a4fed4ca3806cb65461214fabb616de7.ppt

- Количество слайдов: 72

Association for Compensatory Educators of Texas Finance Academy Presented by Omar Garcia Region XIII ESC October 28, 2008 Copyright© 2007 Education Service Center Region XIII 1

Association for Compensatory Educators of Texas Finance Academy Presented by Omar Garcia Region XIII ESC October 28, 2008 Copyright© 2007 Education Service Center Region XIII 1

The Current System • At least 3/4 of the system is based on a fixed amount of revenue per student • Enacted by HB 1, 3 rd Called Session of the 79 th Legislature – Response to Texas Supreme Court ruling in West Orange-Cove case – Majority of districts were at $1. 50 M&O tax rate…deemed a statewide property tax – No longer had “meaningful discretion” Copyright© 2007 Education Service Center Region XIII 2

The Current System • At least 3/4 of the system is based on a fixed amount of revenue per student • Enacted by HB 1, 3 rd Called Session of the 79 th Legislature – Response to Texas Supreme Court ruling in West Orange-Cove case – Majority of districts were at $1. 50 M&O tax rate…deemed a statewide property tax – No longer had “meaningful discretion” Copyright© 2007 Education Service Center Region XIII 2

The Current System 2 • HB 1 – Began in 2006 -07 – Was primarily a tax relief bill – Provided what the Legislature perceived to be “meaningful discretion” – Over a 2 -year period, school districts’ M&O tax rates were reduced (compressed) by 1/3 Copyright© 2007 Education Service Center Region XIII 3

The Current System 2 • HB 1 – Began in 2006 -07 – Was primarily a tax relief bill – Provided what the Legislature perceived to be “meaningful discretion” – Over a 2 -year period, school districts’ M&O tax rates were reduced (compressed) by 1/3 Copyright© 2007 Education Service Center Region XIII 3

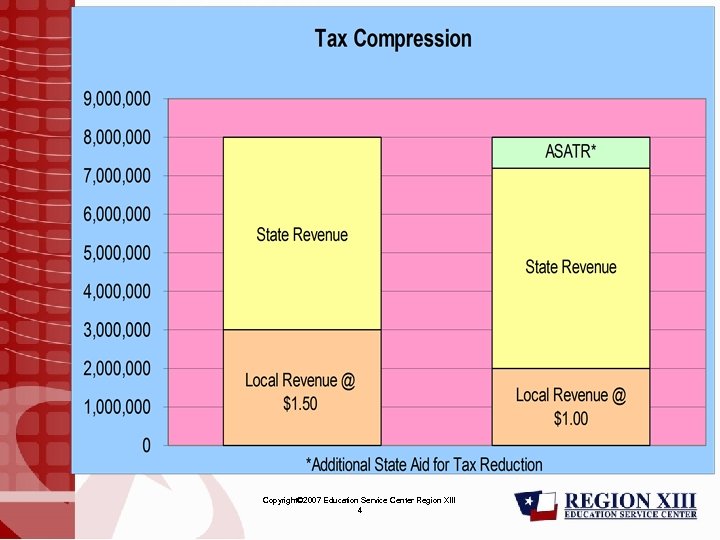

Copyright© 2007 Education Service Center Region XIII 4

Copyright© 2007 Education Service Center Region XIII 4

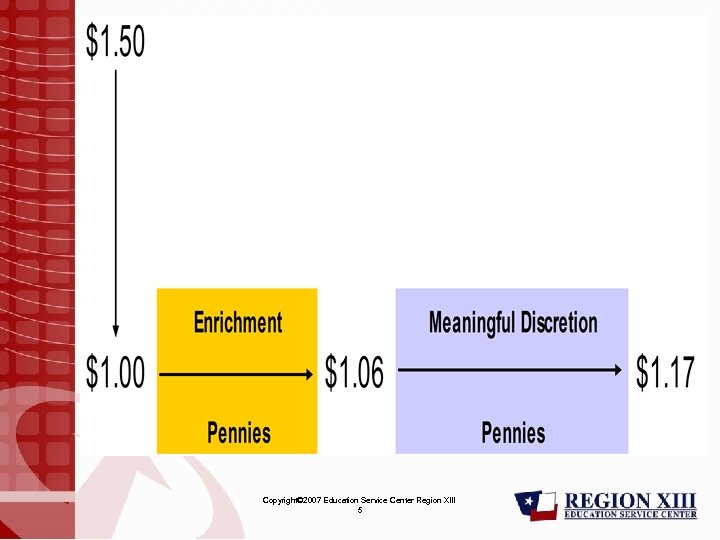

Copyright© 2007 Education Service Center Region XIII 5

Copyright© 2007 Education Service Center Region XIII 5

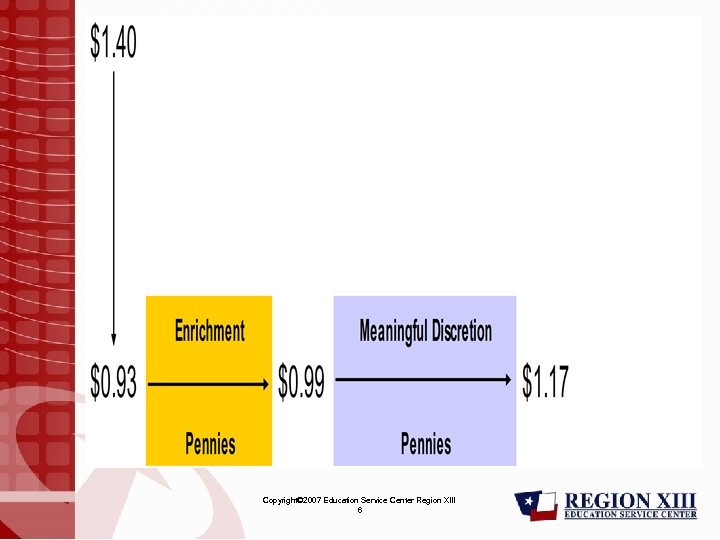

Copyright© 2007 Education Service Center Region XIII 6

Copyright© 2007 Education Service Center Region XIII 6

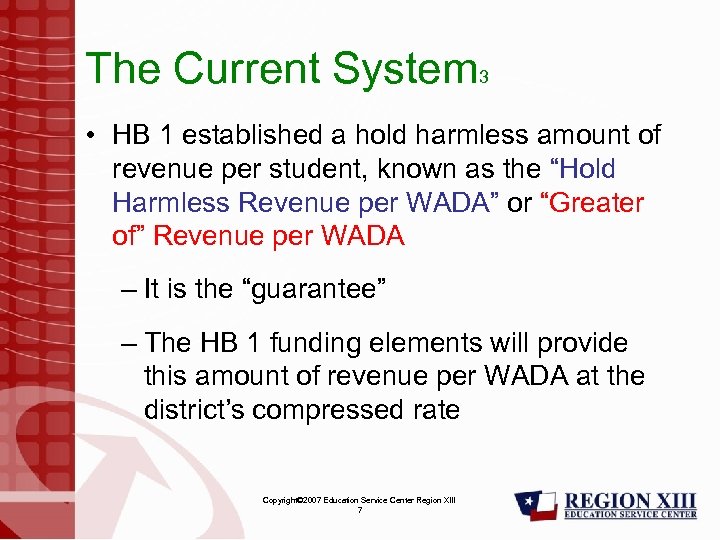

The Current System 3 • HB 1 established a hold harmless amount of revenue per student, known as the “Hold Harmless Revenue per WADA” or “Greater of” Revenue per WADA – It is the “guarantee” – The HB 1 funding elements will provide this amount of revenue per WADA at the district’s compressed rate Copyright© 2007 Education Service Center Region XIII 7

The Current System 3 • HB 1 established a hold harmless amount of revenue per student, known as the “Hold Harmless Revenue per WADA” or “Greater of” Revenue per WADA – It is the “guarantee” – The HB 1 funding elements will provide this amount of revenue per WADA at the district’s compressed rate Copyright© 2007 Education Service Center Region XIII 7

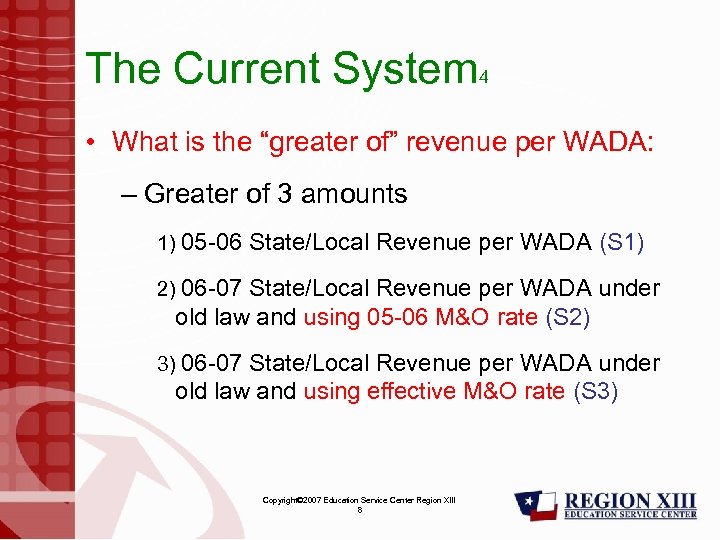

The Current System 4 • What is the “greater of” revenue per WADA: – Greater of 3 amounts 1) 05 -06 State/Local Revenue per WADA (S 1) 2) 06 -07 State/Local Revenue per WADA under old law and using 05 -06 M&O rate (S 2) 3) 06 -07 State/Local Revenue per WADA under old law and using effective M&O rate (S 3) Copyright© 2007 Education Service Center Region XIII 8

The Current System 4 • What is the “greater of” revenue per WADA: – Greater of 3 amounts 1) 05 -06 State/Local Revenue per WADA (S 1) 2) 06 -07 State/Local Revenue per WADA under old law and using 05 -06 M&O rate (S 2) 3) 06 -07 State/Local Revenue per WADA under old law and using effective M&O rate (S 3) Copyright© 2007 Education Service Center Region XIII 8

The Current System 5 “Greater of” Number x WADA + Salary Allotment + High School Allotment = “Target Revenue” • At the district’s compressed tax rate, it is both the “floor” and the “ceiling” – Won’t get any less – Can’t have any more Copyright© 2007 Education Service Center Region XIII 9

The Current System 5 “Greater of” Number x WADA + Salary Allotment + High School Allotment = “Target Revenue” • At the district’s compressed tax rate, it is both the “floor” and the “ceiling” – Won’t get any less – Can’t have any more Copyright© 2007 Education Service Center Region XIII 9

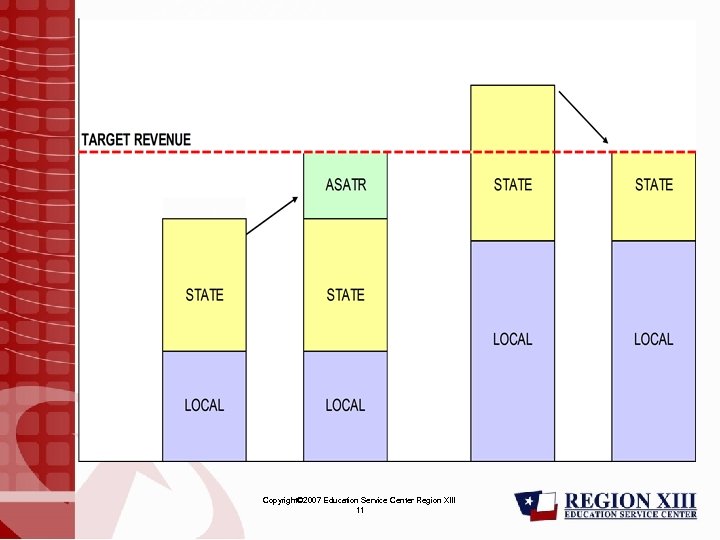

The Current System 6 • If HB 1 state/local revenue at the district’s compressed rate falls short of the target, Additional State Aid for Tax Reduction makes up the difference • If HB 1 state/local revenue at the district’s compressed rate is more than the target, the district is brought down to the target Copyright© 2007 Education Service Center Region XIII 10

The Current System 6 • If HB 1 state/local revenue at the district’s compressed rate falls short of the target, Additional State Aid for Tax Reduction makes up the difference • If HB 1 state/local revenue at the district’s compressed rate is more than the target, the district is brought down to the target Copyright© 2007 Education Service Center Region XIII 10

Copyright© 2007 Education Service Center Region XIII 11

Copyright© 2007 Education Service Center Region XIII 11

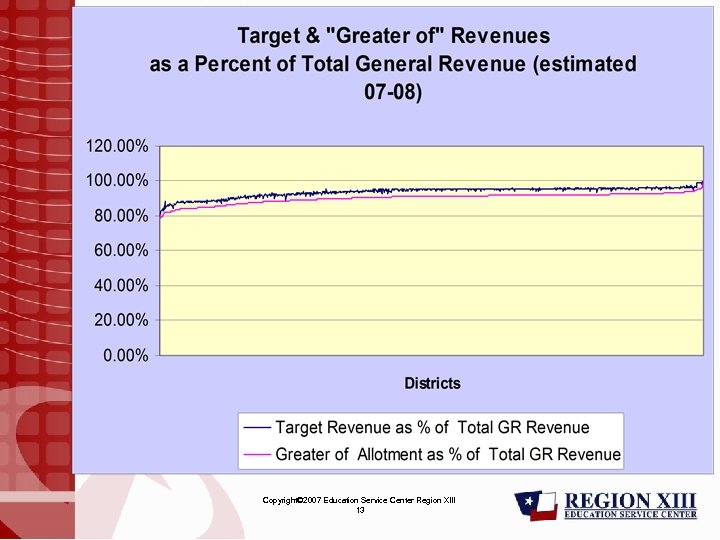

The Current System 7 • This “greater of” revenue per WADA is the fixed amount of revenue per student that makes up at least 75% of the current system – 78% to 85% for 70 districts – 85% to 99% for all other districts Copyright© 2007 Education Service Center Region XIII 12

The Current System 7 • This “greater of” revenue per WADA is the fixed amount of revenue per student that makes up at least 75% of the current system – 78% to 85% for 70 districts – 85% to 99% for all other districts Copyright© 2007 Education Service Center Region XIII 12

Copyright© 2007 Education Service Center Region XIII 13

Copyright© 2007 Education Service Center Region XIII 13

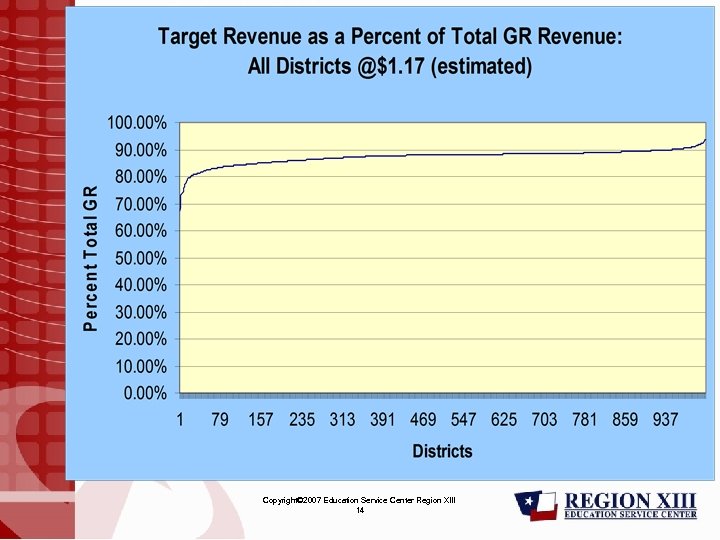

Copyright© 2007 Education Service Center Region XIII 14

Copyright© 2007 Education Service Center Region XIII 14

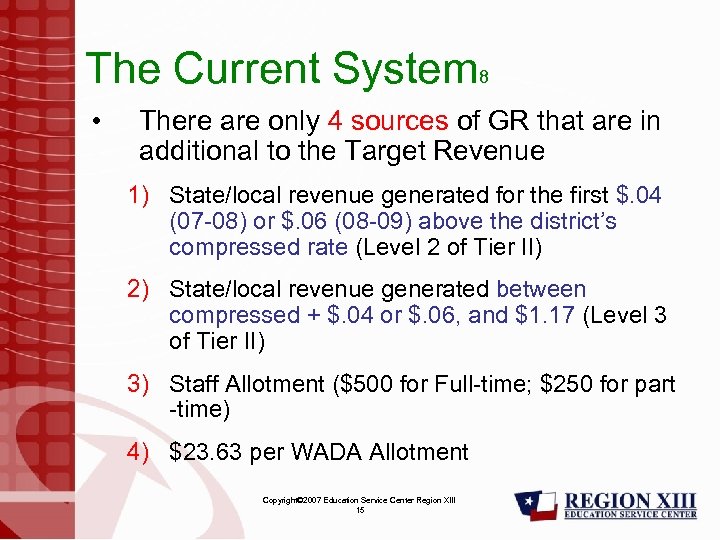

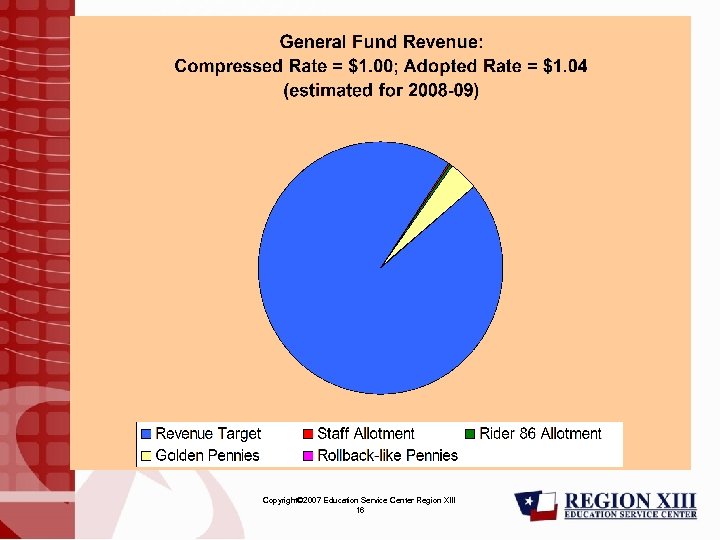

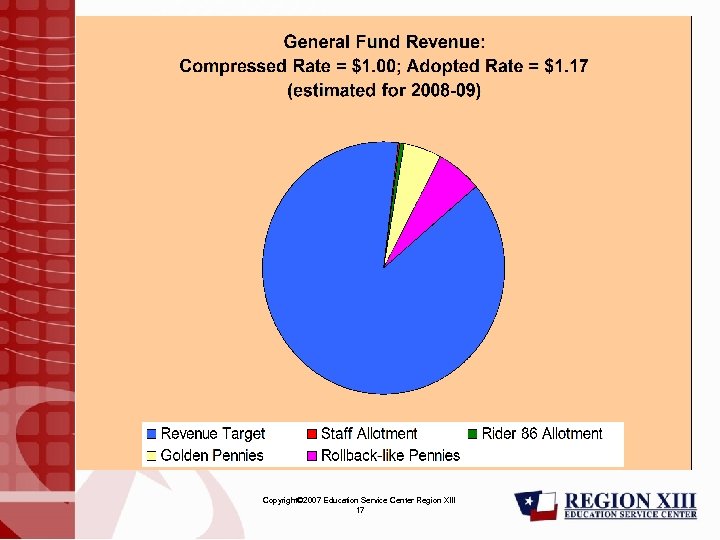

The Current System 8 • There are only 4 sources of GR that are in additional to the Target Revenue 1) State/local revenue generated for the first $. 04 (07 -08) or $. 06 (08 -09) above the district’s compressed rate (Level 2 of Tier II) 2) State/local revenue generated between compressed + $. 04 or $. 06, and $1. 17 (Level 3 of Tier II) 3) Staff Allotment ($500 for Full-time; $250 for part -time) 4) $23. 63 per WADA Allotment Copyright© 2007 Education Service Center Region XIII 15

The Current System 8 • There are only 4 sources of GR that are in additional to the Target Revenue 1) State/local revenue generated for the first $. 04 (07 -08) or $. 06 (08 -09) above the district’s compressed rate (Level 2 of Tier II) 2) State/local revenue generated between compressed + $. 04 or $. 06, and $1. 17 (Level 3 of Tier II) 3) Staff Allotment ($500 for Full-time; $250 for part -time) 4) $23. 63 per WADA Allotment Copyright© 2007 Education Service Center Region XIII 15

Copyright© 2007 Education Service Center Region XIII 16

Copyright© 2007 Education Service Center Region XIII 16

Copyright© 2007 Education Service Center Region XIII 17

Copyright© 2007 Education Service Center Region XIII 17

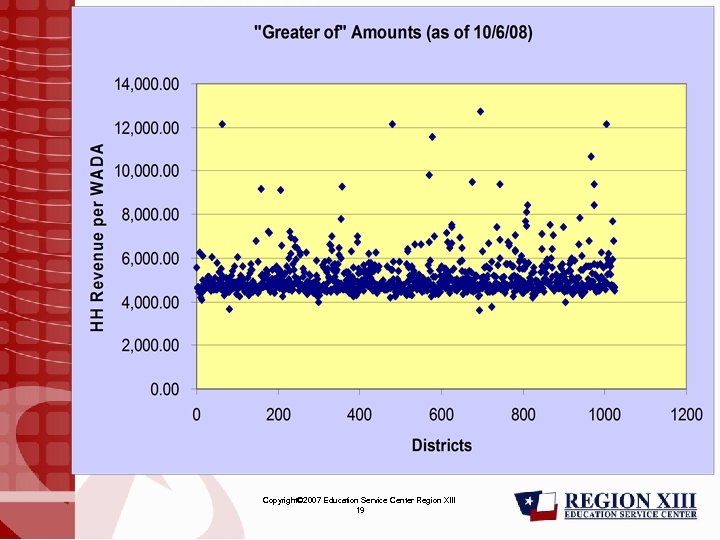

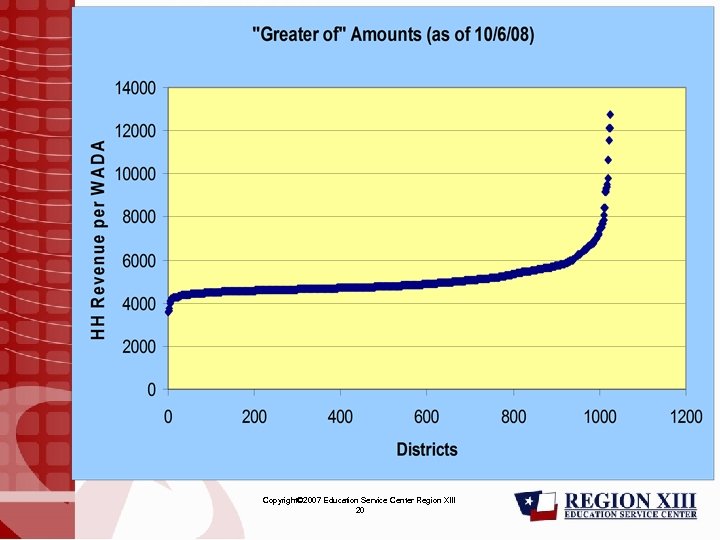

The Current System 9 • As of 10/6/08: – 196 districts have “S 1” (05 -06) as their “greater of” – 566 districts have “S 2” (06 -07 old law using 05 -06 M&O tax rate) as “greater of” – 264 districts have “S 3” (06 -07 old law using 06 -07 effective M&O rate) as “greater of” Copyright© 2007 Education Service Center Region XIII 18

The Current System 9 • As of 10/6/08: – 196 districts have “S 1” (05 -06) as their “greater of” – 566 districts have “S 2” (06 -07 old law using 05 -06 M&O tax rate) as “greater of” – 264 districts have “S 3” (06 -07 old law using 06 -07 effective M&O rate) as “greater of” Copyright© 2007 Education Service Center Region XIII 18

Copyright© 2007 Education Service Center Region XIII 19

Copyright© 2007 Education Service Center Region XIII 19

Copyright© 2007 Education Service Center Region XIII 20

Copyright© 2007 Education Service Center Region XIII 20

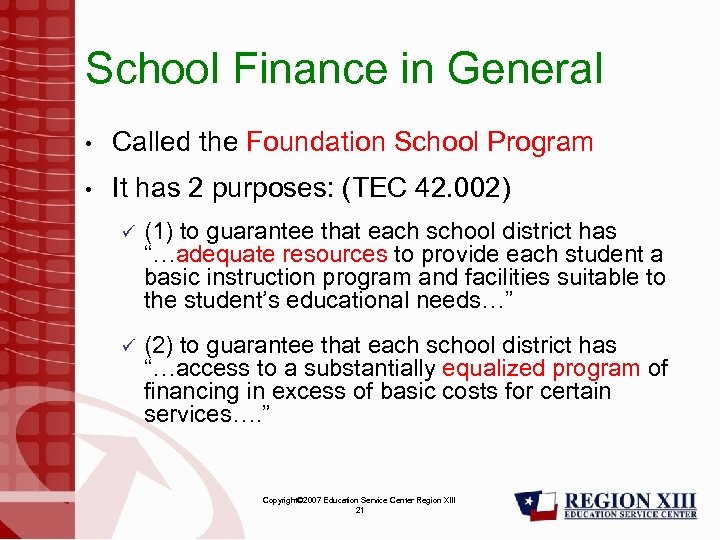

School Finance in General • Called the Foundation School Program • It has 2 purposes: (TEC 42. 002) ü (1) to guarantee that each school district has “…adequate resources to provide each student a basic instruction program and facilities suitable to the student’s educational needs…” ü (2) to guarantee that each school district has “…access to a substantially equalized program of financing in excess of basic costs for certain services…. ” Copyright© 2007 Education Service Center Region XIII 21

School Finance in General • Called the Foundation School Program • It has 2 purposes: (TEC 42. 002) ü (1) to guarantee that each school district has “…adequate resources to provide each student a basic instruction program and facilities suitable to the student’s educational needs…” ü (2) to guarantee that each school district has “…access to a substantially equalized program of financing in excess of basic costs for certain services…. ” Copyright© 2007 Education Service Center Region XIII 21

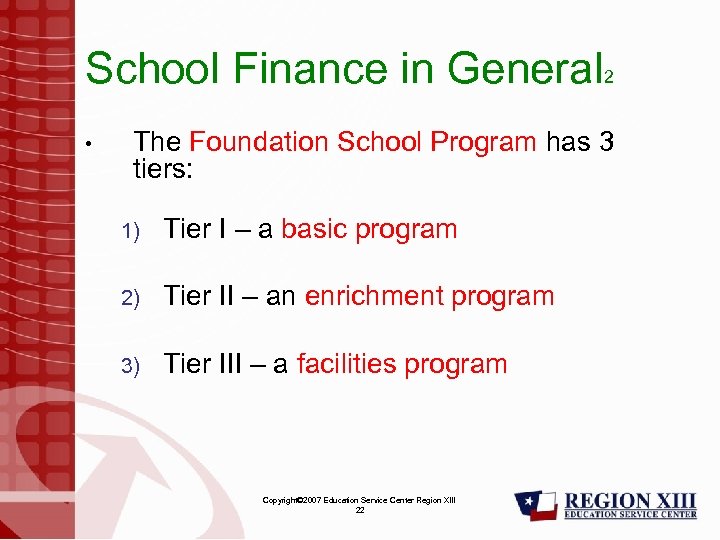

School Finance in General 2 • The Foundation School Program has 3 tiers: 1) Tier I – a basic program 2) Tier II – an enrichment program 3) Tier III – a facilities program Copyright© 2007 Education Service Center Region XIII 22

School Finance in General 2 • The Foundation School Program has 3 tiers: 1) Tier I – a basic program 2) Tier II – an enrichment program 3) Tier III – a facilities program Copyright© 2007 Education Service Center Region XIII 22

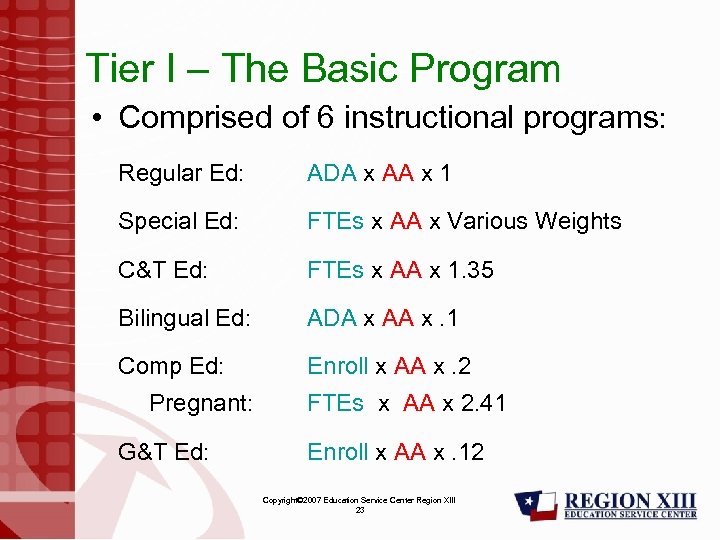

Tier I – The Basic Program • Comprised of 6 instructional programs: Regular Ed: ADA x AA x 1 Special Ed: FTEs x AA x Various Weights C&T Ed: FTEs x AA x 1. 35 Bilingual Ed: ADA x AA x. 1 Comp Ed: Enroll x AA x. 2 Pregnant: FTEs x AA x 2. 41 G&T Ed: Enroll x AA x. 12 Copyright© 2007 Education Service Center Region XIII 23

Tier I – The Basic Program • Comprised of 6 instructional programs: Regular Ed: ADA x AA x 1 Special Ed: FTEs x AA x Various Weights C&T Ed: FTEs x AA x 1. 35 Bilingual Ed: ADA x AA x. 1 Comp Ed: Enroll x AA x. 2 Pregnant: FTEs x AA x 2. 41 G&T Ed: Enroll x AA x. 12 Copyright© 2007 Education Service Center Region XIII 23

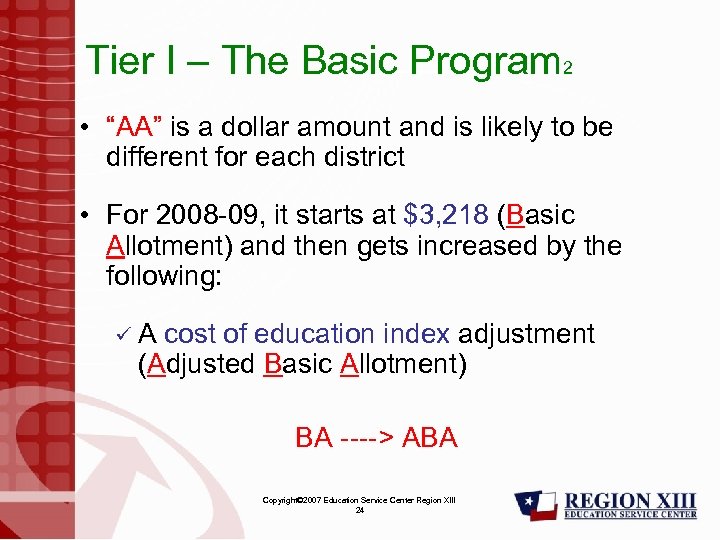

Tier I – The Basic Program 2 • “AA” is a dollar amount and is likely to be different for each district • For 2008 -09, it starts at $3, 218 (Basic Allotment) and then gets increased by the following: ü A cost of education index adjustment (Adjusted Basic Allotment) BA ----> ABA Copyright© 2007 Education Service Center Region XIII 24

Tier I – The Basic Program 2 • “AA” is a dollar amount and is likely to be different for each district • For 2008 -09, it starts at $3, 218 (Basic Allotment) and then gets increased by the following: ü A cost of education index adjustment (Adjusted Basic Allotment) BA ----> ABA Copyright© 2007 Education Service Center Region XIII 24

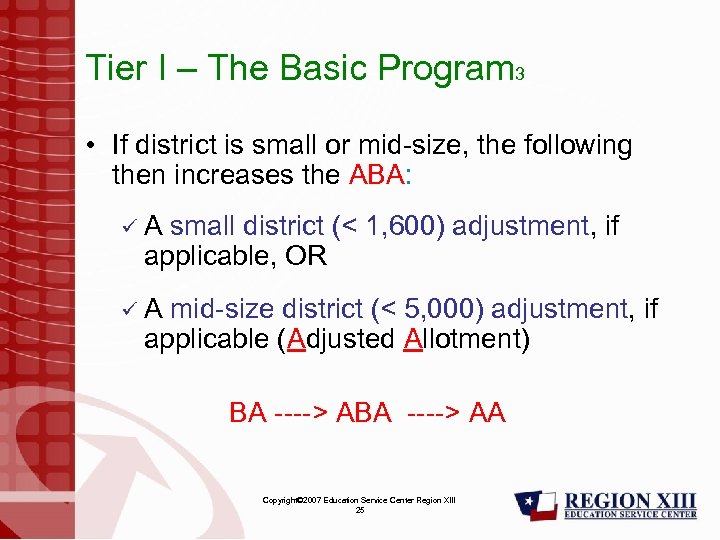

Tier I – The Basic Program 3 • If district is small or mid-size, the following then increases the ABA: ü A small district (< 1, 600) adjustment, if applicable, OR ü A mid-size district (< 5, 000) adjustment, if applicable (Adjusted Allotment) BA ----> AA Copyright© 2007 Education Service Center Region XIII 25

Tier I – The Basic Program 3 • If district is small or mid-size, the following then increases the ABA: ü A small district (< 1, 600) adjustment, if applicable, OR ü A mid-size district (< 5, 000) adjustment, if applicable (Adjusted Allotment) BA ----> AA Copyright© 2007 Education Service Center Region XIII 25

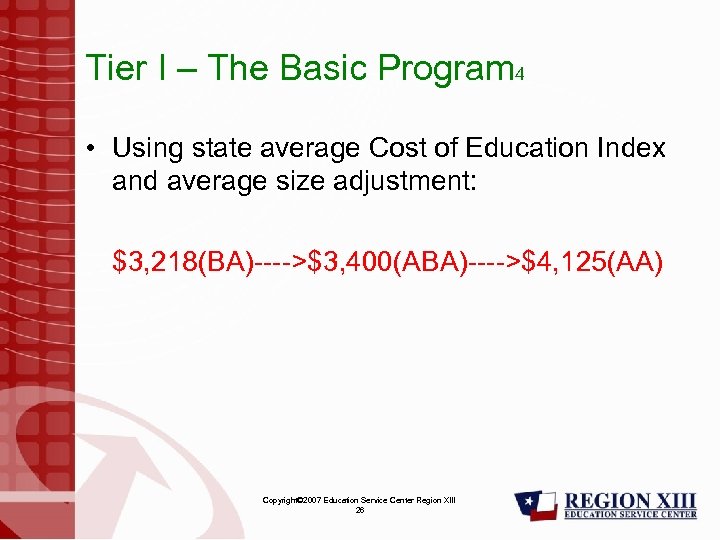

Tier I – The Basic Program 4 • Using state average Cost of Education Index and average size adjustment: $3, 218(BA)---->$3, 400(ABA)---->$4, 125(AA) Copyright© 2007 Education Service Center Region XIII 26

Tier I – The Basic Program 4 • Using state average Cost of Education Index and average size adjustment: $3, 218(BA)---->$3, 400(ABA)---->$4, 125(AA) Copyright© 2007 Education Service Center Region XIII 26

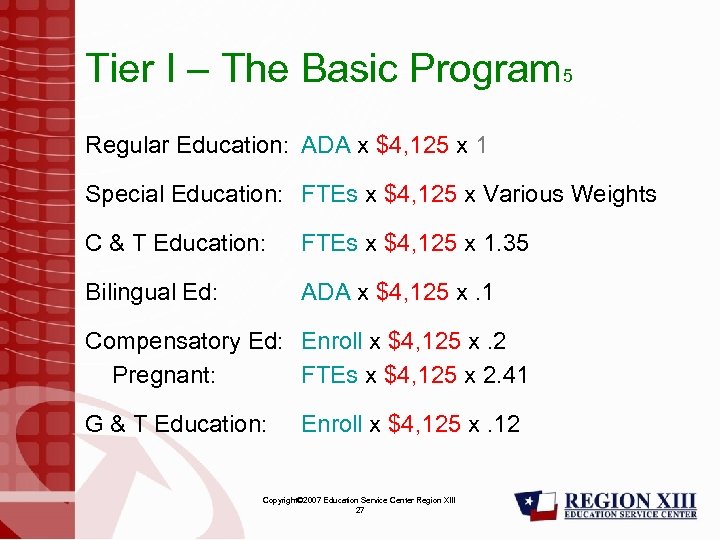

Tier I – The Basic Program 5 Regular Education: ADA x $4, 125 x 1 Special Education: FTEs x $4, 125 x Various Weights C & T Education: FTEs x $4, 125 x 1. 35 Bilingual Ed: ADA x $4, 125 x. 1 Compensatory Ed: Enroll x $4, 125 x. 2 Pregnant: FTEs x $4, 125 x 2. 41 G & T Education: Enroll x $4, 125 x. 12 Copyright© 2007 Education Service Center Region XIII 27

Tier I – The Basic Program 5 Regular Education: ADA x $4, 125 x 1 Special Education: FTEs x $4, 125 x Various Weights C & T Education: FTEs x $4, 125 x 1. 35 Bilingual Ed: ADA x $4, 125 x. 1 Compensatory Ed: Enroll x $4, 125 x. 2 Pregnant: FTEs x $4, 125 x 2. 41 G & T Education: Enroll x $4, 125 x. 12 Copyright© 2007 Education Service Center Region XIII 27

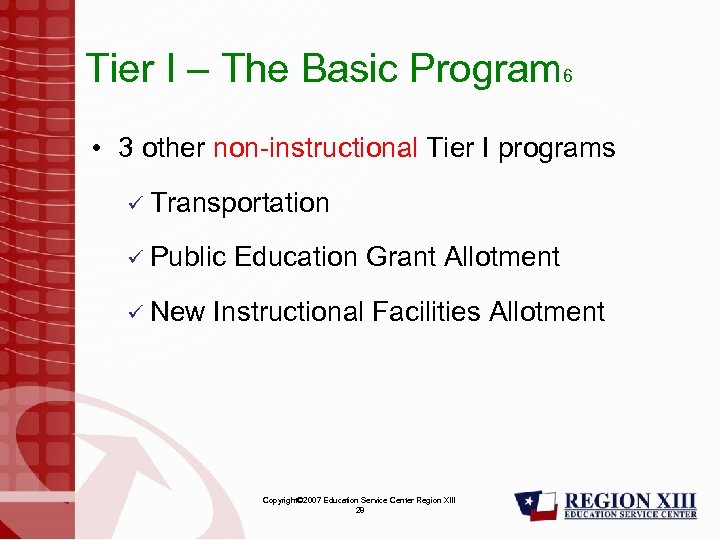

Tier I – The Basic Program 6 • 3 other non-instructional Tier I programs ü Transportation ü Public Education Grant Allotment ü New Instructional Facilities Allotment Copyright© 2007 Education Service Center Region XIII 28

Tier I – The Basic Program 6 • 3 other non-instructional Tier I programs ü Transportation ü Public Education Grant Allotment ü New Instructional Facilities Allotment Copyright© 2007 Education Service Center Region XIII 28

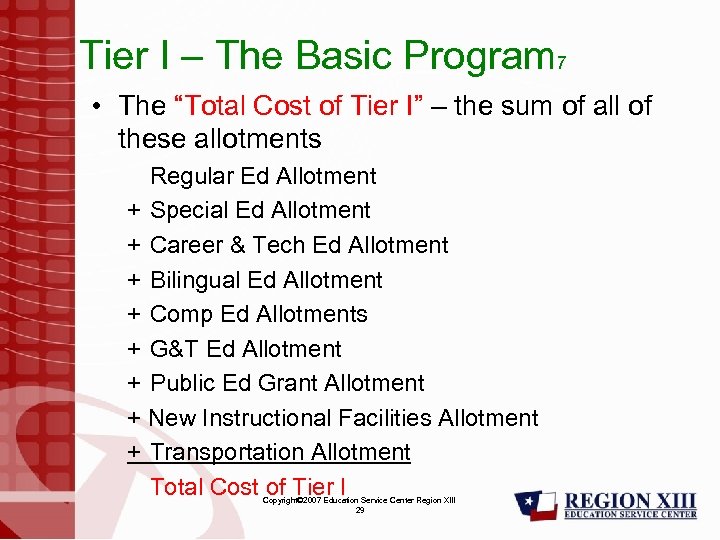

Tier I – The Basic Program 7 • The “Total Cost of Tier I” – the sum of all of these allotments Regular Ed Allotment + Special Ed Allotment + Career & Tech Ed Allotment + Bilingual Ed Allotment + Comp Ed Allotments + G&T Ed Allotment + Public Ed Grant Allotment + New Instructional Facilities Allotment + Transportation Allotment Total Cost of Tier I Copyright© 2007 Education Service Center Region XIII 29

Tier I – The Basic Program 7 • The “Total Cost of Tier I” – the sum of all of these allotments Regular Ed Allotment + Special Ed Allotment + Career & Tech Ed Allotment + Bilingual Ed Allotment + Comp Ed Allotments + G&T Ed Allotment + Public Ed Grant Allotment + New Instructional Facilities Allotment + Transportation Allotment Total Cost of Tier I Copyright© 2007 Education Service Center Region XIII 29

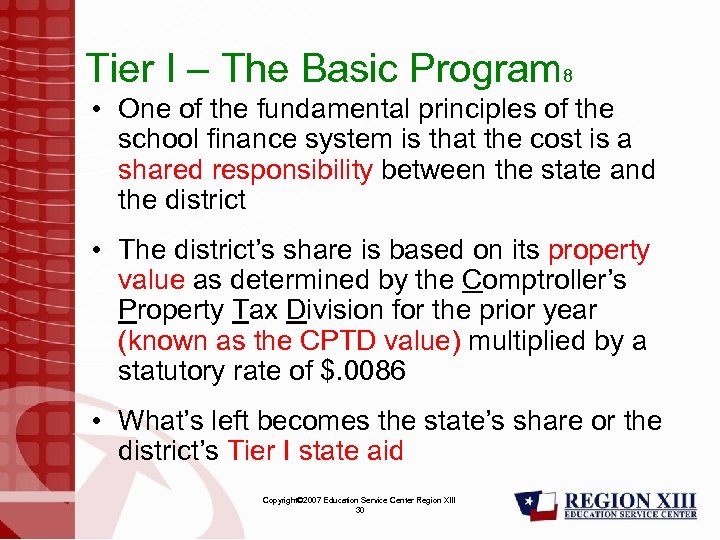

Tier I – The Basic Program 8 • One of the fundamental principles of the school finance system is that the cost is a shared responsibility between the state and the district • The district’s share is based on its property value as determined by the Comptroller’s Property Tax Division for the prior year (known as the CPTD value) multiplied by a statutory rate of $. 0086 • What’s left becomes the state’s share or the district’s Tier I state aid Copyright© 2007 Education Service Center Region XIII 30

Tier I – The Basic Program 8 • One of the fundamental principles of the school finance system is that the cost is a shared responsibility between the state and the district • The district’s share is based on its property value as determined by the Comptroller’s Property Tax Division for the prior year (known as the CPTD value) multiplied by a statutory rate of $. 0086 • What’s left becomes the state’s share or the district’s Tier I state aid Copyright© 2007 Education Service Center Region XIII 30

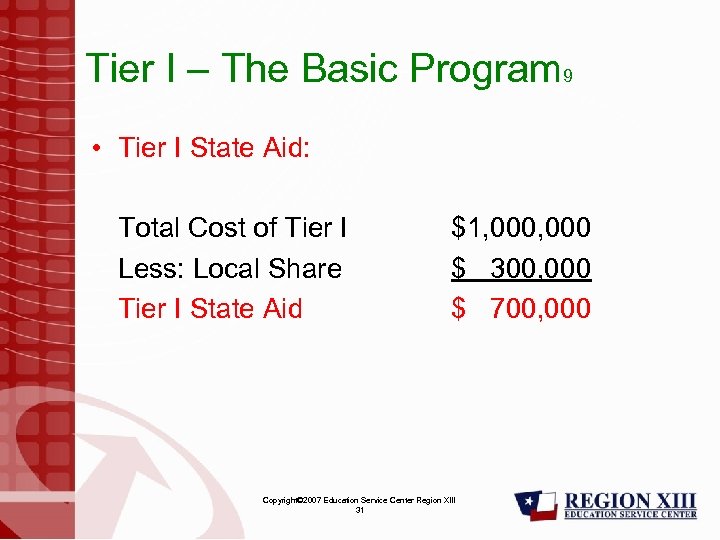

Tier I – The Basic Program 9 • Tier I State Aid: Total Cost of Tier I Less: Local Share Tier I State Aid $1, 000 $ 300, 000 $ 700, 000 Copyright© 2007 Education Service Center Region XIII 31

Tier I – The Basic Program 9 • Tier I State Aid: Total Cost of Tier I Less: Local Share Tier I State Aid $1, 000 $ 300, 000 $ 700, 000 Copyright© 2007 Education Service Center Region XIII 31

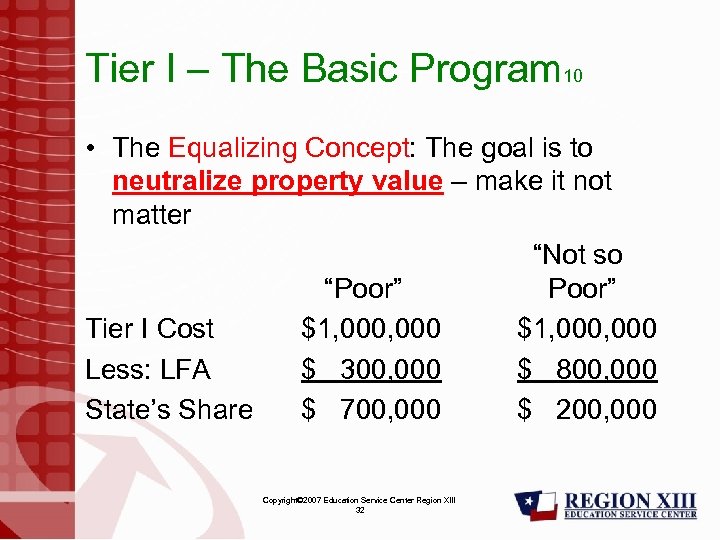

Tier I – The Basic Program 10 • The Equalizing Concept: The goal is to neutralize property value – make it not matter “Not so “Poor” Poor” Tier I Cost $1, 000, 000 Less: LFA $ 300, 000 $ 800, 000 State’s Share $ 700, 000 $ 200, 000 Copyright© 2007 Education Service Center Region XIII 32

Tier I – The Basic Program 10 • The Equalizing Concept: The goal is to neutralize property value – make it not matter “Not so “Poor” Poor” Tier I Cost $1, 000, 000 Less: LFA $ 300, 000 $ 800, 000 State’s Share $ 700, 000 $ 200, 000 Copyright© 2007 Education Service Center Region XIII 32

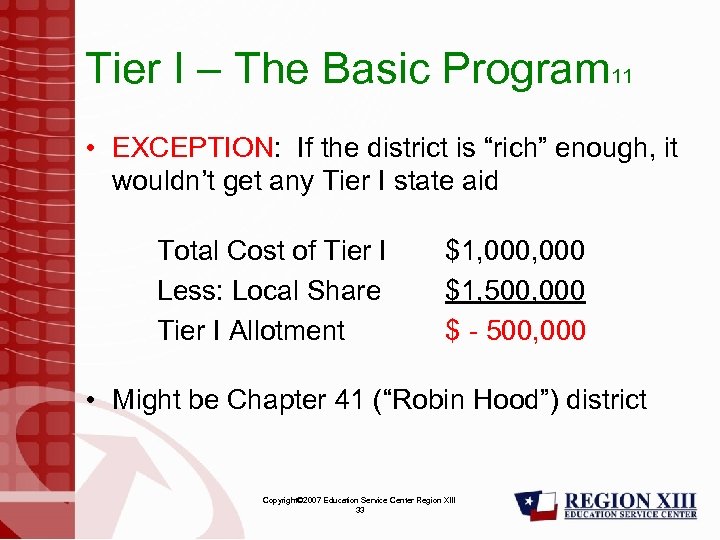

Tier I – The Basic Program 11 • EXCEPTION: If the district is “rich” enough, it wouldn’t get any Tier I state aid Total Cost of Tier I Less: Local Share Tier I Allotment $1, 000 $1, 500, 000 $ - 500, 000 • Might be Chapter 41 (“Robin Hood”) district Copyright© 2007 Education Service Center Region XIII 33

Tier I – The Basic Program 11 • EXCEPTION: If the district is “rich” enough, it wouldn’t get any Tier I state aid Total Cost of Tier I Less: Local Share Tier I Allotment $1, 000 $1, 500, 000 $ - 500, 000 • Might be Chapter 41 (“Robin Hood”) district Copyright© 2007 Education Service Center Region XIII 33

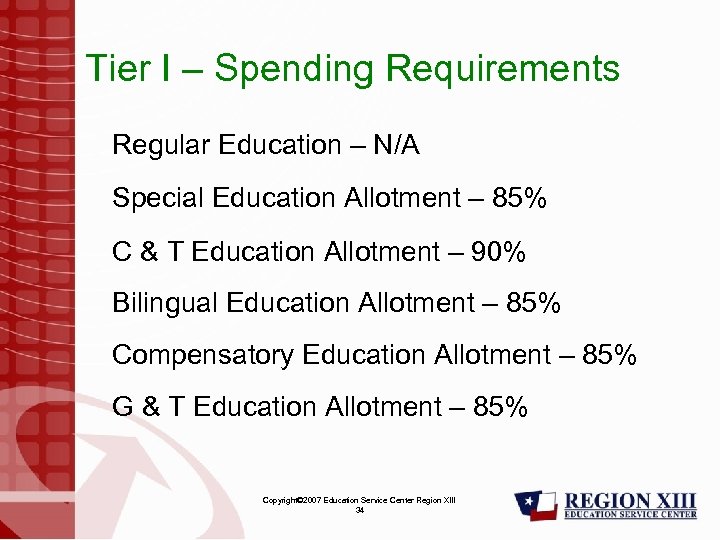

Tier I – Spending Requirements Regular Education – N/A Special Education Allotment – 85% C & T Education Allotment – 90% Bilingual Education Allotment – 85% Compensatory Education Allotment – 85% G & T Education Allotment – 85% Copyright© 2007 Education Service Center Region XIII 34

Tier I – Spending Requirements Regular Education – N/A Special Education Allotment – 85% C & T Education Allotment – 90% Bilingual Education Allotment – 85% Compensatory Education Allotment – 85% G & T Education Allotment – 85% Copyright© 2007 Education Service Center Region XIII 34

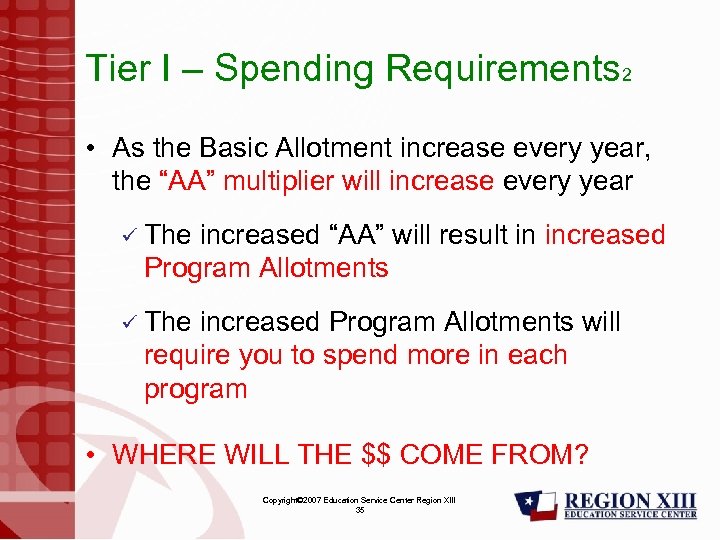

Tier I – Spending Requirements 2 • As the Basic Allotment increase every year, the “AA” multiplier will increase every year ü The increased “AA” will result in increased Program Allotments ü The increased Program Allotments will require you to spend more in each program • WHERE WILL THE $$ COME FROM? Copyright© 2007 Education Service Center Region XIII 35

Tier I – Spending Requirements 2 • As the Basic Allotment increase every year, the “AA” multiplier will increase every year ü The increased “AA” will result in increased Program Allotments ü The increased Program Allotments will require you to spend more in each program • WHERE WILL THE $$ COME FROM? Copyright© 2007 Education Service Center Region XIII 35

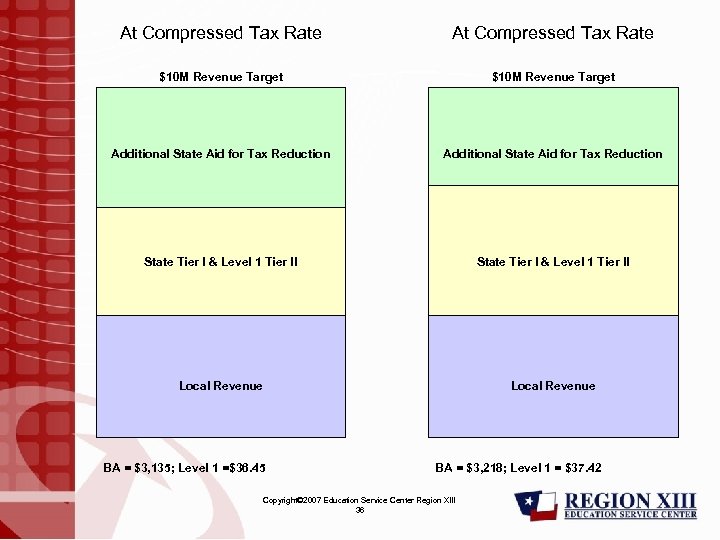

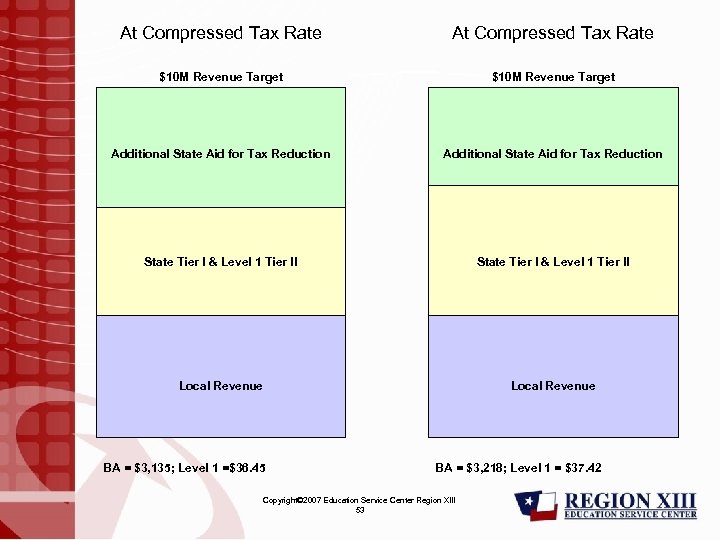

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Tier I & Level 1 Tier II Local Revenue BA = $3, 135; Level 1 =$36. 45 BA = $3, 218; Level 1 = $37. 42 Copyright© 2007 Education Service Center Region XIII 36

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Tier I & Level 1 Tier II Local Revenue BA = $3, 135; Level 1 =$36. 45 BA = $3, 218; Level 1 = $37. 42 Copyright© 2007 Education Service Center Region XIII 36

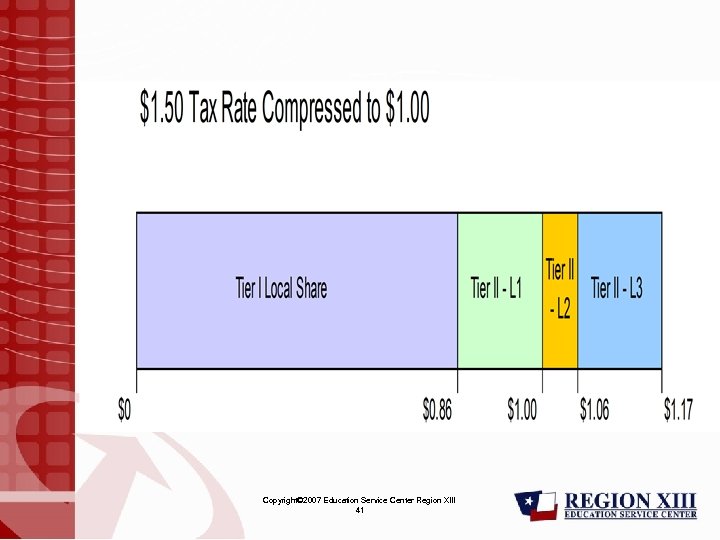

Tier II • Tier II – supplements/enriches the basic Tier I program at the level the district or its taxpayers are willing to tax above the $. 0086 that is required for Tier I local share ü There are 3 levels of Tier II Copyright© 2007 Education Service Center Region XIII 37

Tier II • Tier II – supplements/enriches the basic Tier I program at the level the district or its taxpayers are willing to tax above the $. 0086 that is required for Tier I local share ü There are 3 levels of Tier II Copyright© 2007 Education Service Center Region XIII 37

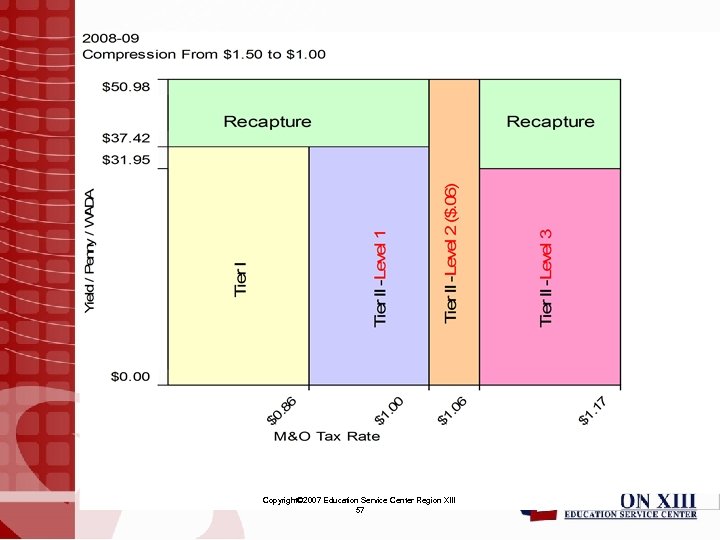

Tier II 2 • Level 1 (2008 -09) ü The state “guarantees” that each penny taxed above the $. 0086, up to the compressed rate, will “yield” no less than $37. 42 per WADA in combination of local & state dollars Does not require voter approval o $37. 42 yield changes annually (yield for district at the 88 th percentile of wealth) o Copyright© 2007 Education Service Center Region XIII 38

Tier II 2 • Level 1 (2008 -09) ü The state “guarantees” that each penny taxed above the $. 0086, up to the compressed rate, will “yield” no less than $37. 42 per WADA in combination of local & state dollars Does not require voter approval o $37. 42 yield changes annually (yield for district at the 88 th percentile of wealth) o Copyright© 2007 Education Service Center Region XIII 38

Tier II 3 • Level 2 (2008 -09) ü The state “guarantees” that each penny taxed above the compressed rate, up to 4 pennies, will “yield” no less than $50. 98 per WADA in combination of local & state dollars Does not require voter approval o $50. 98 yield changes annually (yield for Austin ISD each year) o Copyright© 2007 Education Service Center Region XIII 39

Tier II 3 • Level 2 (2008 -09) ü The state “guarantees” that each penny taxed above the compressed rate, up to 4 pennies, will “yield” no less than $50. 98 per WADA in combination of local & state dollars Does not require voter approval o $50. 98 yield changes annually (yield for Austin ISD each year) o Copyright© 2007 Education Service Center Region XIII 39

Tier II 4 • Level 3 (2008 -09) ü The state “guarantees” that each penny taxed beyond the compressed rate + 6 pennies, will “yield” no less than $31. 95 per WADA in combination of local & state dollars Requires voter approval o $31. 95 yield is fixed o Copyright© 2007 Education Service Center Region XIII 40

Tier II 4 • Level 3 (2008 -09) ü The state “guarantees” that each penny taxed beyond the compressed rate + 6 pennies, will “yield” no less than $31. 95 per WADA in combination of local & state dollars Requires voter approval o $31. 95 yield is fixed o Copyright© 2007 Education Service Center Region XIII 40

Copyright© 2007 Education Service Center Region XIII 41

Copyright© 2007 Education Service Center Region XIII 41

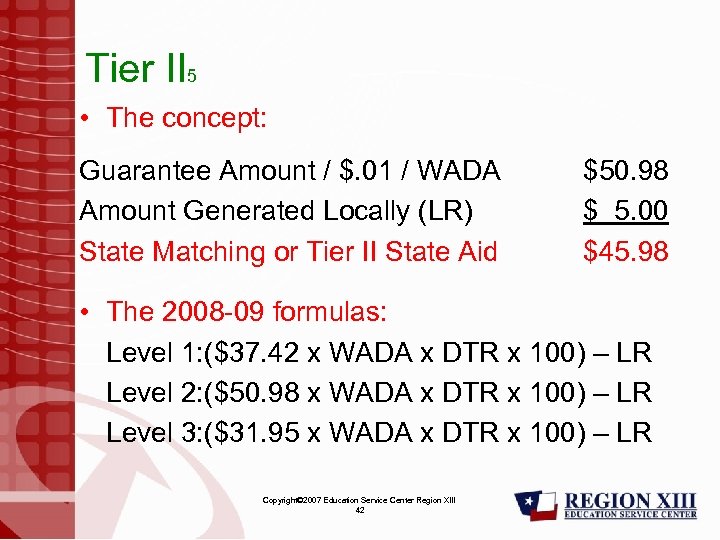

Tier II 5 • The concept: Guarantee Amount / $. 01 / WADA Amount Generated Locally (LR) State Matching or Tier II State Aid $50. 98 $ 5. 00 $45. 98 • The 2008 -09 formulas: Level 1: ($37. 42 x WADA x DTR x 100) – LR Level 2: ($50. 98 x WADA x DTR x 100) – LR Level 3: ($31. 95 x WADA x DTR x 100) – LR Copyright© 2007 Education Service Center Region XIII 42

Tier II 5 • The concept: Guarantee Amount / $. 01 / WADA Amount Generated Locally (LR) State Matching or Tier II State Aid $50. 98 $ 5. 00 $45. 98 • The 2008 -09 formulas: Level 1: ($37. 42 x WADA x DTR x 100) – LR Level 2: ($50. 98 x WADA x DTR x 100) – LR Level 3: ($31. 95 x WADA x DTR x 100) – LR Copyright© 2007 Education Service Center Region XIII 42

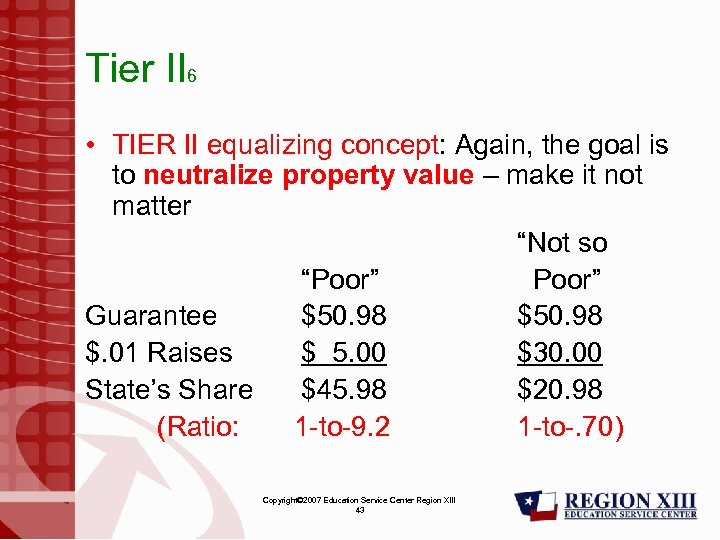

Tier II 6 • TIER II equalizing concept: Again, the goal is to neutralize property value – make it not matter “Not so “Poor” Guarantee $50. 98 $. 01 Raises $ 5. 00 $30. 00 State’s Share $45. 98 $20. 98 (Ratio: 1 -to-9. 2 1 -to-. 70) Copyright© 2007 Education Service Center Region XIII 43

Tier II 6 • TIER II equalizing concept: Again, the goal is to neutralize property value – make it not matter “Not so “Poor” Guarantee $50. 98 $. 01 Raises $ 5. 00 $30. 00 State’s Share $45. 98 $20. 98 (Ratio: 1 -to-9. 2 1 -to-. 70) Copyright© 2007 Education Service Center Region XIII 43

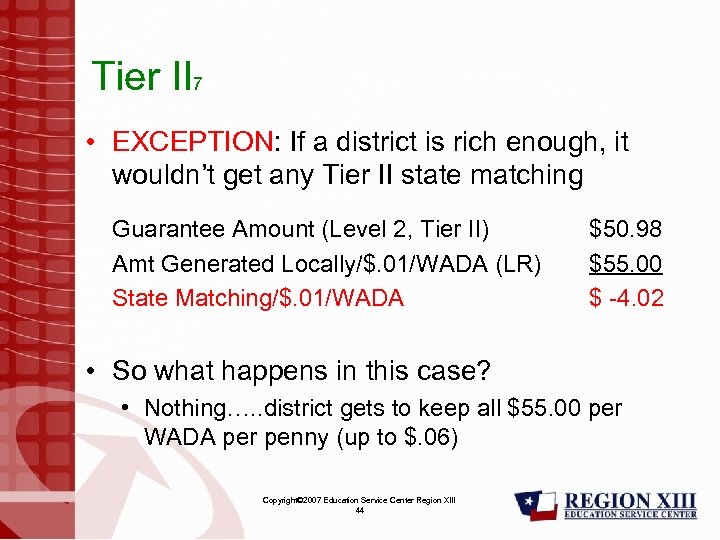

Tier II 7 • EXCEPTION: If a district is rich enough, it wouldn’t get any Tier II state matching Guarantee Amount (Level 2, Tier II) Amt Generated Locally/$. 01/WADA (LR) State Matching/$. 01/WADA $50. 98 $55. 00 $ -4. 02 • So what happens in this case? • Nothing…. . district gets to keep all $55. 00 per WADA per penny (up to $. 06) Copyright© 2007 Education Service Center Region XIII 44

Tier II 7 • EXCEPTION: If a district is rich enough, it wouldn’t get any Tier II state matching Guarantee Amount (Level 2, Tier II) Amt Generated Locally/$. 01/WADA (LR) State Matching/$. 01/WADA $50. 98 $55. 00 $ -4. 02 • So what happens in this case? • Nothing…. . district gets to keep all $55. 00 per WADA per penny (up to $. 06) Copyright© 2007 Education Service Center Region XIII 44

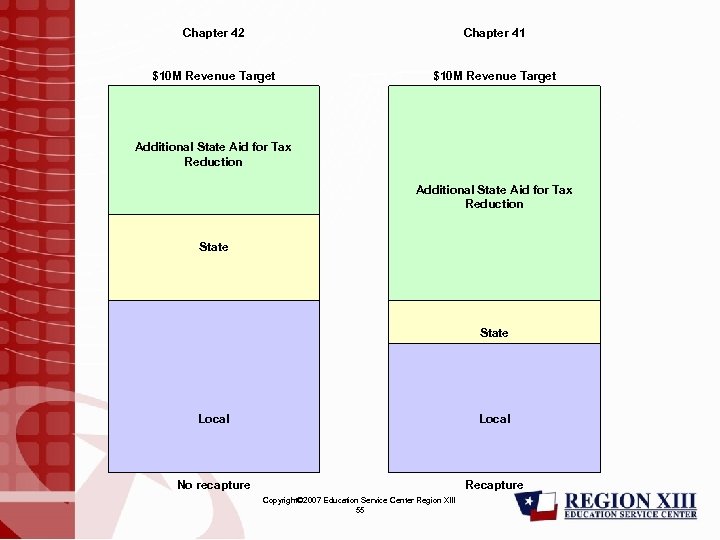

Robin Hood • 2 levels of recapture (Robin Hood) 1) For taxes collected up to the district’s compressed rate, the Equalized Wealth Level (the wealth per WADA a district can keep before recapture sets in) is $374, 200 per WADA • Tied to the Level 1, Tier II yield ($37. 42 per penny per WADA = $374, 200 in value per WADA) 2) For taxes collected on pennies beyond the district’s compressed rate plus $. 06, the Equalized Wealth Level is $319, 500 per WADA Copyright© 2007 Education Service Center Region XIII 45

Robin Hood • 2 levels of recapture (Robin Hood) 1) For taxes collected up to the district’s compressed rate, the Equalized Wealth Level (the wealth per WADA a district can keep before recapture sets in) is $374, 200 per WADA • Tied to the Level 1, Tier II yield ($37. 42 per penny per WADA = $374, 200 in value per WADA) 2) For taxes collected on pennies beyond the district’s compressed rate plus $. 06, the Equalized Wealth Level is $319, 500 per WADA Copyright© 2007 Education Service Center Region XIII 45

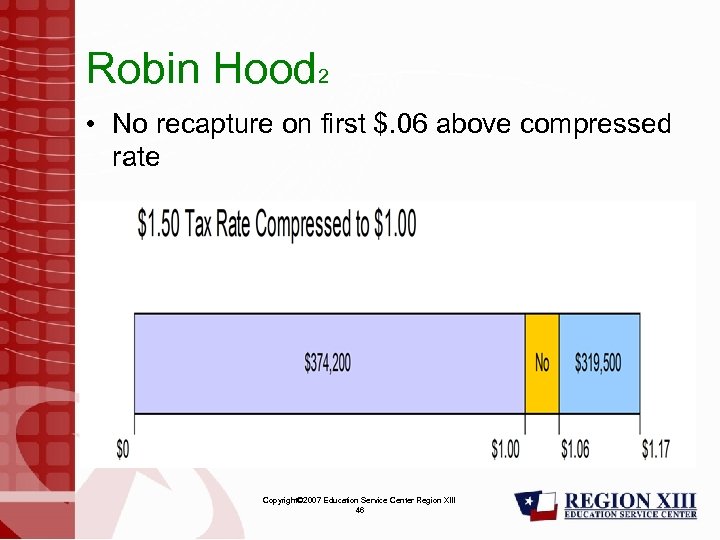

Robin Hood 2 • No recapture on first $. 06 above compressed rate Copyright© 2007 Education Service Center Region XIII 46

Robin Hood 2 • No recapture on first $. 06 above compressed rate Copyright© 2007 Education Service Center Region XIII 46

Robin Hood 3 • Example: Wealth per WADA Equalized wealth level Excess wealth per WADA Percent excess • What does this mean? Copyright© 2007 Education Service Center Region XIII 47 $589, 260 $374, 200 $215, 060 36. 50%

Robin Hood 3 • Example: Wealth per WADA Equalized wealth level Excess wealth per WADA Percent excess • What does this mean? Copyright© 2007 Education Service Center Region XIII 47 $589, 260 $374, 200 $215, 060 36. 50%

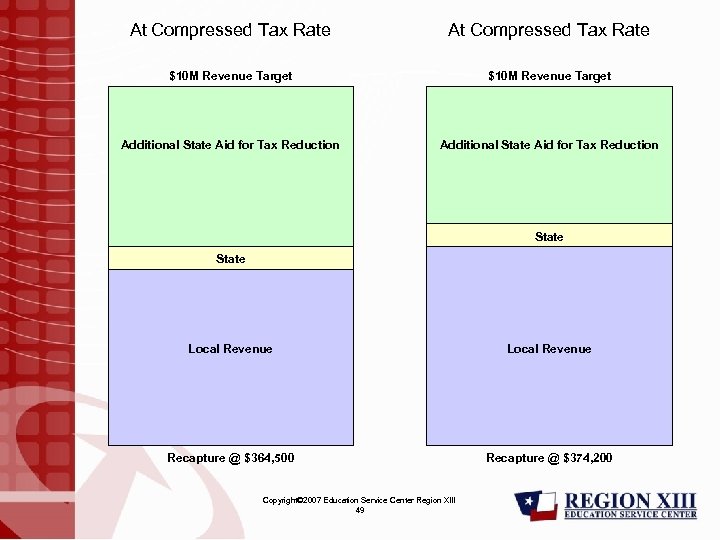

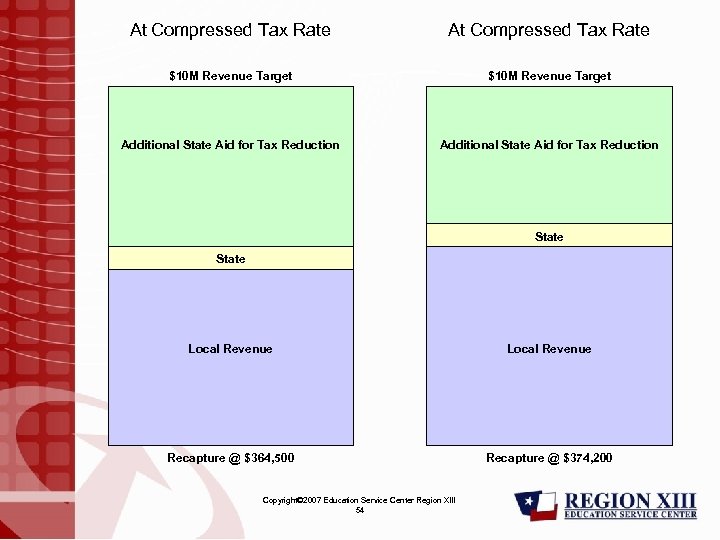

Robin Hood 4 • For every M&O $1 collected up to the compressed rate, district must send out (referred to as “recapture”) $. 365 and therefore gets to keep $. 635 • However, this 1 st level of recapture doesn’t matter • It is within the Target Revenue • The more/less recapture is at this level, the more/less local revenue retained…. the more/less retained, the more/less the state has to kick in to get up to the Target Revenue Copyright© 2007 Education Service Center Region XIII 48

Robin Hood 4 • For every M&O $1 collected up to the compressed rate, district must send out (referred to as “recapture”) $. 365 and therefore gets to keep $. 635 • However, this 1 st level of recapture doesn’t matter • It is within the Target Revenue • The more/less recapture is at this level, the more/less local revenue retained…. the more/less retained, the more/less the state has to kick in to get up to the Target Revenue Copyright© 2007 Education Service Center Region XIII 48

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Local Revenue Recapture @ $364, 500 Copyright© 2007 Education Service Center Region XIII 49 Recapture @ $374, 200

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Local Revenue Recapture @ $364, 500 Copyright© 2007 Education Service Center Region XIII 49 Recapture @ $374, 200

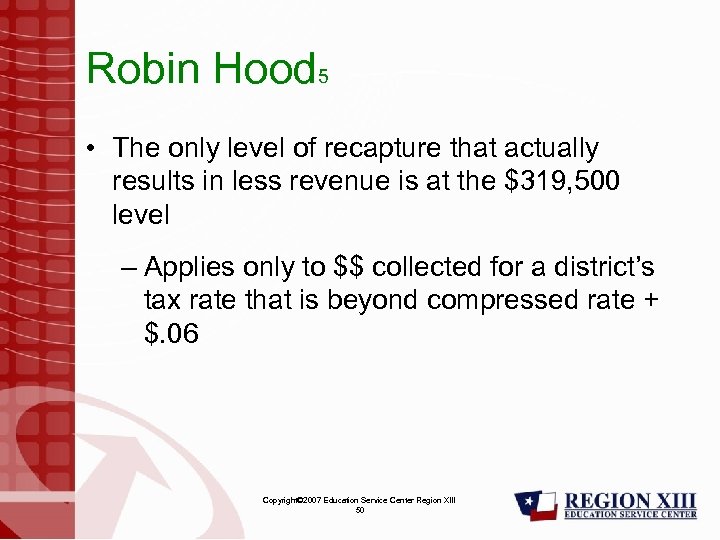

Robin Hood 5 • The only level of recapture that actually results in less revenue is at the $319, 500 level – Applies only to $$ collected for a district’s tax rate that is beyond compressed rate + $. 06 Copyright© 2007 Education Service Center Region XIII 50

Robin Hood 5 • The only level of recapture that actually results in less revenue is at the $319, 500 level – Applies only to $$ collected for a district’s tax rate that is beyond compressed rate + $. 06 Copyright© 2007 Education Service Center Region XIII 50

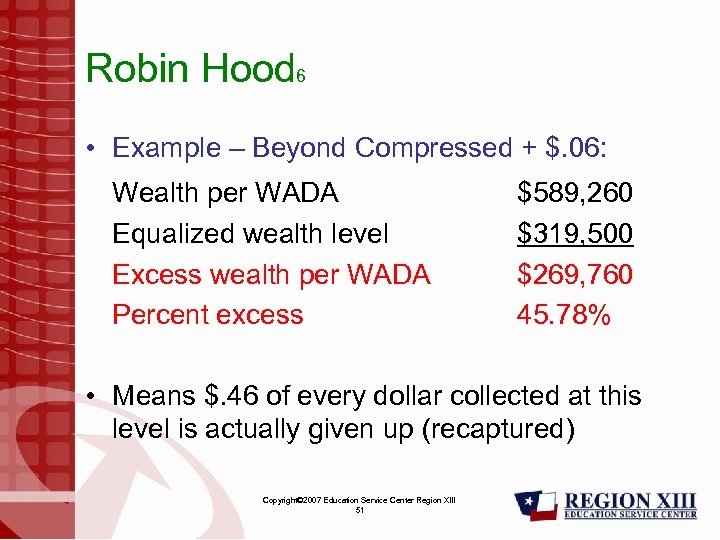

Robin Hood 6 • Example – Beyond Compressed + $. 06: Wealth per WADA Equalized wealth level Excess wealth per WADA Percent excess $589, 260 $319, 500 $269, 760 45. 78% • Means $. 46 of every dollar collected at this level is actually given up (recaptured) Copyright© 2007 Education Service Center Region XIII 51

Robin Hood 6 • Example – Beyond Compressed + $. 06: Wealth per WADA Equalized wealth level Excess wealth per WADA Percent excess $589, 260 $319, 500 $269, 760 45. 78% • Means $. 46 of every dollar collected at this level is actually given up (recaptured) Copyright© 2007 Education Service Center Region XIII 51

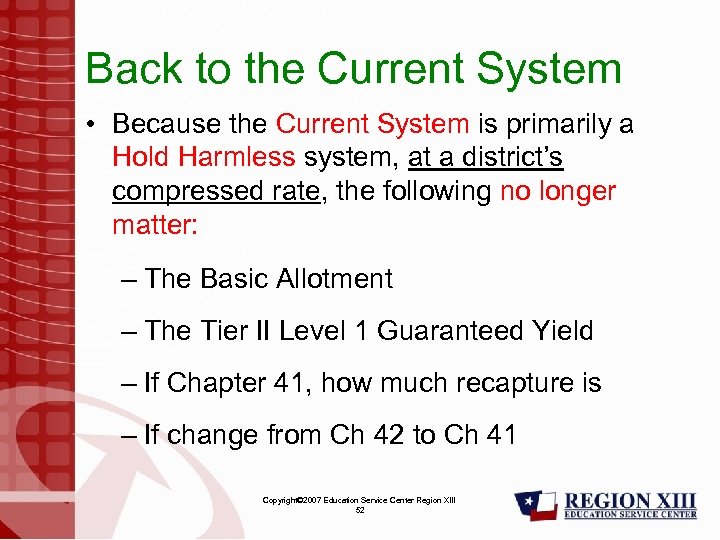

Back to the Current System • Because the Current System is primarily a Hold Harmless system, at a district’s compressed rate, the following no longer matter: – The Basic Allotment – The Tier II Level 1 Guaranteed Yield – If Chapter 41, how much recapture is – If change from Ch 42 to Ch 41 Copyright© 2007 Education Service Center Region XIII 52

Back to the Current System • Because the Current System is primarily a Hold Harmless system, at a district’s compressed rate, the following no longer matter: – The Basic Allotment – The Tier II Level 1 Guaranteed Yield – If Chapter 41, how much recapture is – If change from Ch 42 to Ch 41 Copyright© 2007 Education Service Center Region XIII 52

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Tier I & Level 1 Tier II Local Revenue BA = $3, 135; Level 1 =$36. 45 BA = $3, 218; Level 1 = $37. 42 Copyright© 2007 Education Service Center Region XIII 53

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Tier I & Level 1 Tier II Local Revenue BA = $3, 135; Level 1 =$36. 45 BA = $3, 218; Level 1 = $37. 42 Copyright© 2007 Education Service Center Region XIII 53

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Local Revenue Recapture @ $364, 500 Copyright© 2007 Education Service Center Region XIII 54 Recapture @ $374, 200

At Compressed Tax Rate $10 M Revenue Target Additional State Aid for Tax Reduction State Local Revenue Recapture @ $364, 500 Copyright© 2007 Education Service Center Region XIII 54 Recapture @ $374, 200

Chapter 42 Chapter 41 $10 M Revenue Target Additional State Aid for Tax Reduction State Local No recapture Recapture Copyright© 2007 Education Service Center Region XIII 55

Chapter 42 Chapter 41 $10 M Revenue Target Additional State Aid for Tax Reduction State Local No recapture Recapture Copyright© 2007 Education Service Center Region XIII 55

Summary • See following graph Copyright© 2007 Education Service Center Region XIII 56

Summary • See following graph Copyright© 2007 Education Service Center Region XIII 56

Copyright© 2007 Education Service Center Region XIII 57

Copyright© 2007 Education Service Center Region XIII 57

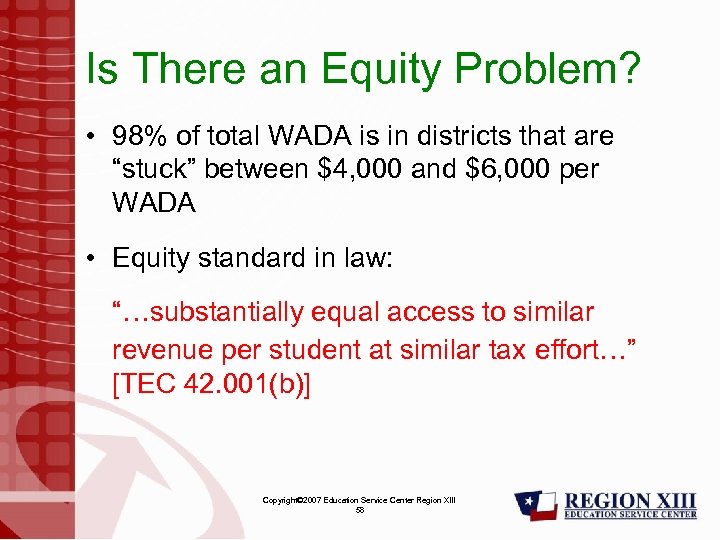

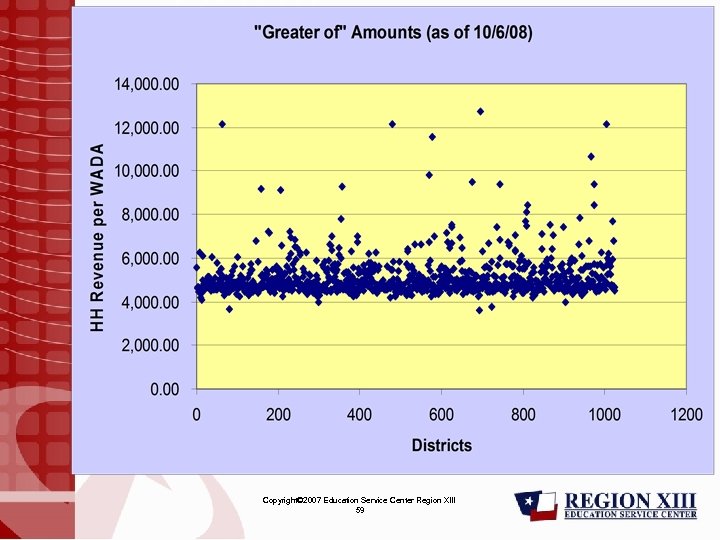

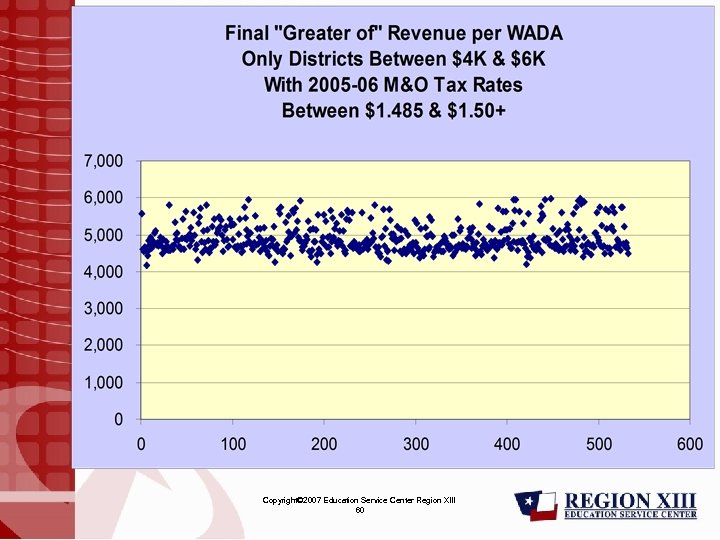

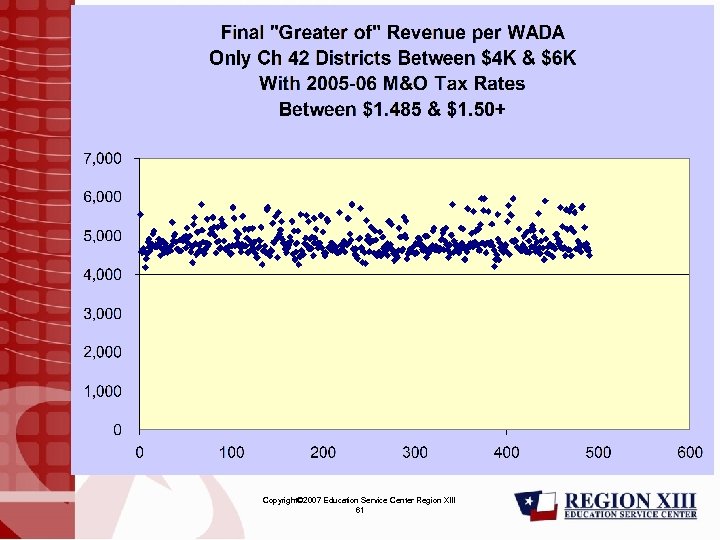

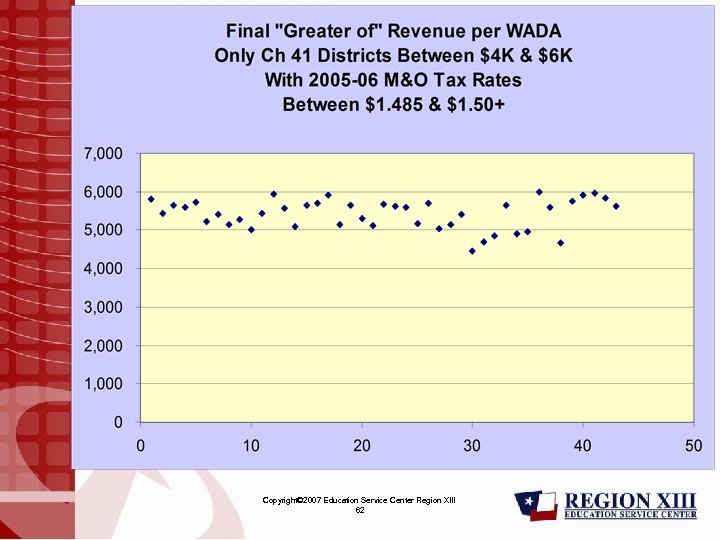

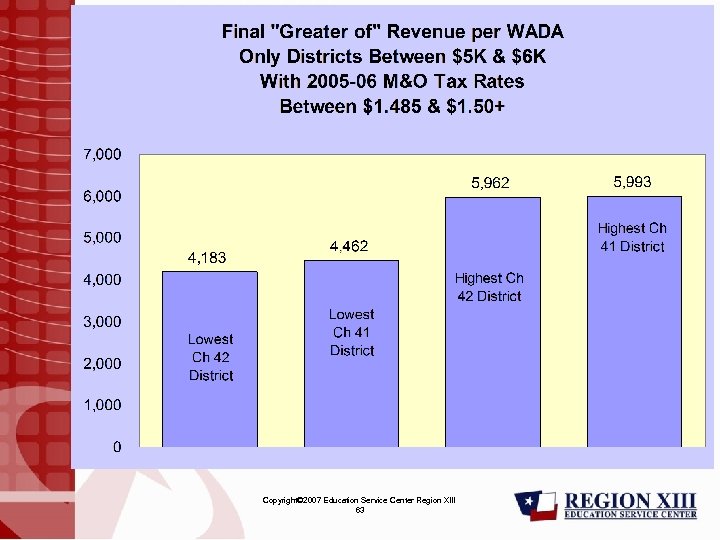

Is There an Equity Problem? • 98% of total WADA is in districts that are “stuck” between $4, 000 and $6, 000 per WADA • Equity standard in law: “…substantially equal access to similar revenue per student at similar tax effort…” [TEC 42. 001(b)] Copyright© 2007 Education Service Center Region XIII 58

Is There an Equity Problem? • 98% of total WADA is in districts that are “stuck” between $4, 000 and $6, 000 per WADA • Equity standard in law: “…substantially equal access to similar revenue per student at similar tax effort…” [TEC 42. 001(b)] Copyright© 2007 Education Service Center Region XIII 58

Copyright© 2007 Education Service Center Region XIII 59

Copyright© 2007 Education Service Center Region XIII 59

Copyright© 2007 Education Service Center Region XIII 60

Copyright© 2007 Education Service Center Region XIII 60

Copyright© 2007 Education Service Center Region XIII 61

Copyright© 2007 Education Service Center Region XIII 61

Copyright© 2007 Education Service Center Region XIII 62

Copyright© 2007 Education Service Center Region XIII 62

Copyright© 2007 Education Service Center Region XIII 63

Copyright© 2007 Education Service Center Region XIII 63

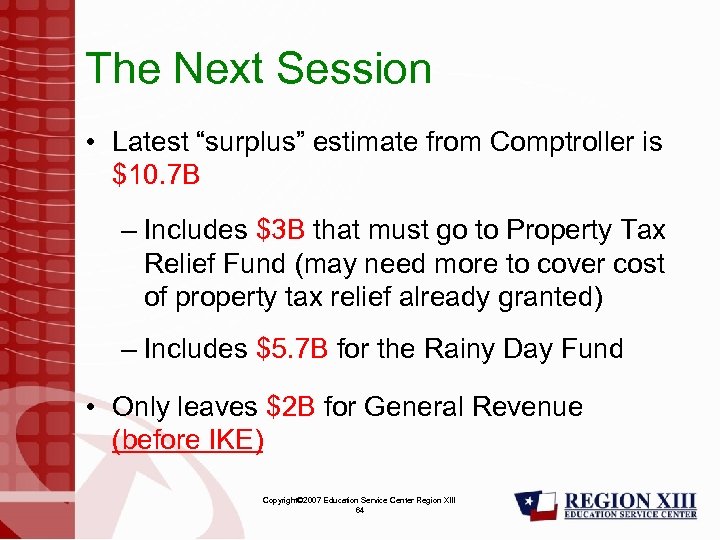

The Next Session • Latest “surplus” estimate from Comptroller is $10. 7 B – Includes $3 B that must go to Property Tax Relief Fund (may need more to cover cost of property tax relief already granted) – Includes $5. 7 B for the Rainy Day Fund • Only leaves $2 B for General Revenue (before IKE) Copyright© 2007 Education Service Center Region XIII 64

The Next Session • Latest “surplus” estimate from Comptroller is $10. 7 B – Includes $3 B that must go to Property Tax Relief Fund (may need more to cover cost of property tax relief already granted) – Includes $5. 7 B for the Rainy Day Fund • Only leaves $2 B for General Revenue (before IKE) Copyright© 2007 Education Service Center Region XIII 64

The Next Session 2 • What to expect – Some tweaking – Push for more property tax relief? ? (Before IKE) • What not to expect – Major overhaul (NOTE: The history of school finance tells you that the Legislature does not voluntarily overhaul school finance…only does so upon court intervention) Copyright© 2007 Education Service Center Region XIII 65

The Next Session 2 • What to expect – Some tweaking – Push for more property tax relief? ? (Before IKE) • What not to expect – Major overhaul (NOTE: The history of school finance tells you that the Legislature does not voluntarily overhaul school finance…only does so upon court intervention) Copyright© 2007 Education Service Center Region XIII 65

The Next Session 3 • EXTRA, Read all about it!! From the Midland Reporter-Telegram, October 12, 2008 – House Speaker Tom Craddick says help likely is on the way from the Texas Legislature in 2009 for districts under pressure from rising fuel, energy and salary costs. – "We know that a number of districts have been hit hard by unexpected increases in fuel and energy costs that are beyond their control. Some districts have accumulated substantial fund balances that help them deal with these kinds of unexpected costs, but others don't have that same flexibility, " Craddick said. Copyright© 2007 Education Service Center Region XIII 66

The Next Session 3 • EXTRA, Read all about it!! From the Midland Reporter-Telegram, October 12, 2008 – House Speaker Tom Craddick says help likely is on the way from the Texas Legislature in 2009 for districts under pressure from rising fuel, energy and salary costs. – "We know that a number of districts have been hit hard by unexpected increases in fuel and energy costs that are beyond their control. Some districts have accumulated substantial fund balances that help them deal with these kinds of unexpected costs, but others don't have that same flexibility, " Craddick said. Copyright© 2007 Education Service Center Region XIII 66

The Next Session 4 • EXTRA, Read all about it!! From the Midland Reporter-Telegram, October 12, 2008 – "But most taxpayers do not understand why they have consistently been asked to pay higher property taxes just so schools can deal with basic inflationary pressures, especially as appraisals were going through the roof. In this session, I expect that districts will receive more state funds to help deal with inflationary pressures like energy and fuel costs. For the long term, this issue needs to be addressed through a significant overhaul of the school finance system, " Craddick said. Copyright© 2007 Education Service Center Region XIII 67

The Next Session 4 • EXTRA, Read all about it!! From the Midland Reporter-Telegram, October 12, 2008 – "But most taxpayers do not understand why they have consistently been asked to pay higher property taxes just so schools can deal with basic inflationary pressures, especially as appraisals were going through the roof. In this session, I expect that districts will receive more state funds to help deal with inflationary pressures like energy and fuel costs. For the long term, this issue needs to be addressed through a significant overhaul of the school finance system, " Craddick said. Copyright© 2007 Education Service Center Region XIII 67

The Next Session 5 • Unknown, however, is the state budget estimate, which makes it hard to figure out how much money will be available for education, Craddick said via e-mail. He does concede, however, that the school finance system needs a "significant overhaul" in the long term. Copyright© 2007 Education Service Center Region XIII 68

The Next Session 5 • Unknown, however, is the state budget estimate, which makes it hard to figure out how much money will be available for education, Craddick said via e-mail. He does concede, however, that the school finance system needs a "significant overhaul" in the long term. Copyright© 2007 Education Service Center Region XIII 68

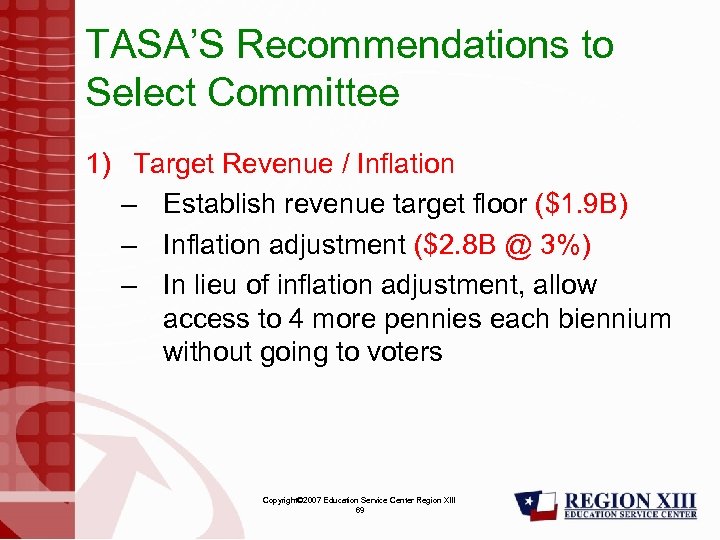

TASA’S Recommendations to Select Committee 1) Target Revenue / Inflation – Establish revenue target floor ($1. 9 B) – Inflation adjustment ($2. 8 B @ 3%) – In lieu of inflation adjustment, allow access to 4 more pennies each biennium without going to voters Copyright© 2007 Education Service Center Region XIII 69

TASA’S Recommendations to Select Committee 1) Target Revenue / Inflation – Establish revenue target floor ($1. 9 B) – Inflation adjustment ($2. 8 B @ 3%) – In lieu of inflation adjustment, allow access to 4 more pennies each biennium without going to voters Copyright© 2007 Education Service Center Region XIII 69

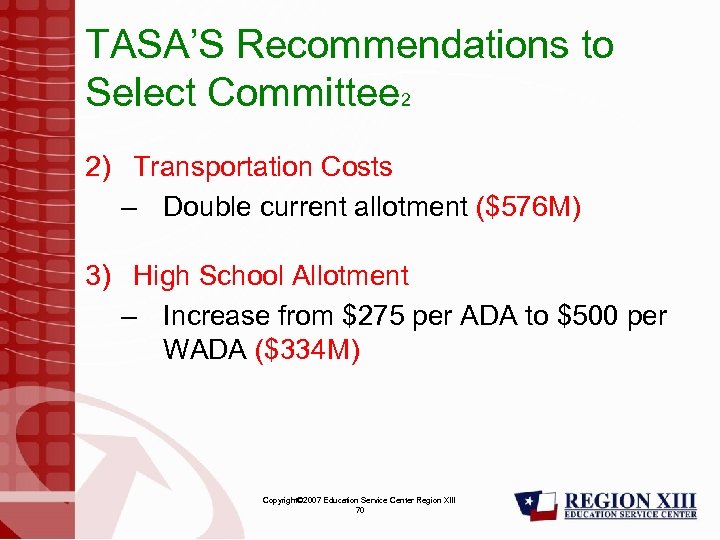

TASA’S Recommendations to Select Committee 2 2) Transportation Costs – Double current allotment ($576 M) 3) High School Allotment – Increase from $275 per ADA to $500 per WADA ($334 M) Copyright© 2007 Education Service Center Region XIII 70

TASA’S Recommendations to Select Committee 2 2) Transportation Costs – Double current allotment ($576 M) 3) High School Allotment – Increase from $275 per ADA to $500 per WADA ($334 M) Copyright© 2007 Education Service Center Region XIII 70

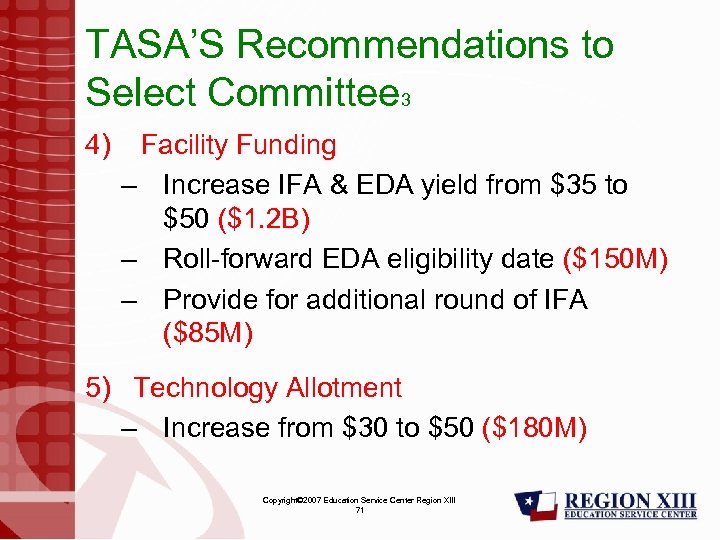

TASA’S Recommendations to Select Committee 3 4) Facility Funding – Increase IFA & EDA yield from $35 to $50 ($1. 2 B) – Roll-forward EDA eligibility date ($150 M) – Provide for additional round of IFA ($85 M) 5) Technology Allotment – Increase from $30 to $50 ($180 M) Copyright© 2007 Education Service Center Region XIII 71

TASA’S Recommendations to Select Committee 3 4) Facility Funding – Increase IFA & EDA yield from $35 to $50 ($1. 2 B) – Roll-forward EDA eligibility date ($150 M) – Provide for additional round of IFA ($85 M) 5) Technology Allotment – Increase from $30 to $50 ($180 M) Copyright© 2007 Education Service Center Region XIII 71

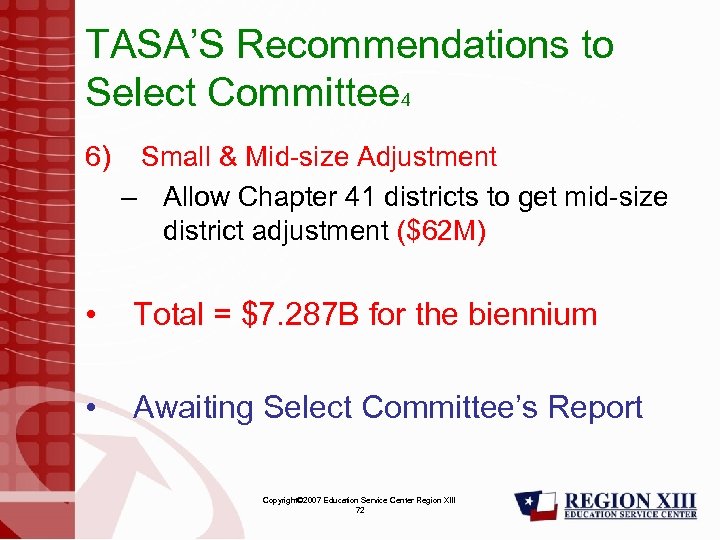

TASA’S Recommendations to Select Committee 4 6) Small & Mid-size Adjustment – Allow Chapter 41 districts to get mid-size district adjustment ($62 M) • Total = $7. 287 B for the biennium • Awaiting Select Committee’s Report Copyright© 2007 Education Service Center Region XIII 72

TASA’S Recommendations to Select Committee 4 6) Small & Mid-size Adjustment – Allow Chapter 41 districts to get mid-size district adjustment ($62 M) • Total = $7. 287 B for the biennium • Awaiting Select Committee’s Report Copyright© 2007 Education Service Center Region XIII 72