and frontend cost sharing (deductible and coinsurance) in exchange for plan paying remainder Assurant Health Access

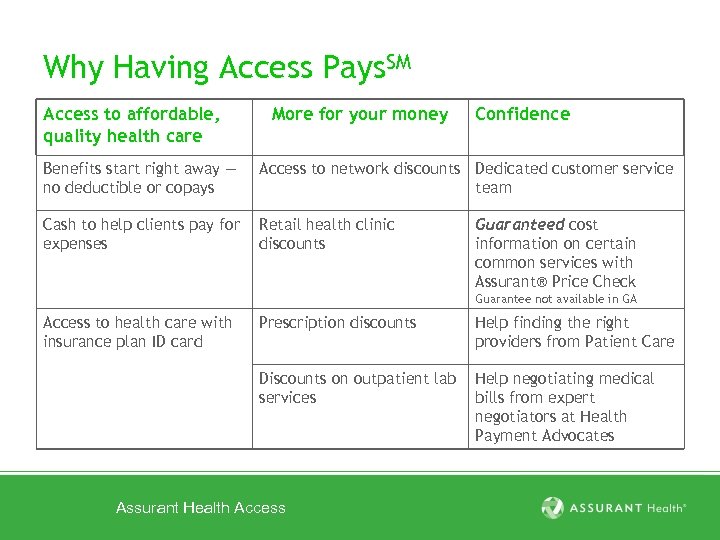

Why Having Access Pays. SM Access to affordable, quality health care More for your money Confidence Benefits start right away — no deductible or copays Access to network discounts Dedicated customer service team Cash to help clients pay for expenses Retail health clinic discounts Guaranteed cost information on certain common services with Assurant® Price Check Guarantee not available in GA Access to health care with insurance plan ID card Prescription discounts Help finding the right providers from Patient Care Discounts on outpatient lab services Help negotiating medical bills from expert negotiators at Health Payment Advocates Assurant Health Access

Why Having Access Pays. SM Access to affordable, quality health care More for your money Confidence Benefits start right away — no deductible or copays Access to network discounts Dedicated customer service team Cash to help clients pay for expenses Retail health clinic discounts Guaranteed cost information on certain common services with Assurant® Price Check Guarantee not available in GA Access to health care with insurance plan ID card Prescription discounts Help finding the right providers from Patient Care Discounts on outpatient lab services Help negotiating medical bills from expert negotiators at Health Payment Advocates Assurant Health Access

Having Access Pays agents too • Agents earn more with Assurant Health Access – Pays the full commission you’re used to earning – Pays annualized advance up to $1, 000 per policy — same as major medical • Addresses the changing market — will have huge appeal – Uninsured population steadily rising because of increasing premiums – Brings new customers — more than 75% of buyers are uninsured and looking for different value Assurant Health Access

Having Access Pays agents too • Agents earn more with Assurant Health Access – Pays the full commission you’re used to earning – Pays annualized advance up to $1, 000 per policy — same as major medical • Addresses the changing market — will have huge appeal – Uninsured population steadily rising because of increasing premiums – Brings new customers — more than 75% of buyers are uninsured and looking for different value Assurant Health Access

Assurant Health Access prospective customers

Assurant Health Access prospective customers

Whom is Assurant Health Access right for? • Customers who don’t see value in a traditional high deductible health plan — meeting that deductible might as well be catastrophic • Place highest value on access to basic health care – They need to stay healthy to keep working – If something really bad happens, they’ll deal with it • Haven’t had coverage recently or can’t afford traditional plans • Dropping an individual or group major medical plan • When major medical is not an option Assurant Health Access

Whom is Assurant Health Access right for? • Customers who don’t see value in a traditional high deductible health plan — meeting that deductible might as well be catastrophic • Place highest value on access to basic health care – They need to stay healthy to keep working – If something really bad happens, they’ll deal with it • Haven’t had coverage recently or can’t afford traditional plans • Dropping an individual or group major medical plan • When major medical is not an option Assurant Health Access

Who can buy Assurant Health Access? • Individuals • Families – Same affordable price for two or more children on plan • Adults • Children (child-only plans available) Assurant Health Access

Who can buy Assurant Health Access? • Individuals • Families – Same affordable price for two or more children on plan • Adults • Children (child-only plans available) Assurant Health Access

Anita Customers like Anita feel that it’s hard to pay for everything that comes up each month. They can’t afford an unexpected doctor visit. They need to stay healthy so they can work and earn the most possible. You’ll recognize Anita because she’s likely to be: • Age: Late 20 s to 30 s • Single mom with children who also need coverage • Working as a waitress or in several part-time jobs • Unsure exactly what her monthly income will be; it varies Statements are illustrative. 10 Assurant Health Access Benefits Anita is looking for: • Basic preventive care to keep her working • Coverage for her children at an affordable price • Help paying for inpatient or outpatient care and ER if something happens • Preventive dental care

Anita Customers like Anita feel that it’s hard to pay for everything that comes up each month. They can’t afford an unexpected doctor visit. They need to stay healthy so they can work and earn the most possible. You’ll recognize Anita because she’s likely to be: • Age: Late 20 s to 30 s • Single mom with children who also need coverage • Working as a waitress or in several part-time jobs • Unsure exactly what her monthly income will be; it varies Statements are illustrative. 10 Assurant Health Access Benefits Anita is looking for: • Basic preventive care to keep her working • Coverage for her children at an affordable price • Help paying for inpatient or outpatient care and ER if something happens • Preventive dental care

Tanya Customers like Tanya know their health is important. But they can’t afford to pay a high premium and a deductible. They want a plan that offers assurance that they can see the doctor when they need to and go in for an annual exam. You’ll recognize Tanya because she’s likely to be: • Single • Age 25 -34 • A high school graduate with no college degree • Employed full time as a sales assistant • Renting her apartment downtown • Shopping at Walmart Statements are illustrative. 11 Assurant Health Access Benefits Tanya is looking for: • A plan she can use right away, not one with a deductible she can’t afford • A plan that saves her money • Additional coverage for inpatient hospitalization • Dental coverage

Tanya Customers like Tanya know their health is important. But they can’t afford to pay a high premium and a deductible. They want a plan that offers assurance that they can see the doctor when they need to and go in for an annual exam. You’ll recognize Tanya because she’s likely to be: • Single • Age 25 -34 • A high school graduate with no college degree • Employed full time as a sales assistant • Renting her apartment downtown • Shopping at Walmart Statements are illustrative. 11 Assurant Health Access Benefits Tanya is looking for: • A plan she can use right away, not one with a deductible she can’t afford • A plan that saves her money • Additional coverage for inpatient hospitalization • Dental coverage

Dennis Customers like Dennis are worried about their employer’s rates going up, and they need a new option. They like to know how their benefits are working and how they can save the most money. They’re always looking for a deal. You’ll recognize Dennis because he’s likely to be: • Recently married and in need of benefits for his wife • Age 31 -40 • A graduate of his local commuter college • At an income level of $75 K • Employed full time • Using coupons and rebates on day-today purchases Statements are illustrative. 12 Assurant Health Access Benefits Dennis is looking for: • A plan that will pay benefits for his ongoing prescriptions • Good coverage for things he can’t anticipate, just in case • Added peace of mind from Accident or Critical Illness plan • Dental plan

Dennis Customers like Dennis are worried about their employer’s rates going up, and they need a new option. They like to know how their benefits are working and how they can save the most money. They’re always looking for a deal. You’ll recognize Dennis because he’s likely to be: • Recently married and in need of benefits for his wife • Age 31 -40 • A graduate of his local commuter college • At an income level of $75 K • Employed full time • Using coupons and rebates on day-today purchases Statements are illustrative. 12 Assurant Health Access Benefits Dennis is looking for: • A plan that will pay benefits for his ongoing prescriptions • Good coverage for things he can’t anticipate, just in case • Added peace of mind from Accident or Critical Illness plan • Dental plan

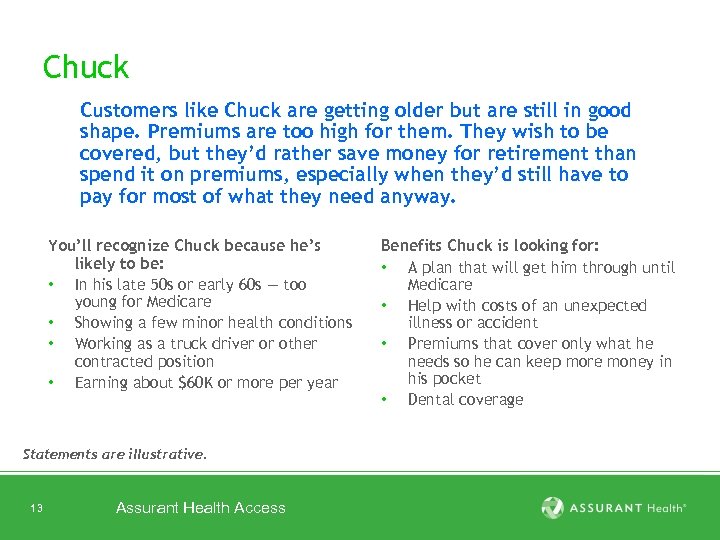

Chuck Customers like Chuck are getting older but are still in good shape. Premiums are too high for them. They wish to be covered, but they’d rather save money for retirement than spend it on premiums, especially when they’d still have to pay for most of what they need anyway. You’ll recognize Chuck because he’s likely to be: • In his late 50 s or early 60 s — too young for Medicare • Showing a few minor health conditions • Working as a truck driver or other contracted position • Earning about $60 K or more per year Statements are illustrative. 13 Assurant Health Access Benefits Chuck is looking for: • A plan that will get him through until Medicare • Help with costs of an unexpected illness or accident • Premiums that cover only what he needs so he can keep more money in his pocket • Dental coverage

Chuck Customers like Chuck are getting older but are still in good shape. Premiums are too high for them. They wish to be covered, but they’d rather save money for retirement than spend it on premiums, especially when they’d still have to pay for most of what they need anyway. You’ll recognize Chuck because he’s likely to be: • In his late 50 s or early 60 s — too young for Medicare • Showing a few minor health conditions • Working as a truck driver or other contracted position • Earning about $60 K or more per year Statements are illustrative. 13 Assurant Health Access Benefits Chuck is looking for: • A plan that will get him through until Medicare • Help with costs of an unexpected illness or accident • Premiums that cover only what he needs so he can keep more money in his pocket • Dental coverage

Assurant Health Access features and benefits

Assurant Health Access features and benefits

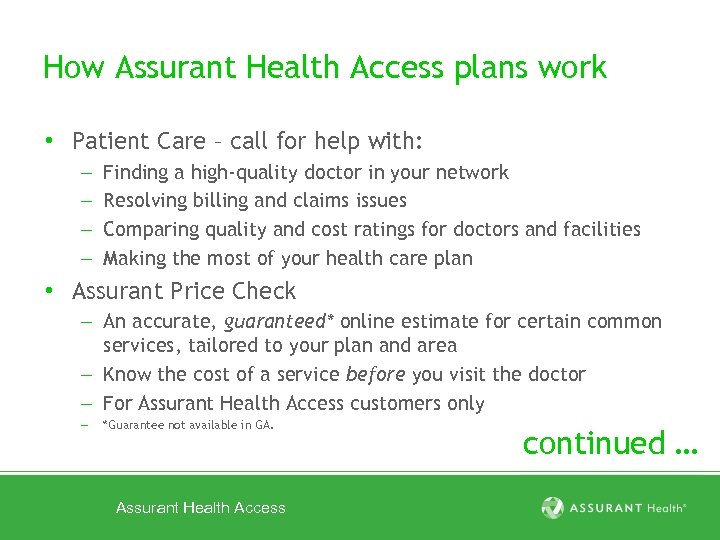

How Assurant Health Access plans work • Patient Care – call for help with: – – Finding a high-quality doctor in your network Resolving billing and claims issues Comparing quality and cost ratings for doctors and facilities Making the most of your health care plan • Assurant Price Check – An accurate, guaranteed* online estimate for certain common services, tailored to your plan and area – Know the cost of a service before you visit the doctor – For Assurant Health Access customers only – *Guarantee not available in GA. Assurant Health Access continued …

How Assurant Health Access plans work • Patient Care – call for help with: – – Finding a high-quality doctor in your network Resolving billing and claims issues Comparing quality and cost ratings for doctors and facilities Making the most of your health care plan • Assurant Price Check – An accurate, guaranteed* online estimate for certain common services, tailored to your plan and area – Know the cost of a service before you visit the doctor – For Assurant Health Access customers only – *Guarantee not available in GA. Assurant Health Access continued …

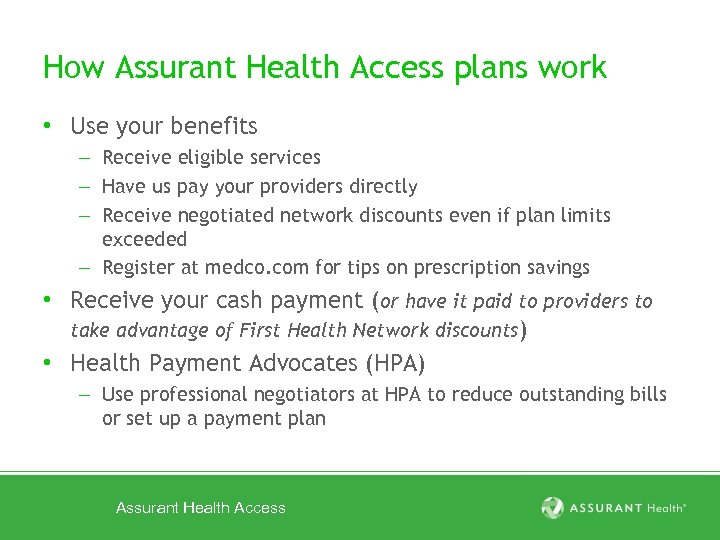

How Assurant Health Access plans work • Use your benefits – Receive eligible services – Have us pay your providers directly – Receive negotiated network discounts even if plan limits exceeded – Register at medco. com for tips on prescription savings • Receive your cash payment (or have it paid to providers to take advantage of First Health Network discounts) • Health Payment Advocates (HPA) – Use professional negotiators at HPA to reduce outstanding bills or set up a payment plan Assurant Health Access

How Assurant Health Access plans work • Use your benefits – Receive eligible services – Have us pay your providers directly – Receive negotiated network discounts even if plan limits exceeded – Register at medco. com for tips on prescription savings • Receive your cash payment (or have it paid to providers to take advantage of First Health Network discounts) • Health Payment Advocates (HPA) – Use professional negotiators at HPA to reduce outstanding bills or set up a payment plan Assurant Health Access

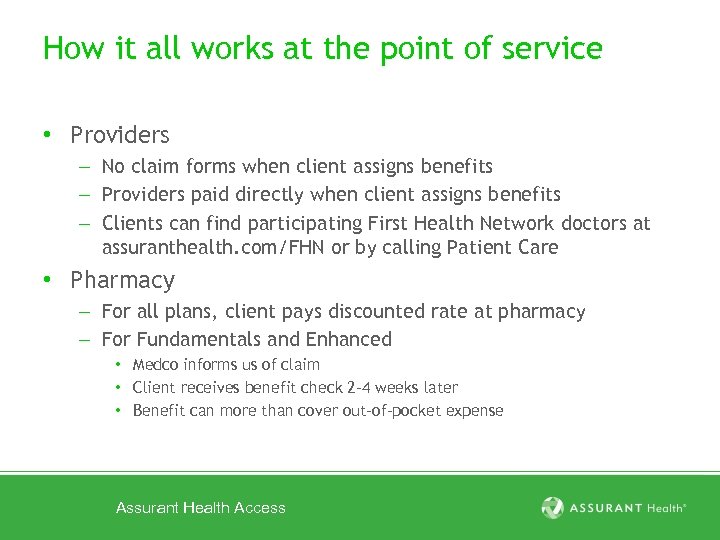

How it all works at the point of service • Providers – No claim forms when client assigns benefits – Providers paid directly when client assigns benefits – Clients can find participating First Health Network doctors at assuranthealth. com/FHN or by calling Patient Care • Pharmacy – For all plans, client pays discounted rate at pharmacy – For Fundamentals and Enhanced • Medco informs us of claim • Client receives benefit check 2 -4 weeks later • Benefit can more than cover out-of-pocket expense Assurant Health Access

How it all works at the point of service • Providers – No claim forms when client assigns benefits – Providers paid directly when client assigns benefits – Clients can find participating First Health Network doctors at assuranthealth. com/FHN or by calling Patient Care • Pharmacy – For all plans, client pays discounted rate at pharmacy – For Fundamentals and Enhanced • Medco informs us of claim • Client receives benefit check 2 -4 weeks later • Benefit can more than cover out-of-pocket expense Assurant Health Access

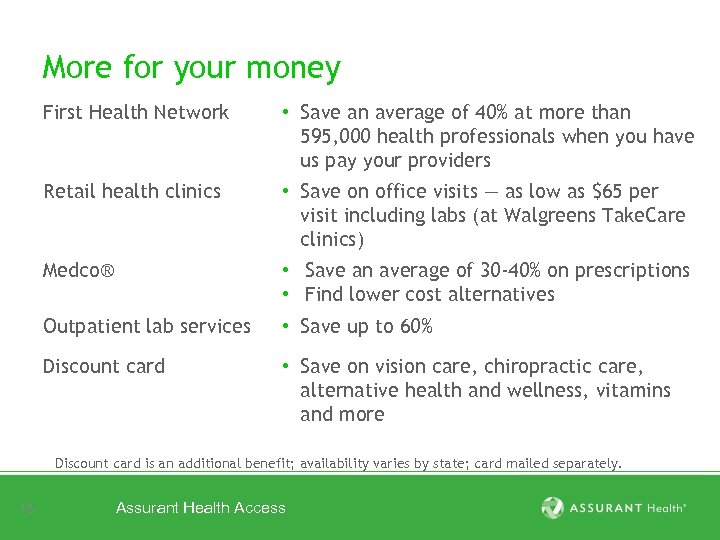

More for your money First Health Network • Save an average of 40% at more than 595, 000 health professionals when you have us pay your providers Retail health clinics • Save on office visits — as low as $65 per visit including labs (at Walgreens Take. Care clinics) Medco® • Save an average of 30 -40% on prescriptions • Find lower cost alternatives Outpatient lab services • Save up to 60% Discount card • Save on vision care, chiropractic care, alternative health and wellness, vitamins and more Discount card is an additional benefit; availability varies by state; card mailed separately. 18 Assurant Health Access

More for your money First Health Network • Save an average of 40% at more than 595, 000 health professionals when you have us pay your providers Retail health clinics • Save on office visits — as low as $65 per visit including labs (at Walgreens Take. Care clinics) Medco® • Save an average of 30 -40% on prescriptions • Find lower cost alternatives Outpatient lab services • Save up to 60% Discount card • Save on vision care, chiropractic care, alternative health and wellness, vitamins and more Discount card is an additional benefit; availability varies by state; card mailed separately. 18 Assurant Health Access

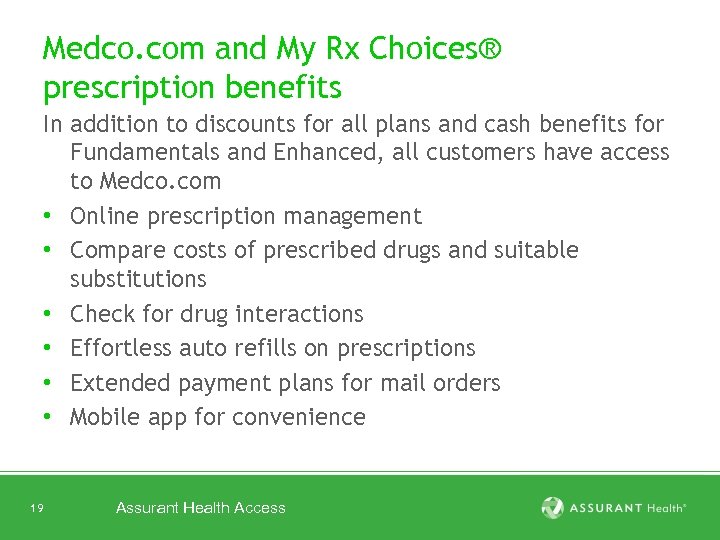

Medco. com and My Rx Choices® prescription benefits In addition to discounts for all plans and cash benefits for Fundamentals and Enhanced, all customers have access to Medco. com • Online prescription management • Compare costs of prescribed drugs and suitable substitutions • Check for drug interactions • Effortless auto refills on prescriptions • Extended payment plans for mail orders • Mobile app for convenience 19 Assurant Health Access

Medco. com and My Rx Choices® prescription benefits In addition to discounts for all plans and cash benefits for Fundamentals and Enhanced, all customers have access to Medco. com • Online prescription management • Compare costs of prescribed drugs and suitable substitutions • Check for drug interactions • Effortless auto refills on prescriptions • Extended payment plans for mail orders • Mobile app for convenience 19 Assurant Health Access

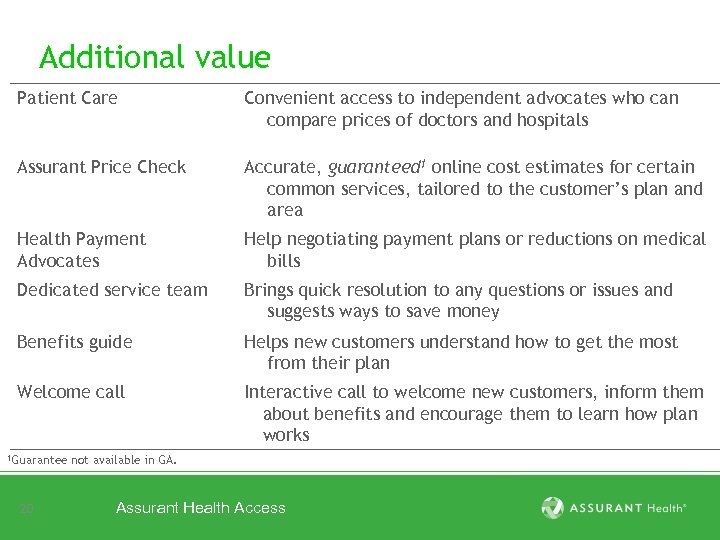

Additional value Patient Care Convenient access to independent advocates who can compare prices of doctors and hospitals Assurant Price Check Accurate, guaranteed 1 online cost estimates for certain common services, tailored to the customer’s plan and area Health Payment Advocates Help negotiating payment plans or reductions on medical bills Dedicated service team Brings quick resolution to any questions or issues and suggests ways to save money Benefits guide Helps new customers understand how to get the most from their plan Welcome call Interactive call to welcome new customers, inform them about benefits and encourage them to learn how plan works 1 Guarantee 20 not available in GA. Assurant Health Access

Additional value Patient Care Convenient access to independent advocates who can compare prices of doctors and hospitals Assurant Price Check Accurate, guaranteed 1 online cost estimates for certain common services, tailored to the customer’s plan and area Health Payment Advocates Help negotiating payment plans or reductions on medical bills Dedicated service team Brings quick resolution to any questions or issues and suggests ways to save money Benefits guide Helps new customers understand how to get the most from their plan Welcome call Interactive call to welcome new customers, inform them about benefits and encourage them to learn how plan works 1 Guarantee 20 not available in GA. Assurant Health Access

Patient Care advantages • Call Patient Care, your independent health advocacy service, for personalized help navigating the health care system. Patient care can … – – – Answer questions about your benefits Compare costs and quality ratings of doctors and hospitals Schedule a doctor appointment for you File your claims for you Research and resolve claims issues Help plan for non-emergency medical services, e. g. • • Colonoscopies Hospital stays MRIs Knee surgery Assurant Health Access

Patient Care advantages • Call Patient Care, your independent health advocacy service, for personalized help navigating the health care system. Patient care can … – – – Answer questions about your benefits Compare costs and quality ratings of doctors and hospitals Schedule a doctor appointment for you File your claims for you Research and resolve claims issues Help plan for non-emergency medical services, e. g. • • Colonoscopies Hospital stays MRIs Knee surgery Assurant Health Access

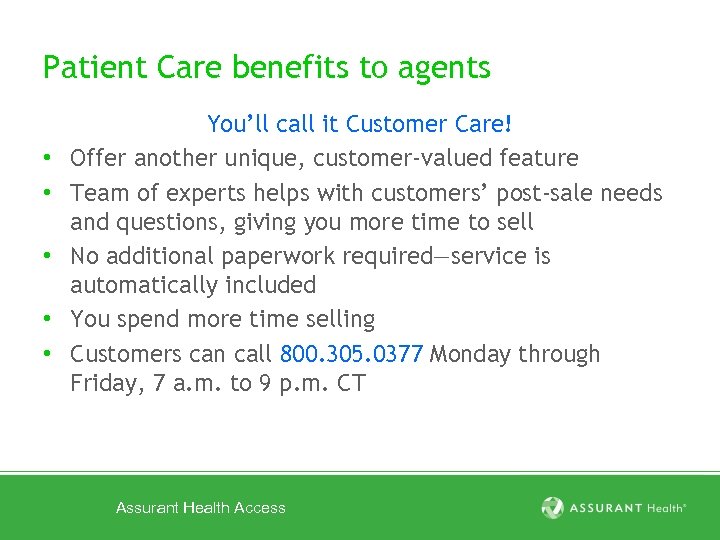

Patient Care benefits to agents • • • You’ll call it Customer Care! Offer another unique, customer-valued feature Team of experts helps with customers’ post-sale needs and questions, giving you more time to sell No additional paperwork required—service is automatically included You spend more time selling Customers can call 800. 305. 0377 Monday through Friday, 7 a. m. to 9 p. m. CT Assurant Health Access

Patient Care benefits to agents • • • You’ll call it Customer Care! Offer another unique, customer-valued feature Team of experts helps with customers’ post-sale needs and questions, giving you more time to sell No additional paperwork required—service is automatically included You spend more time selling Customers can call 800. 305. 0377 Monday through Friday, 7 a. m. to 9 p. m. CT Assurant Health Access

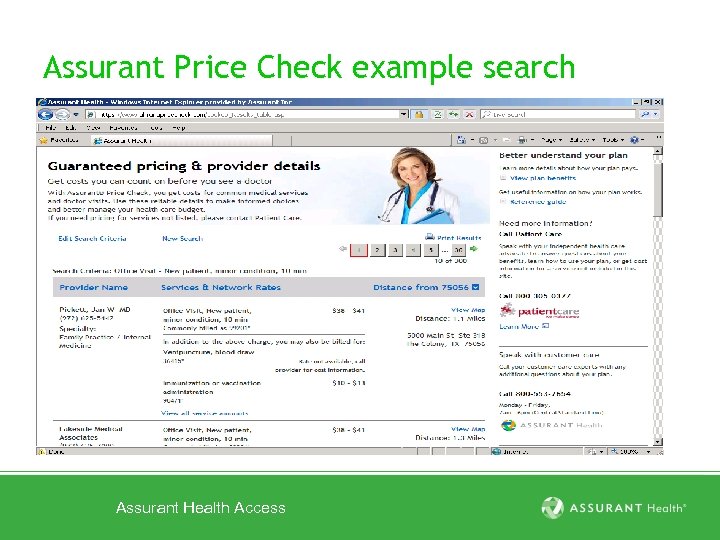

Assurant Price Check guaranteed pricing With Assurant Price Check, your customers can visit Assurant. Price. Check. com at their own convenience and … • • Get accurate, guaranteed cost estimates for certain common services from network doctors Choose their doctor and know before their appointment what certain services will cost Get details that are specific to them, down to their plan and ZIP code Gain valuable knowledge that will help them navigate the health care system with confidence Assurant Price Check is available only to Assurant Health Access customers! Assurant® Price Check Guarantee Customers will not be responsible for any cost that exceeds the quoted price range, provided they receive services for the procedure code shown, from the doctor listed, and for which their First Health Network discounts apply. This price guarantee is good for services received up to 30 days after the date Assurant Price Check provides pricing. * Assurant Price Check is not insurance. It is a price estimate of what you would be charged after your network discount is applied. Assurant Price Check is not a guarantee of Assurant Health Access plan benefits. The program is subject to change. *Guarantee is not available in Georgia. Assurant Health Access

Assurant Price Check guaranteed pricing With Assurant Price Check, your customers can visit Assurant. Price. Check. com at their own convenience and … • • Get accurate, guaranteed cost estimates for certain common services from network doctors Choose their doctor and know before their appointment what certain services will cost Get details that are specific to them, down to their plan and ZIP code Gain valuable knowledge that will help them navigate the health care system with confidence Assurant Price Check is available only to Assurant Health Access customers! Assurant® Price Check Guarantee Customers will not be responsible for any cost that exceeds the quoted price range, provided they receive services for the procedure code shown, from the doctor listed, and for which their First Health Network discounts apply. This price guarantee is good for services received up to 30 days after the date Assurant Price Check provides pricing. * Assurant Price Check is not insurance. It is a price estimate of what you would be charged after your network discount is applied. Assurant Price Check is not a guarantee of Assurant Health Access plan benefits. The program is subject to change. *Guarantee is not available in Georgia. Assurant Health Access

Assurant Price Check example search Assurant Health Access

Assurant Price Check example search Assurant Health Access

HPA capabilities HPA expert negotiators work to: • Negotiate bills of about $300 and higher • Reduce amount owed by policyholder • Establish payment plan to ease financial burden • Review final bill for accuracy of charges (including verifying network discounts, questionable charges) • Identify charitable or financial assistance programs Assurant Health Access

HPA capabilities HPA expert negotiators work to: • Negotiate bills of about $300 and higher • Reduce amount owed by policyholder • Establish payment plan to ease financial burden • Review final bill for accuracy of charges (including verifying network discounts, questionable charges) • Identify charitable or financial assistance programs Assurant Health Access

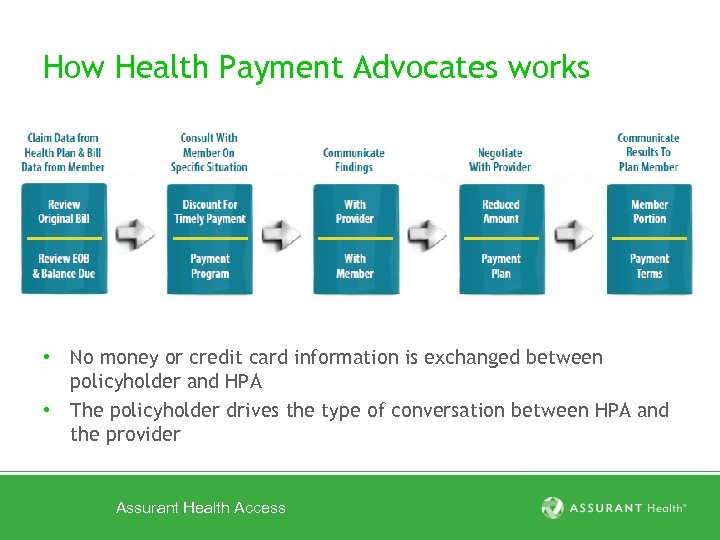

How Health Payment Advocates works • No money or credit card information is exchanged between policyholder and HPA • The policyholder drives the type of conversation between HPA and the provider Assurant Health Access

How Health Payment Advocates works • No money or credit card information is exchanged between policyholder and HPA • The policyholder drives the type of conversation between HPA and the provider Assurant Health Access

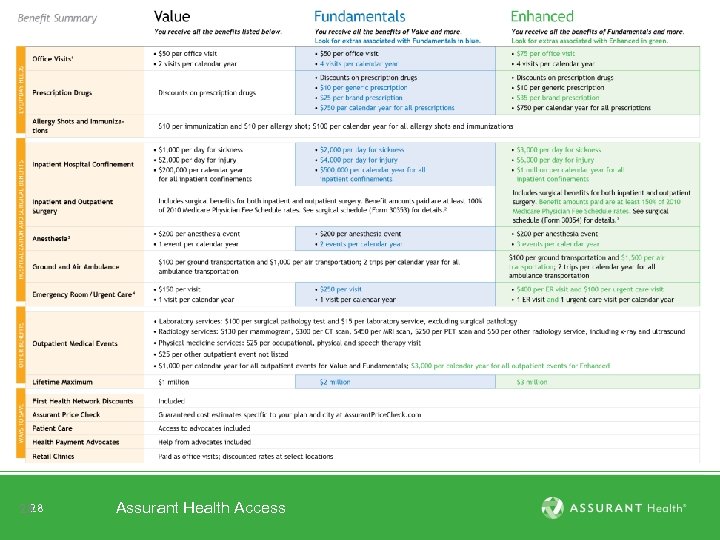

Assurant Health Access benefit levels

Assurant Health Access benefit levels

28 28 Assurant Health Access

28 28 Assurant Health Access

The Assurant Health Access portfolio Value • For access to health care and Assurant Health discounts, choose the affordability of Value. – Access to network and prescription discounts – Benefits for preventive care and unexpected illnesses and injuries – Sickness and wellness benefits – Benefits for office visits Fundamentals Enhanced Assurant Health Access

The Assurant Health Access portfolio Value • For access to health care and Assurant Health discounts, choose the affordability of Value. – Access to network and prescription discounts – Benefits for preventive care and unexpected illnesses and injuries – Sickness and wellness benefits – Benefits for office visits Fundamentals Enhanced Assurant Health Access

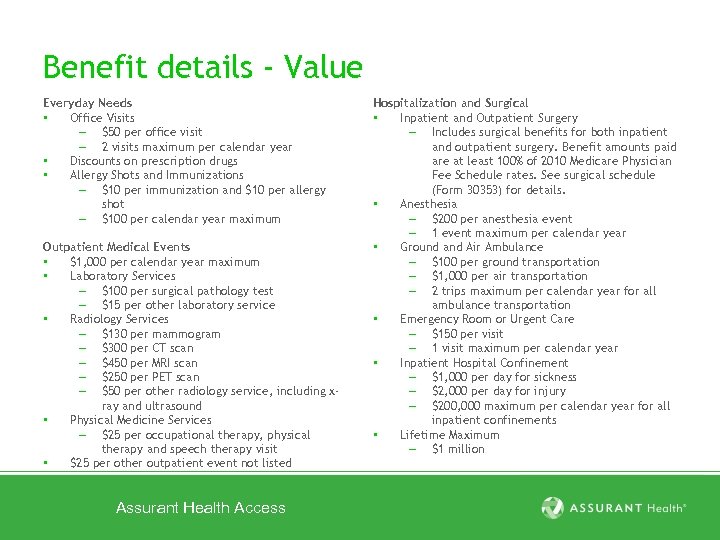

Benefit details - Value Everyday Needs • Office Visits – $50 per office visit – 2 visits maximum per calendar year • Discounts on prescription drugs • Allergy Shots and Immunizations – $10 per immunization and $10 per allergy shot – $100 per calendar year maximum Outpatient Medical Events • $1, 000 per calendar year maximum • Laboratory Services – $100 per surgical pathology test – $15 per other laboratory service • Radiology Services – $130 per mammogram – $300 per CT scan – $450 per MRI scan – $250 per PET scan – $50 per other radiology service, including xray and ultrasound • Physical Medicine Services – $25 per occupational therapy, physical therapy and speech therapy visit • $25 per other outpatient event not listed Assurant Health Access Hospitalization and Surgical • Inpatient and Outpatient Surgery – Includes surgical benefits for both inpatient and outpatient surgery. Benefit amounts paid are at least 100% of 2010 Medicare Physician Fee Schedule rates. See surgical schedule (Form 30353) for details. • Anesthesia – $200 per anesthesia event – 1 event maximum per calendar year • Ground and Air Ambulance – $100 per ground transportation – $1, 000 per air transportation – 2 trips maximum per calendar year for all ambulance transportation • Emergency Room or Urgent Care – $150 per visit – 1 visit maximum per calendar year • Inpatient Hospital Confinement – $1, 000 per day for sickness – $2, 000 per day for injury – $200, 000 maximum per calendar year for all inpatient confinements • Lifetime Maximum – $1 million

Benefit details - Value Everyday Needs • Office Visits – $50 per office visit – 2 visits maximum per calendar year • Discounts on prescription drugs • Allergy Shots and Immunizations – $10 per immunization and $10 per allergy shot – $100 per calendar year maximum Outpatient Medical Events • $1, 000 per calendar year maximum • Laboratory Services – $100 per surgical pathology test – $15 per other laboratory service • Radiology Services – $130 per mammogram – $300 per CT scan – $450 per MRI scan – $250 per PET scan – $50 per other radiology service, including xray and ultrasound • Physical Medicine Services – $25 per occupational therapy, physical therapy and speech therapy visit • $25 per other outpatient event not listed Assurant Health Access Hospitalization and Surgical • Inpatient and Outpatient Surgery – Includes surgical benefits for both inpatient and outpatient surgery. Benefit amounts paid are at least 100% of 2010 Medicare Physician Fee Schedule rates. See surgical schedule (Form 30353) for details. • Anesthesia – $200 per anesthesia event – 1 event maximum per calendar year • Ground and Air Ambulance – $100 per ground transportation – $1, 000 per air transportation – 2 trips maximum per calendar year for all ambulance transportation • Emergency Room or Urgent Care – $150 per visit – 1 visit maximum per calendar year • Inpatient Hospital Confinement – $1, 000 per day for sickness – $2, 000 per day for injury – $200, 000 maximum per calendar year for all inpatient confinements • Lifetime Maximum – $1 million

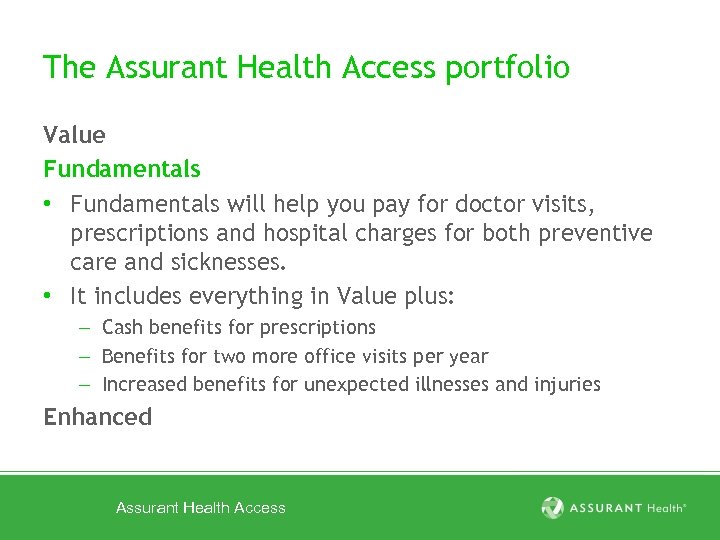

The Assurant Health Access portfolio Value Fundamentals • Fundamentals will help you pay for doctor visits, prescriptions and hospital charges for both preventive care and sicknesses. • It includes everything in Value plus: – Cash benefits for prescriptions – Benefits for two more office visits per year – Increased benefits for unexpected illnesses and injuries Enhanced Assurant Health Access

The Assurant Health Access portfolio Value Fundamentals • Fundamentals will help you pay for doctor visits, prescriptions and hospital charges for both preventive care and sicknesses. • It includes everything in Value plus: – Cash benefits for prescriptions – Benefits for two more office visits per year – Increased benefits for unexpected illnesses and injuries Enhanced Assurant Health Access

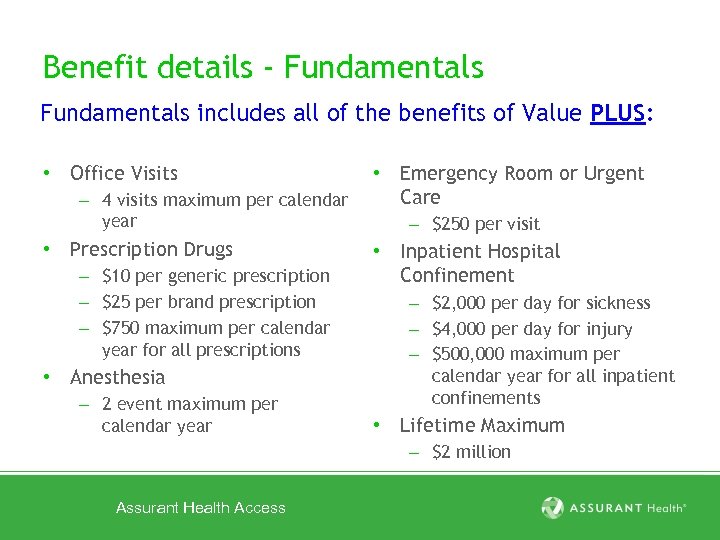

Benefit details - Fundamentals includes all of the benefits of Value PLUS: • Office Visits – 4 visits maximum per calendar year • Prescription Drugs – $10 per generic prescription – $25 per brand prescription – $750 maximum per calendar year for all prescriptions • Anesthesia – 2 event maximum per calendar year • Emergency Room or Urgent Care – $250 per visit • Inpatient Hospital Confinement – $2, 000 per day for sickness – $4, 000 per day for injury – $500, 000 maximum per calendar year for all inpatient confinements • Lifetime Maximum – $2 million Assurant Health Access

Benefit details - Fundamentals includes all of the benefits of Value PLUS: • Office Visits – 4 visits maximum per calendar year • Prescription Drugs – $10 per generic prescription – $25 per brand prescription – $750 maximum per calendar year for all prescriptions • Anesthesia – 2 event maximum per calendar year • Emergency Room or Urgent Care – $250 per visit • Inpatient Hospital Confinement – $2, 000 per day for sickness – $4, 000 per day for injury – $500, 000 maximum per calendar year for all inpatient confinements • Lifetime Maximum – $2 million Assurant Health Access

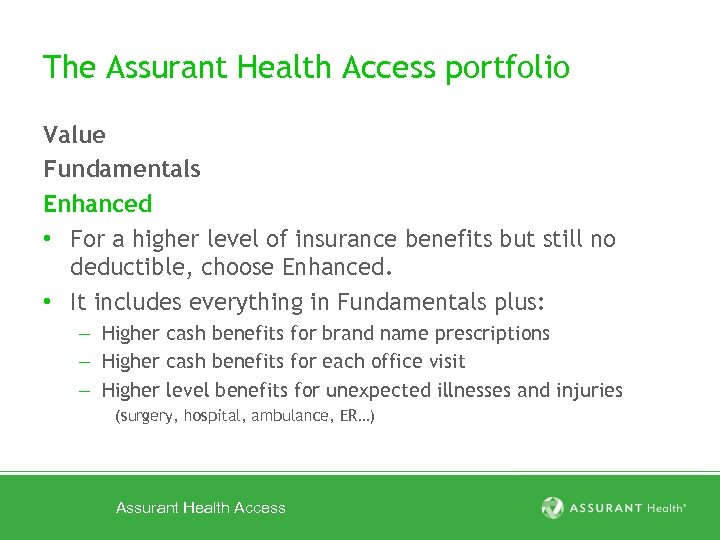

The Assurant Health Access portfolio Value Fundamentals Enhanced • For a higher level of insurance benefits but still no deductible, choose Enhanced. • It includes everything in Fundamentals plus: – Higher cash benefits for brand name prescriptions – Higher cash benefits for each office visit – Higher level benefits for unexpected illnesses and injuries (surgery, hospital, ambulance, ER…) Assurant Health Access

The Assurant Health Access portfolio Value Fundamentals Enhanced • For a higher level of insurance benefits but still no deductible, choose Enhanced. • It includes everything in Fundamentals plus: – Higher cash benefits for brand name prescriptions – Higher cash benefits for each office visit – Higher level benefits for unexpected illnesses and injuries (surgery, hospital, ambulance, ER…) Assurant Health Access

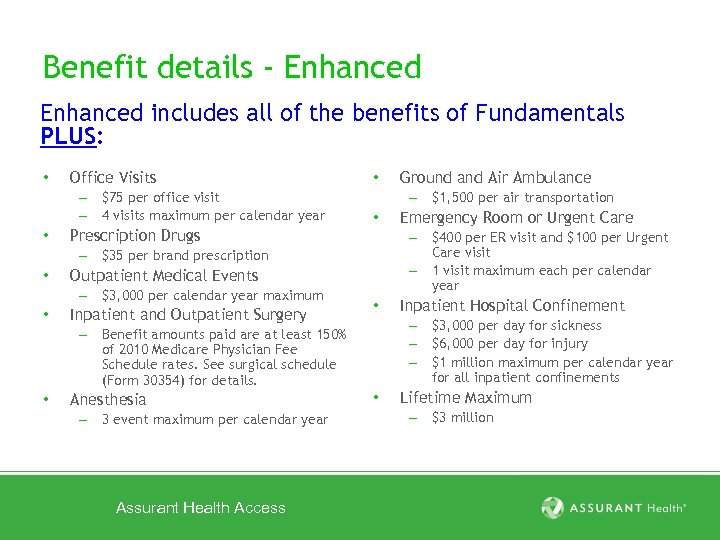

Benefit details - Enhanced includes all of the benefits of Fundamentals PLUS: • Office Visits – $75 per office visit – 4 visits maximum per calendar year • Prescription Drugs • – $1, 500 per air transportation • Outpatient Medical Events – $3, 000 per calendar year maximum • Inpatient and Outpatient Surgery • Anesthesia – 3 event maximum per calendar year Assurant Health Access Inpatient Hospital Confinement – $3, 000 per day for sickness – $6, 000 per day for injury – $1 million maximum per calendar year for all inpatient confinements – Benefit amounts paid are at least 150% of 2010 Medicare Physician Fee Schedule rates. See surgical schedule (Form 30354) for details. • Emergency Room or Urgent Care – $400 per ER visit and $100 per Urgent Care visit – 1 visit maximum each per calendar year – $35 per brand prescription • Ground and Air Ambulance • Lifetime Maximum – $3 million

Benefit details - Enhanced includes all of the benefits of Fundamentals PLUS: • Office Visits – $75 per office visit – 4 visits maximum per calendar year • Prescription Drugs • – $1, 500 per air transportation • Outpatient Medical Events – $3, 000 per calendar year maximum • Inpatient and Outpatient Surgery • Anesthesia – 3 event maximum per calendar year Assurant Health Access Inpatient Hospital Confinement – $3, 000 per day for sickness – $6, 000 per day for injury – $1 million maximum per calendar year for all inpatient confinements – Benefit amounts paid are at least 150% of 2010 Medicare Physician Fee Schedule rates. See surgical schedule (Form 30354) for details. • Emergency Room or Urgent Care – $400 per ER visit and $100 per Urgent Care visit – 1 visit maximum each per calendar year – $35 per brand prescription • Ground and Air Ambulance • Lifetime Maximum – $3 million

Examples of how Assurant Health Access pays benefits

Examples of how Assurant Health Access pays benefits

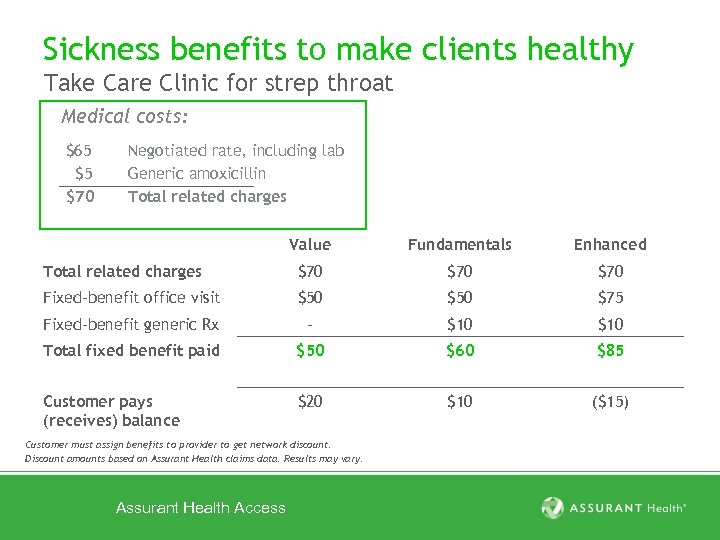

Sickness benefits to make clients healthy Take Care Clinic for strep throat Medical costs: $65 $5 $70 Negotiated rate, including lab Generic amoxicillin Total related charges Value Fundamentals Enhanced Total related charges $70 $70 Fixed-benefit office visit $50 $75 Fixed-benefit generic Rx - $10 Total fixed benefit paid $50 $60 $85 Customer pays (receives) balance $20 $10 ($15) Customer must assign benefits to provider to get network discount. Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

Sickness benefits to make clients healthy Take Care Clinic for strep throat Medical costs: $65 $5 $70 Negotiated rate, including lab Generic amoxicillin Total related charges Value Fundamentals Enhanced Total related charges $70 $70 Fixed-benefit office visit $50 $75 Fixed-benefit generic Rx - $10 Total fixed benefit paid $50 $60 $85 Customer pays (receives) balance $20 $10 ($15) Customer must assign benefits to provider to get network discount. Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

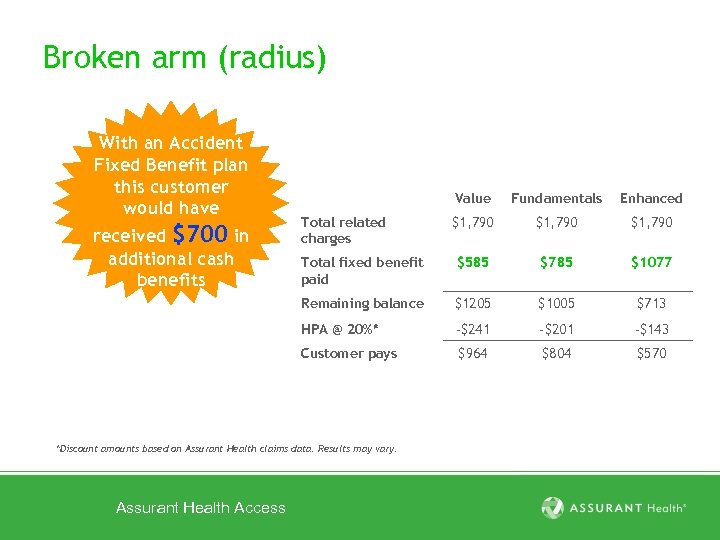

Broken arm (radius) With an Accident Fixed Benefit plan this customer would have Fundamentals Enhanced $1, 790 Total fixed benefit paid $585 $785 $1077 Remaining balance $1205 $1005 $713 HPA @ 20%* -$241 -$201 -$143 Customer pays received $700 in additional cash benefits Value $964 $804 $570 Total related charges *Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

Broken arm (radius) With an Accident Fixed Benefit plan this customer would have Fundamentals Enhanced $1, 790 Total fixed benefit paid $585 $785 $1077 Remaining balance $1205 $1005 $713 HPA @ 20%* -$241 -$201 -$143 Customer pays received $700 in additional cash benefits Value $964 $804 $570 Total related charges *Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

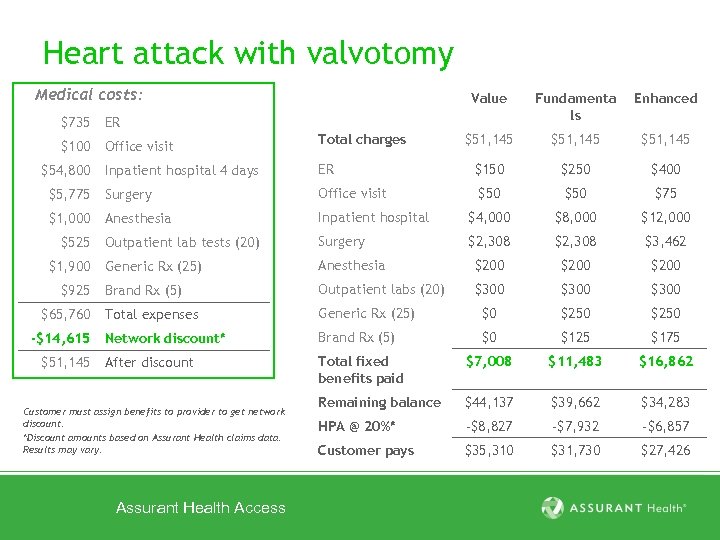

Heart attack with valvotomy Medical costs: Value Fundamenta ls Enhanced $51, 145 $735 ER $100 Office visit Total charges Inpatient hospital 4 days ER $150 $250 $400 $5, 775 Surgery Office visit $50 $75 $1, 000 Anesthesia Inpatient hospital $4, 000 $8, 000 $12, 000 Outpatient lab tests (20) Surgery $2, 308 $3, 462 Generic Rx (25) Anesthesia $200 Brand Rx (5) Outpatient labs (20) $300 Total expenses Generic Rx (25) $0 $250 Network discount* Brand Rx (5) $0 $125 $175 After discount Total fixed benefits paid $7, 008 $11, 483 $16, 862 Remaining balance $44, 137 $39, 662 $34, 283 HPA @ 20%* -$8, 827 -$7, 932 -$6, 857 Customer pays $35, 310 $31, 730 $27, 426 $54, 800 $525 $1, 900 $925 $65, 760 -$14, 615 $51, 145 Customer must assign benefits to provider to get network discount. *Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

Heart attack with valvotomy Medical costs: Value Fundamenta ls Enhanced $51, 145 $735 ER $100 Office visit Total charges Inpatient hospital 4 days ER $150 $250 $400 $5, 775 Surgery Office visit $50 $75 $1, 000 Anesthesia Inpatient hospital $4, 000 $8, 000 $12, 000 Outpatient lab tests (20) Surgery $2, 308 $3, 462 Generic Rx (25) Anesthesia $200 Brand Rx (5) Outpatient labs (20) $300 Total expenses Generic Rx (25) $0 $250 Network discount* Brand Rx (5) $0 $125 $175 After discount Total fixed benefits paid $7, 008 $11, 483 $16, 862 Remaining balance $44, 137 $39, 662 $34, 283 HPA @ 20%* -$8, 827 -$7, 932 -$6, 857 Customer pays $35, 310 $31, 730 $27, 426 $54, 800 $525 $1, 900 $925 $65, 760 -$14, 615 $51, 145 Customer must assign benefits to provider to get network discount. *Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

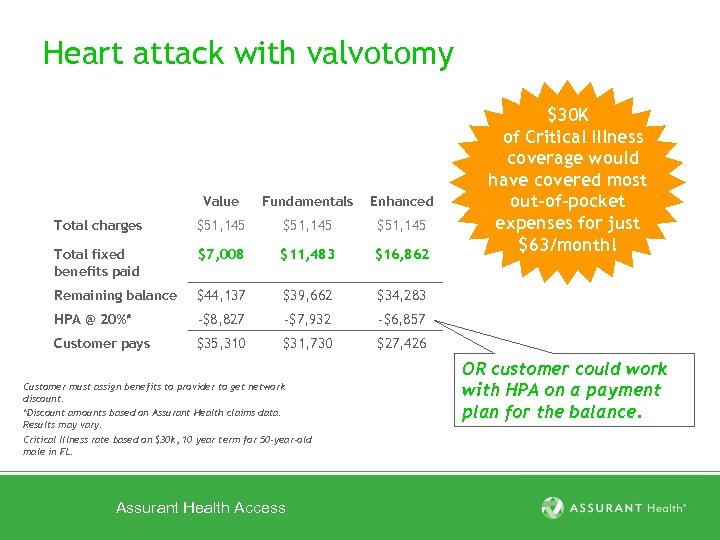

Heart attack with valvotomy Value Fundamentals Enhanced Total charges $51, 145 Total fixed benefits paid $7, 008 $11, 483 $16, 862 Remaining balance $44, 137 $39, 662 $34, 283 HPA @ 20%* -$8, 827 -$7, 932 -$6, 857 Customer pays $35, 310 $31, 730 $30 K of Critical Illness coverage would have covered most out-of-pocket expenses for just $63/month! $27, 426 Customer must assign benefits to provider to get network discount. *Discount amounts based on Assurant Health claims data. Results may vary. Critical Illness rate based on $30 k, 10 year term for 50 -year-old male in FL. Assurant Health Access OR customer could work with HPA on a payment plan for the balance.

Heart attack with valvotomy Value Fundamentals Enhanced Total charges $51, 145 Total fixed benefits paid $7, 008 $11, 483 $16, 862 Remaining balance $44, 137 $39, 662 $34, 283 HPA @ 20%* -$8, 827 -$7, 932 -$6, 857 Customer pays $35, 310 $31, 730 $30 K of Critical Illness coverage would have covered most out-of-pocket expenses for just $63/month! $27, 426 Customer must assign benefits to provider to get network discount. *Discount amounts based on Assurant Health claims data. Results may vary. Critical Illness rate based on $30 k, 10 year term for 50 -year-old male in FL. Assurant Health Access OR customer could work with HPA on a payment plan for the balance.

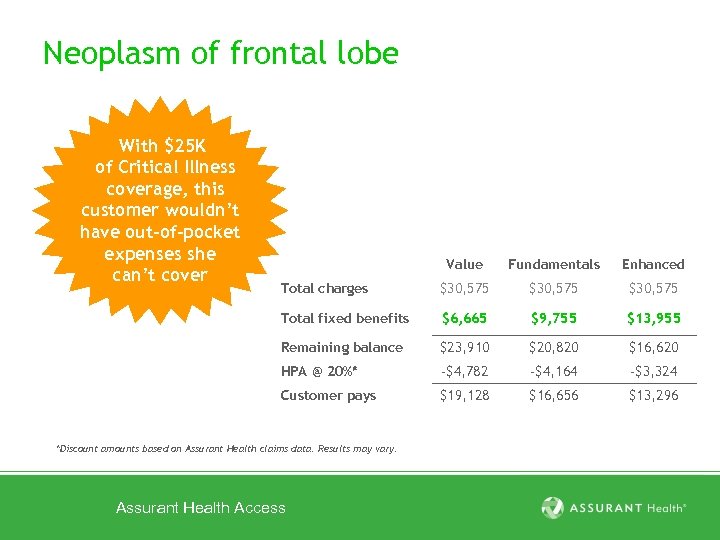

Neoplasm of frontal lobe With $25 K of Critical Illness coverage, this customer wouldn’t have out-of-pocket expenses she can’t cover Value Fundamentals Enhanced Total charges $30, 575 Total fixed benefits $6, 665 $9, 755 $13, 955 Remaining balance $23, 910 $20, 820 $16, 620 HPA @ 20%* -$4, 782 -$4, 164 -$3, 324 Customer pays $19, 128 $16, 656 $13, 296 *Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

Neoplasm of frontal lobe With $25 K of Critical Illness coverage, this customer wouldn’t have out-of-pocket expenses she can’t cover Value Fundamentals Enhanced Total charges $30, 575 Total fixed benefits $6, 665 $9, 755 $13, 955 Remaining balance $23, 910 $20, 820 $16, 620 HPA @ 20%* -$4, 782 -$4, 164 -$3, 324 Customer pays $19, 128 $16, 656 $13, 296 *Discount amounts based on Assurant Health claims data. Results may vary. Assurant Health Access

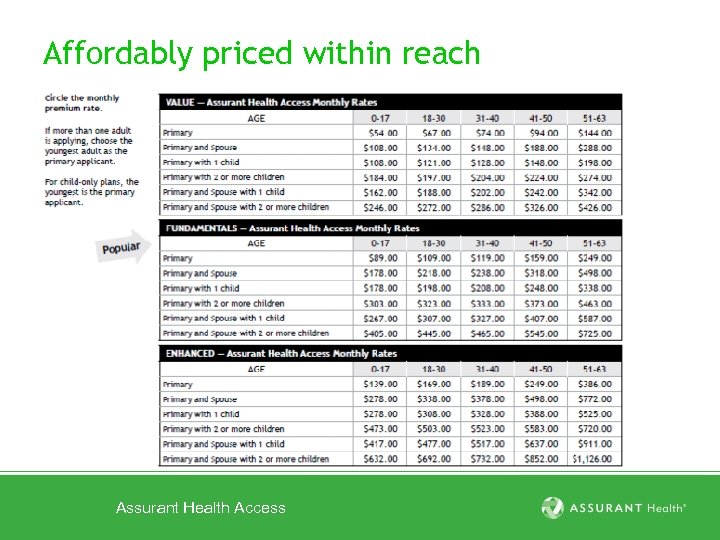

Assurant Health Access affordable rates

Assurant Health Access affordable rates

Affordably priced within reach Assurant Health Access

Affordably priced within reach Assurant Health Access

Selling Assurant Health Access

Selling Assurant Health Access

Easy selling process • Only a few medical questions to answer • Instant decision in most cases • Simplified rating – – – – • • Not gender rated Not area rated No height or weight restrictions Not rated for risk class No smoker status Very broad age bands Based on age of primary applicant One-time, $25 processing fee Simplified underwriting process improves placement Effective date is either the 1 st or 15 th of the following month Payment by recurring monthly credit card available Assurant Health Access

Easy selling process • Only a few medical questions to answer • Instant decision in most cases • Simplified rating – – – – • • Not gender rated Not area rated No height or weight restrictions Not rated for risk class No smoker status Very broad age bands Based on age of primary applicant One-time, $25 processing fee Simplified underwriting process improves placement Effective date is either the 1 st or 15 th of the following month Payment by recurring monthly credit card available Assurant Health Access

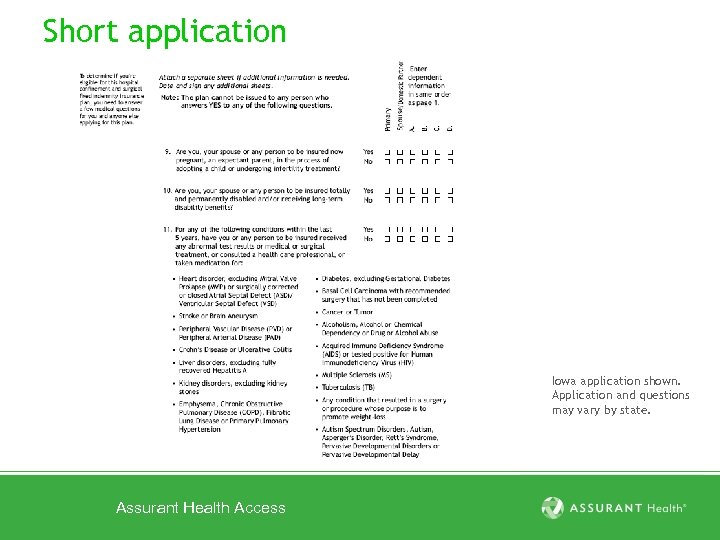

Short application Iowa application shown. Application and questions may vary by state. Assurant Health Access

Short application Iowa application shown. Application and questions may vary by state. Assurant Health Access

Edelivery makes policy delivery easy Your clients may choose electronic delivery of their policy information • Clients receive materials more quickly • Clients receive access to policy materials online • Save paper to help the planet Assurant Health Access

Edelivery makes policy delivery easy Your clients may choose electronic delivery of their policy information • Clients receive materials more quickly • Clients receive access to policy materials online • Save paper to help the planet Assurant Health Access

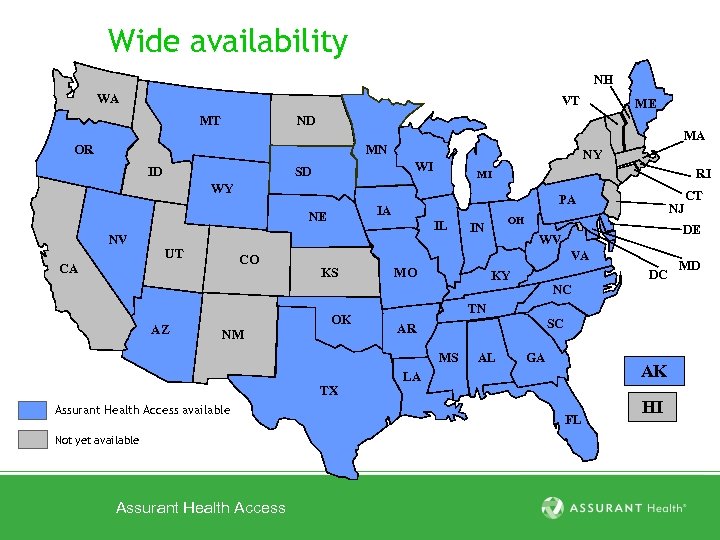

Wide availability NH WA VT MT ND OR MA MN ID NY WI SD RI MI WY UT CO CA AZ IL KS NM MO TX Assurant Health Access DE WV DC KY NC TN SC AR MS Not yet available OH IN VA OK Assurant Health Access available CT NJ PA IA NE NV ME AL GA AK LA FL HI MD

Wide availability NH WA VT MT ND OR MA MN ID NY WI SD RI MI WY UT CO CA AZ IL KS NM MO TX Assurant Health Access DE WV DC KY NC TN SC AR MS Not yet available OH IN VA OK Assurant Health Access available CT NJ PA IA NE NV ME AL GA AK LA FL HI MD

Create customized coverage for clients • Assurant provides integrated solutions allowing you to add supplemental products to clients’ Assurant Health Access plans – Add accident and dental benefits with no additional medical questions or underwriting – Add critical illness plan with short separate application • Help your clients fill gaps in coverage with supplemental plans Assurant Health Access

Create customized coverage for clients • Assurant provides integrated solutions allowing you to add supplemental products to clients’ Assurant Health Access plans – Add accident and dental benefits with no additional medical questions or underwriting – Add critical illness plan with short separate application • Help your clients fill gaps in coverage with supplemental plans Assurant Health Access

Assurant Supplemental Coverage provides added value for clients Dental 53 Term Life — Critical Illness Assurant Health Access Accident Fixed Benefit Accident Medical Expense

Assurant Supplemental Coverage provides added value for clients Dental 53 Term Life — Critical Illness Assurant Health Access Accident Fixed Benefit Accident Medical Expense

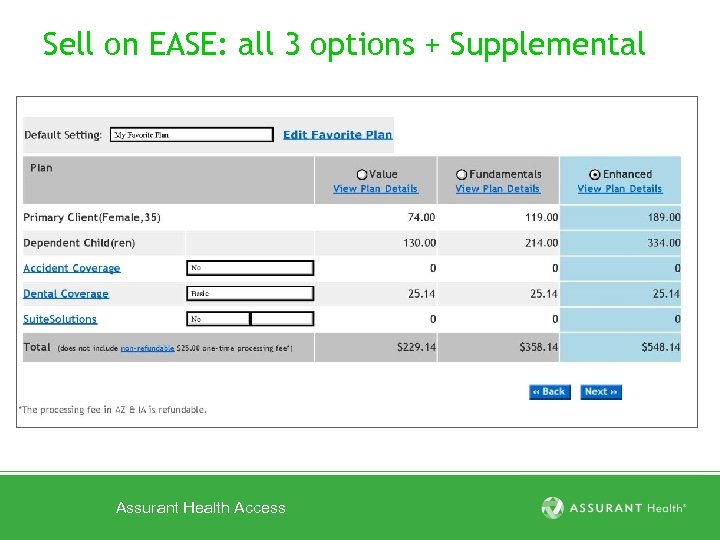

Sell on EASE: all 3 options + Supplemental Assurant Health Access

Sell on EASE: all 3 options + Supplemental Assurant Health Access

Assurant Health Access exclusions Maintenance care and therapies: • Routine hearing care, artificial hearing devices, cochlear implants, auditory prostheses, routine vision care, vision therapy, surgery to correct vision, routine foot care and foot orthotics • Routine dental care, unless you choose the dental insurance option Cosmetic services and procedures: • Services including chemical peels, plastic surgery and medications • Any correction of malocclusion (irregular tooth contact), protrusion, hypoplasia (abnormality in dental enamel) or hyperplasia (abnormality) of the jaws Reproductive-related procedures or concerns: • Diagnosis and treatment of infertility • Maternity, pregnancy (except complications of pregnancy), routine newborn care, surrogate pregnancy, routine nursery care and abortion • Sterilization and contraceptive procedures, drugs or devices Quality of life concerns: • Inpatient treatment of chronic pain disorders • Storage of umbilical cord stem cells or other blood components in the absence of sickness or injury • Genetic testing, counseling and services • Treatment, services and supplies related to sex transformation, gender dysphoric disorder and gender reassignment; treatment of sexual dysfunction or inadequacy; or restoration or enhancement of sexual performance or desire • Treatment for smoking cessation and hair loss • Cognitive enhancement • Prophylactic treatment, services and surgery Assurant Health Access

Assurant Health Access exclusions Maintenance care and therapies: • Routine hearing care, artificial hearing devices, cochlear implants, auditory prostheses, routine vision care, vision therapy, surgery to correct vision, routine foot care and foot orthotics • Routine dental care, unless you choose the dental insurance option Cosmetic services and procedures: • Services including chemical peels, plastic surgery and medications • Any correction of malocclusion (irregular tooth contact), protrusion, hypoplasia (abnormality in dental enamel) or hyperplasia (abnormality) of the jaws Reproductive-related procedures or concerns: • Diagnosis and treatment of infertility • Maternity, pregnancy (except complications of pregnancy), routine newborn care, surrogate pregnancy, routine nursery care and abortion • Sterilization and contraceptive procedures, drugs or devices Quality of life concerns: • Inpatient treatment of chronic pain disorders • Storage of umbilical cord stem cells or other blood components in the absence of sickness or injury • Genetic testing, counseling and services • Treatment, services and supplies related to sex transformation, gender dysphoric disorder and gender reassignment; treatment of sexual dysfunction or inadequacy; or restoration or enhancement of sexual performance or desire • Treatment for smoking cessation and hair loss • Cognitive enhancement • Prophylactic treatment, services and surgery Assurant Health Access

Assurant Health Access exclusions, cont. Prescription drug benefits do not include and will not provide benefits for: • Over-the-counter products • Drugs not approved by the FDA • Drugs obtained from sources outside the United States • Take-home drugs dispensed at an institution This plan also will not provide benefits for: • Any amount in excess of any maximum benefit or for non-covered events and associated complications • Durable medical equipment and personal medical equipment • Treatment undergone outside the United States • Treatment of behavioral health or substance abuse • Treatment, services, supplies, diagnosis, drugs, medication, surgery or medical regimen related to controlling weight, obesity or morbid obesity • Treatment for snoring or sleep disorders • Experimental or investigational treatments; homeopathic treatments; alternative treatments, including acupuncture; spinal and other adjustments, manipulations, subluxation and services; massage therapy • Telehealth and telemedicine (including but not limited to treatment rendered through the use of interactive audio, video or other electronic media) • Illness or injury caused by war or while in the military; commission of a felony; or influence of an illegal substance • Illness or injury caused or aggravated by suicide, attempted suicide or self-infliction • Treatment or services due to injury from hazardous activities, such as extreme sports, whether or not for compensation, including, but not limited to, hang-gliding, parachute or bungee jumping, rock or mountain climbing • Services ordered, directed or performed by a health care practitioner or medical provider who is an immediate family member • Treatment used to improve memory or slow the normal process of aging • Home health care, hospice care, skilled nursing facility care, inpatient rehabilitation services, custodial care and respite care • Sickness or injury arising out of or as the result of any work for wage or profit that is eligible for benefits under Workers’ Compensation, employers’ liability or similar laws Assurant Health Access

Assurant Health Access exclusions, cont. Prescription drug benefits do not include and will not provide benefits for: • Over-the-counter products • Drugs not approved by the FDA • Drugs obtained from sources outside the United States • Take-home drugs dispensed at an institution This plan also will not provide benefits for: • Any amount in excess of any maximum benefit or for non-covered events and associated complications • Durable medical equipment and personal medical equipment • Treatment undergone outside the United States • Treatment of behavioral health or substance abuse • Treatment, services, supplies, diagnosis, drugs, medication, surgery or medical regimen related to controlling weight, obesity or morbid obesity • Treatment for snoring or sleep disorders • Experimental or investigational treatments; homeopathic treatments; alternative treatments, including acupuncture; spinal and other adjustments, manipulations, subluxation and services; massage therapy • Telehealth and telemedicine (including but not limited to treatment rendered through the use of interactive audio, video or other electronic media) • Illness or injury caused by war or while in the military; commission of a felony; or influence of an illegal substance • Illness or injury caused or aggravated by suicide, attempted suicide or self-infliction • Treatment or services due to injury from hazardous activities, such as extreme sports, whether or not for compensation, including, but not limited to, hang-gliding, parachute or bungee jumping, rock or mountain climbing • Services ordered, directed or performed by a health care practitioner or medical provider who is an immediate family member • Treatment used to improve memory or slow the normal process of aging • Home health care, hospice care, skilled nursing facility care, inpatient rehabilitation services, custodial care and respite care • Sickness or injury arising out of or as the result of any work for wage or profit that is eligible for benefits under Workers’ Compensation, employers’ liability or similar laws Assurant Health Access

Assurant Health Access exclusions, cont. Treatment for behavioral modification or behavioral (conduct) problems; learning disabilities; developmental delays; attention deficit disorders; hyperactivity; educational testing, training or materials; memory improvement; cognitive enhancement or training; vocational or work-hardening programs and transitional living • Growth hormone stimulation treatment to promote or delay growth • Treatment for TMJ and/or CMJ and certain jaw/tooth disorders • Services incurred due to a pre-existing condition for the first 12 months the plan is in force Pre-existing conditions (varies by state): A pre-existing condition is a sickness or injury and related complications for which any of the following occurred during the 12 -month period immediately prior to the effective date of your Assurant Health Access plan: • You sought, received or were recommended to receive medical advice, consultation, diagnosis, care or treatment; • You were prescribed prescription drugs; • You experienced signs or symptoms significant enough that either: — the signs or symptoms should have or would have allowed a health care provider to diagnose the condition; or — the signs or symptoms reasonably should have or would have caused an ordinarily prudent person to seek diagnosis or treatment We will not pay benefits for charges incurred due to a pre-existing condition or its complications until you have been continuously insured under the plan for 12 months. After the 12 -month period, benefits are paid for a preexisting condition as long as the covered event occurs while the plan is in force. Exclusion for Value only: • Charges for dispensation or fulfillment of prescription drugs Assurant Health Access

Assurant Health Access exclusions, cont. Treatment for behavioral modification or behavioral (conduct) problems; learning disabilities; developmental delays; attention deficit disorders; hyperactivity; educational testing, training or materials; memory improvement; cognitive enhancement or training; vocational or work-hardening programs and transitional living • Growth hormone stimulation treatment to promote or delay growth • Treatment for TMJ and/or CMJ and certain jaw/tooth disorders • Services incurred due to a pre-existing condition for the first 12 months the plan is in force Pre-existing conditions (varies by state): A pre-existing condition is a sickness or injury and related complications for which any of the following occurred during the 12 -month period immediately prior to the effective date of your Assurant Health Access plan: • You sought, received or were recommended to receive medical advice, consultation, diagnosis, care or treatment; • You were prescribed prescription drugs; • You experienced signs or symptoms significant enough that either: — the signs or symptoms should have or would have allowed a health care provider to diagnose the condition; or — the signs or symptoms reasonably should have or would have caused an ordinarily prudent person to seek diagnosis or treatment We will not pay benefits for charges incurred due to a pre-existing condition or its complications until you have been continuously insured under the plan for 12 months. After the 12 -month period, benefits are paid for a preexisting condition as long as the covered event occurs while the plan is in force. Exclusion for Value only: • Charges for dispensation or fulfillment of prescription drugs Assurant Health Access

Thank you! Assurant Health Access plans have limitations and exclusions. A list is available at assuranthealth. com. Assurant Health is the brand name for products underwritten and issued by Time Insurance Company, Milwaukee, WI. J-78881 (Revised 1/2012)

Thank you! Assurant Health Access plans have limitations and exclusions. A list is available at assuranthealth. com. Assurant Health is the brand name for products underwritten and issued by Time Insurance Company, Milwaukee, WI. J-78881 (Revised 1/2012)