Assignment of Entry Capacity – A Shipper / Trader Perspective Richard Fairholme April 2009

Assignment of Entry Capacity – A Shipper / Trader Perspective Richard Fairholme April 2009

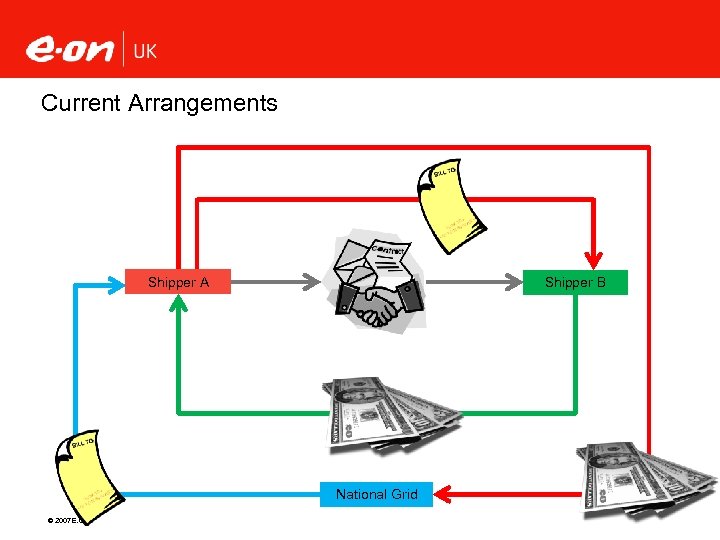

Current Arrangements Shipper A Shipper B National Grid © 2007 E. ON

Current Arrangements Shipper A Shipper B National Grid © 2007 E. ON

Problems for Shippers with the Current Arrangements As can be seen from previous slide, a secondary trade results in complicated invoicing and payment arrangements between Shippers, comprising of: • Settlement costs (initial set-up and then monthly invoicing) • Legal costs if contractual chain is broken (e. g. if Seller defaults) © 2007 E. ON Page 3

Problems for Shippers with the Current Arrangements As can be seen from previous slide, a secondary trade results in complicated invoicing and payment arrangements between Shippers, comprising of: • Settlement costs (initial set-up and then monthly invoicing) • Legal costs if contractual chain is broken (e. g. if Seller defaults) © 2007 E. ON Page 3

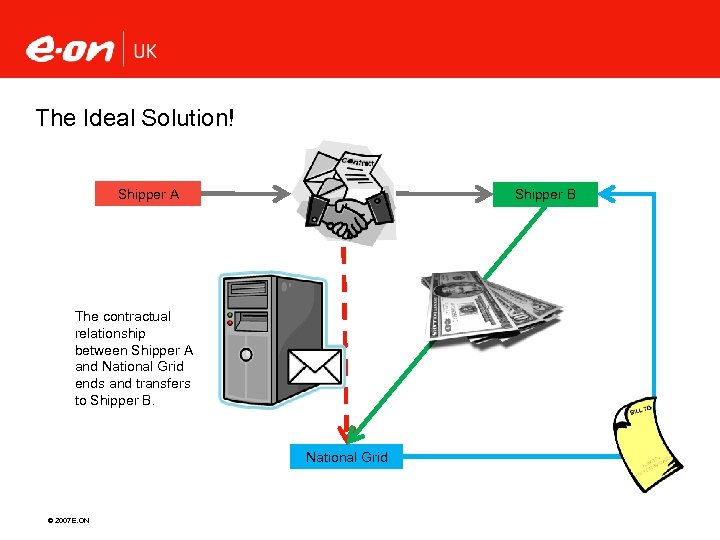

The Ideal Solution! Shipper A Shipper B The contractual relationship between Shipper A and National Grid ends and transfers to Shipper B. National Grid © 2007 E. ON

The Ideal Solution! Shipper A Shipper B The contractual relationship between Shipper A and National Grid ends and transfers to Shipper B. National Grid © 2007 E. ON

Capacity Assignment – Our Initial Views • Only really suitable for long-term capacity – i. e. capacity bought in QSEC auctions. • Shorter term capacity (i. e. capacity sold in RMTTSECs, DSECs etc) can just be sold/transferred using the existing processes. • Process should allow for partial assignment (i. e. for a particular purchase of capacity, just part of the capacity is assigned to a third party). • Assignment of entry capacity is allowed by other European TSOs and so implementation in UK may support alignment of gas codes across Europe. • Assignment may also support wider development of the secondary trading market, by removing potential barriers to trade. © 2007 E. ON

Capacity Assignment – Our Initial Views • Only really suitable for long-term capacity – i. e. capacity bought in QSEC auctions. • Shorter term capacity (i. e. capacity sold in RMTTSECs, DSECs etc) can just be sold/transferred using the existing processes. • Process should allow for partial assignment (i. e. for a particular purchase of capacity, just part of the capacity is assigned to a third party). • Assignment of entry capacity is allowed by other European TSOs and so implementation in UK may support alignment of gas codes across Europe. • Assignment may also support wider development of the secondary trading market, by removing potential barriers to trade. © 2007 E. ON

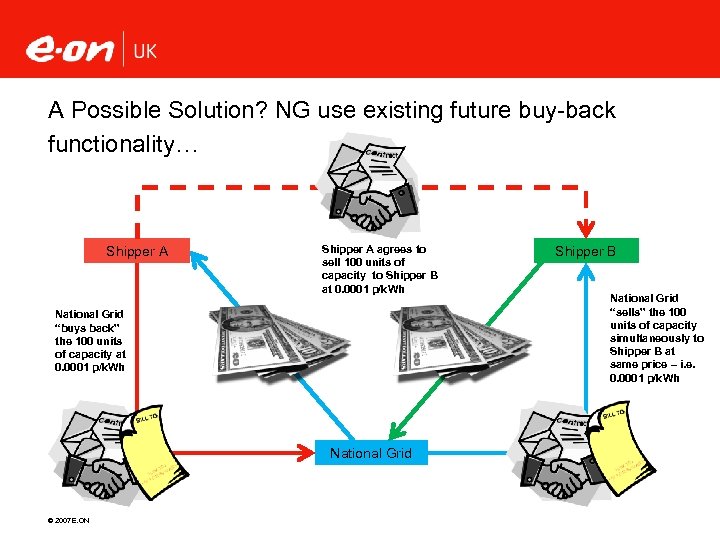

A Possible Solution? NG use existing future buy-back functionality… Shipper A agrees to sell 100 units of capacity to Shipper B at 0. 0001 p/k. Wh National Grid “buys back” the 100 units of capacity at 0. 0001 p/k. Wh National Grid © 2007 E. ON Shipper B National Grid “sells” the 100 units of capacity simultaneously to Shipper B at same price – i. e. 0. 0001 p/k. Wh

A Possible Solution? NG use existing future buy-back functionality… Shipper A agrees to sell 100 units of capacity to Shipper B at 0. 0001 p/k. Wh National Grid “buys back” the 100 units of capacity at 0. 0001 p/k. Wh National Grid © 2007 E. ON Shipper B National Grid “sells” the 100 units of capacity simultaneously to Shipper B at same price – i. e. 0. 0001 p/k. Wh

A Possible Solution: Continued… • This approach could make use of existing system functionality used by National Grid for future buy-back of capacity tenders; i. e. trade between Shippers is treated as a future ‘buy-back’ and then a ‘sell’. • National Grid acts purely as the facilitator of the trade. • Ensures ownership of capacity is transferred cleanly between Shippers & process is transparent. • Overcomes difficulties (such as commercial confidentiality) where capacity is sold at a different price from the original purchase price. • However…National Grid would know how much was paid (and how much profit / loss) made on a secondary trade. Currently, National Grid continue to invoice the seller based on original cost of allocated capacity and are unaware how much it may have subsequently been sold for. Is this an issue? © 2007 E. ON Page 7

A Possible Solution: Continued… • This approach could make use of existing system functionality used by National Grid for future buy-back of capacity tenders; i. e. trade between Shippers is treated as a future ‘buy-back’ and then a ‘sell’. • National Grid acts purely as the facilitator of the trade. • Ensures ownership of capacity is transferred cleanly between Shippers & process is transparent. • Overcomes difficulties (such as commercial confidentiality) where capacity is sold at a different price from the original purchase price. • However…National Grid would know how much was paid (and how much profit / loss) made on a secondary trade. Currently, National Grid continue to invoice the seller based on original cost of allocated capacity and are unaware how much it may have subsequently been sold for. Is this an issue? © 2007 E. ON Page 7